6396T 1-2019-11-15.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information (Materials) Provided to the Shareholders in Preparation for the Annual General Shareholders Meeting of PJSC Uralkali on September 30, 2020

PLEASE NOTE: TEXT OF THIS DOCUMENT IN ENGLISH LANGUAGE IS A TRANSLATION PREPARED FOR INFORMATION PURPOSES ONLY. THE TRANSLATION MAY CONTAIN DISCREPANCIES AND OMISSIONS AND DOES NOT REPLACE THE RUSSIAN TEXT OF THIS DOCUMENT. IN ANY AND ALL CASES THE TEXT OF THIS DOCUMENT IN RUSSIAN LANGUAGE SHALL PREVAIL Information (materials) provided to the shareholders in preparation for the annual general shareholders meeting of PJSC Uralkali on September 30, 2020 INFORMATION Candidates nominated for election to the Board of Directors of PJSC Uralkali PLEASE NOTE: TEXT OF THIS DOCUMENT IN ENGLISH LANGUAGE IS A TRANSLATION PREPARED FOR INFORMATION PURPOSES ONLY. THE TRANSLATION MAY CONTAIN DISCREPANCIES AND OMISSIONS AND DOES NOT REPLACE THE RUSSIAN TEXT OF THIS DOCUMENT. IN ANY AND ALL CASES THE TEXT OF THIS DOCUMENT IN RUSSIAN LANGUAGE SHALL PREVAIL Information on candidates nominated for election to the Board of Directors of PJSC Uralkali Alexander V. Bazarov Born in 1962 In 1984, Mr. Bazarov graduated from Shevchenko Kiev State Teachers University with a degree in Political Economy. Alexander Bazarov has an MBA and a degree in accounting & finance from the Wharton School of the University of Pennsylvania that he earned in 1995. From July 2008 until June 2018 – Mr. Bazarov served on the Management Board of Sberbank. He worked as Vice President of Sberbank of Russia and as Director of the Department for Major Sberbank Client. Since 2012 – Chairman of the Management Board of SLB Commercial Bank (hereinafter — Sberbank AG). From January 2012 until 2018 - Co-Director of the Corporate Investment Block of Sberbank (CIB). Since 2013 – Senior Vice President of PJSC Sberbank. -

Angola's New President

Angola’s new president Reforming to survive Paula Cristina Roque President João Lourenço – who replaced José Eduardo dos Santos in 2017 – has been credited with significant progress in fighting corruption and opening up the political space in Angola. But this has been achieved against a backdrop of economic decline and deepening poverty. Lourenço’s first two years in office are also characterised by the politicisation of the security apparatus, which holds significant risks for the country. SOUTHERN AFRICA REPORT 38 | APRIL 2020 Key findings The anti-corruption drive is not transparent While fear was endemic among the people and President João Lourenço is accused of under Dos Santos, there is now ‘fear among targeting political opponents and protecting the elites’ due to the perceived politicised those who support him. anti-corruption drive. Despite this targeted approach, there is an Economic restructuring is leading to austerity attempt by the new president to reform the measures and social tension – the greatest risk economy and improve governance. to Lourenço’s government. After decades of political interference by The greatest challenge going forward is reducing the Dos Santos regime, the fight against poverty and reviving the economy. corruption would need a complete overhaul of Opposition parties and civil society credit the judiciary and public institutions. Lourenço with freeing up the political space The appointment of a new army chief led and media. to the deterioration and politicisation of the Angolan Armed Forces. Recommendations For the president and the Angolan government: Use surplus troops and military units to begin setting up cooperative farming arrangements Urgently define, fund and implement an action with diverse communities, helping establish plan to alleviate the effects of the recession on irrigation systems with manual labour. -

Post-War State-Making in the Angolan Periphery

165 RECHERCHES Ricardo Soares de Oliveira “O Governo Está Aqui”: Post-war State-Making in the Angolan Periphery For the duration of Angola’s twenty-seven-year civil war, the central state did not control up to 80% of its nominal territory. In the aftermath of its 2002 victory over the Unita rebels, however, the oil-rich MPLA (Movimento Popular de Libertação de Angola) regime enthusiastically embraced the commitment to build a self-styled “modern state” across Angola. The resulting effort to break out of the enclaves it had long held and occupy the vast and sparsely populated territory, extend civil administration and rebuild infrastructure is a key political dynamic in present-day Angola. This article is an attempt at understanding the post-2002 state-building drive in Angola’s periphery through the prism of both the regime’s ambitions and the historical trajectory of the Angolan state and centre-periphery relations. The article argues that there is a clear project of establishing state hegemony across Angola 1. Though phrased in developmental terms, this is SULPDULO\DERXWWKHDFKLHYHPHQWRISROLWLFDOFRQWURO7KHÀUVWVHFWLRQEULHÁ\ surveys the challenges faced by state builders in Angola from the pre-Scramble colonial pockets to the last years of the civil war. It posits that the MPLA’s state rationalities and methods on the periphery must be understood historically in terms of the existence of a coastal and urban culture of the state; a long-extraverted economy; and the political geography and logistical limitations that severely hamper the broadcasting of state power. All of these have elicited striking continuities in the pattern of centre-periphery relations. -

Eliana Miss Angola Em Portugal

Jornal Bimestral de Actualidade Angolana SETEMBRO | OUTUBRO 2009 EDIÇÃO GRATUITA www.embaixadadeangola.org EDIÇÃO DOS SERVIÇOS DE IMPRENSA DA EMBAIXADA DE ANGOLA EM PORTUGAL ELIANA MISS ANGOLA EM PORTUGAL Pág. 16 EMBAIXADOR STÉLVIO COMENTA PATRIÓTICO! RELAÇÕES COM PORTUGAL Pág. 14 FESTA DOS FAMOSOS EM LISBOA Pág. 11 ASSUNÇÃO DOS ANJOS DISCURSA NA ONU Pág. 3 Pág. 2 2 Política SETEMBRO • OUTUBRO 2009 NA 64ª SESSÃO DA AG DA ONU ASSUNÇÃO DOS ANJOS PEDE CONCLUSÃO DAS REFORMAS Governo angolano apelou à con- igualmente, factores de extrema im- desarmamento, a persistência dos con- ca, o desenvolvimento e o progresso O clusão das negociações iniciadas portância que requerem permanente- flitos armados e as suas consequências do continente. O ministro sublinhou em 2005, tendo em vista a reforma mente a atenção das Nações Unidas, na vida das populações, a fome e a que Angola acredita ser possível re- do Conselho de Segurança das Na- reclamando maior eficácia nas medi- pobreza, as doenças endémicas, como duzir, substancialmente, o défice da ções Unidas, particularmente no que das a adoptar e um maior engaja- a malária e a tuberculose, que provo- segurança alimentar em África se a diz respeito à sua composição e de- mento da comunidade Internacional”, cam milhões de mortes por ano, e, em comunidade internacional se congre- mocratização do seu mecanismo de frisou. Assunção dos Anjos apontou África, devastam toda uma geração, gar em torno de eixos fundamentais, tomada de decisões. O apelo foi feito outros desafios, como as questões do pondo em causa, de forma dramáti- como a manutenção das reservas pelo ministro das Relações Exteriores, mínimas de alimentos e medicamen- Assunção dos Anjos, quando discursa- tos para as ajudas de emergência e va, em Nova Iorque, na 64ª sessão da humanitárias às populações carentes. -

2007 Outubro 06-13 Imperícia, Falta De Independência Do Judiciário Ou Parcialidade? Três Actos Da Trama Que Condenou Graça Campos

2007 Outubro 06-13 Imperícia, falta de independência do judiciário ou parcialidade? Três actos da trama que condenou Graça Campos O julgamento que condenou Graça Campos a oito meses de prisão efectiva e ao pagamento de uma indemnização de 250 mil dólares a Paulo Tjipilica foi feito à revelia, decorrendo na sua ausência e também na dos seus representantes legais. A 25 de Agosto último, quando o juiz Pedro Viana reuniu o tribunal para deliberar a acção em que o Provedor de Justiça pedia que Graça Campos fosse condenado e reparasse alegados crimes de injúria e difamação por via de uma indemnização, o jornalista não se encontrava em Angola. Os seus advogados, João Gourgel e Paulo Rangel, não estavam avisados da ocorrência do julgamento e também não compareceram ao tribunal. Quando, regressado ao país, o jornalista se apercebeu do desenrolar dos acontecimentos, accionou os serviços dos seus advogados, que se apressaram a justificar as faltas e solicitaram a realização de novo julgamento, tudo isso de acordo com aquilo que a lei prevê para situações do género. Os advogados justificaram a falta com «dificuldades com as notificações e ausência do país do seu constituinte». Com isso, a defesa pretendia esclarecer plenamente os factos em resposta às petições de Paulo Tjipilica e permitir que fossem produzidas as provas que possibilitassem que fosse feita justiça. Mas o juiz Paulo Viana indeferiu essa petição dos advogados, dando prosseguimento à acção no quadro das precárias «démarches» já encetadas. Segundo informações disponíveis, quando Graça Campos estava ausente de Angola e não pôde zelar pela sua defesa e muito menos fazer-se presente para julgamento, Pedro Viana escreveu â Ordem dos Advogados de Angola (Oaa) solicitando defesa oficiosa. -

Angola: Parallel Governments, Oil and Neopatrimonial System Reproduction

Institute for Security Studies Situation Report Date issued: 6 June 2011 Author: Paula Cristina Roque* Distribution: General Contact: [email protected] Angola: Parallel governments, oil and neopatrimonial system reproduction Introduction Over the last 35 years, the central government in Luanda has not only survived a potent insurgency, external intervention, international isolation, sanctions and economic collapse, but it has also managed to emerge victorious from a highly destructive and divisive civil war, achieving double-digit economic growth less than a decade after the cessation of hostilities. Hence the state in Angola may be regarded as resilient and even effective. However, closer examination of the Angolan political order reveals a very distinct reality of two parallel ruling structures: the formal, fragile government ruled by the Movimento Popular de Libertação de Angola (MPLA) and the more resilient ‘shadow’ government controlled and manipulated by the presidency, with Sonangol, the national oil company, as its chief economic motor. While these structures are mutually dependent, their internal functions are sometimes at odds with each other. Recent changes to these structures reveal the faultlines the ruling elite has tried to conceal, as well as new opportunities for engagement with the ruling structures of Angola by African and international policymakers. The Angolan The Angolan state displays several aspects of failure and resilience that, in its oil state: Two hybrid configuration, combines formal and informal operating procedures, is governments highly adaptable and able to survive great difficulties. Reforms in Angola are between more a reflection of the need to adapt to change as a means to maintain control democracy of the state – and to control the rate at which any change occurs – than a genuine and hegemony opening of the political space to ideas of good governance, let alone popular (2008–2010) accountability. -

Information (Materials) Provided to the Shareholders in Preparation for the Annual General Shareholders Meeting of PJSC Uralkali on June 29, 2018

PLEASE NOTE: THE TEXT OF THIS DOCUMENT IN ENGLISH IS A TRANSLATION PREPARED FOR INFORMATION PURPOSES ONLY. THE TRANSLATION MAY CONTAIN DISCREPANCIES AND OMISSIONS AND DOES NOT REPLACE THE RUSSIAN TEXT OF THIS DOCUMENT. IN ANY AND ALL CASES THE TEXT OF THIS DOCUMENT IN THE RUSSIAN LANGUAGE SHALL PREVAIL. Information (materials) provided to the shareholders in preparation for the annual general shareholders meeting of PJSC Uralkali on June 29, 2018 INFORMATION Candidates nominated for election to the Board of Directors of PJSC Uralkali PLEASE NOTE: THE TEXT OF THIS DOCUMENT IN ENGLISH IS A TRANSLATION PREPARED FOR INFORMATION PURPOSES ONLY. THE TRANSLATION MAY CONTAIN DISCREPANCIES AND OMISSIONS AND DOES NOT REPLACE THE RUSSIAN TEXT OF THIS DOCUMENT. IN ANY AND ALL CASES THE TEXT OF THIS DOCUMENT IN THE RUSSIAN LANGUAGE SHALL PREVAIL. Information on candidates nominated for election to the Board of Directors of PJSC Uralkali Daniel L. Wolfe Born in 1965 In 1987, Mr. Wolfe graduated from Dartmouth University (Hannover, New Hampshire, USA) with a BA in Russian Language and Literature and Political Science. In 1991, he earned his Juris doctor degree from Columbia Law School (New York, USA). From November 2010 until May 2014, Daniel worked as Deputy CEO, member of the Management Board and member of the Board of Directors at OAO Kvadra (formerly TGK-4), where he currently serves on the Board of Directors, Compensation and Remuneration Committee and Audit Committee. In 2014-2017, Mr. Wolfe was Deputy CEO at Onexim Group, served on the Board of Directors of Brooklyn Nets, Barclays Center, and Renaissance Capital, where he also held the post of Chairman of the Audit Committee. -

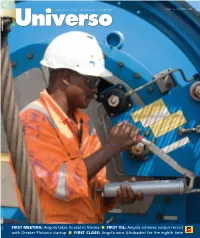

Angola Achieves Output Record with Greater Plutonio Startup

SONANGOL ANGOLA | OIL | BUSINESS | CULTURE ISSUE 16 WINTER 2007 UNIVERSO Universo ISSUE 16 – WINTER 2007 FIRST MEETING: Angola takes its seat in Vienna ■ FIRST OIL: Angola achieves output record with Greater Plutonio startup ■ FIRST CLASS: Angola wins Afrobasket for the eighth time ISSUE 16 WINTER 2007 INSIDE SONANGOL INSIDE ANGOLA Moving On 8. Turned On 32. Weekend Away The amazing changes that have Eight years after the initial discovery on With every year that passes since the materialised in Angola Block 18, first oil flows from the Greater end of hostilities in 2003, the possibil- during the four years Plutonio field bringing Angola’s production ities for tourism offered by Angola’s that Universo has goal of 2 million barrels per day a signifi- welcoming coast and countryside been published seem TENTS cant step closer become increasingly evident scarcely credible. In 2004, the coun- try was little known except as a war zone. Now it is one of Africa’s major oil pro- ducers, set to achieve CON the coveted daily production level of 2 million 38. The Hungry bpd in the new year. In September Angola took Dragon its seat in Vienna as member of the exclusive Opec club – and in another demonstration of China’s rising profile on the the country’s coming of age as an oil state, 12. In the Big League Now African continent, particularly in Luanda was recently the setting for the 2nd Angola, offers important oppor- Admission to Opec has put Angola on the front line of Deepwater Offshore West Africa Conference, tunities as well as challenges for global petropolitics, so Universo joined the international attended by leading oil engineers, scientists the countries involved media corps to catch the tension and drama in Vienna and other industry leaders from all over the world. -

Angola Country Report

ANGOLA COUNTRY REPORT October 2004 Country Information & Policy Unit IMMIGRATION AND NATIONALITY DIRECTORATE HOME OFFICE, UNITED KINGDOM Angola October 2004 CONTENTS 1. Scope of the document 1.1 2. Geography 2.1 3. Economy 3.1 4. History Post-Independence background since 1975 4.1 Multi-party politics and the 1992 Elections 4.2 Lusaka Peace Accord 4.6 Political Situation and Developments in the Civil War September 1999 - February 4.13 2002 End of the Civil War and Political Situation since February 2002 4.19 5. State Structures The Constitution 5.1 Citizenship and Nationality 5.4 Political System 5.9 Presidential and Legislative Election Plans 5.14 Judiciary 5.19 Court Structure 5.20 Traditional Courts 5.23 UNITA - Operated Courts 5.24 The Effect of the Civil War on the Judiciary 5.25 Corruption in the Judicial System 5.28 Legal Documents 5.30 Legal Rights/Detention 5.31 Death Penalty 5.38 Internal Security 5.39 Angolan National Police (ANP) 5.40 Armed Forces of Angola (Forças Armadas de Angola, FAA) 5.43 Prison and Prison Conditions 5.45 Military Service 5.49 Forced Conscription 5.52 Draft Evasion and Desertion 5.54 Child Soldiers 5.56 Medical Services 5.59 HIV/AIDS 5.67 Angola October 2004 People with Disabilities 5.72 Mental Health Treatment 5.81 Educational System 5.82 6. Human Rights 6.A Human Rights Issues General 6.1 Freedom of Speech and the Media 6.5 Newspapers 6.10 Radio and Television 6.13 Journalists 6.18 Freedom of Religion 6.25 Religious Groups 6.28 Freedom of Association and Assembly 6.29 Political Activists – UNITA 6.43 -

United Chemical Company Uralchem: the True Content of Business Strategy

UNITED CHEMICAL COMPANY URALCHEM: THE TRUE CONTENT OF BUSINESS STRATEGY Study of the Corporate Strategy of United Chemical Company URALCHEM, Open Joint Stock Company. Assessment of Social and Environmental Effects of Activities. INDEPENDENT REPORT Moscow, 2010 2 CONTENT INTRODUCTION ................................................................................................................................3 1. URALCHEM AS AN INVESTOR..................................................................................................4 Preamble ............................................................................................................................................4 1.1. URALCHEM Company and its management experience in the sphere of chemical fertilizers production ....................................................................................................................5 1.2. Financial solvency of United Chemical Company URALCHEM as an investor.............8 1.3. Relations between United Chemical Company URALCHEM and its owners with their partners..........................................................................................................................................9 1.4. Risks of France – preferences for the United Kingdom ...................................................10 Company’s goals in the course of Dieppe project implementation ........................................10 Conclusion .......................................................................................................................................12 -

Evolving NPK Demand in Africa Opens up Growth Opportunities

Argus White Paper: Evolving NPK demand in Africa opens up growth opportunities The use of NPKs in sub-Saharan Africa continued to rewarded for their patience, securing higher prices this year grow last year with rising requirements in a number at 369,500 CFA francs/t ($645/t) fot for 14-18-18+6S+1B or of annual tenders and government agencies driving 14-18-18+6s+1B+2.5CaO and CFAfr315,000/t fot for the 17-17- the consumption of more specialised grades. 17 grade. The requirement in the latest tender was up from the Moroccan producer OCP has found success in its 89,000t of 14-18-18+6S+1B and 25,000t of 17-17-17 purchased African strategy by securing two of the largest in CMDT’s previous annual tender. annual tenders in the region — Ethiopia and Benin Ivory Coast firm Intercoton’s annual tender seeking 112,050t — in recent years and developing local production of 15-15-15+6S+1B for delivery this year, up from the 78,000t plans. But the growth potential of the region has required for 2018, was awarded in December after being is- also caught the attention of Russian producers. sued in August. The volumes were awarded to Yara and Olam with prices confirmed in a range of CFAfr240,000-250,000/t Increasing demand ($415.30-432.60/t) fot bagged delivered to farm. Fertiliser pro- Much of Africa’s consumption of NPKs is fulfilled through ducer Solevo — formerly a Louis Dreyfus and Helios subsidiary annual tenders that typically begin in the fourth quarter. -

Efficiency As a Growth Driver

URALCHEM ANNUAL REPORT 2013 ANNUAL REPORT 2013 ANNUAL REPORT 2013 EFFICIENCY AS A GROWTH DRIVER www.uralchem.com EFFICIENCY AS A CONTACT INFORMATION GROWTH DRIVER Legal and mailing address 10 Presnenskaya naberezhnaya, Moscow, Russia, 123317 Phone: +7 (495) 721 89 89 Fax: +7 (495) 721 85 85 Е-mail: [email protected] Despite a difficult market environment, URALCHEM delivered a solid financial and operating performance in 2013. Our success was due to the hard work and professionalism of employees, as well as to a resilient and flexible business model which ensures strong performance in any market conditions. We have maintained our leadership among Russia’s nitrogen fertilizer producers. Continuous improvements in production efficiency supported by a stable financial position give us confidence in our ability to deliver long- term business and value growth for URALCHEM Group. Except when otherwise specified, all information and data contained in this Annual Report are as of 31 December 2013. Unless otherwise specified in the Annual Report, the financial information refers to the activities of the URALCHEM Group. Some statements in this document may refer to projects or forecasts with regard to forthcoming events or future financial results of the Company. The Company wishes to forewarn that such statements are nothing but assumptions, and the actual course of events or results may be different from those contained in the statements. The Company shall not obligate itself to reconsider such statements with a view to correlating them with actual