Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reports of Select Committees on the 2017/18 Annual Reviews Of

I.20D Reports of select committees on the 2017/18 annual reviews of Government departments, Offices of Parliament, Crown entities, public organisations, and State enterprises Volume 1 Financial Statements of the Government for the year ended 30 June 2018 Economic Development and Infrastructure Sector Education Sector Environment Sector External Sector Finance and Government Administration Sector Fifty-second Parliament April 2019 Presented to the House of Representatives I.20D Contents Crown entity/public Select Committee Date presented Page organisation/State enterprise Financial Statements of the Finance and Expenditure 22 Feb 2019 1 Government of New Zealand for the year ended 30 June 2018 Economic Development and Infrastructure Sector Accident Compensation Education and Workforce 5 Apr 2019 14 Corporation Accreditation Council Economic Development, 5 Apr 2019 23 Science and Innovation AgResearch Limited Economic Development, 5 Apr 2019 24 Science and Innovation Air New Zealand Limited Transport and Infrastructure 5 Apr 2019 29 Airways Corporation of New Transport and Infrastructure 5 Apr 2019 29 Zealand Limited Callaghan Innovation Economic Development, 5 Apr 2019 30 Science and Innovation City Rail Link Limited Transport and Infrastructure 5 Apr 2019 36 Civil Aviation Authority of New Transport and Infrastructure 5 Apr 2019 39 Zealand Commerce Commission Economic Development, 5 Apr 2019 42 Science and Innovation Crown Infrastructure Partners Transport and Infrastructure 5 Apr 2019 48 Limited (previously called Crown Fibre Holdings -

How Was Effective Communication Between New Zealand's Leadership, Healthcare System, and Citizens Related to the Success of Their COVID-19 Elimination Strategy?

1 How was effective communication between New Zealand's leadership, healthcare system, and citizens related to the success of their COVID-19 elimination strategy? Parisa Ansari Anika Bhatia William Choi Fiona Davoudi Vandya Goel Minji Kim Karin Liu Mia Raimondi Nethra Srinivasan Nancy Zheng (Leland High School, San Jose, USA) Mrs. Sarkar 2 Abstract The purpose of this paper is to provide in depth information and analysis regarding New Zealand’s response to the COVID-19 epidemic and how their success was closely related to effective communication that occurred between their government, healthcare system, and citizens. We have found that New Zealand’s leadership took the advice of their healthcare experts and acted quickly to mitigate the pandemic before it overwhelmed their hospital system. Constant communication between the healthcare system and government allowed for plans to adapt and fit the needs of the country as the pandemic evolved. The government was also honest and clear in their communication of plans to citizens, ensuring that mitigation plans were carried out to the fullest extent in order to protect vulnerable communities. Case numbers and fatality rates have reflected New Zealand’s highly effective mitigation strategy, as there have been only 1,567 cases and 22 deaths as of August 2, 2020. Cases were evenly distributed among ethnic groups, genders, and geography. The elderly and other high risk groups experienced far lower case rates compared to other developed countries due to effective government plans. As a result of strict lockdowns lasting several weeks, New Zealand’s economy has suffered. However, the government has allocated $50 billion to a COVID-19 Response and Recovery fund and has also set aside several billion dollars to help small businesses that suffered during the lockdown. -

Opportunities to Improve NZ Policy Coherence for Development

Ministry of Foreign Affairs and Trade Opportunities to Improve New Zealand's Policy Coherence for Development Peter MacIntyre, David Moore and Eva Hendriks 28 March 2014 About Sapere Research Group Limited Sapere Research Group is one of the largest expert consulting firms in Australasia and a leader in provision of independent economic, forensic accounting and public policy services. Sapere provides independent expert testimony, strategic advisory services, data analytics and other advice to Australasia’s private sector corporate clients, major law firms, government agencies, and regulatory bodies. Wellington Auckland Level 9, 1 Willeston St Level 17, 3-5 Albert St PO Box 587 PO Box 2475 Wellington 6140 Auckland 1140 Ph: +64 4 915 7590 Ph: +64 9 913 6240 Fax: +64 4 915 7596 Fax: +64 9 913 6241 Sydney Canberra Melbourne Level 14, 68 Pitt St Unit 3, 97 Northbourne Ave Level 2, 65 Southbank GPO Box 220 Turner ACT 2612 Boulevard NSW 2001 GPO Box 252 GPO Box 3179 Ph: + 61 2 9234 0200 Canberra City, ACT 2601 Melbourne, VIC 3001 Fax: + 61 2 9234 0201 Ph: +61 2 6267 2700 Ph: + 61 3 9626 4333 Fax: +61 2 6267 2710 Fax: + 61 3 9626 4231 For information on this report please contact: Name: Peter MacIntyre Telephone: 049157617 Mobile: 0212768819 Email: [email protected] Page i 17 December 2015 4.51 PM Contents Glossary ......................................................................................................................... v Executive summary ...................................................................................................... -

Tourism New Zealand Briefing for the Incoming Minister 3 November 2020

Tourism New Zealand Briefing for the Incoming Minister 3 November 2020 Tourism New Zealand: Briefing for the Incoming Minister – November 2020 1 Contents 1. Foreword from the Chief Executive 2. Overview of Tourism New Zealand 3. Tourism New Zealand’s key activity 4. COVID-19 – the impact on tourism and Tourism New Zealand’s response 5. Work with government partners: advising government on economic recovery 6. The next quarter 7. Communication with Ministers, Board and Executive Team Annex: Te Õhanga Productivity Report Tourism New Zealand: Briefing for the Incoming Minister – November 2020 2 1. Foreword from the Chief Executive Minister, Welcome to the tourism portfolio. Tourism is vital to New Zealand and its success. From large corporates to individual Kiwis, tourism enriches our country across the four capitals, contributing to our economic, social, human and natural wellbeing while providing exceptional experiences to our domestic and international visitors. Research about New Zealanders’ views towards tourism’s future, conducted by Angus and Associates in September 2020, showed that New Zealanders see tourism as vital to New Zealand’s economic and social recovery from COVID-19, with a view to creating jobs at scale in the community and improving local infrastructure. Prior to COVID-19, tourism made up 20% of New Zealand exports, making it our largest export earner. One in ten New Zealanders was either employed by the tourism sector, or indirectly by related sectors. Tourism is a diverse and dispersed sector. It captures some of New Zealand’s biggest and smallest businesses operating in wide ranging contexts, in cities, towns and rural areas. -

Annual Report Tourism New Zealand | 2017/2018 Tourism New Zealand Annual Report | 2017/2018 Highlights

G25 Kia ora, Welcome. Annual Report Tourism New Zealand | 2017/2018 Tourism New Zealand Annual Report | 2017/2018 Highlights Highlights % of Kiwis agree or strongly agree . that international tourism is shoulder season holiday arrival growth good for New Zealand ‘Mood of the Nation’ survey, March . % BILLION International visitor spend with an average of million active visits to newzealand.com million followers on Facebook spent per holiday arrival. .% increase in regional spend : Leading to .m return on investment . million in markets on value generated from international referrals to tourism businesses partnership campaigns media about New Zealand % Pure New Zealand Specialists . bids to bring conferences to With a further New Zealand supported MILLION through TNZ’s Conference Assistance Programme with , Arrivals into New Zealand registered in the an estimated value of % Pure agents attended . MILLION New Zealand % Pure New Zealand of which were holiday arrivals .m Specialist Programme Specialist Programme famil 2 3 Tourism New Zealand Annual Report | 2017/2018 Tourism New Zealand Annual Report | 2017/2018 Contents 2017/2018 at a glance ........................................................6 Chair and Chief Executive report ..................................... 6-8 Performance overview ...................................................... 9 Who we are and what we do ............................................ 10 Our offices ................................................................. 10-11 Our markets .............................................................. -

Sustaining Tourism Growth in Queenstown

SUSTAINING TOURISM GROWTH IN QUEENSTOWN Final Report March 2018 CONTENTS Executive Summary 1 Impact on international visitor spend 83 Introduction 3 Impact on GDP, GST and employment 88 PART ONE: STRATEGIC CASE 6 The preferred way forward 98 Background 7 PART THREE: FINANCIAL CASE 101 How did we get here? 11 Financing the ‘sustained’ scenario 102 Queenstown today 13 Alternative funding options 107 A negative Queenstown experience could damage New APPENDICES Zealand’s tourism brand and economy 35 Appendix 1 : List of tables and figures in the Business Challenges to shaping Queenstown’s future 39 Case 109 Changes needed to sustain tourism growth 54 Appendix 2 : Terms of reference 112 PART TWO: ECONOMIC CASE 58 Appendix 3 : Investment objectives – What does success Introduction 59 look like? 116 Three Scenarios: Queenstown’s future 61 Appendix 4 : Strategies, plans and players shaping Queenstown’s future 117 Comparing the scenarios 66 Appendix 5 : Introducing Helga 120 Scenario 1: Eroded scenario 68 Appendix 6 : Financial summary of the scenarios 121 Scenario 2: Sustained scenario 73 Scenario 3: Enhanced scenario 78 Commercial In Confidence PREFACE This report has been prepared for Queenstown Lakes District Council by Disclaimer Nick Carlaw, Mette Mikkelsen, Jason Leung-Wai, Nick Hunn and Nick Davis This Report has been prepared solely for the purposes stated herein and from MartinJenkins (Martin, Jenkins & Associates Limited). should not be relied upon for any other purpose. To the fullest extent MartinJenkins advises clients in the public, private and not-for-profit sectors, permitted by law, we accept no duty of care to any third party in connection providing services in these areas: with the provision of this Report. -

TOURISM NEW ZEALAND ANNUAL REPORT 2007–2008 ‘Youngest Country’

G25 TOURISM NEW ZEALAND ANNUAL REPORT 2007–2008 ‘Youngest Country’ New Zealand is ‘The Youngest Country on Earth’, the last habitable land mass to be settled by human kind. This is the basis of Tourism New Zealand’s refreshed international marketing campaign which launched in August 2007. www.tourismnewzealand.com G25 CONTENTS 2007–2008 Chairman’s Report 02 Statement of Service Performance 12 Chief Executive’s Overview 12 Marketing of New Zealand as a Visitor Destination: 13 Report 04 Campaign 14 About Tourism Channel 23 New Zealand 07 Capability 26 Management Management Statements 28 at Tourism Financials 31 New Zealand 08 Statement of Responsibility 31 Statement of Financial Performance 32 Governance Statement of Financial Position 33 at Tourism Statement of Changes in Equity 33 New Zealand 09 Statement of Cash Flows 34 Board Members 11 Notes to the Financial Statements 35 Note 1 Statement of accounting policies 35 Note 2 Crown Revenue 38 Note 3 Other Revenue 38 Note 4 Foreign Exchange Gains 38 Note 5 Other Expenses 38 Note 6 Foreign exchange losses 40 Note 7 Total Expenditure of Parent 40 Note 8 Subsidiary Companies 40 Note 9 Associate Company 42 Note 10 Cash 42 Note 11 Receivables 43 Note 12 Derivative financial instruments 44 Note 13 Property plant and equipment 44 Note 14 Accommodation bonds 46 Note 15 Creditors and other payables 46 Note 16 Employee entitlements 46 Note 17 Provisions 46 Note 18 Reconciliation of surplus (deficit) to net cash from operating activities 47 Note 19 Contingent liabilities and contingent assets 47 Note -

Tourism Toolkit

Tourism Toolkit CONTENTS Tourism in Southland 2 Working within the tourism industry 4 Starting a business 6 Promoting your product in print 8 Promoting your product online 10 Promoting your business at the i-SITE 13 Working with media 15 How to write a media release 17 What is trade? 18 Working with trade 20 Delivering a quality experience 23 Glossary of tourism terms 25 [email protected] Tourism in Southland SOUTHLAND - A VISITOR DESTINATION The Southland region is comprised of multiple destinations, with the well-known Southern Scenic Route linking many of these places, plus additional inland destinations. The Southern Scenic Route officially starts in Dunedin and finishes in Queenstown. Destinations within Southland include: + Invercargill + Bluff + Stewart Island + The Catlins and Southern Southland + Gore and Eastern Southland + Riverton and Western Southland + Winton and Central Southland + Lumsden and Northern Southland + Te Anau and Fiordland As a region, Southland is well suited to New Zealand’s ideal traveller, having world class natural attractions (Fiordland) and emerging destinations that offer a chance to explore at a more relaxed pace (the Catlins, Stewart Island, Western Southland). Southern charm is growing in reputation and no other region in New Zealand recognises explicitly that its local residents offer a particular point of difference with southern hospitality. With the perceived hustle and bustle of other Southland also showcases New Zealand’s + Southern hospitality, popular destinations such as Queenstown, global position: + Wilderness on a large scale, Rotorua, Bay of Islands and the Abel + Outstanding natural scenery and wildlife + Cultural heritage, Tasman area, Southland offers unhurried, – Fiordland and Stewart Island are + Unhurried, non-crowded, timeless and relaxed experiences. -

New Zealand Influenza Pandemic Plan: a Framework for Action (2Nd Edn)

New Zealand Influenza Pandemic Plan A framework for action Released 2017 health.govt.nz Acknowledgement The Ministry of Health would particularly like to acknowledge its debt to Professor Geoffrey W Rice. Professor Rice’s history of the impact of the 1918 pandemic on New Zealand, Black November, compiled from primary sources and interviews with people who were affected, has been invaluable to our planning (Rice 2005). Comments The New Zealand Influenza Pandemic Action Plan has been in existence since 2002, but has undergone substantial revision since then due to the evolving threat from H5N1 influenza, the influenza A (H1N1) 2009 pandemic and the subsequent all-of-government programme of pandemic planning and exercises that have been implemented. This plan will continue to evolve. If you have any comments please send them to the Ministry of Health: by post to: NZIPAP Emergency Management Team Ministry of Health 133 Molesworth Street PO Box 5013 Wellington 6145 or by email to: [email protected] Version Date: August 2017 Key revisions since last version: Changes have been made to reflect changes in terminology, legislation, agencies names, population based calculations and references to publications and websites. Citation: Ministry of Health. 2017. New Zealand Influenza Pandemic Plan: A framework for action (2nd edn). Wellington: Ministry of Health. First published in April 2010, 2nd edition in August 2017 by the Ministry of Health PO Box 5013, Wellington 6140, New Zealand ISBN 978-1-98-850285-4 (print) ISBN 978-1-98-850264-9 (online) HP 6638 This document is available at health.govt.nz This work is licensed under the Creative Commons Attribution 4.0 International licence. -

Annual Report

G25 Annual Report Tourism New Zealand 2016/2017 Sara Orme 2.64 53,000 million Australian and British visitors followers on during the British and Irish Lions Rugby Tour Facebook 13% more visitors during spring and autumn 10,679 stories generated (estimated value: $227.2 million) 6.3 85 bids million supported through the referrals to tourism Conference Assistance Programme businesses from (estimated value: newzealand.com $164 million) 3.6 million visitors 41 396 million media outlets hosted visits to in 180 visits newzealand.com Miles Holden 40 major trade events 42% increase in premium attended by visitor spend Tourism New Zealand 96% of Kiwis agree or strongly agree that international tourism is good for New Zealand $10.25 6000 billion people surveyed for our partnership campaign with the contributed to the Department of Conservation New Zealand economy by (launching in FY18) international visitors 4,607 100% Pure New Zealand Specialists 181 $3,800 incentive conference average holiday spend bids supported per holiday arrival Adam Bryce Contents 02. Tourism New Zealand — Who We Are 04. Chair and Chief Executive Report 10. Governance 12. Board Members 16. Core Leadership Team 18. Strategic Priorities and Outcomes 29. Statement of Performance 40. Equal Employment Opportunities 45. Financial Statements 50. Notes to the Financial Statements 76. Independent Auditor’s Report 1 London Seoul Beijing* Tokyo New Delhi* Shanghai Guangzhou Mumbai Singapore Jakarta Sydney Tourism New Zealand — Who We Are Tourism New Zealand is the Government organisation responsible for promoting New Zealand to the world and encouraging international visitors to this amazing country. Tourism New Zealand was established in 1991 as a Crown Entity by the New Zealand Tourism Board Act, and since then our staff has worked tirelessly to create award winning campaigns marketing New Zealand as an international visitor destination. -

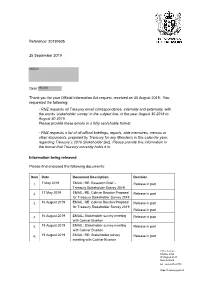

Official Information Act Response 20190605

Reference: 20190605 25 September 2019 s9(2)(a) Dear s9(2)(a) Thank you for your Official Information Act request, received on 30 August 2019. You requested the following: - RNZ requests all Treasury email correspondence, internally and externally, with the words ‘stakeholder survey’ in the subject line, in the year August 30 2018 to August 30 2019. Please provide these emails in a fully searchable format. - RNZ requests a list of all official briefings, reports, aide memoires, memos or other documents, prepared by Treasury for any Minister/s in this calendar year, regarding Treasury’s 2019 Stakeholder [sic]. Please provide this information in the format that Treasury currently holds it in. Information being released Please find enclosed the following documents: Item Date Document Description Decision 1. 7 May 2019 EMAIL: RE: Research Brief – Release in part Treasury Stakeholder Survey 2019 2. 17 May 2019 EMAIL: RE: Colmar Brunton Proposal Release in part for Treasury Stakeholder Survey 2019 3. 16 August 2019 EMAIL: RE: Colmar Brunton Proposal Release in part for Treasury Stakeholder Survey 2019 Release in part 4. 16 August 2019 EMAIL: Stakeholder survey meeting Release in part with Colmar Brunton 5. 19 August 2019 EMAIL: Stakeholder survey meeting Release in part with Colmar Brunton 6. 19 August 2019 EMAIL: RE: Stakeholder survey Release in part meeting with Colmar Brunton 1 The Terrace PO Box 3724 Wellington 6140 New Zealand tel. +64-4-472-2733 https://treasury.govt.nz 7. 30 August 2019 EMAIL: RE: 2019 Stakeholder Release in part Engagement Survey - your stakeholder lists by COB next Thursday please! 8. -

How Clean and Green Is New Zealand Tourism?

How Clean and Green is New Zealand Tourism? Lifecycle and Future Environmental Impacts Murray Patterson Massey University Garry McDonald Landcare Research Landcare Research Science Series No. 24 How Clean and Green is New Zealand Tourism? Lifecycle and Future Environmental Impacts Murray Patterson New Zealand Centre for Ecological Economics Massey University Palmerston North Garry McDonald Landcare Research Palmerston North Landcare Research Science Series No. 24 Manaaki Whenua PRESS Lincoln, Canterbury, New Zealand 2004 2 © Landcare Research New Zealand Ltd 2004 This information may be copied or reproduced electronically and distributed to others without limitation, provided Landcare Research New Zealand Limited is acknowledged as the source of information. Under no circumstances may a charge be made for this information without the express permission of Landcare Research New Zealand Limited. CATALOGUING IN PUBLICATION Patterson, M. G. (Murray Graham), 1955- How clean and green is New Zealand tourism? : lifecycle and future environmental impacts / Murray Patterson [and] Garry McDonald. — Lincoln, N.Z. : Manaaki Whenua Press, 2004. (Landcare Research science series, ISSN 1172-269X ; no. 24) ISBN 0-478-09359-4 I. McDonald, Garry C. II. Title. III. Series. UDC 338.48(931):504.05 Edited by Christine Bezar Layout and typesetting by Kirsty Cullen Cover design by Anouk Wanrooy Production by Catherine Montgomery Published by Manaaki Whenua Press, Landcare Research, PO Box 40, Lincoln 8152, New Zealand 3 Contents Page Summary i 1. Introduction 1 1.1 Scope of the report 1 1.2 Why assess the environmental impact of the tourism sector? 2 1.3 Rationale for this study 5 1.4 Related previous research 7 1.5 Definitions 8 1.5.1 Tourist 8 1.5.2 Tourism sector and tourism ratios 9 1.6 Systems boundaries 10 2.