CDP Russia Climate Change Report 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Expiry Notice

Expiry Notice 19 January 2018 London Stock Exchange Derivatives Expiration prices for IOB Derivatives Please find below expiration prices for IOB products expiring in January 2018: Underlying Code Underlying Name Expiration Price AFID AFI DEVELOPMENT PLC 0.1800 ATAD PJSC TATNEFT 58.2800 FIVE X5 RETAIL GROUP NV 39.2400 GAZ GAZPROM NEFT 23.4000 GLTR GLOBALTRANS INVESTMENT PLC 9.9500 HSBK JSC HALYK SAVINGS BANK OF KAZAKHSTAN 12.4000 HYDR PJSC RUSHYDRO 1.3440 KMG JSC KAZMUNAIGAS EXPLORATION PROD 12.9000 LKOD PJSC LUKOIL 67.2000 LSRG LSR GROUP 2.9000 MAIL MAIL.RU GROUP LIMITED 32.0000 MFON MEGAFON 9.2000 MGNT PJSC MAGNIT 26.4000 MHPC MHP SA 12.8000 MDMG MD MEDICAL GROUP INVESTMENTS PLC 10.5000 MMK OJSC MAGNITOGORSK IRON AND STEEL WORKS 10.3000 MNOD MMC NORILSK NICKEL 20.2300 NCSP PJSC NOVOROSSIYSK COMM. SEA PORT 12.9000 NLMK NOVOLIPETSK STEEL 27.4000 NVTK OAO NOVATEK 128.1000 OGZD GAZPROM 5.2300 PLZL POLYUS PJSC 38.7000 RIGD RELIANCE INDUSTRIES 28.7000 RKMD ROSTELEKOM 6.9800 ROSN ROSNEFT OJSC 5.7920 SBER SBERBANK 18.6900 SGGD SURGUTNEFTEGAZ 5.2450 SMSN SAMSUNG ELECTRONICS CO 1148.0000 SSA SISTEMA JSFC 4.4200 SVST PAO SEVERSTAL 16.8200 TCS TCS GROUP HOLDING 19.3000 TMKS OAO TMK 5.4400 TRCN PJSC TRANSCONTAINER 8.0100 VTBR JSC VTB BANK 1.9370 Underlying code Underlying Name Expiration Price D7LKOD YEAR 17 DIVIDEND LUKOIL FUTURE 3.2643 YEAR 17 DIVIDEND MMC NORILSK NICKEL D7MNOD 1.8622 FUTURE D7OGZD YEAR 17 DIVIDEND GAZPROM FUTURE 0.2679 D7ROSN YEAR 17 DIVIDEND ROSNEFT FUTURE 0.1672 D7SBER YEAR 17 DIVIDEND SBERBANK FUTURE 0.3980 D7SGGD YEAR 17 DIVIDEND SURGUTNEFTEGAZ FUTURE 0.1000 D7VTBR YEAR 17 DIVIDEND VTB BANK FUTURE 0.0414 Members are asked to note that reports showing exercise/assignments should be available by approx. -

Information Translation JSC Inter RAO 2014 Annual Report

1 Information translation JSC Inter RAO 2014 Annual Report Preliminarily approved by the Board of Directors of JSC Inter RAO on April 07, 2015 (Minutes No. 138 of the meeting of the Board of Directors dated April 09, 2015). Management Board Boris Kovalchuk Chairman Chief Accountant Alla Vaynilavichute 2 Table of content 1 Report overview ........................................................................................................................ 4 2 General information on Inter RAO Group .................................................................................. 8 2.1 About Inter RAO Group ..................................................................................................... 8 2.2 Group's key performance indicators ................................................................................. 14 2.3 Inter RAO Group on the energy market ........................................................................... 15 2.4 Associations and partnerships ......................................................................................... 15 3 Statement for JSC Inter RAO shareholders and other stakeholders ........................................ 18 4 Development strategy of Inter RAO Group and its implementation ......................................... 21 4.1 Strategy of the Company ................................................................................................. 21 4.2 Business model .............................................................................................................. -

Specialised Asset Management

specialised research and investment group Russian Power: The Greatest Sector Reform on Earth www.sprin-g.com November 2010 specialised research and investment group Specialised Research and Investment Group (SPRING) Manage Investments in Russian Utilities: - HH Generation - #1 among EM funds (12 Months Return)* #2 among EM funds (Monthly return)** David Herne - Portfolio Manager Previous positions: Member, Board of Directors - Unified Energy Systems, Federal Grid Company, RusHydro, TGK-1, TGK-2, TGK-4, OGK-3, OGK-5, System Operator, Aeroflot, etc. (2000-2008) Chairman, Committee for Strategy and Reform - Unified Energy Systems (2001-2008) Boston Consulting Group, Credit Suisse First Boston, Brunswick. * Top 10 (by 12 Months Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 30 September 2010 ** Top 10 (by Monthly Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 31 August 2010 2 specialised research and investment group Russian power sector reform: Privatization Pre-Reform Post-Reform Government Government 52% 1 RusHydro 1 FSK RAO ES RAO UES 58% 79% hydro generation HV distribution 53% Far East Holding control control Independent energos 53% 1 MRSK Holding 14 TGKs 0% (Bashkir, Novosibirsk, ~72 energos 0% generation (CHP) generation Irkutsk, Tat) 35 federal plants transmission thermal 11 MRSK distribution 51% hydro LV distribution 0% ~72 SupplyCos supply 6 OGKs other 0% generation 45% InterRAO 0% ~100 RepairCos Source: UES, Companies Data, SPRING research 3 specialised research -

Russian M&A Review 2017

Russian M&A review 2017 March 2018 KPMG in Russia and the CIS kpmg.ru 2 Russian M&A review 2017 Contents page 3 page 6 page 10 page 13 page 28 page 29 KEY M&A 2017 OUTLOOK DRIVERS OVERVIEW IN REVIEW FOR 2018 IN 2017 METHODOLOGY APPENDICES — Oil and gas — Macro trends and medium-term — Financing – forecasts sanctions-related implications — Appetite and capacity for M&A — Debt sales market — Cross-border M&A highlights — Sector highlights © 2018 KPMG. All rights reserved. Russian M&A review 2017 3 Overview Although deal activity increased by 13% in 2017, the value of Russian M&A Deal was 12% lower than the previous activity 13% year, at USD66.9 billion, mainly due to an absence of larger deals. This was in particular reflected in the oil and gas sector, which in 2016 was characterised by three large deals with a combined value exceeding USD28 billion. The good news is that investors have adjusted to the realities of sanctions and lower oil prices, and sought opportunities brought by both the economic recovery and governmental efforts to create a new industrial strategy. 2017 saw a significant rise in the number and value of deals outside the Deal more traditional extractive industries value 37% and utility sectors, which have historically driven Russian M&A. Oil and gas sector is excluded If the oil and gas sector is excluded, then the value of deals rose by 37%, from USD35.5 billion in 2016 to USD48.5 billion in 2017. USD48.5bln USD35.5bln 2016 2017 © 2018 KPMG. -

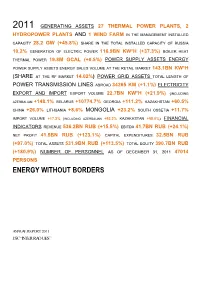

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

A N N U a L R E P O

ANNUAL2011 REPORT PIK Group Annual Report 2011 New Level of Development PIK Group at a glance Annual Report 2011 PIK Group 3 PIK Group at a glance RESPONSIBILITY STATEMENT We are a leading residential real estate developer in Russia, with OUR CORE ACTIVITIES ARE: BUSINESS HIGHLIGHTS a particular strategic focus on the Moscow Metropolitan Area. The development of residential Each of the Directors confirms that, to the best of his or real estate properties and sales A LEADING MASS MARKET RESIDENTIAL her knowledge: Our principal activity is the development, construction and sale of completed units. DEVELOPER IN RUSSIA WITH 17 YEAR (a) the financial statements, prepared in accordance of mass-market residential properties in the Russian real estate market. TRACK RECORD 1 with International Financial Reporting Standards and The construction of reinforced concrete panel housing, the requirements of Cypriot Companies Law, Cap. FINANCIAL FIGURES 113, in each case included in this Annual Report, give production and assembly of a true and fair view of the assets, liabilities, financial prefabricated panel residential position and profit and losses of the Company and buildings, including construction Around 10.5% market share1 in Moscow Metropolitan Area the undertakings included in the consolidation taken at our development sites and (MMA)2 in 2011 as a whole; and 46.0 bn RUR 9.4 bn RUR 11.7 bn RUR construction services provided Over 12 mln sqm of net selling area (NSA) completed since (b) the Management Report included in this Annual Revenue -

Notes on Moscow Exchange Index Review

Notes on Moscow Exchange index review Moscow Exchange approves the updated list of index components and free float ratios effective from 16 March 2018. X5 Retail Group N.V. (DRs) will be added to Moscow Exchange indices with the expected weight of 1.13 per cent. As these securities were offered initially, they were added without being in the waiting list under consideration. Thus, from 16 March the indices will comprise 46 (component stocks. The MOEX Russia and RTS Index moved to a floating number of component stocks in December 2017. En+ Group plc (DRs) will be in the waiting list to be added to Moscow Exchange indices, as their liquidity rose notably over recent three months. NCSP Group (ords) with low liquidity, ROSSETI (ords) and RosAgro PLC with their weights now below the minimum permissible level (0.2 per cent) will be under consideration to be excluded from the MOEX Russia Index and RTS Index. The Blue Chip Index constituents remain unaltered. X5 Retail Group (DRs), GAZ (ords), Obuvrus LLC (ords) and TNS energo (ords) will be added to the Broad Market Index, while Common of DIXY Group and Uralkali will be removed due to delisting expected. TransContainer (ords), as its free float sank below the minimum threshold of 5 per cent, and Southern Urals Nickel Plant (ords), as its liquidity ratio declined, will be also excluded. LSR Group (ords) will be incuded into SMID Index, while SOLLERS and DIXY Group (ords) will be excluded due to low liquidity ratio. X5 Retail Group (DRs) and Obuvrus LLC (ords) will be added to the Consumer & Retail Index, while DIXY Group (ords) will be removed from the Index. -

An Overview of Russian Ipos

www.pwc.ru/capital-markets An overview of Russian IPOs: 2005 to 2014 Listing centres, investment banks, legal counsels, auditors and issuers’ jurisdictions IPOs by listing centre (2005 – September 2014) IPOs on LSE by markets Number of IPOs Total (2005 – September 2014*) Listing centre Sept 2005 2006 2007 2008 2009 2010 2011 2012 2013 No. % 2014 Main Market (Premium) London Stock Exchange (LSE) 11 19 15 3 2 3 7 5 1 1 67 57 2 Moscow Exchange 3 7 14 3 1 7 - - 2 - 37 32 Alternative NASDAQ (US) - 1 - - - - 1 1 1 - 4 3 Investment 17 Deutsche Börse - 1 1 - - - 1 - - - 3 2 Market (AIM) NASDAQ OMX (Europe) - - 2 - - - - - - - 2 2 Hong Kong Stock Exchange (HKEX) - - - - - 2 - - - - 2 2 NYSE - - - - - - - 1 1 - 2 2 Number of IPOs* 14 28 32 6 3 12 9 7 5 1 117 100 * The overview contains a selection of Russian IPOs and may not be a full list of deals for the period. Issuers with IPOs on LSE subsequently moved to premium listing 48 Main Market (GDRs**) Issuer Original market / year Premium listing year Polyus Gold Main Market (GDRs) / 2006 2012 *Of the total 67 IPOs on LSE Polymetal International Main Market (GDRs) / 2007 2011 **Global Depositary Receipts EVRAZ Main Market (GDRs) / 2005 2011 AFI Development Main Market (GDRs) / 2007 2010 Raven Russia AIM / 2005 2010 IPOs by industry and listing centre (2005 – September 2014) 15 14 14 LSE Moscow Exchange NASDAQ (US) NASDAQ OMX (Europe) Deutsche Borse HKEX NYSE 2 1 2 1 11 4 10 10 4 2 2 1 8 1 3 6 6 12 2 7 1 5 Number of IPOs 9 4 4 4 8 8 5 1 3 3 1 5 5 5 5 1 1 4 2 3 3 1 2 1 1 1 Metals & Mining Financial -

An Overview of Boards of Directors at Russia's Largest Public Companies

An Overview Of Boards Of Directors At Russia’s Largest Public Companies Andrei Rakitin Milena Barsukova Arina Mazunova Translated from Russian August 2020 Key Results According to information disclosed by 109 of Russia’s largest public companies: “Classic” board compositions of 11, nine, and seven seats prevail The total number of persons on Boards of the companies under study is not as low as it might seem: 89% of all Directors were elected to only one such Board Female Directors account for 12% and are more often elected to the audit, nomination, and remuneration committees than to the strategy committee Among Directors, there are more “humanitarians” than “techies,” while the share of “techies” among chairs is greater than across the whole sample The average age for Directors is 53, 56 for Chairmen, and 58 for Independent Directors Generation X is the most visible on Boards, and Generation Y Directors will likely quickly increase their presence if the impetuous development of digital technologies continues The share of Independent Directors barely reaches 30%, and there is an obvious lack of independence on key committees such as audit Senior Independent Directors were elected at 17% of the companies, while 89% of Chairs are not independent The average total remuneration paid to the Board of Directors is RUR 69 million, with the difference between the maximum and minimum being 18 times Twenty-four percent of the companies disclosed information on individual payments made to their Directors. According to this, the average total remuneration is approximately RUR 9 million per annum for a Director, RUR 17 million for a Chair, and RUR 11 million for an Independent Director The comparison of 2020 findings with results of a similar study published in 2012 paints an interesting dynamic picture. -

a Leading Energy Company in the Nordic Area

- a leading energy company in the Nordic area Presentation for investors September 2007 Disclaimer This presentation does not constitute an invitation to underwrite, subscribe for, or otherwise acquire or dispose of any Fortum shares. Past performance is no guide to future performance, and persons needing advice should consult an independent financial adviser. 2 • Fortum today • European power markets • Russia • Financials / outlook • Supplementary material 3 Fortum's strategy Fortum focuses on the Nordic and Baltic Rim markets as a platform for profitable growth Become the leading Become the power and heat energy supplier company of choice Benchmark business performance 4 Presence in focus market areas Nordic Generation 53.2 TWh Electricity sales 60.2 TWh Distribution cust. 1.6 mill. Electricity cust. 1.3 mill. NW Russia Heat sales 20.1 TWh (in associated companies) Power generation ~6 TWh Heat production ~7 TWh Baltic countries Heat sales 1.0 TWh Poland Distribution cust. 23,000 Heat sales 3.6 TWh Electricity sales 8 GWh 2006 numbers 5 Fortum Business structure Fortum Markets Fortum's comparable Large operating profit in 2006 NordicNordic customers EUR 1,437 million Fortum wholesalewholesale Small Power marketmarket customers Generation Nord Pool and Markets 0% bilateral Other retail companies Deregulated Distribution 17% Regulated Transmission Power and system Fortum Heat 17% Generation services Distribution 66% 6 Strong financial position ROE (%) EPS, cont. (EUR) Total assets (EUR billion) 20 1.50 1.42 20.0 16.8 17.5 17.3 1.22 18 15.1 -

2008-062 Russia's Emerging Multinationals

Working Paper Series #2008-062 RUSSIA’S EMERGING MULTINATIONALS: TRENDS AND ISSUES Sergey Filippov United Nations University - Maastricht Economic and social Research and training centre on Innovation and Technology Keizer Karelplein 19, 6211 TC Maastricht, The Netherlands 1 Tel: (31) (43) 388 4400, Fax: (31) (43) 388 4499, e-mail: [email protected], URL: http://www.merit.unu.edu 2 RUSSIA’S EMERGING MULTINATIONALS: TRENDS AND ISSUES Sergey Filippov UNU-MERIT (United Nations University and Maastricht University) Keizer Karelplein 19, Maastricht, 6211TC, The Netherlands Tel: +31 43 3884400, e-mail: [email protected] Abstract: The paper focuses on the emergence of Russia’s multinational companies. It aims to analyse their motives to internationalise as well as the approaches to internationalisation. While relevance of the theoretical perspectives is highlighted, the intention of the paper is to contribute to the understanding of the present-day phenomenon of emerging Russian multinationals; a phenomenon that has been largely overshadowed by the remarkable rise of Chinese and Indian companies. A special attention is devoted to the R&D activities of Russian multinational companies, and access to foreign technology as a driver of corporate restructuring. A discussion of the challenges and opportunities for host countries and policy implications is provided. Keywords: Russia, multinational companies, emerging economies, foreign investment JEL codes: F21, F23, L21, O32 UNU-MERIT Working Papers ISSN 1871-9872 Maastricht Economic and social Research and training centre on Innovation and Technology, UNU-MERIT UNU-MERIT Working Papers intend to disseminate preliminary results of research carried out at the Centre to stimulate discussion on the issues raised. -

Cold-Rolled Steel, Russia, Preliminary Decision Memo

UNITI!C STATES DEPARTMENT OF COMMERCE International Trade Administration Washingt:on . D .C . 20230 C-821-823 Investigation POl: 0 1/0 1/2014 - 12/31/2014 Public Document Office Jll, Operations: KJ, SM, EBG December 15, 2015 MEMORANDUM TO: Paul Piquado Assistant Secretary for Enforcement and Compliance FROM: Christian Marsh a1v1 Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations SUBJECT: Decision Memorandum for the Preliminary Affirmative Determination, Preliminary Negative Critical Circumstances Determination, and Alignment of Final Detennination With Final Antidumping Duty Determination: Countervailing Duty Investigation of Certain Cold-Rolled Steel Flat Products from the Russian Federation I. SUMMARY The Department of Commerce (the Department) preliminarily determines that countervailable subsidies are being provided to producers and exporters of certain cold-rolled steel flat products (cold-rolled steel) from the Russjan Federation (Russia), as provided in section 703 of the Tariff Act of 1930, as amended (the Act). Additionally, the Department determines that critical circumstances do not exist with regard to cold-rolled steel from Russia, as provided under section 703(e)(l )(A) of the Act. ll. BACKGROUND A. Case History On July, 28, 2015. the Department received countervailing duty (CVD) and antidumping duty (AD) Petitions concerning imports of cold-rolled steel from Russia, fil ed on behalf of the AK Steel Corporation, ArcelorMinal USA EEC, Nucor Corporation, Steel Dynamics, Inc., and United States Steel Corporation (co11ectively, Petitioners).1 On August 17, 201 5, the Department 1 See " Petitions for the Imposition of Antidumping and Countervailing Duties: Certain Cold-Rolled Steel Flat Products from Brazil, the People's Republic of China, India, Japan.