Specialised Asset Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information Translation JSC Inter RAO 2014 Annual Report

1 Information translation JSC Inter RAO 2014 Annual Report Preliminarily approved by the Board of Directors of JSC Inter RAO on April 07, 2015 (Minutes No. 138 of the meeting of the Board of Directors dated April 09, 2015). Management Board Boris Kovalchuk Chairman Chief Accountant Alla Vaynilavichute 2 Table of content 1 Report overview ........................................................................................................................ 4 2 General information on Inter RAO Group .................................................................................. 8 2.1 About Inter RAO Group ..................................................................................................... 8 2.2 Group's key performance indicators ................................................................................. 14 2.3 Inter RAO Group on the energy market ........................................................................... 15 2.4 Associations and partnerships ......................................................................................... 15 3 Statement for JSC Inter RAO shareholders and other stakeholders ........................................ 18 4 Development strategy of Inter RAO Group and its implementation ......................................... 21 4.1 Strategy of the Company ................................................................................................. 21 4.2 Business model .............................................................................................................. -

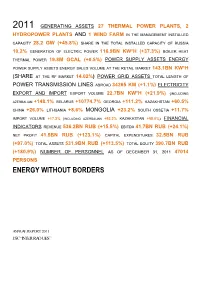

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

a Leading Energy Company in the Nordic Area

- a leading energy company in the Nordic area Presentation for investors September 2007 Disclaimer This presentation does not constitute an invitation to underwrite, subscribe for, or otherwise acquire or dispose of any Fortum shares. Past performance is no guide to future performance, and persons needing advice should consult an independent financial adviser. 2 • Fortum today • European power markets • Russia • Financials / outlook • Supplementary material 3 Fortum's strategy Fortum focuses on the Nordic and Baltic Rim markets as a platform for profitable growth Become the leading Become the power and heat energy supplier company of choice Benchmark business performance 4 Presence in focus market areas Nordic Generation 53.2 TWh Electricity sales 60.2 TWh Distribution cust. 1.6 mill. Electricity cust. 1.3 mill. NW Russia Heat sales 20.1 TWh (in associated companies) Power generation ~6 TWh Heat production ~7 TWh Baltic countries Heat sales 1.0 TWh Poland Distribution cust. 23,000 Heat sales 3.6 TWh Electricity sales 8 GWh 2006 numbers 5 Fortum Business structure Fortum Markets Fortum's comparable Large operating profit in 2006 NordicNordic customers EUR 1,437 million Fortum wholesalewholesale Small Power marketmarket customers Generation Nord Pool and Markets 0% bilateral Other retail companies Deregulated Distribution 17% Regulated Transmission Power and system Fortum Heat 17% Generation services Distribution 66% 6 Strong financial position ROE (%) EPS, cont. (EUR) Total assets (EUR billion) 20 1.50 1.42 20.0 16.8 17.5 17.3 1.22 18 15.1 -

Joining Efforts Annual Report 2018 | Joining Efforts

JOINING EFFORTS JOINING EFFORTS ANNUAL REPORT IDGC OF CENTER AND VOLGA REGION, PJSC ANNUAL REPORT 2018 | JOINING EFFORTS INFORMATION ABOUT THE REPORT The Annual Report of IDGC of Center and Volga Region for 2018 (hereinafter “the Annual Report”) represents the production and financial results and covers certain aspects of the Company’s corporate governance activities. The Annual Report also includes a brief disclosure of information about the Company’s activities associated with its sustainable growth using certain elements of the GRI Standards methodology, and identifying the UN goals, to which the Company is committed. A more detailed information disclosure on sustainable development issues in full compliance with the requirements of the GRI Standards methodology is provided as part of a specialized report published on the Company’s official website every two years (https://www.mrsk-cp.ru/stockholder_investor/ disclosure_reporting_info/sotsialnye-otchety/). The Annual Report was prepared based on the effective data available to the Company at the time of its drafting. Financial and economic indicators contained in the Annual Report comply with the IFRS, unless otherwise specified. In a number of sections of the Annual Report, figures for the previous periods and expectations, forecasts or plans of the Company regarding future periods are provided to demonstrate the dynamics of significant processes. The information disclosed in the Annual Report, with the exception of financial results under the IFRS, does not include subsidiaries and affiliates of IDGC of Center and Volga Region, as they do not have a significant impact neither on the Company’s performance indicators, nor on the results of its activities aimed at sustainable development. -

QUARTERLY REPORT Public Joint-Stock Company

QUARTERLY REPORT Public Joint-Stock Company Federal Hydrogeneration Company RusHydro Code of the Issuer: 55038-E for Q4 2015 Address of the Issuer: 43 Dubrovinskogo St., bldg. 1, Krasnoyarsk, Krasnoyarsk Krai, 660017. The information contained herein is subject to disclosure pursuant to the securities legislation of the Russian Federation Chairman of the Management Board ― General Director ___________________ N.G. Shulginov Date: 15.04.2016 signature _________________ D.V. Finkel Chief Accountant signature Date: 15.04.2016 Contact person: Roman Yurievich Sorokin, Head of Methodology of Corporate Governance and Property Management Department Tel.: +7 800 333 8000 Fax: +7(495) 225-3737 E-mail: [email protected] The address of the Internet site (sites) where the information contained herein is to be disclosed: www.rushydro.ru, http://www.e-disclosure.ru/portal/company.aspx?id=8580 1 Table of Contents Table of Contents .................................................................................................................................................... 2 I. Information on Bank Accounts, Auditor (Audit Organization), Appraiser, and Financial Advisor of the Issuer, as well as on Persons who Have Signed the Quarterly Report ................................................................................ 6 1.1. Information on the Issuer's Bank Accounts .................................................................................................. 6 1.2. Information on the Issuer's Auditor (Audit Organization) .......................................................................... -

ANNUAL GENERAL MEETING of SHAREHOLDERS Public Joint-Stock Company Inter RAO UES Location: Moscow, Russian Federation

ANNUAL GENERAL MEETING OF SHAREHOLDERS Public Joint-Stock Company INTER RAO UES May 21, 2018 Information (materials) provided in preparation for the AGM 2018 Contents NOTIFICATION ON HOLDING OF THE ANNUAL GENERAL MEETING OF SHAREHOLDERS .............. 3 VOTING AT THE GENERAL MEETING OF COMPANY SHAREHOLDERS .................................................... 7 RECOMMENDATIONS OF THE BOARD OF DIRECTORS AND VOTING PROCEDURE ON AGENDA ITEMS OF THE MEETING .......................................................................................................................................... 8 1. Approval of the Company's annual report ............................................................................................. 10 2. Approval of the Company's annual accounting (financial) statements ................................................ 11 3. Distribution of the Company's profit and loss ........................................................................................ 16 4. Payment (declaration) of dividends based on 2017 results .................................................................... 16 5. Payment of remuneration to Members of the Company Board of Directors ...................................... 23 6. Payment of remuneration to Members of the Company Revision Commission.................................. 24 7. Election of Members of the Company Board of Directors .................................................................... 25 8. Election of Members of the Revision Commission of the Company .................................................... -

2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility

INFORMATION TRANSLATION Draft 2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility Chairman of the Management Board Boris Kovalchuk Chief Accountant Alla Vainilavichute Contents 1. Strategic Report ...................................................................................................................................................................................... 8 1.1. At a Glance .................................................................................................................................................................................. 8 1.2. About the Report ........................................................................................................................................................................ 11 Differences from the Development Process of the 2016 Report ............................................................................................................ 11 Scope of Information ............................................................................................................................................................................. 11 Responsibility for the Report Preparation .............................................................................................................................................. 11 Statement on Liability Limitations ......................................................................................................................................................... -

Public Joint-Stock Company Issuer’S Code: 10214-A

QUARTERLY REPORT "Interregional Distribution Grid Company of Centre", Public Joint-Stock Company Issuer’s code: 10214-A for Quarter 1, 2016 Location of the issuer: 2nd Yamskaya, 4, Moscow, Russian Federation, 127018 The information containing in this quarterly report is subject to disclosure in accordance with the legislation of the Russian Federation on securities ____________ O.Y. Isaev General Director signature Date: 13 May 2016 Chief Accountant - Head of Financial and Tax Accounting and ____________ L.A. Sklyarova signature Reporting Department Date: 13 May 2016 Contact person: Principal Specialist of Corporate Office of the Department for Corporate Governance and Interaction with Shareholders, Yulia Dmitrievna Naumova Phone: (495) 747-9292 #3286 Fax: (495) 747-9295 E-mail: [email protected] Internet site used by the issuer for the information disclosure, containing in this quarterly report: http://www.e-disclosure.ru/portal/company.aspx?id=7985; http://www.mrsk-1.ru/ru/information/. 1 Table of contents Table of contents .............................................................................................................................................. 2 Introduction ...................................................................................................................................................... 5 Section I. Data on bank accounts, on the auditor, appraiser and financial adviser of the issuer, and also persons, who signed the quarterly report ........................................................................................................................ -

Identifying Russia's Structural Leaders

June 7, 2011 GS SUSTAIN Equity Research Identifying Russia’s structural leaders Identifying long-term winners with SUSTAIN Russia Structural Leaders List We have applied the GS SUSTAIN framework to We have identified eight companies that have RUSSIA STRUCTURAL LEADERS 75 companies across our Russian coverage to delivered and in our view will continue to deliver y identify those well positioned to deliver long-term industry leading cash returns: Mechel, EDCL, Company Sector quality quartile position quartile Management CROCI CROCI average 2011- % 13E, CROCI change 2006-10, % quartile CROCI outperformance through sustained high cash Alliance Oil, Rosneft and Novatek in the natural Novatek Energy 32.1% 0.3% 1 1 1 Oil Serv & Pipe Eurasia Drilling Co 28.2% -2.1% 2 1 1 returns. The framework combines forecast cash resources space and Magnit, Cherkizovo and M- producers Mechel Steel 21.9% -0.6% 2 1 1 returns with objective measures of industry Video in the consumer segment. Investing in this Alliance Oil CompaEnergy 17.4% 0.8% 2 1 1 Magnit (GDR) Consumer 17.1% -0.2% 2 1 1 positioning and management quality, which in a list of companies would have generated over Cherkizovo Group Consumer 16.1% 1.2% 2 1 2 M-VIDEO Consumer 15.0% 1.4% 2 1 2 Russian context focus predominantly on 300% outperformance vs. the MSCI Russia since Rosneft Energy 13.9% 1.0% 2 1 2 ownership and corporate governance issues. January 2006. RUSSIA STRUCTURAL LEADERS WATCH LIST Russia at the intersection of global structural Russia Structural Leaders Watch List Company Sector dust y CROCI average 2011-13E, % CROCI change 2006-10, % quartile CROCI position quartile Management quality quartile trends Disclosure remains sub par in many Russian Uralkali Mining 38.3% 2.4% 1 1 3 Globaltrans Transport 20.3% 2.3% 1 1 3 Oil Serv & Pipe Russia’s economy and equity market are corporates and is the main reason why a number ChelPipe 18.0% -1.3% 2 1 3 producers undergoing a dramatic transformation through of companies that are forecast to generate Mail.ru Group Ltd. -

3. Inter RAO Group Today | 11

10 | PJSC Inter RAO | 2016 Annual Report 3. INTER RAO GROUP TODAY The Group operates in the following segments: A leading electricity export and import operator in Rus- — Electricity and heat generation sia. The Inter RAO Group’s supply geography comprises — Electricity supply and heat supply Finland, Belarus, Lithuania, Latvia, Estonia, Poland, Nor- — International electricity trading way, Ukraine, Georgia, Azerbaijan, South Ossetia, Ka- A diversified energy holding company — Engineering, power equipment export zakhstan, China and Mongolia. managing assets in Russia, as well as — Management of electricity distribution grids outside Russia Effectively manages power supply companies – guaran- in European and CIS countries. teed suppliers in 12 regions of Russia. Since 2010, PJSC Inter RAO has been rated in the List of Strategic Enterprises and Strategic Joint Stock Compa- Owns independent suppliers of electricity to large indus- nies of the Russian Federation1. trial consumers. GENERATING ASSETS SUPPLY ACTIVITIES ELECTRICITY EXPORT in 2016 THERMAL POWER PLANTS 41 17.0bn kWh ELECTRICITY IMPORT HYDROPOWER PLANTS 62 (including 5 low capacity HPPs) 10 in 2016 IN 62 REGIONS OF RUSSIA bn kWh WIND FARMS 3.1 1 According to the Decree of the President of Russia No. 1190 dated 30.09.2010 PJSC Inter RAO was included in the List of Strategic Enterprises and Strategic Joint-Stock Companies (Section 2 of the List of Open Joint Stock Companies with its assets held in federal ownership managed by the Russian Federation in order to ensure strategic 2 interests of State defence and security, moral values, healthcare, rights and legitimate interests protection of the citizens of the Russian Federation). -

Testing Feasibility of Measuring Market Risk by Predicted Beta with Liquidity Adjustment1

Testing Feasibility of Measuring Market Risk by Predicted Beta with Liquidity Adjustment1 State University – Higher School of Economics Laboratory of Financial Markers Analysis Abstract The present paper assesses the CAPM predicted beta coefficient which is employed by a number of Russian investment companies in the calculation of a discount rate for future cash flows valuation. It is common practice to estimate the target stock price within the DCF method using the single-factor CAPM where the beta coefficient is the only measure of investment risk. A shift from the historical to the predicted beta coefficient is due to low liquidity of the majority of Russian stocks which results in rather low historical beta coefficients obtained by regressing on historical data. The paper assesses a new method of calculating the beta coefficient introduced by Aton Investment Company which dismisses company’s industry-specific characteristics while accentuating company’s size (measured by market capitalization) and liquidity (measured by the free-float coefficient). The sample size is 72 Russian stocks traded on the Russian Trading System (RTS) Stock Exchange. The sample period is from 2007 to the first half of 2008. Key words: CAPM, historical beta, free-float, adjusted beta, predicted beta adjusted for liquidity. 1 A working paper version. Problems in application of CAPM in emerging capital markets The single-factor equilibrium Capital Asset Pricing Model (CAPM) of the rate of return on equity and equity risk premium (ERP) remains the most popular one for setting a discount rate which is further used in calculating the equity (company) fair price within the Discounted Cash Flow method (DCF). -

Jsc Ogk-2 Annual Report 2017

JSC OGK-2 ANNUAL REPORT 2017 JSC OGK-2 ANNUAL REPORT 2017 This 2017 annual report (hereinafter referred to as the “Annual Report”) has been prepared using the information available to Joint-Stock Company “Second Wholesale Power Market Generating Company” (hereinafter, OGK-2, or the Company) at the time of its preparation. Some statements included in this Annual Report of the Company are forecasts for future events. Words such as “plans”, “will be”, “expected”, “will take place”, “estimates”, “will total”, “will occur”, and the like are forecasting by nature. Investors should not fully rely on the estimates and forecasts as they imply a risk of contradiction to reality. For this reason, the Company warns that the actual results or course of any events may significantly differ from forecast statements included in this annual report. Except as otherwise established by the applicable laws, the Company does not undertake to revise or confirm any expectations and estimates or publish updates and changes of forecast statements of the annual report as a result of any subsequent events or if new information becomes available. The information about the Company’s management staff is provided under the Federal Law No. 152-FZ “On Personal Data” dated July 27, 2006. 2 JSC OGK-2 ANNUAL REPORT 2017 Table of Contents 1. INFORMATION ABOUT THE COMPANY ............................................................................. 5 ADDRESS BY CHAIRMAN OF THE BOARD OF DIRECTORS OF JSC OGK-2, DIRECTOR GENERAL OF GAZPROM ENERGOHOLDING LLC D.V. FEDOROV ..... 10 ADDRESS BY DIRECTOR GENERAL OF JSC OGK-2 S.A. ANANYEV ........................ 11 1.1. Business Model ....................................................................................................................................... 12 1.2.