E P R G W O R K in G P a P

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Specialised Asset Management

specialised research and investment group Russian Power: The Greatest Sector Reform on Earth www.sprin-g.com November 2010 specialised research and investment group Specialised Research and Investment Group (SPRING) Manage Investments in Russian Utilities: - HH Generation - #1 among EM funds (12 Months Return)* #2 among EM funds (Monthly return)** David Herne - Portfolio Manager Previous positions: Member, Board of Directors - Unified Energy Systems, Federal Grid Company, RusHydro, TGK-1, TGK-2, TGK-4, OGK-3, OGK-5, System Operator, Aeroflot, etc. (2000-2008) Chairman, Committee for Strategy and Reform - Unified Energy Systems (2001-2008) Boston Consulting Group, Credit Suisse First Boston, Brunswick. * Top 10 (by 12 Months Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 30 September 2010 ** Top 10 (by Monthly Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 31 August 2010 2 specialised research and investment group Russian power sector reform: Privatization Pre-Reform Post-Reform Government Government 52% 1 RusHydro 1 FSK RAO ES RAO UES 58% 79% hydro generation HV distribution 53% Far East Holding control control Independent energos 53% 1 MRSK Holding 14 TGKs 0% (Bashkir, Novosibirsk, ~72 energos 0% generation (CHP) generation Irkutsk, Tat) 35 federal plants transmission thermal 11 MRSK distribution 51% hydro LV distribution 0% ~72 SupplyCos supply 6 OGKs other 0% generation 45% InterRAO 0% ~100 RepairCos Source: UES, Companies Data, SPRING research 3 specialised research -

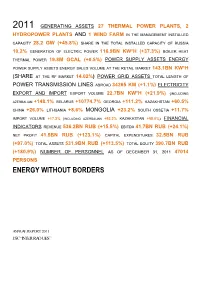

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

a Leading Energy Company in the Nordic Area

- a leading energy company in the Nordic area Presentation for investors September 2007 Disclaimer This presentation does not constitute an invitation to underwrite, subscribe for, or otherwise acquire or dispose of any Fortum shares. Past performance is no guide to future performance, and persons needing advice should consult an independent financial adviser. 2 • Fortum today • European power markets • Russia • Financials / outlook • Supplementary material 3 Fortum's strategy Fortum focuses on the Nordic and Baltic Rim markets as a platform for profitable growth Become the leading Become the power and heat energy supplier company of choice Benchmark business performance 4 Presence in focus market areas Nordic Generation 53.2 TWh Electricity sales 60.2 TWh Distribution cust. 1.6 mill. Electricity cust. 1.3 mill. NW Russia Heat sales 20.1 TWh (in associated companies) Power generation ~6 TWh Heat production ~7 TWh Baltic countries Heat sales 1.0 TWh Poland Distribution cust. 23,000 Heat sales 3.6 TWh Electricity sales 8 GWh 2006 numbers 5 Fortum Business structure Fortum Markets Fortum's comparable Large operating profit in 2006 NordicNordic customers EUR 1,437 million Fortum wholesalewholesale Small Power marketmarket customers Generation Nord Pool and Markets 0% bilateral Other retail companies Deregulated Distribution 17% Regulated Transmission Power and system Fortum Heat 17% Generation services Distribution 66% 6 Strong financial position ROE (%) EPS, cont. (EUR) Total assets (EUR billion) 20 1.50 1.42 20.0 16.8 17.5 17.3 1.22 18 15.1 -

QUARTERLY REPORT Public Joint-Stock Company

QUARTERLY REPORT Public Joint-Stock Company Federal Hydrogeneration Company RusHydro Code of the Issuer: 55038-E for Q4 2015 Address of the Issuer: 43 Dubrovinskogo St., bldg. 1, Krasnoyarsk, Krasnoyarsk Krai, 660017. The information contained herein is subject to disclosure pursuant to the securities legislation of the Russian Federation Chairman of the Management Board ― General Director ___________________ N.G. Shulginov Date: 15.04.2016 signature _________________ D.V. Finkel Chief Accountant signature Date: 15.04.2016 Contact person: Roman Yurievich Sorokin, Head of Methodology of Corporate Governance and Property Management Department Tel.: +7 800 333 8000 Fax: +7(495) 225-3737 E-mail: [email protected] The address of the Internet site (sites) where the information contained herein is to be disclosed: www.rushydro.ru, http://www.e-disclosure.ru/portal/company.aspx?id=8580 1 Table of Contents Table of Contents .................................................................................................................................................... 2 I. Information on Bank Accounts, Auditor (Audit Organization), Appraiser, and Financial Advisor of the Issuer, as well as on Persons who Have Signed the Quarterly Report ................................................................................ 6 1.1. Information on the Issuer's Bank Accounts .................................................................................................. 6 1.2. Information on the Issuer's Auditor (Audit Organization) .......................................................................... -

2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility

INFORMATION TRANSLATION Draft 2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility Chairman of the Management Board Boris Kovalchuk Chief Accountant Alla Vainilavichute Contents 1. Strategic Report ...................................................................................................................................................................................... 8 1.1. At a Glance .................................................................................................................................................................................. 8 1.2. About the Report ........................................................................................................................................................................ 11 Differences from the Development Process of the 2016 Report ............................................................................................................ 11 Scope of Information ............................................................................................................................................................................. 11 Responsibility for the Report Preparation .............................................................................................................................................. 11 Statement on Liability Limitations ......................................................................................................................................................... -

Public Joint-Stock Company Issuer’S Code: 10214-A

QUARTERLY REPORT "Interregional Distribution Grid Company of Centre", Public Joint-Stock Company Issuer’s code: 10214-A for Quarter 1, 2016 Location of the issuer: 2nd Yamskaya, 4, Moscow, Russian Federation, 127018 The information containing in this quarterly report is subject to disclosure in accordance with the legislation of the Russian Federation on securities ____________ O.Y. Isaev General Director signature Date: 13 May 2016 Chief Accountant - Head of Financial and Tax Accounting and ____________ L.A. Sklyarova signature Reporting Department Date: 13 May 2016 Contact person: Principal Specialist of Corporate Office of the Department for Corporate Governance and Interaction with Shareholders, Yulia Dmitrievna Naumova Phone: (495) 747-9292 #3286 Fax: (495) 747-9295 E-mail: [email protected] Internet site used by the issuer for the information disclosure, containing in this quarterly report: http://www.e-disclosure.ru/portal/company.aspx?id=7985; http://www.mrsk-1.ru/ru/information/. 1 Table of contents Table of contents .............................................................................................................................................. 2 Introduction ...................................................................................................................................................... 5 Section I. Data on bank accounts, on the auditor, appraiser and financial adviser of the issuer, and also persons, who signed the quarterly report ........................................................................................................................ -

3. Inter RAO Group Today | 11

10 | PJSC Inter RAO | 2016 Annual Report 3. INTER RAO GROUP TODAY The Group operates in the following segments: A leading electricity export and import operator in Rus- — Electricity and heat generation sia. The Inter RAO Group’s supply geography comprises — Electricity supply and heat supply Finland, Belarus, Lithuania, Latvia, Estonia, Poland, Nor- — International electricity trading way, Ukraine, Georgia, Azerbaijan, South Ossetia, Ka- A diversified energy holding company — Engineering, power equipment export zakhstan, China and Mongolia. managing assets in Russia, as well as — Management of electricity distribution grids outside Russia Effectively manages power supply companies – guaran- in European and CIS countries. teed suppliers in 12 regions of Russia. Since 2010, PJSC Inter RAO has been rated in the List of Strategic Enterprises and Strategic Joint Stock Compa- Owns independent suppliers of electricity to large indus- nies of the Russian Federation1. trial consumers. GENERATING ASSETS SUPPLY ACTIVITIES ELECTRICITY EXPORT in 2016 THERMAL POWER PLANTS 41 17.0bn kWh ELECTRICITY IMPORT HYDROPOWER PLANTS 62 (including 5 low capacity HPPs) 10 in 2016 IN 62 REGIONS OF RUSSIA bn kWh WIND FARMS 3.1 1 According to the Decree of the President of Russia No. 1190 dated 30.09.2010 PJSC Inter RAO was included in the List of Strategic Enterprises and Strategic Joint-Stock Companies (Section 2 of the List of Open Joint Stock Companies with its assets held in federal ownership managed by the Russian Federation in order to ensure strategic 2 interests of State defence and security, moral values, healthcare, rights and legitimate interests protection of the citizens of the Russian Federation). -

Testing Feasibility of Measuring Market Risk by Predicted Beta with Liquidity Adjustment1

Testing Feasibility of Measuring Market Risk by Predicted Beta with Liquidity Adjustment1 State University – Higher School of Economics Laboratory of Financial Markers Analysis Abstract The present paper assesses the CAPM predicted beta coefficient which is employed by a number of Russian investment companies in the calculation of a discount rate for future cash flows valuation. It is common practice to estimate the target stock price within the DCF method using the single-factor CAPM where the beta coefficient is the only measure of investment risk. A shift from the historical to the predicted beta coefficient is due to low liquidity of the majority of Russian stocks which results in rather low historical beta coefficients obtained by regressing on historical data. The paper assesses a new method of calculating the beta coefficient introduced by Aton Investment Company which dismisses company’s industry-specific characteristics while accentuating company’s size (measured by market capitalization) and liquidity (measured by the free-float coefficient). The sample size is 72 Russian stocks traded on the Russian Trading System (RTS) Stock Exchange. The sample period is from 2007 to the first half of 2008. Key words: CAPM, historical beta, free-float, adjusted beta, predicted beta adjusted for liquidity. 1 A working paper version. Problems in application of CAPM in emerging capital markets The single-factor equilibrium Capital Asset Pricing Model (CAPM) of the rate of return on equity and equity risk premium (ERP) remains the most popular one for setting a discount rate which is further used in calculating the equity (company) fair price within the Discounted Cash Flow method (DCF). -

QUARTERLY REPORT JSC Interregional Distribution Grid

QUARTERLY REPORT JSC Interregional Distribution Grid Companies Holding Issuer Code: 55385-Е Quarter 3 of 2012 Registered address of the issuer: Russia, 107996, Moscow, Ulansky pereulok, 26 The information contained in this Quarterly Report is subject to disclosure in accordance with the securities laws of the Russian Federation Executive Director of JSC IDGC Holding ____________ A. Ye. Murov signature Details of the agreement whereby the powers of the issuer’s sole executive body were transferred: Agreement No. 1007 of July 10, 2012, valid until July 9, 2013 Power of Attorney of September 12, 2012, valid until September 11, 2013 Date: November 14, 2012 Chief Accountant ____________ G. I. Zhabbarova signature Date: November 12, 2012 Contact person: Kseniya Valerievna Khokholkova, Head of the Information Disclosure Unit of the Department for Corporate Governance and Shareholder Relations Telephone: (495) 995-5333 #5595 Fax: (495) 620-1755 E-mail: [email protected] The information contained in this Quarterly Report is available on the Internet at www.holding-mrsk.ru / http://www.e-disclosure.ru/portal/company.aspx?id=13806 1 Contents Contents................................................................................................................................................................... 2 Introduction............................................................................................................................................................. 5 I. Brief Information Concerning Individual Members of -

INTER RAO Share Placement Price – 0.0535 RUB

Additional share issue Fundamentals Basic results of Private placement : INTER RAO share placement price – 0.0535 RUB Number of shares issued – 13,800,000,000,000 common shares Total number of shares placed with the participants of private placement – 6,822,972,629,771 shares. A total of 49.4% of newly issued shares were placed Number of shares placed with Inter RAO Capital – 2,917,890,939,501 (including shares for deal with Norilsk Nickel, stock option program and future deals) Final volume of Inter RAO’s authorized capital after private placement - 9,716,000,000,000 ordinary shares (increase by a factor of 3.36) Value of the share capital of the Company - 272.997 billion RUB* Total value of assets acquired by Inter RAO within the private placement: • Shares of utility companies - 283.2 bn RUB** • Cash – 81.8 bn RUB Share of government and state-owned companies in the authorized capital of Inter RAO amounts to 60%; Registration of additional share placement report by Federal Service for Financial Markets is planned for June 2011 Newly issued shares should start trading in June 2011 and merge into main symbol in October 2011 (MICEX) * Par value of 1 share - 0.02809767 RUB ** Value of assets based on independent appraisers. It does not include assets that might be received by INTER RAO’ s subsidiaries (closed subscription participants) after May, 17 2 Ownership structure Equity structure before Equity structure to May 17, 2011 Target equity structure after deals placement Minority finalization shareholders Federal Property Federal Property -

KYMENLAAKSON AMMATTIKORKEAKOULU University of Applied Sciences Energy Engineering Double Degree / Specialization

KYMENLAAKSON AMMATTIKORKEAKOULU University of Applied Sciences Energy Engineering Double Degree / Specialization Iuliia Gerlitc Rinat Biktuganov A REVIEW TO WIND ENERGY UTILIZATION IN NORTH-WEST RUSSIA Bachelor’s Thesis 2013 ABSTRACT KYMENLAAKSON AMMATTIKORKEAKOULU University of Applied Sciences Energy Engineering Gerlitc Iuliia Biktuganov Rinat A Review to Wind Energy Utilization in North-West Russia Bachelor’s Thesis 79 pages + 1 page of appendices Supervisor Mäkelä Merja, Principal Lecturer Commissioned by Empower Oy November 2013 Keywords Wind turbines, electrical grid, and grid connection The problem of using renewable energy sources is studied in this thesis work. The at- tention is concentrated on the feasibilities of using the wind energy in the North-West Russia and on some problems which can appear. Some of them are the place of a pos- sible wind farm, laws of new sources connection, and the protection of the electrical grid. The aim of the work was to realize the possibility of inserting new energy resources into the Russian electrical grid and the importance of using renewables. An answer was sought to the question why the country network had no changes for a long time and what factors are preventing the changes. The study was carried out with the help of technical encyclopedias and energy com- panies official websites. Some information was retrieved through the conversation with specialists from the largest Russian energy companies. The idea of inserting new energy resources in the Russian economy looks very prom- ising. Naturally, some investments and time are needed. In the next few years the problem of renewables will become very actual and then this work will be very useful. -

INTER RAO UES Generating Assets: Target Shareholding Structure

INTER RAO UES Generating Assets: Target Shareholding Structure March,16 2012 1. Strategy recap and update INTER RAO at a Glance A Leading Russian Power Company Diversified Group Structure . Diversified power holding involved in electricity/heat generation and supply, export/import of electricity and engineering . Operates and manages 27 thermal, 2 hydro power plants and 1 wind power farm Domestic Engineering . Total installed electricity capacity of 29GW and electricity output of Generation Trading Supply International 117 TWh⁽¹⁾ in 2011 . INTER RAO – . RAO Nordic Oy . 9 supply companies . Generation: . Quartz Group . 2 Hydro PP - 0.2 GW Electrogeneration (Finland) . Customer base: . 4 Thermal PP - 5.2 GW . JV with Worley Leading Russian export-import operator accounting for 97% of Russian (100%) . Kazenergoresurs . 1 wind power farm - Parsons electricity export in 2011 . 314 thousand 0.03 GW . OGK-1 (75%) (Kazakhstan) legal entities and . Distribution . JV with Rosatom . OGK-3 (82%) . TGR Enerji (Turkey) . c. 34 ths. km of power . Operations in over 14 countries, including Russia, Belarus, Lithuania, 9.8 million . JV with GE lines (Georgia, residential . TGK-11 (68%) . INTER RAO Lietuva Armenia) Georgia, Armenia, Kazakhstan, Tajikistan, Moldova, and Finland . EMAlliance (the Baltics) customers Engineering (2) . Listed on RTS and MICEX (List A1), MCAP of $10.2bn. Shares are (2) included into MSCI Large Caps Index (0,54%) . GDRs admitted to LSE trading Ownership Structure Broad Geographical Coverage INTER RAO UES Finland Generation Assets