Osos Sobre Toro

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Submission to the Nuclear Fuel Cycle Royal Commission

Roman Oszanski A Submission to the Nuclear Fuel Cycle Royal Commission Preamble I have chosen not to follow the issues papers: their questions are more suited to those planning to expand the nuclear industry, and many of the issues raised are irrelevant if one believes that, based on the evidence, the industry should be left to die a natural death, rather than being supported to the exclusion of more promising technologies. Executive Summary The civil nuclear industry is in decline globally. [Ref charts on existing reactors, rising costs]. It is not an industry of the future, but of the past. If it were not for the intimate connection to the military industry, it would not exist today. There is no economic advantage to SA in expanding the existing industry in this state. Nuclear power does not offer a practical solution to climate change: total lifetime emissions are likely to be (at best) similar to those of gas power plants, and there is insufficient uranium to replace all the goal fired generators. A transition to breeder technologies leaves us with major problems of waste disposal and proliferation of weapons material. Indeed, the problems of weapons proliferation and the black market in fissionable materials mean that we should limit sales of Uranium to countries which are known proliferation risks, or are non- signatories to the NNPT: we should ban sales of Australian Uranium to Russia and India. There is a current oversupply of enrichment facilities, and there is considerable international concern at the possibility of using such facilities to enrich Uranium past reactor grade to weapons grade. -

HON. GIZ WATSON B. 1957

PARLIAMENTARY HISTORY ADVISORY COMMITTEE AND STATE LIBRARY OF WESTERN AUSTRALIA TRANSCRIPT OF AN INTERVIEW WITH HON. GIZ WATSON b. 1957 - STATE LIBRARY OF WESTERN AUSTRALIA - ORAL HISTORY COLLECTION DATE OF INTERVIEW: 2015-2016 INTERVIEWER: ANNE YARDLEY TRANSCRIBER: ANNE YARDLEY DURATION: 19 HOURS REFERENCE NUMBER: OH4275 COPYRIGHT: PARLIAMENT OF WESTERN AUSTRALIA & STATE LIBRARY OF WESTERN AUSTRALIA. GIZ WATSON INTERVIEW TRANSCRIPTS NOTE TO READER Readers of this oral history memoir should bear in mind that it is a verbatim transcript of the spoken word and reflects the informal, conversational style that is inherent in such historical sources. The Parliament and the State Library are not responsible for the factual accuracy of the memoir, nor for the views expressed therein; these are for the reader to judge. Bold type face indicates a difference between transcript and recording, as a result of corrections made to the transcript only, usually at the request of the person interviewed. FULL CAPITALS in the text indicate a word or words emphasised by the person interviewed. Square brackets [ ] are used for insertions not in the original tape. ii GIZ WATSON INTERVIEW TRANSCRIPTS CONTENTS Contents Pages Introduction 1 Interview - 1 4 - 22 Parents, family life and childhood; migrating from England; school and university studies – Penrhos/ Murdoch University; religion – Quakerism, Buddhism; countryside holidays and early appreciation of Australian environment; Anti-Vietnam marches; civil-rights movements; Activism; civil disobedience; sport; studying environmental science; Albany; studying for a trade. Interview - 2 23 - 38 Environmental issues; Campaign to Save Native Forests; non-violent Direct Action; Quakerism; Alcoa; community support and debate; Cockburn Cement; State Agreement Acts; campaign results; legitimacy of activism; “eco- warriors”; Inaugural speech . -

Dollars for Death Say No to Uranium Mining & Nuclear Power

Dollars for Death Say No to Uranium Mining & Nuclear Power Jim Green & Others 2 Dollars for Death Contents Preface by Jim Green............................................................................3 Uranium Mining ...................................................................................5 Uranium Mining in Australia by Friends of the Earth, Australia..........................5 In Situ Leach Uranium Mining Far From ‘Benign’ by Gavin Mudd.....................8 How Low Can Australia’s Uranium Export Policy Go? by Jim Green................10 Uranium & Nuclear Weapons Proliferation by Jim Falk & Bill Williams..........13 Nuclear Power ...................................................................................16 Ten Reasons to Say ‘No’ to Nuclear Power in Australia by Friends of the Earth, Australia...................................................................16 How to Make Nuclear Power Safe in Seven Easy Steps! by Friends of the Earth, Australia...................................................................18 Japan: One Year After Fukushima, People Speak Out by Daniel P. Aldrich......20 Nuclear Power & Water Scarcity by Sue Wareham & Jim Green........................23 James Lovelock & the Big Bang by Jim Green......................................................25 Nuclear Waste ....................................................................................28 Nuclear Power: Watt a Waste .............................................................................28 Nuclear Racism .................................................................................31 -

Mann, Monique& Rimmer, Matthew (2016) Submission to the Senate Economics References Committee on the 2016 Census

This may be the author’s version of a work that was submitted/accepted for publication in the following source: Mann, Monique& Rimmer, Matthew (2016) Submission to the Senate Economics References Committee on the 2016 Census. This file was downloaded from: https://eprints.qut.edu.au/99687/ c Copyright 2016 Monique Mann and Matthew Rimmer This work is covered by copyright. Unless the document is being made available under a Creative Commons Licence, you must assume that re-use is limited to personal use and that permission from the copyright owner must be obtained for all other uses. If the docu- ment is available under a Creative Commons License (or other specified license) then refer to the Licence for details of permitted re-use. It is a condition of access that users recog- nise and abide by the legal requirements associated with these rights. If you believe that this work infringes copyright please provide details by email to [email protected] Notice: Please note that this document may not be the Version of Record (i.e. published version) of the work. Author manuscript versions (as Sub- mitted for peer review or as Accepted for publication after peer review) can be identified by an absence of publisher branding and/or typeset appear- ance. If there is any doubt, please refer to the published source. September 2016 SUBMISSION TO THE SENATE ECONOMICS REFERENCES COMMITTEE ON THE 2016 CENSUS DR MONIQUE MANN LECTURER SCHOOL OF JUSTICE FACULTY OF LAW QUEENSLAND UNIVERSITY OF TECHNOLOGY DR MATTHEW RIMMER PROFESSOR OF INTELLECTUAL PROPERTY -

Take Heart and Name WA's New Federal Seat Vallentine 2015 Marks 30 Years Since Jo Vallentine Took up Her Senate Position

Take heart and name WA’s new federal seat Vallentine 2015 marks 30 years since Jo Vallentine took up her senate position, the first person in the world to be elected on an anti-nuclear platform. What better way to acknowledge her contribution to peace, nonviolence and protecting the planet than to name a new federal seat after her? The official Australian parliament website describes Jo Vallentine in this way: Jo Vallentine was elected in 1984 to represent Western Australia in the Senate for the Nuclear Disarmament Party, running with the slogan ‘Take Heart—Vote Vallentine’. She commenced her term in July 1985 as an Independent Senator for Nuclear Disarmament, claiming in her first speech that she was the first member of any parliament in the world to be elected on this platform. When she stood for election again in 1990, she was elected as a senator for The Greens (Western Australia), and was the first Green in the Australian Senate. … During her seven years in Parliament, Vallentine was a persistent voice for peace, nuclear disarmament, Aboriginal land rights, social justice and the environment (emphasis added)i. Jo Vallentine’s parliamentary and subsequent career should be recognised in the named seat of Vallentine because: 1. Jo Vallentine was the first woman or person in several roles, in particular: The first person in the world to win a seat based on a platform of nuclear disarmament The first person to be elected to federal parliament as a Greens party politician. The Greens are now Australia’s third largest political party, yet no seat has been named after any of their political representatives 2. -

Chain-Reaction-#114-April-2012.Pdf

Issue #114 | April 2012 RRP $5.50 The National Magazine of Friends of the Earth Australia www.foe.org.au ukushima fone year on • Occupy Texas Can we save the • Fighting Ferguson’s nuclear dump Murray-Darling? • A smart grid and seven energy sources • How low can uranium export policy go? 1 Chain Reaction #114 April 2012 Contents Edition #114 − April 2012 Regular items Publisher FoE Australia News 4 FoE Australia Contacts Friends of the Earth, Australia Chain Reaction ABN 81600610421 FoE Australia ABN 18110769501 FoE International News 8 inside back cover www.foe.org.au youtube.com/user/FriendsOfTheEarthAUS Features twitter.com/FoEAustralia facebook.com/pages/Friends-of-the-Earth- MURRAY-DARLING NUCLEAR POWER & FUKUSHIMA Australia/16744315982 AND RIVER RED GUMS Fighting Ferguson’s Dump 20 flickr.com/photos/foeaustralia Can we save the Natalie Wasley Chain Reaction website Murray-Darling Basin? 10 Global Conference for a www.foe.org.au/chain-reaction Jonathan La Nauze Nuclear Power Free World 22 Climate change and the Cat Beaton and Peter Watts Chain Reaction contact details Murray-Darling Plan 13 Fukushima − one year on: PO Box 222,Fitzroy, Victoria, 3065. Jamie Pittock photographs 24 email: [email protected] phone: (03) 9419 8700 River Red Gum vegetation Australia’s role in the survey project 14 Fukushima disaster 26 Chain Reaction team Aaron Eulenstein Jim Green Jim Green, Kim Stewart, Georgia Miller, Rebecca Pearse, Who is to blame for the Richard Smith, Elena McMaster, Tessa Sellar MIC CHECK: Fukushima nuclear disaster? 28 Layout -

A Report on the Erosion of Press Freedom in Australia

BREAKING: A report on the erosion of press freedom in Australia REPORT WRITTEN BY: SCOTT LUDLAM AND DAVID PARIS Press Freedom in Australia 2 Our Right to a Free Press 3 Law Enforcement and Intelligence Powers 4 Surveillance 7 Detention of Australian Journalists and Publishers 10 Freedom of Information 11 CONTENTS Defamation Law 12 The Australian Media Market 13 ABC at Risk 14 Fair and Balanced Legislation Proposal 15 How Does Australia Compare Internationally? 16 What Can We Do? 17 A Media Freedom Act 18 About the Authors: David Paris and Scott Ludlam 19 References 20 1 PRESS FREEDOM IN AUSTRALIA “Freedom of information journalists working on national is the freedom that allows security issues, and the privacy of the Australian public. Australians you to verify the existence are now among the most heavily of all the other freedoms.” surveilled populations in the world. - Win Tin, Burmese journalist. Law enforcement agencies can access extraordinary amounts In June 2019, the Australian of information with scant Federal Police raided the ABC and judicial oversight, and additional the home of a journalist from the safeguards for journalists within Daily Telegraph. These alarming these regimes are narrowly raids were undertaken because framed and routinely bypassed. of journalists doing their jobs reporting on national security Australia already lagged behind issues in the public interest, in when it comes to press freedom. part enabled by whistleblowers We are the only democracy on inside government agencies. the planet that has not enshrined the right to a free press in our This was just the latest step in constitution or a charter or bill what has been a steady erosion of rights. -

Collection Name

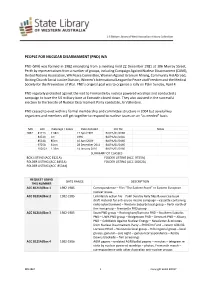

PEOPLE FOR NUCLEAR DISARMAMENT (PND) WA PND (WA) was formed in 1982 emanating from a meeting held 22 December 1981 at 306 Murray Street, Perth by representatives from a number of groups, including Campaign Against Nuclear Disarmament (CANE), United Nations Association, WA Peace Committee, Women Against Uranium Mining, Community Aid Abroad, Uniting Church Social Justice Division, Women’s International League for Peace and Freedom and the Medical Society for the Prevention of War. PND’s original goal was to organise a rally on Palm Sunday, April 4. PND regularly protested against the visit to Fremantle by nuclear powered warships and conducted a campaign to have the US military base at Exmouth closed down. They also assisted in the successful election to the Senate of Nuclear Disarmament Party candidate, Jo Vallentine. PND ceased to exist within a formal membership and committee structure in 2004 but several key organizers and members still get together to respond to nuclear issues on an “as needed” basis. MN ACC meterage / boxes Date donated CIU file Notes 2867 8121A 2.38m 17 April 1991 BA/PA/01/0166 8451A 1m 1996 BA/PA/01/0166 8534A 85cm 16 April 2009 BA/PA/01/0166 9725A 61cm 28 December 2011 BA/PA/01/0166 10202A 1.36m 14 January 2016 BA/PA/01/0166 SUMMARY OF CLASSES BOX LISTING (ACC 8121A) FOLDER LISTING (ACC 9725A) FOLDER LISTING (ACC 8451A) FOLDER LISTING (ACC 10202A) FOLDER LISTING (ACC 8534A) REQUEST USING DATE RANGE DESCRIPTION THIS NUMBER ACC 8121A/Box 1 1982-1985 Correspondence – File; “The Eastern Front” re Eastern European nuclear -

Leadership and the Australian Greens

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Online @ ECU Edith Cowan University Research Online ECU Publications Post 2013 1-1-2014 Leadership and the Australian Greens Christine Cunningham Edith Cowan University, [email protected] Stewart Jackson Follow this and additional works at: https://ro.ecu.edu.au/ecuworkspost2013 Part of the Leadership Studies Commons, and the Political Science Commons 10.1177/1742715013498407 This is an Author's Accepted Manuscript of: Cunningham, C., & Jackson, S. (2014). Leadership and the Australian Greens. Leadership, 10(4), 496-511. Reprinted by permission of SAGE Publications. Available here. This Journal Article is posted at Research Online. https://ro.ecu.edu.au/ecuworkspost2013/26 Leadership and the Australian Greens Christine Cunningham School of Education, Education and the Arts Faculty, Edith Cowan University, Australia Stewart Jackson Department of Government and International Relations, Faculty of Arts, The University of Sydney, Australia Abstract This paper examines the inherent tension between a Green political party’s genesis and official ideology and the conventional forms and practices of party leadership enacted in the vast bulk of other parties, regardless of their place on the ideological spectrum. A rich picture is painted of this ongoing struggle through a case study of the Australian Greens with vivid descriptions presented on organisational leadership issues by Australian state and federal Green members of parliaments. What emerges from the data is the Australian Green MPs’ conundrum in retaining an egalitarian and participatory democracy ethos while seeking to expand their existing frame of leadership to being both more pragmatic and oriented towards active involvement in government. -

Joint ENGO Submission on Nuclear Issues As They Relate to the Environmental Protection & Biodiversity Conservation Act Revie

Joint ENGO Submission on Nuclear Issues as they Relate to the Environmental Protection & Biodiversity Conservation Act Review 2020 Written by Mia Pepper, Jim Green, Dave Sweeney, David Noonan & Annica Schoo. Contents Introduction ............................................................................................................................. 3 Summary of Recommendations ................................................................................................ 3 Uranium: ............................................................................................................................... 3 Nuclear Power: ...................................................................................................................... 3 Other Matters: ...................................................................................................................... 4 Uranium Trigger – Matters of National Environmental Significance ........................................... 4 Australia’s uranium mine legacy ............................................................................................. 7 Mining Legacies ................................................................................................................... 12 In Situ Leach Mining: ........................................................................................................... 14 Regulating Uranium – Inquiries ............................................................................................ 15 Bureau d’audiences publiques sur -

The Rise of the Australian Greens

Parliament of Australia Department of Parliamentary Services Parliamentary Library Information, analysis and advice for the Parliament RESEARCH PAPER www.aph.gov.au/library 22 September 2008, no. 8, 2008–09, ISSN 1834-9854 The rise of the Australian Greens Scott Bennett Politics and Public Administration Section Executive summary The first Australian candidates to contest an election on a clearly-espoused environmental policy were members of the United Tasmania Group in the 1972 Tasmanian election. Concerns for the environment saw the emergence in the 1980s of a number of environmental groups, some contested elections, with successes in Western Australia and Tasmania. An important development was the emergence in the next decade of the Australian Greens as a unified political force, with Franklin Dam activist and Tasmanian MP, Bob Brown, as its nationally-recognised leader. The 2004 and 2007 Commonwealth elections have resulted in five Australian Green Senators in the 42nd Parliament, the best return to date. This paper discusses the electoral support that Australian Greens candidates have developed, including: • the emergence of environmental politics is placed in its historical context • the rise of voter support for environmental candidates • an analysis of Australian Greens voters—who they are, where they live and the motivations they have for casting their votes for this party • an analysis of the difficulties such a party has in winning lower house seats in Australia, which is especially related to the use of Preferential Voting for most elections • the strategic problems that the Australian Greens—and any ‘third force’—have in the Australian political setting • the decline of the Australian Democrats that has aided the Australian Greens upsurge and • the question whether the Australian Greens will ever be more than an important ‘third force’ in Australian politics. -

Built Environment Meets Parliament’ Summit, Canberra

1 of 8 FINANCE AND GOVERNANCE COMMITTEE Agenda Item 6.3 REPORT 13 October 2009 COUNCILLOR CLARKE POST TRAVEL REPORT ‘BUILT ENVIRONMENT MEETS PARLIAMENT’ SUMMIT, CANBERRA Report by Councillor Peter Clarke Purpose 1. To report to the Finance and Governance Committee on the travel undertaken by Cr Peter Clarke to Canberra to participate in the ‘Built Environment Meets Parliament’ (BEMP) Summit, Parliament House, Canberra on 12 August 2009. Recommendation 2. That the Finance and Governance Committee note this report and the incorporated summary of benefits and outcomes. Background 3. Cr Clarke’s participation in the BEMP 09 Summit was approved by the Lord Mayor on 4 August in accordance with the Councillor Expenses and Resources Guidelines. Due to time constraints, the proposal was unable to be submitted to the Finance and Governance Committee as the next meeting of the Committee was scheduled for 11 August which was the day before the Summit. Key Issues Details of Travel 4. Cr Clarke attended the BEMP 2009 Summit on Wednesday 12 August. 5. The Summit was held in the Theatre, Parliament House, Canberra from 8.30am – 5pm. BEMP 2009 was attended by 200 delegates including architects, planners, engineers, developers, key government department representatives, ministers, shadow ministers, members of parliament and parliamentary advisors. 6. The annual BEMP Summit is co-hosted by the following organisations: 6.1. Association of Consulting Engineers, Australia; 6.2. Australian Institute of Architects; 6.3. Green Building Council of Australia; 6.4. The Planning Institute of Australia; and 6.5. Property Council of Australia. 7. A copy of the Summit program is included at Attachment 1.