FKR2343 SR CHINA B 2013.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preqin Research Report Fig

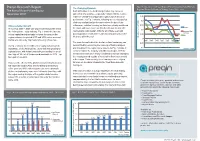

Preqin Research Report Fig. 3 Comparison of Private Equity Performance by Fund Primary The Changing Dynamic Regional Focus for Funds of Vintage Years 1995 - 2007 The Rise of Asian Private Equity Such diffi culties in the fundraising market may come as November 2010 somewhat of a surprise – especially considering the relative resilience of Asia-focused private equity funds in terms of 0.25 performance. As Fig. 3 shows, following an extended period 0.2 of strong median fund performance since the turn of the Unprecedented Growth millennium, vehicles focusing on Asia have clearly weathered 0.15 the storm with more success than their European and US Europe The period 2003 – 2008 saw unprecedented growth within 0.1 the Asian private equity industry. Fig. 1 shows the increase counterparts, with median IRRs for all vintage years still Asia and Rest of World posting positive results while funds focusing primarily on the 0.05 in total capital raised annually by funds focusing on the US region between the period 2003 and 2008, when a record West are still in the red. IRR Median Net-to-LP 0 $91bn was raised by 194 funds achieving a fi nal close. 1995 1997 1999 2001 2003 2005 2007 The main factors behind the decline in Asia fundraising can -0.05 As Fig. 2 shows, the record level of capital raised saw the be identifi ed by examining the make-up of fund managers -0.1 Vintage Year importance of the Asian private equity industry growing on and investors in the region more closely. As Fig. -

China - Latin America Commodity Trade & Investment: Enduring Trends Towards 2027… Rafael Valdez Mingramm, Ke-Li Wang, Antonio Jiménez and Jesús J

China - Latin America Commodity Trade & Investment: Enduring Trends Towards 2027… Rafael Valdez Mingramm, Ke-Li Wang, Antonio Jiménez and Jesús J. Reyes1 + 86 (21) 6109-9568 x 8015 / [email protected] Trade & investment between China and Latin America has increased more than tenfold since 2000, a result of China’s economic reforms and over 30 years of sustainable growth. Soybean, copper, oil and timber are some of Latin America’s commodities that are being increasingly exported to China. This report aims to provide a general overview of the commodity trade and sample investments between these two regions, its current environment, and future trends. By studying Japan and South Korea’s per capita commodity consumption patterns, we develop a reference forecast of selected commodities through the year 2027… 1 Rafael Valdez Mingramm is one of the Founding Partners of SinoLatin Capital, Ke-Li Wang and Antonio Jimenez Rosa are pursuing an MBA at The China Europe International Business School (CEIBS), and Jesus J. Reyes Muñoz is doing the Joint MBA/MA program at The Wharton School & the Lauder Institute for International Studies of the University of Pennsylvania. Copyright © SinoLatin Capital Inc. All rights reserved. [email protected] www.sinolatincapital.com + 86 (21) 6109-9568 x 8015 November, 2009 Overview China’s 30 years of sustainable Commodities such as minerals, fuel, forestry goods, and agriculture crops are a economic growth, the cornerstone of today’s global economy. These are produced, transported, and emergence of a vibrant middle processed to satisfy our everyday needs of food, energy, and raw materials for class and massive spending in virtually every product we consume on a daily basis. -

Shroud Over Show Industry

Life World Stories Carrie Underwood carved 1st woman to Business in stone win award of top Collector of ancient bricks Stocks plummet 5% reconstructs picture of past. entertainer twice > Page 13 CHINA> Page 20 > Page 10 TUESDAY, April 20, 2010 chinadaily.com.cn RMB ¥1.5 Life limping back to normal By FU JING Inside CHINA DAILY Additional coverage, pages 2,3 Editorial: Spirit of volunteerism, YUSHU, Qinghai — As page 8 truckloads of food, water and tents poured in amid inclement also rescued at 5:30 pm aft er weather, a state of relative nor- being trapped under debris for malcy has begun to return to 130 hours. Gyegu, the epicenter of a pow- Badly-needed daily necessi- erful tremor last Wednesday ties as well as the fi rst batch of that has left 1944 people dead television sets arrived Monday and 216 missing in Qinghai morning from Xining, the pro- province. vincial capital 840 km away. Vendors returned to the Earlier eff orts to send aid to streets for the first time since this remote plateau town, the 7.1 magnitude earthquake home to 100,000 people, had — China’s strongest in nearly been hampered by poor road two years — which reduced and weather conditions as well nearly 90 percent of buildings as heavy traffi c. to rubble. Survivors packed temporary Dispelling the gloom briefl y phone booths and charger sta- was news of two miracle res- tions on Gyegu’s main street, cues. trying to make free calls to Five days after the catas- relatives and friends or recharge trophe, an elderly woman their cellphones. -

ANNUAL REVIEW 2017 Land of the Giants Cycle-Tested Credit Expertise Extensive Market Coverage Comprehensive Solutions Relative Value Focus

ANNUAL REVIEW 2017 Land of the giants Cycle-Tested Credit Expertise Extensive Market Coverage Comprehensive Solutions Relative Value Focus Ares Management is honored to be recognized as Lender of the Year in North America for the fourth consecutive year as well as Lender of the Year in Europe Lender of the year in Europe Ares Management, L.P. (NYSE: ARES) is a leading global alternative asset manager with approximately $106 billion of AUM1 and offices throughout the United States, Europe, Asia and Australia. With more than $70 billion in AUM1 and approximately 235 investment professionals, the Ares Credit Group is one of the largest global alternative credit managers across the non-investment grade credit universe. Ares is also one of the largest direct lenders to the U.S. and European middle markets, operating out of twelve office locations in both geographies. Note: As of December 31, 2017. The performance, awards/ratings noted herein may relate only to selected funds/strategies and may not be representative of any client’s given experience and should not be viewed as indicative of Ares’ past performance or its funds’ future performance. 1. AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and a registered investment adviser. learn more at: www.aresmgmt.com | www.arescapitalcorp.com The battle of the brands the US market on page 80, advisor Hamilton TOBY MITCHENALL Lane said it had received a record number EDITOR'S of private placement memoranda in 2017 – ISSN 1474–8800 LETTER MARCH 2018 around 800 – and that this, combined with Senior Editor, Private Equity faster fundraising processes, has made it dif- Toby Mitchenall, Tel: +44 207 566 5447 [email protected] ficult to some investors to make considered Special Projects Editor decisions. -

PEI June2020 PEI300.Pdf

Cover story 20 Private Equity International • June 2020 Cover story Better capitalised than ever Page 22 The Top 10 over the decade Page 24 A decade that changed PE Page 27 LPs share dealmaking burden Page 28 Testing the value creation story Page 30 Investing responsibly Page 32 The state of private credit Page 34 Industry sweet spots Page 36 A liquid asset class Page 38 The PEI 300 by the numbers Page 40 June 2020 • Private Equity International 21 Cover story An industry better capitalised than ever With almost $2trn raised between them in the last five years, this year’s PEI 300 are armed and ready for the post-coronavirus rebuild, writes Isobel Markham nnual fundraising mega-funds ahead of the competition. crisis it’s better to be backed by a pri- figures go some way And Blackstone isn’t the only firm to vate equity firm, particularly and to towards painting a up the ante. The top 10 is around $30 the extent that it is able and prepared picture of just how billion larger than last year’s, the top to support these companies, which of much capital is in the 50 has broken the $1 trillion mark for course we are,” he says. hands of private equi- the first time, and the entire PEI 300 “The businesses that we own at Aty managers, but the ebbs and flows of has amassed $1.988 trillion. That’s the Blackstone that are directly affected the fundraising cycle often leave that same as Italy’s GDP. Firms now need by the pandemic, [such as] Merlin, picture incomplete. -

Preface 1 Introduction

NOTES Preface 1. R. Evan Ellis, China: The Whats and Wherefores (Boulder, CO: Lynne Rienner Publishers, 2009). 2. Ibid. 3. R. Evan Ellis, The Strategic Dimension of China’s Engagement with Latin America (Washington, DC: Center for Hemispheric Defense Studies, 2013). 1 Introduction 1. Direction of Trade Statistics Quarterly (Washington, DC: International Monetary Fund, September 2013), 23. 2. Ibid. 3. Indeed, China’s diplomatic initiatives toward Latin America at this time may have been motivated, in part, by its desire to secure entry into the WTO. See Alex E. Fernandez Jilberto and Barbara Hogenboom, “Latin America and China: South-South Relations in a New Era,” in Latin America Facing China: South-South Relations Beyond the Washington Consensus, eds., Alex. E. Fernandez Jilberto and Barbara Hogenboom (New York: Berghahn Books, 2012). 4. Latin America scholar Dan Erikson argues that it was from this moment that China’s expansion into Latin America began to attract “wide- spread notice” in the United States. Daniel P. Erikson, “Conflicting U.S. Perceptions of China’s Inroads in Latin America,” in China Engages Latin America: Tracing the Trajectory, eds., A. H. Hearn and José Luis León Marquez (Boulder, CO: Lynne Rienner Publishers, 2011), 121. See also “Foreign Minister Li Zhaoxing Comments on the Fruitful Results of President Hu Jintao’s Trip to Latin America,” Ministry of Foreign Affairs of the People’s Republic of China. November 26, 2004. http://www.fmprc .gov.cn/eng/topics/huvisit/t172349.htm. 5. Alejandro Rebossio, “La mayor economía de Asia continental se expande fuera de su territorio y de a poco aparecen las verdaderas inver siones chinas,” La Nación, November 14, 2004. -

Market Insight – October 2019

SYDNEY MELBOURNE Level 15 Level 9 60 Castlereagh Street 41 Exhibition Street SYDNEY NSW 2000 MELBOURNE VIC 3000 Tel 61 2 9235 9400 Tel 61 3 9653 8600 Market Insight – October 2019 “Movers & Shakers” INVESTMENT & CORPORATE BANKING Investment Banking • Hein Vogel has departed Investec where he was Head of Emerging Companies & Financial Services. • Duncan Hogg who was Managing Director, Investment Banking at BAML has joined EY as a Partner in Sydney. • Steven Boggiano has joined Allier Capital as Managing Director. Steven previously founded Magnes Capital and was also Managing Director & Head of Healthcare, Consumer, Retail & Real Estate at Barclays. • Anna Ellis previously Investment Director with Besen in Melbourne, has also joined EY as Director, PE & Deal Origination, Transaction Advisory Services. • Grant Mansell has joined Investec as Director, Corporate Advisory. He has prior experience as Director, M&A with HSBC. Pierre Josset also joins Investec’s Corporate Advisory team, he was previously an Associate with Aura Group. • Nomura has hired Srihari Sharma as a Senior Associate, FIG from Investec, Ben St Claire as an Associate from Blackpeak Capital and Henry Ball, ex EY as an Investment Banking Analyst, Consumer, Retail & Healthcare. • Benjamin Gribble has joined Houlihan Lokey as an Associate, he was previously with Moelis Australia as an Investment Banking Associate & Houlihan Lokey in London. • Nicholas Tregoning joined Moelis Australia as Senior Analyst, Investment Banking, Nicholas joins from Shaw & Partners. • Gigi Li has joined Ironstone Capital as an Analyst from KPMG. • Samantha Riegel (ex FTI Consulting) & Ice Tan & have joined Highbury Partnership as Analysts. • Macquarie Capital has hired Anthony Yao, ex Lazard, as an Analyst in the General Industrials teams, Rita Dalton joins as an Analyst in the TMET team from Nomura & James Watkins ex Flagstaff Partners Analyst joins the firm’s resources team. -

VENTURA COUNTY EMPLOYEES' RETIREMENT ASSOCIATION BOARD of RETIREMENT BUSINESS MEETING May 19, 2014 AGENDA

VENTURA COUNTY EMPLOYEES’ RETIREMENT ASSOCIATION BOARD OF RETIREMENT BUSINESS MEETING May 19, 2014 AGENDA PLACE: Ventura County Employees' Retirement Association Second Floor Boardroom 1190 South Victoria Avenue Ventura, CA 93003 TIME: 9:00 a.m. ITEM: I. CALL TO ORDER Master Page No. II. APPROVAL OF AGENDA 1 – 4 III. APPROVAL OF MINUTES A. Disability Meeting of May 5, 2014. 5 – 13 IV. CONSENT AGENDA A. Approve Regular and Deferred Retirements and 14 – 15 Survivors Continuances for the Month of April 2014. B. Receive and File Report of Checks Disbursed in April 16 – 25 2014. C. Receive and File Budget Summary for FY 2013-14 26 Month Ending April 2014. D. Receive and File Statements of Fiduciary Net Position, 27 – 38 Statements of Changes in Fiduciary Net Position, Investments & Cash Equivalents, and Schedules of Investment Management Fees for the Periods Ending March 31, 2014, and April 30, 2014. MASTER PAGE NO. 1 BOARD OF RETIREMENT May 19, 2014 AGENDA BUSINESS MEETING PAGE 2 V. STANDING ITEM A. Receive an Oral Update on Pensionable Compensation and PEPRA. VI. ANNUAL INVESTMENT PRESENTATIONS A. Receive Annual Investment Presentation, Bridgewater 39 – 91 Associates LP, Joel Whidden, Senior Relationship Manager, and David Greely, Senior Research Associate (30 Minutes). B. Receive Annual Investment Presentation, Tortoise 92 – 117 Capital Advisors LLC, Ken Malvey, Managing Director, and Andy Goldsmith, Head of Institutional Sales and Consultant Relations (30 Minutes). VII. INVESTMENT INFORMATION A. NEPC – Don Stracke, Senior Consultant, Chris Hill, Research Consultant. 1. Receive and File Performance Report Month 118 – 124 Ending April 30, 2014. 2. Receive and File Investment Summary – Quarter 125 – 176 Ending March 31, 2014. -

MBA Career Report 2009 WHARTON Was the First Collegiate Business School in 1881, and That Spirit in This Report of Innovation Still Drives Us Today

MBA CAREER REPORT 2009 WHARTON was the first collegiate business school in 1881, and that spirit In This Report of innovation still drives us today. Our Recruiting Wharton Students and Alumni 2 professors are leading scholars who are Class of 2009, Full-Time Employment Profile 6 committed to pushing the boundaries of Industry 7 Offer Sources and Compensation 8 business knowledge through their research Function 9 Location 10 and teaching. We are at the forefront of Class of 2010, Summer Internships global business education, providing the Profile 12 Industry 13 broadest range of degree programs and Offer Sources and Compensation 14 Function 15 educational resources for more than a Location 16 million executives and students in 189 Employer Recognition 18 Top Hirers countries. Through our engagement with Full-Time, Class of 2009 20 Summer, Class of 2010 20 leading companies and policy-makers, Employer Offers 2009 21 we bridge the gap between research Wharton MBA and practice and influence public policy Management Team Back Cover around the world. It is my pleasure to share with you the 2009 Wharton MBA Career Report. While the past year represented one of the most challenging job markets for our students in decades, Wharton students still achieved significant success in mak- ing their career aspirations a reality. The Wharton MBA Career Report reflects the diversity of talent at Wharton and celebrates the incredible support we received from employers and alumni who continue to value the capabilities, skills and experience of our students. MBA Career Management addressed changing student and employer needs by increasing the number of staff, renewing our focus on job skills and expanding our emphasis on school-wide corporate outreach. -

The New Farm Owners Table

Corporate investors lead the rush for control over overseas farmland Investment Legal base Type Participating Details vehicle investors Abraaj Capital UAE Investment Abraaj Capital reported in 2008 that it had been buying farmland in Pakistan. The company also said it would invest in dairy firm farming in Pakistan from its US$250 million fund for Pakistan. Abraaj manages five equity funds and its parent group, Abraaj Capital Holdings Limited, has an issued share capital of US$ 1 billion and US$5bn of assets spread across the Middle East, North Africa and the South Asia AC Agri Germany Specialised - Aquila Capital Aquila Capital Group is an investment company with US$2.4 billion under management. Its AC Agri Opportunity Fund seeks to Opportunity fund (Germany) take over farm properties in Brazil, Australia and New Zealand. The fund is targeting an investment of up to US$400 million, Fund with a first capital raising of US$100 million. It is run by Detlef Schoen, an ex-CEO of Cargill Germany. The farm properties selected will be producers of dairy, beef cattle, sugar cane and row crops in stable least-cost locations, ensuring the minimisation of risk through both commodity and location diversity. This fund is composed of two sub-funds: the Oceania Dairy Fund (ODF) and the Brazil AgriFund (BAF), with rate of return targets of 12% and 25% respectively for a minimum of 5 years. Investments, set at a minimum of US$5m, will be generally allocated between the ODF and BAF at 30% and 70%, but investors will be able to select their own allocations depending on their individual needs. -

NYSCRF Monthly Transacation Report December 2017

THOMAS P. DiNAPOLI 110 STATE STREET STATE COMPTROLLER ALBANY, NEW YORK 12236 STATE OF NEW YORK OFFICE OF THE STATE COMPTROLLER NEW YORK STATE COMMON RETIREMENT FUND Thomas P. DiNapoli New York State Comptroller MONTHLY TRANSACTION REPORT December 2017 Global Equity The New York State Common Retirement Fund (CRF) invests with external managers to meet its global equity allocation. This report will include additions and terminations of external managers or addition or removal of assets from an existing manager. The Channing Capital Management Domestic Equity account was funded with an additional $227 million in December 2017. The account was funded from cash. No placement agents were involved in this transaction. The Brown Capital Management Domestic Equity account was reduced by $300 million in December 2017 and allocated to cash. No placement agents were involved in this transaction. Private Equity CRF invests in private equity partnerships directly and through separately managed accounts. Significant activity includes new commitments to private equity partnerships, as well as new commitments made through separately managed accounts. Affinity Equity Partners – Affinity Asia Pacific Fund V, L. P. - $350 million commitment. Affinity will make investments across a diverse mix of industries within Asia, focusing on 4 regions; Korea, Australia/New Zealand, Southeast Asia and China. The funding of capital calls will come from cash. Affinity is an existing relationship for the CRF. No placement agents were involved in this transaction. This investment closed on December 15, 2017. New York State Common Retirement Fund Monthly Transaction Report December 2017 Page 2 DCP Capital I, L. P. – through Asia Alternatives IV, L. -

Investment Fees for the Fiscal Year Ended June 30, 2018 Transparency of the Montana Investment Expenses

Investment Fees For the Fiscal Year Ended June 30, 2018 Transparency of the Montana Investment Expenses The Montana Board of Investment’s Investment Fees Report is a breakdown of the Investment Fees section of the Unified Investment Program (UIP) Financial Statements. The Investment Fees Report is unaudited and may be subject to change. Board expenses are allocated and segmented using an activity-based budgeting process that incorporates time estimates, functional investment activities and cost centers that can change over time. Custodial bank fees are contractual based on holdings, transactions and other pre-defined variables such as the number of active accounts. Custody expenses are allocated across the various investment pools based on holdings, transactions, or a direct charge. Contractual fees for external managers are aggregated at the parent company level across all partnerships and investment accounts. Additional information can be found at www.investmentmt.com Montana Board of Investments | June 30, 2018 | 2 Table of Contents FY2018 Investment Fees from UIP Financial Statements 4 Consolidated Asset Pension Pool (CAPP) 5 Trust Funds Investment Pool (TFIP) 8 Short Term Investment Pool (STIP) 9 Separately Managed Investments (SMI) 10 End Notes 11 Montana Board of Investments | June 30, 2018 | 3 Total Fiscal Year 2018 Investment Fees (in thousands) Custodial External Pool and SMI Board Bank Managers Total Consolidated Asset Pension Pool (CAPP) $ 3 ,730 $ 1 ,249 $ 4 7,834 $ 5 2,813 Trust Funds Investment Pool (TFIP) 331 126 1,648