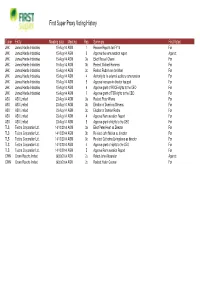

First Super Proxy Voting Register from 1 July 2017 to May-19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Monthly Investment Report As at 30 November 2017 Solaris Core Australian Equity Fund - Performance Alignment (APIR: SOL0001AU)

Monthly Investment Report as at 30 November 2017 Solaris Core Australian Equity Fund - Performance Alignment (APIR: SOL0001AU) Market Review The S&P/ASX200 Accumulation Index finished up 1.6% for the month of November with the Real Estate sector leading the way, up 5.3%. The sector outperformed after a period of weak performance and a rotation to defensives during the month. The Australian market underperformed the S&P500 (+2.8%) with U.S. GDP growth exceeding expectations and renewed hope over the potential for the Trump administration’s proposed corporate tax cuts. In company news, the Santos Limited share price was up 12.9% after the press reported a potential takeover bid from Harbour Energy. An indicative offer in August from Harbour Energy proposed to acquire the company for $4.55 per share, however this proposal was rejected by the board. S&P/ASX200 Top & Bottom performing sectors for the month ending 30 November: The best performing sectors in the S&P/ASX200 Accumulation Index for the month were Consumer Durables & Apparel (+13.3%), Capital Goods (+6.1%) and Automobiles & Components (+5.9%). The worst performing sectors included Telecommunication Services (-1.6%), Banks (-1.4%) and Food Beverage & Tobacco (-0.9%). S&P/ASX200 Top & Bottom performing stocks for the month ending 30 November: The top 5 performing stocks in the S&P/ASX200 Accumulation Index for the month were Orocobre Limited (+29.3%), Speedcast International Limited (+24.5%), Syrah Resources Limited (+22.3%), News Corporation (+18.1%) and Credit Corp Group Limited (+14.3%). The bottom 5 performers included Webjet Limited (-17.7%), Orica Limited (-17.3%), Corporate Travel Management Limited (-15.4%), Nanosonics Limited (-15.3%) and ALS Limited (-12.7%). -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 02 March 2018 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 12.11 2.89 41.31 136.99 450.45 172.57 - - - - ABC Adelaide Brighton 6.71 -3.17 0.90 17.51 25.64 19.93 19.93 16.49 9.33 47 ABP Abacus Property Grp. 3.44 0.00 -5.49 -2.22 14.48 13.15 8.30 14.82 -1.94 113 AFI Australian Foundat. 6.06 -0.66 -2.53 4.58 9.57 8.95 2.86 5.97 4.48 77 AGL AGL Energy Limited. 21.47 -0.42 -5.41 -9.87 -8.38 12.64 16.55 10.72 10.44 40 AIA Auckland Internation 5.92 -0.50 -2.95 -0.08 -9.11 3.61 14.22 23.94 12.61 30 AIZ Air New Zealand 3.02 5.96 4.86 -3.73 43.40 18.90 12.05 30.24 12.15 32 ALL Aristocrat Leisure 23.98 -1.96 -1.96 14.54 43.91 55.66 48.93 46.20 9.54 43 ALQ ALS Limited 7.10 1.28 0.85 -9.80 19.41 34.61 11.55 -5.15 6.78 63 ALU Altium Limited 19.96 0.10 28.13 97.93 179.50 91.94 72.34 82.96 44.32 3 AMC Amcor Limited 14.03 0.93 -1.57 -9.77 1.89 3.52 4.09 14.96 11.64 34 AMP AMP Limited 5.27 0.38 2.56 7.23 10.10 5.17 -2.02 4.40 0.41 103 ANN Ansell Limited 25.74 2.14 2.36 19.76 20.64 24.17 2.56 12.52 8.89 52 ANZ ANZ Banking Grp Ltd 28.57 0.46 -1.86 -0.74 -3.76 14.82 -2.02 5.27 7.05 60 APA APA Group 7.82 -4.97 -5.31 -8.52 -4.27 1.28 -1.92 10.97 14.13 23 ARG Argo Investments 8.06 -0.25 -1.73 4.92 10.05 9.57 3.86 7.74 3.78 82 AST AusNet Services Ltd 1.635 -1.80 -4.11 -3.65 5.85 12.17 8.25 11.72 7.71 56 ASX ASX Limited 57.85 -0.43 3.69 7.47 14.89 20.40 12.70 -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Code Security Description ABC ADELAIDE BRIGHTON ALL

4-May-16 smartMOZY NTA & Allotment Notice The manager of the SmartMOZY advises that as at close of business on 3 May 2016 a total of Nil units has been redeemed or allotted since 2 May 2016. The total number of units on issue on that day was 13,457,274. The asset backing for each smartMOZY unit at close of business (Sydney) on 3 May 2016 was $5.71154 (NTA is net of applicable tax liability). The tracking difference was -3.54% The following companies are currently in the Fund: Code Security description ABC ADELAIDE BRIGHTON ALL ARISTOCRAT LEISURE LT ALQ ALS LIMITED ANN ANSELL LIMITED AST AUSNET SERVICES AWC ALUMINA LIMITED BEN BENDIGO AND ADELAIDE BLD BORAL LIMITED BOQ BANK OF QUEENSLAND BSL BLUESCOPE STEEL LIMIT CAR CARSALES COM LTD CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O COH COCHLEAR LIMITED CSR CSR LIMITED CWN CROWN RESORTS LTD CYB CYBG PLC DLX DULUX GROUP LIMITED O DMP DOMINOS PIZZA ENTERPRISES LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FMG FORTESCUE METALS GROU FXJ FAIRFAX MEDIA LTD GNC GRAINCORP LIMITED HGG HENDERSON GROUP PLC HSO HEALTHSCOPE LTD HVN HARVEY NORMAN HOLDING IFL IOOF HOLDINGS LTD ILU ILUKA RESOURCES LIMIT INM IRON MOUNTAIN (CDI) IOF INVESTA OFFICE FUND JBH JB HI-FI LIMITED MFG MAGELLAN FINANCIAL GR NVT NAVITAS LIMITED ORA ORORA LIMITED ORDINAR PPT PERPETUAL TRUSTEES AU PRY PRIMARY HEALTH CARE L QUB QUBE HOLDINGS LIMITED REA REA GROUP LTD RMD RESMED INC SGR THE STAR ENTERTAINMENT GROUP LTD SKI SPARK INFRASTRUCTURE SPO SPOTLESS GROUP HOLDINGS LIMITED SRX SIRTEX MEDICAL LTD TAH TABCORP HOLDINGS LTD TPM TPG TELECOM LTD TTS TATTS GROUP LIMITED TWE TREASURY WINE ESTATES VOC VOCUS COMMUNICATIONS LTD For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

State Street Australian Equities Index Trust

1 July 2017 to 30 June 2018 State Street Australian Equities Index Trust Proxy Voting Record Vote Summary Report Reporting Period: 07/01/2017 to 06/30/2018 Location(s): All Locations Institution Account(s): State Street Australian Equities Index Trust BGP Holdings Plc Meeting Date: 07/03/2017 Country: Malta Primary Security ID: Record Date: 05/25/2017 Meeting Type: Special Ticker: N/A Shares Voted: 7,171,006 Vote Proposal Voting Vote Against Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction Mgmt 1 Approve Reduction of Share Premium Account Mgmt For For For No 2 Approve Distribution of EUR 5 Million to Mgmt For Against Against Yes Directors 3 Approve Distribution of EUR 1.5 Million to Mgmt For Against Against Yes Directors ALS Limited Meeting Date: 07/20/2017 Country: Australia Primary Security ID: Q0266A116 Record Date: 07/18/2017 Meeting Type: Annual Ticker: ALQ Shares Voted: 244,044 Vote Proposal Voting Vote Against Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction Mgmt 1 Elect Grant Murdoch as Director Mgmt For For For No 2 Elect John Mulcahy as Director Mgmt For For For No 3 Approve the Remuneration Report Mgmt For For For No 4 Approve the Grant of Performance Rights to Mgmt For Against Against Yes Raj Naran, Managing Director and CEO of the Company AusNet Services Meeting Date: 07/20/2017 Country: Australia Primary Security ID: Q0708Q109 Record Date: 07/18/2017 Meeting Type: Annual Ticker: AST Shares Voted: 852,633 Vote Proposal Voting Vote Against Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction -

First Super Proxy Voting History

First Super Proxy Voting History Ticker Entity Meeting date Meeting Res. Summary First Voted JHX James Hardie Industries 15-Aug-14 AGM 1 Receive Reports for FY14 For JHX James Hardie Industries 15-Aug-14 AGM 2 Approve the remuneration report Against JHX James Hardie Industries 15-Aug-14 AGM 3a Elect Russell Chenu For JHX James Hardie Industries 15-Aug-14 AGM 3b Reelect Michael Hammes For JHX James Hardie Industries 15-Aug-14 AGM 3c Reelect Rudolf van der Meer For JHX James Hardie Industries 15-Aug-14 AGM 4 Authority to fix external auditors remuneration For JHX James Hardie Industries 15-Aug-14 AGM 5 Approve increase in director fee pool For JHX James Hardie Industries 15-Aug-14 AGM 6 Approve grant of ROCE rights to the CEO For JHX James Hardie Industries 15-Aug-14 AGM 7 Approve grant of TSR rights to the CEO For ASX ASX Limited 23-Aug-14 AGM 3a Reelect Peter Warne For ASX ASX Limited 23-Aug-14 AGM 3b Election of Domininc Stevens For ASX ASX Limited 23-Aug-14 AGM 3c Election of Damian Roche For ASX ASX Limited 23-Aug-14 AGM 4 Approve Remuneration Report For ASX ASX Limited 23-Aug-14 AGM 5 Approve grant of rights to the CEO For TLS Telstra Corporation Ltd. 14/10/2014 AGM 3a Elect Peter Heart as Director For TLS Telstra Corporation Ltd. 14/10/2014 AGM 3b Re-elect John Mullen as director For TLS Telstra Corporation Ltd. 14/10/2014 AGM 3c Re-elect Catherine Livingstone as director For TLS Telstra Corporation Ltd. -

Annual Report 2016

ANNUAL REPORT 2016 GLOBAL DIVERSIFIED INDUSTRIAL CHEMICALS OUR OPERATIONS Ekati e Diavik e e Meadowbank CANADA Flin Flon e e Ishpeming Tumbler Ridge e North Bay Calgary a Maitland Biwabik e Boisbriand Tirana St Helens a e Ormstown Bucharest Barry i Simsbury Ankara Salt Lake City USA Cheyenne e a a Soma i e Donora TURKEY Carthage i e e Duffield CHINA Louisiana, Missouri a e Van Wyck i Linyi (Fabchem) PAKISTAN Waggaman, Louisiana e Brooksville New Delhi Dinamita i i Graham Hong Kong Gomez Palacios i Wolf Lake INDIA Guadalajara e MEXICO e Muara Tuhup e Tenggarong Batu Arang (TKEB) i e Berau PAPUA NEW GUINEA SOUTH Sibolga Tanjung Tabalong e e Papua New Guinea AFRICA Jakarta Batu Kajang e INDONESIA e a Moranbah Townsville Port Hedland e LATIN Mt Isa e Moura AMERICA Phosphate Hill (Queensland Nitrates) AUSTRALIA Gibson Island Kalgoorlie e i Helidon La Serena i Kooragang Island i Johannesburg (SASOL Dyno Nobel) Perth a Santiago Port Adelaide e Warkworth i Johannesburg (DetNet) Melbourne Portland Geelong Devonport Cover photograph: New IPL World Class Ammonia Plant, Louisiana USA VISION STATEMENT To be the best in our markets, delivering Zero Harm and outstanding business performance through our people, our culture and our customer focus. Ekati e Diavik e e Meadowbank CANADA Flin Flon e e Ishpeming Tumbler Ridge e North Bay Calgary a Maitland Biwabik e Boisbriand Tirana St Helens a e Ormstown Bucharest Barry i Simsbury Ankara Salt Lake City USA Cheyenne e a a Soma i e Donora TURKEY Carthage i e e Duffield CHINA Louisiana, Missouri a e Van Wyck -

For Personal Use Only Use Personal For

Office of the Company Secretary ABN 42 004 080 264 Registered Office: Level 8, 28 Freshwater Place Southbank Victoria 3006 Tel: (61 3) 8695 4400 Fax: (61 3) 8695 4419 25 November 2011 www.incitecpivot.com.au The Manager Company Announcements Office Australian Securities Exchange Level 45, South Tower Rialto 525 Collins Street MELBOURNE VIC 3000 Dear Sir or Madam Electronic Lodgement 2011 Annual Report In accordance with the listing rules, I attach a copy of Incitec Pivot Limited’s Annual Report for 2011 for release to the market. Yours faithfully Kerry Gleeson Company Secretary Attach. For personal use only 2011ANNUAL REPORT 2011 For personal use only STRATEGY ON TRACK AND DELIVERING CANADA Boisbriand Calgary North Bay Lausanne Louisiana Maitland Tirana St Helens Ormstown Bucharest Simsbury Ankara Salt Lake City USA Port Ewen Soma Cheyenne Donora TURKEY Carthage Duffield Wolf Lake CHINA Linyi (Fabchem) Savannah PAKISTAN Graham New Delhi Dinamita Hong Kong INDIA MEXICO TKEB PAPUA Arkon Binungan, Lati NEW GUINEA & Sambarata SOUTH Martabe AFRICA Adaro Lihir Jakarta INDONESIA Moranbah Port Hedland Townsville Mt Isa Moura (Queensland Nitrates) LATIN Phosphate Hill AMERICA AUSTRALIA Gibson Island Kalgoorlie Helidon La Serena Johannesburg (SASOL) Perth Kooragang Island Santiago Port Adelaide Johannesburg (DetNet) Melbourne Portland Geelong Devonport “Incitec Pivot’s strategy is Incitec Pivot Limited to leverage value from the Company Headquarters industrialisation and urbanisation Incitec Pivot Fertilisers Nitromak of Asia by positioning ourselves