First Super Proxy Voting Register from Jul-18 to Oct-20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 ANNUAL FINANCIAL REPORT Contents

2016 ANNUAL FINANCIAL REPORT Contents Annual Financial Report of The GPT Group 1 Annual Financial Report of GPT Management Holdings Limited and its Controlled Entities 71 Supplementary Information 130 Corporate Directory 132 Corporate Governance The GPT Group (GPT or the Group) comprises GPT Management Holdings Limited (ACN 113 510 188) (GPTMHL) and General Property Trust (Trust). GPT RE Limited (ACN 107 426 504) (GPTRE) AFSL (286511) is the Responsible Entity of the Trust. GPT’s stapled securities are listed on the Australian Securities Exchange (ASX). The third edition of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations (Principles) provides a framework for good corporate governance for listed entities. GPT’s Corporate Governance Statement sets out how the Group has complied with the Principles. The Group’s Corporate Governance Statement is available on GPT’s website at: www.gpt.com.au/About-GPT/Corporate-Governance/Principles-and-Policies. GPT has also lodged an Appendix 4G (Key to Disclosures – Corporate Governance Principles and Recommendations) with the ASX. Annual Financial Report of The GPT Group Year ended 31 December 2016 Contents Directors’ Report ............................................................................................................................................................................ 2 Auditor’s Independence Declaration ........................................................................................................................................... -

Market Overview Funds at a Glance

As of 31 August 2020 Market overview Global markets were positive again in August on vaccine hope and a very strong For more information on our Funds, tech sector. The US S&P500 was up 7.2% and the MSCI World index up 6.3%. All please contact: share markets were positive, including Australia up 2.8% and NZ up 1.8%. Global bonds were weak (yields rose), with the US 10-year up 0.17% to 0.70% and the David Boyle Australian 10-year up the same to 0.98%. NZ bonds bucked the offshore moves Head of Sales & Marketing and our 10-year bond fell 0.14% to 0.61%. Level 25, SAP Tower 151 Queen Street, Auckland It was reporting season in NZ and Australia in August. NZ was generally better than New Zealand expectations, or at least not as bad as it might have been. Revenue and earnings were slightly ahead of expectations in aggregate; however, dividends disappointed P 0800 646 833 a bit as boards took an understandably conservative approach to distributions. E [email protected] Only one third of companies gave guidance for the period ahead reflecting the www.mintasset.co.nz prevailing highly uncertain operating environment. EPS for companies reporting in Australia fell 20% for the year ending June, an outcome on a par with the GFC. However, this too was slightly better than expectations, with resilience in Consumer Staples, Building Materials and Discretionary Retail. The key upside factor this reporting season was better than expected cash flows, reflecting a fall in inventories and some delay in capex. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

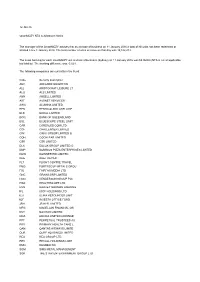

Code Security Description ABC ADELAIDE BRIGHTON ALL

12-Jan-16 smartMOZY NTA & Allotment Notice The manager of the SmartMOZY advises that as at close of business on 11 January 2016 a total of Nil units has been redeemed or allotted since 8 January 2016. The total number of units on issue on that day was 12,182,274. The asset backing for each smartMOZY unit at close of business (Sydney) on 11 January 2016 was $4.96903 (NTA is net of applicable tax liability). The tracking difference was -3.02% The following companies are currently in the Fund: Code Security description ABC ADELAIDE BRIGHTON ALL ARISTOCRAT LEISURE LT ALQ ALS LIMITED ANN ANSELL LIMITED AST AUSNET SERVICES AWC ALUMINA LIMITED BEN BENDIGO AND ADELAIDE BLD BORAL LIMITED BOQ BANK OF QUEENSLAND BSL BLUESCOPE STEEL LIMIT CAR CARSALES COM LTD CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O COH COCHLEAR LIMITED CSR CSR LIMITED DLX DULUX GROUP LIMITED O DMP DOMINOS PIZZA ENTERPRISES LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FMG FORTESCUE METALS GROU FXJ FAIRFAX MEDIA LTD GNC GRAINCORP LIMITED HGG HENDERSON GROUP PLC HSO HEALTHSCOPE LTD HVN HARVEY NORMAN HOLDING IFL IOOF HOLDINGS LTD ILU ILUKA RESOURCES LIMIT IOF INVESTA OFFICE FUND JBH JB HI-FI LIMITED MFG MAGELLAN FINANCIAL GR NVT NAVITAS LIMITED ORA ORORA LIMITED ORDINAR PPT PERPETUAL TRUSTEES AU PRY PRIMARY HEALTH CARE L QAN QANTAS AIRWAYS LIMITE QUB QUBE HOLDINGS LIMITED REA REA GROUP LTD REC RECALL HOLDINGS LIMIT RMD RESMED INC SGM SIMS METAL MANAGEMENT SGR THE STAR ENTERTAINMENT GROUP LTD SKI SPARK INFRASTRUCTURE SPO SPOTLESS GROUP HOLDINGS LIMITED SRX SIRTEX MEDICAL LTD TAH TABCORP HOLDINGS LTD TPM TPG TELECOM LTD TTS TATTS GROUP LIMITED TWE TREASURY WINE ESTATES WOR WORLEYPARSONS LTD For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

Scheme Booklet

SCHEME BOOKLET For a scheme of arrangement in relation to the proposed combination of Tatts Group Limited (ABN 19 108 686 040) and Tabcorp Holdings Limited (ABN 66 063 780 709) Time and date of Scheme Meeting Time: 10:00 am (Brisbane time) Date: 18 October 2017 Venue: Brisbane Convention & Exhibition Centre, cnr Merivale & Glenelg St, South Bank, QLD 4101 VOTE IN FAVOUR THE TATTS DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU VOTE IN FAVOUR OF THE RESOLUTION TO APPROVE THE SCHEME, IN THE ABSENCE OF A SUPERIOR PROPOSAL. THE INDEPENDENT EXPERT HAS CONCLUDED THAT THE SCHEME IS IN THE BEST INTERESTS OF TATTS SHAREHOLDERS, IN THE ABSENCE OF A SUPERIOR PROPOSAL. This is an important document and requires your immediate attention. You should read this document in its entirety before deciding how to vote on the Scheme. If you are in any doubt as to how to deal with this document, please consult your legal, investment, tax or other professional adviser immediately. If you have recently sold all of your Tatts Shares, please ignore this document. Tatts Shareholders who have any questions or require further information about the Scheme should contact the Tatts Shareholder Information Line on 1300 648 141 (within Australia) or +61 3 9415 4127 (outside Australia), Monday to Friday, between 8.30am and 5.30pm. Financial Adviser Legal Adviser Tatts Group Limited Scheme Booklet For a scheme of arrangement between Tatts Group Limited (ABN 19 108 686 040) and its shareholders in relation to the proposed combination of Tatts and Tabcorp Holdings Limited (ABN 66 063 780 709). -

Monthly Investment Report As at 30 November 2017 Solaris Core Australian Equity Fund - Performance Alignment (APIR: SOL0001AU)

Monthly Investment Report as at 30 November 2017 Solaris Core Australian Equity Fund - Performance Alignment (APIR: SOL0001AU) Market Review The S&P/ASX200 Accumulation Index finished up 1.6% for the month of November with the Real Estate sector leading the way, up 5.3%. The sector outperformed after a period of weak performance and a rotation to defensives during the month. The Australian market underperformed the S&P500 (+2.8%) with U.S. GDP growth exceeding expectations and renewed hope over the potential for the Trump administration’s proposed corporate tax cuts. In company news, the Santos Limited share price was up 12.9% after the press reported a potential takeover bid from Harbour Energy. An indicative offer in August from Harbour Energy proposed to acquire the company for $4.55 per share, however this proposal was rejected by the board. S&P/ASX200 Top & Bottom performing sectors for the month ending 30 November: The best performing sectors in the S&P/ASX200 Accumulation Index for the month were Consumer Durables & Apparel (+13.3%), Capital Goods (+6.1%) and Automobiles & Components (+5.9%). The worst performing sectors included Telecommunication Services (-1.6%), Banks (-1.4%) and Food Beverage & Tobacco (-0.9%). S&P/ASX200 Top & Bottom performing stocks for the month ending 30 November: The top 5 performing stocks in the S&P/ASX200 Accumulation Index for the month were Orocobre Limited (+29.3%), Speedcast International Limited (+24.5%), Syrah Resources Limited (+22.3%), News Corporation (+18.1%) and Credit Corp Group Limited (+14.3%). The bottom 5 performers included Webjet Limited (-17.7%), Orica Limited (-17.3%), Corporate Travel Management Limited (-15.4%), Nanosonics Limited (-15.3%) and ALS Limited (-12.7%). -

FNZ NTA & Allotment Notice

Friday, 1 March 2019 FNZ NTA & Allotment Notice Smartshares Limited would like to report details of the Units on Issue for the NZ Top 50 Fund (FNZ) as at 28 February 2019. Units on Issue: 194,951,179 Units Allotted/(Redeemed): - Net Tangible Assets (NTA): $2.63544 Tracking Difference: 0.35% The objective of the NZ Top 50 Fund (FNZ) is to provide a return that closely matches the return on the S&P/NZX 50 Portfolio Index. The S&P/NZX 50 Portfolio Index comprises 50 of the largest entities listed on the NZX Main Board. The following companies are currently held in the Fund: Code Security description AIA Auckland International Airport Ltd. AIR Air New Zealand Ltd. ANZ Australia and New Zealand Banking Group Ltd. ARG Argosy Property Ltd ARV Arvida Group Ltd. ATM The a2 Milk Company Ltd. CEN Contact Energy Ltd. CNU Chorus Ltd. EBO Ebos Group Ltd. FBU Fletcher Building Ltd. FPH Fisher & Paykel Healthcare Corporation Ltd. FRE Freightways Ltd. FSF Fonterra Shareholders' Fund Units GMT Goodman Property Trust GNE Genesis Energy Ltd. GTK Gentrack Group Ltd. HGH Heartland Group Holdings Ltd. IFT Infratil Ltd IPL Investore Property Ltd. KMD Kathmandu Holdings Ltd KPG Kiwi Property Group Ltd. MCY Mercury NZ Ltd. MEL Meridian Energy Ltd MET Metlifecare Ltd MFT Mainfreight Ltd. NZR The New Zealand Refining Company Ltd. NZX NZX Ltd. PCT Precinct Properties New Zealand Ltd. PFI Property for Industry Ltd. POT Port Of Tauranga Ltd. PPH Pushpay Ltd. RBD Restaurant Brands NZ Ltd. RYM Ryman Healthcare Ltd. www.smartshares.co.nz SAN Sanford Ltd. -

Voting Report 31 December 2016

Voting report for the period 1 July 2016 to 31 December 2016 Meeting Date Ticker Company Name Summary CareSuper Vote 08/11/16 NCM Newcrest Mining Ltd. Elect Peter Hay as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Philip Aiken as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Rick Lee as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect John Spark as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Vickki McFadden as Director For 08/11/16 NCM Newcrest Mining Ltd. Approve the Grant of Performance Rights to Sandeep Biswas For 08/11/16 NCM Newcrest Mining Ltd. Approve the Grant of Performance Rights to Gerard Bond For 08/11/16 NCM Newcrest Mining Ltd. Approve the Remuneration Report For 04/07/16 BAP Bapcor Limited Approve the Change of Company Name to BAPCOR Limited For 12/07/16 SEA Sundance Energy Australia Ltd. Ratify the Past Issuance of Shares to Certain Sophisticated, Professional or Institutional Investors Abstain^ 12/07/16 SEA Sundance Energy Australia Ltd. Approve the Issuance of Shares to Certain Sophisticated, Professional and Institutional Investors Abstain^ 12/07/16 SEA Sundance Energy Australia Ltd. Approve the Issuance of SPP Shares to Shareholders Abstain^ 14/07/16 AAC Australian Agricultural Company Ltd. Approve the Remuneration Report For 14/07/16 AAC Australian Agricultural Company Ltd. Elect David Crombie as Director For 14/07/16 AAC Australian Agricultural Company Ltd. Elect Tom Keene as Director For 14/07/16 AAC Australian Agricultural Company Ltd. Elect Neil Reisman as Director For 14/07/16 AAC Australian Agricultural Company Ltd. -

Vanguard Australian Shares Index Fund

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD AUSTRALIAN SHARES INDEX FUND --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: Abacus Property Group TICKER: ABP CUSIP: Q0015N187 MEETING DATE: 11/15/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #2: APPROVE THE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: ELECT MARK HABERLIN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #4: APPROVE GRANT OF SECURITY ACQUISITION ISSUER YES FOR FOR RIGHTS TO STEVEN SEWELL --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: Accent Group Ltd. TICKER: AX1 CUSIP: Q0R618101 MEETING DATE: 11/23/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3a: ELECT MICHAEL HAPGOOD AS DIRECTOR ISSUER YES AGAINST AGAINST PROPOSAL #3b: ELECT STEPHEN GODDARD AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #3c: ELECT DONNA PLAYER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #3d: ELECT BRETT BLUNDY AS DIRECTOR ISSUER YES FOR FOR --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: Adelaide Brighton Ltd. TICKER: ABC CUSIP: Q0109N101 MEETING