Scheme Booklet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code Security Description ABC ADELAIDE BRIGHTON ALL

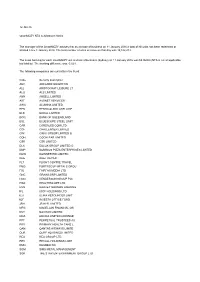

12-Jan-16 smartMOZY NTA & Allotment Notice The manager of the SmartMOZY advises that as at close of business on 11 January 2016 a total of Nil units has been redeemed or allotted since 8 January 2016. The total number of units on issue on that day was 12,182,274. The asset backing for each smartMOZY unit at close of business (Sydney) on 11 January 2016 was $4.96903 (NTA is net of applicable tax liability). The tracking difference was -3.02% The following companies are currently in the Fund: Code Security description ABC ADELAIDE BRIGHTON ALL ARISTOCRAT LEISURE LT ALQ ALS LIMITED ANN ANSELL LIMITED AST AUSNET SERVICES AWC ALUMINA LIMITED BEN BENDIGO AND ADELAIDE BLD BORAL LIMITED BOQ BANK OF QUEENSLAND BSL BLUESCOPE STEEL LIMIT CAR CARSALES COM LTD CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O COH COCHLEAR LIMITED CSR CSR LIMITED DLX DULUX GROUP LIMITED O DMP DOMINOS PIZZA ENTERPRISES LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FMG FORTESCUE METALS GROU FXJ FAIRFAX MEDIA LTD GNC GRAINCORP LIMITED HGG HENDERSON GROUP PLC HSO HEALTHSCOPE LTD HVN HARVEY NORMAN HOLDING IFL IOOF HOLDINGS LTD ILU ILUKA RESOURCES LIMIT IOF INVESTA OFFICE FUND JBH JB HI-FI LIMITED MFG MAGELLAN FINANCIAL GR NVT NAVITAS LIMITED ORA ORORA LIMITED ORDINAR PPT PERPETUAL TRUSTEES AU PRY PRIMARY HEALTH CARE L QAN QANTAS AIRWAYS LIMITE QUB QUBE HOLDINGS LIMITED REA REA GROUP LTD REC RECALL HOLDINGS LIMIT RMD RESMED INC SGM SIMS METAL MANAGEMENT SGR THE STAR ENTERTAINMENT GROUP LTD SKI SPARK INFRASTRUCTURE SPO SPOTLESS GROUP HOLDINGS LIMITED SRX SIRTEX MEDICAL LTD TAH TABCORP HOLDINGS LTD TPM TPG TELECOM LTD TTS TATTS GROUP LIMITED TWE TREASURY WINE ESTATES WOR WORLEYPARSONS LTD For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

ASD NTA & Allotment Notice

Friday, 8 March 2019 ASD NTA & Allotment Notice Smartshares Limited would like to report details of the Units on Issue for the Australian Dividend Fund (ASD) as at 7 March 2019. Units on Issue: 15,304,541 Units Allotted/(Redeemed): - Net Tangible Assets (NTA): $1.61250 Tracking Difference: 1.04% The objective of the Australian Dividend Fund (ASD) is to provide a return that closely matches the return on the S&P/ASX Dividend Opportunities Index. The S&P/ASX Dividend Opportunities Index comprises the 50 highest yielding common stocks from the Australian equity market. The following companies are currently held in the Fund: Code Security description ABC Adelaide Brighton Ltd. APA APA Group API Australian Pharmaceutical Industries Ltd. ASL Ausdrill Ltd. AST AusNet Services Ltd. ASX ASX Ltd. AWC Alumina Ltd. BEN Bendigo and Adelaide Bank Ltd. CBA Commonwealth Bank of Australia CCL Coca-Cola Amatil Ltd. CTX Caltex Australia Ltd. CWN Crown Resorts Ltd. DLX DuluxGroup Ltd. DOW Downer EDI Ltd. ECX Eclipx Group Ltd. FMG Fortescue Metals Group Ltd. GUD G.U.D. Holdings Ltd. GWA GWA Group Ltd. HVN Harvey Norman Holdings Ltd. IAG Insurance Australia Group Ltd. ILU Iluka Resources Ltd. ING Inghams Group Ltd. IPH IPH Ltd. JBH JB Hi-Fi Ltd. LLC Lendlease Group MFG Magellan Financial Group Ltd. MIN Mineral Resources Ltd. MMS McMillan Shakespeare Ltd. MQG Macquarie Group Ltd. MTS Metcash Ltd. NEC Nine Entertainment Co. Holdings Ltd. NHC New Hope Corporation Ltd. PDL Pendal Group Ltd. PMV Premier Investments Ltd. RIO Rio Tinto Ltd. www.smartshares.com RRL Regis Resources Ltd. -

STOXX AUSTRALIA 150 Selection List

STOXX AUSTRALIA 150 Last Updated: 20210701 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 112.2 1 1 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 90.6 2 2 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 82.2 3 3 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 59.9 4 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.8 5 5 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 50.7 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 42.4 7 7 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 32.5 8 9 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 30.6 9 8 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 29.8 10 10 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 28.3 11 11 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 25.5 12 12 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 24.7 13 13 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 22.5 14 14 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD Y 18.7 15 17 AU000000ALL7 6253983 ALL.AX 605156 Aristocrat Leisure Ltd. AU AUD Y 17.4 16 15 AU0000030678 BYWR0T5 COL.AX AU80Q2 Coles Group AU AUD Y 14.4 17 18 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. -

Betashares Portfolio Holdings ETF Name BETASHARES FTSE RAFI AUSTRALIA 200 ETF ETF ASX Code QOZ Date: 6/09/2016 Security

BetaShares Portfolio Holdings ETF Name BETASHARES FTSE RAFI AUSTRALIA 200 ETF ETF ASX Code QOZ Date: 6/09/2016 Security/Code Security Name Weighting # securities Market value BHP BHP BILLITON LTD 9.13% 385,882 $ 7,848,840 CBA COMMONWEALTH BANK OF AUSTRAL 7.49% 89,038 $ 6,438,338 ANZ AUST AND NZ BANKING GROUP 7.39% 233,137 $ 6,352,983 WBC WESTPAC BANKING CORP 7.13% 206,613 $ 6,130,208 NAB NATIONAL AUSTRALIA BANK LTD 6.63% 206,485 $ 5,703,116 WES WESFARMERS LTD 4.17% 84,121 $ 3,583,555 WOW WOOLWORTHS LTD 3.73% 133,217 $ 3,203,869 RIO RIO TINTO LTD 2.12% 37,909 $ 1,823,423 SUN SUNCORP-METWAY LTD 2.09% 139,200 $ 1,794,288 WPL WOODSIDE PETROLEUM LTD 1.76% 53,115 $ 1,514,309 ORG ORIGIN ENERGY LTD 1.69% 276,343 $ 1,450,801 MQG MACQUARIE GROUP LTD 1.66% 17,366 $ 1,426,443 TLS TELSTRA CORP LTD 1.61% 269,524 $ 1,388,049 AMP AMP LTD 1.50% 240,024 $ 1,286,529 QBE QBE INSURANCE GROUP LTD 1.46% 127,707 $ 1,259,191 FMG FORTESCUE METALS GROUP LTD 1.46% 249,258 $ 1,251,275 SCG SCENTRE GROUP 1.01% 176,862 $ 866,624 IAG INSURANCE AUSTRALIA GROUP 1.00% 152,729 $ 858,337 WOR WORLEYPARSONS LTD 0.91% 96,847 $ 785,429 STO SANTOS LTD 0.90% 175,609 $ 777,948 AMC AMCOR LIMITED 0.90% 47,631 $ 774,004 CTX CALTEX AUSTRALIA LTD 0.85% 21,632 $ 733,108 FBU FLETCHER BUILDING LTD 0.84% 70,092 $ 724,751 AGL AGL ENERGY LTD 0.80% 37,247 $ 690,932 SGP STOCKLAND 0.78% 138,071 $ 666,883 CSL CSL LTD 0.77% 6,338 $ 664,983 LLC LEND LEASE GROUP 0.74% 44,545 $ 633,875 NCM NEWCREST MINING LTD 0.72% 26,978 $ 622,382 ORI ORICA LTD 0.71% 42,615 $ 609,821 MTS METCASH LTD 0.65% 265,979 -

(ASX100) Women on Boards Analysis

Australia/NZ | Australia Thematic Investing (Citi) Equities 18 August 2011 │ 32 pages ESG: ASX100 Women on Board Analysis Increasing Focus on Board Diversity Women on Boards of ASX100 Companies — The ASX Corporate Governance Council’s new principles and recommendations on diversity commenced on 1 January Elaine Prior 2011. This is likely to lead to increasing focus on companies’ approaches to diversity +61-2-8225-4891 issues, including female representation on company boards. This report looks at data [email protected] on women directors on ASX100 company boards. The number of women directors has Felipe Faria increased, particularly in recent months (Figure 5 to Figure 8). Board diversity may [email protected] enhance effectiveness, by providing a wider range of perspectives and knowledge. Women on Boards Data — We collected and analysed data on female board directors of S&P/ASX100 companies from FY08 to 8 August 2011 (Figure 5 to Figure 9). At 8 August 2011 there were 134 women on ASX100 boards, a 46% increase from FY08. ASX100 companies with no female board directors were AQP, CQO, EGP, FMG, IPL, JHX, LEI, LYC, OSH, PDN, PRY, RHC, RMD, SGM and SWM. Companies with three female directors (the highest number identified) are AMP, BEN, CBA, MQG, QAN, QBE and WBC. Seven female directors each currently hold three ASX100 directorships. Business Case for Gender Diversity — Reibey Institute research found that those ASX500 companies with women directors on 30 June 2010 had a 3-year return on equity (ROE) 10.7% higher than those without any women directors. The 5-year ROE was 11.1% higher. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Dow Jones Sustainability Australia Index

Effective as of 23 November 2020 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia and New Zealand Banking Group Limited Australia Banks National Australia Bank Limited Australia Banks Westpac Banking Corporation Australia Banks CIMIC Group Limited Australia Capital Goods Brambles Limited Australia Commercial & Professional Services Downer EDI Limited Australia Commercial & Professional Services Tabcorp Holdings Limited Australia Consumer Services The Star Entertainment Group Limited Australia Consumer Services Janus Henderson Group plc United Kingdom Diversified Financials Oil Search Limited Papua New Guinea Energy Woodside Petroleum Ltd Australia Energy Coles Group Limited Australia Food & Staples Retailing Fisher & Paykel Healthcare Corporation Limited New Zealand Health Care Equipment & Services Asaleo Care Limited Australia Household & Personal Products Insurance Australia Group Limited Australia Insurance QBE Insurance Group Limited Australia Insurance Suncorp Group Limited Australia Insurance Addition Amcor plc Switzerland Materials Addition BHP Group Australia Materials Boral Limited Australia Materials Evolution Mining Limited Australia Materials Fletcher Building Limited New Zealand Materials Fortescue Metals Group Limited Australia Materials IGO Limited Australia Materials Iluka Resources Limited Australia Materials Incitec Pivot Limited Australia Materials Newcrest Mining Limited Australia Materials Orocobre Limited Australia Materials Rio Tinto Ltd Australia Materials South32 Limited -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

For Personal Use Only

01 March 2021 ASX Limited ASX Market Announcements Office Exchange Centre Level 6, 20 Bridge Street SYDNEY NSW 2000 EINVEST INCOME GENERATOR FUND (MANAGED FUND) (ASX: EIGA) Monthly Portfolio Disclosure Notification 31 January 2021 We advise that the portfolio for the Fund as at 31 January 2021 comprised the following securities: Stock Ticker % Total Portfolio Cash CASH 9.30 Commonwealth Bank of Australia CBA 6.50 BHP Group Ltd BHP 6.44 National Australian Bank NAB 5.34 Westpac Banking WBC 5.31 Aust And Nz Bank ANZ 4.73 Wesfarmers Ltd WES 4.43 Macquarie Group MQG 3.87 Woolworths Group WOW 3.83 Telstra Corp TLS 3.67 Woodside Petroleum WPL 2.87 GPT Group GPT 2.39 Dexus DXS 2.39 Mirvac Group MGR 2.27 Ampol Ltd ALD 2.20 Metcash Ltd MTS 2.20 Aurizon Holdings AZJ 2.09 Rio Tinto Ltd RIO 2.09 Charter Hall Wale REIT CLW 2.06 Fortescue Metals FMG 1.98 United Malt Group UMG 1.94 Coles Group Ltd COL 1.90 Event Hospitality EVT 1.83 Aristocrat Leisure ALL 1.77 Downer Edi Ltd DOW 1.74 For personal use only Suncorp Group Ltd SUN 1.74 Medibank Private MPL 1.48 Orora Ltd ORA 1.43 Insurance Australia IAG 1.37 Sonic Healthcare SHL 1.28 Platinum Asset PTM 1.22 Perennial Investment Management Limited. ABN 13 108 747 637 AFS Licence No. 275101 www.perennial.com.au Level 27, 88 Phillip Street, Sydney NSW 2000, Australia. Tel: 1300 730 032 (from overseas +612 8274 2777) Email: [email protected] Amcor Plc-Cdi AMC 1.16 Seven Group Hold SVW 1.14 Perpetual Ltd PPT 1.07 Healius Ltd HLS 0.97 Monadelphous Group MND 0.81 Graincorp Ltd-A GNC 0.71 Crown Resorts Ltd CWN 0.28 Tabcorp Holdings TAH 0.17 Yours sincerely, Bill Anastasopoulos Company Secretary Perennial Investment Management Limited as Responsible Entity for eInvest Income Generator Fund (Managed Fund). -

Lotteries & Kenoco Wagering & Gamingco

5 July 2021 Australian Securities Exchange Companies Announcements Platform 20 Bridge Street Sydney NSW 2000 STRATEGIC REVIEW CONCLUSION AND INTENTION TO DEMERGE LOTTERIES & KENO PRESENTATION Attached is a presentation in relation to Tabcorp Holdings Limited’s (Tabcorp) announcement regarding the conclusion of the Strategic Review and intention to demerge the Lotteries & Keno business, to be presented by Steven Gregg, Tabcorp Chairman. This presentation will be webcast on Tabcorp’s website at www.tabcorp.com.au from 10.00am (Melbourne time) today. The information contained in this presentation should be read in conjunction with today’s announcement by Tabcorp lodged with ASX entitled ‘Tabcorp announces intention to demerge Lotteries & Keno, creating two market leading companies’. This announcement was authorised for release by the Tabcorp Board. For more information: Media: Nicholas Tzaferis, GM Corporate Communications, +61 3 9868 2529 Investors/Analysts: Chris Richardson, GM Investor Relations & Treasury, +61 3 9868 2800 Level 21, Tower 2 GPO Box 1943 Tabcorp tabcorp.com.au 727 Collins Street Melbourne VIC Australia Holdings Limited ABN 66 063 780 709 Melbourne VIC 3008 3001 HOLDINGS LIMITED 2021 STRATEGIC REVIEW CONCLUSION AND INTENTION TO DEMERGE LOTTERIES & KENO 05 JULY 2021 ABN 66 063 780 709 T A B L E O F CONTENTS 0 3 - 10 Summary of strategic review and demerger rationale 1 2 - 14 Demerger overview 1 6 - 18 Overview of Lotteries & KenoCo 2 0 - 23 Overview of Wagering & GamingCo 25 Conclusion 27 Appendix OVERVIEW AND SUMMARY TABCORP