ASD NTA & Allotment Notice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sigma Emerging Companies Strategy

Sigma Emerging Companies Strategy Quarterly update as at 30 June 2017 Since Quarter FYTD 1 year 3 years 5 years Inception^ % % % % p.a. % p.a. % p.a. Sigma Emerging Companies Strategy* (1.3) 20.9 20.9 5.7 8.5 6.5 S&P/ASX Small Ord. Acc. Index (0.3) 7.0 7.0 7.1 5.7 1.7 Value added (detracted) (1.0) 13.9 13.9 (1.4) 2.8 4.8 *Gross Performance. Past performance is not a reliable indicator of future performance. ^Since Inception: 1 January 2010 Key points • Small Cap “value opportunity” clearly evident as traditional metrics remain compelling • Cyclical sectors expected to benefit as earnings bottom and risk appetite increases • Fund positioned for cyclical re-rating and away from lower return defensives Individual stock performance of note • The absence of Mayne Pharmaceuticals (-24%), Sigma The Sigma Emerging Companies Strategy (Strategy) Pharmaceuticals (32%) and Myer (-31%) contributed to underperformed a falling small cap market in the June quarter. performance in a relative sense. Stock selection was important, and generally speaking over Strategy performance was driven negatively by: the last 6 months we have seen the performance tilt away from the value recovery we saw during the first half of the financial • Infigen (-25%), lower following an earnings downgrade due year. A recovery in high PE stocks and the move towards to poor wind conditions in the final quarter which impacted more defensive positioning has proven to be a drag on the power generation. We view this as a one-off event and portfolio. -

Realindex Australian Share Fund

Realindex Australian Share Fund Fact sheet - 31 Aug 2015 Fund strategy Fund facts The Realindex Australian Share Fund uses the RAFI® methodology in the Benchmark S&P / ASX 200 Accumulation Index construction of its portfolios which selects and weights companies Funds under management $2800.1 million according to their economic footprint defined by fundamental measures of Inception Date 17 November 2008 company size (sales, cash flow, book value and dividends). The portfolio is further enhanced by applying additional factors such as quality of earnings and debt coverage. Commentary The Realindex Australian Shares Fund returned -7.39% (gross of fees) during August 2015 outperforming the S&P/ASX 200 Accumulation Index which returned -7.79% (its worst monthly performance since October 2008). Value (-7.3%) slightly outperformed Growth (-8.0%) during the month, extending the longer-term outperformance trend (-2.4% vs. -6.1%, 12 months to 31 August 2015). This outcome is typically favourable for portfolio performance, given the Value tilt inherent in the Fundamental Indexation methodology. The Materials sector (-5.2%) was the top contributor to relative performance during the month, driven by overweight holdings in steel companies Sims Metal Management (+21.4%) and BlueScope Steel (+18.7%). Sims reported a better-than-expected FY15 result, while BlueScope committed to $200m cost out by FY17, which was well received by investors. An overweight holding in Spark New Zealand (+13.0%) led the portfolio’s outperformance in the Telecommunications sector (-8.3%). Spark rallied after announcing positive earnings growth and an annual dividend increase at its FY15 results. Spark was the top contributor to relative performance across the portfolio at a company level. -

16 August 2021 Company Announcements Office Australian

16 August 2021 Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 2021 FULL YEAR RESULTS – ANNUAL REPORT Seven West Media Limited (ASX: SWM) attaches the Annual Report for the year ended 26 June 2021. This release has been authorised to be given to ASX by the Board of Seven West Media Limited. For further information, please contact: Investors/Analysts Media Alan Stuart Rob Sharpe T: +61 2 8777 7211 T: +61 437 928 884 E: [email protected] E: [email protected] Seven West Media Limited / 50 Hasler Road, Osborne Park WA 6017 Australia / PO Box 7077, Alexandria NSW 2015 Australia T +61 2 8777 7777 / ABN 91 053 480 845 Repositioned for growth. Annual Report 2021 Big Brother Contents Our Strategy Who We Are 2 Our Strategic Priorities and Performance Dashboard 4 Executive Letters Letter from the Chairman 6 Letter from the Managing Director and Chief Executive Officer 8 Review of Operations Group Performance – Key Highlights and Summary of Financial Performance 11 Seven Network 17 The West 20 Corporate Social Responsibility Risk, Environment, People and Social Responsibility 22 Seven in the Community 28 Governance Board of Directors 33 Corporate Governance Statement 36 Directors’ Report 47 Remuneration Report 52 Auditor’s Independence Declaration 73 Financial Statements Financial Statements 74 Directors’ Declaration 132 Independent Auditor’s Report 133 Investor Information 138 Shareholder Information 139 Company Information 141 1 Section 1: Our Strategy Seven West Media Limited Annual Report 2021 Who We Are Transforming to lead Seven West Media is being transformed to drive long-term success. -

Tassal Group Limited Macquarie Connections Australian Emerging

Tassal Group Limited Macquarie Connections Australian Emerging Leaders Conference (Hilton Hotel, Sydney ) 7th May 2009 Presenter: Mark Ryan CEO and Managing Director Tassal Group Limited 1 Agenda 3 Tassal Overview 3 Strategy 3 How Are We Tracking? 3 Financial Performance 3 Hatchery 3 Marine 3 Processing 3 Branding 3 Revenue 3 Risk Management 3 ESG 3 Competitive Advantages 3 Economic Conditions & Outlook 3 Conclusions 3 Appendices 2 Overview Tassal Group Limited in FY2009… 3 Australia’s leading aquaculture company 3 Benefitinggg from strong domestic and g lobal demand 3 Well positioned to escalate key export market penetration 3 Leading branding 3 Delhflfdddddflivering strong growth in financial performance and increased dividends for shareholders 3 Continued reduction in cost of production and automated processing driving transition to global best practice 3 Significant capital investment undertaken targeted at growth, innovation, efficiency and risk mitigation 3 Low gearing profile and ample debt facility head room 3 Balance sheet well capitalised and positioned to support continued growth 3 No change to previous earnings guidance for FY2009 3 Strategic Plan FY2015 3 Strategic Plan FY2015 in place – we clearly understand where Tassal is heading … there is a plan in place and we are achieving the hurdles set 3 Strategy - Global cost competitiveness in both aquaculture production and processing, together with achieving premium returns from our sales and marketing initiatives 3 FY2009 Focus – to build on our FY2008 achievements to drive -

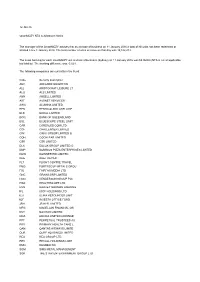

Code Security Description ABC ADELAIDE BRIGHTON ALL

12-Jan-16 smartMOZY NTA & Allotment Notice The manager of the SmartMOZY advises that as at close of business on 11 January 2016 a total of Nil units has been redeemed or allotted since 8 January 2016. The total number of units on issue on that day was 12,182,274. The asset backing for each smartMOZY unit at close of business (Sydney) on 11 January 2016 was $4.96903 (NTA is net of applicable tax liability). The tracking difference was -3.02% The following companies are currently in the Fund: Code Security description ABC ADELAIDE BRIGHTON ALL ARISTOCRAT LEISURE LT ALQ ALS LIMITED ANN ANSELL LIMITED AST AUSNET SERVICES AWC ALUMINA LIMITED BEN BENDIGO AND ADELAIDE BLD BORAL LIMITED BOQ BANK OF QUEENSLAND BSL BLUESCOPE STEEL LIMIT CAR CARSALES COM LTD CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O COH COCHLEAR LIMITED CSR CSR LIMITED DLX DULUX GROUP LIMITED O DMP DOMINOS PIZZA ENTERPRISES LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FMG FORTESCUE METALS GROU FXJ FAIRFAX MEDIA LTD GNC GRAINCORP LIMITED HGG HENDERSON GROUP PLC HSO HEALTHSCOPE LTD HVN HARVEY NORMAN HOLDING IFL IOOF HOLDINGS LTD ILU ILUKA RESOURCES LIMIT IOF INVESTA OFFICE FUND JBH JB HI-FI LIMITED MFG MAGELLAN FINANCIAL GR NVT NAVITAS LIMITED ORA ORORA LIMITED ORDINAR PPT PERPETUAL TRUSTEES AU PRY PRIMARY HEALTH CARE L QAN QANTAS AIRWAYS LIMITE QUB QUBE HOLDINGS LIMITED REA REA GROUP LTD REC RECALL HOLDINGS LIMIT RMD RESMED INC SGM SIMS METAL MANAGEMENT SGR THE STAR ENTERTAINMENT GROUP LTD SKI SPARK INFRASTRUCTURE SPO SPOTLESS GROUP HOLDINGS LIMITED SRX SIRTEX MEDICAL LTD TAH TABCORP HOLDINGS LTD TPM TPG TELECOM LTD TTS TATTS GROUP LIMITED TWE TREASURY WINE ESTATES WOR WORLEYPARSONS LTD For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

Scheme Booklet

SCHEME BOOKLET For a scheme of arrangement in relation to the proposed combination of Tatts Group Limited (ABN 19 108 686 040) and Tabcorp Holdings Limited (ABN 66 063 780 709) Time and date of Scheme Meeting Time: 10:00 am (Brisbane time) Date: 18 October 2017 Venue: Brisbane Convention & Exhibition Centre, cnr Merivale & Glenelg St, South Bank, QLD 4101 VOTE IN FAVOUR THE TATTS DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU VOTE IN FAVOUR OF THE RESOLUTION TO APPROVE THE SCHEME, IN THE ABSENCE OF A SUPERIOR PROPOSAL. THE INDEPENDENT EXPERT HAS CONCLUDED THAT THE SCHEME IS IN THE BEST INTERESTS OF TATTS SHAREHOLDERS, IN THE ABSENCE OF A SUPERIOR PROPOSAL. This is an important document and requires your immediate attention. You should read this document in its entirety before deciding how to vote on the Scheme. If you are in any doubt as to how to deal with this document, please consult your legal, investment, tax or other professional adviser immediately. If you have recently sold all of your Tatts Shares, please ignore this document. Tatts Shareholders who have any questions or require further information about the Scheme should contact the Tatts Shareholder Information Line on 1300 648 141 (within Australia) or +61 3 9415 4127 (outside Australia), Monday to Friday, between 8.30am and 5.30pm. Financial Adviser Legal Adviser Tatts Group Limited Scheme Booklet For a scheme of arrangement between Tatts Group Limited (ABN 19 108 686 040) and its shareholders in relation to the proposed combination of Tatts and Tabcorp Holdings Limited (ABN 66 063 780 709). -

Participant List

PARTICIPANT LIST Please find below a list of current participants in the Quarterly Salary Review. For a complete list by super sector, sector and segment refer to Mercer WIN®. 3M Australia API 7-Eleven Stores API Management A Menarini Australia APL Co. (Aus) - BR A.P.Moller-Maersk AS (AU) Apotex Abbott Australasia APT Management Services (APA Group) AbbVie Aquila Resources Actelion Pharmaceuticals Australia Arrium Mining & Materials Adama Australia Arrow Electronics Australia Adelaide Brighton Asahi Beverages Australia Adelaide Football Club Asaleo Care Australia adidas Australia Ascendas Hospitality Australia Fund Management Adventist Healthcare Aspen Australia AECOM Astrazeneca Afton Chemical Asia Pacific LLC AT & T Global Network Services Australia Aggreko Australia ATCO Australia AIA Australia Atlas Iron Aimia Proprietary Loyalty Australia Ausenco Air New Zealand – Australia AusGroup Akzo Nobel Australia Australia Post Alcatel-Lucent Australia Australian Catholic University Alcon (Novartis) Laboratories Australia Australian Computer Society Alexion Australasia Australian Fashion Labels Allergan Australian Red Cross Blood Service Alphapharm Avaloq Australia Alstom Transport Australia Aveo Group Amadeus IT Pacific Aviall Australia American Express Global Business Travel Australia AVJennings Holdings Amgen Australia Avon Products AMT Group BaptistCare NSW & ACT Amway of Australia Barminco Apex Tool Group BASF Australia © March 2017 Mercer Consulting (Australia) Pty Ltd Quarterly Salary Review 4.1 PARTICIPANT LIST Beam Global Australia -

STOXX AUSTRALIA 150 Selection List

STOXX AUSTRALIA 150 Last Updated: 20210701 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 112.2 1 1 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 90.6 2 2 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 82.2 3 3 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 59.9 4 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.8 5 5 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 50.7 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 42.4 7 7 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 32.5 8 9 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 30.6 9 8 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 29.8 10 10 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 28.3 11 11 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 25.5 12 12 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 24.7 13 13 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 22.5 14 14 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD Y 18.7 15 17 AU000000ALL7 6253983 ALL.AX 605156 Aristocrat Leisure Ltd. AU AUD Y 17.4 16 15 AU0000030678 BYWR0T5 COL.AX AU80Q2 Coles Group AU AUD Y 14.4 17 18 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. -

Bringing the Future Faster

6mm hinge Bringing the future faster. Annual Report 2019 WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Bringing the future faster Spark New Zealand Annual Report 2019 Bringing the future faster Contents Build customer intimacy We need to understand BRINGING THE FUTURE FASTER and anticipate the needs of New Zealanders, and Spark performance snapshot 4 technology enables us Chair and CEO review 6 to apply these insights Our purpose and strategy 10 to every interaction, Our performance 12 helping us serve our Our customers 14 customers better. Our products and technology 18 Read more pages 7 and 14. Our people 20 Our environmental impact 22 Our community involvement 24 Our Board 26 Our Leadership Squad 30 Our governance and risk management 32 Our suppliers 33 Leadership and Board remuneration 34 FINANCIAL STATEMENTS Financial statements 38 Notes to the financial statements 44 Independent auditor’s report 90 OTHER INFORMATION Corporate governance disclosures 95 Managing risk framework roles and 106 responsibilities Materiality assessment 107 Stakeholder engagement 108 Global Reporting Initiative (GRI) content 109 index Glossary 112 Contact details 113 This report is dated 21 August 2019 and is signed on behalf of the Board of Spark New Zealand Limited by Justine Smyth, Chair and Charles Sitch, Chair, Audit and Risk Management Committee. Justine Smyth Key Dates Annual Meeting 7 November 2019 Chair FY20 half-year results announcement 19 February 2020 FY20 year-end results announcement 26 August 2020 Charles Sitch Chair Audit and Risk Management Committee WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Create New Zealand’s premier sports streaming business Spark Sport is revolutionising how New Zealanders watch their favourite sports events. -

Hybrids: Monthly Update - August 2020

Hybrids: Monthly Update - August 2020 Month: Aug-20 Trading days: 21 Period ending: Monday, 31 August 2020 Snapshot by Category Trades Value Australian Segment Bond Segment Number listed Market Cap $b Total (#) Trades per day (#) Volume (#) $m Convertible Preference Shares and Capital Notes 41 38.9 21,947 1,045 4,812,627 488.2 Convertible Bonds 4 0.3 327 16 791,325 5.3 Hybrid Securities 5 3.4 1,594 76 306,338 28.5 Total 50 42.59 23,868 1,137 5,910,290 521.9 Recent Listings Interest Rate / Distribution Entity ASX Code Size ($m) Type Listing Date Issue Price Maturity / Conv / Reset Dividend Frequency Last Price Macquarie Bank Limited MBLPC 641.0 Convertible Preference Shares and Capital03-Jun-2020 Notes $100.00 N/A 4.80% Qtrly $107.00 AMP Limited AMPPB 275.0 Convertible Preference Shares and 24-Dec-2019Capital Notes $100.00 16-Dec-2025 4.60% Qtrly $97.99 Suncorp Group Limited SUNPH 389.0 Convertible Preference Shares and 18-Dec-2019Capital Notes $100.00 17-Jun-2026 3.10% Qtrly $98.80 Clean Seas Seafood Limited CSSG 12.3 Convertible Bonds 18-Nov-2019 $1.00 18-Nov-2022 8.00% S/A $1.04 Commonwealth Bank of Australia CBAPI 1,650.0 Convertible Preference Shares and 15-Nov-2019Capital Notes $100.00 20-Apr-2027 3.10% Qtrly $99.21 Macquarie Group Limited MQGPD 905.5 Convertible Preference Shares and 28-Mar-2019Capital Notes $100.00 10-Sep-2026 4.25% Qtrly $104.85 National Australia Bank Limited NABPF 1,874.1 Convertible Preference Shares and 21-Mar-2019Capital Notes $100.00 17-Jun-2026 4.10% Qtrly $104.43 Westpac Banking Corporation WBCPI 1,423.1 -

Annual Report 2018 Sustainability Report 2018

SUSTAINABILITY REPORTANNUAL REPORT 2018 SIMS METAL MANAGEMENT LIMITED SUSTAINABILITY REPORT 2018 ABOUT THIS REPORT Stewards of our world’s limited resources... ABOUT SIMS METAL MANAGEMENT ALIGNING TO INVESTOR INTEREST We at Sims Metal Management are proud Over the past year, our investors of our role as stewards of our world’s have increasingly asked about Sims’ Recycling for posture and performance in the areas >100 years limited resources for over 100 years. As a global leader of metals and electronics of environmental, social and corporate recycling we play an intrinsic role in the governance (ESG). As the graphic below circular economy, by keeping resources in illustrates, Sims is very much aligned with use as long as possible, extracting the the circular economy – where materials maximum value from those resources remain in useful life for as long as possible. >250 facilities We discuss this in detail later in this report. including JVs while in use, and then recovering and regenerating products and materials at In June 2017, the G20 Financial Stability the end of their useful life. Our efforts Board’s Task Force on Climate-Related contribute to the sustainable future of Financial Disclosures (TCFD) released its our world. final recommendations on the disclosure Operations in Our core businesses are: of the risks and opportunities as we 18 countries transition into a lower carbon economy. • Metals Recycling - As the world’s We have organized this report around leading publicly listed metals recycler, the four main categories of the TCFD Sims buys and sells ferrous and recommendations. (Governance, Strategy, non-ferrous recycled metals.