Participating Organisations | May 2021 Aon Rewards Solutions Proprietary and Confidential

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 4E Carsales.Com Ltd Results for Announcement to the Market

Appendix 4E carsales.com Ltd ABN 91 074 444 018 Results for Announcement to the Market Full-year ended 30 June 2020 (Previous corresponding period: Full-year ended 30 June 2019) A$’000 Revenue from continuing operations Down (5.25%) to 395,585 Profit for the year after tax Up 38.84% to 116,953 Net profit for the period attributable to members Up 36.49% to 114,668 Adjusted net profit* for the period attributable to members Up 6.17% to 138,189 Franked Amount amount Dividends/Distribution per security per security 2019 Final Dividend paid 25.0 cents 25.0 cents 2020 Interim Dividend paid 22.0 cents 22.0 cents 2020 Final Dividend declared 25.0 cents 25.0 cents 2020 final dividend dates Record date for determining entitlements to the dividends 23rd September 2020 Latest date for dividend reinvestment plan participation 24th September 2020 Dividend payable 7th October 2020 30 June 2019 30 June 2020 30 June 2019 Restated*** Net tangible assets backing per ordinary share** (138.1 cents) (128.9 cents) (158.4 cents) * The presentation of adjusted net profit provides the best measure to assess the performance of the Group by excluding COVID-19 Dealer Support Package, fair value gain arising from discontinuing the equity method (net of NCI), gain on associate investment dilution (net of NCI), loss on disposal of subsidiary, one-off transaction and restructure costs, one-off bad debt expenses, changes in fair value of put option liabilities and deferred consideration, one-off tax adjustment, option unwinding discount and non-cash acquired intangible amortisation from the reported IFRS measure. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Times and the Tough Annual Report 2020 2019/20 Highlights

Banking that works for you through the good times and the tough Annual Report 2020 2019/20 Highlights Vision Recognition Value Created To be the First $ % Choice for Easy 2.730M 88 Achieved strong profit in times of Reduced landfill wasteconsumption to Understand Named Australian uncertainty of $2.730M, allowing us by 88% Banking to continue our investment in your Mutual Lender of Credit Union The Year % Mission 77 Reduced paper waste consumption 859 by 77% Launched new initiatives to To help our strengthen customer services Customers, Inducted into the and celebrated with families, NSW Business entrepreneurs, individuals and 173 People and groups with 859 loans funded Supported 173 individuals, families, Community Chamber Hall of businesses and communities Realise Their Fame through COVID-19 Relief Packages For providing Excellence in $ and was successful in our application Dreams Professional Service, recognising our to participate in the Australian 85,000 Governments Coronavirus SME unprecedented three consecutive Partnered with over 50 local Guarantee Scheme year win in this category organisations and gave over $85,000 back to community groups across the Northern Rivers to make a real difference in the places we call home Awarded Excellence in Business At the NSW Business Chamber, Northern Rivers Regional Business Awards Contents Opening Statement CHAIRMAN & CEO’S At the heart of our strategy remains our focus on delivering a better DECLARATIONS REPORT 01 35 experience for our customers, businesses and communities. Opening Statement 01 Directors Declaration 35 Never before has this been so meaningful and timely in the unprecedented times in which we now find ourselves, and Financial Performance 06 Auditors Independence Declaration 36 as we continue our journey to invest in our systems, team, services and online technologies to be more responsive, Risk, Regulation, Compliance & Governance 08 relevant and digitally enabled. -

16 August 2021 Company Announcements Office Australian

16 August 2021 Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 2021 FULL YEAR RESULTS – ANNUAL REPORT Seven West Media Limited (ASX: SWM) attaches the Annual Report for the year ended 26 June 2021. This release has been authorised to be given to ASX by the Board of Seven West Media Limited. For further information, please contact: Investors/Analysts Media Alan Stuart Rob Sharpe T: +61 2 8777 7211 T: +61 437 928 884 E: [email protected] E: [email protected] Seven West Media Limited / 50 Hasler Road, Osborne Park WA 6017 Australia / PO Box 7077, Alexandria NSW 2015 Australia T +61 2 8777 7777 / ABN 91 053 480 845 Repositioned for growth. Annual Report 2021 Big Brother Contents Our Strategy Who We Are 2 Our Strategic Priorities and Performance Dashboard 4 Executive Letters Letter from the Chairman 6 Letter from the Managing Director and Chief Executive Officer 8 Review of Operations Group Performance – Key Highlights and Summary of Financial Performance 11 Seven Network 17 The West 20 Corporate Social Responsibility Risk, Environment, People and Social Responsibility 22 Seven in the Community 28 Governance Board of Directors 33 Corporate Governance Statement 36 Directors’ Report 47 Remuneration Report 52 Auditor’s Independence Declaration 73 Financial Statements Financial Statements 74 Directors’ Declaration 132 Independent Auditor’s Report 133 Investor Information 138 Shareholder Information 139 Company Information 141 1 Section 1: Our Strategy Seven West Media Limited Annual Report 2021 Who We Are Transforming to lead Seven West Media is being transformed to drive long-term success. -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

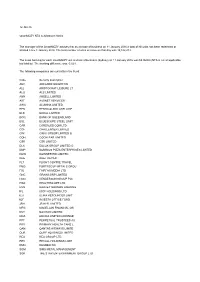

Code Security Description ABC ADELAIDE BRIGHTON ALL

12-Jan-16 smartMOZY NTA & Allotment Notice The manager of the SmartMOZY advises that as at close of business on 11 January 2016 a total of Nil units has been redeemed or allotted since 8 January 2016. The total number of units on issue on that day was 12,182,274. The asset backing for each smartMOZY unit at close of business (Sydney) on 11 January 2016 was $4.96903 (NTA is net of applicable tax liability). The tracking difference was -3.02% The following companies are currently in the Fund: Code Security description ABC ADELAIDE BRIGHTON ALL ARISTOCRAT LEISURE LT ALQ ALS LIMITED ANN ANSELL LIMITED AST AUSNET SERVICES AWC ALUMINA LIMITED BEN BENDIGO AND ADELAIDE BLD BORAL LIMITED BOQ BANK OF QUEENSLAND BSL BLUESCOPE STEEL LIMIT CAR CARSALES COM LTD CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O COH COCHLEAR LIMITED CSR CSR LIMITED DLX DULUX GROUP LIMITED O DMP DOMINOS PIZZA ENTERPRISES LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FMG FORTESCUE METALS GROU FXJ FAIRFAX MEDIA LTD GNC GRAINCORP LIMITED HGG HENDERSON GROUP PLC HSO HEALTHSCOPE LTD HVN HARVEY NORMAN HOLDING IFL IOOF HOLDINGS LTD ILU ILUKA RESOURCES LIMIT IOF INVESTA OFFICE FUND JBH JB HI-FI LIMITED MFG MAGELLAN FINANCIAL GR NVT NAVITAS LIMITED ORA ORORA LIMITED ORDINAR PPT PERPETUAL TRUSTEES AU PRY PRIMARY HEALTH CARE L QAN QANTAS AIRWAYS LIMITE QUB QUBE HOLDINGS LIMITED REA REA GROUP LTD REC RECALL HOLDINGS LIMIT RMD RESMED INC SGM SIMS METAL MANAGEMENT SGR THE STAR ENTERTAINMENT GROUP LTD SKI SPARK INFRASTRUCTURE SPO SPOTLESS GROUP HOLDINGS LIMITED SRX SIRTEX MEDICAL LTD TAH TABCORP HOLDINGS LTD TPM TPG TELECOM LTD TTS TATTS GROUP LIMITED TWE TREASURY WINE ESTATES WOR WORLEYPARSONS LTD For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

Countertop EFTPOS User Guide

CounterTop EFTPOS machine User guide Welcome to your new CounterTop EFTPOS machine For easy install and set up of your EFTPOS machine, use this guide. After set up, please keep this guide somewhere handy, close to your EFTPOS machine. It provides useful tips and steps for commonly used functions and questions: Getting started . 3 Getting started Getting set up . 6 Network .....................................................6 EFTPOS machine ............................................7 What’s in the box? Notes on passwords .........................................8 Tyro App, Tyro Portal and more ...............................9 Your new CounterTop EFTPOS machine Pairing your POS/PMS with your EFTPOS machine. 11 Power adapter Start transacting . 12 Ethernet cable EFTPOS features available on request . 14 Cleaning your EFTPOS machine . 16 Ways to pay stickers for your window/door, Troubleshooting . 17 Point of Sale area and EFTPOS machine Rebooting your EFTPOS machine ...........................17 Returns and damages ......................................17 If any of the items are missing, please contact Decline codes ..............................................18 Customer Support on 1300 108 976. 2 Bendigo Bank EFTPOS powered by Tyro, CounterTop EFTPOS machine user guide 3 Handy information • As part of the process you will be assigned and emailed a Merchant ID number (MID)* The first step is • Note: You may have been assigned multiple MIDs, depending on the requirements of your business and EFTPOS machine to activate your Examples include if you have more than one trading location, or EFTPOS machine . wish to settle different machines to different bank accounts • MIDs are unique identifiers for your EFTPOS machine/s with Tyro Call 1300 108 976 We suggest you note them down here for future reference to speak to our Australian-based MID Customer Support MID team available 24/7, 365 days a year . -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

Participant List

PARTICIPANT LIST Please find below a list of current participants in the Quarterly Salary Review. For a complete list by super sector, sector and segment refer to Mercer WIN®. 3M Australia API 7-Eleven Stores API Management A Menarini Australia APL Co. (Aus) - BR A.P.Moller-Maersk AS (AU) Apotex Abbott Australasia APT Management Services (APA Group) AbbVie Aquila Resources Actelion Pharmaceuticals Australia Arrium Mining & Materials Adama Australia Arrow Electronics Australia Adelaide Brighton Asahi Beverages Australia Adelaide Football Club Asaleo Care Australia adidas Australia Ascendas Hospitality Australia Fund Management Adventist Healthcare Aspen Australia AECOM Astrazeneca Afton Chemical Asia Pacific LLC AT & T Global Network Services Australia Aggreko Australia ATCO Australia AIA Australia Atlas Iron Aimia Proprietary Loyalty Australia Ausenco Air New Zealand – Australia AusGroup Akzo Nobel Australia Australia Post Alcatel-Lucent Australia Australian Catholic University Alcon (Novartis) Laboratories Australia Australian Computer Society Alexion Australasia Australian Fashion Labels Allergan Australian Red Cross Blood Service Alphapharm Avaloq Australia Alstom Transport Australia Aveo Group Amadeus IT Pacific Aviall Australia American Express Global Business Travel Australia AVJennings Holdings Amgen Australia Avon Products AMT Group BaptistCare NSW & ACT Amway of Australia Barminco Apex Tool Group BASF Australia © March 2017 Mercer Consulting (Australia) Pty Ltd Quarterly Salary Review 4.1 PARTICIPANT LIST Beam Global Australia -

Sep Tem B Er

4 201 Quarterly Newsletter September FML S In this quarterly edition we review performance and attribution. We profile GBST Holdings and IProperty Group. Offshore we take a look at QE and US Energy. We also consider how Technology for the Ages changes with each generation. Photo: School holidays - no worries, surfing for a 9 year old maybe as good as it gets and no technology needed. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au selector About Selector We are a boutique fund manager and we have a combined experience of over 150 years. We believe in long term wealth creation and building lasting relationships with our investors. Our focus is stock selection. Our funds are high conviction, concentrated and index unaware. As a result we have low turnover and produce tax effective returns. First we identify the best business franchises with the best management teams. Then we focus on valuations. Please forward to us contact details if you would like future newsletters to be emailed to family, friends or business colleagues. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000, Australia Telephone 612 8090 3612 Web www.selectorfund.com.au selector September 2014 Selector High Conviction Equity Fund Quarterly Newsletter #45 Dear Investor, With the company reporting season over for another year, investor attention has quickly shifted to the road ahead. Here the simple message, proceed with caution, has been top of mind and for good reason. -

ASX Announcement

ASX Announcement COVID-19 TRADING UPDATE #50 - WEEK ENDED 26 FEBRUARY 2021 Sydney, 1 March 2021 – As previously announced Tyro Payments had committed to provide weekly transaction value updates until the publication of its full year results for FY21. This temporary measure introduced to provide transparency as to the impact of COVID-19 on our operations. The information in the table below provides our transaction value data up to and including 26 February 2021. Please note the financial information provided is based upon unaudited management accounts which have not been independently reviewed or verified. In addition we note that past performance may not be a reliable indicator of future performance. Period FY20 FY19 % Increase March $1.600 billion $1.559 billion 3% April $0.911 billion $1.468 billion (38%) May $1.285 billion $1.562 billion (18%) June $1.656 billion $1.553 billion 7% FY20 $20.131 billion $17.497 billion 15% Period FY21 FY20 % Increase July $1.851 billion $1.667 billion 11% August $1.701 billion $1.766 billion (4%) September $1.787 billion $1.696 billion 5% October $1.994 billion $1.817 billion 10% November $2.159 billion $1.913 billion 13% December $2.626 billion $2.206 billion 19% January $2.022 billion $1.830 billion 10% February to 26 February (date-on-date)* $1.801 billion $1.556 billion 16% February (same day-on-day) ** $1.801 billion $1.591 billion 13% February (year-to-date) $15.941 billion $14.451 billion 10% *February 2020 was a 29 day month **Assessing against the same corresponding day of week in prior comparative period rather than the calendar date.