Global Industrials Weekly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tuesday July 30, 1996

7±30±96 Tuesday Vol. 61 No. 147 July 30, 1996 Pages 39555±39838 federal register 1 II Federal Register / Vol. 61, No. 147 / Tuesday, July 30, 1996 SUBSCRIPTIONS AND COPIES PUBLIC Subscriptions: Paper or fiche 202±512±1800 FEDERAL REGISTER Published daily, Monday through Friday, Assistance with public subscriptions 512±1806 (not published on Saturdays, Sundays, or on official holidays), by General online information 202±512±1530 the Office of the Federal Register, National Archives and Records Administration, Washington, DC 20408, under the Federal Register Single copies/back copies: Act (49 Stat. 500, as amended; 44 U.S.C. Ch. 15) and the Paper or fiche 512±1800 regulations of the Administrative Committee of the Federal Register Assistance with public single copies 512±1803 (1 CFR Ch. I). Distribution is made only by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC FEDERAL AGENCIES 20402. Subscriptions: The Federal Register provides a uniform system for making Paper or fiche 523±5243 available to the public regulations and legal notices issued by Assistance with Federal agency subscriptions 523±5243 Federal agencies. These include Presidential proclamations and For other telephone numbers, see the Reader Aids section Executive Orders and Federal agency documents having general applicability and legal effect, documents required to be published at the end of this issue. by act of Congress and other Federal agency documents of public interest. Documents are on file for public inspection in the Office of the Federal Register the day before they are published, unless earlier filing is requested by the issuing agency. -

P 01.Qxd 6/30/2005 2:00 PM Page 1

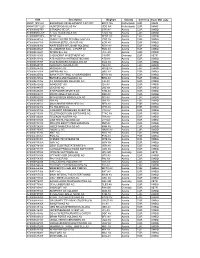

p 01.qxd 6/30/2005 2:00 PM Page 1 June 27, 2005 © 2005 Crain Communications GmbH. All rights reserved. €14.95; or equivalent 20052005 GlobalGlobal MarketMarket DataData BookBook Global Vehicle Production and Sales Regional Vehicle Production and Sales History and Forecast Regional Vehicle Production and Sales by Model Regional Assembly Plant Maps Top 100 Global Suppliers Contents Global vehicle production and sales...............................................4-8 2005 Western Europe production and sales..........................................10-18 North America production and sales..........................................19-29 Global Japan production and sales .............30-37 India production and sales ..............39-40 Korea production and sales .............39-40 China production and sales..............39-40 Market Australia production and sales..........................................39-40 Argentina production and sales.............45 Brazil production and sales ....................45 Data Book Top 100 global suppliers...................46-50 Mary Raetz Anne Wright Curtis Dorota Kowalski, Debi Domby Senior Statistician Global Market Data Book Editor Researchers [email protected] [email protected] [email protected], [email protected] Paul McVeigh, News Editor e-mail: [email protected] Irina Heiligensetzer, Production/Sales Support Tel: (49) 8153 907503 CZECH REPUBLIC: Lyle Frink, Tel: (49) 8153 907521 Fax: (49) 8153 907425 e-mail: [email protected] Tel: (420) 606-486729 e-mail: [email protected] Georgia Bootiman, Production Editor e-mail: [email protected] USA: 1155 Gratiot Avenue, Detroit, MI 48207 Tel: (49) 8153 907511 SPAIN, PORTUGAL: Paulo Soares de Oliveira, Tony Merpi, Group Advertising Director e-mail: [email protected] Tel: (35) 1919-767-459 Larry Schlagheck, US Advertising Director www.automotivenewseurope.com Douglas A. Bolduc, Reporter e-mail: [email protected] Tel: (1) 313 446-6030 Fax: (1) 313 446-8030 Tel: (49) 8153 907504 Keith E. -

World Automotive Aftermarket

Study Publication Date: April 2001 Freedonia Industry Study #1408 Price: $4,500 Pages: 408 World Automotive Aftermarket World Automotive Aftermarket, a new study from The Freedonia Group, provides you with an in-depth analysis of the major trends in the world automotive aftermarket and the outlook for product segments -- critical informa- tion to help you with strategic planning. This brochure gives you an indication of the scope, depth and value of Freedonia's new study, World Automo- tive Aftermarket. Ordering information is included on the back page of the brochure. Brochure Table of Contents Study Highlights ............................................................................... 2 Study Table of Contents and List of Tables and Charts ................... 4 Sample Pages and Tables from: Market Environment.................................................... 6 World Supply and Demand.......................................... 7 Supply and Demand by Country and Region............... 8 Industry Structure ........................................................ 9 Company Profiles ...................................................... 10 List of Companies Profiled ........................................ 11 Forecasting Methodology ............................................................... 12 About the Company ....................................................................... 13 Advantages of Freedonia Reports ................................................... 13 About Our Customers ................................................................... -

NOMURA FUNDS IRELAND PLC Interim Report and Unaudited

NOMURA FUNDS IRELAND PLC Interim Report and Unaudited Financial Statements for the half year ended 30th June, 2010 Company Registration No. 418598 NOMURA FUNDS IRELAND PLC TABLE OF CONTENTS Page MANAGEMENT AND ADMINISTRATION 2 GENERAL INFORMATION 3 INVESTMENT MANAGER’S REPORT NOMURA FUNDS IRELAND - GLOBAL EMERGING MARKETS FUND 7 NOMURA FUNDS IRELAND - INDIA EQUITY FUND 9 NOMURA FUNDS IRELAND - ASIA PACIFIC EX JAPAN FUND 11 NOMURA FUNDS IRELAND - FUNDAMENTAL INDEX GLOBAL EQUITY FUND 13 NOMURA FUNDS IRELAND - US HIGH YIELD BOND FUND 14 NOMURA FUNDS IRELAND - JAPAN STRATEGIC VALUE FUND 16 STATEMENT OF FINANCIAL POSITION 18 STATEMENT OF COMPREHENSIVE INCOME 22 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO HOLDERS OF REDEEMABLE PARTICIPATING SHARES 25 STATEMENT OF CASH FLOWS 28 NOTES TO THE FINANCIAL STATEMENTS 31 STATEMENT OF INVESTMENTS NOMURA FUNDS IRELAND - GLOBAL EMERGING MARKETS FUND 77 NOMURA FUNDS IRELAND - INDIA EQUITY FUND 101 NOMURA FUNDS IRELAND - ASIA PACIFIC EX JAPAN FUND 105 NOMURA FUNDS IRELAND - FUNDAMENTAL INDEX GLOBAL EQUITY FUND 113 NOMURA FUNDS IRELAND - US HIGH YIELD BOND FUND 212 NOMURA FUNDS IRELAND - JAPAN STRATEGIC VALUE FUND 234 STATEMENT OF CHANGES IN THE PORTFOLIO NOMURA FUNDS IRELAND - GLOBAL EMERGING MARKETS FUND 242 NOMURA FUNDS IRELAND - INDIA EQUITY FUND 244 NOMURA FUNDS IRELAND - ASIA PACIFIC EX JAPAN FUND 246 NOMURA FUNDS IRELAND - FUNDAMENTAL INDEX GLOBAL EQUITY FUND 248 NOMURA FUNDS IRELAND - US HIGH YIELD BOND FUND 250 NOMURA FUNDS IRELAND - JAPAN STRATEGIC VALUE FUND 252 1 NOMURA FUNDS IRELAND PLC -

Dimensional Investment Group

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2008-04-29 | Period of Report: 2008-02-29 SEC Accession No. 0001104659-08-027772 (HTML Version on secdatabase.com) FILER DIMENSIONAL INVESTMENT GROUP INC/ Business Address 1299 OCEAN AVE CIK:861929| IRS No.: 000000000 | State of Incorp.:MD | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-06067 | Film No.: 08784216 SANTA MONICA CA 90401 2133958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-6067 DIMENSIONAL INVESTMENT GROUP INC. (Exact name of registrant as specified in charter) 1299 Ocean Avenue, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary Dimensional Investment Group Inc., 1299 Ocean Avenue, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: February 29, 2008 ITEM 1. SCHEDULE OF INVESTMENTS. Dimensional Investment Group Inc. Form N-Q February 29, 2008 (Unaudited) Table of Contents Definitions of Abbreviations and Footnotes Schedules of Investments U.S. Large Cap Value Portfolio II U.S. Large Cap Value Portfolio III LWAS/DFA U.S. High Book to Market Portfolio DFA International Value Portfolio Copyright © 2012 www.secdatabase.com. -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of NEW YORK ------X : in Re : Chapter 11 : Chrysler LLC, Et Al., : Case No

JONES DAY 222 East 41st Street New York, New York 10017 Telephone: (212) 326-3939 Facsimile: (212) 755-7306 Corinne Ball Veerle Roovers JONES DAY North Point 901 Lakeside Avenue Cleveland, Ohio 44114 Telephone: (216) 586-3939 Facsimile: (216) 579-0212 David G. Heiman JONES DAY 1420 Peachtree Street, N.E. Suite 800 Atlanta, Georgia 30309 Telephone: (404) 521-3939 Facsimile: (404) 581-8309 Jeffrey B. Ellman Proposed Attorneys for Debtors and Debtors in Possession UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------x : In re : Chapter 11 : Chrysler LLC, et al., : Case No. 09-50002 (AJG) : Debtors. : (Jointly Administered) : ---------------------------------------------------------------x APPLICATION OF DEBTORS AND DEBTORS IN POSSESSION, PURSUANT TO SECTIONS 327(a), 328(a), 329(a) AND 364 OF THE BANKRUPTCY CODE, BANKRUPTCY RULES 2014(a) AND 2016(b) AND LOCAL BANKRUPTCY RULES 2014-1 AND 2016-1, FOR AN ORDER AUTHORIZING THEM TO RETAIN AND EMPLOY JONES DAY AS COUNSEL, NUNC PRO TUNC AS OF THE PETITION DATE NYI-4179615v5 TO THE HONORABLE UNITED STATES BANKRUPTCY JUDGE: Chrysler LLC ("Chrysler") and 24 of its domestic direct and indirect subsidiaries, as debtors and debtors in possession (collectively with Chrysler, the "Debtors"), respectfully represent as follows: Background 1. On the date hereof (the "Petition Date"), the Debtors commenced their reorganization cases by filing voluntary petitions for relief under chapter 11 of title 11 of the United States Code (the "Bankruptcy Code"). By a motion filed on the Petition Date, the Debtors have requested that their chapter 11 cases be consolidated for procedural purposes only and administered jointly. 2. The Debtors are authorized to continue to operate their business and manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. -

Annual Report

Annual Report For the year ended 31 March 2014 Simplifying payments for everyone OUR BUSINESS Today, there is an ever-expanding number of ways to pay. Customers increasingly expect Contents to pay the way they want, wherever they are and at any time. PayPoint is the answer to Page that demand. We take all the complexity of multi-channel payments and translate it into convenient, simple, value-added solutions. Strategic report Highlights 1 We are an international leader in our field, and a pioneer of a range of payment technologies. Every year, we handle over £14 billion in payments, for more than 6,000 Chairman’s statement 2 clients and merchants. Our solutions transform payments for everyone from consumer and financial services companies to retailers, utilities, media, gaming and government Chief Executive’s review 3 clients. They are delivered through a unique combination of local shops, mobile and Strategy and business model 5 online distribution channels. Key performance indicators 6 Retail networks Review of business 7 We operate branded retail networks across the UK, Ireland and Romania. Trends and factors on future 10 In the UK, our growing network already includes terminals in over 26,700 local shops development including Co-op, Spar, McColls, Costcutter, Sainsbury’s Local, Tesco Express, One Stop, Risks and uncertainties 11 Asda, Londis and thousands of independent outlets. These outlets are quick and convenient places to make energy meter prepayments, bill payments, benefit payments, Environmental matters, 13 mobile phone top-ups, transport tickets, BBC TV licences, cash withdrawals and a range employees, social, community and of other transactions. -

Appendix Specimen Financial Statements

1723 Appendix Specimen financial statements This appendix contains the annual report and accounts of a mythical UK company - Good Group P.L.C., a listed public company with subsidiaries. The report and accounts are only illustrative and do not attempt to show all possible disclosure requirements. In any case of doubt as to the legal or other requirements, it is essential to refer to the relevant source and, where necessary, to seek appropriate professional advice. Although the specimen accounts attempt to illustrate the most likely disclosure requirements of a manufacturing company, they should not be regarded as a comprehensive checklist of statutory and accounting requirements. They comply with the Companies Act 1985, as amended (the Companies Act), with other requirements in force at 31 July 1997 and are drawn up in accordance with current best practice at the date of issue. The requirements of exposure drafts are not dealt with in these specimen accounts. The formats used in the specimen accounts are consolidated accounts with the profit and loss account in format 1 and the balance sheet in format 1 taken from Schedule 4 to the Companies Act. The marginal annotations accompanying the accounts contain source references to the Companies Act, Statements of Standard Accounting Practice, Financial Reporting Standards and Urgent Issues Task Force abstracts, together with the requirements of the London Stock Exchange for listed companies. The recommendations of the Committee on the Financial Aspects of Corporate Governance (the 'Cadbury Committee') have been reflected in the accounts for Good Group P.L.C. Northern Ireland The specimen accounts are based on the statutory requirements for Great Britain. -

Europe Market Value (NOK 1000) Ownership Stake (Per Cent) Market Value (NOK 1000) Ownership Stake (Per Cent) Market Value (NOK 1000) Ownership Stake (Per Cent)

38 Holdings of equities at 31 December 2002 Europe Market value (NOK 1000) Ownership stake (per cent) Market value (NOK 1000) Ownership stake (per cent) Market value (NOK 1000) Ownership stake (per cent) Austria Fortum Oyj 140 224 0.365 Thomson/ex-TMM 83 091 0.251 Andritz AG 2 674 0.123 Huhtamaki Oyj 21 591 0.307 Total Fina Elf SA 2 803 577 0.414 Austrian Airlines 502 0.031 Instrumentarium Oyj 22 204 0.166 Trader Classified Media NV 8 795 0.179 Baumax AG 2 551 0.362 Jaakko Poyry Group Oyj 4 689 0.312 Union du Credit-Bail Immobilier 17 645 0.076 BBAG Oesterreichische Brau-Beteiligungs AG 20 634 0.494 KCI Konecranes International 1 693 0.070 Union Financiere de France BQE SA 4 696 0.178 Boehler-Uddeholm 5 383 0.153 Kemira Oyj 2 381 0.041 Valeo SA 104 910 0.588 Brau Union AG 25 542 0.633 Kone Oyj 5 200 0.039 Vinci SA 112 307 0.335 BWT AG 842 0.067 Metso Oyj 42 815 0.420 Vivendi Environnement 70 290 0.108 CA Immobilien Anlagen AG 1 438 0.050 Nokia OYJ 2 179 792 0.414 Vivendi Universal SA 845 465 0.694 Erste Bank Der Oesterreichischen Sparkassen AG 66 749 0.239 Nokian Renkaat Oyj 11 156 0.427 EVN AG 5 264 0.048 Novo Group Oyj 847 0.122 Greece Flughafen Wien AG 3 586 0.073 OKO Bank 23 971 0.484 Aegek S.A. 1 393 0.125 IMMOFINANZ Immobilien Anlagen AG 5 065 0.077 Outokumpu Oyj 64 030 0.615 Aktor Sa Technical Company 14 465 0.307 Lenzing AG 1 511 0.063 Perlos Oyj 1 966 0.086 Alpha Bank AE 8 045 0.052 Mayr-Melnhof Karton AG 4 884 0.088 Pohjola Group Plc 3 783 0.069 Alpha Investment AE 211 0.012 OMV AG 166 881 0.913 Rautaruukki Oyj 2 751 0.079 Altec Sa Information & Communication Systems 769 0.100 Palfinger AG 284 0.029 Sampo Oyj 53 636 0.183 Aluminum of Greece S.A.I.C. -

Full NX List

ISIN Description BbgSym Country Currency Exch MIC code ANN3116N1661 EUROPEAN DEVELOPMENT CAP CRP EDCC NA Netherlands EUR XAMS ANN4327C1220 HUNTER DOUGLAS NV HDG NA Netherlands EUR XAMS AT000000STR1 STRABAG SE-BR STR AV Austria EUR XWBO AT00000ATEC9 A-TEC INDUSTRIES AG ATEC AV Austria EUR XWBO AT00000BENE6 BENE AG BENE AV Austria EUR XWBO AT0000499157 CHRIST WATER TECHNOLOGY AG CWT AV Austria EUR XWBO AT0000603709 AGRANA BETEILIGUNGS AG AGR AV Austria EUR XWBO AT0000606306 RAIFFEISEN INTL BANK HOLDING RIBH AV Austria EUR XWBO AT0000609607AT0000609607 ALLGEMEINE BAU - A. PORR AG POS AV AustriaAustria EUR XWBO AT0000612601 INTERCELL AG ICLL AV Austria EUR XWBO AT0000613005 C-QUADRAT INVESTMENT AG C8I GR Germany EUR XETR AT0000617832 ATB AUSTRIA ANTRIEBSTECHNIK ATB AV Austria EUR XWBO AT0000617907 ECO BUSINESS-IMMOBILIEN AG ECO AV Austria EUR XWBO AT0000620158 AUSTRIAN AIRLINES AG AUA AV Austria EUR XWBO AT0000624705 BKS BANK AG BKUS AV Austria EUR XWBO AT0000625108 OBERBANK AG OBS AV Austria EUR XWBO AT0000625504 BANK FUER TIROL & VORARLBERG BTUV AV Austria EUR XWBO ATAT00006405520000640552BBURGENLANDURGENLAND HHOLDINGOLDING AAGG BHD AV AAustriaustria EEURUR XWBXWBOO AT0000641352 CA IMMOBILIEN ANLAGEN AG CAI AV Austria EUR XWBO AT0000642806 IMMOEAST AG IEA AV Austria EUR XWBO AT0000644505 LENZING AG LNZ AV Austria EUR XWBO AT0000645403 KTM POWER SPORTS AG KTM AV Austria EUR XWBO AT0000652011 ERSTE GROUP BANK AG EBS AV Austria EUR XWBO AT0000652250 SPARKASSEN IMMOBILIEN AG SPI AV Austria EUR XWBO AT0000676903 RHI AG RHI AV Austria EUR XWBO -

Private Equity

DECISIONS THAT COUNT ANNUAL REPORT 2006 ADDITIONAL INFORMATION Annual Report 2006 – Additional Information I. Tables of returns 1. Auditors’ Report ................................................................................................. 1 2. General Notes .................................................................................................... 2 3. Short Term Investments ....................................................................................... 4 4. Real Return Bonds............................................................................................... 6 5. Long Term Bonds................................................................................................. 8 6. Bonds ..............................................................................................................10 7. Fixed Income - Bonds .........................................................................................12 8. Canadian Equity ................................................................................................14 9. Canadian Equity Quoted Markets .........................................................................16 10. U.S. Equity (Hedged) .........................................................................................18 11. U.S. Equity (Unhedged) .......................................................................................20 12. U.S. Equity Quoted Markets ................................................................................22 13. EAFE Foreign Equity (Hedged) -

A State Affiliate of the U.S. Census Bureau Governor of Ohio Lt

A State Affiliate of the U.S. Census Bureau Governor of Ohio Lt. Governor of Ohio Director, Ohio Department of Development INTRODUCTION AND EXPLANATIONS • • • • • • “ ” Establishments and Employment by Country Country Establishments Employees Japan 559 51,747 Pacific Rim Australia 37 1,300 China 10 902 China - Hong Kong 13 1,427 China - Taiwan 4 161 India 31 2,218 New Zealand 8 699 Singapore 5 30 South Korea 10 426 Thailand 1 60 France 131 13,012 Germany 528 29,848 Switzerland 133 13,130 United Kingdom 774 25,942 Europe Austria 14 789 Belgium 55 6,608 Denmark 3 270 Finland 15 1,399 Ireland 51 3,711 Italy 73 6,541 Liechtenstein 3 49 Luxembourg 170 5,700 Netherlands 78 5,663 Norway 5 339 Russia 10 1,045 Spain 9 418 Sweden 26 1,819 Ukraine 1 100 Canada 545 14,936 Americas Bermuda 1 15 Brazil 7 167 British Virgin Islands 3 112 Colombia 2 640 Mexico 13 1,479 Panama 1 3 Middle East Israel 7 94 Kuwait 2 70 Saudi Arabia 5 145 Turkey 11 230 UAE 5 675 South Africa 4 161 Totals 3,363 194,080 International Investment in Ohio Percent Employment by Country Other 23% Japan 27% Canada 8% France 7% United Kingdom Germany 13% 15% Switzerland 7% COUNTRY INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS ESTABLISHMENTS EMPLOYING 5 OR MORE COMPANY CITY COUNTY SIC CODE EMPLOYEES ULTIMATE PARENT COUNTRY: AUSTRALIA TOTAL OHIO ESTABLISHMENTS: 37 1,300 Amcor Pet Packaging USA Inc Napoleon Henry 3089 33 AMCOR LTD Ansell Protective Products Inc Coshocton Coshocton 3842 250 ANSELL LIMITED Boral Bricks, Inc Dayton Montgomery 3251 7 BORAL LIMITED BOVIS LEND LEASE, INC Columbus Franklin 6513 60 LEND LEASE CORPORATION LTD Dyno Nobel Transportation, Inc Cambridge Guernsey 4212 30 ORICA LIMITED Eden Cryogenics LLC Plain City Franklin 3559 6 COOTE INDUSTRIAL LTD Energy Developments, Inc.