Full NX List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

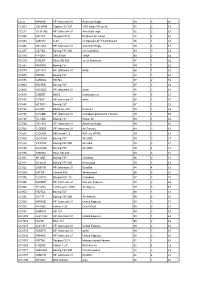

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Corporate Responsibility in the UK Construction Industry: a Study of Activities and Reporting

Corporate Responsibility in the UK Construction Industry: A Study of Activities and Reporting James Daniel Brown, BSc, PgDip. Thesis submitted to the University of Nottingham for the degree of Doctor of Philosophy July 2012 Abstract Corporate Responsibility (CR) defines the process of self-regulation, whereby an organisation seeks to measure and improve its performance related to the social, environmental and economic expectations placed upon it by society. In the past two decades the prominence, and therefore uptake of CR activities and reporting has increased across many sectors. The pace of this change has varied significantly, with many industries quickly becoming aware of its importance and integrating it into their business operations while others have seen CR as lower priority and have been much slower to embrace it. In the UK, while some of the individual components of CR are governed by legislation (e.g. environmental activities and health & safety), others such as social interactions and CR reporting have little or no legislation associated with them. This lack of any clear legislative requirements effectively allows organisations to report on any topics they wish and results in a very varied approach to implementing and reporting upon the subject. While some aspects of CR, such as reporting (Jones, Comfort et al. 2006), performance benchmarking (BITC, Graafland et al (2003)) and attitudes to CR (Herridge, (2003), Petrovic- Lazarevic, (2008)) have been investigated in isolation, there has been no attempt to provide a holistic view of the industry. This research seeks to do just that by combining a range of data in an effort to build a broad evidence base of the industry‟s reporting practices, performance and perceptions of the industry with regards to CR. -

Scott Wilson Scotland: a History Volume 11 the Interchange Years

Doc 12.56: Scott Wilson Scotland: A History: Vol 11: The Interchange Years 2005-2009 JP McCafferty Scott Wilson Scotland: A History Volume 11 The Interchange Years 2005-2009 Transcribed and edited from ‘Interchange’ JP McCafferty 1 Doc 12.56: Scott Wilson Scotland: A History: Vol 11: The Interchange Years 2005-2009 JP McCafferty Significant or notable projects, people and events are highlighted as follows for ease of reference:- Projects/Disciplines People Issue/Date Actions Contents Background ......................................................................................................................................... 12 Interchange ......................................................................................................................................... 12 JP McCafferty [Find Issues 1-40; Fix Pics P 16, 21; Fix P 68 150 Header 2]...................................... 12 Interchange 41 [21.10.2005] ............................................................................................................... 13 The Environment section in Edinburgh is delighted to welcome Nicholas Whitelaw ..................... 13 Interchange 42 [28.10.2005] ............................................................................................................... 13 S W Renewable Energy at British Wind Energy Association [Wright; Morrison] ............................. 13 Interchange 43 [4.11.2005] ................................................................................................................. 14 Jobs: Civil -

Development Securities PLC Annual Report 2006

Development Securities PLC Annual Report 2006 1 Financial highlights Development Securities PLC Annual Report 2006 Financial highlights £23.6m 6.75p 63.4p Profit after tax Annual dividends per share Earnings per share £231.4m £14.4m 568p Net assets Net borrowings Net assets per share Net assets per share Earnings per share Dividends per share 06 568* 06 63.4* 06 6.75* 05 510* 05 54.8* 05 6.37* 04 472* 04 54.3* 04 6.0* 03 444 03 4.2 03 5.4 02 423 02 26.9 02 5.0 01 423 01 24.0 01 4.5 Contents 02 Chairman’s statement 04 Our strategy 12 Review of operations 18 Property investment portfolio 22 Sustainability report 24 Board of Directors 26 Report of the Directors 28 Corporate governance 32 Contents of the financial statements 68 Remuneration report 76 Financial calendar and advisors *stated in accordance with IFRS 2 Chairman’s statement Development Securities PLC Annual Report 2006 Chairman’s statement I am pleased to report another very for other potential property acquisitions. The growing size and strength of our satisfactory year for your Company, We were pleased with the strength of support balance sheet, recently augmented by the resulting in a significant uplift in demonstrated by both existing and new £23.1 million share placing, supports our shareholder funds. shareholders for this successful placing. adjusted business model, whereby we now consider it appropriate to secure direct An increased contribution from our development Strategy ownership of land for development. Our recent activities, coupled with a strong performance Shareholders will be aware that the strategic £33.5 million acquisition of Curzon Park, in from our property investment portfolio enables focus of our development activities over the equal partnership with Grainger PLC, is a me to report a profit after tax of £23.6 million last two years has been suburban London case in point. -

Crr 412/2002

HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management Prepared by Risk Solutions for the Health and Safety Executive CONTRACT RESEARCH REPORT 412/2002 HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management E Baker Risk Solutions 1st floor, Central House 14 Upper Woburn Place London, WC1H 0JN United Kingdom The concept of good practice is central to HSE’s approach to regulation of health and safety management. There must therefore be a common understanding of what good practice is and where it can be found. A survey was conducted to explore how industry actually identifies good practice in health and safety management, decides how to adopt it, and how this is communicated with others. The findings are based primarily on a segmentation of the survey results by organisation size, due to homogeneity of the returns along other axes of analysis. A key finding is that there is no common understanding of the term good practice or how this is distinguished from best practice. Regulatory interpretation of good practice is perceived to be inconsistent. Three models were identified: A) Large organisations, primarily in privatised industries, have effective Trade Associations where good practice is developed and guidance disseminated industry-wide. B) Large and medium-sized organisations in competitive industries have ineffective trade associations. They develop good practices in-house and may only share these with their competitors when forced to do so. C) Small organisations have little contact with their competitors. -

View Annual Report

GROWTH THROUGH INNOVATION Halma plc Annual Report and Accounts 2012 Overview 01 Investment Proposition 02 Group at a Glance 04 Strategy and Business Model 06 Innovation in Healthcare and Analysis 08 Innovation in Infrastructure Sensors 10 Innovation in Industrial Safety Business review 12 Chairman’s Statement 14 Performance against Strategy 20 Strategic Review 25 Strategy in Action 30 Sector Reviews 30 Health and Analysis 38 Infrastructure Sensors 46 Industrial Safety 54 Financial Review 59 Risk Management and Internal Control 61 Principal Risks and Uncertainties 64 Corporate Responsibility Governance 68 Board of Directors and Executive Board 71 Chairman’s Introduction to Governance 72 Corporate Governance 76 Audit Committee Report 78 Nomination Committee Report 79 Remuneration Committee Report 80 Remuneration Report 87 Other Statutory Information 90 Directors’ Responsibilities Financial statements 91 Independent Auditor’s Report – Group 92 Consolidated Income Statement 92 Consolidated Statement of Comprehensive Income and Expenditure 93 Consolidated Balance Sheet 94 Consolidated Statement of Changes in Equity 95 Consolidated Cash Flow Statement 96 Accounting Policies 102 Notes to the Accounts 135 Independent Auditor’s Report – Company 136 Company Balance Sheet 137 Notes to the Company Accounts 142 Summary 2003 to 2012 144 Halma Directory 148 Shareholder Information and Advisers Overview Business review Governance Financial statements INVESTMENT PROS PO ITION Halma has an impressive record of creating sustained shareholder value through the economic cycle. We have consistently delivered record profits, high returns, strong cash flows, low levels of balance sheet gearing and have a 30+ year track record of growing dividend payments by 5% or more every year. Our ability to achieve record profits through the recent periods of economic turbulence is derived from our strategy of having a group of businesses building strong competitive advantage in specialised safety, health and environmental technology markets with resilient growth drivers. -

Cubesat Data Analysis Revision

371-XXXXX Revision - CubeSat Data Analysis Revision - November 2015 Prepared by: GSFC/Code 371 National Aeronautics and Goddard Space Flight Center Space Administration Greenbelt, Maryland 20771 371-XXXXX Revision - Signature Page Prepared by: ___________________ _____ Mark Kaminskiy Date Reliability Engineer ARES Corporation Accepted by: _______________________ _____ Nasir Kashem Date Reliability Lead NASA/GSFC Code 371 1 371-XXXXX Revision - DOCUMENT CHANGE RECORD REV DATE DESCRIPTION OF CHANGE LEVEL APPROVED - Baseline Release 2 371-XXXXX Revision - Table of Contents 1 Introduction 4 2 Statement of Work 5 3 Database 5 4 Distributions by Satellite Classes, Users, Mass, and Volume 7 4.1 Distribution by satellite classes 7 4.2 Distribution by satellite users 8 4.3 CubeSat Distribution by mass 8 4.4 CubeSat Distribution by volume 8 5 Annual Number of CubeSats Launched 9 6 Reliability Data Analysis 10 6.1 Introducing “Time to Event” variable 10 6.2 Probability of a Successful Launch 10 6.3 Estimation of Probability of Mission Success after Successful Launch. Kaplan-Meier Nonparametric Estimate and Weibull Distribution. 10 6.3.1 Kaplan-Meier Estimate 10 6.3.2 Weibull Distribution Estimation 11 6.4 Estimation of Probability of mission success after successful launch as a function of time and satellite mass using Weibull Regression 13 6.4.1 Weibull Regression 13 6.4.2 Data used for estimation of the model parameters 13 6.4.3 Comparison of the Kaplan-Meier estimates of the Reliability function and the estimates based on the Weibull regression 16 7 Conclusion 17 8 Acknowledgement 18 9 References 18 10 Appendix 19 Table of Figures Figure 4-1 CubeSats distribution by mass .................................................................................................... -

Introductory Note

Introductory Note: Section 58 of the New Zealand Superannuation and Retirement Income Act 2001 requires that the Guardians must invest the Fund on a prudent, commercial basis, and in a manner consistent with best-practice portfolio management. The Guardians have determined that this requires broad diversification of investments. The Fund’s investment strategy includes holding investments benchmarked to global market indices. On 30 June 2011, the Fund’s portfolio held over 6000 listed companies, providing diversification across most of the world’s countries and industries. The Table below sets out our direct exposure to listed companies, by country of exposure. Country of exposure is defined as location of the ultimate global parent's place of incorporation, except in the case of tax haven countries, where we instead look to the place of business for the headquarters of the ultimate global parent. The Fund also has indirect exposure to other companies through total return swaps linked to market indices and through investment in pooled funds. As the Fund increases in value, both the number of securities and the average size of each holding tend to increase. Security Name Value in New Zealand Dollars Australia Abacus Property Group 32,897 Acrux Ltd 36,391 Adelaide Brighton Ltd 101,165 AGL Energy Ltd 1,957,445 Alesco Corp Ltd 19,809 Alkane Resources Ltd 28,026 Alumina Ltd 145,456 Amcor Ltd 255,625 AMP Ltd 4,032,208 Ansell Ltd 116,456 APA Group 131,716 APN News & Media Ltd 2,829,583 Aquila Resources Ltd 84,275 ARB Corp Ltd 32,632 Ardent Leisure -

The Intu Difference Intu Properties Plc Annual Report 2016 Welcome to Our Annual Report 2016

The intu difference intu properties plc Annual report 2016 Welcome to our annual report 2016 Our purpose is to create compelling, joyful experiences that surprise and delight our customers and make them smile. We are a people business and everything we do is guided by our culture and our values. We’re passionate about providing people with their perfect shopping experience so that our retailers flourish. And it’s this that powers our business, creating opportunity for our retailers and value for our investors; benefiting our communities and driving our long-term success. Contents Overview Governance Highlights of 2016 2 Chairman’s introduction 58 Our top properties 4 Board of Directors 60 Executive Committee 62 Strategic report The Board 63 Chairman’s statement 6 Viability statement 68 Chief Executive’s review 8 Audit Committee 69 Our growth story 10 Nomination and Review Committee 74 Investment case 12 Directors’ remuneration report 76 Directors’ report 94 The intu difference Statement of Directors’ responsibilities 96 Making the difference 14 Understanding our markets 16 Financial statements Optimising asset performance 18 Independent auditors’ report 98 Delivering UK developments 20 Consolidated income statement 106 Making the brand count 22 Consolidated statement of Seizing the growth opportunity in Spain 24 comprehensive income 107 At the heart of communities 26 Balance sheets 108 Our business model 28 Statements of changes in equity 109 Relationships 30 Statements of cash flows 112 Strategy overview 32 Notes to the financial statements -

Consolidated Management Report

26 Consolidated management report CON SOLIDATED MANAGEMENT REPORT I. BUSINESS AND GENERAL CONDITIONS 27 1. BUSINESS STRUCTURE 27 2. EMPLOYEES 27 3. PrOCUREMENT 28 4. PrODUCTION 28 5. CAPITAL EXPENDITURES 29 6. R&D REPORT 29 7. ORGANISatiON, ADMINISTRATION AND COMPANY STRUCTURE 29 IIT. RESUL S OF OPERATIONS, NET ASSETS AND FINANCIAL POSITION 30 1. MACROECONOMIC ENVIRONMENT 30 2. DEVELOPMENT OF THE FROZEN FOOD MARKET 30 3. BUSINESS DEVELOPMENT 31 4. SEGMENT REPORTING 32 4.1. PerFORMANCE OF THE FRoSTA OPERATING SEGMENT 32 4.2. PerFORMANCE OF THE “COPACK” opERATING SEGMENT 34 5. INDIVIDUAL FINANCIAL STATEMENTS OF FRoSTA AG 34 6. THE FRoSTA SHARE 36 III. RISK MANAGEMENT SYSTEM / INTERNAL CONTROL SYSTEM 37 IV. REPORT ON RISKS AND OPPORTUNITIES 38 1. PrOCUREMENT MARKET 38 2. CURRENCY SITUATION 38 3. SaLES MARKET 39 4. FiNANCING 39 5. LEGAL RISKS 39 V . REPORT ON POST-BALANCE SHEET DATE EVENTS 40 VI. BRANCH REPORT 40 VII. FORECAST 40 FRoSTA Annual Report 2015 Consolidated management report 27 I. BUSINESS AND GENERAL CONDITIONS 1. BUSINESS STRUCTURE Our sales activities are split into three areas: 1. the brand business with our FRoSTA brand 2. the private label business and 3. the non-retail business including the Foodservice and Home Delivery business units In addition to our distribution activities in Germany and Poland we also operate sales offices in France, Italy, the Czech Republic, Romania, Hungary and Russia. Our products are manufactured in four specialised facilities: vegetables and herbs harvested by ourselves in Lommatzsch and Bobenheim-Roxheim, and fish and meals in Bremerhaven and Bydgoszcz (Poland). In general, we make a distinction between our own brand FRoSTA and our customers’ brands, which we produce according to their requirements. -

The 2009 Mars Telecom Orbier Mission

The 2009 Mars Telecom Orbiter Mission1,2 Stephen F. Franklina, John P. Slonski, Jr.a, Stuart Kerridgea, Gary Noreena, Joseph E. Riedela, Tom Komareka, Dorothy Stosica, Caroline Rachoa, Bernard Edwardsb, Don Borosonc a-Jet Propulsion Laboratory, California Institute of Technology; Pasadena, Ca. 91109; b-NASA Goddard Spaceflight Center, Greenbelt, Md. 20771 USA c-MIT-Lincoln Laboratory, Lexington, Ma, 02420 Abstract—This paper provides an overview of the Mars Mission and flight system requirements have been written. Telecom Orbiter (MTO) mission, and is an update to the The flight system requirements define the flight system paper presented at last year’s conference. Launched in performance and functionality to the competing system 2009, MTO will provide Mars-to-Earth relay services for contract proposers. NASA missions arriving at Mars between 2010 and 2020, enabling far higher science data return and lowering the A Rendezvous and Autonomous Navigation (RAN) telecom and operations costs for these missions. MTO demonstration has been added. An orbiting sample canister carries an optical communications payload, which will will be released and tracked by the ground using on-board demonstrate downlink bit rates from 1 Mbps up to and cameras. The spacecraft will then rendezvous with the possibly exceeding 30 Mbps. MTO will also demonstrate canister using its autonomous navigation capability, coming the ability to autonomously navigate, and to search for and to within ten meters of (but not capturing) the canister. This rendezvous with an orbiting sample, in preparation for operation demonstrates capabilities that the proposed NASA NASA’s proposed Mars Sample Return Mission. A to-be- Mars Sample Return orbiter will require to capture the Mars defined science instrument will also be carried.