Banks and Microfinance Institutions Loan Schemes for Private Schools

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The a to Z Guide to Afghanistan Assistance

The Afghanistan Research and Evaluation Unit The A to Z Guide to Afghanistan Assistance 2nd Edition, August 2003 Writer: Shawna Wakefield Editor: Christina Bennett, Kathleen Campbell With special thanks to: Kristen Krayer, Nellika Little, Mir Ahmad Joyenda Cover illustration: Parniyan Design and Printing: The Army Press © 2003 The Afghanistan Research and Evaluation Unit (AREU). All rights reserved. Preface This is the second edition of The A to Z Guide to Afghanistan Assistance. Our first edition was brought out one year ago at a time of great change in Afghanistan. At that time, coordination mechanisms and aid processes were changing so fast that old hands and new arrivals alike were sometimes overwhelmed by the multiplicity of acronyms and references to structures and entities that had been recently created, abolished or re-named. Eighteen months after the fall of the Taliban and the signing of the Bonn Agreement, there are still rapid new developments, a growing complexity to the reconstruction effort and to planning processes and, of course, new acronyms! Our aim therefore remains to provide a guide to the terms, structures, mechanisms and coordinating bodies critical to the Afghanistan relief and reconstruction effort to help ensure a shared vocabulary and common understanding of the forces at play. We’ve also included maps and a contact directory to make navigating the assistance community easier. This 2nd edition also includes a section called “Resources,” containing information on such things as media organisations, security information, and Afghanistan-related web sites. Another new addition is a guide to the Afghan government. As the objective of so many assistance agencies is to support and strengthen government institutions, we felt that understanding how the Afghan government is structured is important to working in the current environment. -

Extreme/Harsh Weather Weekly Situation Report, 1 February-12 March 2017

HUMANITARIAN ASSISTANCE PROGRAMME EXTREME/HARSH WEATHER WEEKLY SITUATION REPORT, 1 FEBRUARY-12 MARCH 2017 Highlights 33 affected provinces 8,209 affected families reported 553 houses completely destroyed 2,282 houses severely damaged 501 houses partially damaged 202 individual deaths 127 individuals injured 3,439 affected families verified following assessments 1,998 families assisted by IOM Distribution of relief items to avalanche-affected families in Badakhshan on 21 February. © IOM 2017 Situation Overview Extreme weather conditions, including avalanches, floods, and heavy snowfall have affected 33 provinces of Afghanistan as of 3 February 2017. Badakhshan and Nooristan provinces were severely hit by two avalanches, resulting in causalities and destruction of houses, followed by flash floods on 18 February that significantly impacted Herat, Zabul and Nimroz provinces. An estimated 8,209 families were reportedly affected across Afghanistan, with 202 deaths and 127 persons sustaining injuries across the country. The majority of the reported caseloads have been assessed, with a total 3,439 families in need of assistance, while the distribution of relief items is underway and expected to be completed by 15 March 2017. Snow and flash floods damaged major roads in Afghanistan, delaying assessments and the dispatching of relief assistance to affected families. Rescuers were unable to reach snow-hit districts in the north, northeast, central, central highland, west, and eastern regions. The majority of the highways and roads linking to various districts that were initially closed have since reopened; however, some roads to districts in Badakhshan, Nooristan, Daikundi, Bamyan and Paktika are still closed. IOM RESPONSE Northeast Region Badakhshan: At least 83 families were affected by avalanches triggered by heavy snowfall in Maimai district on 3 February 2017, with 15 persons killed and 27 wounded. -

Watershed Atlas Part IV

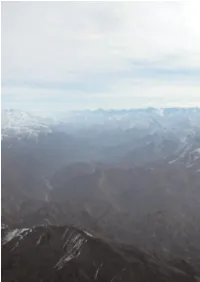

PART IV 99 DESCRIPTION PART IV OF WATERSHEDS I. MAP AND STATISTICS BY WATERSHED II. AMU DARYA RIVER BASIN III. NORTHERN RIVER BASIN IV. HARIROD-MURGHAB RIVER BASIN V. HILMAND RIVER BASIN VI. KABUL (INDUS) RIVER BASIN VII. NON-DRAINAGE AREAS PICTURE 84 Aerial view of Panjshir Valley in Spring 2003. Parwan, 25 March 2003 100 I. MAP AND STATISTICS BY WATERSHED Part IV of the Watershed Atlas describes the 41 watersheds Graphs 21-32 illustrate the main characteristics on area, popu- defined in Afghanistan, which includes five non-drainage areas lation and landcover of each watershed. Graph 21 shows that (Map 10 and 11). For each watershed, statistics on landcover the Upper Hilmand is the largest watershed in Afghanistan, are presented. These statistics were calculated based on the covering 46,882 sq. km, while the smallest watershed is the FAO 1990/93 landcover maps (Shapefiles), using Arc-View 3.2 Dasht-i Nawur, which covers 1,618 sq. km. Graph 22 shows that software. Graphs on monthly average river discharge curve the largest number of settlements is found in the Upper (long-term average and 1978) are also presented. The data Hilmand watershed. However, Graph 23 shows that the largest source for the hydrological graph is the Hydrological Year Books number of people is found in the Kabul, Sardih wa Ghazni, of the Government of Afghanistan – Ministry of Irrigation, Ghorband wa Panjshir (Shomali plain) and Balkhab watersheds. Water Resources and Environment (MIWRE). The data have Graph 24 shows that the highest population density by far is in been entered by Asian Development Bank and kindly made Kabul watershed, with 276 inhabitants/sq. -

DONOR REPORT Afghanistan Emergency Summer 2014

DONOR REPORT AFGHANISTAN EMERGENCY Summer 2014 UPDATED: AuGUST 2014 ISLAMIC RELIEF USA AFGHANISTAN EMERGENCY: SUMMARY Heavy rains in Afghanistan have caused flash flooding in the region, and heavy rains in Badakhshan, a remote part of northeastern Afghanistan, triggered a landside. Islamic Relief is currently responding to the effects of the flooding in Afghanistan by providing food aid to those affected in the highest priority provinces. Islamic Relief is monitoring the situation very closely for more developments and ways to help the emergency response in other areas. The number of people affected by floods in Afghanistan rose to more than 120,000 people in 16 provinces (85 districts). AFGHANISTAN EMERGENCY PROJECTS SuppORTED BY DONORS LIKE YOU EMERGENCY RESPONSE FOR FLOOD VICTIMS JUNE 2014 - SEPT. 2014 Location: Balkh, Samangan, and Jawazjan provinces This project aims to provide emergency food and supplies to flood affected families in Afghanistan. PROJECT OBJECTIVES: • 7,542 households (45,252 individuals) will be provided emergency food packets in Balkh, Samangan and Jawazjan • Non-food item kits will be provided including: tents, kitchen kits, carpets, sleeping mats, blankets and hygiene kitsw THIS PROJECT WILL HELP MORE THAN 45,200 INDIVIDUALS. EMERGENCY FOOD ASSISTANCE FOR FLOOD VICTIMS MAY 2014 - AUG. 2014 Location: Jawazjan province This project aims to provide emergency food packs to flood affected families in Afghanistan. PROJECT OBJECTIVES: • Provide emergency food packets to 2,000 families including: Wheat, beans, oil, salt, sugar and rice TRANSITIONAL SHELTER FOR LANDSLIDE AFFECTED FAMILIES JUNE 2014 - Nov. 2015 Location: Badakshan region This project aims to provide emergency transitional shelter and resources to families affected by the landslide in Badakshan. -

Download at and Most in Hardcopy for Free from the AREU Office in Kabul

Nomad-settler conflict in Afghanistan today Dr. Antonio Giustozzi October 2019 Afghanistan Research and Evaluation Unit Synthesis paper Nomad-settler conflict in Afghanistan today Dr. Antonio Giustozzi October 2019 Editor: Matthew Longmore ISBN: 978-9936-641-40-2 Front cover photo: AREU AREU Publication Code: 1907 E © 2019 This publication may be quoted, cited, or reproduced only for non-commercial purposes and provided that the source is acknowledged. The opinions expessed in this publication are those of the author and do not necessarily reflect that of AREU. Where this publication is reproduced, stored, or transmitted electronically, a link to AREU’s website (www.areu.org.af) should be provided. Afghanistan Research and Evaluation Unit 2019 About the Afghanistan Research and Evaluation Unit The Afghanistan Research and Evaluation Unit (AREU) is an independent research institute based in Kabul that was established in 2002 by the assistance of the international community in Afghanistan. AREU’s mission is to inform and influence policy and practice by conducting high-quality, policy relevant, evidence-based research and actively disseminating the results and promote a culture of research and learning. As the top think-tank in Afghanistan and number five in Central Asia according to the Global Go To Think Tank Index Report at the University of Pennsylvania, AREU achieves its mission by engaging with policy makers, civil society, researchers and academics to promote their use of AREU’s research-based publications and its library, strengthening their research capacity and creating opportunities for analysis, reflection and debate. AREU is governed by a Board of Directors comprised of representatives of donor organizations, embassies, the United Nations and other multilateral agencies, Afghan civil society and independent experts. -

VEIL of TEARS Afghans’ Stories of Loss in Childbirth

VEIL OF TEARS Afghans’ stories of loss in childbirth “Veil of Tears” is a collection of transcribed audio testimonies from women, men and children, interviewed by members of the IRIN Radio production team in 2005-2009. Their stories share the pain of the loss of a child, a wife, or a mother, in childbirth. Few families in Afghanistan have not been touched by this kind of experience. The stories transcribed in this booklet were first broadcast as part of IRIN Radio’s Dari and Pashto programming in Afghanistan. Copyright © IRIN 2009. All rights reserved. IRIN contact details IRIN Nairobi HQ: +254-20-7622147 email: [email protected] www.irinnews.org Cover Photo: Two teenage girls sewing burqas at home in Kabul, 30 September 2009 By Kate Holt/CARE International/IRIN Other Photos by: Masoud Popalzai, Kate Holt, Salma Zulfiqar Principal Reporter and Translator: Masoud Popalzai Other Story Contributors: Parwin Faiz, Mohammad Raja, Masooma Mohammadi, Sayed Mohammad Ali Minayar Editor: Louise Tunbridge Design and Layout: Jinita Shah/UNON Printing: Publishing Services Section, Nairobi, ISO 14001:2004 - certified. Copyright © IRIN 2009. All rights reserved Reproduction of excerpts from the text is permissible, other than for commercial purposes, provided the Integrated Regional Information Networks (IRIN) is acknowledged as the author. IRIN provides humanitarian news and analysis through on-line articles, special reports, printed publications, film documentaries and radio. IRIN is part of the UN Office for the Coordination of Humanitarian Affairs (OCHA) but its services are editorially independent. Its reports do not necessarily reflect the views of the United Nations and its agencies, nor its member states. -

The a to Z Guide to Afghanistan Assistance 2009

The A to Z Guide to Afghanistan Assistance 2009 AFGHANISTAN RESEARCH AND EVALUATION UNIT Improving Afghan Lives Through Research The A to Z Guide to Afghanistan Assistance 2009 Seventh Edition AFGHANISTAN RESEARCH AND EVALUATION UNIT Improving Afghan Lives Through Research IMPORTANT NOTE: The information presented in this Guide relies on the voluntary contributions of ministries and agencies of the Afghan government, embassies, development agencies and other organisations representing donor countries, national and international NGOs, and other institutions. While AREU undertakes with each edition of this Guide to provide the most accurate and current information possible, details evolve and change continuously. Users of this guide are encouraged to submit updates, additions, corrections and suggestions to [email protected]. © Copyright Afghanistan Research and Evaluation Unit, January 2009. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, recording or otherwise without prior written permission of the publisher, the Afghanistan Research and Evaluation Unit. Permission can be obtained by emailing areu@ areu.org.af or by calling +93 799 608 548. Coordinating Editor: Cynthia Lee Contacts Section: Sheela Rabani and Noorullah Elham Contributors: Ahmadullah Amarkhil, Amanullah Atel, Chris Bassett, Mia Bonarski, Colin Deschamps, Noorullah Elham, Susan Fakhri, Paula Kantor, Anna Larson, Sheela Rabani, Rebecca Roberts, Syed Mohammad Shah, -

April 02, 2015

Page 4 April 02, 2015 (1) Danish Introduces... A total of some 7,000 Russian The 15-member commission napping. Germany who will return to their tenced to death in the killing of 11 troops are stationed at three mili- chaired by female lawmaker He told Pajhwok Afghan News previous posts after receiving de- the Minister of Higher Education; police officers. tary facilities collectively known Shukria Barekzai was announced their comrades had launched an grees. (KP) Nasrin Oryakhail as the Minister In the United States, at least 72 as the 201st military base - in Du- only hours before the departure of investigation into the abduction. of Labors and Social Affairs and (17) DCA Officers ... death sentences were announced shanbe, Qurghon Teppa, some 100 Ghani and Abdullah to the United Mujahid also rejected if the Tali- Ali Ahmad Osmani as the Minis- last year. kilometers from Dushanbe, and States; however, the commission is ban had any council in Quetta. heroin were found on the spot. ter of Water and Energy. Amnesty International also ex- Kulob, about 200 kilometers south- yet to hold their maiden meeting, Afghan security forces had carried The lab owner was engaged in While introducing the ministe- pressed concern about countries west of Dushanbe. (Asia-Plus ) something the commentators link out operations in Zabul’s Khak-i- smuggling drugs into Tajikistan rial nominees, Danish emphasized that resumed the practice of exe- to the odds between the Afghan Afghan and Arghandab districts, and Pakistan. that the government re spected the (6) Afghanistan among ... cutions, including Pakistan, which leaders. killing a number of foreign mili- Tajik counternarcotics agency has decision of the House of Represen- reinstated the death penalty in De- was ranked fifth and Pakistan was According to the analysts, the tants, but could not find any clue posted liaison officers in north- tatives. -

New Zealand's Achievements from 10 Years of Development

Annex Two New Zealand’s Achievements from 10 Years of Development Assistance in Bamyan, Afghanistan 21 March 2013 Published March 2013 by the New Zealand Ministry of Foreign Affairs and Trade. For more information about the New Zealand Aid Programme please visit www.aid.govt.nz On the cover: the empty niches of the famous Buddha that were demolished by the Taliban in 2001 dominate Bamyan valley. Contents Purpose ...................................................................... 1 Executive Summary .................................................... 2 General ...................................................................... 6 Bamyan overview .................................................................... 6 New Zealand’s development assistance ...................................... 6 Looking to the future ................................................................ 7 Snapshot of Bamyan compared to the rest of Afghanistan ............. 7 Education ................................................................... 9 Key achievements .................................................................... 9 Facts and figures ..................................................................... 9 Governance, Justice, and Rule of Law ....................... 12 Key achievements ................................................................... 12 Facts and figures .................................................................... 12 Health ...................................................................... 16 Key achievements -

Needs Assessment Report

Takht FS assessment report Needs Assessment Report “An assessment of the food security of the population of Takht, Waras District, Bamyan Province” nd th Date of Assessment 22 -26 November 2013 Region Takht, Waras District, Bamyan Province (see map 1, page 5) Estimated population size 8217 individuals Needs Assessment team leader Arianna Zorzi Meneguzzo 1 Takht FS assessment report Table of Contents 1. Introduction and objectives .................................................................................................... 3 2. Justification for the assessment .............................................................................................. 3 3. Humanitarian Context ............................................................................................................ 4 4. Methodology ......................................................................................................................... 6 5. Summary of findings household survey .................................................................................. 7 5.1 Food Consumption Score ........................................................................................................... 7 5.2 Household Dietary diversity ....................................................................................................... 8 5.3 Coping Strategy Index ................................................................................................................ 8 5.4 Longer term coping mechanisms .............................................................................................. -

Translation of the Death List As Given by Late Afghan Minister of State Security Ghulam Faruq Yaqoubi to Lord Bethell in 1989

Translation of the death list as given by late Afghan Minister of State Security Ghulam Faruq Yaqoubi to Lord Bethell in 1989. The list concerns prisonners of 1357 and 1358 (1978-1979). For further details we refer to the copy of the original list as published on the website. Additional (handwritten) remarks in Dari on the list have not all been translated. Though the list was translated with greatest accuracy, translation errors might exist. No.Ch Name Fathers Name Profession Place Accused Of 1 Gholam Mohammad Abdul Ghafur 2nd Luitenant Of Police Karabagh Neg. Propaganda 2 Shirullah Sultan Mohammad Student Engineering Nerkh-Maidan Enemy Of Rev. 3 Sayed Mohammad Isa Sayed Mohammad Anwar Mullah Baghlan Khomeini 4 Sefatullah Abdul Halim Student Islam Wardak Ikhwani 5 Shujaudin Burhanudin Pupil 11th Grade Panjsher Shola 6 Mohammad Akbar Mohabat Khan Luitenant-Colonel Kohestan Ikhwani 7 Rahmatullah Qurban Shah Police Captain Khanabad Ikhwani 8 Mohammad Azam Mohammad Akram Head Of Archive Dpt Justice Nejrab Ikhwani 9 Assadullah Faludin Unemployed From Iran Khomeini 10 Sayed Ali Reza Sayed Ali Asghar Head Of Income Dpt Of Trade Chardehi Khomeini 11 Jamaludin Amanudin Landowner Badakhshan Ikhwani 12 Khan Wasir Kalan Wasir Civil Servant Teachers Education Panjsher Khomeini 13 Gholam Reza Qurban Ali Head Of Allhjar Transport. Jamal-Mina Khomeini 14 Sayed Allah Mohammad Ajan Civil Servant Carthographical Off. Sorubi Anti-Revolution 15 Abdul Karim Haji Qurban Merchant Farjab Ikhwani 16 Mohammad Qassem Nt.1 Mohammad Salem Teacher Logar Antirevol. -

Facts & Figures

Islamic Republic of Afghanistan Capital Region Independent Development Authority FACTS & FIGURES crida.gov.af [email protected] crida.afg crida_afg crida.afg crida.afg Messages H.E. President of Islamic Republic of Afghanistan Cities should be livable not only in terms of their physical structure but also socially and culturally. We must remove outdated bureaucratic hurdles and red tape, and formulate the right policies for urban planning and housing. Urban affairs have been the focus of our attention during the past years, and we now have the opportunity of practical implementation. Development of affordable housing will not be exclusive to the civilian sector, affordable housing will be extended to the personnel of all Army Corps. Referring to the fact that cities and villages underpin the nation, work on strengthening ties between cities and villages has been initiated, and ties between cities and villages feature in our planning for strengthening a national marketplace. CEO of Capital Region Independent Development Authority The absence of sound urban environment in the Capital of the country has caused this city with huge challenges, where considering its insignificant concentrated commercial and service centers, the population increases, along with the graph of problems also moves upward. Therefore, to address the issue, the solution should be mainstreamed in the capital region including Kabul, Parwan, Kapisa, Maidan Wardak and Logar Provinces. Capital Region Independent Development Authority (CRIDA) is established with the vision to lay down strong platform to address the current issues through rehabilitating the originality of capital zone, by developing a dynamic, self-sustained, self-reliant city, equipped with standardized infrastructure, public facilities, commercial, social and cultural centers.