China Properties Group Limited (於開曼群島註冊成立之有限公司) (股份代號:1838)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHINA PROPERTIES GROUP LIMITED (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1838)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for information purposes only and does not constitute an invitation or a solicitation of an offer to acquire, purchase or subscribe for securities or an invitation to enter into an agreement to do any such things, nor is it calculated to invite any offer to acquire, purchase or subscribe for any securities. This announcement is not an offer of securities for sale or the solicitation of an offer to buy any securities in the United States or any country or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such country or jurisdiction. Neither this announcement nor anything herein forms the basis of any contract of commitment whatsoever. Neither this announcement nor any copy hereof may be takenintoordistributedintheUnitedStates.Securities may not be offered or sold in the United States absent registration or an exemption from registration. The Company has not registered and does not intend to register any of the Notes in the United States. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the Company and management, as well as financial statements. -

Stock Margin Ratio (Effective from July 01, 2020) the Following Stock

Stock Margin Ratio (Effective from July 01, 2020) The following stock margin ratios are for reference only, which are subjected to change as determined by the market conditions, client’s trading accounts status and other relevant factors. We deserve the right to vary margin ratios and/or stop offering loan for financing margin trading at all times under any circumstances without prior notice to clients. Margin Ratio Stock Code Name of stock (%) 1 HK Equity CK HUTCHISON HOLDINGS LTD 70 2 HK Equity CLP HOLDINGS LTD 70 3 HK Equity HONG KONG & CHINA GAS 70 4 HK Equity WHARF HOLDINGS LTD 70 5 HK Equity HSBC HOLDINGS PLC 70 6 HK Equity POWER ASSETS HOLDINGS LTD 70 7 HK Equity HONG KONG FINANCE INVESTMENT 0 8 HK Equity PCCW LTD 60 9 HK Equity KEYNE LTD 0 10 HK Equity HANG LUNG GROUP LTD 60 11 HK Equity HANG SENG BANK LTD 70 12 HK Equity HENDERSON LAND DEVELOPMENT 70 14 HK Equity HYSAN DEVELOPMENT CO 50 15 HK Equity VANTAGE INTERNATIONAL 0 16 HK Equity SUN HUNG KAI PROPERTIES 70 17 HK Equity NEW WORLD DEVELOPMENT 70 18 HK Equity ORIENTAL PRESS GROUP LTD 0 19 HK Equity SWIRE PACIFIC LTD - CL A 70 20 HK Equity WHEELOCK & CO LTD 70 21 HK Equity GREAT CHINA PROPERTIES HOLDI 0 22 HK Equity MEXAN LTD 0 23 HK Equity BANK OF EAST ASIA LTD 50 24 HK Equity BURWILL HOLDINGS LTD 0 25 HK Equity CHEVALIER INTERNATIONAL HOLD 0 26 HK Equity CHINA MOTOR BUS CO 10 27 HK Equity GALAXY ENTERTAINMENT GROUP L 70 28 HK Equity TIAN AN CHINA INVESTMENT 0 29 HK Equity DYNAMIC HOLDINGS LTD. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

S42009131318p3.Ps, Page 1-24 @ Normalize 2

2009 年第 13 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 13/2009 D1117 ENGLISH AUTHOR INDEX, 2007 139 Holdings Limited 7056 APT Satellite Holdings Limited 3135 82 Republic 8086 Aptus Holdings Limited 10975 Abbs, Brian 3107 Architectural Services Department 22, abc Multiactive Limited 10 7101-7102 Abyar, Narges 13197 Archworld 666, 2242, 2719 Accountancy Training Company 11-15, Arlon, Penelope 4919, 5035, 5544, 6766 10946-10954 Armentrout, Fred 308, 7211 Achtemeier, Paul J 2474 Armstrong, J. K. 3461, 3469, 7300, 7317, AcrossAsia Limited 3115 11138, 11148-11150, 11152, Adams, Penny 3116-3118 11161-11162 Adrian-Vallance, D’Arcy 10956-10957 Arnobius 4869 Adrian-Vallance, Evadne 10966-10967 Arnold, Bill T 10253 Aesop 1078 Arnold, Peter 9895, 13676, 13802 Agriculture and Fisheries Art Textile Technology International Department 3119, 7082 Company Limited 10979 Agriculture, Fisheries and Arterburn, Stephen 8835 Conservation Department 7083 Artfield Group Limited 3141, 7104, 10980 AGTech Holdings Limited 10958 Arthur, David 1452-1453 Ahluwalia, Libby 11577 Arthur, Kay 1146-1147, 1370-1371, 1452-1453, Ahoor, Darviz 12297 1505-1506, 1536-1537, 2198-2199, Ai, Weiwei 3120 2652-2653 Akrami, Jamaloldin 12085 Artist Commune Administration Alata 587-588, 1129, 12024-12025 Office 7804, 7849, 7857 Albaut, Corinne 18-19 Arts Optical International Holdings Albee, Edward 5952, 6891 Limited 3142 Albornoz-Chacon, Ruth 315 Aru 3031, 10784 Alco Holdings Limited 7085 Ashcroft, Minnie 9043, 9045 Alcott, Louisa May 3121 Asia Monitor Resource Center 261 Alder, C 9870 Asia -

Us$150,000,000

OFFERING CIRCULAR CONFIDENTIAL US$150,000,000 (Incorporated in the Cayman Islands with limited liability) 13.50% Senior Notes due 2018 We are offering US$150,000,000 13.50% senior notes due 2018 (the ‘‘Notes’’). The Notes will bear interest at the rate of 13.50% per annum. The Notes will bear interest from the Original Issue Date, payable semi-annually in arrears on April 16 and October 16 of each year, commencing April 16, 2014. The Notes will mature on October 16, 2018. At any time on or after October 16, 2016, we may redeem the Notes in whole or in part, at the redemption prices specified under ‘‘Description of the Notes — Optional Redemption.’’ At any time prior to October 16, 2016, we may redeem the Notes at our option, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Notes plus the Applicable Premium (as defined in ‘‘Description of the Notes’’) applicable to the Notes as of, plus accrued and unpaid interest, if any, to, the redemption date. Before October 16, 2016, we may redeem up to 35% in aggregate principal amount of the Notes, at a redemption price equal to 113.5% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to the redemption date, with the proceeds from sales of certain kinds of ordinary shares. We may redeem the Notes at our option, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to the redemption date, in the event of certain changes in specified tax laws or other circumstances. -

Share and Connected Transactions

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Greentown China Holdings Limited, you should at once hand this circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for onward transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. GREENTOWN CHINA HOLDINGS LIMITED * (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3900) SHARE AND CONNECTED TRANSACTIONS The Independent Financial Adviser to the Independent Board Committee and the Shareholders A letter from the Board is set out on pages 6 to 16 of this circular and a letter from the Independent Board Committee is set out on pages 17 to 18 of this circular. A letter from Hercules Capital, the Independent Financial Adviser to the Independent Board Committee and the Shareholders, containing its advice to the Independent Board Committee and the Shareholders in relation to the Acquisition is set out on pages 19 to 36 of this circular. -

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON HOLDINGS LTD 70 2 CLP HOLDINGS LTD 70 3 HONG KONG & CHINA GAS 70 4 WHARF HOLDINGS LTD 70 5 HSBC HOLDINGS PLC 70 6 POWER ASSETS HOLDINGS LTD 70 7 HONG KONG FINANCE INVESTMENT 0 8 PCCW LTD 60 9 NINE EXPRESS LTD 0 10 HANG LUNG GROUP LTD 60 11 HANG SENG BANK LTD 70 12 HENDERSON LAND DEVELOPMENT 70 14 HYSAN DEVELOPMENT CO 50 15 VANTAGE INTERNATIONAL 0 16 SUN HUNG KAI PROPERTIES 70 17 NEW WORLD DEVELOPMENT 70 18 ORIENTAL PRESS GROUP LTD 0 19 SWIRE PACIFIC LTD - CL A 70 20 WHEELOCK & CO LTD 70 21 GREAT CHINA PROPERTIES HOLDI 0 22 MEXAN LTD 0 23 BANK OF EAST ASIA LTD 60 24 BURWILL HOLDINGS LTD 0 25 CHEVALIER INTERNATIONAL HOLD 0 26 CHINA MOTOR BUS CO 0 27 GALAXY ENTERTAINMENT GROUP L 70 28 TIAN AN CHINA INVESTMENT 0 29 DYNAMIC HOLDINGS LTD. 0 30 BAN LOONG HOLDINGS LTD 0 31 CHINA AEROSPACE INTL HLDG 0 32 CROSS-HARBOUR HOLDINGS LTD 0 33 ASIA INVESTMENT FINANCE GROU 0 34 KOWLOON DEVELOPMENT CO LTD 30 35 FAR EAST CONSORTIUM INTERNAT 10 36 FAR EAST HOLDINGS INTL LTD 0 37 FAR EAST HOTELS & ENT LTD 0 38 FIRST TRACTOR CO-H 0 39 CHINA BEIDAHUANG INDUSTRY 0 40 GOLD PEAK INDUSTRIES HOLDING 0 41 GREAT EAGLE HOLDINGS LTD 50 42 NORTHEAST ELECTRIC DEVELOP-H 0 43 CP POKPHAND CO LTD 0 45 HONGKONG & SHANGHAI HOTELS 50 46 COMPUTER & TECHNOLOGIES HLDG 0 47 HOP HING GROUP HOLDINGS LTD 0 48 CHINA AUTOMOTIVE INTERIOR 0 50 HONG KONG FERRY(HOLDINGS)CO. -

Your Professional Adviser

YOUR PROFESSIONAL ADVISER C100 M35 Y 25 K0 01 About Ascent Partners Ascent Partners is a leading provider of Independent Valuation, Corporate Advisory, Cost Management, Human Capital – Executive Search and Technology Advisory. We partner with our clients to ensure that our tailored solutions align with their strategic vision to deliver stellar results. The firm’s vision is to build and grow long-term business relationships with our clients. Our Commitment Ascent Partners’ commitment in providing independent, timely, professional advice and services gives our clients the information they need to effectively manage their business strategies and operations. Our Services Valuation: Ascent Partners provides impartial and independent valuations of businesses, properties and financial instruments that meet stringent international standards and regulatory requirements. 02 Corporate Advisory: valuation and risk management system Our Corporate Advisory services and platform. range from Transaction Support, Risk Analysis, Initial Public Offerings (IPOs) The Big Picture to Mergers & Acquisitions (M&As). Our clients enjoy the benefit of leveraging on the many years of legal, financial and Cost Management: accounting experience of our multi- Our Cost Management Specialists focus disciplinary team. on helping clients to achieve maximum cost efficiencies within the short-to- Clients have the benefit of accessing medium-term. the wide connections and resources of our carefully cultivated network of Human Capital – Executive Search: professional and business contacts. This Our extensive network enables us is especially critical when they are in to place the best candidates for the the market for investors or looking for positions created as our client’s potential targets for acquisitions. companies grow. We do not provide advice in isolation. -

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd. 20% 8 電訊盈科 60% 9 NINE EXPRESS LTD 20% 10 恒隆集團 60% 11 恒生銀行 70% 12 恒基地產 70% 14 希慎興業 60% 15 Vantage International (Holdings) Ltd. 50% 16 新鴻基地產 70% 17 新世界發展 70% 18 Oriental Press Group Ltd. 15% 19 太古股份公司A 70% 20 會德豐 60% 22 Mexan Ltd. 15% 23 東亞銀行 70% 25 Chevalier International Holdings Ltd. 20% 26 China Motor Bus Co., Ltd. 25% 27 銀河娛樂 70% 28 TIAN AN CHINA INVESTMENTS CO LTD 40% 29 Dynamic Holdings Ltd. 40% 31 China Aerospace International Holdings Ltd. 55% 32 Cross-Harbour (Holdings) Ltd., The 35% 33 Asia Investment Finance Group Ltd. 15% 34 Kowloon Development Co. Ltd. 40% 35 Far East Consortium International Ltd. 50% 38 第一拖拉機股份 50% 39 China Beidahuang Industry Group Holdings Ltd. 10% 41 Great Eagle Holdings Ltd. 60% 42 Northeast Electric Development Co. Ltd. - H Shares 40% 43 C.P. POKPHAND 40% 44 Hong Kong Aircraft Engineering Co. Ltd. 45% 45 Hongkong and Shanghai Hotels, Ltd., The 40% 46 Computer And Technologies Holdings Ltd. 15% 47 Hop Hing Group Holdings Ltd. 15% 48 China Automotive Interior Decoration Holdings Ltd. 20% 50 Hong Kong Ferry (Holdings) Co. Ltd. 35% 51 Harbour Centre Development Ltd. 15% 52 Fairwood Holdings Ltd. 55% 53 GUOCO GROUP 40% 54 合和實業 60% 55 NEWAY GROUP HOLDINGS LTD 20% 56 Allied Properties (HK) Ltd. 35% 57 Chen Hsong Holdings Ltd. 10% 58 Sunway International Holdings Ltd. -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 11/30/2020 Fund’s investments As of 11-30-20 (unaudited) Shares Value Common stocks 98.2% $240,294,118 (Cost $187,641,986) Australia 0.0% 87,009 MMG, Ltd. (A) 200,000 87,009 Belgium 0.0% 40,238 Titan Cement International SA (A) 2,468 40,238 Brazil 4.4% 10,708,306 AES Tiete Energia SA 14,746 44,617 AES Tiete Energia SA 83 50 Alliar Medicos A Frente SA 3,900 7,891 Alupar Investimento SA 7,050 31,661 Ambev SA, ADR 73,852 196,446 Arezzo Industria e Comercio SA 1,894 24,553 Atacadao SA 12,800 48,047 B2W Cia Digital (A) 1,700 22,339 B3 SA - Brasil Bolsa Balcao 30,078 315,130 Banco ABC Brasil SA (A) 61 159 Banco Bradesco SA 16,545 66,861 Banco BTG Pactual SA 7,088 104,810 Banco do Brasil SA 12,237 77,341 Banco Santander Brasil SA 4,000 29,231 BB Seguridade Participacoes SA 24,029 128,097 BR Malls Participacoes SA (A) 41,304 75,478 BR Properties SA 8,524 16,722 BrasilAgro - Cia Brasileira de Propriedades Agricolas 4,216 21,421 Braskem SA, ADR (A)(B) 4,563 38,420 BRF SA (A) 18,790 77,266 Camil Alimentos SA 11,340 23,580 CCR SA 63,269 153,998 Centrais Eletricas Brasileiras SA 5,600 32,466 Cia Brasileira de Distribuicao 8,517 110,091 Cia de Locacao das Americas 18,348 93,291 Cia de Saneamento Basico do Estado de Sao Paulo 11,299 93,937 Cia de Saneamento de Minas Gerais-COPASA 12,405 34,408 Cia de Saneamento do Parana 17,145 80,006 Cia de Saneamento do Parana 3,000 2,861 Cia Energetica de Minas Gerais 7,709 20,374 Cia Hering 4,235 13,747 Cia Paranaense de Energia 1,600 19,463 Cia Siderurgica -

Value Partners Greater China High Yield Income Fund

惠理大中華高收益債券基金 VALUE PARTNERS GREATER CHINA HIGH YIELD INCOME FUND 半年度報告2014 SEMI-ANNUAL REPORT 2014 截至二零一四年六月三十日止六個月 For the six months ended 30 June 2014 Value Partners Hong Kong Limited 9th Floor, Nexxus Building 41 Connaught Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartners.com.hk In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. VALUE PARTNERS GREATER CHINA HIGH YIELD INCOME FUND (A Cayman Islands Unit Trust) CONTENTS Pages General information 2 - 3 Manager’s report 4 - 6 Statement of financial position (unaudited) 7 - 8 Investment portfolio (unaudited) 9 - 19 Investment portfolio movements (unaudited) 20 SEMI–ANNUAL REPORT 2014 1 For the six months ended 30 June 2014 1 VALUE PARTNERS GREATER CHINA HIGH YIELD INCOME FUND (A Cayman Islands Unit Trust) GENERAL INFORMATION Directors Registered Office Mr Tse Wai Ming, Timothy P.O. Box 484 Mr Mo Chun Wah, Jonathan HSBC House (appointed on 3 July 2013) 68 West Bay Road Grand Cayman KY1-1106 Manager Cayman Islands Value Partners Hong Kong Limited 9th Floor, Nexxus Building Auditor 41 Connaught Road Central PricewaterhouseCoopers Hong Kong P.O. Box 258 George Town Directors of the Manager Grand Cayman, KY1-1104 Dato’ Cheah Cheng Hye Cayman Islands Mr Ho Man Kei, Norman Mr So Chun Ki Louis Legal Advisors With respect to Cayman Islands law Administrator Walkers HSBC Trustee (Cayman) Limited Walker House P.O. Box 484 87 Mary Street, George Town HSBC House Grand Cayman KY1-9001 -

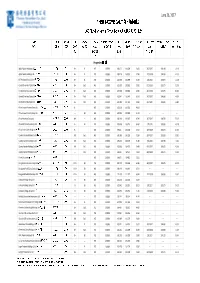

June 26, 2017 FIXED INCOME FIXED INCOME DAILY 每日債券資訊

June 26, 2017 FIXED INCOME DAILY 每日債券資每日債券資每日債券資訊每日債券資訊訊訊 USD Non-Investment Grade Bonds 美元非投資級別債券 Issuer Maturity Coupon S&P Moody’s Listed in Minimum Investment Bid Ask Price Ask YTM (%) Next Callable Next Callable Price Ask YTC (%) 發行人 到期日 票息 標普評 穆迪評級 HKEX^ 最低投資額 Price 賣出價 到期收益率(%) Date 下次贖回價 最低收益率(%) 級 港交所掛牌 買入價 下次贖回日 上市^ Properties 房地產房地產房地產 Agile Property Holdings Ltd 雅居樂地產 18/2/2019 8.375% B+ B1 YES 200000 104.175 104.478 5.474 26/7/2017 104.188 4.316 Agile Property Holdings Ltd 雅居樂地產 21/5/2020 9.000% B+ B1 YES 200000 108.178 108.555 5.748 21/5/2018 104.500 4.153 CIFI Holdings (Group) Co Ltd 旭輝控股 5/6/2020 7.750% B+ B1 YES 200000 106.599 106.999 5.149 5/6/2018 103.875 4.148 Central China Real Estate Ltd 建業地產 8/11/2021 6.750% B+ Ba3 NO 200000 102.658 103.001 5.956 8/11/2019 103.375 5.956 Central China Real Estate Ltd 建業地產 23/1/2021 8.750% B+ Ba3 NO 200000 107.658 108.036 6.203 23/1/2019 104.375 6.003 Central China Real Estate Ltd 建業地產 28/1/2020 8.000% B+ Ba3 NO 200000 103.541 103.942 6.319 26/7/2017 104.000 4.489 Central China Real Estate Ltd 建業地產 4/6/2018 6.500% B+ Ba3 NO 200000 101.089 101.365 4.980 26/7/2017 101.625 4.980 China Aoyuan Property Group Ltd 中國奧園地產 26/5/2018 10.875% B- --- NO 200000 105.139 105.510 4.619 --- --- --- China Aoyuan Property Group Ltd 中國奧園地產 25/4/2019 6.525% --- B3 NO 200000 102.032 102.410 5.120 --- --- --- China Properties Group Ltd 16/10/2018 13.500% NR --- NO 200000 104.936 105.627 8.796 26/7/2017 106.750 5.533 China SCE Property Holdings Ltd 中駿置業 2/7/2020 10.000% B- B2 YES 200000 109.358 109.713 6.402