S42009131318p3.Ps, Page 1-24 @ Normalize 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017/18 2017/18

NIMBLE HOLDINGS COMPANY LIMITED (於開曼群島註冊成立並於百慕達繼續經營之有限公司) (Incorporated in the Cayman Islands and continued ) (前稱嘉域集團有限公司) in Bermuda with limited liability (Formerly known as The Grande Holdings Limited) 股份代號 : 186 Stock code: 186 敏捷控股有限公司 年度報告 ANNUAL REPORT 2017/18 2017/18 追求 BUILDING ON 卓越 EXCELLENCE Annual Report 2017/18 年度報告 CONTENTS CONTENTS Corporate Information 2 Chairman’s Statement 3 Management Discussion and Analysis 4 Biographies of Directors 8 Report of the Directors 10 Corporate Governance Report 18 Environmental, Social and Governance Report 31 Independent Auditor’s Report 39 Consolidated Income Statement 41 Consolidated Statement of Comprehensive Income 42 Consolidated Statement of Financial Position 43 Consolidated Statement of Changes in Equity 45 Consolidated Statement of Cash Flows 46 Notes to Consolidated Financial Statements 48 Five-Year Financial Summary 109 Nimble Holdings Company Limited Annual Report 2017/2018 1 CORPORATE INFORMATION CORPORATE INFORMATION BOARD OF DIRECTORS LEGAL ADVISORS EXECUTIVE DIRECTORS Stephenson Harwood Mr. Tan Bingzhao Johnnie Yam, Jackie Lee & Co. Mr. Deng Xiangping AUDITOR INDEPENDENT NON-EXECUTIVE Moore Stephens CPA Limited DIRECTORS Dr. Lin Jinying REGISTERED OFFICE Dr. Lu Zhenghua Wessex House, 5th Floor Dr. Ye Hengqing 45 Reid Street Hamilton HM 12, Bermuda AUDIT COMMITTEE Dr. Lu Zhenghua (Chairman) PRINCIPAL PLACE OF BUSINESS IN Dr. Lin Jinying HONG KONG Dr. Ye Hengqing 11/F., The Grande Building 398 Kwun Tong Road REMUNERATION COMMITTEE Kowloon Dr. Lin Jinying (Chairman) Hong Kong Dr. Lu Zhenghua Dr. Ye Hengqing SHARE REGISTRAR AND TRANSFER OFFICE NOMINATION COMMITTEE Tricor Tengis Limited Mr. Tan Bingzhao (Chairman) Level 22, Hopewell Center Dr. Lin Jinying 183 Queen’s Road East Dr. -

CHINA PROPERTIES GROUP LIMITED (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1838)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for information purposes only and does not constitute an invitation or a solicitation of an offer to acquire, purchase or subscribe for securities or an invitation to enter into an agreement to do any such things, nor is it calculated to invite any offer to acquire, purchase or subscribe for any securities. This announcement is not an offer of securities for sale or the solicitation of an offer to buy any securities in the United States or any country or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such country or jurisdiction. Neither this announcement nor anything herein forms the basis of any contract of commitment whatsoever. Neither this announcement nor any copy hereof may be takenintoordistributedintheUnitedStates.Securities may not be offered or sold in the United States absent registration or an exemption from registration. The Company has not registered and does not intend to register any of the Notes in the United States. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the Company and management, as well as financial statements. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

Stock Margin Ratio (Effective from July 01, 2020) the Following Stock

Stock Margin Ratio (Effective from July 01, 2020) The following stock margin ratios are for reference only, which are subjected to change as determined by the market conditions, client’s trading accounts status and other relevant factors. We deserve the right to vary margin ratios and/or stop offering loan for financing margin trading at all times under any circumstances without prior notice to clients. Margin Ratio Stock Code Name of stock (%) 1 HK Equity CK HUTCHISON HOLDINGS LTD 70 2 HK Equity CLP HOLDINGS LTD 70 3 HK Equity HONG KONG & CHINA GAS 70 4 HK Equity WHARF HOLDINGS LTD 70 5 HK Equity HSBC HOLDINGS PLC 70 6 HK Equity POWER ASSETS HOLDINGS LTD 70 7 HK Equity HONG KONG FINANCE INVESTMENT 0 8 HK Equity PCCW LTD 60 9 HK Equity KEYNE LTD 0 10 HK Equity HANG LUNG GROUP LTD 60 11 HK Equity HANG SENG BANK LTD 70 12 HK Equity HENDERSON LAND DEVELOPMENT 70 14 HK Equity HYSAN DEVELOPMENT CO 50 15 HK Equity VANTAGE INTERNATIONAL 0 16 HK Equity SUN HUNG KAI PROPERTIES 70 17 HK Equity NEW WORLD DEVELOPMENT 70 18 HK Equity ORIENTAL PRESS GROUP LTD 0 19 HK Equity SWIRE PACIFIC LTD - CL A 70 20 HK Equity WHEELOCK & CO LTD 70 21 HK Equity GREAT CHINA PROPERTIES HOLDI 0 22 HK Equity MEXAN LTD 0 23 HK Equity BANK OF EAST ASIA LTD 50 24 HK Equity BURWILL HOLDINGS LTD 0 25 HK Equity CHEVALIER INTERNATIONAL HOLD 0 26 HK Equity CHINA MOTOR BUS CO 10 27 HK Equity GALAXY ENTERTAINMENT GROUP L 70 28 HK Equity TIAN AN CHINA INVESTMENT 0 29 HK Equity DYNAMIC HOLDINGS LTD. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

Us$150,000,000

OFFERING CIRCULAR CONFIDENTIAL US$150,000,000 (Incorporated in the Cayman Islands with limited liability) 13.50% Senior Notes due 2018 We are offering US$150,000,000 13.50% senior notes due 2018 (the ‘‘Notes’’). The Notes will bear interest at the rate of 13.50% per annum. The Notes will bear interest from the Original Issue Date, payable semi-annually in arrears on April 16 and October 16 of each year, commencing April 16, 2014. The Notes will mature on October 16, 2018. At any time on or after October 16, 2016, we may redeem the Notes in whole or in part, at the redemption prices specified under ‘‘Description of the Notes — Optional Redemption.’’ At any time prior to October 16, 2016, we may redeem the Notes at our option, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Notes plus the Applicable Premium (as defined in ‘‘Description of the Notes’’) applicable to the Notes as of, plus accrued and unpaid interest, if any, to, the redemption date. Before October 16, 2016, we may redeem up to 35% in aggregate principal amount of the Notes, at a redemption price equal to 113.5% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to the redemption date, with the proceeds from sales of certain kinds of ordinary shares. We may redeem the Notes at our option, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to the redemption date, in the event of certain changes in specified tax laws or other circumstances. -

Share and Connected Transactions

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Greentown China Holdings Limited, you should at once hand this circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for onward transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. GREENTOWN CHINA HOLDINGS LIMITED * (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3900) SHARE AND CONNECTED TRANSACTIONS The Independent Financial Adviser to the Independent Board Committee and the Shareholders A letter from the Board is set out on pages 6 to 16 of this circular and a letter from the Independent Board Committee is set out on pages 17 to 18 of this circular. A letter from Hercules Capital, the Independent Financial Adviser to the Independent Board Committee and the Shareholders, containing its advice to the Independent Board Committee and the Shareholders in relation to the Acquisition is set out on pages 19 to 36 of this circular. -

Akai Liquidator Cosimo Borrelli's Pursuit of Truth Unravels Corporate Collapse Naomi Rovnick

Hard work pays off for 'vicious' Akai liquidator Cosimo Borrelli's pursuit of truth unravels corporate collapse Naomi Rovnick Updated on Oct 06, 2009 A tycoon is accused of stealing more than US$800 million from his international conglomerate and bankrupting the company, while another businessman allegedly conspires to hide the rest of the failed firm's assets from its creditors. The affair leads to a High Court trial, which collapses. The conglomerate's Big Four auditor is said to have fabricated documents, then gets raided by the anti-fraud police and sees one of its partners arrested. The events look like scenes from a crime thriller, but the saga of Akai Holdings, the former empire of disgraced entrepreneur James Ting that collapsed in 2000, is very real and has shaken the foundations of corporate Hong Kong, heightening fears about freewheeling tycoons and the auditors and regulators that are meant to protect companies' shareholders and lenders. The scandal resurfaced in a High Court case against Akai's former auditor, Ernst & Young Hong Kong, last month. The claimants, Akai's liquidators, accused the auditor of tampering with and faking audit files to shield itself from the US$1 billion negligence claim. The Commercial Crime Bureau has launched a fraud investigation into Ernst & Young and late last month arrested Edmund Dang, one of its partners, who was freed on bail without being charged. Yesterday, in a separate trial, Hong Kong tycoon Christopher Ho Wing-on settled a High Court case where Akai's liquidators had accused him of misappropriating the failed electronics firm's assets into his Grande Holdings vehicle in 1999, so Akai's creditors could not retrieve any money. -

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON HOLDINGS LTD 70 2 CLP HOLDINGS LTD 70 3 HONG KONG & CHINA GAS 70 4 WHARF HOLDINGS LTD 70 5 HSBC HOLDINGS PLC 70 6 POWER ASSETS HOLDINGS LTD 70 7 HONG KONG FINANCE INVESTMENT 0 8 PCCW LTD 60 9 NINE EXPRESS LTD 0 10 HANG LUNG GROUP LTD 60 11 HANG SENG BANK LTD 70 12 HENDERSON LAND DEVELOPMENT 70 14 HYSAN DEVELOPMENT CO 50 15 VANTAGE INTERNATIONAL 0 16 SUN HUNG KAI PROPERTIES 70 17 NEW WORLD DEVELOPMENT 70 18 ORIENTAL PRESS GROUP LTD 0 19 SWIRE PACIFIC LTD - CL A 70 20 WHEELOCK & CO LTD 70 21 GREAT CHINA PROPERTIES HOLDI 0 22 MEXAN LTD 0 23 BANK OF EAST ASIA LTD 60 24 BURWILL HOLDINGS LTD 0 25 CHEVALIER INTERNATIONAL HOLD 0 26 CHINA MOTOR BUS CO 0 27 GALAXY ENTERTAINMENT GROUP L 70 28 TIAN AN CHINA INVESTMENT 0 29 DYNAMIC HOLDINGS LTD. 0 30 BAN LOONG HOLDINGS LTD 0 31 CHINA AEROSPACE INTL HLDG 0 32 CROSS-HARBOUR HOLDINGS LTD 0 33 ASIA INVESTMENT FINANCE GROU 0 34 KOWLOON DEVELOPMENT CO LTD 30 35 FAR EAST CONSORTIUM INTERNAT 10 36 FAR EAST HOLDINGS INTL LTD 0 37 FAR EAST HOTELS & ENT LTD 0 38 FIRST TRACTOR CO-H 0 39 CHINA BEIDAHUANG INDUSTRY 0 40 GOLD PEAK INDUSTRIES HOLDING 0 41 GREAT EAGLE HOLDINGS LTD 50 42 NORTHEAST ELECTRIC DEVELOP-H 0 43 CP POKPHAND CO LTD 0 45 HONGKONG & SHANGHAI HOTELS 50 46 COMPUTER & TECHNOLOGIES HLDG 0 47 HOP HING GROUP HOLDINGS LTD 0 48 CHINA AUTOMOTIVE INTERIOR 0 50 HONG KONG FERRY(HOLDINGS)CO. -

Your Professional Adviser

YOUR PROFESSIONAL ADVISER C100 M35 Y 25 K0 01 About Ascent Partners Ascent Partners is a leading provider of Independent Valuation, Corporate Advisory, Cost Management, Human Capital – Executive Search and Technology Advisory. We partner with our clients to ensure that our tailored solutions align with their strategic vision to deliver stellar results. The firm’s vision is to build and grow long-term business relationships with our clients. Our Commitment Ascent Partners’ commitment in providing independent, timely, professional advice and services gives our clients the information they need to effectively manage their business strategies and operations. Our Services Valuation: Ascent Partners provides impartial and independent valuations of businesses, properties and financial instruments that meet stringent international standards and regulatory requirements. 02 Corporate Advisory: valuation and risk management system Our Corporate Advisory services and platform. range from Transaction Support, Risk Analysis, Initial Public Offerings (IPOs) The Big Picture to Mergers & Acquisitions (M&As). Our clients enjoy the benefit of leveraging on the many years of legal, financial and Cost Management: accounting experience of our multi- Our Cost Management Specialists focus disciplinary team. on helping clients to achieve maximum cost efficiencies within the short-to- Clients have the benefit of accessing medium-term. the wide connections and resources of our carefully cultivated network of Human Capital – Executive Search: professional and business contacts. This Our extensive network enables us is especially critical when they are in to place the best candidates for the the market for investors or looking for positions created as our client’s potential targets for acquisitions. companies grow. We do not provide advice in isolation. -

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd. 20% 8 電訊盈科 60% 9 NINE EXPRESS LTD 20% 10 恒隆集團 60% 11 恒生銀行 70% 12 恒基地產 70% 14 希慎興業 60% 15 Vantage International (Holdings) Ltd. 50% 16 新鴻基地產 70% 17 新世界發展 70% 18 Oriental Press Group Ltd. 15% 19 太古股份公司A 70% 20 會德豐 60% 22 Mexan Ltd. 15% 23 東亞銀行 70% 25 Chevalier International Holdings Ltd. 20% 26 China Motor Bus Co., Ltd. 25% 27 銀河娛樂 70% 28 TIAN AN CHINA INVESTMENTS CO LTD 40% 29 Dynamic Holdings Ltd. 40% 31 China Aerospace International Holdings Ltd. 55% 32 Cross-Harbour (Holdings) Ltd., The 35% 33 Asia Investment Finance Group Ltd. 15% 34 Kowloon Development Co. Ltd. 40% 35 Far East Consortium International Ltd. 50% 38 第一拖拉機股份 50% 39 China Beidahuang Industry Group Holdings Ltd. 10% 41 Great Eagle Holdings Ltd. 60% 42 Northeast Electric Development Co. Ltd. - H Shares 40% 43 C.P. POKPHAND 40% 44 Hong Kong Aircraft Engineering Co. Ltd. 45% 45 Hongkong and Shanghai Hotels, Ltd., The 40% 46 Computer And Technologies Holdings Ltd. 15% 47 Hop Hing Group Holdings Ltd. 15% 48 China Automotive Interior Decoration Holdings Ltd. 20% 50 Hong Kong Ferry (Holdings) Co. Ltd. 35% 51 Harbour Centre Development Ltd. 15% 52 Fairwood Holdings Ltd. 55% 53 GUOCO GROUP 40% 54 合和實業 60% 55 NEWAY GROUP HOLDINGS LTD 20% 56 Allied Properties (HK) Ltd. 35% 57 Chen Hsong Holdings Ltd. 10% 58 Sunway International Holdings Ltd. -

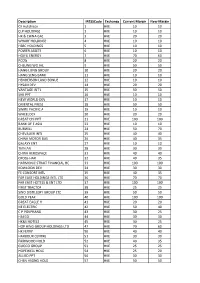

CFD Margin 201704.Xlsx

Description IRESSCode Exchange Current Margin New Margin CK Hutchison 1 HKE 10 10 CLP HOLDINGS 2 HKE 10 10 HK & CHINA GAS 3 HKE 20 20 WHARF HOLDINGS 4 HKE 10 10 HSBC HOLDINGS 5 HKE 10 10 POWER ASSETS 6 HKE 10 10 HOIFU ENERGY 7 HKE 70 60 PCCW 8 HKE 20 20 CHEUNG WO IHL 9 HKE 50 50 HANG LUNG GROUP 10 HKE 20 20 HANG SENG BANK 11 HKE 10 10 HENDERSON LAND BONUS 12 HKE 10 10 HYSAN DEV 14 HKE 20 20 VANTAGE INT'L 15 HKE 50 50 SHK PPT 16 HKE 10 10 NEW WORLD DEV 17 HKE 10 10 ORIENTAL PRESS 18 HKE 50 50 SWIRE PACIFIC A 19 HKE 10 10 WHEELOCK 20 HKE 20 20 GREAT CHI PPT 21 HKE 100 100 BANK OF E ASIA 23 HKE 10 10 BURWILL 24 HKE 50 70 CHEVALIER INTL 25 HKE 40 40 CHINA MOTOR BUS 26 HKE 40 35 GALAXY ENT 27 HKE 10 10 TIAN AN 28 HKE 30 30 CHINA AEROSPACE 31 HKE 40 40 CROSS-HAR 32 HKE 40 35 HARMONIC STRAIT FINANCIAL HO 33 HKE 100 100 KOWLOON DEV 34 HKE 30 30 FE CONSORT INTL 35 HKE 40 35 FAR EAST HOLDINGS INTL LTD 36 HKE 70 70 FAR EAST HOTELS & ENT LTD 37 HKE 100 100 FIRST TRACTOR 38 HKE 25 25 SINO DISTILLERY GROUP LTD 39 HKE 50 50 GOLD PEAK 40 HKE 100 100 GREAT EAGLE H 41 HKE 20 20 NE ELECTRIC 42 HKE 50 40 C P POKPHAND 43 HKE 30 25 HAECO 44 HKE 30 30 HK&S HOTELS 45 HKE 30 25 HOP HING GROUP HOLDINGS LTD 47 HKE 70 60 HK FERRY 50 HKE 40 40 HARBOUR CENTRE 51 HKE 30 30 FAIRWOOD HOLD 52 HKE 40 35 GUOCO GROUP 53 HKE 25 25 HOPEWELL HOLD 54 HKE 25 20 ALLIED PPT 56 HKE 30 30 CHEN HSONG HOLD 57 HKE 50 50 SUNWAY INTERNATIONAL HLDGS 58 HKE 70 70 SKYFAME REALTY 59 HKE 70 60 NORTH ASIA RESOURCES HOLDING 61 HKE 50 50 TRANSPORT INTL 62 HKE 30 30 WINFOONG INTERNATIONAL LTD 63