In the High Court of the Hong Kong Special

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017/18 2017/18

NIMBLE HOLDINGS COMPANY LIMITED (於開曼群島註冊成立並於百慕達繼續經營之有限公司) (Incorporated in the Cayman Islands and continued ) (前稱嘉域集團有限公司) in Bermuda with limited liability (Formerly known as The Grande Holdings Limited) 股份代號 : 186 Stock code: 186 敏捷控股有限公司 年度報告 ANNUAL REPORT 2017/18 2017/18 追求 BUILDING ON 卓越 EXCELLENCE Annual Report 2017/18 年度報告 CONTENTS CONTENTS Corporate Information 2 Chairman’s Statement 3 Management Discussion and Analysis 4 Biographies of Directors 8 Report of the Directors 10 Corporate Governance Report 18 Environmental, Social and Governance Report 31 Independent Auditor’s Report 39 Consolidated Income Statement 41 Consolidated Statement of Comprehensive Income 42 Consolidated Statement of Financial Position 43 Consolidated Statement of Changes in Equity 45 Consolidated Statement of Cash Flows 46 Notes to Consolidated Financial Statements 48 Five-Year Financial Summary 109 Nimble Holdings Company Limited Annual Report 2017/2018 1 CORPORATE INFORMATION CORPORATE INFORMATION BOARD OF DIRECTORS LEGAL ADVISORS EXECUTIVE DIRECTORS Stephenson Harwood Mr. Tan Bingzhao Johnnie Yam, Jackie Lee & Co. Mr. Deng Xiangping AUDITOR INDEPENDENT NON-EXECUTIVE Moore Stephens CPA Limited DIRECTORS Dr. Lin Jinying REGISTERED OFFICE Dr. Lu Zhenghua Wessex House, 5th Floor Dr. Ye Hengqing 45 Reid Street Hamilton HM 12, Bermuda AUDIT COMMITTEE Dr. Lu Zhenghua (Chairman) PRINCIPAL PLACE OF BUSINESS IN Dr. Lin Jinying HONG KONG Dr. Ye Hengqing 11/F., The Grande Building 398 Kwun Tong Road REMUNERATION COMMITTEE Kowloon Dr. Lin Jinying (Chairman) Hong Kong Dr. Lu Zhenghua Dr. Ye Hengqing SHARE REGISTRAR AND TRANSFER OFFICE NOMINATION COMMITTEE Tricor Tengis Limited Mr. Tan Bingzhao (Chairman) Level 22, Hopewell Center Dr. Lin Jinying 183 Queen’s Road East Dr. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

S42009131318p3.Ps, Page 1-24 @ Normalize 2

2009 年第 13 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 13/2009 D1117 ENGLISH AUTHOR INDEX, 2007 139 Holdings Limited 7056 APT Satellite Holdings Limited 3135 82 Republic 8086 Aptus Holdings Limited 10975 Abbs, Brian 3107 Architectural Services Department 22, abc Multiactive Limited 10 7101-7102 Abyar, Narges 13197 Archworld 666, 2242, 2719 Accountancy Training Company 11-15, Arlon, Penelope 4919, 5035, 5544, 6766 10946-10954 Armentrout, Fred 308, 7211 Achtemeier, Paul J 2474 Armstrong, J. K. 3461, 3469, 7300, 7317, AcrossAsia Limited 3115 11138, 11148-11150, 11152, Adams, Penny 3116-3118 11161-11162 Adrian-Vallance, D’Arcy 10956-10957 Arnobius 4869 Adrian-Vallance, Evadne 10966-10967 Arnold, Bill T 10253 Aesop 1078 Arnold, Peter 9895, 13676, 13802 Agriculture and Fisheries Art Textile Technology International Department 3119, 7082 Company Limited 10979 Agriculture, Fisheries and Arterburn, Stephen 8835 Conservation Department 7083 Artfield Group Limited 3141, 7104, 10980 AGTech Holdings Limited 10958 Arthur, David 1452-1453 Ahluwalia, Libby 11577 Arthur, Kay 1146-1147, 1370-1371, 1452-1453, Ahoor, Darviz 12297 1505-1506, 1536-1537, 2198-2199, Ai, Weiwei 3120 2652-2653 Akrami, Jamaloldin 12085 Artist Commune Administration Alata 587-588, 1129, 12024-12025 Office 7804, 7849, 7857 Albaut, Corinne 18-19 Arts Optical International Holdings Albee, Edward 5952, 6891 Limited 3142 Albornoz-Chacon, Ruth 315 Aru 3031, 10784 Alco Holdings Limited 7085 Ashcroft, Minnie 9043, 9045 Alcott, Louisa May 3121 Asia Monitor Resource Center 261 Alder, C 9870 Asia -

Akai Liquidator Cosimo Borrelli's Pursuit of Truth Unravels Corporate Collapse Naomi Rovnick

Hard work pays off for 'vicious' Akai liquidator Cosimo Borrelli's pursuit of truth unravels corporate collapse Naomi Rovnick Updated on Oct 06, 2009 A tycoon is accused of stealing more than US$800 million from his international conglomerate and bankrupting the company, while another businessman allegedly conspires to hide the rest of the failed firm's assets from its creditors. The affair leads to a High Court trial, which collapses. The conglomerate's Big Four auditor is said to have fabricated documents, then gets raided by the anti-fraud police and sees one of its partners arrested. The events look like scenes from a crime thriller, but the saga of Akai Holdings, the former empire of disgraced entrepreneur James Ting that collapsed in 2000, is very real and has shaken the foundations of corporate Hong Kong, heightening fears about freewheeling tycoons and the auditors and regulators that are meant to protect companies' shareholders and lenders. The scandal resurfaced in a High Court case against Akai's former auditor, Ernst & Young Hong Kong, last month. The claimants, Akai's liquidators, accused the auditor of tampering with and faking audit files to shield itself from the US$1 billion negligence claim. The Commercial Crime Bureau has launched a fraud investigation into Ernst & Young and late last month arrested Edmund Dang, one of its partners, who was freed on bail without being charged. Yesterday, in a separate trial, Hong Kong tycoon Christopher Ho Wing-on settled a High Court case where Akai's liquidators had accused him of misappropriating the failed electronics firm's assets into his Grande Holdings vehicle in 1999, so Akai's creditors could not retrieve any money. -

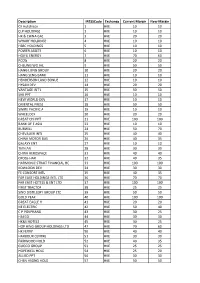

CFD Margin 201704.Xlsx

Description IRESSCode Exchange Current Margin New Margin CK Hutchison 1 HKE 10 10 CLP HOLDINGS 2 HKE 10 10 HK & CHINA GAS 3 HKE 20 20 WHARF HOLDINGS 4 HKE 10 10 HSBC HOLDINGS 5 HKE 10 10 POWER ASSETS 6 HKE 10 10 HOIFU ENERGY 7 HKE 70 60 PCCW 8 HKE 20 20 CHEUNG WO IHL 9 HKE 50 50 HANG LUNG GROUP 10 HKE 20 20 HANG SENG BANK 11 HKE 10 10 HENDERSON LAND BONUS 12 HKE 10 10 HYSAN DEV 14 HKE 20 20 VANTAGE INT'L 15 HKE 50 50 SHK PPT 16 HKE 10 10 NEW WORLD DEV 17 HKE 10 10 ORIENTAL PRESS 18 HKE 50 50 SWIRE PACIFIC A 19 HKE 10 10 WHEELOCK 20 HKE 20 20 GREAT CHI PPT 21 HKE 100 100 BANK OF E ASIA 23 HKE 10 10 BURWILL 24 HKE 50 70 CHEVALIER INTL 25 HKE 40 40 CHINA MOTOR BUS 26 HKE 40 35 GALAXY ENT 27 HKE 10 10 TIAN AN 28 HKE 30 30 CHINA AEROSPACE 31 HKE 40 40 CROSS-HAR 32 HKE 40 35 HARMONIC STRAIT FINANCIAL HO 33 HKE 100 100 KOWLOON DEV 34 HKE 30 30 FE CONSORT INTL 35 HKE 40 35 FAR EAST HOLDINGS INTL LTD 36 HKE 70 70 FAR EAST HOTELS & ENT LTD 37 HKE 100 100 FIRST TRACTOR 38 HKE 25 25 SINO DISTILLERY GROUP LTD 39 HKE 50 50 GOLD PEAK 40 HKE 100 100 GREAT EAGLE H 41 HKE 20 20 NE ELECTRIC 42 HKE 50 40 C P POKPHAND 43 HKE 30 25 HAECO 44 HKE 30 30 HK&S HOTELS 45 HKE 30 25 HOP HING GROUP HOLDINGS LTD 47 HKE 70 60 HK FERRY 50 HKE 40 40 HARBOUR CENTRE 51 HKE 30 30 FAIRWOOD HOLD 52 HKE 40 35 GUOCO GROUP 53 HKE 25 25 HOPEWELL HOLD 54 HKE 25 20 ALLIED PPT 56 HKE 30 30 CHEN HSONG HOLD 57 HKE 50 50 SUNWAY INTERNATIONAL HLDGS 58 HKE 70 70 SKYFAME REALTY 59 HKE 70 60 NORTH ASIA RESOURCES HOLDING 61 HKE 50 50 TRANSPORT INTL 62 HKE 30 30 WINFOONG INTERNATIONAL LTD 63 -

Law Man-Chung 羅敏聰⼤律師

LAW MAN-CHUNG 羅敏聰⼤律師 Call: 1997 (HK) Accredited as Mediator by CEDR in 2010 PROFILE MC Law has a broad civil and commercial practice, with focus on cross-border disputes and company disputes. He advises and acts in disputes in various fields, including conflict of laws, company and shareholders disputes, PRC joint ventures, corporate finance, insolvency, general commercial and contractual disputes, libel and slander, banking, probate, land and conveyancing (including DMC disputes, land resumption, etc), confidential information; discrimination, trusts and arbitration. He has also involved in various applications for interlocutory injunctions, appointment and removal of receivers and provisional liquidators. Recent cases include Competition Commission v. Nutanix (first competition trial in Hong Kong); China Life Insurance v. Li Xiaoming, Yu Rui Co Ltd (acting for China Life in investment disputes in Mongolia and winding up of foreign company); Shenzhen Futaihong v. BYD (acting for Foxconn companies against BYD companies for breach of confidence claims). CONTACT Email: [email protected] Tel: (+852) 2523 2003 Fax: (+852) 2810 0302 SECRETARY Name: Amy Chan Email: [email protected] Tel: (+852) 2248 1894 PRACTICE AREAS Conflict of Laws Company Commercial Injunction / Contempt Insolvency Equity / Trust Banking / Finance Professional Liability Defamation / Media Securities & Regulation Discrimination Civil Fraud / Asset Recovery Probate / Succession Restitution / Unjust Enrichment Arbitration Confidentiality / Privacy Technology, Media and Telecommunications Property & Conveyancing Insurance Competition Mediation APPOINTMENTS AND PUBLIC OFFICE External Examiner – Chinese University of Hong Kong PCLL (2008 - ) External Examiner - City University of Hong Kong PCLL (2008 - ) EDUCATION 1986 - 1993 Queen’s College, Hong Kong 1996 BA (Jurisprudence), University of Oxford SCHOLARSHIP AND PRIZES 1993 - 1996 Lee Shau Kee Scholarship tenable at Wadham College, University of Oxford SELECTED CASES CONFLICT OF LAWS First Laser Ltd v. -

Why BRIFE? 展會優勢? Expanding Business & Markets Developing the Belt and Road Network 擴展「一帶一路」市場 拓展「一帶一路」網絡

Belt and Road Countries「一帶一路」國家 The Belt and Road Initiative covers and links up over 70 countries spanning over China, ASEAN, Middle East, Central and Eastern Europe etc. 「一帶一路」倡議覆蓋及聯繫70多個國家,當中包括中國、東盟、中東、中歐及東歐。 China 中國 Northeast Asia 東北亞 Australasia 澳大利西亞 • CHINA 中國 • MONGOLIA 蒙古 • NEW ZEALAND 新西蘭 • REPUBLIC OF KOREA 韓國 Southeast Asia 東南亞 Central and Eastern Europe • BRUNEI 汶萊 Middle East 中東 中歐及東歐 • CAMBODIA 柬埔寨 • BAHRAIN 巴林 • ALBANIA 阿爾巴尼亞 • INDONESIA 印尼 • EGYPT 埃及 • BELARUS 白俄羅斯 • LAOS 老撾 • IRAN 伊朗 • BOSNIA AND HERZEGOVINA • MALAYSIA 馬來西亞 • IRAQ 伊拉克 波斯尼亞與黑塞哥維那 • MYANMAR 緬甸 • ISRAEL 以色列 • BULGARIA 保加利亞 • PHILIPPINES 菲律賓 • JORDAN 約旦 • CROATIA 克羅地亞 • SINGAPORE 新加坡 • KUWAIT 科威特 • CZECH REPUBLIC 捷克 • THAILAND 泰國 • LEBANON 黎巴嫩 • ESTONIA 愛沙尼亞 • TIMOR-LESTE 東帝汶 • OMAN 阿曼 • GEORGIA 格魯吉亞 • VIETNAM 越南 • PALESTINE 巴勒斯坦 • HUNGARY 匈牙利 • QATAR 卡塔爾 • LATVIA 拉脫維亞 South Asia 南亞 • SAUDI ARABIA 沙特阿拉伯 • LITHUANIA 立陶宛 • BANGLADESH 孟加拉 • SYRIA 敘利亞 • MACEDONIA 馬其頓 • BHUTAN 不丹 • UNITED ARAB EMIRATE • MOLDOVA 摩爾多瓦 • INDIA 印度 阿拉伯聯合酋長國 • MONTENEGRO 黑山 • MALDIVES 馬爾代夫 • YEMEN 也門 • POLAND 波蘭 • NEPAL 尼泊爾 • ROMANIA 羅馬尼亞 • PAKISTAN 巴基斯坦 Africa 非洲 • RUSSIA 俄羅斯 • SRI-LANKA 斯里蘭卡 • ETHIOPIA 埃塞俄比亞 • SERBIA 塞爾維亞 • SOUTH AFRICA 南非 • SLOVAKIA 斯洛伐克 Central Asia 中亞 • SLOVENIA 斯洛文尼亞 • AFGHANISTAN 阿富汗 • TURKEY 土耳其 • ARMENIA 亞美尼亞 • UKRAINE 烏克蘭 • AZERBAIJAN 阿塞拜疆 • KAZAKHSTAN 哈薩克 • KYRGYZSTAN 吉爾吉斯 • TAJIKISTAN 塔吉克 • TURKMENISTAN 土庫曼 • UZBEKISTAN 烏茲別克 P.1 Unimpeded Trade is the Major Goal of The Belt & Road Initiative 貿易暢通是「一帶一路」倡議的主要目標 Unimpeded Trade Policy 貿易暢通 People-to-people Co-ordination Bonds 政策溝通 民心相通 1 2 3 4 5 Facilities Financial Connectivity Integration 設施聯通 資金融通 P.2 Apothegm 題辭 Mr Edward Yau Tang-wah, GBS, JP Secretary for Commerce and Economic Development Hong Kong Special Administrative Region Government 邱騰華先生, 金紫荊星章,太平紳士 香港特別行政區商務及經濟發展局局長 Converging the Gourmets, Thriving all Flavors. -

Linda Chan Sc 陳靜芬資深大律師

LINDA CHAN SC 陳靜芬資深大律師 Call: 1996 (HK); 1996 (England & Wales) Inner Bar: 2011 Accredited as mediator by CEDR in 2007 P R O F I L E Linda Chan’s practice comprises litigation and advisory work in the fields of company law, insolvency law, commercial dispute and professional negligence, with particular focus on applications under the Companies Ordinance, matters relating to directors’ duties, shareholders’ rights and remedies, corporate restructuring, capital restructuring and schemes of arrangement. She has been instructed in relation to numerous shareholders disputes, derivative actions, unfair prejudice petitions, “just and equitable” winding up petitions and bankruptcy matters. She has also been instructed to advise the liquidators in relation to complicated liquidations involving substantial listed companies in Hong Kong including the liquidation of Akai Holdings Limited, Kong Wah Holdings Limited, The New China Hong Kong Group Ltd, Ocean Grand Holdings Ltd, China Metal Recycling (Holdings) Ltd and China Medical Technologies, Inc.. C O N T A C T Email: [email protected] Tel: (+852) 2523 2003 SECRETARY Name: Karmen Yiu Tel: (+852) 2248 1883 P R A C T I C E A R E A S Company Commercial Civil Fraud / Asset Recovery Insolvency Injunction / Contempt Professional Liability Securities & Regulation Arbitration A P P O I N T M E N T S A N D P U B L I C O F F I C E Current Recorder of the Court of First Instance, High Court (2015-) Board Member, Airport Authority Board (2018-) Member, Standing Committee on Company Law Reform (2017-) -

新成立/ 註冊及已更改名稱的公司名單list of Newly Incorporated

This is the text version of a report with Reference Number "RNC063" and entitled "List of Newly Incorporated /Registered Companies and Companies which have changed Names". The report was created on 09-11-2020 and covers a total of 2666 related records from 02-11-2020 to 08-11-2020. 這是報告編號為「RNC063」,名稱為「新成立 / 註冊及已更改名稱的公司名單」的純文字版報告。這份報告在 2020 年 11 月 9 日建立,包含從 2020 年 11 月 2 日到 2020 年 11 月 8 日到共 2666 個相關紀錄。 Each record in this report is presented in a single row with 6 data fields. Each data field is separated by a "Tab". The order of the 6 data fields are "Sequence Number", "Current Company Name in English", "Current Company Name in Chinese", "C.R. Number", "Date of Incorporation / Registration (D-M-Y)" and "Date of Change of Name (D-M-Y)". 每個紀錄會在報告內被設置成一行,每行細分為 6 個資料。 每個資料會被一個「Tab 符號」分開,6 個資料的次序為「順序編號」、「現用英文公司名稱」、「現用中文公司名稱」、「公司註冊編號」、「成立/ 註冊日期(日-月-年)」、「更改名稱日期(日-月-年)」。 Below are the details of records in this report. 以下是這份報告的紀錄詳情。 1. 1 PERCENT BETTER COMPANY LIMITED 2990306 03-11-2020 2. 1628Mall Co Limited 2989722 02-11-2020 3. 1688 Dropshipping Limited 2991826 06-11-2020 4. 2 FORTUNE CREDIT LIMITED 易豐信貸有限公司 2991934 06-11-2020 5. 2 INS CHILDREN DEVELOPMENT CENTRE COMPANY LIMITED 啟創兒童潛能發展中心有限公司 2991155 05-11-2020 6. 21Vianet Jupiter International Investment Limited 世紀互聯木星國際投資有限公司 2991152 05-11-2020 7. 24 FIT LIMITED 2991523 06-11-2020 8. 38 Wine Limited 38 葡萄酒進口有限公司 2989815 02-11-2020 9. 3Q Global Supply Chain Service Co., Limited 金林洪泰全球供應鏈服務有限公司 2990523 03-11-2020 10. -

Hang Ten Group Holdings Limited (Incorporated in Bermuda with Limited Liability) on the Stock Exchange of Hong Kong Limited by Way of Introduction

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this document or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Akai Holdings Limited (In Compulsory Liquidation), you should at once hand this document together with the enclosed forms of proxy to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document does not constitute a public offering of securities nor is it calculated to invite public offers for securities and it must not be used for the purposes of offering or inviting offers for any securities to the public. Proposal for Akai Holdings Limited (In Compulsory Liquidation) (incorporated in Bermuda with limited liability) by way of a shareholders’ scheme of arrangement (under section 99 of the Companies Act 1981 of Bermuda) and withdrawal of the listing of the shares of Akai Holdings Limited (In Compulsory Liquidation) and the listing of the ordinary shares of Hang Ten Group Holdings Limited (incorporated in Bermuda with limited liability) on The Stock Exchange of Hong Kong Limited by way of introduction Sponsor Kim Eng Capital (Hong Kong) Limited Co-Sponsor Independent financial adviser to shareholders of Akai Holdings Limited (In Compulsory Liquidation) A letter from the joint and several liquidators of Akai Holdings Limited (In Compulsory Liquidation) is set out on pages 38 to 41 of this document. -

Directors, Senior Management, and Employees

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED ‘‘WARNING’’ ON THE COVER OF THIS DOCUMENT. DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES MEMBERS OF OUR BOARD AND SENIOR MANAGEMENT Our Board has the ultimate responsibility for the management of our Company. The powers and duties of our Board include convening general meetings and reporting our Board’s work at our Shareholders’ meetings, determining our business and investment plans, preparing our annual financial budgets and final reports, formulating proposals for profit distributions and for the increase or reduction of our registered capital as well as exercising other powers, functions and duties as conferred by our Memorandum and Articles. Our Board currently consists of five Directors, comprising two executive Directors and three independent non-executive Directors. Our senior management team consists of four individuals. The table below sets forth the brief information regarding our Directors and senior management: Directors Relationship with Date of other Directors Date of joining appointment as and/or our senior Name Age Position our Group Director Responsibilities in our Group management Mr. CHU Kwok Fun 49 Executive Director, 4 May 2007 14 November Primarily responsible for the overall N/A (朱國歡先生) Chairman, and Chief 2018 management, strategic planning, Executive Officer and development of our business operations Mr. TSANG Chiu Wan 61 Executive Director 1 February 24 May 2019 Primarily responsible for supervising, N/A (曾昭維先生) 2011 managing and overseeing the day- to-day operation and administration of our business Ms. LEUNG Yin Fai 55 Independent non- 5 March 2020 5 March 2020 Supervising and providing N/A (梁燕輝女士) executive Director independent advice to our Board Mr. -

The Grande Holdings Limited 嘉域集團有限公司

THIS PROSPECTUS IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this Prospectus or as to the action you should take, you should consult a licensed securities dealer or other registered institution in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in The Grande Holdings Limited (In Liquidation in Hong Kong)(the ‘‘Company’’), you should at once hand this Prospectus and the accompanying application form to the purchaser or transferee or to the bank, the licensed securities dealer or registered institution or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Subject to the granting of the listing of, and permission to deal in, the New Shares, the Offer Shares and the Creditor Shares on the Stock Exchange, the New Shares, the Offer Shares and the Creditor Shares will be accepted as eligible securities by HKSCC for deposit, clearance and settlement in CCASS with effect from the commencement date of dealings in the New Shares, the Offer Shares and the Creditor Shares on the Stock Exchange or under contingent situation, such other date as determined by HKSCC. Settlement of transactions between participants of the Stock Exchange on any trading day is required to take place in CCASS on the second business day thereafter. All activities under CCASS are subject to the General Rules of CCASS and CCASS Operational Procedures in effect from time to time. A copy of each of the Prospectus Documents, together with the other documents specified in the paragraph headed ‘‘Documents delivered to the Registrar of Companies’’ in Appendix III to this Prospectus, has been registered with the Registrar of Companies in Hong Kong pursuant to Section 342C of the Companies (Winding Up and Miscellaneous Provisions) Ordinance.