Stock Margin Ratio (Effective from July 01, 2020) the Following Stock

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

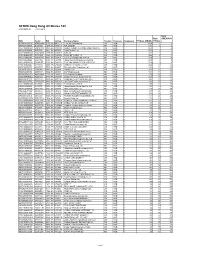

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

CHINA PROPERTIES GROUP LIMITED (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1838)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for information purposes only and does not constitute an invitation or a solicitation of an offer to acquire, purchase or subscribe for securities or an invitation to enter into an agreement to do any such things, nor is it calculated to invite any offer to acquire, purchase or subscribe for any securities. This announcement is not an offer of securities for sale or the solicitation of an offer to buy any securities in the United States or any country or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such country or jurisdiction. Neither this announcement nor anything herein forms the basis of any contract of commitment whatsoever. Neither this announcement nor any copy hereof may be takenintoordistributedintheUnitedStates.Securities may not be offered or sold in the United States absent registration or an exemption from registration. The Company has not registered and does not intend to register any of the Notes in the United States. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the Company and management, as well as financial statements. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

S42009131318p3.Ps, Page 1-24 @ Normalize 2

2009 年第 13 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 13/2009 D1117 ENGLISH AUTHOR INDEX, 2007 139 Holdings Limited 7056 APT Satellite Holdings Limited 3135 82 Republic 8086 Aptus Holdings Limited 10975 Abbs, Brian 3107 Architectural Services Department 22, abc Multiactive Limited 10 7101-7102 Abyar, Narges 13197 Archworld 666, 2242, 2719 Accountancy Training Company 11-15, Arlon, Penelope 4919, 5035, 5544, 6766 10946-10954 Armentrout, Fred 308, 7211 Achtemeier, Paul J 2474 Armstrong, J. K. 3461, 3469, 7300, 7317, AcrossAsia Limited 3115 11138, 11148-11150, 11152, Adams, Penny 3116-3118 11161-11162 Adrian-Vallance, D’Arcy 10956-10957 Arnobius 4869 Adrian-Vallance, Evadne 10966-10967 Arnold, Bill T 10253 Aesop 1078 Arnold, Peter 9895, 13676, 13802 Agriculture and Fisheries Art Textile Technology International Department 3119, 7082 Company Limited 10979 Agriculture, Fisheries and Arterburn, Stephen 8835 Conservation Department 7083 Artfield Group Limited 3141, 7104, 10980 AGTech Holdings Limited 10958 Arthur, David 1452-1453 Ahluwalia, Libby 11577 Arthur, Kay 1146-1147, 1370-1371, 1452-1453, Ahoor, Darviz 12297 1505-1506, 1536-1537, 2198-2199, Ai, Weiwei 3120 2652-2653 Akrami, Jamaloldin 12085 Artist Commune Administration Alata 587-588, 1129, 12024-12025 Office 7804, 7849, 7857 Albaut, Corinne 18-19 Arts Optical International Holdings Albee, Edward 5952, 6891 Limited 3142 Albornoz-Chacon, Ruth 315 Aru 3031, 10784 Alco Holdings Limited 7085 Ashcroft, Minnie 9043, 9045 Alcott, Louisa May 3121 Asia Monitor Resource Center 261 Alder, C 9870 Asia -

Us$150,000,000

OFFERING CIRCULAR CONFIDENTIAL US$150,000,000 (Incorporated in the Cayman Islands with limited liability) 13.50% Senior Notes due 2018 We are offering US$150,000,000 13.50% senior notes due 2018 (the ‘‘Notes’’). The Notes will bear interest at the rate of 13.50% per annum. The Notes will bear interest from the Original Issue Date, payable semi-annually in arrears on April 16 and October 16 of each year, commencing April 16, 2014. The Notes will mature on October 16, 2018. At any time on or after October 16, 2016, we may redeem the Notes in whole or in part, at the redemption prices specified under ‘‘Description of the Notes — Optional Redemption.’’ At any time prior to October 16, 2016, we may redeem the Notes at our option, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Notes plus the Applicable Premium (as defined in ‘‘Description of the Notes’’) applicable to the Notes as of, plus accrued and unpaid interest, if any, to, the redemption date. Before October 16, 2016, we may redeem up to 35% in aggregate principal amount of the Notes, at a redemption price equal to 113.5% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to the redemption date, with the proceeds from sales of certain kinds of ordinary shares. We may redeem the Notes at our option, in whole but not in part, at a redemption price equal to 100% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to the redemption date, in the event of certain changes in specified tax laws or other circumstances. -

Share and Connected Transactions

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Greentown China Holdings Limited, you should at once hand this circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for onward transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. GREENTOWN CHINA HOLDINGS LIMITED * (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3900) SHARE AND CONNECTED TRANSACTIONS The Independent Financial Adviser to the Independent Board Committee and the Shareholders A letter from the Board is set out on pages 6 to 16 of this circular and a letter from the Independent Board Committee is set out on pages 17 to 18 of this circular. A letter from Hercules Capital, the Independent Financial Adviser to the Independent Board Committee and the Shareholders, containing its advice to the Independent Board Committee and the Shareholders in relation to the Acquisition is set out on pages 19 to 36 of this circular. -

STOXX Hong Kong All Shares 180 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 180 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

An Assessment of Environmental and Social Transparency of Food Related Companies Currently Listing in Hong Kong Stock Exchange

An assessment of Environmental and Social transparency of food related companies currently listing in Hong Kong Stock Exchange October 2017 Hong Kong 1 Executive Summary Oxfam Hong Kong seeks to better understand opportunities to engage with companies in Hong Kong. Oxfam Hong Kong commissioned CSR Asia to conduct a benchmarking exercise to assess the Environmental and Social transparency in the food, beverages, and agricultural products sectors in Hong Kong. The aims of this exercise were: To assess food companies’ Environment and Social transparency To summarise the Environment and Social transparency of selected companies. To assess what companies are doing to create more inclusive business models relating to both products and value chains, and to engage with issues associated with access to food products for poor people. To make recommendations on the business case for food companies to implement responsible business policies In total, 61 companies were benchmarked in this study. Data was compiled from publicly available information published in 2015 including corporate websites, annual reports and sustainability reports. Overall, the level of disclosure by the 61 companies is relatively low and indeed they were failed. Only 3 companies achieved over 30 points and 55 of the companies scoring below 20 points. This may seem disappointing at first but it should be recognized that the GRI indicators are very comprehensive and that most companies in Hong Kong are a long way from being able to report on them. Companies demonstrated weak performance in both categories in which the average score of social and environment are 12.5 and 8.7 respectively. -

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON HOLDINGS LTD 70 2 CLP HOLDINGS LTD 70 3 HONG KONG & CHINA GAS 70 4 WHARF HOLDINGS LTD 70 5 HSBC HOLDINGS PLC 70 6 POWER ASSETS HOLDINGS LTD 70 7 HONG KONG FINANCE INVESTMENT 0 8 PCCW LTD 60 9 NINE EXPRESS LTD 0 10 HANG LUNG GROUP LTD 60 11 HANG SENG BANK LTD 70 12 HENDERSON LAND DEVELOPMENT 70 14 HYSAN DEVELOPMENT CO 50 15 VANTAGE INTERNATIONAL 0 16 SUN HUNG KAI PROPERTIES 70 17 NEW WORLD DEVELOPMENT 70 18 ORIENTAL PRESS GROUP LTD 0 19 SWIRE PACIFIC LTD - CL A 70 20 WHEELOCK & CO LTD 70 21 GREAT CHINA PROPERTIES HOLDI 0 22 MEXAN LTD 0 23 BANK OF EAST ASIA LTD 60 24 BURWILL HOLDINGS LTD 0 25 CHEVALIER INTERNATIONAL HOLD 0 26 CHINA MOTOR BUS CO 0 27 GALAXY ENTERTAINMENT GROUP L 70 28 TIAN AN CHINA INVESTMENT 0 29 DYNAMIC HOLDINGS LTD. 0 30 BAN LOONG HOLDINGS LTD 0 31 CHINA AEROSPACE INTL HLDG 0 32 CROSS-HARBOUR HOLDINGS LTD 0 33 ASIA INVESTMENT FINANCE GROU 0 34 KOWLOON DEVELOPMENT CO LTD 30 35 FAR EAST CONSORTIUM INTERNAT 10 36 FAR EAST HOLDINGS INTL LTD 0 37 FAR EAST HOTELS & ENT LTD 0 38 FIRST TRACTOR CO-H 0 39 CHINA BEIDAHUANG INDUSTRY 0 40 GOLD PEAK INDUSTRIES HOLDING 0 41 GREAT EAGLE HOLDINGS LTD 50 42 NORTHEAST ELECTRIC DEVELOP-H 0 43 CP POKPHAND CO LTD 0 45 HONGKONG & SHANGHAI HOTELS 50 46 COMPUTER & TECHNOLOGIES HLDG 0 47 HOP HING GROUP HOLDINGS LTD 0 48 CHINA AUTOMOTIVE INTERIOR 0 50 HONG KONG FERRY(HOLDINGS)CO. -

Your Professional Adviser

YOUR PROFESSIONAL ADVISER C100 M35 Y 25 K0 01 About Ascent Partners Ascent Partners is a leading provider of Independent Valuation, Corporate Advisory, Cost Management, Human Capital – Executive Search and Technology Advisory. We partner with our clients to ensure that our tailored solutions align with their strategic vision to deliver stellar results. The firm’s vision is to build and grow long-term business relationships with our clients. Our Commitment Ascent Partners’ commitment in providing independent, timely, professional advice and services gives our clients the information they need to effectively manage their business strategies and operations. Our Services Valuation: Ascent Partners provides impartial and independent valuations of businesses, properties and financial instruments that meet stringent international standards and regulatory requirements. 02 Corporate Advisory: valuation and risk management system Our Corporate Advisory services and platform. range from Transaction Support, Risk Analysis, Initial Public Offerings (IPOs) The Big Picture to Mergers & Acquisitions (M&As). Our clients enjoy the benefit of leveraging on the many years of legal, financial and Cost Management: accounting experience of our multi- Our Cost Management Specialists focus disciplinary team. on helping clients to achieve maximum cost efficiencies within the short-to- Clients have the benefit of accessing medium-term. the wide connections and resources of our carefully cultivated network of Human Capital – Executive Search: professional and business contacts. This Our extensive network enables us is especially critical when they are in to place the best candidates for the the market for investors or looking for positions created as our client’s potential targets for acquisitions. companies grow. We do not provide advice in isolation. -

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd

Sinolink Securities (Hong Kong) Company Limited 1/12/2016 1 長和 70% 2 中電控股 70% 3 香港中華煤氣 70% 4 九龍倉集團 70% 5 匯豐控股 70% 6 電能實業 70% 7 Hoifu Energy Group Ltd. 20% 8 電訊盈科 60% 9 NINE EXPRESS LTD 20% 10 恒隆集團 60% 11 恒生銀行 70% 12 恒基地產 70% 14 希慎興業 60% 15 Vantage International (Holdings) Ltd. 50% 16 新鴻基地產 70% 17 新世界發展 70% 18 Oriental Press Group Ltd. 15% 19 太古股份公司A 70% 20 會德豐 60% 22 Mexan Ltd. 15% 23 東亞銀行 70% 25 Chevalier International Holdings Ltd. 20% 26 China Motor Bus Co., Ltd. 25% 27 銀河娛樂 70% 28 TIAN AN CHINA INVESTMENTS CO LTD 40% 29 Dynamic Holdings Ltd. 40% 31 China Aerospace International Holdings Ltd. 55% 32 Cross-Harbour (Holdings) Ltd., The 35% 33 Asia Investment Finance Group Ltd. 15% 34 Kowloon Development Co. Ltd. 40% 35 Far East Consortium International Ltd. 50% 38 第一拖拉機股份 50% 39 China Beidahuang Industry Group Holdings Ltd. 10% 41 Great Eagle Holdings Ltd. 60% 42 Northeast Electric Development Co. Ltd. - H Shares 40% 43 C.P. POKPHAND 40% 44 Hong Kong Aircraft Engineering Co. Ltd. 45% 45 Hongkong and Shanghai Hotels, Ltd., The 40% 46 Computer And Technologies Holdings Ltd. 15% 47 Hop Hing Group Holdings Ltd. 15% 48 China Automotive Interior Decoration Holdings Ltd. 20% 50 Hong Kong Ferry (Holdings) Co. Ltd. 35% 51 Harbour Centre Development Ltd. 15% 52 Fairwood Holdings Ltd. 55% 53 GUOCO GROUP 40% 54 合和實業 60% 55 NEWAY GROUP HOLDINGS LTD 20% 56 Allied Properties (HK) Ltd. 35% 57 Chen Hsong Holdings Ltd. 10% 58 Sunway International Holdings Ltd. -

2010 PUF Detailed Schedule of Investments

PERMANENT UNIVERSITY FUND DETAIL SCHEDULES OF INVESTMENT SECURITIES AND INDEPENDENT AUDITORS’ REPORT August 31, 2010 Independent Auditors’ Report The Board of Regents of The University of Texas System The Board of Directors of The University of Texas Investment Management Company We have audited, in accordance with auditing standards generally accepted in the United States of America, the financial statements of the Permanent University Fund (the “PUF”), as of and for the year ended August 31, 2010, and have issued our unqualified report thereon dated October 29, 2010. We have also audited the accompanying schedule of PUF’s equity securities (Schedule A), preferred stocks and convertible securities (Schedule B), purchased options (Schedule C), debt securities (Schedule D), investment funds (Schedule E), cash and cash equivalents (Schedule F), hedge fund investment pools (Schedule G), and the private investment pools (Schedule H) as of August 31, 2010. These schedules are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these Schedules based on our audit. In our opinion, the Schedules referred to above, when read in conjunction with the financial statements of the PUF referred to above, present fairly, in all material respects, the information set forth therein. October 29, 2010 PERMANENT UNIVERSITY FUND SCHEDULE A EQUITY SECURITIES August 31, 2010 SECURITY SHARES VALUE COST ($) ($) DOMESTIC COMMON STOCKS ACTUATE SOFTWARE CORP................................................................ 198,496 791,999 963,243 AES CORP.............................................................................................. 21,740 222,618 249,543 AKAMAI TECHNOLOGIES INC............................................................... 22,610 1,041,643 970,133 ALCOA INC............................................................................................. 104,043 1,062,279 1,295,450 ALEXANDERS INC.................................................................................