Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interchange from NWFB and Citybus to Turbojet Save Ferry Fare up to $30 and Enjoy an Exclusive Seat Class Upgrade with $50

Interchange from NWFB and Citybus to TurboJET Save Ferry Fare Up to $30 and Enjoy an Exclusive Seat Class Upgrade with $50 (17 May 2019, Hong Kong) New World First Bus (“NWFB”) and Citybus announced a collaboration with TurboJET today to launch “One tap to board with Octopus” interchange discount scheme. From now to 31 December 2019, Octopus paying passengers of NWFB and Citybus routes can enjoy an interchange discount equivalent to bus fare of the last single trip, when using the “One Tap to Board with Octopus” service to pay their ferry fare at the first gate of ferry terminal to Macau at Hong Kong Macau Ferry Terminal in Sheung Wan, Tuen Mun Ferry Terminal and China Hong Kong City Ferry Terminal. The maximum discount is $30. In addition, passengers of NWFB and Citybus can at the same time enjoy an exclusive offer by TurboJET for seat class upgrade with $50 using “One Tap to Board with Octopus” service. Please visit http://www.turbojet.com.hk/en/promotions/octopus-tj-discount.aspx for *terms and conditions. – END – *Terms and conditions 1. The offer is valid from now until 31 December 2019, provided by TurboJET. 2. Interchange must take place within 120 minutes after the bus fare payment and the use of “One Tap to Board with Octopus” service at designated Ferry Terminals; same Octopus has to be used in order to enjoy the offer. 3. The interchange discount is equivalent to the bus fare of the last paid trip, to be directly deducted from the ferry fare during the use of “One Tap to Board with Octopus” service. -

Annual Report 2009

NWS HOLDINGS LIMITED NWS Holdings Limited (incorporated in Bermuda with limited liability) ANNUAL REPORT 2009 ANNUAL REPORT 28/F New World Tower 18 Queen’s Road Central Hong Kong Tel: (852) 2131 0600 Fax: (852) 2131 0611 E-mail: [email protected] Sustaining Growth www.nws.com.hk Striving for Excellence NWS Holdings Limited takes every practicable measure to conserve resources and minimize waste. NWS HOLDINGS LIMITED This annual report is printed on FSC certified paper using vegetable oil-based inks. Pulps used are elemental chlorine-free. ANNUAL REPORT 2009 The FSC logo identifies product group from well-managed forests and other controlled sources in accordance with the rules of the Forest Stewardship Council. STOCK CODE: 659 VISION To build a dynamic and premier group of infrastructure and service management companies driven by a shared passion for customer value and care MISSION Synergize and develop business units that: • Nurture total integrity • Attain total customer satisfaction • Foster learning culture and employee pride • Build a world-class service provider brand • Maximize financial returns CORE VALUES • Reputable customer care • Pride and teamwork • Innovation • Community contributions and environmental awareness • Stakeholders’ interest CONTENTS 2 CORPORATE PROFILE 4 MILESTONES 6 FINANCIAL HIGHLIGHTS 8 CHAIRMAN’S STATEMENT 10 BOARD OF DIRECTORS 14 CORPORATE GOVERNANCE REPORT 26 KEY INFORMATION FOR SHAREHOLDERS 30 HUMAN CAPITAL 32 COMMUNITY CARE 34 ENVIRONMENTAL FRIENDLINESS 36 MANAGEMENT DISCUSSION AND ANALYSIS 48 REPORTS AND FINANCIAL STATEMENTS 150 FIVE-YEAR FINANCIAL SUMMARY 152 PROJECT KEY FACTS AND FIGURES 164 GLOSSARY OF TERMS 166 CORPORATE INFORMATION CORPORATE PROFILE About NWS Holdings NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) And

HUTCHISON WHAMPOA INTERNATIONAL (03/33) LIMITED (the “Issuer”) US$1,500,000,000 7.45% Guaranteed Notes due 2033 (the “Notes”) (ISIN: US44841SAC35/CUSIP: 44841SAC3/Common Code: 018124572 for Rule 144A Notes) (ISIN: USG4672CAC94/CUSIP: G4672CAC9/Common Code: 018124629 for Regulation S Notes) unconditionally and irrevocably guaranteed by CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) and HUTCHISON WHAMPOA LIMITED In accordance with Regulation (EU) No. 596/2014 on market abuse and the law of 11 January 2008 on transparency requirements, as amended, the Issuer is filing with the Commission de Surveillance du Secteur Financier, storing with the Officially Appointed Mechanism and publishing the attached unaudited results for the six months ended 30 June 2019 of CK Hutchison, a guarantor of the Notes issued by the Issuer. The attached document was also published by CK Hutchison at 4:31 pm and 4:32 pm (Hong Kong time), 1 August 2019 on the websites of Hong Kong Exchanges and Clearing Limited and CK Hutchison, respectively. Hutchison Whampoa International (03/33) Limited Edith Shih Director and Company Secretary 1 August 2019 Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 HIGHLIGHTS -

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

Environmental Information from the Listed Companies (Main Board) In

Environmental The reports published annually to report the Hang Seng Stock Information company 's environmental performance No. Company Industry Code published on the Previous Classification 2019 2018 2017 website Report(s) 1 0043 C.P. Pokphand Company Ltd. 20 N/A N/A N/A N/A N/A Year 2016 2 0341 Café de Coral Holdings Ltd. 30 EI N/A SR SR and / or before Year 2016 Canvest Environmental Protection Group 3 1381 40 N/A N/A SR SR and / or Company Limited before Year 2016 4 0510 CASH Financial Services Group Ltd. 50 EI N/A AR AR and / or before Year 2016 5 0293 Cathay Pacific Airways Ltd. 30 EI AR SR SR and / or before Year 2016 Celestial Asia Securities Holdings Ltd. 6 1049 80 EI AR AR AR and / or (Net2Gather (China) Holdings Ltd.) before Year 2016 CGN New Energy Holdings Co., Ltd 7 1811 40 N/A N/A ER ER and / or (CGN Meiya Power Holdings Co., Ltd.) before Environmental The reports published annually to report the Hang Seng Stock Information company 's environmental performance No. Company Industry Code published on the Previous Classification 2019 2018 2017 website Report(s) CK Hutchison Holdings Limited N/A N/A N/A N/A N/A (Cheung Kong (Holdings) Ltd.) Citybase Property Management Ltd 8 0001 80 N/A N/A N/A N/A N/A (member of Cheung Kong Property Group) Goodwell Property Management Ltd EI N/A N/A N/A N/A (member of Cheung Kong Property Group ) Year 2016 9 2778 Champion Real Estate Investment Trust 50 EI AR AR AR and / or before Year 2016 10 0092 Champion Technology Holdings Ltd. -

Annual Report 2018 Connecting Lives Building Futures

NWS HOLDINGS LIMITED NWS HOLDINGS LIMITED STOCK CODE: 659 NWS Holdings Limited (incorporated in Bermuda with limited liability) ANNUAL REPO 28/F New World Tower 18 Queen’s Road Central Central, Hong Kong Tel : (852) 2131 0600 Fax : (852) 2131 0611 E-mail : [email protected] R T www.nws.com.hk 2018 Annual Report 2018 Connecting Lives Building Futures NWS Holdings Limited takes every practicable measure to conserve resources and minimize waste. ™ This annual report is printed on FSC certified paper and other controlled material using chemistry free plate system and soy ink. The FSC™ logo identifies product group from responsible forestry in accordance with the rules of the Forest Stewardship Council®. About NWS Holdings NWS Holdings Limited (Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). Listed on the Hong Kong Stock Exchange, NWS Holdings embraces a range of businesses predominately in Hong Kong and Mainland China. With a workforce of approximately 30,000 people, NWS Holdings is committed to achieving sustainable growth in its two core business areas of infrastructure and services. VISION MISSION CORE VALUES To build a dynamic and Synergize and develop • Reputable customer care premier group of business units that: • Pride and teamwork infrastructure and service • Nurture total integrity • Innovation management companies • Attain total customer driven by a shared • Community contributions satisfaction passion for customer value and environmental and care • Foster learning culture awareness and employee pride • Stakeholders’ interest • Build a world-class service provider brand • Maximize financial returns CONNECTING LIVES • BUILDING FUTURES NWS HOLDINGS LIMITED This year’s annual report features a brightly coloured bird, its vibrancy NWS HOLDINGS LIMITED STOCK CODE: 659 representing the Group’s diverse and flourishing business segments. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

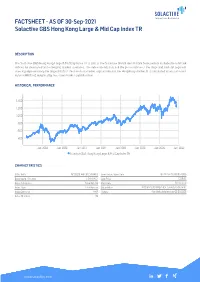

FACTSHEET - AS of 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR

FACTSHEET - AS OF 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR DESCRIPTION The Solactive GBS Hong Kong Large & Mid Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Hong Kong market. It is calculated as a totalreturn index in HKD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,400 1,200 1,000 800 600 400 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Hong Kong Large & Mid Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4H36 / SLA4H3 Base Value / Base Date 462.12 Points / 08.05.2006 Bloomberg / Reuters / .SHKLMCT Last Price 1256.93 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency HKD History Available daily back to 08.05.2006 Index Members 52 FACTSHEET - AS OF 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -6.80% -10.27% -11.73% 9.67% -4.51% 171.99% Performance (p.a.) - - - - - 6.71% Volatility (p.a.) 21.54% 18.63% 16.63% 17.91% 18.51% 20.09% High 1364.34 1419.58 1482.24 1493.61 1493.61 1493.61 Low 1228.29 1228.29 1228.29 1115.51 1228.29 287.41 Sharpe Ratio -2.67 -1.91 -1.34 0.55 -0.32 0.33 Max. -

Negativliste. Fossil Energi

Bilag 6. Negativliste. Fossil energi Maj 2017 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten. Rækkeetiketter Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Africa Oil Corp Africa Oil Corp Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine Development Co Black Mountain Resources LLC Bluff Spur Coal Corp Boone Energy Co Bull Mountain Mining Corp Central Penn Energy Co Inc Central West Virginia Energy Co Clear Fork Coal Co CoalSolv LLC Cobra Natural Resources LLC Crystal Fuels Co Cumberland Resources Corp Dehue Coal Co Delbarton Mining Co Douglas Pocahontas Coal Corp Duchess Coal Co Duncan Fork Coal Co Eagle Energy Inc/US Elk Run Coal Co Inc Exeter Coal Corp Foglesong Energy Co Foundation Coal -

中国の石油産業における 第2グループ(Second-Tiers)

JOGMEC K Y M C JOGMEC 調査部 竹原 美佳 アナリシス 中国の石油産業における 第2グループ(second-tiers) はじめに 中国の石油産業は長年3大国有石油企業CNPC、SINOPEC、CNOOC 3社の寡占状態にある。業界寡 占度は電力や石炭など他のエネルギー産業に比べ著しく高い。3社は原油生産の9割、天然ガス生産の8 割、精製処理量の7割を占めている(図1)。輸送、貯蔵・販売事業についても3社が過半を占める。 原油・天然ガス輸入パイプラインはCNPC/PetroChinaがほぼ一手に担い、国内の主要なLNG受入基 地は国有石油企業3社が地方政府と共同で建設。地方政府やその傘下のガス企業も出資しているが、上 海の受入基地を除き3社の出資比率が最も高い。また天然ガス(LNG)の輸入(長期売買契約)の9割以上 が3社によるものだ。 しかし、近年、習近平政権が推し進める「混合所有制(国有企業への国有〈異業種〉、集団、民間企業に よる資本参加)」(すなわち、国有石油企業の独占打破)政策や石油産業を対象とした汚職腐敗取り締ま りが追い風となり、国有石油企業の牙城で“第2グループ(second-tiers)”と呼ばれる企業の活動領域が 拡大しつつある。 国外ガスバリューチェーン展開の動きはまだ見られないが、今後、“第2グループ”の間で統合・再編 が行われ、国外探鉱開発事業と国内精製・販売を中核とした中堅石油企業が出現する可能性がある。 原油生産 天然ガス生産 精製処理量 陝西延長 6% 外資等 CNOOC 陝西延長 0% 18% その他 PetroChina 19% 28% 23% CNOOC PetroChina Sinopec 5% Sinopec PetroChina 52% 15% 62% 17% CNOOC Sinopec 6% 43% 外資等 6% 出所:各社年報、BP 統計等に基づき作成 図1 国有石油企業の原油・天然ガス生産、精製処理量の割合(2016年) 1.“第2グループ”企業の概要と石油・ガス産業での活動 “第2グループ(second-tiers)”企業は石油、電力・ガス、 中心に石油企業原油3社、電力・ガス9社、金融・その 金融他、政府系ファンドに大別することができる。本稿 他(国家ファンドを含む)7社計18社を抽出した。 では国外探鉱開発事業とLNG輸入事業に関わる活動を 企業別の概要と活動状況を以下に示す。 45 石油・天然ガスレビュー JOGMEC K Y M C アナリシス 表1 第2グループ企業の概要 LNG 売買 国内石油・ 国内 LNG 受入基 都市ガス販売・顧客数 契約 ガス生産 主な国外 地出資基地数 上段:販売量(億m3) (百万トン) 2016 年 油ガス田資産等 上段:操業中 下段:顧客 上段:契約 (万 boed) 下段:建設中 (万戸) 下段:合意 国有 中国中化 ブラジル Peregrino 油 未公表 Sinochem 田 石油 中国化工 ChemChina 地方政府 陝西延長 マダガスカル 23 Yanchang 国有 中国華電 複数計画あり 契約:1.0 販売:N.A Huadian 合意:3.0 顧客:N.A 地方政府 北京控股(北京燃気) ロシア 操業中 1:河北・ 販売:138 Beijing Enterprise/Beijing Verkhnechonsk 油田 唐山 顧客:660 Gas (2015 年) 申能 操業中 2:上海・ 販売:76 Shenergy 洋山、五号溝 顧客:660(LPG、 未公表 石炭ガス込み) (2016 年) 浙江能源 交渉中 操業中1:浙江・ 販売:65 -

Li Ka-Shing's Flagship Is Looking Like a Bargain

Li Ka-shingʼs Flagship Is Looking Like a Bargain - Barron's 28.05.18, 1359 This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers visit http://www.djreprints.com. https://www.barrons.com/articles/li-ka-shings-flagship-is-looking-like-a-bargain-1527292801 FEATURE Li Ka-shing’s Flagship Is Looking Like a Bargain By Andrew Bary May 26, 2018 Victor Li, right, recently took over as chairman of the Hong Kong–based conglomerate CK Hutchison Holdings from his father, Li Ka-shing. PHOTO: ZHANG WEI/CHINA NEWS SERVICE/VCG VIA GETTY IMAGES; DALE DE LA REY/BLOOMBERG VIA GETTY IMAGES; ILLUSTRATION BY JOEL ARBAJE Over 68 years, Li Ka-shing assembled an enormous Hong Kong–based empire. Now, with the reins having passed to his son, Victor Li, a big chunk of it is languishing on the stock market. Known as “superman” in Hong Kong, Li Ka-shing, 89, became one of the Asia’s wealthiest men with an estimated net worth of $34 billion. He drew comparisons to Warren Buffett because of his success in buying, developing, and periodically selling a wide range of assets. Li Ka-shing’s company, CK Hutchison Holdings (ticker: 1.Hong Kong), controls the world’s largest port business and has operations in Rotterdam, the Netherlands, Europe’s largest container port. It owns 3 Group, a leading European wireless company; several Asian and European drugstore chains; and a 40% stake in oil-and-gas producer Energy (HSE.Canada).