Allegheny County

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Muhlenberg College/Morning Call Poll Uses a Three Step Process

MUHLENBERG COLLEGE /MORNING CALL 2010 Pennsylvania General Election Tracking Poll RELEASE #13 – November 1, 2010 FIELDING PERIOD – October 28-31, 2010 SAMPLE – 474 Likely Voters in Pennsylvania MARGIN OF ERROR - +/- 4.5% at 95% Level of Confidence TOTALS MAY NOT EQUAL 100% DUE TO ROUNDING METHODOLOGY: Beginning on October 20 and ending on November 1, 2010, The Muhlenberg College Institute of Public Opinion and the Morning Call will be releasing daily results from their statewide general election tracking poll. The results are drawn from telephone surveys of likely voters in the Commonwealth of Pennsylvania. Each day’s release will be based on the results of interviews conducted during the previous four days. For example, the initial release on Wednesday, October 20th was produced from interviews conducted between October 16th and 9th. While the total sample size will alternate from day to day because of varying completion rates, the average sample sizes will be approximately 400. Precise margins of error will be identified with each release and average around +/-5% at a 95% level of confidence. All interviews will be conducted by individuals who have been trained in standard interviewing procedures. The sampling frame for this research is a list of registered voters in the Commonwealth of Pennsylvania. To determine if an individual is a likely voter the Muhlenberg College/Morning Call poll uses a three step process. First, the individual must be registered to vote in the Commonwealth of Pennsylvania. This is validated through the use of registered voting records provided by the Secretary of State in Pennsylvania. Second, the individual must identify their likelihood of voting in the November, 2010 election as either “definite” or “very likely.” Finally, the individual must have voted in at least half of the general elections in which they were eligible since 2002 or who had registered to vote since 2008 and voted in the 2010 primary election. -

05A N N U a L R E P O

05 ANNUAL REPORT | CONVERGENCE | COLLABORATION | COMPETITIVENESS | ALLEGHENY CONFERENCE ON COMMUNITY DEVELOPMENT AND ITS AFFILIATES PITTSBURGH REGIONAL ALLIANCE GREATER PITTSBURGH CHAMBER OF COMMERCE PENNSYLVANIA ECONOMY LEAGUE OF SOUTHWESTERN PENNSYLVANIA ABOUT THE CONFERENCE The PENNSYLVANIA ECONOMY LEAGUE OF SOUTHWESTERN PENNSYLVANIA, LLC Founded in 1944, the Allegheny Conference established in 1936, provides public policy on Community Development is the leading research and analysis. economic and community development organization for the 10-county Pittsburgh The GREATER PITTSBURGH CHAMBER OF region of southwestern Pennsylvania. COMMERCE, southwestern Pennsylvania’s Together with public and private sector leading business organization for more partners, we work to stimulate growth and than 100 years, advocates at all levels of improve our region’s quality of life. Our government to secure public sector focus is 0n economic competitiveness and investment and legislative and regulatory regional promotion. The Conference relies improvements to the region’s public sector upon the Regional Investors Council, a business climate. broad-based coalition of more than 270 member companies and organizations, to The PITTSBURGH REGIONAL ALLIANCE provide time, talent and resources to further markets southwestern Pennsylvania to the Conference agenda. employers across the region and around the world, to encourage job creation and Through three affiliated organizations, capital investment. which also have long and impressive legacies, the Conference provides research and analysis, advocacy and marketing to advance the vision of its leadership. | CONVERGENCE | COLLABORATION | COMPETITIVENESS | FROM THE CHAIRMAN Simply put, the people of Pittsburgh live in a 250-year tradition of world-changing in which we have built a competitive advan- a great region – and the list of evidence is innovation to accelerate the growth of tage, including life sciences, information long and compelling. -

Muhlenberg College/Morning Call Poll Uses a Three Step Process

MUHLENBERG COLLEGE /MORNING CALL 2010 Pennsylvania General Election Tracking Poll RELEASE #2 – October 21, 2010 FIELDING PERIOD – October 17-20, 2010 SAMPLE – 420 Likely Voters in Pennsylvania MARGIN OF ERROR - +/- 5% at 95% Level of Confidence TOTALS MAY NOT EQUAL 100% DUE TO ROUNDING METHODOLOGY: Beginning on October 20 and ending on November 1, 2010, The Muhlenberg College Institute of Public Opinion and the Morning Call will be releasing daily results from their statewide general election tracking poll. The results are drawn from telephone surveys of likely voters in the Commonwealth of Pennsylvania. Each day’s release will be based on the results of interviews conducted during the previous four days. For example, the initial release on Wednesday, October 20th was produced from interviews conducted between October 16th and 9th. While the total sample size will alternate from day to day because of varying completion rates, the average sample sizes will be approximately 400. Precise margins of error will be identified with each release and average around +/-5% at a 95% level of confidence. All interviews will be conducted by individuals who have been trained in standard interviewing procedures. The sampling frame for this research is a list of registered voters in the Commonwealth of Pennsylvania. To determine if an individual is a likely voter the Muhlenberg College/Morning Call poll uses a three step process. First, the individual must be registered to vote in the Commonwealth of Pennsylvania. This is validated through the use of registered voting records provided by the Secretary of State in Pennsylvania. Second, the individual must identify their likelihood of voting in the November, 2010 election as either “definite” or “very likely.” Finally, the individual must have voted in at least half of the general elections in which they were eligible since 2002 or who had registered to vote since 2008 and voted in the 2010 primary election. -

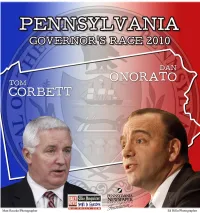

Corbett Leads Unknowns in Pennsylvania Governor's Race, Quinnipiac University Poll Finds; Voters Oppose Rendell Sales Tax

Peter Brown, Assistant Director, Quinnipiac University Polling Institute FOR RELEASE: MARCH 3, 2010 CORBETT LEADS UNKNOWNS IN PENNSYLVANIA GOVERNOR’S RACE, QUINNIPIAC UNIVERSITY POLL FINDS; VOTERS OPPOSE RENDELL SALES TAX PLAN Pennsylvania Attorney General Tom Corbett has a 43 – 5 percent lead over State Representative Sam Rohrer for the Republican nomination for governor and holds double-digit leads over the top Democratic candidates, all of whom who are virtual unknowns even to their own party members, according to a Quinnipiac University poll released today. “Don’t know” leads the field for the Democratic nomination with 59 percent, followed by Allegheny County Executive Dan Onorato with 16 percent, State Auditor General Jack Wagner with 11 percent, 2004 U.S. Senate nominee Joel Hoeffel at 10 percent and State. Sen. Tony Williams at 2 percent, the independent Quinnipiac (KWIN-uh-pe-ack) University poll finds. Gov. Ed Rendell remains unpopular with voters as he completes his final year in office, as voters disapprove 49 – 43 percent of the job he is doing, unchanged from December 17. Voters say 49 – 6 percent Gov. Rendell’s plan to increase state spending next year by 4.1 percent was too much rather than too little. Another 35 percent say it’s about right. By a 53 – 40 percent margin, voters oppose the Governor’s plan to raise more money by cutting the state sales tax but expanding items covered by it. “The Democratic candidates for Governor are almost invisible men as far as the voters are concerned. One of them will win the nomination, but at this point they are so closely bunched together and such mystery men to the vast majority of primary voters that any result is possible, given that the primary is little more than 10 weeks away,” said Peter Brown, assistant director of the Quinnipiac University Polling Institute. -

Performance Audit: Port Authority of Allegheny County

December 3, 2007 Mr. Stephen G. Bland, CEO Port Authority of Allegheny County Heinz 57 Center 345 Sixth Avenue Pittsburgh, PA 15222-2527 Dear Mr. Bland: Enclosed is our performance audit of the Port Authority of Allegheny County for the period of July 1, 2002, through June 30, 2006, with updated information through August 22, 2007. The Second Class County Port Authority Act requires that we conduct a performance audit of the Port Authority at least once every four years, and we completed the audit in accordance with generally accepted government auditing standards as issued by the Comptroller General of the United States. The most significant finding in this report, Finding One, concerns the Port Authority’s governance. Specifically, we report that the Commonwealth contributes more than 55 percent of the operating revenues to the Port Authority but has no representation on the Port Authority’s board of directors. Instead, as you know, the nine board members are all appointed by one local official, the chief executive of Allegheny County. This arrangement—which does not result in a structure of checks and balances inherent in a more diversely appointed board—will have to be corrected through a legislative change. We are recommending such a change, and we call for your active support of it. In Finding Two, we report that the Port Authority contributed to its own fiscal crisis by committing $15.5 million to rent prime downtown office space unnecessarily. The $15.5 million includes $7.7 million to renovate the new space in the downtown Heinz Center and $7.8 million to enter into a 10-year lease for that prime new space. -

March 2010 Franklin & Marshall College Poll

For immediate release Wednesday, March 24, 2010 March 2010 Franklin & Marshall College Poll SURVEY OF PENNSYLVANIANS SUMMARY OF FINDINGS Prepared by: Center for Opinion Research Floyd Institute for Public Policy Franklin & Marshall College BERWOOD A. YOST DIRECTOR, FLOYD INSTITUTE FOR PUBLIC POLICY DIRECTOR, CENTER FOR OPINION RESEARCH HEAD METHODOLOGIST, FRANKLIN & MARSHALL COLLEGE POLL G. TERRY MADONNA DIRECTOR, CENTER FOR POLITICS AND PUBLIC AFFAIRS DIRECTOR, FRANKLIN & MARSHALL COLLEGE POLL JENNIFER L. HARDING PROJECT MANAGER, CENTER FOR OPINION RESEARCH PROJECT MANAGER, FRANKLIN & MARSHALL COLLEGE POLL KAY K. HUEBNER PROGRAMMER, CENTER FOR OPINION RESEARCH March 23, 2010 Table of Contents METHODOLOGY ..................................................................................................................... 2 KEY FINDINGS ........................................................................................................................ 4 THE RACE FOR PENNSYLVANIA GOVERNOR ...................................................................4 THE RACE FOR U.S. SENATE ...............................................................................................5 PENNSYLVANIA LEGISLATIVE CORRUPTION TRIALS .....................................................6 PENNSYLVANIA TAX PROPOSALS ......................................................................................7 TABLE A-1 ............................................................................................................................... 8 TABLE A-2 -

Franklin & Marshall

For immediate release Wednesday, May 12, 2010 May 2010 Franklin & Marshall College Poll SURVEY OF PENNSYLVANIANS SUMMARY OF FINDINGS Prepared by: Center for Opinion Research Floyd Institute for Public Policy Franklin & Marshall College BERWOOD A. YOST DIRECTOR, FLOYD INSTITUTE FOR PUBLIC POLICY DIRECTOR, CENTER FOR OPINION RESEARCH HEAD METHODOLOGIST, FRANKLIN & MARSHALL COLLEGE POLL G. TERRY MADONNA DIRECTOR, CENTER FOR POLITICS AND PUBLIC AFFAIRS DIRECTOR, FRANKLIN & MARSHALL COLLEGE POLL ANGELA N. KNITTLE SENIOR PROJECT MANAGER, CENTER FOR OPINION RESEARCH PROJECT MANAGER, FRANKLIN & MARSHALL COLLEGE POLL KAY K. HUEBNER PROGRAMMER, CENTER FOR OPINION RESEARCH May 12, 2010 Table of Contents METHODOLOGY ..................................................................................................................... 2 KEY FINDINGS ........................................................................................................................ 4 THE DEMOCRATIC US SENATE PRIMARY .................................................................................4 OTHER PENNSYLVANIA PRIMARY RACES .................................................................................7 ABOUT THE LIKELY VOTER MODEL .........................................................................................8 TABLE A-1 ............................................................................................................................... 9 MARGINAL FREQUENCY REPORT .....................................................................................10 -

Act 44 Disclosure

IDENTIFICATION OF CONTRACTORS & RELATED PERSONNEL Brighton Township Identify the Municipal Pension System(s) for which you are providing information: Indicate all that apply with an “X”: Non-Uniform Plan Police Plan Fire Plan Q.1 Lorna Kinzler, Account Administrator: • Provides daily contact with client regarding administration of account • Facilitates pension disbursements • Coordinates in-flows and out-flows of cash • Provides audit support Joyce Frydryck, Client Services Group Team Leader: • Leadership oversight of Account Administrator including problem resolution, product development, and project management. Steve Shapiro, Institutional Client Advisor: • Meets with clients to ensure their needs are being met • Introduces new products and services that will add value for client The following individuals provides managerial oversight of the individuals listed above: • Sylvia Diez - PNC Institutional Investments, Market Director – Pittsburgh • Mark Leib - PNC Institutional Investments, Managing Director - Centralized Administration • Michael Wilson - PNC Institutional Investments, Managing Director Q.2 PNC Capital Advisors. The individual below has managerial oversight over the services provided by PNC Bank, N.A. for the Plan: Mark McGlone, President and Chief Investment Officer of PNC Capital Advisors Q.3 According to our records, no individuals who are providing professional services to the Brighton Township’s Pension Plan are current or former employees of the Brighton Township. Q.4 According to our records, no individuals who are providing professional services to the Brighton Township’s Pension plan are current or former registered State or Federal lobbyists. Q.5 PNC has not employed or paid compensation to a third party intermediary, agent or lobbyist to directly or indirectly communicate with any official or employee of Brighton Township’s Pension Plan or in connection with any transaction or investment involving PNC and the municipal pension system. -

Commonwealth

COMMONWEALTH A JOURNAL OF POLITICAL SCIENCE PUBLISHED BY THE PENNSYLVANIA POLITICAL SCIENCE ASSOCIATION VOL. 17, NO. 1, 2015 © Copyright 2015 by the Pennsylvania Political Science Association ISSN 0890-2410. COMMONWEALTH A Journal of Political Science EDITOR IN CHIEF J. Wesley Leckrone, Widener University BOOK REVIEW EDITOR/ASSOCIATE EDITOR Thomas J. Baldino, Wilkes University ASSOCIATE EDITORS Michelle Atherton, Temple University Christopher Borick, Muhlenberg College Paula Holoviak, Kutztown University Joseph McLaughlin, Temple University MANAGING EDITOR Michael E. Cassidy, Temple University EDITORIAL ADVISORY BOARD Bruce Caswell, Rowan University Beverly Cigler, Pennsylvania State University Harrisburg Richardson Dilworth, Drexel University John Kennedy, West Chester University John Kincaid, Lafayette College David Y. Miller, University of Pittsburgh Joseph Marbach, Georgian Court University Megan Mullin, Duke University Richard Stafford, Carnegie Mellon University COPY EDITOR Barbara Crawford EDITORIAL ASSISTANT Nicole Crossey, Widener University FOUNDING EDITOR EMERITUS Donald G. Tannenbaum, Gettysburg College EDITORS EMERITUS Thomas J. Baldino, Wilkes University Gerard J. Fitzpatrick, Ursinus College i PENNSYLVANIA POLITICAL SCIENCE ASSOCIATION Officers and Executive Council 2015–16 PRESIDENT Christopher Borick Muhlenberg College FIRST VICE PRESIDENT SECOND VICE PRESIDENT Steven Peterson Lanethea Mathews-Schultz Pennsylvania State University, Harrisburg Muhlenberg College TREASURER SECRETARY Steven B. Lem Paula Holoviak Kutztown University Kutztown University EXECUTIVE COUNCIL 2013–16 Term Joseph McLaughlin Ayesha Ray Temple University Kings College 2014–17 Term Michelle DeMary Kyle Kreider Susquehanna University Wilkes University 2015–18 Term Michelle Atherton Michael Greenberg Temple University Shippensburg University EX OFFICIO MEMBERS PAST PRESIDENT PAST PRESIDENT Brooke Harlowe Stanley Berard Lock Haven University Lock Haven University EDITORIAL STAFF OF COMMONWEALTH: A Journal of Political Science EDITOR-IN-CHIEF J. -

Governor.Pdf

The Pennsylvania Governor’s Race 2010 Dear Students: Every four years, elementary and high school teachers scramble to gather materials that will enhance their curriculum Politics in the News regarding the Governor’s Election (Nov. 2, 2010). They have No matter what time of the year it is, there are always some the tough job of trying to explain this important election political stirrings being reported on in your local newspaper. Think process to you and the affects local politics will have on your about how many months go by when a President is campaigning. Every life. day the press is talking about some type of update. Look through the pages of your newspaper for a story about a candidate either running or From explaining what the election process is to identifying the in office. What is the story about? Why do you think this story should role of newspapers in this process, teachers, in their own ways, or shouldn’t be in the news? expose students to this precious right – freedom to choose a governor. This right may be the most important one, as it gives you a voice in the way the government works. Without a voice, freedom is not a certain advantage. Media Media Everywhere This guide, “Pennsylvania Governor’s Race 2010,” was Today, there are so many media outlets, it isn’t just newspapers that created to give teachers a resource to help explain these get the big story. Think about the immediate media sources that you important government processes. We have found that many can get up to date information from. -

As Pittsburgh Faces Its Worst Financial Crisis in Decades, a Foundations-Funded Study Goes

As Pittsburgh faces its worst financial crisis in decades, a foundations-funded study goes 13 By Jim Davidson Illustrations by Jud Guitteau BORDER CROSSING past boundaries to flush out the metro killers: pinched politics, fragmented government and ever-widening sprawl. t was the evening of Dec. 9 in the cavernous ballroom of Many in the audience had a vested interest in the proceedings, the new International Brotherhood of Electrical Workers especially firefighters and other city employees, past and present. Ihall, built on a brownfield occupied not so long ago by Some were among the 640 who had been laid off in November Jones & Laughlin’s South Side Works. More than 300 people as Pittsburgh Mayor Tom Murphy made a game but fruitless had turned out on a bitingly cold Tuesday to hear a parade of attempt to balance the city’s 2004 budget. This was a tough sworn witnesses tell Pennsylvania’s secretary of community crowd. Yet they would clap for David Roderick, lately the co-chair and economic development why Pittsburgh should be ruled of the Public Financial Management commission, who never a financially distressed community under Act 47, the state’s heard that kind of applause in the 1980s when he was running more palatable alternative to municipal bankruptcy. U.S. Steel and shutting down the local mills. The crowd would Jim Davidson, a former journalism professor and editor at Carnegie Mellon University, is a frequent contributor to h. His last story, in the spring 2003 issue, was an introduction to the Endowments’ Civic Design Initiative. 14 -

October 2010 Franklin & Marshall College Poll

For immediate release Wednesday, October 27, 2010 October 2010 Franklin & Marshall College Poll SURVEY OF PENNSYLVANIANS SUMMARY OF FINDINGS Prepared by: Center for Opinion Research Floyd Institute for Public Policy Franklin & Marshall College BERWOOD A. YOST DIRECTOR, FLOYD INSTITUTE FOR PUBLIC POLICY DIRECTOR, CENTER FOR OPINION RESEARCH HEAD METHODOLOGIST, FRANKLIN & MARSHALL COLLEGE POLL G. TERRY MADONNA DIRECTOR, CENTER FOR POLITICS AND PUBLIC AFFAIRS DIRECTOR, FRANKLIN & MARSHALL COLLEGE POLL ANGELA N. KNITTLE SENIOR PROJECT MANAGER, CENTER FOR OPINION RESEARCH PROJECT MANAGER, FRANKLIN & MARSHALL COLLEGE POLL KAY K. HUEBNER PROGRAMMER, CENTER FOR OPINION RESEARCH October 27, 2010 Table of Contents METHODOLOGY ..................................................................................................................... 2 KEY FINDINGS ........................................................................................................................ 4 US SENATE RACE ..................................................................................................................5 GOVERNOR’S RACE ................................................................................................................6 THE ELECTORAL CONTEXT IN PENNSYLVANIA ..........................................................................8 TABLE A-1 – SENATE CHOICE DEMOGRAPHICS ............................................................10 TABLE A-2 – GOVERNOR CHOICE DEMOGRAPHICS ......................................................11 MARGINAL