Euronext 2014 Registration Document Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CN DASHBOARD Marketing Meer Informatie? Ga Naar: of Bel 0900 MARKETS (0900-6275387; Lokaal Tarief) Samenstelling Document: Nico P.R

BNP PARIBAS - Corparate & Intitutional Banking TA: CN DASHBOARD Marketing Meer informatie? Ga naar: www.bnpparibasmarkets.nl of bel 0900 MARKETS (0900-6275387; lokaal tarief) Samenstelling document: Nico P.R. Bakker & Wouter de Boer www.nicoprbakker.nl updates via Twitter @TheDailyTurbo De weergegeven signalen zijn momentopnamen en kunnen na publicatie van dit document veranderen. Check dan ook de actuele rangen en standen als u transacties overweegt. DASHBOARD Coaching en Conditie EL Enter Long Coaching UP Up, koopstatus, stijging in uptrend XL Exit Long Coaching RES Resistance, correctiestatus, daling in uptrend ES Enter Short Coaching CN Dashboard DOWN Down, verkoopstatus, daling in downtrend Coaching & Conditie XS Exit Short Coaching SUP Support, herstelstatus, stijging in downtrend DW Dag- en weekgrafiek hebben dezelfde conditie (c) (d) closed of delayed koersdata Update DAILY Coaching en Conditie WEEKLY Coaching en Conditie 25-2-2020 Koers Fondsen Nederland Fondsen Nederland DAILY Signalen Nederlandse Fondsen Aantal van Signaal DW EL UP XL RES ES DOWN XS SUP EL UP XL RES ES DOWN XS SUP 0 AALBERTS NV 40,31 1 AALBERTS NV 1 DOWN ABN AMRO BANK N.V. 14,16 1 ABN AMRO BANK N.V. 1 0 ADYEN 841,40 1 ADYEN 1 DOWN AEGON 3,52 1 AEGON 1 0 AEX25 Index 596,83 1 AEX25 Index 1 0 AHOLD DEL 23,00 1 AHOLD DEL 1 DOWN AIR FRANCE -KLM 8,37 1 AIR FRANCE -KLM 1 DOWN AKZO NOBEL 81,36 1 AKZO NOBEL 1 UP ALTICE EUROPE N.V. 6,18 1 ALTICE EUROPE N.V. 1 DOWN AMG 20,40 1 AMG 1 0 AMX-INDEX 927,92 1 AMX-INDEX 1 0 APERAM 29,55 1 APERAM 1 RES ARCADIS 23,36 1 ARCADIS -

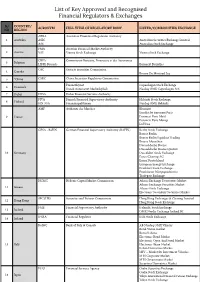

List of Key Approved and Recognised Financial Regulators & Exchanges

List of Key Approved and Recognised Financial Regulators & Exchanges S/ COUNTRY/ ACRONYM FULL TITLE OF REGULATORY BODY LISTED/COMMODITIES EXCHANGE NO REGION APRA Australian Prudential Regulation Authority 1 Australia ASIC Australian Securities Exchange Limited ASE Australian Stock Exchange FMA Austrian Financial Market Authority 2 Austria VSE Vienna Stock Exchange Vienna Stock Exchange CBFA Commission Bancaire, Financiere et des Assurances 3 Belgium LIFFE Brussels Euronext Bruxelles OSC Ontario Securities Commission 4 Canada Bourse De Montreal Inc 5 *China CSRC China Securities Regulatory Commission Finanstilsynet Copenhagen Stock Exchange 6 Denmark Dansk Autoriseret Markedsplads Nasdaq OMX Copenhagen A/S 7 Dubai DFSA Dubai Financial Services Authority FIVA Finnish Financial Supervisory Authority Helsinki Stock Exchange 8 Finland FIN-FSA Finansinspektionen Nasdaq OMX Helsinki AMF Authorite des Marches Bluenext Eurolist by Euronext Paris 9 France Euronext Paris Matif Euronext Paris Monep LCH SA GFSA - BaFIN German Financial Supervisory Authority (BAFIN) Berlin Stock Exchange Boerse Berlin Boerse Berlin Equiduct Trading Boerse Muenchen Duesseldorfer Boerse Duesseldorfer Boerse Quotrix 10 Germany Dusseldorf Stock Exchange Eurex Clearing AG Eurex Deutschland European Energy Exchange Frankfurt Stock Exchange Frankfurter Wertpapierboerse Tradegate Exchange HCMC Hellenic Capital Market Commission Athens Exchange Derivatives Market Athens Exchange Securities Market 11 Greece Athens Stock Exchange Electronic Secondary Securities Market SFC (HK) -

Annotated Presentation of Regulated Markets and National Provisions

15.7.2011 EN Official Journal of the European Union C 209/21 Annotated presentation of regulated markets and national provisions implementing relevant requirements of MiFID (Directive 2004/39/EC of the European Parliament and of the Council) (2011/C 209/13) Article 47 of the Markets in Financial Instruments Directive (Directive 2004/39/EC, OJ L 145, 30.4.2004) authorises each Member State to confer the status of ‘regulated market’ on those markets constituted on its territory and which comply with its regulations. Article 4, paragraph 1, point 14 of Directive 2004/39/EC defines a ‘regulated market’ as a multilateral system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments — in the system and in accordance with its non-discretionary rules — in a way that results in a contract, in respect of the financial instruments admitted to trading under its rules and/or systems, and which is authorised and functions regularly and in accordance with the provisions of Title III of Directive 2004/39/EC. Article 47 of Directive 2004/39/EC requires that each Member State maintains an updated list of regulated markets authorised by it. This information should be communicated to other Member States and the European Commission. Under the same article (Article 47 of Directive 2004/39/EC), the Commission is required to publish a list of regulated markets, notified to it, on a yearly basis in the Official Journal of the European Union. The present list has been compiled pursuant to this requirement. -

Financial Market Data for R/Rmetrics

Financial Market Data for R/Rmetrics Diethelm Würtz Andrew Ellis Yohan Chalabi Rmetrics Association & Finance Online R/Rmetrics eBook Series R/Rmetrics eBooks is a series of electronic books and user guides aimed at students and practitioner who use R/Rmetrics to analyze financial markets. A Discussion of Time Series Objects for R in Finance (2009) Diethelm Würtz, Yohan Chalabi, Andrew Ellis R/Rmetrics Meielisalp 2009 Proceedings of the Meielisalp Workshop 2011 Editor Diethelm Würtz Basic R for Finance (2010), Diethelm Würtz, Yohan Chalabi, Longhow Lam, Andrew Ellis Chronological Objects with Rmetrics (2010), Diethelm Würtz, Yohan Chalabi, Andrew Ellis Portfolio Optimization with R/Rmetrics (2010), Diethelm Würtz, William Chen, Yohan Chalabi, Andrew Ellis Financial Market Data for R/Rmetrics (2010) Diethelm W?rtz, Andrew Ellis, Yohan Chalabi Indian Financial Market Data for R/Rmetrics (2010) Diethelm Würtz, Mahendra Mehta, Andrew Ellis, Yohan Chalabi Asian Option Pricing with R/Rmetrics (2010) Diethelm Würtz R/Rmetrics Singapore 2010 Proceedings of the Singapore Workshop 2010 Editors Diethelm Würtz, Mahendra Mehta, David Scott, Juri Hinz R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer School and Workshop 2011 Editor Diethelm Würtz III tinn-R Editor (2010) José Cláudio Faria, Philippe Grosjean, Enio Galinkin Jelihovschi and Ri- cardo Pietrobon R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer Scholl and Workshop 2011 Editor Diethelm Würtz R/Rmetrics Meielisalp 2012 Proceedings of the Meielisalp Summer Scholl and Workshop 2012 Editor Diethelm Würtz Topics in Empirical Finance with R and Rmetrics (2013), Patrick Hénaff FINANCIAL MARKET DATA FOR R/RMETRICS DIETHELM WÜRTZ ANDREW ELLIS YOHAN CHALABI RMETRICS ASSOCIATION &FINANCE ONLINE Series Editors: Prof. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

INDEX RULE BOOK Leverage, Short, and Bear Indices

INDEX RULE BOOK Leverage, Short, and Bear Indices Version 20-02 Effective from 15 May 2020 indices.euronext.com Index 1. Index Summary 1 2. Governance and Disclaimer 8 2.1 Indices 8 2.2 Administrator 8 2.3 Cases not covered in rules 8 2.4 Rule book changes 8 2.5 Liability 8 2.6 Ownership and trademarks 8 3. Calculation 9 3.1 Definition and Composition of the Index 9 3.2 Calculation of the Leverage Indices 9 3.3 Calculation of the Bear and Short Indices 9 3.4 Reverse split of index level 10 3.5 Split of index level 10 3.6 Financing Adjustment Rate (FIN) 10 4. Publication 11 4.1 Dissemination of Index Values 11 4.2 Exceptional Market Conditions and Corrections 11 4.3 Announcement Policy 14 5. ESG Disclosures 15 1. INDEX SUMMARY Factsheet Leverage, Short and Bear indices Index names Various based on AEX®, BEL 20®, CAC 40®, PSI 20® and ISEQ® Index type Indices are based on price index versions or Net return index or Gross return index versions. Administrator Euronext Paris is the Administrator and is responsible for the day-to-day management of the index. The underlying indices have independent Steering Committees acting as Independent Supervisor. Calculation Based on daily leverage. May include spread on interest rate or Financing Adjustment rate in the calculation Rule for exceptional trading Either suspend or reset if underlying index moved beyond certain threshold. See reference circumstances table. 1 Mnemo Full name Underlying Factor Rule for ISIN Base level index exceptional and date trading circumstances AEX® based AEXLV AEX® Leverage AEX® 2 Suspend if Underlying QS0011095898 1,000 at Index < 75% of close 31Dec2002 of previous day AEXNL AEX® Leverage AEX® NR 2 Suspend if Underlying QS0011216205 1,000 at NR Index < 75% of close 31Dec2002 of previous day AEXTL AEX® Leverage AEX® GR 2 Suspend if Underlying QS0011179239 1,000 at GR Index < 75% of close 31Dec2002 of previous day AEX3L AEX® NR 3 Reset if Underlying QS0011230115 10,000 at AEX® X3 Leverage Index < 85% of close 31Dec2008 NR of previous day. -

EU Emissions Trading the Role Of

School of Management and Law EU Emissions Trading: The Role of Banks and Other Financial Actors Insights from the EU Transaction Log and Interviews SML Working Paper No. 12 Johanna Cludius, Regina Betz ZHAW School of Management and Law St.-Georgen-Platz 2 P.O. Box 8401 Winterthur Switzerland Department of Business Law www.zhaw.ch/abl Author/Contact Johanna Cludius [email protected] Regina Betz [email protected] March 2016 ISSN 2296-5025 Copyright © 2016 Department of Business Law, ZHAW School of Management and Law All rights reserved. Nothing from this publication may be reproduced, stored in computerized systems, or published in any form or in any manner, including electronic, mechanical, reprographic, or photographic, without prior written permission from the publisher. 3 Abstract This paper is an empirical investigation of the role of the financial sector in the EU Emissions Trading Scheme (EU ETS). This topic is of particular interest because non-regulated entities are likely to have played an important part in increasing the efficiency of the EU ETS by reducing trading transaction costs and providing other services. Due to various reasons (new rules and regulations, reduced return prospects, VAT fraud investigations) banks have reduced their engagement in EU Emissions Trading and it is unclear how this will impact on the functioning of the carbon market. Our regression analysis based on data from the EU Transaction Log shows that large companies and companies with extensive trading experience are more likely to interact with the financial sector, which is why we expect banks’ pulling out of the EU ETS to affect larger companies more significantly. -

Thomson One Symbols

THOMSON ONE SYMBOLS QUICK REFERENCE CARD QUOTES FOR LISTED SECURITIES TO GET A QUOTE FOR TYPE EXAMPLE Specific Exchange Hyphen followed by exchange qualifier after the symbol IBM-N (N=NYSE) Warrant ' after the symbol IBM' When Issued 'RA after the symbol IBM'RA Class 'letter representing class IBM'A Preferred .letter representing class IBM.B Currency Rates symbol=-FX GBP=-FX QUOTES FOR ETF TO GET A QUOTE FOR TYPE Net Asset Value .NV after the ticker Indicative Value .IV after the ticker Estimated Cash Amount Per Creation Unit .EU after the ticker Shares Outstanding Value .SO after the ticker Total Cash Amount Per Creation Unit .TC after the ticker To get Net Asset Value for CEF, type XsymbolX. QRG-383 Date of issue: 15 December 2015 © 2015 Thomson Reuters. All rights reserved. Thomson Reuters disclaims any and all liability arising from the use of this document and does not guarantee that any information contained herein is accurate or complete. This document contains information proprietary to Thomson Reuters and may not be reproduced, transmitted, or distributed in whole or part without the express written permission of Thomson Reuters. THOMSON ONE SYMBOLS Quick Reference Card MAJOR INDEXES US INDEXES THE AMERICAS INDEX SYMBOL Dow Jones Industrial Average .DJIA Airline Index XAL Dow Jones Composite .COMP AMEX Computer Tech. Index XCI MSCI ACWI 892400STRD-MS AMEX Institutional Index XII MSCI World 990100STRD-MS AMEX Internet Index IIX MSCI EAFE 990300STRD-MS AMEX Oil Index XOI MSCI Emerging Markets 891800STRD-MS AMEX Pharmaceutical Index -

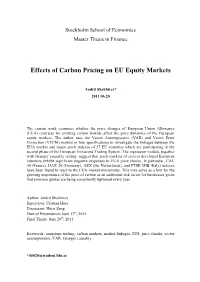

Effects of Carbon Pricing on EU Equity Markets

Stockholm School of Economics Master Thesis in Finance Effects of Carbon Pricing on EU Equity Markets Andrii Shekhirev* 2011.06.20 The current work examines whether the price changes of European Union Allowance (EUA) contracts for emitting carbon dioxide affect the price dynamics of the European equity markets. The author uses the Vector Autoregressive (VAR) and Vector Error Correction (VECM) models in four specifications to investigate the linkages between the EUA market and major stock indexes of 27 EU countries which are participating in the second phase of the European Emissions Trading System. The regression models, together with Granger causality testing, suggest that stock markets of several developed European countries exhibit significant negative responses to EUA price shocks. In particular, CAC 40 (France), DAX 30 (Germany), AEX (the Netherlands), and FTSE MIB (Italy) indexes have been found to react to the EUA market movements. This may serve as a hint for the growing importance of the price of carbon as an additional risk factor for businesses given that emission quotas are being consistently tightened every year. Author: Andrii Shekhirev Supervisor: Cristian Huse Discussant: Huizi Zeng Date of Presentation: June 13th, 2011 Final Thesis: June 20th, 2011 Keywords: emissions trading, carbon markets, market linkages, ETS, price shocks, vector autoregression, VAR, Granger causality *[email protected] Andrii Shekhirev Effects of Carbon Pricing on EU Equity Markets Table of Contents 1. Introduction ......................................................................................................................... -

CHAPTER 1: EU ETS: Origins, Description and Markets in Europe

CO2 Markets Maria Mansanet Bataller Motivation Climate Change Importance Increasingly Kyoto Protocol: International Response to Climate Change Flexibility Mechanisms EMISSIONS TRADING CARBON MARKETS The presentation is organized as follows… Carbon Trading Origins. Carbon Trading in Europe : the EU ETS. Carbon Markets in Europe. Linking with UN Carbon Markets. Conclusion and final remarks The presentation is organized as follows… Carbon Trading Origins. Carbon Trading in Europe : the EU ETS. Carbon Markets in Europe. Linking with UN Carbon Markets. Conclusion and final remarks Origins of the EU ETS Kyoto Protocol ( UNFCCC). 1997 & 2005 55 Parts of the Convention including the developed countries representing 55% of their total emissions. Global emissions by 5% from 1990. Commitment period 2008 - 2012. 6 GHG: CO2, CH4, N2O, HFCs, PFCs, and SF6. ol Canada otoc r Liechtenstein oto P y New he K Zealand to t e Australia anc t s i D Japan ) Switzerland % United States 2005 ( Norway ange 1990- h Monaco c ons i s s Croatia i em al e Iceland R Russian et Federation g r a Ukraine o T ot y K 0 0 0 0 0 0 0 10 Commitments by Country 40 30 20 -1 -5 -2 -3 -4 -6 Spain Austria ol oc ot Luxembourg r Italy o P ot y Portugal he K Denmark t o Ireland e t anc Slovenia t EU-15 Dis Belgium Netherlands ) % Germany Greece 2005 ( France Finland United Kingdom hange 1990- Sweden c ons Czech Rep. i s Slovakia is Poland Hungary Real em Romania Bulgaria get r Estonia a Lithuania o T ot y Latvia K 0 0 0 0 0 0 0 60 50 40 30 20 10 -1 -2 -3 -4 -5 -6 Commitments in Europe Kyoto Flexibility Mechanisms Realization Emission Reduction Projects Joint Implementation (art. -

Introducing Best of Book

CASH MARKETS INTRODUCING BEST OF BOOK The Best Execution Service for Retail Simple. Impartial. Safe. Transparent. EURONEXT Euronext’s Best of Book is a Best Execution service for retail orders. Dedicated liquidity providers offer price improvement for your retail flow. The service operates within Euronext’s robust and highly regulated Central Order Book. Euronext’s Best of Book service helps retail brokers RLP quotes are firm orders and execute in direct meet MiFID best execution requirements within a single competition with the Euronext Central Order Book. These platform for all liquid stocks traded across Euronext, quotes are at, or better, than the European Best Bid and potentially saving brokers the need to connect to Offer (EBBO)1. multiple platforms. By becoming a Retail Member Organisation (RMO), you A specially designed Retail Liquidity Provider (RLP) will be able to execute your retail order flow within Best programme provides price improvement for retail of Book and with potential price improvement versus the investors. The RLP programme is highly competitive EBBO, through your existing access to Euronext. and is open to all Euronext members, thus ensuring absolute neutrality. You will also receive daily best execution reports, provided via an independent data provider to ensure compliance with your best execution policy. SIMPLE IMPARTIAL SAFE TRANSPARENT Makes your life easier Does not take sides You can trust us The price you see is the price you get Reconsider the need Unlike our competitors, We have 400 years’ See competitive to connect to other Euronext offers you a experience in running prices compared platforms to get Best true price to trade as exchanges - and we are to the EBBO1 in a Execution as you can you are trading in full continuously improving. -

Part I INDEX and EQUITY PRODUCTS

Part I Last update: 1 July 2020 INDEX AND EQUITY PRODUCTS Order Prioritisation (TP Large-in-ScaleTrade Facility (LiS) Technical Trade Facility Evening Trading Trade invalidation at Request for Trading at 3.3.1) (TP 4.5)2 Session (TP 2.5) a member’s request Cross (RFC) Index Close (TP (TP 3.5) "Minimum 3.10) Contract Exchange for Swaps (EFS) Against Actuals FUTURE CONTRACTS Volume RFC Code and Exchange of Options Facility (AGA) (TP Price/Time Pro Rata Standard trading day Expiry day for Options (EOO) 4.4) Responses" (TP 4.2) Amsterdam Market AEX-Index® KF.FTI ✓ 07:15 – 22:00 07:15 – 16:00 18:30 – 22:00 AEX-Index® Mini KF.MFA ✓ 07:15 – 22:00 07:15 – 16:00 18:30 – 22:00 AEX-Index® Weeklies KF._FT ✓ 07:15 – 22:00 07:15 – 16:00 18:30 – 22:00 AMX-Index® KF.FMX 07:15 – 17:00 ✓ 07:15 – 18:30 AEX® Dividend Index KF.AXF ✓ 07:15 – 18:30 07:15 – 13:00 Single Stock Futures AF. 6 ✓ 07:15 – 18:30 07:15 – 17:40 Single Stock Dividend Futures AF. 8 ✓ 07:15 – 18:30 07:15 – 12:00 Morningstar Eurozone 50 Index Future KF.FME ✓ 07:15 – 18:30 07:15 – 18:00 Brussels Market BEL 20® FF.BXF 07:15 – 18:30 07:15 – 16:00 ✓ ✓ 07:15 – 18:30 07:15 – 17:40 Single Stock Futures BF. 6 Single Stock Dividend Futures BF. 8 ✓ 07:15 – 18:30 07:15 – 12:00 Lisbon Market 07:15 – 18:30 07:15 – 17:40 PSI 20® Index MF.PSI ✓ Single Stock Futures SF.