Annotated Presentation of Regulated Markets and National Provisions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Entrepreneurship in Regulated Markets: Burden Or Boon?

Entrepreneurship in regulated markets: Burden or boon? Chair: Vickie Gibbs, Executive Director, Entrepreneurship Center, UNC Kenan-Flagler Business School Panelists: Susan Cates, Partner, Leeds Equity Partners, LLC Chris Elmore, Community Evangelist, AvidXchange Eric Ghysels, Faculty Director, Rethinc. Labs; Edward Bernstein Distinguished Professor of Economics, UNC-Chapel Hill; Professor of Finance, UNC Kenan-Flagler Business School Bill Starling, CEO, Synecor Regulatory barriers to entry can distort markets and limit innovation, but also result in breakthrough business models facing less competition. Examples include fintech, medtech and edtech. This session examined the challenges specific to entrepreneurship and innovation in regulated industries. Bill Starling started the session by describing the regulatory complexities of the medtech market. Food and Drug Administration (FDA) approval for medical device products can sometimes take more than a decade. For example, approval for the TAVR heart valve replacement device took 17 years and $2 billion in funding. One strategy for ventures is to minimize the number of approvals required to bring a product to market. For example, iRhythm focused on the unmet customer need for an affordable way to detect heart conditions. The company created a simple, bandage-like device that collected data about the heart, which allowed them to avoid regulatory scrutiny. Even so, the product required $100 million to complete the clinical trials. Starling closed by noting that regulated markets are difficult to enter, but once a venture successfully enters the market, it can do very well and find protected positions. Susan Cates provided perspective as both a business operator and as an investor within education. Cates believes that success in regulated markets often requires “nontraditional thinking inside traditional institutions.” Cates described the “stroke of the pen” risks and tailwinds that can occur when policymakers pass new laws or provide regulatory guidance. -

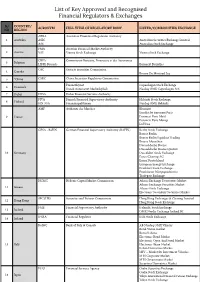

List of Key Approved and Recognised Financial Regulators & Exchanges

List of Key Approved and Recognised Financial Regulators & Exchanges S/ COUNTRY/ ACRONYM FULL TITLE OF REGULATORY BODY LISTED/COMMODITIES EXCHANGE NO REGION APRA Australian Prudential Regulation Authority 1 Australia ASIC Australian Securities Exchange Limited ASE Australian Stock Exchange FMA Austrian Financial Market Authority 2 Austria VSE Vienna Stock Exchange Vienna Stock Exchange CBFA Commission Bancaire, Financiere et des Assurances 3 Belgium LIFFE Brussels Euronext Bruxelles OSC Ontario Securities Commission 4 Canada Bourse De Montreal Inc 5 *China CSRC China Securities Regulatory Commission Finanstilsynet Copenhagen Stock Exchange 6 Denmark Dansk Autoriseret Markedsplads Nasdaq OMX Copenhagen A/S 7 Dubai DFSA Dubai Financial Services Authority FIVA Finnish Financial Supervisory Authority Helsinki Stock Exchange 8 Finland FIN-FSA Finansinspektionen Nasdaq OMX Helsinki AMF Authorite des Marches Bluenext Eurolist by Euronext Paris 9 France Euronext Paris Matif Euronext Paris Monep LCH SA GFSA - BaFIN German Financial Supervisory Authority (BAFIN) Berlin Stock Exchange Boerse Berlin Boerse Berlin Equiduct Trading Boerse Muenchen Duesseldorfer Boerse Duesseldorfer Boerse Quotrix 10 Germany Dusseldorf Stock Exchange Eurex Clearing AG Eurex Deutschland European Energy Exchange Frankfurt Stock Exchange Frankfurter Wertpapierboerse Tradegate Exchange HCMC Hellenic Capital Market Commission Athens Exchange Derivatives Market Athens Exchange Securities Market 11 Greece Athens Stock Exchange Electronic Secondary Securities Market SFC (HK) -

Markets Not Capitalism Explores the Gap Between Radically Freed Markets and the Capitalist-Controlled Markets That Prevail Today

individualist anarchism against bosses, inequality, corporate power, and structural poverty Edited by Gary Chartier & Charles W. Johnson Individualist anarchists believe in mutual exchange, not economic privilege. They believe in freed markets, not capitalism. They defend a distinctive response to the challenges of ending global capitalism and achieving social justice: eliminate the political privileges that prop up capitalists. Massive concentrations of wealth, rigid economic hierarchies, and unsustainable modes of production are not the results of the market form, but of markets deformed and rigged by a network of state-secured controls and privileges to the business class. Markets Not Capitalism explores the gap between radically freed markets and the capitalist-controlled markets that prevail today. It explains how liberating market exchange from state capitalist privilege can abolish structural poverty, help working people take control over the conditions of their labor, and redistribute wealth and social power. Featuring discussions of socialism, capitalism, markets, ownership, labor struggle, grassroots privatization, intellectual property, health care, racism, sexism, and environmental issues, this unique collection brings together classic essays by Cleyre, and such contemporary innovators as Kevin Carson and Roderick Long. It introduces an eye-opening approach to radical social thought, rooted equally in libertarian socialism and market anarchism. “We on the left need a good shake to get us thinking, and these arguments for market anarchism do the job in lively and thoughtful fashion.” – Alexander Cockburn, editor and publisher, Counterpunch “Anarchy is not chaos; nor is it violence. This rich and provocative gathering of essays by anarchists past and present imagines society unburdened by state, markets un-warped by capitalism. -

Questions and Answers on the Issue of a Regulated Market for Currently Illegal Drugs

Questions and answers on the issue of a regulated market for currently illegal drugs Mark Haden Vancouver Coastal Health Draft: June 2010 For the past decade I have been involved with public presentations which explore the failures of drug prohibition. In these presentations I recommend a public health, human rights model of drug control which brings all currently illegal drugs into a regulatory framework. The following is a list of the most common challenges I experience: Q: Are you saying that you want to legalize all drugs? A: No: Legalization is often interpreted to mean that the current capitalist free market system would be used to advertise and distribute currently illegal drugs. The goal of the free market is to increase consumption. The concept of a regulated market is different as the goal is to reduce the health and social problems associated with drugs. Q: What do you mean by a regulated market for illegal drugs? A: A regulated market would actively control drugs based on the principles of public health and human rights. Prohibition paradoxically stimulates a illegal market that makes concentrated and sometimes toxic, drugs widely available. The goal is to greatly reduce or shut down the illegal market and regulate drugs in a way that reduces harm to individuals, families and our society as a whole. Seeing drug use as primarily a health and social issue rather than a criminal issue allows us to explore a wide range of tools to manage the problems associated with drugs in a more effective way. Q: Are you saying “yes” to drugs? A: No – but we are saying “yes” to using more effective ways of controlling drugs and their problems. -

On the American Paradox of Laissez Faire and Mass Incarceration

ON THE AMERICAN PARADOX OF LAISSEZ FAIRE AND MASS INCARCERATION Bernard E. Harcourt∗ What we come to believe — so often, in reality, mere fiction and myth — takes on the character of truth and has real effects, tangible effects on our social and political condition. These beliefs, these hu- man fabrications, are they simply illusions? Are they fantasies? Are they reflections on a cave wall? Over the past two centuries at least, brilliant and well-regarded thinkers have proposed a range of theories and methods to emancipate us from these figments of our imagination. They have offered genealogies and archaeologies, psychoanalysis, Ideologiekritik, poststructuralism, and deconstruction — to name but a few. Their writings are often obscure and laden with a jargon that has gotten in the way of their keen insights, but their central point contin- ues to resonate loudly today: our collective imagination has real effects on our social condition and on our politics. It is important, it is vital to question what passes as truth. Any sophisticated listener, for instance, would have understood immediately what Barack Obama was doing when he declared on the campaign trail in 2008 that “[t]he market is the best mechanism ever invented for efficiently allocating resources to maximize production.”1 Or when he quickly added, “I also think that there is a connection be- tween the freedom of the marketplace and freedom more generally.”2 Obama was tapping into a public imaginary, one reflected at the time by the overwhelming belief, shared by more than two-thirds -

Regulation History As Politics Or Markets

Book Review Regulation History as Politics or Markets The Regulated Economy: A Historical Approach to Political Economy (Claudia Goldin & Gary D. Libecap, eds.). Chicago: University of Chicago Press, 1994. 312 + viii pp., bibliographies, index, drawings, tables. ISBN: 0-226-30110-9. Cloth. $56.00. Herbert Hovenkampt Introduction: The S-P-P and Neoclassical Models of Regulation This interesting group of essays explores the history of American regulatory policy in an assortment of markets. The editors introduce their collection as "an effort to better understand the historical development of government intervention."' Although some authors represented in the collection are more explicit than others, most accept some version of the Stigler-Posner-Peltzman (S-P-P) model of regulation, which views political bargaining among rent-seeking special interest groups as the best explanation of regulatory outcomes. 2 While this interest group model is often powerful, it is hardly the only model for explaining regulation. Most of the regulation described in these essays can be fully accounted for by neoclassical economics, whose regulatory theory looks at the characteristics of the economic market to which regulation is applied, rather than the political market in which the decision to regulate is made. Under the S-P-P theory, interest groups form political coalitions in order to promote legislation that advances their own interests by limiting competition or restricting entry by new firms. Elected legislators t Ben V. & Dorothy Willie Professor of Law, University of Iowa. 1. THE REGULATED ECONOMY: A HISTORICAL APPROACH TO POLITICAL ECONOMY 2 (Claudia Goldin & Gary D. Libecap eds., 1994) [hereinafter THE REGULATED ECONOMY]. -

Gordon Tullock

SUBSCRIBE NOW AND RECEIVE CRISIS AND LEVIATHAN* FREE! “The Independent Review does not accept “The Independent Review is pronouncements of government officials nor the excellent.” conventional wisdom at face value.” —GARY BECKER, Noble Laureate —JOHN R. MACARTHUR, Publisher, Harper’s in Economic Sciences Subscribe to The Independent Review and receive a free book of your choice* such as the 25th Anniversary Edition of Crisis and Leviathan: Critical Episodes in the Growth of American Government, by Founding Editor Robert Higgs. This quarterly journal, guided by co-editors Christopher J. Coyne, and Michael C. Munger, and Robert M. Whaples offers leading-edge insights on today’s most critical issues in economics, healthcare, education, law, history, political science, philosophy, and sociology. Thought-provoking and educational, The Independent Review is blazing the way toward informed debate! Student? Educator? Journalist? Business or civic leader? Engaged citizen? This journal is for YOU! *Order today for more FREE book options Perfect for students or anyone on the go! The Independent Review is available on mobile devices or tablets: iOS devices, Amazon Kindle Fire, or Android through Magzter. INDEPENDENT INSTITUTE, 100 SWAN WAY, OAKLAND, CA 94621 • 800-927-8733 • [email protected] PROMO CODE IRA1703 Of Stranded Costs and Stranded Hopes The Difficulties of Deregulation —————— ✦ —————— FRED S. MCCHESNEY iven the manifest inefficiency of government regulation, why is there so little deregulation? Of course, some deregulation, including the privatization G of state-owned industries, has occurred in recent decades. The United States experienced a spate of high-profile deregulations from 1978 to 1980 in the natural gas, trucking, and airline industries (Crandall and Ellig 1997). -

EU Emissions Trading the Role Of

School of Management and Law EU Emissions Trading: The Role of Banks and Other Financial Actors Insights from the EU Transaction Log and Interviews SML Working Paper No. 12 Johanna Cludius, Regina Betz ZHAW School of Management and Law St.-Georgen-Platz 2 P.O. Box 8401 Winterthur Switzerland Department of Business Law www.zhaw.ch/abl Author/Contact Johanna Cludius [email protected] Regina Betz [email protected] March 2016 ISSN 2296-5025 Copyright © 2016 Department of Business Law, ZHAW School of Management and Law All rights reserved. Nothing from this publication may be reproduced, stored in computerized systems, or published in any form or in any manner, including electronic, mechanical, reprographic, or photographic, without prior written permission from the publisher. 3 Abstract This paper is an empirical investigation of the role of the financial sector in the EU Emissions Trading Scheme (EU ETS). This topic is of particular interest because non-regulated entities are likely to have played an important part in increasing the efficiency of the EU ETS by reducing trading transaction costs and providing other services. Due to various reasons (new rules and regulations, reduced return prospects, VAT fraud investigations) banks have reduced their engagement in EU Emissions Trading and it is unclear how this will impact on the functioning of the carbon market. Our regression analysis based on data from the EU Transaction Log shows that large companies and companies with extensive trading experience are more likely to interact with the financial sector, which is why we expect banks’ pulling out of the EU ETS to affect larger companies more significantly. -

On the American Paradox of Laissez Faire and Mass Incarceration Bernard E

University of Chicago Law School Chicago Unbound Public Law and Legal Theory Working Papers Working Papers 2012 On the American Paradox of Laissez Faire and Mass Incarceration Bernard E. Harcourt Follow this and additional works at: https://chicagounbound.uchicago.edu/ public_law_and_legal_theory Part of the Law Commons Chicago Unbound includes both works in progress and final versions of articles. Please be aware that a more recent version of this article may be available on Chicago Unbound, SSRN or elsewhere. Recommended Citation Bernard E. Harcourt, "On the American Paradox of Laissez Faire and Mass Incarceration" (University of Chicago Public Law & Legal Theory Working Paper No. 376, 2012). This Working Paper is brought to you for free and open access by the Working Papers at Chicago Unbound. It has been accepted for inclusion in Public Law and Legal Theory Working Papers by an authorized administrator of Chicago Unbound. For more information, please contact [email protected]. CHICAGO JOHN M. OLIN LAW & ECONOMICS WORKING PAPER NO. 590 (2D SERIES) PUBLIC LAW AND LEGAL THEORY WORKING PAPER NO. 376 ON THE AMERICAN PARADOX OF LAISSEZ FAIRE AND MASS INCARCERATION Bernard E. Harcourt THE LAW SCHOOL THE UNIVERSITY OF CHICAGO March 2012 This paper can be downloaded without charge at the John M. Olin Program in Law and Economics Work‐ ing Paper Series: http://www.law.uchicago.edu/Lawecon/index.html and at the Public Law and Legal Theory Working Paper Series: http://www.law.uchicago.edu/academics/publiclaw/index.html and The Social Science Research Network Electronic Paper Collection. ON THE AMERICAN PARADOX OF LAISSEZ FAIRE AND MASS INCARCERATION Bernard E. -

Alternatives to Capitalism Proposals for a Democratic Economy

ALTERNATIVES TO CAPITALISM PROPOSALS FOR A DEMOCRATIC ECONOMY Robin Hahnel Erik Olin Wright CONTENTS Acknowledgements ii Introduction iii Part One 1. The Case for Participatory Economics 2 Robin Hahnel 2. Participatory Economics: A Sympathetic 11 Critique Erik Olin Wright 3. In Defence of Participatory Economics 38 Robin Hahnel Part Two 4. Socialism and Real Utopias 61 Erik Olin Wright 5. Breaking With Capitalism 85 Robin Hahnel 6. Final Thoughts 107 Erik Olin Wright About the authors 121 i ACKNOWLEDGEMENTS Robin would like to thank Mesa Refuge, a writers retreat in Point Reyes Station, California, where he was a resident for two weeks during this last year. ii INTRODUCTION New Left Project Poverty, exploitation, instability, hierarchy, subordination, environmental exhaustion, radical inequalities of wealth and power—it is not difficult to list capitalism’s myriad injustices. But is there a preferable and workable alternative? What would a viable free and democratic free society look like? Alternatives to Capitalism: Proposals for a Democratic Economy presents a debate between two such possibilities: Robin Hahnel’s “participatory economics” and Erik Olin Wright’s “real utopian” socialism. It is a detailed and at times technical discussion that rewards careful engagement. Those who put the effort in will, we hope, find that it illuminates a range of issues and dilemmas of crucial importance to any serious effort to build a better world. Is it worth devoting energy to thinking about alternatives to capitalism? There is a tradition within anti-capitalist politics which thinks not. It is argued that idle speculation distracts from what really matters: the struggles emerging in the here and now, which are the soil from which any emancipatory future will spring. -

Effects of Carbon Pricing on EU Equity Markets

Stockholm School of Economics Master Thesis in Finance Effects of Carbon Pricing on EU Equity Markets Andrii Shekhirev* 2011.06.20 The current work examines whether the price changes of European Union Allowance (EUA) contracts for emitting carbon dioxide affect the price dynamics of the European equity markets. The author uses the Vector Autoregressive (VAR) and Vector Error Correction (VECM) models in four specifications to investigate the linkages between the EUA market and major stock indexes of 27 EU countries which are participating in the second phase of the European Emissions Trading System. The regression models, together with Granger causality testing, suggest that stock markets of several developed European countries exhibit significant negative responses to EUA price shocks. In particular, CAC 40 (France), DAX 30 (Germany), AEX (the Netherlands), and FTSE MIB (Italy) indexes have been found to react to the EUA market movements. This may serve as a hint for the growing importance of the price of carbon as an additional risk factor for businesses given that emission quotas are being consistently tightened every year. Author: Andrii Shekhirev Supervisor: Cristian Huse Discussant: Huizi Zeng Date of Presentation: June 13th, 2011 Final Thesis: June 20th, 2011 Keywords: emissions trading, carbon markets, market linkages, ETS, price shocks, vector autoregression, VAR, Granger causality *[email protected] Andrii Shekhirev Effects of Carbon Pricing on EU Equity Markets Table of Contents 1. Introduction ......................................................................................................................... -

CHAPTER 1: EU ETS: Origins, Description and Markets in Europe

CO2 Markets Maria Mansanet Bataller Motivation Climate Change Importance Increasingly Kyoto Protocol: International Response to Climate Change Flexibility Mechanisms EMISSIONS TRADING CARBON MARKETS The presentation is organized as follows… Carbon Trading Origins. Carbon Trading in Europe : the EU ETS. Carbon Markets in Europe. Linking with UN Carbon Markets. Conclusion and final remarks The presentation is organized as follows… Carbon Trading Origins. Carbon Trading in Europe : the EU ETS. Carbon Markets in Europe. Linking with UN Carbon Markets. Conclusion and final remarks Origins of the EU ETS Kyoto Protocol ( UNFCCC). 1997 & 2005 55 Parts of the Convention including the developed countries representing 55% of their total emissions. Global emissions by 5% from 1990. Commitment period 2008 - 2012. 6 GHG: CO2, CH4, N2O, HFCs, PFCs, and SF6. ol Canada otoc r Liechtenstein oto P y New he K Zealand to t e Australia anc t s i D Japan ) Switzerland % United States 2005 ( Norway ange 1990- h Monaco c ons i s s Croatia i em al e Iceland R Russian et Federation g r a Ukraine o T ot y K 0 0 0 0 0 0 0 10 Commitments by Country 40 30 20 -1 -5 -2 -3 -4 -6 Spain Austria ol oc ot Luxembourg r Italy o P ot y Portugal he K Denmark t o Ireland e t anc Slovenia t EU-15 Dis Belgium Netherlands ) % Germany Greece 2005 ( France Finland United Kingdom hange 1990- Sweden c ons Czech Rep. i s Slovakia is Poland Hungary Real em Romania Bulgaria get r Estonia a Lithuania o T ot y Latvia K 0 0 0 0 0 0 0 60 50 40 30 20 10 -1 -2 -3 -4 -5 -6 Commitments in Europe Kyoto Flexibility Mechanisms Realization Emission Reduction Projects Joint Implementation (art.