2020 Victory Final Roll (PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Durham E-Theses

Durham E-Theses Investigation of some astronomical phenomena in medieval Arabic chronicles Al-Trabulsy, Hussain Ali M. How to cite: Al-Trabulsy, Hussain Ali M. (1993) Investigation of some astronomical phenomena in medieval Arabic chronicles, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/5691/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk 2 INVESTIGATION OF SOME ASTRONOMICAL PHENOMENA IN MEDIEVAL ARABIC CHRONICLES BY Hussain Ali M. al-Trabulsy The copyright of this thesis rests with the author. No quotation from it should be published without his prior written consent and information derived from it should be acknowledged. A thesis submitted to the University of Durham for the degree of Master of science September 1993 1 5 JUN 1994 To My Father, Loving Memory of My Mother And My Wife Um Ali INVESTIGATION OF SOME ASTRONOMICAL PHENOMENA IN MEDIEVAL ARABIC CHRONICLES By Hussain A. -

MS 111 Stanley: Misc

Corpus Christi College Cambridge / PARKER-ON-THE-WEB M.R. James, Descriptive Catalogue of the Manuscripts in the Library of Corpus Christi College, Cambridge 1912 MS 111 Stanley: Misc. G TJames: 316 The Bath Cartulary and related items. Antiquarian Transcripts of Charters Registrum Chartarum Abbatiae Bathoniensis. Apographa Chartarum, etc. Codicology: Vellum and paper, mm 300 x 220, (12 x 8.6 in.), pp. 454. Cent. xi-xvi. Collation: 14 212 36 4 (five leaves) || 58 66 (+ a slip after 2) 78-98 104 (+ 1 paper leaf after 3). The rest of the volume is of paper. Collation: Diagram of quire 4: f. 5 (pp. 7, 8) is of cent. xi. Foliation: pp. a-f + (1-2 missing) + 3-74 + 74a-d +75-138 + 138a-b + 139-226 + 226a-d + 227-382 + 382a-b + 383-410 + 410a + 411a + 411-414 + 415-454 + g-l. Language: Latin and Old English. Contents: 1. 4-4 Homagium factum priori Bathonensi[] pro messuagio Homagium factum priori Bathonensi[] pro messuagio, etc. in Olveston[] per Ioannem de Weston[] [Nasmith:] [manu neoterica] The paging begins with 3: p. 3 blank On p. 4, of cent. xiv (44 Edw. III) 2. 5-5 Ad parcum de Westberi[] claudendum Qui tenentur claudere parcum de Westberi[] Of cent. xii Followed by another copy of 1 3. 6-6 Relic list Reliquiae sanctorum A continuation in another hand of the list of relics 4 (1) It is in Latin, of cent. xiii (?) 4. 7-10 Anglo-Saxon relic lists and manumissions from Bath[] Folium a libro evangeliorum Saxonico, hujus bibliothecae Cod. CXL avulsum, in quo continentur Saxonice [Nasmith:] (1) Scriptum Saxonicum de reliquiis sanctorum quas in scriniis Bathoniensis ecclesiae[] reperierunt Ælsigus abbas[] et fratres ejusdem monasterii. -

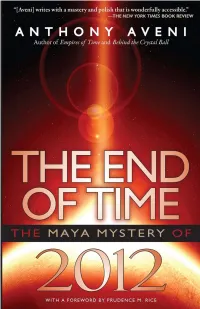

The End of Time: the Maya Mystery of 2012

THE END OF TIME ALSO BY ANTHONY AVENI Ancient Astronomers Behind the Crystal Ball: Magic, Science and the Occult from Antiquity Through the New Age Between the Lines: The Mystery of the Giant Ground Drawings of Ancient Nasca, Peru The Book of the Year: A Brief History of Our Seasonal Holidays Conversing with the Planets: How Science and Myth Invented the Cosmos Empires of Time: Calendars, Clocks and Cultures The First Americans: Where They Came From and Who They Became Foundations of New World Cultural Astronomy The Madrid Codex: New Approaches to Understanding an Ancient Maya Manuscript (with G. Vail) Nasca: Eighth Wonder of the World Skywatchers: A Revised and Updated Version of Skywatchers of Ancient Mexico Stairways to the Stars: Skywatching in Three Great Ancient Cultures Uncommon Sense: Understanding Nature’s Truths Across Time and Culture THE END OF TIME T H E Ma Y A M YS T ERY O F 2012 AN T H O N Y A V E N I UNIVERSI T Y PRESS OF COLOR A DO For Dylan © 2009 by Anthony Aveni Published by the University Press of Colorado 5589 Arapahoe Avenue, Suite 206C Boulder, Colorado 80303 All rights reserved Printed in the United States of America The University Press of Colorado is a proud member of the Association of American University Presses. The University Press of Colorado is a cooperative publishing enterprise supported, in part, by Adams State College, Colorado State University, Fort Lewis College, Mesa State College, Metropolitan State College of Denver, University of Colorado, University of Northern Colorado, and Western State College of Colorado. -

The Lives of the Popes in the Early Middle Ages

Wxhmmmi^ W^^^^&smMo^^vm^, >-«%9\9 *^ »*• THE LIVES OF THE POPES VOL. V. Digitized by tine Internet Arciiive in 2009 witii funding from Boston Library Consortium IVIember Libraries Iittp://www.arcliive.org/details/livesofpopesinea05mann Area of regal or imperial influence, and sometimes of rule, i.e., the area north of the Po, and west of the dotted line from the Po, which runs between Mutina and Bononia, Arctium, Perugia and on to Populonia. The part coloured yellow on the Map. Area of papal influence or rule, i.e., the area included between the above dotted line, and another starting between Ancona and Firmum and going round Camerinum nnd Assisium to Sora and Terracina. The part coloured blue on the Map. Area of influence or rule of the Lombard and other petty princes, i.e., the area between the last mentioned dotted line and another between the rivers Trinius and Lao. The part coloured red on the Map Area of Greek influence or rule, i.e., the area south of the line from the Trinius to the Lao. The part coloured green on the Map. Corsica, Sardinia, and Sicily, were in the hands of the Saracens during most of this period THE LIVES OF THE POPES IN THE EARLY MIDDLE AGES REV. HORACE K. MANN " De gente Anglorum, qui maxime familiares Apostolicse Sedis semper existunt" {Gesta AM. Fontanel. A.D. 747-752, ap. M.G. SS. II. 289). HEAD MASTER OF ST. CUTHBERT's GRAMMAR SCHOOL, NE\VCASTLE-ON-TYNE CORRESPONDING MEMBER OF THE ROYAL ACADEMY OF HISTORY OF SPAIN THE POPES IN THE DAYS OF FEUDAL ANARCHY FoRMosus TO Damasus II. -

Class Set Please Do Not Remove from the Class Room

CLASS SET PLEASE DO NOT REMOVE FROM THE CLASS ROOM Criminal System Orientation Manual Harris County Information Technology Center; Education & Career Development Division 1310 Prairie; Suite 1220 Houston, Texas 77002 http://www.jims.hctx.net/jimshome/ Table of Contents WELCOME TO JIMS .....................................................................................................................1 LOGGING ON TO CICS2 ..............................................................................................................2 Changing your password............................................................................................................3 LOGGING ON THROUGH HCP ...................................................................................................4 SECURITY CODES AND CLEARANCES ...................................................................................5 COMMONLY SEEN FIELDS ........................................................................................................6 SPN (System Person Number) ...................................................................................................6 NAME ........................................................................................................................................7 PTY (Party Types) .....................................................................................................................7 RACE ........................................................................................................................................7 -

Keystone Advertising Rates (GST Incl.): Back Cover: Is the Journal of Full Page, Full Colour: $120 Christian Home Schoolers of New Zealand

Keystone Advertising Rates (GST incl.): Back Cover: is the Journal of Full Page, Full Colour: $120 Christian Home Schoolers of New Zealand. Inside: It is published six times a year, Black & White: at the end of each odd-numbered month. 1/4 page (h 130 x w 95mm) = $35 Subscription information can be found 1/2 page = $50 on page four. h 185 x w 130mm (portrait) h 130 x w 185mm (landscape) Keystone correspondence to: h 250 x w 95mm (column) Craig S. Smith, Editor Full Page (h 280 x w 190mm) = $70 4 Tawa St. Palmerston North, 5301 Advertising Supplements: New Zealand Provide 350 copies of brochure or A4 sheet Ph.: +64 6 357-4399 printed both sides, and it will be included with Fax: +64 6 357-4389 Keystone mailout for $35. (Charges for E-mail: [email protected] catalogues, ie. something bound or with staples, on application.) is the journal of Christian Home Keystone Schoolers of New Zealand, a part of the Home Advertising Consecutively: Education Foundation, a Charitable Trust Three of same size = 10% off. established to promote the concept of home Six of same size = Sixth one free. education to the Christian community and beyond. Home Education Family Cottage Industries Keystone is intended to inform, challenge, Special rates may apply. Please contact the encourage and inspire. The Christian faith is editor. being undervalued. Christianity alone is fully able to present a world view that is Deadlines: comprehensive, coherent, consistent and Keystone is published on the last Monday of complete. January, March, May, July, September and November. -

The Multiple Facets of Time

The Multiple Facets of Time Reckoning, Representing, and Understanding Time in Medieval Iceland Martina Ceolin Dissertation towards the degree of Doctor of Philosophy University of Iceland School of Humanities Faculty of Icelandic and Comparative Cultural Studies August 2020 Íslensku- og menningardeild Háskóla Íslands hefur metið ritgerð þessa hæfa til varnar við doktorspróf í íslenskum miðaldabókmenntum Reykjavík, 15. júní 2020 Gauti Kristmannsson varadeildarforseti The Faculty of Icelandic and Comparative Cultural Studies at the University of Iceland has declared this dissertation eligible for a defence leading to a Ph.D. degree in Medieval Icelandic Literature Doctoral Committee: Torfi H. Tulinius, supervisor Ármann Jakobsson Massimiliano Bampi The Multiple Facets of Time: Reckoning, Representing, and Understanding Time in Medieval Iceland © Martina Ceolin Reykjavík 2020 Dissertation for a doctoral degree at the University of Iceland. All rights reserved. No part of this publication may be reproduced in any form without written permission of the author. ISBN 978-9935-9245-4-4 Printing: Háskólaprent ABSTRACT This work investigates the multivalent and dynamic portrayal of time in a se- lection of early Old Icelandic texts from the twelfth and thirteenth centuries. The main objective is to map out the representations of time in terms of the patterns conveyed, and to examine how the authors configured time through narrative. An extension of this goal is to build up a theoretical understanding of how the people involved in the production of the texts, and possibly their contemporaries as well, reckoned, organized, and understood time. The primary texts analysed for these purposes are Íslendingabók and two Íslendingasögur, Eyrbyggja saga and Laxdæla saga. -

V·1\Il·1 University Microfilms International a Bell & Howellinformalion Company 300 North Zeeb Road

Human responses to past climate, environment, and population in two Mogollon areas of New Mexico. Item Type text; Dissertation-Reproduction (electronic) Authors Shaw, Chester Worth, Jr. Publisher The University of Arizona. Rights Copyright © is held by the author. Digital access to this material is made possible by the University Libraries, University of Arizona. Further transmission, reproduction or presentation (such as public display or performance) of protected items is prohibited except with permission of the author. Download date 07/10/2021 18:23:21 Link to Item http://hdl.handle.net/10150/186167 INFORMATION TO USERS This manuscript has been reproduced from the microfilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are in typewriter face, while others may be from any type of computer printer. The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleed through, substandard margins, and improper alignment can adversely affect reproduction. In the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Also, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e.g., maps, drawings, charts) are reproduced by sectioning the original, beginning at the upper left-hand corner and continuing from left to right in equal sections with small overlaps. Each original is also photographed in one exposure and is included in reduced form at the back of the book. -

The Western Question in Greece and Turkey

i&y^si&s^iisMi -^&m:''-i'!--!^WXiXI 3tifata. Mtw fnrit BOUGHT WITH THE INCOME OF THE SAGE ENDOWMENT FUND THE GIFT OF HENRY W. SAGE 1891 Cornell University Library D 465.T75 Western question in Greece and Turkey. 3 1924 027 921 778 Cornell University Library The original of tiiis book is in tine Cornell University Library. There are no known copyright restrictions in the United States on the use of the text. http://www.archive.org/details/cu31924027921778 THE WESTERN QUESTION THE WESTERN QUESTION IN GREECE AND TURKEY A STUDY IN THE CONTACT OF CIVILISATIONS BY ARNOLD J. TOYNBEE 'For we are also His oflfspring' CONSTABLE AND COMPANY LTD LONDON • BOMBAY • SYDNEY 1922 TO THE PRESIDENT AND FACULTY OP THE AMERICAN COLLEGE FOR GIRLS AT CONSTANTINOPLE this book is dedicated by the authoe and his wife in gratitude for their hospitality and in admiration of their neutral-mindedness in circumstances in which neutrality is 'hard and rare' viii THE WESTERN QUESTION crimes incidental to an abnormal process, which all parties have committed in turn, and not as the peculiar practice of one denomination or nationality. Finally, the masterful influence of our Western form of society upon people of other civilisations can be discerned beneath the new phenomena and the old, omnipresent and indefatigable in creation and destruction, like some gigantic force of nature. Personally, I am convinced that these subjects are worth studying, apart from the momentary sensations and quandaries of diplomacy and war which are given more prominence in the Press, and this for students of human affairs who have no personal or even national concern in the Eastern Question. -

Early Church Organization in Skagafjörður, North Iceland. the Results of the Skagafjörður Church Project

CM 2014 ombrukket3.qxp_CM 30.04.15 15.46 Side 23 Early church organization in Skagafjörður, North Iceland. The results of the Skagafjörður Church Project GUÐNÝ ZOËGA The article discusses the results of the Skagafjörður Church project. The aim of the project is to establish the number and nature of the earliest, Christian cemeteries and churches in the county of Skagafjörður, north Iceland. By employing a systematic regional ap- proach to the study of early Christian cemeteries, a more nuanced interpretation of early church development can be generated. The research suggests that at least 130 cemeteries may have been established in Skagafjörður in the 11th century, following the official adap- tion of Christianity AD 999/1000. The results indicate a swift adoption of Christian burial rites and cemetery architecture and that at first most independent farmsteads had their own Christian household cemetery. The apparent uniformity of burial customs and architecture suggests some form of management or communality from the outset. Many of these cemeteries appear to have gone out of use in the late 11th/ early 12th centuries, an indication of increasing ecclesiastical control. Introduction Although Christianity was known to, and possibly practiced by, a section of the set- tlement population of Iceland, it is generally considered to have been officially adopted at the national assembly Althing in AD 999/1000. This heralded religious, political and societal changes leading to the establishment of two ecclesiastical power centres, the bishopric of Skálholt in the south and the bishopric at hólar in the north. The former was established in AD 1056 and the latter in AD 1106. -

CONTINUITY and CHANGE in ENGLISH MONETARY HISTORY C.973- 1086

CONTINUITY AND CHANGE IN ENGLISH MONETARY HISTORY c.973- 1086 PART I D. M. METCALF BETWEEN Eadgar's reform of the coinage and the date of the Domesday Book, there are a good hundred years from which the available numismatic evidence is incom- parably rich and detailed. Our understanding of the work of the mints, in matters such as the relative chronology of the issues, the arrangements for the supply of dies, and the use of multiple weight-standards, makes the late Anglo-Saxon series one of the show- pieces of medieval numismatics. But this is still not the whole story. We may know in great detail how the coinage was issued, but how was it used? It has proved difficult to find unambiguous evidence bearing on that second question, and there is still an unresolved conflict between two schools of thought. Professor Sawyer, for example, in a lecture to the Royal Historical Society in 1964 spoke about the wealth of England in the eleventh century, and emphasized the quantities of silver coins that were minted, the existence of a money economy even at the peasant level of society, and the importance of the export trade in wool. England was rich, he suggested, because of its wool.1 Most other students have been inclined to minimize the everyday use of coinage and to stress the probable connection between mint activity (including the choice of weight-standards) and the need for cash to pay danegelds. Thus Dr Stafford, lecturing to us in 1978 on the historical implications of die production under ^Ethelred II, argued that because relatively few Helmet coins have been found in Scandinavia even though a very large geld was paid during the currency of the type, the much greater number of Crux, Long Cross, and Last Small Cross coins found there may reflect the payment of other unknown gelds of which we have no documentary record.2 It may be possible to offer economic and political interpretations of this monetary situation which although very different are not in conflict. -

Viking Identities and Ethnic Boundaries in England and Normandy, C.950 – C.1015

1 Enemy and Ancestor: Viking Identities and Ethnic Boundaries in England and Normandy, c.950 – c.1015 Katherine Clare Cross UCL Submitted for the degree of Doctor of Philosophy 2 I, Katherine Cross, confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm that this has been indicated in the thesis. Signed 3 Abstract This thesis is a comparison of ethnicity in Viking Age England and Normandy. It focuses on the period c.950-c.1015, which begins several generations after the initial Scandinavian settlements in both regions. The comparative approach enables an investigation into how and why the two societies’ inhabitants differed in their perceptions of viking heritage and its impact on ethnic relations in this period. Written sources provide the key to these perceptions: genealogies, histories, hagiographies, charters and law codes. The thesis is the first study to juxtapose and compare these sources and aspects of Viking Age England and Normandy. The approach to ethnicity is informed by the social sciences, especially Fredrik Barth’s Ethnic Groups and Boundaries. The emphasis here is on ethnic identity as a social construct and as a product of belief in group membership. In particular, this investigation treats ethnic identity separately from cultural markers such as names, dress, appearance, and art. In doing so, it presents a new perspective in discussions of assimilation after Scandinavian settlement. For the purpose of analysis, ‘ethnicity’ has been divided into three strands: genealogical, historical and geographical identity. Sources from England and Normandy are compared within each of the three strands.