Food Marketing Policy Center

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is There a World Beyond Supermarkets? Bought These from My Local Farmers’ My Local Box Market Scheme Delivers This I Grew These Myself!

www.ethicalconsumer.org EC178 May/June 2019 £4.25 Is there a world beyond supermarkets? Bought these from my local farmers’ My local box market scheme delivers this I grew these myself! Special product guide to supermarkets PLUS: Guides to Cat & dog food, Cooking oil, Paint feelgood windows Enjoy the comfort and energy efficiency of triple glazed timber windows and doors ® Options to suit all budgets Friendly personal service and technical support from the low energy and Passivhaus experts www.greenbuildingstore.co.uk t: 01484 461705 g b s windows ad 91x137mm Ethical C dec 2018 FINAL.indd 1 14/12/2018 10:42 CAPITAL AT RISK. INVESTMENTS ARE LONG TERM AND MAY NOT BE READILY REALISABLE. ABUNDANCE IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (525432). add to your without arming rainy day fund dictators abundance investment make good money abundanceinvestment.com Editorial ethicalconsumer.org MAY/JUNE 2019 Josie Wexler Editor This is a readers choice issue – we ask readers to do ethical lifestyle training. We encourage organisations and an online survey each Autumn on what they’d like us networks focussed on environmental or social justice to cover. It therefore contains guides to some pretty issues to send a representative. disparate products – supermarkets, cooking oil, pet food and paint. There is also going to be a new guide to rice Our 30th birthday going up on the web later this month. As we mentioned in the last issue, it was Ethical Animal welfare is a big theme in both supermarkets and Consumer’s 30th birthday in March this year. -

Ethical Shopping Guide to Cat and Dog Food

THANK YOU FOR DOWNLOADING THIS ETHICAL CONSUMER RESEARCH REPORT. It contains a buyers’ guide complete with: • a detailed article • rankings table • Best Buy advice • all the stories behind the marks on the table • company ownership and contact details • full list of references £4.25 EC121 November/December 2009 www.ethicalconsumer.org Subscribe to Ethical Consumer and get instant access to over 80 similar reports (worth over £240) as part of your subscription. Subscribers also get: Revealing the dark heart Ethical Consumer magazine of the chocolate industry – play fair, not dirty Toys & games consoles – cutting the environmental costs - keeping you up to date with all the latest ethical news and analysis Razors & shavers Rating • Unique buyers’ guides with detailed ratings tables, Best Buys advice, (out of 20) Brand 17 company profiles, news, boycotts, comment and more Equal Exchange tea 17 [F,O] 17 Online back issues archive HampsteadCo tea Tea [F,O] & Coffee • 17 Purely Organic tea [F,O] Steenbergs English • Available in print through the post or as a digital download breakfast tea [F,O] Unlimited, 24 hour access to our premium website ethiscore.org been a contributor to carbon emissions which had a damaging effect on the environment. (ref: 3) or dolphin No palm oil policy Sustainable(July 2009) forestry policy (2008) contacted, 123 had a dmitted to selling whale and/ A search was madeWal-Mart of the Walmart did not website respond (www.walmartstores. to a request by ECRA in Ocober 2008 meat. It said Sea Shepherd had been urging its members and the com) on 8th July 2009.for the No company’s policy on popalmlicy oil on could the sustainable be found. -

From Wikipedia, the Rom Wikipedia, the Free

Tesco FFrom Wikipedia, the free encyclopedia Jump to: navigation,, search For other uses, see Tesco (disambiguation).. T Tesco PLC Type Public limited company Traded as L!:: TC" #!$:: TC" Industry %etailing &'&'( ') years ago Founded *ackney,, London, !ngland Founder Jack Cohen +e Tesco *ouse -elamere %oad Cheshunt Headquarters *ertfordshire !+. 'L !ngland Number of ),/.0 stores 12s of 3arch locations 45&06 1see table below66 Area served Worldide •• ir %ichard 7roadbent Key people 1Chairman6 -ave Leis 18roup C!"6 Products upermarket *ypermarket uperstore Revenue 9)44.0 billion 145&;6<&= Operating >9;/'4 billion 145&;6<&= income Net income >9;/)) billion 145&;6<&= Total equity 9/5/& billion 145&;6<&= Number of ;55,555 145&;6 <4= employees T Tesco tores Ltd Tesco 7ank Tesco 3obile Tesco #reland -obbies 8arden Centres ubsidiaries T Tesco Family -ining Ltd 8ira?e %estaurants -unnhumby "akood -istribution Ltd !ebsite tescocom Tesco P"# is a 7ritish multinational grocery and general merchandise retailer head@uartered in Cheshunt,, *ertfordshire, !ngland, Anited Bingdom<= #t is the third largest retailer in the orld measured by proDts<0=<;= and second>largest retailer in the orld measured by revenues #t has stores in &4 countries across 2sia and !urope and is the grocery market leader in the AB 1here it has a market share of around 4.0E6, #reland,, *ungary,,<)= 3alaysia, and Thailand</=<.= T Tesco as founded in &'&' by Jack Cohen as a group of market stalls<'= The Tesco name Drst appeared in &'40, after Cohen purchased a shipment of tea from -

Sfo V Tesco Dpa 2017

Case No: U20170287 IN THE CROWN COURT AT SOUTHWARK IN THE MATTER OF s. 45 OF THE CRIME AND COURTS ACT 2013 Royal Courts of Justice Strand, London, WC2A 2LL Date: 10 April 2017 Before : THE PRESIDENT OF THE QUEEN’S BENCH DIVISION (THE RT. HON. SIR BRIAN LEVESON) - - - - - - - - - - - - - - - - - - - - - Between : SERIOUS FRAUD OFFICE Applicant - and - TESCO STORES LIMITED Respondent - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Sasha Wass QC and Esther Schutzer-Weissmann (instructed by the SFO) for the Applicant Clare Montgomery Q.C. and Clare Sibson Q.C. (instructed by Kingsley Napley and Freshfields Bruckhaus Deringer) for the Respondent Hearing dates: 27 March, 10 April 2017 - - - - - - - - - - - - - - - - - - - - - Approved Judgment Judgment Approved by the court for handing down. SFO v Tesco Stores Limited Sir Brian Leveson P: Introduction 1. If false or misleading information is provided to the market by a listed company, a false market can be created. As a consequence, securities will trade at a higher (or, depending on the nature of the false or misleading information, a lower) price than otherwise would be the case. Thus, in the case of a higher price, purchasers of the securities will have paid more than they would have paid had there not been a false market; in the case of a lower price, vendors will have received less. Thus, for such a company, the accuracy of financial results reported to the market is of critical importance and substantial loss can be caused if material inaccuracy is subsequently identified. 2. For the financial year 2013/2014, ending for Tesco plc on 22 February 2014, the accounts and financial statements were published on 22 May 2014. -

Cereal Secrets: the World's Largest Grain Traders and Global Agriculture

OXFAM RESEARCH REPORTS AUGUST 2012 CEREAL SECRETS The world's largest grain traders and global agriculture MS. SOPHIA MURPHY INDEPENDENT CONSULTANT AND SENIOR ADVISOR AT THE INSTITUTE FOR AGRICULTURE AND TRADE POLICY DR. DAVID BURCH HONORARY PROFESSOR SOCIOLOGY, THE UNIVERSITY OF QUEENSLAND DR. JENNIFER CLAPP PROFESSOR, ENVIRONMENT AND RESOURCE STUDIES AND INTERNATIONAL AFFAIRS, UNIVERSITY OF WATERLOO The four big commodity traders – Archer Daniels Midland (ADM), Bunge, Cargill and Louis Dreyfus, collectively referred to as ‘the ABCD companies’ – are dominant traders of grain globally and central to the modern agri-food system. This report considers the ABCDs in relation to several global issues pressing on agriculture: the ‘financialization’ of both commodity trade and agricultural production; the emergence of global competitors to the ABCDs, in particular from Asia; and some of the implications of large-scale industrial biofuels, a sector in which the ABCDs are closely involved. The report includes a discussion of how smallholders in developing countries are affected by these changes, and highlights some development policy implications, given the importance of the ABCD firms in shaping the world of food and agriculture. The report highlights the ways in which these four firms are decisive actors in the global restructuring of the overlapping food, feed, and fuel complexes that is now under way, and considers how the firms are evolving as they respond to and shape the new pressures and opportunities in the modern agri-food system. Oxfam Research Reports are written to share research results, to contribute to public debate and to invite feedback on development and humanitarian policy and practice. -

Transformational Challenge Nestlé 1990–2005

I wanted to stimulate your creative thinking and give Our goal is to earn consumers’ trust as their preferred you a more in-depth feeling of some of the resources Food, Beverage, Nutrition, Health and Wellness Company available in the Group, which are not always suffi ciently both for their own needs and those of their family mem- exploited. We have therefore again organised, not only bers, including their pets. We understand consumers’ the very much appreciated Product Exhibition, but also Nestlé 1990–2005 Challenge Transformational nutritional and emo- a visit to IMD, where we will be exposed to the latest tional needs/prefer- thinking on relevant business issues seen from the aca- TTransformational ransformational ences and provide demic point of view. A visit to our Research Centre at CChallenge hallenge them with innova- Lausanne, which, by the way, celebrates its 10th anni- tive branded prod- versary, will give you the opportunity to get a better idea NNestléestlé 11990–2005990–2005 ucts and services of how those 650 people can help you to achieve a AAlbertlbert PPfifi fffnerfner based on superior higher degree of competitiveness in the market place. HHans-Jörgans-Jörg RRenkenk science and technol- But before starting on the specifi c issues, let me make ogy. By serving our a preliminary remark: it is only fair that I should explain consumers and im- to you how most of our subjects for discussion fi t into proving their quality a broader framework, namely the development strategy of life, everywhere in of our Group. Over the past years, I have had more than the world, we ensure once the opportunity to refl ect on the shape of things profi table, sustain- to come, to use H.G. -

French Food Vs. Fast Food: José Bové Takes on Mcdonald’S

FRENCH FOOD VS. FAST FOOD: JOSÉ BOVÉ TAKES ON MCDONALD’S A thesis presented to the faculty of the College of Arts and Sciences of Ohio University In partial fulfillment of the requirements for the degree Master of Arts Rixa Ann Spencer Freeze June 2002 This thesis entitled FRENCH FOOD VS. FAST FOOD: JOSÉ BOVÉ TAKES ON MCDONALD’S BY RIXA ANN SPENCER FREEZE has been approved for the Department of History and the College of Arts and Sciences by Chester J. Pach Associate Professor of History Leslie A. Flemming Dean, College of Arts and Sciences FREEZE, RIXA ANN SPENCER. M.A. June 2002. History. French Food vs. Fast Food: José Bové Takes on McDonald’s (184 pp.) Director of Thesis: Chester J. Pach This thesis explores the French farmer and activist José Bové and his widely publicized protest against McDonald’s France in August 1999. With the help of 300 demonstrators, he dismantled a partially constructed McDonald’s restaurant and caused an international stir. Many factors influenced Bové’s protest: his background in radical agricultural activism, a historical overview of French-American cultural relations, and tensions over globalization in France. José Bové’s protest has undergone many interpretations, some that favor his cause and some that do not. Even after his trial a year later, several issues remained unresolved—how much damage the protest caused and whether the action against McDonald’s was a legitimate (if illegal) form of protest. McDonald’s France has responded to Bové’s criticisms by changing its image, décor, and menu offerings. José Bové is a complex character; though his tactics are extreme at times, he has successfully raised awareness about issues that contemporary French society faces. -

Comparing Global Food Safety Initiative (Gfsi) Recognised Standards

COMPARING GLOBAL FOOD SAFETY INITIATIVE (GFSI) RECOGNISED STANDARDS A DISCUSSION ABOUT THE SIMILARITIES AND DIFFERENCES BETWEEN THE REQUIREMENTS OF THE GFSI BENCHMARKED FOOD SAFETY STANDARDS APRIL 2011 AUTHORS Supreeya Sansawat Global Food Business Manager, SGS Victor Muliyil Technical Manager for North America Food Safety Services, SGS ABSTRACT This document aims to provide an and the GLOBALG.A.P. For each of a customised single food audit. This overview of the Global Food Safety these, the requirements, benefits and could be of benefit because food safety Initiative (GFSI) and what it means for certification processes are reviewed. standards have an extensive cross-over an international food safety standard There are five further schemes that with environmental, health & safety to be GFSI approved. It then goes on are covered in brief. The most generic and quality standards. A further issue to discuss each of the GFSI approved of the schemes and those most is that there is not necessarily one schemes individually looking in detail commonly adopted by branded goods ‘optimal fit’ food safety standard for at the key schemes which are offered manufacturers (FSSC 22000, BRC, SQF any given organisation. This means by the Global Food Standard (BRC), 2000 and IFS) are then compared, by that a combination of schemes brought FSSC 22000, the International Features discussing the criteria, similarities and together in one audit procedure may be Standard Food (IFS Food), the Safe differences between the schemes. a more suitable solution. Quality Food SQF 2000 and 1000 The paper then looks at the merits of CONTENTS I. EXECUTIVE SUMMARY 2 II. -

How Cultural Entrepreneurs Mainstreamed a Movement

Veganized: How Cultural Entrepreneurs Mainstreamed a Movement The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation Gheihman, Nina. 2020. Veganized: How Cultural Entrepreneurs Mainstreamed a Movement. Doctoral dissertation, Harvard University, Graduate School of Arts & Sciences. Citable link https://nrs.harvard.edu/URN-3:HUL.INSTREPOS:37365705 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA Veganized How Cultural Entrepreneurs Mainstreamed a Movement A dissertation presented by Nina Gheihman to The Department of Sociology in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the subject of Sociology Harvard University Cambridge, Massachusetts April 2020 © 2020 – Nina Gheihman All rights reserved. Dissertation Advisor: Michèle Lamont Author: Nina Gheihman Veganized: How Cultural Entrepreneurs Mainstreamed a Movement Abstract In the last few years, veganism transformed from a marginalized animal rights movement into a mainstream lifestyle. This shift occurred through the promotional work of change agents called cultural entrepreneurs. Drawing on over 150 interviews with these movement leaders, I describe three archetypes that emerged inductively from the analysis: Icons (image entrepreneurs), Informers (knowledge entrepreneurs), and Innovators (market entrepreneurs). Collectively, cultural entrepreneurs sacrifice ideological purity in pursuit of popularity. However, they are both enabled and constrained by the national contexts in which they are embedded. I compare the United States with two “shadow cases” that represent barriers to (France) and openings for (Israel) cultural diffusion. -

Société Des Produits Nestlé SA -V- Cadbury UK Ltd Judgment

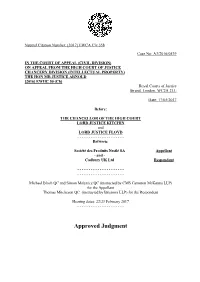

Neutral Citation Number: [2017] EWCA Civ 358 Case No: A3/2016/0539 IN THE COURT OF APPEAL (CIVIL DIVISION) ON APPEAL FROM THE HIGH COURT OF JUSTICE CHANCERY DIVISION (INTELLECTUAL PROPERTY) THE HON MR JUSTICE ARNOLD [2016] EWHC 50 (Ch) Royal Courts of Justice Strand, London, WC2A 2LL Date: 17/05/2017 Before: THE CHANCELLOR OF THE HIGH COURT LORD JUSTICE KITCHIN and LORD JUSTICE FLOYD - - - - - - - - - - - - - - - - - - - - - Between: Société des Produits Nestlé SA Appellant - and - Cadbury UK Ltd Respondent - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Michael Bloch QC and Simon Malynicz QC (instructed by CMS Cameron McKenna LLP) for the Appellant Thomas Mitcheson QC (instructed by Bristows LLP) for the Respondent Hearing dates: 22/23 February 2017 - - - - - - - - - - - - - - - - - - - - - Approved Judgment Judgment Approved by the court for handing down. Nestlé v Cadbury Lord Justice Kitchin: Introduction 1. This is an appeal by Société des Produits Nestlé S.A. (“Nestlé”) from the judgment of Arnold J given on 20 January 2016 ([2016] EWHC 50 (Ch)) and his consequential order dismissing its appeal against the decision of Mr Allan James, the hearing officer acting for the Registrar of Trade Marks, dated 20 June 2013 (O/257/13). 2. The appeal concerns an application made by Nestlé on 8 July 2010 to register as a UK trade mark the three-dimensional sign shown below (the “Trade Mark”) in respect of chocolate and various other goods in class 30: 3. The Trade Mark corresponds to the shape of the well-known four-finger product sold by Nestlé under the name Kit Kat in the United Kingdom save that it lacks the Kit Kat logo which is embossed onto each of the fingers of the actual product. -

Business Management Review Semester 2 – 2010 BUSINESS MANAGEMENT REVIEW Tesco PLC

By Dionne van het Kaar Student no. 09028730 Class: ES3-1C Tutor: Mr. L.J. Harris Course: Management of Organisations in Europe Business Management Review Semester 2 – 2010 BUSINESS MANAGEMENT REVIEW Tesco PLC Introduction Description of the company: Tesco is an international hypermarket chain. It was founded in 1924 in Britain. It is the largest British retailer by its global sales and local market share. Tesco is the third largest retailer in the world behind Wal-Mart in the United States, and Carrefour of France. The chain uses the slogan: "Every Little Helps". Brief History Tesco was founded by British businessman Jack Cohen in 1919, who began to sell groceries from a stall in East London (Hackney). He became market stall holder of a number of stalls and started a wholesale business. In 1924 the Tesco brand made its appearance. The name originates from when Jack Cohen ordered a shipment of tea from tea supplier T.E. Stockwell. He took the two initials of the supplier and the first letter of his surname (TES), and then he combined it with the first two letters of his own surname (CO), forming ‘TESCO’ as the brand name.The first domestic brand sold by Cohen was Tesco Tea. The first Tesco store was established in 1929 in Burnt Oak, Edgware, Middlesex. In 1932 Tesco Stores Ltd became a private limited company (PLC) and by 1939, Jack owned a hundred Tesco stores. Tesco Stores (Holdings) Ltd floated on the stock exchange with a share price of 25 pence in 1947. Expansion and successes During the 1950s and the 1960s Tesco grew significantly, until it eventually had more than 800 stores. -

Pathways to Veganism Full Report

Pathways to Veganism: Exploring Effective Messages in Vegan Transition FINAL REPORT Professor Claire Parkinson & Dr Richard Twine Dr Naomi Griffin Centre for Human Animal Studies (CfHAS), Edge Hill University, UK. 1 Principal Investigators: Professor Claire Parkinson (Edge Hill University), Dr Richard Twine (Edge Hill University). Lead authors: Professor Claire Parkinson and Dr Richard Twine Contributing author: Dr Naomi Griffin Recommended citation: Parkinson, C., Twine, R., and N. Griffin (2019) Pathways to Veganism: Exploring Effective Messages in Vegan Transition. Final Report, Edge Hill University. This publication arises from activities funded by The Vegan Society and Edge Hill University. The analysis and report were conducted by the authors. The views and facts presented in this report are those of the authors and do necessarily reflect those of the funders. The authors would like to thank the academics who peer reviewed this report. Contact information: Edge Hill University St Helens Road Ormskirk Lancashire L39 4QP First draft: January 2019 Peer reviewed report: June 2019 Project partners: Edge Hill University is based on an award-winning 160-acre campus in Lancashire. The University is one of the select few universities to have held the Times Higher Education University of the Year title (2014/15). Edge Hill is ranked Gold in the Teaching Excellent Framework (TEF). The Edge Hill University Centre for Human / Animal Studies (CfHAS) is an interdisciplinary centre for research and activities that engage with the complex material, ethical and symbolic relationships between humans and other animals. It was the first centre of its kind to be established in the UK in 2014.