Ladda Ner Rapporten PDF 1471

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

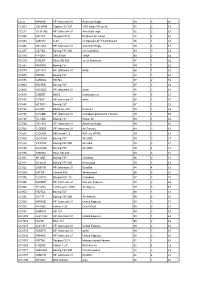

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Amtsblatt Der Europäischen Gemeinschaften Veröffentlichung

Nr. C 366/6 Amtsblatt der Europäischen Gemeinschaften 22 . 12 . 94 Veröffentlichung der Entscheidungen der Mitgliedstaaten über die Erteilung oder den Widerruf von Betriebsgenehmigungen nach Artikel 13 Absatz 4 der Verordnung (EWG) Nr. 2407/92 über die Erteilung von Betriebsgenehmigungen an Luftfahrtunternehmen (') (94/C 366/05) SCHWEDEN Erteilte Betriebsgenehmigungen (2) Kategorie A : Betriebsgenehmigungen ohne die in Artikel 5 Absatz 7 Buchstabe a) der Verordnung (EWG) Nr. 2407/92 vorgesehene Beschränkung Name des Anschrift des Luftfahrtunternehmens Berechtigt zur Entscheidung Luftfährtunternehmens Beförderung von rechtswirksam seit Aerotransport AB Box 7751 , S- 1 03 96 Stockholm Fluggästen, Post, Fracht 30 . 6 . 1994 Air Nordic Swe Aviation Västerås flygplats, S-721 31 Västerås Fluggästen, Post, Fracht 26 . 7 . 1994 AB Air Operations of Europe Hammarbacken 4, Stockholm Nord, S- 191 49 Fluggästen, Post, Fracht 18 . 2 . 1994 AB Sollentuna Euro Flight Sweden AB Box 2174, S-438 14 Landvetter Fluggästen, Post, Fracht 8 . 8 . 1994 Falcon Aviation AB Box 36, S-230 32 Malmö-Sturup Fluggästen, Post, Fracht 17 . 6 . 1994 Flying Entreprise AB Flygfältsgatan 31 , S-423 37 Torslanda Fluggästen, Post, Fracht 4 . 2 . 1994 Golden Air Flyg AB Box 900, S-531 19 Lidköping Fluggästen, Post, Fracht 25 . 5 . 1994 Holmström Air Hudiksvall Skogsta 41 , S-824 92 Hudiksvall Fluggästen, Post, Fracht 26 . 7 . 1994 AB Malmö Aviation Schedule Box 6, S-230 32 Malmö-Sturup Fluggästen, Post, Fracht 26 . 7 . 1994 AB Nordic East Airways AB Box 79, S- 1 90 45 Stockholm-Arlanda Fluggästen, Post, Fracht 21 . 7 . 1994 Skyways AB Box 1537 , S-581 15 Lidköping Fluggästen, Post, Fracht 21 . -

![Contents [Edit] Africa](https://docslib.b-cdn.net/cover/9562/contents-edit-africa-79562.webp)

Contents [Edit] Africa

Low cost carriers The following is a list of low cost carriers organized by home country. A low-cost carrier or low-cost airline (also known as a no-frills, discount or budget carrier or airline) is an airline that offers generally low fares in exchange for eliminating many traditional passenger services. See the low cost carrier article for more information. Regional airlines, which may compete with low-cost airlines on some routes are listed at the article 'List of regional airlines.' Contents [hide] y 1 Africa y 2 Americas y 3 Asia y 4 Europe y 5 Middle East y 6 Oceania y 7 Defunct low-cost carriers y 8 See also y 9 References [edit] Africa Egypt South Africa y Air Arabia Egypt y Kulula.com y 1Time Kenya y Mango y Velvet Sky y Fly540 Tunisia Nigeria y Karthago Airlines y Aero Contractors Morocco y Jet4you y Air Arabia Maroc [edit] Americas Mexico y Aviacsa y Interjet y VivaAerobus y Volaris Barbados Peru y REDjet (planned) y Peruvian Airlines Brazil United States y Azul Brazilian Airlines y AirTran Airways Domestic y Gol Airlines Routes, Caribbean Routes and y WebJet Linhas Aéreas Mexico Routes (in process of being acquired by Southwest) Canada y Allegiant Air Domestic Routes and International Charter y CanJet (chartered flights y Frontier Airlines Domestic, only) Mexico, and Central America y WestJet Domestic, United Routes [1] States and Caribbean y JetBlue Airways Domestic, Routes Caribbean, and South America Routes Colombia y Southwest Airlines Domestic Routes y Aires y Spirit Airlines Domestic, y EasyFly Caribbean, Central and -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Market Report a Publication of Saab Aircraft Leasing

Issue 27 December 2011 MARKET REPORT A PUBLICATION OF SAAB AIRCRAFT LEASING DARWIN DEVELOPS EUROPEAN NETWORK PlottING A NEW COURSE GULFSTREAM INTERNATIONAL ADDS SAAB 340Bplus AIRCRAFT AND BECOMES SILVER AIRWAYS messaGE FROM CONTENTS Michael Magnusson Golden Air shines as niche Swedish carrier ......................... 3-5 Reflecting on 2011 activity and Darwin develops European network .................................... 6-9 readying for next year’s priorities Flying to the finish line. .................................................... 10-12 Pinnacle positions .................................................................13 As 2011 draws to a close, we can look back over a busy year during which Lakeshore luxury ..................................................................13 we transacted business on many Saab Plotting a new course 340Bplus aircraft. As we have taken Gulfstream International adds Saab 340Bplus aircraft aircraft back from Mesaba, we have found and becomes Silver Airways ........................................... 14-16 new homes for them with both old and new customers. The 30-seat turboprop Saab 340 operators in Thailand expand regional airline service ...........................................................17 continues to be a perfect regional aircraft choice on many regional routes. Saab Destination: Scatsta Airport, Shetland – Scotland. ......18 We are especially pleased that a revitalized Gulfstream International Airlines in Saab 340 Global Operators Conference set for 2012 ...........19 Florida, soon -

Are European Regionals' Successful Days Numbered?

2013 Are European ReJLRQDOV· Successful Days Numbered? Copyright @ 2013 PROLOGIS AG & ch-aviation GmbH Authors: All rights reserved. This study or any portion thereof may not be reproduced or used in any manner whatsoever Hanna Schaal (PROLOGIS) without the express written permission of the publisher [email protected] except for the use of brief quotations embodied in critical Max Oldorf (ch-aviatIon) reviews and certain other noncommercial uses permitted by [email protected] copyright law. $UH (XURSHDQ 5HJLRQDOV· Successful Days Numbered? 33.33% of all regional carriers in Europe went out of business between 2008 and today, nearly one fourth of the employees lost their jobs. PROLOGIS and ch- Figure 1 DYLDWLRQKDYHVFUXWLQL]HG(XURSH·V regional airline market. 'RHVQ·W LW VRPHWLPHV IHHO OLNH (XURSH·V UHJLRQDO DLUOLQHV· PDUNHW H[LWV DUH as FRPPRQ DV WKHLU HQWULHV" 'RQ·W \RX occasIonally wonder If thIs Industry still bears any potential? In order to gaIn clarIty In thIs matter, PROLOGIS and ch- Figure 2 aviation conducted a study of the European regIonal market, comparIng The Affiliates ² Dwindling data from 2008 with data from 2013. Partnerships The results are quIte frIghtenIng: 44 new It all started In the early days with the aIrlInes were founded from 2008 on, 22 traditional regIonal carrIer model, whIch of them have already vanIshed. The Is still very popular today. AffIlIated overall mortalIty rate was 33.33% (see DLUOLQHV VXSSO\ RU ¶IHHG· ODUJH QHWZRUN Figure 1). But the most concernIng FDUULHUV· KXEV ZLWK SDVVHQJHUV IURP number Is probably a job loss rate of 23 small, nearby regIonal aIrports. -

Norwegian Air Shuttle ASA (A Public Limited Liability Company Incorporated Under the Laws of Norway)

REGISTRATION DOCUMENT Norwegian Air Shuttle ASA (a public limited liability company incorporated under the laws of Norway) For the definitions of capitalised terms used throughout this Registration Document, see Section 13 “Definitions and Glossary”. Investing in the Shares involves risks; see Section 1 “Risk Factors” beginning on page 5. Investing in the Shares, including the Offer Shares, and other securities issued by the Issuer involves a particularly high degree of risk. Prospective investors should read the entire Prospectus, comprising of this Registration Document, the Securities Note dated 6 May 2021 and the Summary dated 6 May 2021, and, in particular, consider the risk factors set out in this Registration Document and the Securities Note when considering an investment in the Company. The Company has been severely impacted by the current outbreak of COVID-19. In a very short time period, the Company has lost most of its revenues and is in adverse financial distress. This has adversely and materially affected the Group’s contracts, rights and obligations, including financing arrangements, and the Group is not capable of complying with its ongoing obligations and is currently subject to event of default. On 18 November 2020, the Company and certain of its subsidiaries applied for Examinership in Ireland (and were accepted into Examinership on 7 December 2020), and on 8 December 2020 the Company applied for and was accepted into Reconstruction in Norway. These processes were sanctioned by the Irish and Norwegian courts on 26 March 2021 and 12 April 2021 respectively, however remain subject to potential appeals in Norway (until 12 May 2021) and certain other conditions precedent, including but not limited to the successful completion of a capital raise in the amount of at least NOK 4,500 million (including the Rights Issue, the Private Placement and issuance of certain convertible hybrid instruments as described further herein). -

RASG-PA ESC/29 — WP/04 14/11/17 Twenty

RASG‐PA ESC/29 — WP/04 14/11/17 Twenty ‐ Ninth Regional Aviation Safety Group — Pan America Executive Steering Committee Meeting (RASG‐PA ESC/29) ICAO NACC Regional Office, Mexico City, Mexico, 29‐30 November 2017 Agenda Item 3: Items/Briefings of interest to the RASG‐PA ESC PROPOSAL TO AMEND ICAO FLIGHT DATA ANALYSIS PROGRAMME (FDAP) RECOMMENDATION AND STANDARD TO EXPAND AEROPLANES´ WEIGHT THRESHOLD (Presented by Flight Safety Foundation and supported by Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP) EXECUTIVE SUMMARY The Flight Data Analysis Program (FDAP) working group comprised by representatives of Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP, is in the process of preparing a proposal to expand the number of functional flight data analysis programs. It is anticipated that a greater number of Flight Data Analysis Programs will lead to significantly greater safety levels through analysis of critical event sets and incidents. Action: The FDAP working group is requesting support for greater implementation of FDAP/FDMP throughout the Pan American Regions and consideration of new ICAO standards through the actions outlined in Section 4 of this working paper. Strategic Safety Objectives: References: Annex 6 ‐ Operation of Aircraft, Part 1 sections as mentioned in this working paper RASG‐PA ESC/28 ‐ WP/09 presented at the ICAO SAM Regional Office, 4 to 5 May 2017. 1. Introduction 1.1 Flight Data Recorders have long been used as one of the most important tools for accident investigations such that the term “black box” and its recovery is well known beyond the aviation industry. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Fly Me Europe AB(Publ)

Fly Me Europe AB (publ) Inbjudan till teckning av aktier i Fly Me Europe AB publ. Org nr 556306-9847 Nya linjer med start 30/3 2006 Befi ntliga linjer FlyMe är Sveriges lågprisfl ygbolag. Med Landvetter som bas erbjuder FlyMe direktfl yg till och från tolv europeiska storstäder och semesterorter. Därtill fl yger FlyMe, med Stockholm/Arlanda som bas, till och från Göteborg, Malmö, Östersund och Helsing- fors. FlyMe är listat på Stockholmsbörsens Nya Marknaden. 2 Erbjudandet i sammandrag Företrädesrätt: En (1) befi ntlig aktie berättigar till tio (10) teckningsrätter. En teckningsrätt berättigar till teckning av en nyemitterad aktie. Teckningskurs: SEK 0,03 Avstämningsdag: 25 januari 2006 Teckningstid: 30 januari – 13 februari 2006 Sista dag för handel med aktier inkl teckningsrätter: 20 januari Första dag för handel med aktier exkl teckningsrätter: 23 januari Handel med teckningsrätter: 30 januari – 8 februari 3 Innehållsförteckning Erbjudandet i sammandrag 3 Sammanfattning 5-7 Inbjudan till teckning av aktier 8 Bakgrund, historik och motiv för emissionen 9 Villkor och anvisningar 10-11 VD har ordet 12 Vision, affärsidé och strategi 13 Marknad 14-15 Verksamhetsbeskrivning 16-17 Styrelse, ledande befattningshavare och revisorer 18 Aktiekapital och aktiekapitalets utveckling 19 Ägarförhållanden 20 Övriga upplysningar 21-22 Skattefrågor 23-24 Finansiell översikt 25 Fem år i sammandrag 26 Nyckeltal 27 Delårsrapport januari-september 2005 28-35 Koncernbalansräkning per 2005-10-31 36 Årsräkenskaper 37-41 Noter, gemensamma för moderbolag och koncern -

Brussels, 01.10.2014 COMMISSION DECISION

EUROPEAN COMMISSION Brussels, 01.10.2014 In the published version of this decision, some PUBLIC VERSION information has been omitted, pursuant to articles 24 and 25 of Council Regulation (EC) This document is made available for No 659/1999 of 22 March 1999 laying down information purposes only. detailed rules for the application of Article 93 of the EC Treaty, concerning non-disclosure of information covered by professional secrecy. The omissions are shown thus […]. COMMISSION DECISION Of 01.10.2014 ON STATE AID CASE SA.18857 (2012/C, ex 2011/NN) Alleged aid to Västerås Airport and Ryanair Ltd (Only the Swedish version is authentic) (Text with EEA relevance) 1 COMMISSION DECISION Of 01.10.2014 ON STATE AID CASE SA.18857 (2012/C, ex 2011/NN) Alleged aid to Västerås Airport and Ryanair Ltd (Text with EEA relevance) (Only the Swedish version is authentic) THE EUROPEAN COMMISSION, Having regard to the Treaty on the Functioning of the European Union, and in particular the first subparagraph of Article 108(2) thereof, Having regard to the Agreement on the European Economic Area, and in particular Article 62(1)(a) thereof, Having called on interested parties to submit their comments pursuant to those provisions1, and having regard to their comments, Whereas: 1. PROCEDURE (1) By letter of 25 January 2012 the Commission informed Sweden that it had decided to initiate proceedings based on Article 108(2) of the Treaty on the Functioning of the European Union (hereafter "the TFEU") in respect of certain measures implemented by the Swedish authorities in respect of Västerås airport and Ryanair Ltd. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010.