Tin from Myanmar – a Scenario for Applying the European Union Regu- Lation on Supply Chain Due Diligence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Comparative Study of Livestock's Name Between Ancient And

US-China Foreign Language, ISSN 1539-8080 September 2014, Vol. 12, No. 9, 728-735 D DAVID PUBLISHING A Comparative Study of Livestock’s Name Between Ancient and Modern Yi Language of China∗ YANG Liu-jin Honghe University, Mengzi City, China The traditional pronunciations of domestic animal lexemes recorded in ancient Nisu(Yi) manuscripts differ significantly from the vernacular pronunciations of their modern counterparts. Thus, in the process of translating such texts, when a translator substitutes modern Nisu for ancient Nisu, not only can many of the characteristics of the original text be lost, but the original meaning may also be completely modified. Currently a number of specialists and scholars, both in China and elsewhere, are familiar with modern Nisu but have no such familiarity with the language’s ancient forms. The paper grants Nisu researchers a better grasp of the differences between the language’s ancient and modern forms in order to help others avoid mistakes in translating ancient Nisu manuscripts. This is accomplished through a brief comparative analysis of Nisu names for livestock and fowl—then and now. Keywords: Yi Language, livestock, name Introduction Nisu is a Tibet-Burman language of the Ngwi branch which has been officially classified as an ethnic linguistic sub-branch of the Yi nationality in China. The Nisu retain use of their language in both spoken and written forms. The current population of the official Yi nationality stands at 7,776,230 (PCPC, 2002) and is distributed through Yunnan, Sichuan, Guangxi, and Guizhou Provinces. Traditionally, in China, the languages spoken by the Yi nationality have been divided into six major dialect regions: Northern, Eastern, Southern, Western, Central, and Southeastern (YYJS, 1987, pp. -

Towards Eliminating Perinatal Transmission of HIV, Syphilis and Hepatitis B in Yunnan a Case Study, 2005–2012

Towards eliminating perinatal transmission of HIV, syphilis and hepatitis B in Yunnan A case study, 2005–2012 Yunnan AIDS Prevention and Control Bureau Towards eliminating perinatal transmission of HIV, syphilis and hepatitis B in Yunnan A case study, 2005–2012 Yunnan AIDS Prevention and Control Bureau WHO Library Cataloguing-in-Publication Data Towards eliminating perinatal transmission of HIV, syphilis and hepatitis B in Yunnan: a case study, 2005-2012 1. HIV infections – prevention and control. 2. Hepatitis B. 3. Syphilis, Congenital. I. World Health Organization Regional Office for the Western Pacific. ISBN 978 92 9061 696 2 (NLM Classification: WC 503.6) © World Health Organization 2015 All rights reserved. Publications of the World Health Organization are available on the WHO web site (www.who.int) or can be purchased from WHO Press, World Health Organization, 20 Avenue Appia, 1211 Geneva 27, Switzerland (tel.: +41 22 791 3264; fax: +41 22 791 4857; e-mail: [email protected]). Requests for permission to reproduce or translate WHO publications –whether for sale or for non-commercial distribution– should be addressed to WHO Press through the WHO web site (www.who.int/about/licensing/copyright_form/en/index.html). For WHO Western Pacific Regional Publications, request for permission to reproduce should be addressed to Publications Office, World Health Organization, Regional Office for the Western Pacific, P.O. Box 2932, 1000, Manila, Philippines, fax: +632 521 1036, e-mail: [email protected] The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the World Health Organization concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

The Collapse of the International Tin Agreement

CORE Metadata, citation and similar papers at core.ac.uk Provided by IDS OpenDocs The Collapse of the International Tin Agreement Michael Prest Introduction unimportant part of an international dispute which it Early on the morning of 24 October 1985 Michael only dimly understood. The field was quickly Brown,chiefexecutiveof the London Metal dominated by national governments, big banks, and in Exchange, was sitting in his office chatting to the the background the United Nations Conference on chairman of the exchange's committee, Ted Jordan. Trade and Development. The telephone range. It was Pieter de Koning, the International Tin Council's buffer stock manager and For the LME the issues were the sanctity of contract the most powerful person in the world tin market. and the preservation of the exchange. But for the other There was a brief conversation. Brown recalls:'I participants it was a matter of realpolitik, in which the turned to Ted and said "de Koning has suspended stakes were the future of international commodity trading".' agreements, the debt crisis, and relations between developing commodity producing countries and In that instant both realised that chaos threatened. industrial consumers of commodities. What originated Their immediate concern was the LME and its as a commercial dispute - the announcement by the members. They knew that around half of the LME's 27 ITC that it could not pay its debts - rapidly ring dealing members' were heavily involved with the intensified and expanded into a test case of the ability buffer stock. They also suspected that de Koning's of commodity agreements to survive in adverse careful word 'suspend' was code for defaulting on his market conditions. -

SPANISH CEPAL Economic Commission

Distr. RESTRICTED E/CEPAL/R.249 1H January 1932 ENGLISH ORIGINAL: SPANISH C E P A L Economic Commission for Latin America LINKS OF THE TRANSNATIONAL CORPORATIONS WITH THE TIN INDUSTRY IN BOLIVIA Jan Kfiakal */ jV The author is a regional expert of the CEPAL/CTC Joint Unit on Transnational Corporations. The views expressed in this working paper are those of the author and do not necessarily reflect the views of the Organization. 81-9-2017 - 1X• • 1» - CONTENTS Page Introduction . i Part One THE INTERNATIONAL TIN INDUSTRY 5 1. Characteristics of the product 5 2. Tin mining and reserves 7 3. Sovereignty of the developing countries over their tin resources 10 4. Tin smelting and position of the main transnational corporations 15 5. Control over the world tin market 20 Part Two THE BOLIVIAN TIN INDUSTRY AND ITS LINKS WITH TRANSNATIONAL CORPORATIONS 29 1. The importance of mining and tin in the Bolivian economy 29 2. Early stage of the industry and its nationalization in 1952 . 31 3. Establishment of the Corporación Minera de Bolivia and the* postnationalization period 34 4. Continued dependence on foreign smelters 36 5. Importance of the public enterprise in tin smelting 42 6. Domestic integration of the mining and metallurgical sector (COMIBOL and ENAF) and reaction of the foreign smelters 44 7. Marketing of metal tin by ENAF 57 8. Industrialization based on tin: its limits and possibilities for increased regional co-operation 64 9. Conclusions to be drawn from the Bolivian experience 71 Annex 1 Selected Bibliography 77 Annex 2 Main clauses and technical specifications included in ENAF's tin marketing contracts 79 Annex 3 Contract between ENAF and an international sales agent . -

2020 Report on Global Tin Resources & Reserves

Global Resources & Reserves Security of long-term Ɵ n supply 2020 Update Contents Global Resources and Reserves .......................................................................................................... 3 Summary ............................................................................................................................................. 3 The Risk: Critical Materials .................................................................................................................. 3 Resources and Reserves ...................................................................................................................... 4 Tin resources and reserves calculation ........................................................................................... 5 ITA’s estimate of global tin resources and reserves ....................................................................... 6 Resources and Reserves by Region ..................................................................................................... 8 North America ................................................................................................................................. 8 South America ................................................................................................................................. 9 Africa ............................................................................................................................................. 10 Europe .......................................................................................................................................... -

Northwestern Iberian Tin Mining from Bronze Age

Northwestern Iberian Tin Mining from Bronze Age to Modern Times: an overview Beatriz Comendador Rey, Emmanuelle Meunier, Elin Figueiredo, Aaron Lackinger, João Fonte, Cristina Fernández Fernández, Alexandre Lima, José Mirão, Rui J.C. Silva To cite this version: Beatriz Comendador Rey, Emmanuelle Meunier, Elin Figueiredo, Aaron Lackinger, João Fonte, et al.. Northwestern Iberian Tin Mining from Bronze Age to Modern Times: an overview. A Celebration of the Tinworking Landscape of Dartmoor in its European context: Prehistory to 20th century, Dartmoor Tinworking Research Group, May 2016, Tavistock, United Kingdom. pp.133-153. hal-02024038 HAL Id: hal-02024038 https://hal.archives-ouvertes.fr/hal-02024038 Submitted on 21 Mar 2019 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Northwestern Iberian Tin Mining from Bronze Age to Modern Times: an overview Beatriz Comendador Rey1*, Emmanuelle Meunier2, Elin Figueiredo3, Aaron Lackinger1, João Fonte4, 1 5 6 3 Cristina Fernández Fernández , Alexandre Lima , José Mirão , Rui J.C. Silva 1. Grupo de Estudos de Arqueoloxía, Antigüidade e Territorio (GEAAT), Universidade de Vigo, Spain 2. Laboratoire TRACES (CNRS), University of Toulouse Jean Jaurès, France 3. Centro de Investigação em Materiais (CENIMAT/I3N), Faculdade de Ciências e Tecnologia, Universidade NOVA de Lisboa, Portugal 4. -

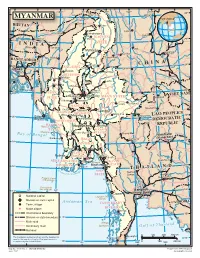

Map of Myanmar

94 96 98 J 100 102 ° ° Indian ° i ° ° 28 n ° Line s Xichang Chinese h a MYANMAR Line J MYANMAR i a n Tinsukia g BHUTAN Putao Lijiang aputra Jorhat Shingbwiyang M hm e ra k Dukou B KACHIN o Guwahati Makaw n 26 26 g ° ° INDIA STATE n Shillong Lumding i w d Dali in Myitkyina h Kunming C Baoshan BANGLADE Imphal Hopin Tengchong SH INA Bhamo C H 24° 24° SAGAING Dhaka Katha Lincang Mawlaik L Namhkam a n DIVISION c Y a uan Gejiu Kalemya n (R Falam g ed I ) Barisal r ( r Lashio M a S e w k a o a Hakha l n Shwebo w d g d e ) Chittagong y e n 22° 22° CHIN Monywa Maymyo Jinghong Sagaing Mandalay VIET NAM STATE SHAN STATE Pongsali Pakokku Myingyan Ta-kaw- Kengtung MANDALAY Muang Xai Chauk Meiktila MAGWAY Taunggyi DIVISION Möng-Pan PEOPLE'S Minbu Magway Houayxay LAO 20° 20° Sittwe (Akyab) Taungdwingyi DEMOCRATIC DIVISION y d EPUBLIC RAKHINE d R Ramree I. a Naypyitaw Loikaw w a KAYAH STATE r r Cheduba I. I Prome (Pye) STATE e Bay Chiang Mai M kong of Bengal Vientiane Sandoway (Viangchan) BAGO Lampang 18 18° ° DIVISION M a e Henzada N Bago a m YANGON P i f n n o aThaton Pathein g DIVISION f b l a u t Pa-an r G a A M Khon Kaen YEYARWARDY YangonBilugyin I. KAYIN ATE 16 16 DIVISION Mawlamyine ST ° ° Pyapon Amherst AND M THAIL o ut dy MON hs o wad Nakhon f the Irra STATE Sawan Nakhon Preparis Island Ratchasima (MYANMAR) Ye Coco Islands 92 (MYANMAR) 94 Bangkok 14° 14° ° ° Dawei (Krung Thep) National capital Launglon Bok Islands Division or state capital Andaman Sea CAMBODIA Town, village TANINTHARYI Major airport DIVISION Mergui International boundary 12° Division or state boundary 12° Main road Mergui n d Secondary road Archipelago G u l f o f T h a i l a Railroad 0 100 200 300 km Chumphon The boundaries and names shown and the designations Kawthuang 10 used on this map do not imply official endorsement or ° acceptance by the United Nations. -

The Micro-Geography of Nineteenth Century Cornish Mining?

MINING THE DATA: WHAT CAN A QUANTITATIVE APPROACH TELL US ABOUT THE MICRO-GEOGRAPHY OF NINETEENTH CENTURY CORNISH MINING? Bernard Deacon (in Philip Payton (ed.), Cornish Studies Eighteen, University of Exeter Press, 2010, pp.15-32) For many people the relics of Cornwall’s mining heritage – the abandoned engine house, the capped shaft, the re-vegetated burrow – are symbols of Cornwall itself. They remind us of an industry that dominated eighteenth and nineteenth century Cornwall and that still clings on stubbornly to the margins of a modern suburbanised Cornwall. The remains of this once thriving industry became the raw material for the successful World Heritage Site bid of 2006. Although the prime purpose of the Cornish Mining World Heritage Site team is to promote the mining landscapes of Cornwall and west Devon and the Cornish mining ‘brand’, the WHS website also recognises the importance of the industrial and cultural landscapes created by Cornish mining in its modern historical phase from 1700 to 1914.1 Ten discrete areas are inscribed as world heritage sites, stretching from the St Just mining district in the far west and spilling over the border into the Tamar Valley and Tavistock in the far east. However, despite the use of innovative geographic information system mapping techniques, visitors to the WHS website will struggle to gain a sense of the relative importance of these mining districts in the history of the industry. Despite a rich bibliography associated with the history of Cornish mining the historical geography of the industry is outlined only indirectly.2 The favoured historiographical approach has been to adopt a qualitative narrative of the relentless cycle of boom and bust in nineteenth century Cornwall. -

The World Bank

Documen; of The World Bank FOR OFFICIAL USE ONLY Report No. P-6821-CHA mEMORANDUMAND RECOMMENDATION OF THE PRESIDENT OF TRE INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT AND THE INTERNATIONAL DEVELOPMENTASSOCIATION TO THE EXECUTIVE DIRECTORS ON A PROPOSED LOAN OF $125 MILLION AND A PROPOSED CREDIT OF SDR 17.4 MILLION TO THE PEOPLE'S REPUBLIC OF CHINA FOR A YUNNAN ENVIRONMENT PROJECT May 28, 1996 This document has a restricted distribution and may be used by recipients only in the performnanceof their official duties. Its contents may not otherwise be disclosed without World Bank authorization. CURRENCY EQUIVALENTS (as of May 1, 1996) Currency = Renminbi Currency Unit = Yuan (Y) Y 1.00 = $0.12 $1.00 = Y 8.3 WEIGHTS AND MEASURES Metric System PRINCIPAL ABBREVIATIONS AND ACRONYMS USED DEAP - Dianchi Environmental Action Plan EPB - Envirotu-nental Protection Bureau EPCSL - Environmental Pollution Control Subloans LIBOR - London Interbank Borrowing Rate MCon - Ministry of Construction NEPA - National Environmental Protection Agency YPG - Yunnan Provincial Government GOVERNMENT FISCAL YEAR January 1 - December 31 FOROFFICIAL USE ONLY CHINA YUNNAN ENVIRONMENT PROJECT LOAN/CREDITAND PROJECTSUMMARY Borrower: The People's Republic of China. Beneficiaries: Yunnan Province; the Municipalities of Gejiu, Kunming and Qujing; the water supply companies of Kunming and Qujing; the wastewater companies of Gejiu, Kunming and Qujing; industrial enterprises. Poverty: Not applicable. Amount: Loan: $125 million. Credit: SDR 17.4 million ($25 million -

Yunnan Provincial Highway Bureau

IPP740 REV World Bank-financed Yunnan Highway Assets management Project Public Disclosure Authorized Ethnic Minority Development Plan of the Yunnan Highway Assets Management Project Public Disclosure Authorized Public Disclosure Authorized Yunnan Provincial Highway Bureau July 2014 Public Disclosure Authorized EMDP of the Yunnan Highway Assets management Project Summary of the EMDP A. Introduction 1. According to the Feasibility Study Report and RF, the Project involves neither land acquisition nor house demolition, and involves temporary land occupation only. This report aims to strengthen the development of ethnic minorities in the project area, and includes mitigation and benefit enhancing measures, and funding sources. The project area involves a number of ethnic minorities, including Yi, Hani and Lisu. B. Socioeconomic profile of ethnic minorities 2. Poverty and income: The Project involves 16 cities/prefectures in Yunnan Province. In 2013, there were 6.61 million poor population in Yunnan Province, which accounting for 17.54% of total population. In 2013, the per capita net income of rural residents in Yunnan Province was 6,141 yuan. 3. Gender Heads of households are usually men, reflecting the superior status of men. Both men and women do farm work, where men usually do more physically demanding farm work, such as fertilization, cultivation, pesticide application, watering, harvesting and transport, while women usually do housework or less physically demanding farm work, such as washing clothes, cooking, taking care of old people and children, feeding livestock, and field management. In Lijiang and Dali, Bai and Naxi women also do physically demanding labor, which is related to ethnic customs. Means of production are usually purchased by men, while daily necessities usually by women. -

Revisiting “Tin in South-Eastern Europe?”

https://doi.org/10.2298/STA2070085P UDC: 903.05034.6"637"(497191.2) Original research article WAYNE POWELL, Department of Earth and Environmental Science, Brooklyn College OGNJEN MLADENOVIĆ, Institute of Archaeology, Belgrade STEFFANIE CRUSE, Colorado School of Mines, Golden, Colorado H. ARTHUR BANKOFF, Department of Anthropology and Archaeology, Brooklyn College RYAN MATHUR, Department of Geology, Juniata College REVISITING “TIN IN SOUTH-EASTERN EUROPE?” email: [email protected] Abstract. – The important role of the Balkans in the origin and development of metallurgy is well established with respect to copper. In addition, Aleksandar Durman, in his 1997 paper “Tin in Southeastern Europe?”, essentially initiated studies into the role of the Balkans in Europe’s Bronze Age tin economy. He identified six geologically favourable sites for tin mineralisation and associated fluvial placer deposits in the former Yugoslavian republics, and suggested that these may have added to the tin supply of the region. The viability of two of these sites has been confirmed (Mt Cer and Bukulja, Serbia) but the exploitation potential for the other locations has remained untested. River gravels from these four sites (Motajica and Prosara in Bosnia and Herzegovina; Bujanovac in Serbia; Ogražden in North Macedonia) were obtained by stream sluicing and panning. The sites of Prosara and Bujanovac were found to be barren with respect to cassiterite (SnO2). Streams flowing from Motajica and Ogražden were both found to contain cassiterite, but in amounts several orders of magnitude less than at Mt Cer and Bukulja. Although it is possible that minor tin recovery occurred at Motajica and Ogražden, it is unlikely that they could have contributed meaningfully to regional tin trade. -

The Economic and Financial Study for the Kunming-Haiphong Expressway Project (Hanoi-Lao Cai)

TA 4050-VIE: Preparing Kunming-Haiphong Transport Corridor Project The Economic and Financial Study for the Kunming-Haiphong Expressway Project (Hanoi-Lao Cai) Final Report November 2005 TABLE OF CONTENS Project Map Preface Abbreviation Chapter 1. Background and Relevant Findings 1.1. Background 1 1.2. Scope of the Study (TOR) 2 1.3. Relevant Findings in Viet Nam 6 1.4. Relevant Findings in China (Yunnan Provinces) 7 1.5. International container cargo flow to/from Yunnan Province 10 Chapter 2. Profile for The Project Area 2.1. Overview of KHTC 12 2.2. Socio-Economic Background of Yunnan Province in China 18 2.3. Socio-Economic Background in Viet Nam 23 2.4. Socio-Economic Relationship Between PRC (Yunnan) and Viet Nam 28 2.4.1 Socio Economic Relationship Between PRC and Viet Nam 28 2.4.2 Socio Economic Relationship Between Yunnan and Viet Nam 30 2.5. Socio-Economic Issues on the Projected Area 32 Chapter 3. Traffic Demand forecasting 3.1.Introduction 33 3.2. Natural Growth Traffic 35 3.2.1 Baseline traffic 35 3.2.2 Growth rate for GDP per capita 36 3.2.3 Elasticity for of the Vehicle Growth rate compared to GDP per capita 36 3.3. Generated Traffic 39 3.4. Traffic demand for the expressway by toll options 41 3.5. Diverted Traffic 43 3.6. Motorbike/Lambretta issues 44 3.7. Conclusion 45 Chapter 4. Initial Alignment and Cost Estimation for the Expressway 4.1 Introduction 47 4.2 Technical Specification 47 4.2.1 Technical Specification Review 47 4.2.2 Criteria for consideration of lane number 50 4.2.3 Consideration for number of lanes 50 4.2.4 Technical Specification 52 4.3.