V/ - Video Games ★ Vidya Gaems

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Contributors

gems_ch001_fm.qxp 2/23/2004 11:13 AM Page xxxiii Contributors Curtis Beeson, NVIDIA Curtis Beeson moved from SGI to NVIDIA’s Demo Team more than five years ago; he focuses on the art path, the object model, and the DirectX ren- derer of the NVIDIA demo engine. He began working in 3D while attending Carnegie Mellon University, where he generated environments for playback on head-mounted displays at resolutions that left users legally blind. Curtis spe- cializes in the art path and object model of the NVIDIA Demo Team’s scene- graph API—while fighting the urge to succumb to the dark offerings of management in marketing. Kevin Bjorke, NVIDIA Kevin Bjorke works in the Developer Technology group developing and promoting next-generation art tools and entertainments, with a particular eye toward the possibilities inherent in programmable shading hardware. Before joining NVIDIA, he worked extensively in the film, television, and game industries, supervising development and imagery for Final Fantasy: The Spirits Within and The Animatrix; performing numerous technical director and layout animation duties on Toy Story and A Bug’s Life; developing games on just about every commercial platform; producing theme park rides; animating too many TV com- mercials; and booking daytime TV talk shows. He attended several colleges, eventually graduat- ing from the California Institute of the Arts film school. Kevin has been a regular speaker at SIGGRAPH, GDC, and similar events for the past decade. Rod Bogart, Industrial Light & Magic Rod Bogart came to Industrial Light & Magic (ILM) in 1995 after spend- ing three years as a software engineer at Pacific Data Images. -

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

Exploration in a Reverse-RPG

Exploration in a Reverse-RPG Robogeddon, a Casual Real-Time Strategy Game A Major Qualifying Project Report submitted to the Faculty of the Worcester Polytechnic Institute in partial fulfillment of the requirements of the Degree of Bachelor of Science On April 28th, 2010 Submitted By: Riley Brown, Sean Crepeau, Karl Gibson, Adam Pastorello, Philip Tang, and Ian Williams Advised By: Professor Joseph Farbrook, Professor Jennifer deWinter and Professor Joseph Beck Exploration in a Reverse RPG – Robogeddon, a Casual Real-Time Strategy Game Abstract This report discusses the design, implementation, and analysis of Robogeddon, a casual real-time- strategy game for the PC, and was created as a WPI MQP for the computer science, interactive media and game development, and professional writing majors. Players in Robogeddon have the unique experience of taking on the role of an overwhelming agent of destruction, in contrast to the typical heroic archetype of many role-playing-games. Robogeddon incorporates “tried and true” elements from classic RTS games, as well as unique new features to attract more casual gamers. This report details the designers’ vision, in terms of artistic style and theme, as well as gameplay and the player experience. Additionally, the report will describe the approach to implementation and the challenges therein. Finally, the creators of Robogeddon describe the lessons learned from the process, and advice to future teams at WPI and beyond. 2 Exploration in a Reverse RPG – Robogeddon, a Casual Real-Time Strategy Game Acknowledgements We would like to extend our deepest gratitude to Professors Farbrook, deWinter, and Beck for their continual guidance in bringing our vision to life. -

Cheers to Oktoberfest Ames Celebrates with Drinks, Fun

Iowa State Daily, October 2019 Iowa State Daily, 2019 10-14-2019 Iowa State Daily (October 14, 2019) Iowa State Daily Follow this and additional works at: https://lib.dr.iastate.edu/iowastatedaily_2019-10 Recommended Citation Iowa State Daily, "Iowa State Daily (October 14, 2019)" (2019). Iowa State Daily, October 2019. 16. https://lib.dr.iastate.edu/iowastatedaily_2019-10/16 This Book is brought to you for free and open access by the Iowa State Daily, 2019 at Iowa State University Digital Repository. It has been accepted for inclusion in Iowa State Daily, October 2019 by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. An independent student newspaper serving Iowa State since 1890 59 45 10.14.2019 Vol. 220 No. 035 MONDAY Cheers to Oktoberfest Ames celebrates with drinks, fun BY JAKE.WEBSTER @iowastatedaily.com The 2019 Ames Oktoberfest featured music, a variety of beers and wines, the Iowa State vs. West Virginia football game and SYDNEY NOVAK/ IOWA STATE DAILY several yard games for entertainment. Nicholas Ryan, freshman in open option, went to various activities with Oktoberfests are held across the world to his family during Family Weekend. Ryan’s parents said they were most celebrate German culture — including its excited to learn more about a typical day for him at Iowa State. music, food and beverages. The first 1,000 people who entered the venue for the eighth annual Ames Family Weekend Oktoberfest, held in the parking lot of Main Street Station, received a free beer mug. offers new activities as Iowa Brewing Company’s “Bohemian Rapids” beer was skillfully poured by one of the individuals running the taps at attendance increases Oktoberfest. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

Embracer Group

Update Equity Research 2 December 2019 Embracer Group Sector: Gaming Unmotivated share price drop FAIR VALUE RANGE BEAR BASE BULL Beating estimates, again 60.0 100.0 125.0 Embracer crushed our estimates during FY’Q2, the top-line came in 25% above forecast, and Operational EBIT showed a 53% beat. As expected, there was a significant decline in volumes within Partner Publishing, so on an annual basis, the net sales were down 1%. EMBRAC.ST VERSUS OMXS30 However, the Gross profit grew by almost 66%, thanks to the uptake in Games revenue. The OMXS 30 Operational EBIT margin came in at 19% compared to our estimate of 16%. On a trailing- Embracer Group 10.0 twelve -month basis, Embracer has produced almost SEK 2bn in cash flow from operations and continues to show a high cash conversion ratio. 8.0 6.0 Investing for the future 4.0 Embracer continues to invest in its pipeline, and the game investments amounted to SEK 2.0 343m during the quarter. The company now has 86 projects in development, where we 0.0 know that at least two are AAA projects that are expected to be released during the next 03-dec 03-mar 01-jun 30-aug 28-nov financial year. The ratio between released games and ongoing development projects on the balance sheet now amounts to 4x; in other words, continued growth is to be expected. REDEYE RATING Shenmue III was released on the 19th of November. The early user reviews indicate strong receptions from fans but mixed from critics. -

THQ Nordic AB (Publ) Acquires Koch Media

THQ Nordic AB (publ) acquires Koch Media Investor Presentation February 14, 2018 Acquisition rationale AAA intellectual property rights Saints Row and Dead Island Long-term exclusive licence within Games for “Metro” based on books by Dmitry Glukhovsky 4 AAA titles in production including announced Metro Exodus and Dead Island 2 2 AAA studios Deep Silver Volition (Champaign, IL) and Deep Silver Dambuster Studios (Nottingham, UK) #1 Publishing partner in Europe for 50+ companies Complementary business models and entrepreneurial cultural fit Potential revenue synergy and strong platform for further acquisitions EPS accretive acquisition to THQ Nordic shareholders 2 Creating a European player of great scale Internal development studios1 7 3 10 External development studios1 18 8 26 Number of IPs1 91 15 106 Announced 12 5 17 Development projects1 Unannounced 24 9 33 Headcount (internal and external)1 462 1,181 1,643 Net sales 2017 9m, Apr-Dec SEK 426m SEK 2,548m SEK 2,933m2 Adj. EBIT 2017 9m, Apr-Dec SEK 156m SEK 296m3 SEK 505m2,3 1) December 31, 2017. 2) Pro forma. 3) Adjusted for write-downs of SEK 552m. Source: Koch Media, THQ Nordic 3 High level transaction structure THQ Nordic AB (publ) Koch Media Holding GmbH, seller (Sweden) (Germany) Purchase price EUR 91.5m 100% 100% SALEM einhundertste Koch Media GmbH, Operations Holding GmbH operative company (Austria) 100% (Austria) Pre-transaction Transaction Transaction information . Purchase price of EUR 91.5m – EUR 66m in cash paid at closing – EUR 16m in cash paid no later than August 14, 2018 – EUR 9.5m in shares paid no later than June 15, 2018 . -

Zeitschrift Für Kanada-Studien

Zeitschrift für Kanada-Studien Im Auftrag der Gesellschaft für Kanada-Studien herausgegeben von Katja Sarkowsky Martin Thunert Doris G. Eibl 36. Jahrgang 2016 Herausgeber der Zeitschrift für Kanada-Studien (ZKS) ist die GESELLSCHAFT FÜR KANADA-STUDIEN vertreten durch Vorstand und Wissenschaftlichen Beirat Vorstand Prof. Dr. Caroline Rosenthal, Friedrich-Schiller-Universität Jena, Institut für Anglistik/Amerikanistik, Lehrstuhl für Amerikanistik, Ernst-Abbe-Platz 8, 07743 Jena Prof. Dr. Kerstin Knopf, Universität Bremen, Fachbereich 10: Sprach- und Literaturwissenschaften, Lehrstuhl für Postcolonial Literary and Cultural Studies, Bibliotheksstraße 1 / Gebäude GW 2, 28359 Bremen Prof. Dr. Bernhard Metz, Schatzmeister, Albrecht-Dürer-Str. 12, 79331 Teningen Wissenschaftlicher Beirat Sprache, Literatur und Kultur im anglophonen Kanada: Prof. Dr. Brigitte Johanna Glaser, Georg- August-Universität Göttingen, Seminar für Englische Philologie, Käte-Hamburger-Weg 3, 37073 Göttingen Sprache, Literatur und Kultur im frankophonen Kanada: Prof. Dr. Hans-Jürgen Lüsebrink, Universität des Saarlandes, Fakultät 4 – Philosophische Fakultät II, Romanistik, Campus A4 -2, Zi. 2.12, 66123 Saarbrücken Frauen- und Geschlechterstudien: Prof. Dr. Jutta Ernst, Johannes Gutenberg-Universität Mainz, Ame- rikanistik, Fachbereich 06: Translations-, Sprach- und Kulturwissenschaft, An der Hochschule 2, 76726 Germersheim Geographie und Wirtschaftswissenschaften: Prof. Dr. Ludger Basten, Technische Universität Dort- mund, Fakultät 12: Erziehungswissenschaft und Soziologie, Institut für Soziologie, Wirtschafts- und Sozialgeographie, August-Schmidt-Str. 6, 44227 Dortmund Geschichtswissenschaften: Prof. Dr. Michael Wala, Ruhr-Universität Bochum, Fakultät für Geschichts- wissenschaft, Historisches Institut, Universitätsstr. 150, 44780 Bochum Politikwissenschaft und Soziologie: Prof. Dr. Steffen Schneider, Universität Bremen, SFB 597 „Staat- lichkeit im Wandel”, Linzer Str. 9a, 28359 Bremen Indigenous and Cultural Studies: Dr. Michael Friedrichs, Wallgauer Weg 13 F, 86163 Augsburg Herausgeber Prof. -

Viggo: a Video Game Corpus for Data-To-Text Generation in Open-Domain Conversation

ViGGO: A Video Game Corpus for Data-To-Text Generation in Open-Domain Conversation Juraj Juraska, Kevin K. Bowden and Marilyn Walker Natural Language and Dialogue Systems Lab University of California, Santa Cruz fjjuraska,kkbowden,[email protected] Abstract give opinion(NAME [SpellForce 3], RATING [poor], GENRES [real-time strategy, role-playing], PLAY- The uptake of deep learning in natural lan- ER PERSPECTIVE [bird view]) guage generation (NLG) led to the release of I think that SpellForce 3 is one of the worst games I’ve both small and relatively large parallel corpora ever played. Trying to combine the real-time strategy for training neural models. The existing data- and role-playing genres just doesn’t work, and the bird’s to-text datasets are, however, aimed at task- eye view makes it near impossible to play. oriented dialogue systems, and often thus lim- verify attribute(NAME [Little Big Adventure], RAT- ited in diversity and versatility. They are typ- ING [average], HAS MULTIPLAYER [no], PLATFORMS ically crowdsourced, with much of the noise [PlayStation]) left in them. Moreover, current neural NLG I recall that you were not that fond of Little Big Ad- models do not take full advantage of large venture. Does single-player gaming on the PlayStation training data, and due to their strong gener- quickly get boring for you? alizing properties produce sentences that look template-like regardless. We therefore present Table 1: Examples of MRs and corresponding refer- a new corpus of 7K samples, which (1) is clean ence utterances in the ViGGO dataset. The DA of the despite being crowdsourced, (2) has utterances MRs is indicated in italics, and the slots in small caps. -

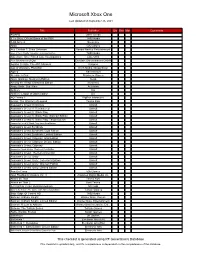

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

Weekly News Digest #47

INVESTGAME Nov 16 — Nov 22, 2020 Weekly News Digest #47 Hi everyone, Last week we decided to create the archive of the weekly newsletter for your convenience — click here to access it. Roblox to go public on the New York Stock Exchange CAbased video game platform Roblox has filed its S1 registration documents targeting an IPO on NYSE before the end of this year. Roblox has neither disclosed the sum it’s planning to raise, nor the valuation of the company. Founded in 2004, Roblox Corporation has raised $335.9m investments over the course of 8 rounds with the most recent Series G round closed in Feb 2020 — raising $150m at a $4B postmoney valuation. Just eight months later in Oct 2020, Roblox’s rumored potential IPO valuation was said to be $8B. Such an impressive valuation enhancement could be explained by the strong demand for entertainment content due to COVID19 and shelterinplace orders (Roblox’s DAUs increased by 90% from 19.1m in Q4’19 to 36.2m DAU in Q3’20). The company’s financial results over the last twelve months ending 30 Sep 2020 are: > $1,477m Bookings vs. $727m Revenue — Roblox gradually recognizes revenue over the average lifetime of a paying user; > ($245m) Loss from operations vs. +$301m Free cash flow. Roblox is an operationally profitable business (taking into account bookings numbers), and we consider the rumored $8B as a probable valuation at IPO. The valuation multiples in such case would be 5.4x Bookings, 11.0x Revenue, and 27x Free cash flow. -

Interim Report • 1 January – 30 September 2018

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 INTERIM REPORT • 1 JANUARY – 30 SEPTEMBER 2018 EBIT INCREASED 278% TO SEK 90.8 MILLION We had another stable quarter with continued momentum. The strategy of diversification is paying off. Net sales increased by 1,403% to a record SEK 1,272.7 million in the quarter. EBITDA increased by 521% to SEK 214.8 million and EBIT increased by 278% to SEK 90.8 million compared to the same period last year. The gross margin percentage decreased due to a large share of net sales with lower margin within Partner Publishing. Cash flow from operating activities in the quarter was SEK –740.1 million, mainly due to the decision to replace forfaiting of receivables with bank debt within Koch Media. Both THQ Nordic and Koch Media contributed to the group’s EBIT during the quarter. Net sales in the THQ Nordic business area were up 47% to SEK 124.2 million. This was driven by the release of Titan Quest, Red Faction Guerilla Re-Mars-tered and This is the Police 2, in addition to continued performance of Wreckfest. Net sales of Deep Silver were SEK 251.8 million, driven by the release of Dakar 18 and a good performance of Pathfinder Kingmaker at the end of the quarter. The digital net sales of the back-catalogue in both business areas continued to have solid performances. Our Partner Publishing business area had a strong quarter driven by significant releases from our business partners Codemasters, SquareEnix and Sega. During the quarter, we acquired several strong IPs such as Alone in the Dark, Kingdoms of Amalur and Time- splitters.