Download Full Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report for the Year 2019-20

CIRCUIT HOUSE AT RUPA Completed during 2019-20 ARUNACHAL BHAWAN, MOHANBARI Completed during 2019-20 GOVERNMENT OF ARUNACHAL PRADESH PUBLIC WORKS DEPARTMENT ITANAGAR ANNUAL REPORT 2019-20 Visitor seating facility at Multipurpose Cultural Hall, Namsai Preface This Annual Report of the Public Works Department is prepared in the office of the Chief Engineer (SID&P) by compiling the achievements under the different zone during a financial year. The main objectives are to document and highlight the achievement of the department in execution of infrastructure as construction agency of the Gov- ernment. This process of publication of Annual Report is a legacy carried over from the process of submitting Annual Administrative Report during the time of CPWD in the State. During the year 2017-18, the achievements in construction of infrastructure under PWD were collected and the first edition of the annual report was published. The Annual Report 2017-18 & 2018-19 was circulated to all stake holders and made available in the official website www.arunachalpwd.org. The Annual Report 2018-19 was rated and ready reference source for important achieve- ments of PWD during 2018-19 and references for guidelines of CSS schemes being executed by PWD. In addition, while circulating the Annual Report 2018-19, it was requested that henceforth, the Annual Report shall be made an annual affair and to make it more befitting document for highlighting the achievements in each year, it was -re quested that the information may be submitted in time and as per the prescribed format, after the compilation of the financial and physical account of each preceding year. -

The Adi House: Manifestation of Traditional Wisdom ~~R.N

ARUNACHAL A monthly english journal DECEMBER 2018 1 REVIEW The Adi House: Manifestation of Traditional Wisdom ~~R.N. Koley he Adis, the blanket name fulfillment of the basic needs away from it. Even, every Adi Tof some sub-groups are in- and the requirements of com- village depicts a definite pat- habited in Siang Valley the cen- munity members. Traditions tern in housing. Prospect of tral part of Arunachal Pradesh. and socio-cultural heritage are water, sunlight and drainage They are comprising around uniformly inherited by individu- facility of domestic waste to- one fourth of the tribal popula- als and society. wards lower slope at a village tion of this state. They are hav- The traditional house site are always wisely taken ing unique tradition and rich of the Adis are constructed in consideration with utmost cultural heritage of their own. with bamboos, woods, canes, importance. All these tradi- In Arunachal Pradesh every leaves etc. which are found tional mechanism reveal a ethnic community has own ar- abundant in their surround- foresight and scientific think- chitectural design of house as ings. Till today the construction ing as outcome of deep expe- part of their traditional wisdom is made always on community rience based on century old to cope with their ecology. Like- or collective basis to which all behavioral science. Security of wise the Adis have own tradi- the abled body villagers con- the houses is also major con- tional architect in constructing tribute their labour spontane- cern in early days. In a village their houses which are tested ously as part of century old tra- houses are camouflaged with over the time. -

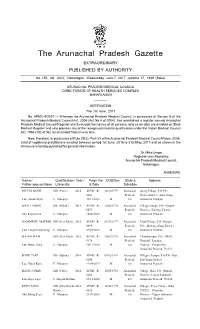

The Arunachal Pradesh Gazette EXTRAORDINARY PUBLISHED by AUTHORITY

The Arunachal Pradesh Gazette EXTRAORDINARY PUBLISHED BY AUTHORITY No. 155, Vol. XXIV, Naharlagun, Wednesday, June 7, 2017 Jyaistha 17, 1939 (Saka) ARUNACHAL PRADESH MEDICAL COUNCIL DIRECTORATE OF HEALTH SERVICES COMPLEX NAHARLAGUN ———— NOTIFICATION The 1st June, 2017 No. APMC-9/2007.— Whereas the Arunachal Pradesh Medical Council, in pursuance of Section 8 of the Arunachal Pradesh Medical Council Act, 2004 (Act No.4 of 2004), has maintained a register namely Arunachal Pradesh Medical Council Register which records the names of all persons, who as on date are enrolled on State Medical Register and who possess any of the recognized medical qualification under the Indian Medical Council Act, 1956 (102 of 56), as amended from time to time. Now, therefore, in pursuance of Rule 29(2), Part-VII of the Arunachal Pradesh Medical Council Rules, 2006, a list of registered practitioners enrolled between period 1st June, 2016 to 31st May, 2017 and as shown in the Annexure is hereby published for general information. Dr. Mika Umpo Registrar-cum-Secretary, Arunachal Pradesh Medical Council, Naharlagun. ANNEXURE Name / Qualification / Year / Regn. No DOB/Sex State & Address Father-spouse Name University & Date Schedule DILEM MODI MD (Path.) 2014 APMC /R/ 24/10/1979 Arunachal Ayeng Village, P.O/P.S:- 0041 Pradesh Mebo, District :-East Siang, Late Tonak Modi U. Manipur 30/11/2016 M 1st Arunachal Pradesh KIPA TUBING MS (Ophth.) 2014 APMC /R/ 23/06/1978 Arunachal Village:-Sango, P.O:- Nyapin, 0077 Pradesh District:- Kurung Kumey, Shri Kipa Kama U. Manipur 15/06/2016 M 1st Arunachal Pradesh GAMMENG MATPAK MD (Gen.Med.) 2015 APMC /R/ 01/03/1977 Arunachal Tarak Village, P.O:- Pangin, 0099 Pradesh P.O :- Boleng, Siang District, Late Tangiat Gammeng U. -

3 T-^A?ISTICS OP’ WEST SIANG DISTRICT 1988-89

GOVT. OF A R U N A C H A L PRADESH wu*H«n* b l o c k : l e 'T’ e 3 T-^a?ISTICS OP’ WEST SIANG DISTRICT 1988-89 PUBLISHED BY: OFFICE OF THE DEPUTY COMMISSIONER ( ECONOMICS AND STATISTICS BRANCH ) WEST SIANG DISTRICT Ar<ONG . 78X OOl ARUNACHAL PRADESH The booklet entitled " Block Level Statis tics of West Siang District 1988-89” is the 4th issue brought out by the Economics and Statistics Branch of office of the Deputy Commissioner/West Siang District Aloneo The Government/.both State and Central have implemented various socio-economic development progr ammes for uplif:: of alround development of concerned block in particular and the District as a whole. xhis booklet will help the Government/the administrators, Research Workers and Sclolars to fo rmulate procrramir.e and Policies and conduct other So- cio-Economics and Socio-cultural studies. I am grateful to the District Statistical O fficer/ and his tram of staffs for the efforts they have taken to publish this booklet and the heads of departm^ent in the District for extension of co-oper- ation r-c;ndered to Statistics Branch in providing in formations relating to tVieir respective departments, I v/iksh the publication all success. O G (T. / V G ( S. Pao ), G Deputy Commissioner , G West Siang District .Along Arunachal Pradesh. ii L a la / I gI NIEPA DC D06127 S 4 l(3 fr 310 ] ( \ j B J ? A/.*,/■ ■y or I N r P. O D U C T I C N * The Block !■ vel Statistics of V'/est Siang District 1988-t3 is the fourth issue of its annual series* * J This PublicatioE is prepared as per ^ directives and guidence of the Director or Economics ■M and Statistics, Govt of ^.runachal Pradesh/ Shillong. -

Histrical Background Changlang District Covered with Picturesque Hills Lies in the South-Eastern Corner of Arunachal Pradesh, Northeast India

Histrical Background Changlang District covered with picturesque hills lies in the south-eastern corner of Arunachal Pradesh, northeast India. It has an area of 4,662 sqr. Km and a population of 1,48,226 persons as per 2011 Census. According to legend the name Changlang owes its origin to the local word CHANGLANGKAN which means a hilltop where people discovered the poisonous herb, which is used for poisoning fish in the river. Changlang District has reached the stage in its present set up through a gradual development of Administration. Prior to 14th November 1987, it was a part of Tirap District. Under the Arunachal Pradesh Reorganization of Districts Amendment Bill, 1987,the Government of Arunachal Pradesh, formally declared the area as a new District on 14th November 1987 and became 10th district of Arunachal Pradesh. The legacy of Second World War, the historic Stilwell Road (Ledo Road), which was constructed during the Second World War by the Allied Soldiers from Ledo in Assam, India to Kunming, China via hills and valleys of impenetrable forests of north Burma (Myanmar) which section of this road is also passed through Changlang district of Arunachal Pradesh and remnant of Second World War Cemetery one can see at Jairampur – Nampong road. Location and Boundary The District lies between the Latitudes 26°40’N and 27°40’N, and Longitudes 95°11’E and 97°11’E .It is bounded by Tinsukia District of Assam and Lohit District of Arunachal Pradesh in the north, by Tirap District in the west and by Myanmar in the south-east. -

Changlang District the ICT Initiatives in the Land of Bio-Diversity

District Informatics Changlang District The ICT initiatives in The Land of Bio-diversity Edited by KAVITA BARKAKOTY he Changlang District, which is one of the easternmost districts of India, is located in the During the Covid-19 pandemic Tsouth-eastern corner of Arunachal Pradesh, having an international boundary with Myanmar period ICT services of the (Burma) in the east and the south. It has an area of National Informatics Centre, 4,662 sq. Km and a population of 1, 48,226 persons as per the 2011 Census. Changlang District was created Changlang District Centre became as the 10th District of the Arunachal Pradesh on 14 November 1987 by carving out part of Tirap District. all the more important. The NIC District Centre, Changlang District Centre in collaboration With its inception in July 1989, NIC Changlang district Centre started its journey with just one NIC with the State Centre officer and a single 386 machine with a handful of Changlang NIC Website has become a implemented various services, terminals. However, the modest resources did not come in their way towards providing ICT support to the single-window platform for accessing var- which facilitated the emergency district administration and in the implementation of ious citizen services, certificate applica- ICT-based citizen services and government schemes tions, Tender notices, Beneficiary details movement of people and goods. in the district. Being one of the remotest districts of Government schemes, and tourism-re- of the country with no other ISPs, in the early years lated information & services. Support was also provided to NICNET played a pivotal role in providing Internet 24x7 IVR helpline for public grievanc- es, e-passes, and online portal for goods help the District Administration in services to the district administration and other departments in the district. -

Districtwise Subsidy 1

DISTRICTWISE UNITS PRESENTLY ENJOYING BENEFITS UNDER THE CONETRAL TRANSPORT SUBSIDY SCHEME. SL. NAME OF NAME OF THE BENEFICIARY UNIT WITH ADDRESS NO. DISTRICTS 1 M/s Gamlin Fabrications, Industrial Estate, Naharlagun, Papum Pare District. Papum Pare 2 M/s Arunachal Furniture, Industrial Estate, Naharlagun, Papum Pare District Papum Pare 3 M/s L.T. Enterprise, Zero Point, Papum Pare District Papum Pare 4 M/s Tama Builders Consultant (P) Ltd., 'A' Sector, Naharlagun, Papum Pare District Papum Pare 5 M/s Kuku Engineering & Industrial Works, Naharlagun, Papum Pare District Papum Pare 6 M/s Taba Engineering Works, Naharlagun, Papum Pare District Papum Pare 7 M/s Premium Craft Korogation, Nirjuli, Papum Pare District Papum Pare 8 M/s Satyam Ispat, N.H. 52, Banderdewa, Papum Pare District Papum Pare 9 M/s SMS Smelters Ltd., Lekhi Village, Naharlagun, Papum Pare District Papum Pare 10 M/s Satyam Ispat NE Ltd., Banderdewa, Papum Pare District Papum Pare 11 M/s Satyam Coke, Banderdewa, Papum Pare District Papum Pare 12 M/s Dari Steel Fabrication, Palin, Kurung Kumey District Kurung Kumey 13 M/s Benzi Eastern Flour Mill, Tezu, Lohit District Lohit 14 M/s Topu Industries, Model Village, Naharlagun, Papum Pare District Papum Pare 15 M/s Taba Enterprise, Naharlagun, Papum Pare District Papum Pare 16 M/s Darbar Industries, Naharlagun, Papum Pare District Papum Pare 17 M/s Yangyio Fabrication Industries, Khimin, Papum Pare District Papum Pare 18 M/s Yayum Weaving Centre, khimin, Papum Pare District Papum Pare 19 M/s Yora Tobam Steel Fabrication, T.T. Marg, Itanagar, Papum Pare District Papum Pare 20 M/s Tai Enterprise, Kharsang, Changlang District Changlang 21 M/s Mount Valley Foods (P) Ltd., Bordumsa, Changlang District Changlang 22 M/s Bulo Steel Fabricator, Daporijo, Upper Subansiri District Upper Subansiri 23 M/s Pertin Wire Products, Yingkiong, Upper Siang District Upper Subansiri 24 M/s Siang Fruit Canning Factory, Nigmoi, East Siang District East Siang DISTRICTWISE UNITS ENJOYED BENEFITS UNDER THE SCHEME BUT CEASED TO AVAIL THE CENTRAL TRANSPORT SUBSIDY SL. -

Shri Dorjee Khandu Hon’Ble Chief Minister Arunachal Pradesh

SPEECH OF SHRI DORJEE KHANDU HON’BLE CHIEF MINISTER ARUNACHAL PRADESH AT THE 54TH NDC MEETING AT VIGYAN BHAVAN New Delhi December 19, 2007 54TH NDC MEETING SPEECH OF SHRI DORJEE KHANDU HON’BLE CHIEF MINISTER ARUNACHAL PRADESH 2 Hon’ble Prime Minister and the Chairman of NDC, Hon’ble Deputy Chairman, Planning Commission, Hon’ble Union Ministers, My colleague Chief Ministers, Distinguished members of the Planning Commission, Senior Officers, Ladies and Gentlemen. It is indeed a proud privilege and honour for me to participate in this 54th NDC meeting. This meeting has been convened essentially to consider and approve the Draft 11th Five Year Plan (2007-2012). The visionary and comprehensive Eleventh Five Year Plan envisions to steer the process of development through rapid reduction of poverty and creation of employment opportunities, access to essential services like health and education specially for the poor, equality of opportunity, empowerment through education and skill development to meet the objectives of inclusiveness and sustainability . However, I would like to share our views on some of the important issues and recommendations highlighted in the agenda. 2) Let me start with reiterating what our Hon’ble Prime Minister has stated in his Independence Day address on 15th August 2005. “ in this new phase of development, we are acutely aware that all regions of the country should develop at the same pace. It is unacceptable for us to see any region of the country left behind other regions in this quest for development. In every scheme of the Government, we will be making all efforts to ensure that backward regions are adequately taken care of. -

Work Wise Details (RIDF State Share)

GOVERNMENT OF ARUNACHAL PRADESH PUBLIC WORKS DEPARTMENT SPECIAL ASSISTANCE PACKAGE (SAP) ANNUAL OPERATING PLAN 2007-2008 VOLUME – E COMMUNICATION SECTOR R.I.D.F. (NABARD) STATE SHARE I N D E X RURAL INFRASTRUCTURE DEVELOPMENT FUND (RIDF) Page No. Sl. No. Name of Division From To 12 34 FORMATS CSS-I (PART-I) 1 3 CSS-II (PART-I) 1 5 1. Tawang 1 2. Bomdila 2 3. Bameng 3 4. Seppa 4 5. Ziro 5 6 6. Sangram 7 9 7. Basar 10 8. Mariyang 11 9. Yingkiong 12 10. Roing 13 11. Jairampur 14 12. Khonsa 15 13. Longding 16 Page 1 FORMAT : CSS-I SPECIAL ASSISTANCE PACKAGE (SAP) ANNUAL OPERATING PLAN : 2007-2008 RURAL INFRASTRUCTURE DEVELOPMENT FUND (NABARD) (Rs. in lakh) Sl. Name of the Scheme Pattern of sharing Estimated Cost (State Share)Cummulative Expenditure Balance Proposed Outlay Remarks No. Expenditure during 9th & 10th Plan Estimated Cost 2007-2008 between Centre and period till March,2007 State Original Revised Total State State Share State Share 1 2 3 5 14 17 19 1 Ring Road at Zemithung (10.80 Km) in Centre - 80% 205.41 205.41 205.41 85.40 S/Culvert-20 Nos & Tawang District State - 20% R&B Wall-300 mtr Non-Divertable 2 Dirang-Tawang BRO Road to Sangti Centre - 80% 169.34 169.34 121.50 47.84 47.85 B/Topping-2.72 Km & Khali Bok via Khaso (14.50 km). State - 20% Steel Bridge-100% Non-Divertable 3 Road from Seppa-Chayangtajo to Centre - 80% 50.89 50.89 50.89 50.90 F/Cutting-3.50 Km Bameng (15.00 Km) in East Kameng State - 20% Non-Divertable District 4 Road from PWD IB to Bali in Seijosa Centre - 80% 252.47 252.47 252.47 100.45 F/Cutting-4.60 Km & (14.60 Km) in East Kameng District State - 20% S/Culvert-10 Nos Non-Divertable 5 Yazali-Mangio Road, (65.00 Km) Centre - 90% 281.99 142.60 424.59 242.36 182.23 82.25 S/Culvert-20 Nos & SH: F/C, Culverts, R&B Wall, State - 10% SBC-85.00 Km Sol, WBM, B/Topping i/c Bridges. -

Our Human Resources

DEPARTMENT OF POWER COMMISSIONER (POWER) Chief Engineer Chief Engineer Chief Engineer Chief Engineer Chief Electrical Inspector (Transmn. P & M Zone) Eastern Electrical Zone (19/03/2005) Central Electrical Zone (19/04/2012) Western Electrical Zone (13/09/2005) (20/03/12) SF & AO SE (PLG).-I SE (PLG)-II SE (PLG.) SE (PLG.) SE (PLG.) EE(PLG.) -I EE(PLG.) -II EE(PLG.)-III EE-I EE-II EE-III EE(PLG.)-I EE(PLG.)-II EE(PLG.)-III EE(PLG.)-IV EE(PLG.)-I EE(PLG.)-II EE(PLG.)-III Administrative Officer AE (PLG.) - I AE (PLG.) - II AE (PLG.) - I AE (PLG.) - II AE (PLG.) - I AE (PLG.) - II AE (PLG.) - I AE (PLG.) - I APEC-VII, Tezu APEC - III, Miao APEC-VI, Aalo APEC - II, Pasighat APEC - V, Ziro APEC - I, Nlgn APEC - IV, Dirang APEC-VIII, SUBU Transmission Circle, Itanagar EE (PLG.) EE (PLG.) EE (PLG.) EE (PLG.)-IEE (PLG.)-II EE (PLG.) EE(PLG.)-I EE(PLG.)-II EE (PLG.) EE (PLG.) SEI, SEI, WEST EAST Itanagar Pasighat AE (PLG.) AE (PLG.) AE (PLG.) AE (PLG.) AE (PLG.) AE (PLG.) AE (PLG.) AE (PLG.) Anini Roing Namsai Miao Yatdam Deomali Longding Aalo Basar Pasighat Ziro Daporijo Itanagar Sagalee Naharlagun Tawang Bomdila Rupa Seppa Transmn. & Hayuliang Rumgong Yingkiong Transmn. Transmn. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Elect. Sangram Elect. Division Elect. Elect. Elect. Elect. Elect. Elect. Elect. SLDC Division - I Division - III Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division Division - II HQ Bomdila HQ, Tezu EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE EE Tawang, West Kameng, Lohit, Namsai, East Kameng Anjaw HQ, Roing HQ, Itanagar AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) AE(PLG.) Dibang Valley, Papum Pare Lower Dibang Valley HQ, Ziro Ind. -

Kibithoo Can Be Configured As an Entrepôt in Indo- China Border Trade

ISSN (Online) - 2349-8846 Kibithoo Can Be Configured as an Entrepôt in Indo- China Border Trade JAJATI K PATTNAIK Jajati K. Pattnaik ([email protected]) is an Associate Professor, at the Department of Political Science, Indira Gandhi Government College, Tezu (Lohit District), Arunachal Pradesh Vol. 54, Issue No. 5, 02 Feb, 2019 Borders are the gateway to growth and development in the trajectory of contemporary economic diplomacy. They provide a new mode of interaction which entails de-territorialised economic cooperation and free trade architecture, thereby making the spatial domain of territory secondary in the global economic relations. Taking a cue from this, both India and China looked ahead to revive their old trade routes in order to restore cross-border ties traversing beyond their political boundaries. Borders are the gateway to growth and development in the trajectory of contemporary economic diplomacy. They provide a new mode of interaction which entails de-territorialised economic cooperation and free trade architecture, thereby making the spatial domain of territory secondary in the global economic relations. Taking a cue from this, both India and China looked ahead to revive their old trade routes in order to restore cross-border ties traversing beyond their political boundaries. The reopening of the Nathula trade route in 2016 was realised as a catalyst in generating trust and confidence between India and China. Subsequently, the success of Nathula propelled the academia, policymakers and the civil society to rethink the model in the perspective of Arunachal Pradesh as well. So, the question that automatically arises here is: Should we apply this cross-border model in building up any entrepôt in Arunachal Pradesh? The response is positive and corroborated by my field interactions at the ground level. -

Governmnet of Arunachal Pradesh Office of the Deputy Commissioner::West Siang District:: Aalo

GOVERNMNET OF ARUNACHAL PRADESH OFFICE OF THE DEPUTY COMMISSIONER::WEST SIANG DISTRICT:: AALO NO.WSD/PLG/DDUSY-128/2019-20 Dated Aalo, the 21st August’2020 ADVERTISEMENT Applications are invited from the unemployed youths of West Siang District in requisite forms under Deen Dayal Upadhyaya Swavalamban Yojana (DDUSY) to encourage entrepreneurship in the district and to gain access to low cost capital. The interested unemployed youths/applicants may submit the duly filled up forms on or before 14th September’2020 in the office of the District Planning Officer, West Siang District, Aalo during office hours. The candidates have to appear before the District Level Screening Committee (DLSC) with Power Point Presentation (PPT) of their project proposals. The candidates should be a Residents of West Siang District, Arunachal Pradesh and above the age of eighteen years having passed the final examination of Xth Standard. The other details along with application form can be collected from DPO office, Aalo during office hours and also downloaded from the district website https://westsiang.nic.in/Schemes/deen-dayal- upadhyaya-swavalamban-yojana Sd/- (Moki Loyi) APCS, Deputy Commissioner West Siang District, Aalo No. WSD/PLG/DDUSY-128/2019-20 Dated Aalo the, 21st August’2020 Copy to:- 1. The ADC, Yomcha/Kamba, West Siang District for information and wide publicity please. 2. The EAC Liromoba for information and wide publicity. 3. The CO, Darak/Bagra/Nikte-Kodum/Kombo/Dev. DC’s office, Aalo for information and wide publicity. 4. All HoOs, West Siang District for information and wide publicity. 5. The DIPRO, Aalo for information with a request for wide publicity.