Q3 2018 Cheetah Mobile Inc Earnings Call on November

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AVG Android App Performance and Trend Report H1 2016

AndroidTM App Performance & Trend Report H1 2016 By AVG® Technologies Table of Contents Executive Summary .....................................................................................2-3 A Insights and Analysis ..................................................................................4-8 B Key Findings .....................................................................................................9 Top 50 Installed Apps .................................................................................... 9-10 World’s Greediest Mobile Apps .......................................................................11-12 Top Ten Battery Drainers ...............................................................................13-14 Top Ten Storage Hogs ..................................................................................15-16 Click Top Ten Data Trafc Hogs ..............................................................................17-18 here Mobile Gaming - What Gamers Should Know ........................................................ 19 C Addressing the Issues ...................................................................................20 Contact Information ...............................................................................21 D Appendices: App Resource Consumption Analysis ...................................22 United States ....................................................................................23-25 United Kingdom .................................................................................26-28 -

Bilibili Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of March 2021 Commission File Number: 001-38429 Bilibili Inc. Building 3, Guozheng Center, No. 485 Zhengli Road Yangpu District, Shanghai, 200433 People’s Republic of China (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ INCORPORATION BY REFERENCE Exhibit 99.1 and exhibit 23.1 to this current report on Form 6-K are incorporated by reference into the registration statement on Form F-3 of Bilibili Inc. (File No. 333-230660) and Form S-8 (No. 333-226216), and shall be a part thereof from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished. EXHIBITS Exhibit 23.1 Consent of Shanghai iResearch Co., Ltd. Exhibit 99.1 Bilibili Inc. Supplemental and Updated Disclosures SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. -

Prospectus Supplement and Plan to File a Final Prospectus Supplement with the SEC to Register the Sale of Shares Under the U.S

ai16158914263_Project S6 cover_ENG_03_20mm spine HR.pdf 1 16/3/2021 18:43:46 GLOBAL OFFERING Stock Code: 9626 (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) Stock Code: 9626 Stock Joint Sponsors, Joint Global Coordinators, Joint Bookrunners, and Joint Lead Managers Joint Bookrunners and Joint Lead Managers Joint Lead Managers IMPORTANT If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. Bilibili Inc. (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) GLOBAL OFFERING Number of Offer Shares under the Global Offering : 25,000,000 Offer Shares (subject to the Over-allotment Option) Number of Hong Kong Offer Shares : 750,000 Offer Shares (subject to adjustment) Number of International Offer Shares : 24,250,000 Offer Shares (subject to adjustment and the Over-allotment Option) Maximum Public Offer Price : HK$988.00 per Offer Share, plus brokerage of 1.0%, SFC transaction levy of 0.0027% and Hong Kong Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund) Par Value : US$0.0001 per Share Stock Code : 9626 Joint Sponsors, Joint Global Coordinators, Joint Bookrunners, and Joint Lead Managers Joint Bookrunners and Joint Lead Managers Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. -

Chinese Companies Listed on Major U.S. Stock Exchanges

Last updated: October 2, 2020 Chinese Companies Listed on Major U.S. Stock Exchanges This table includes Chinese companies listed on the NASDAQ, New York Stock Exchange, and NYSE American, the three largest U.S. exchanges.1 As of October 2, 2020, there were 217 Chinese companies listed on these U.S. exchanges with a total market capitalization of $2.2 trillion.2 3 Companies are arranged by the size of their market cap. There are 13 national- level Chinese state-owned enterprises (SOEs) listed on the three major U.S. exchanges. In the list below, SOEs are marked with an asterisk (*) next to the stock symbol.4 This list of Chinese companies was compiled using information from the New York Stock Exchange, NASDAQ, commercial investment databases, and the Public Company Accounting Oversight Board (PCAOB). 5 NASDAQ information is current as of February 25, 2019; NASDAQ no longer publicly provides a centralized listing identifying foreign-headquartered companies. For the purposes of this table, a company is considered “Chinese” if: (1) it has been identified as being from the People’s Republic of China (PRC) by the relevant stock exchange; or, (2) it lists a PRC address as its principal executive office in filings with U.S. Securities and Exchange Commission. Of the Chinese companies that list on the U.S. stock exchanges using offshore corporate entities, some are not transparent regarding the primary nationality or location of their headquarters, parent company or executive offices. In other words, some companies which rely on offshore registration may hide or not identify their primary Chinese corporate domicile in their listing information. -

Mobile Security 2015

Product Review: Mobile Security 2015 www.av-comparatives.org AV-Comparatives Mobile Security Review Language: English August 2015 Last revision: 17th September 2015 www.av-comparatives.org Product Review: Mobile Security 2015 www.av-comparatives.org Contents Overview ............................................................... 6 Products tested ...................................................... 8 Battery usage ......................................................... 9 Protection against Android malware ......................... 11 AVC UnDroid Analyser ............................................. 11 Test Set & Test Results ........................................... 12 Android Security .................................................... 14 AVG AntiVirus ........................................................ 16 AhnLab V3 Mobile Security ...................................... 19 Antiy AVL for Android ............................................. 22 Avast Mobile Security ............................................. 24 Avira Antivirus Security .......................................... 28 Baidu Mobile Guard ................................................ 31 Bitdefender Mobile Security and Antivirus ................. 34 CheetahMobile Clean Master .................................... 37 CheetahMobile CM Security Antivirus ........................ 40 ESET Mobile Security .............................................. 44 G Data Internet Security ......................................... 47 Kaspersky Internet Security .................................... -

Chinese Companies Listed on Major U.S. Stock Exchanges

Last updated: May 5, 2021 Chinese Companies Listed on Major U.S. Stock Exchanges This table includes Chinese companies listed on the NASDAQ, New York Stock Exchange, and NYSE American, the three largest U.S. exchanges. i As of May 5, 2021, there were 248 Chinese companies listed on these U.S. exchanges with a total market capitalization of $2.1 trillion. On October 2, 2020, when this table was last updated, there were 217 companies with a total market capitalization of $2.2 trillion. In the list below, newly added companies are marked with a section symbol (§) next to the stock symbol. ii Companies are arranged by the size of their market cap. There are eight national-level Chinese state-owned enterprises (SOEs) listed on the three major U.S. exchanges. In the list below, SOEs are marked with an asterisk (*) next to the stock symbol. iii Since this table was last updated in October 2020, 17 Chinese companies have delisted. Two companies currently trade over the counter: Kingold Jewelry (KGJI, $3 million market cap) and state-owned Guangshen Railway (GSHHY, $2,256 million market cap). The 17 delisted companies also include four companies targeted by the Executive Order 13959 (“Addressing the Threat from Securities Investments That Finance Communist Chinese Military Companies”), which prohibited investment in Communist Chinese Military Companies. These are: China Unicom, China Telecom, China Mobile, and CNOOC Limited. In addition, Semiconductor Manufacturing International Corporation (SMIC) stopped trading over the counter as a result of the order.1 The remaining U.S.-listed company subject to the order is Luokung Technology Corp. -

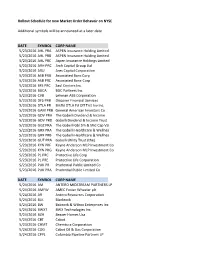

Rollout Schedule for New Market Order Behavoir on NYSE Additional

Rollout Schedule for new Market Order Behavoir on NYSE Additional symbols will be announced at a later date DATE SYMBOL CORP NAME 5/23/2016 AHL PRA ASPEN Insurance Holding Limited 5/23/2016 AHL PRB ASPEN Insurance Holding Limited 5/23/2016 AHL PRC Aspen Insurance Holdings Limited 5/23/2016 ARH PRC Arch Capital Group Ltd 5/23/2016 ARU Ares Capital Corporation 5/23/2016 ASB PRB Associated Banc Corp 5/23/2016 ASB PRC Associated Banc-Corp 5/23/2016 BFS PRC Saul Centers Inc. 5/23/2016 BGCA BGC Partners Inc. 5/23/2016 CVB Lehman ABS Corporation 5/23/2016 DFS PRB Discover Financial Services 5/23/2016 DTLA PR Brkfld DTLA Fd Off Trst Inv Inc. 5/23/2016 GAM PRB General American Investors Co 5/23/2016 GDV PRA The Gabelli Dividend & Income 5/23/2016 GDV PRD Gabelli Dividend & Income Trust 5/23/2016 GGZ PRA The Gabelli Gbl Sm & Mid Cap Val 5/23/2016 GRX PRA The Gabelli Healthcare & Wellnes 5/23/2016 GRX PRB The Gabelli Healthcare & Wellnes 5/23/2016 GUT PRA Gabelli Utility Trust (the) 5/23/2016 KYN PRF Kayne Anderson MLP Investment Co 5/23/2016 KYN PRG Kayne Anderson MLP Investment Co 5/23/2016 PL PRC Protective Life Corp 5/23/2016 PL PRE Protective Life Corporation 5/23/2016 PUK PR Prudential Public Limited Co 5/23/2016 PUK PRA Prudrntial Public Limited Co DATE SYMBOL CORP NAME 5/24/2016 AM ANTERO MIDSTREAM PARTNERS LP 5/24/2016 AMFW AMEC Foster Wheeler plc 5/24/2016 AR Antero Resources Corporation 5/24/2016 BLK Blackrock 5/24/2016 BW Babcock & Wilcox Enterprises Inc 5/24/2016 BWXT BWX Technologies Inc. -

Avast Android App Performance & Trend Report for Q3 2016

Avast® AndroidTM App Performance & Trend Report Q3 2016 | by Avast® Software Contents Executive Summary .............................................................................................................2 A Insights and Analysis...........................................................................................................3 Q3 App Trends ..................................................................................................................... 4-7 Most Used Devices Q3 2016 ..............................................................................................8 Top 50 Installed Apps .....................................................................................................9-10 B Key Findings ............................................................................................................................11 World’s Greediest Mobile Apps ..................................................................................12-13 Top Ten Battery Draining Apps ...................................................................................14-15 Top Ten Storage Hogging Apps .................................................................................16-17 Top Data Traffic Hogging Apps ...................................................................................18-19 Mobile Gaming - What Gamers Should Know ...........................................................20 C Addressing the Issues ...................................................................................................... -

![[CMCM] - Cheetah Mobile, Inc](https://docslib.b-cdn.net/cover/3875/cmcm-cheetah-mobile-inc-5013875.webp)

[CMCM] - Cheetah Mobile, Inc

[CMCM] - Cheetah Mobile, Inc. Fourth Quarter and Full Year 2017 Earnings Conference Call Monday, March 19, 2018, 8:00 AM Eastern Time Officers Ms. Helen Jing Zhu, Director, IR Mr. Fu Sheng, CEO, Director Mr. Vincent Jiang, CFO Analysts Thomas Chong, Credit Suisse Wendy Huang, Macquarie Group Andrew Orchard, Nomura Liping Zhao, CICC Presentation Operator: Good day, and welcome to the Cheetah Mobile fourth quarter and full year 2017 earnings conference call. (Operator Instructions). Please note this event is being recorded. I would now like to turn the conference over to Helen Zhu, IR Director. Please go ahead. Helen Jing Zhu: Thank you, Operator. Welcome to Cheetah Mobile's fourth quarter 2017 earnings conference call. With us today are Mr. Fu Sheng, CEO and Chairman, and Mr. Vincent Jiang, CFO. Following management's prepared remarks, we will conduct a Q&A session. Before we begin, I refer you to the safe harbor statements in our earnings release, which also applies to our conference call today, as we will make forward-looking statements. At this time, I would now like to turn the conference call over to our Chairman and CEO, Mr. Fu Sheng. Please go ahead. Fu Sheng: Thanks, Helen, and hi, everyone. We had strong results in Q4. Total revenues grew by 9% year-over-year and 16% quarter-over-quarter to RMB1.4 billion. Operating profits grew by almost 2.6 times year-over-year and 68% quarter-over-quarter to RMB222 million. Now let me give you more details on each of our business lines. Our utility products and related service continued to earn strong profits and cash flow. -

Security Survey 2017

Security Survey 2017 www.av-comparatives.org IT Security Survey 201 7 Language: English Last Revision: 26 th January 2017 www.av-comparatives.org - 1 - Security Survey 2017 www.av-comparatives.org Security Survey 2017 We conducted our annual survey to improve our service to the end-user community. Respondents were asked for their opinions on various topics related to anti-virus software testing and anti-virus software in general. The results were invaluable to us. We would like to thank everyone who took the time to complete the survey. Key data Survey Period: 15 th December 2016 – 15th January 2017 Valid responses of real users: 2,513 The survey contained some control questions and checks. This allowed us to filter out invalid responses and users who tried to distort the results by e.g. giving impossible/conflicting answers. We were primarily interested in the opinions of everyday users. The survey results in this public report do not take into account the responses of participants who are involved with anti-virus companies. The survey results are invaluable to us. This report contains the results of the survey questions. Overview Use of the Internet by home and business users continues to grow in all parts of the world. How users access the Internet is changing, though. There has been increased usage of smartphones by users to access the Internet. The tablet market has taken off as well. This has resulted in a drop in desktop and laptop sales. With regard to attacks by cyber criminals, this means that their focus has evolved. -

FORM 20-F Cheetah Mobile Inc

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR _ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016. OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report . Commission file number: 001-36427 Cheetah Mobile Inc. (Exact name of Registrant as specified in its charter) N/A (Translation of Registrant’s name into English) Cayman Islands (Jurisdiction of incorporation or organization) Building No. 8 Hui Tong Times Square Yaojiayuan South Road Beijing 100123 People’s Republic of China (Address of principal executive offices) Yuk Keung Ng Director and Principal Financial Officer Cheetah Mobile Inc. Building No. 8 Hui Tong Times Square Yaojiayuan South Road Beijing 100123 People’s Republic of China Tel: +86-10-6292-7779 Email: [email protected] (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered American depositary shares, each The New York Stock Exchange representing ten Class A ordinary shares Class A ordinary shares, par value US$0.000025 per share* * Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares, each representing ten Class A ordinary shares. -

JHVIT Quarterly Holdings 6.30.2021

John Hancock Variable Insurance Trust Portfolio of Investments — June 30, 2021 (unaudited) (showing percentage of total net assets) 500 Index Trust 500 Index Trust (continued) Shares or Shares or Principal Principal Amount Value Amount Value COMMON STOCKS – 97.6% COMMON STOCKS (continued) Communication services – 10.9% Hotels, restaurants and leisure (continued) Diversified telecommunication services – 1.2% Marriott International, Inc., Class A (A) 55,166 $ 7,531,262 McDonald’s Corp. 155,101 35,826,780 AT&T, Inc. 1,476,336 $ 42,488,950 MGM Resorts International 86,461 3,687,562 Lumen Technologies, Inc. 208,597 2,834,833 Norwegian Cruise Line Holdings, Ltd. (A) 75,206 2,211,808 Verizon Communications, Inc. 858,032 48,075,533 Penn National Gaming, Inc. (A) 30,865 2,360,864 93,399,316 Royal Caribbean Cruises, Ltd. (A) 45,409 3,872,480 Entertainment – 1.9% Starbucks Corp. 244,224 27,306,685 Activision Blizzard, Inc. 160,872 15,353,624 Wynn Resorts, Ltd. (A) 21,994 2,689,866 Electronic Arts, Inc. 60,072 8,640,156 Yum! Brands, Inc. 62,442 7,182,703 Live Nation Entertainment, Inc. (A) 30,014 2,628,926 151,933,613 Netflix, Inc. (A) 91,957 48,572,607 Household durables – 0.4% Take-Two Interactive Software, Inc. (A) 24,146 4,274,325 D.R. Horton, Inc. 68,073 6,151,757 The Walt Disney Company (A) 376,832 66,235,761 Garmin, Ltd. 31,500 4,556,160 145,705,399 Leggett & Platt, Inc. 27,959 1,448,556 Interactive media and services – 6.3% Lennar Corp., A Shares 55,918 5,555,453 Alphabet, Inc., Class A (A) 62,420 152,416,532 Mohawk Industries, Inc.