Pipelines and Land Facilities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preparing for Carbon Pricing: Case Studies from Company Experience

TECHNICAL NOTE 9 | JANUARY 2015 Preparing for Carbon Pricing Case Studies from Company Experience: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company Acknowledgments and Methodology This Technical Note was prepared for the PMR Secretariat by Janet Peace, Tim Juliani, Anthony Mansell, and Jason Ye (Center for Climate and Energy Solutions—C2ES), with input and supervision from Pierre Guigon and Sarah Moyer (PMR Secretariat). The note comprises case studies with three companies: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E). All three have operated in jurisdictions where carbon emissions are regulated. This note captures their experiences and lessons learned preparing for and operating under policies that price carbon emissions. The following information sources were used during the research for these case studies: 1. Interviews conducted between February and October 2014 with current and former employees who had first-hand knowledge of these companies’ activities related to preparing for and operating under carbon pricing regulation. 2. Publicly available resources, including corporate sustainability reports, annual reports, and Carbon Disclosure Project responses. 3. Internal company review of the draft case studies. 4. C2ES’s history of engagement with corporations on carbon pricing policies. Early insights from this research were presented at a business-government dialogue co-hosted by the PMR, the International Finance Corporation, and the Business-PMR of the International Emissions Trading Association (IETA) in Cologne, Germany, in May 2014. Feedback from that event has also been incorporated into the final version. We would like to acknowledge experts at Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E)—among whom Laurel Green, David Hone, Sue Lacey and Neil Marshman—for their collaboration and for sharing insights during the preparation of the report. -

Oil and Gas Fields in Norway

This book is a work of reference which provides an easily understandable Oil and gas fields in n survey of all the areas, fields and installations on the Norwegian continental shelf. It also describes developments in these waters since the 1960s, Oil and gas fields including why Norway was able to become an oil nation, the role of government and the rapid technological progress made. In addition, the book serves as an industrial heritage plan for the oil in nOrway and gas industry. This provides the basis for prioritising offshore installations worth designating as national monuments and which should be documented. industrial heritage plan The book will help to raise awareness of the oil industry as industrial heritage and the management of these assets. Harald Tønnesen (b 1947) is curator of the O Norwegian Petroleum Museum. rway rway With an engineering degree from the University of Newcastle-upon- Tyne, he has broad experience in the petroleum industry. He began his career at Robertson Radio i Elektro before moving to ndustrial Rogaland Research, and was head of research at Esso Norge AS before joining the museum. h eritage plan Gunleiv Hadland (b 1971) is a researcher at the Norwegian Petroleum Museum. He has an MA, majoring in history, from the University of Bergen and wrote his thesis on hydropower ????????? development and nature conser- Photo: Øyvind Hagen/Statoil vation. He has earlier worked on projects for the Norwegian Museum of Science and Technology, the ????????? Norwegian Water Resources and Photo: Øyvind Hagen/Statoil Energy Directorate (NVE) and others. 55 tHe ekoFIsk AReA The Ekofisk area lies in 70-75 metres of water at the southern end of Norway’s North Sea sector, about 280 kilometres south-west of Stavanger. -

Mongstad Mongstad

North Sea Sweden Project Profile Norway Mongstad Mongstad The Mongstad facilities in western Norway have been in operation since the mid-1970’s and today encompass a refinery, a crude oil terminal, a technical development center and a wet gas processing factory. Throughout decades of expansion and modernization, ABB has kept pace with Mongstad’s dynamic process control and electrification requirements by providing advanced, flexible solutions designed to meet both current and future needs. A key link in the Norwegian oil supply chain OilUpstream & andGas Midstream Comprising Norway’s largest oil refinery, a high-traffic shipping port and storage facilities for around one-third of the crude oil produced by the Norwegian state, Mongstad is vital to the Norwegian oil industry. Keeping the oil flowing in and out of Mongstad in a safe, efficient and environmental manner takes state-of-the-art technology, including electric power and process Facts about Mongstad: automation systems from ABB. ABB is the leading supplier of integrated The oil refinery is the largest of its kind electrotechnical solutions to the oil and gas industry, and has provided in Norway with an annual capacity of innovative solutions to the Mongstad facilities for over 30 years. 10 million tons of crude. It is owned by By consistently providing reliable, high performance process control capabilities Mongstad Refining (79% StatoilHydro to Mongstad, the scope of ABB automation technology has steadily increased. and 21% Shell). Today, ABB automation technology at Mongstad encompasses: The crude oil terminal provides inter- 2,700 I/O boards with over 25,000 I/O´s 4 INFINET rings mediate storage of more than 1/3 of 150 redundant controllers distributed 13 HMI servers, 33 dual-VDU consoles over 17 equipment outstations all crude oil produced on the Norwegian 500 process graphics continental shelf. -

New Document

ANNUAL STATEMENT OF RESERVES 2016 AKER BP ASA Annual Statement of Reserves 2016 Annual Statement of Reserves 2016 Table of Contents 1 Classification of Reserves and Contingent Resources 1 2 Reserves, Developed and Non-Developed 2 3 Description of Reserves 5 3.1 Producing Assets 5 3.1.1 Alvheim and Viper/Kobra (PL036, Pl088BS, PL203) 5 3.1.2 Vilje (PL036D) 7 3.1.3 Volund (PL150) 8 3.1.4 Bøyla (PL340) 9 3.1.5 Atla (PL102C) 11 3.1.6 Jette (PL027D), PL169C, PL504) 11 3.1.7 Jotun (PL027B, PL203B) 12 3.1.8 Varg (PL038) 12 3.1.9 Ivar Aasen Unit and Hanz (Pl001B, PL028B, PL242, PL338BS, PL457) 13 3.1.10 Valhall (PL006B, PL033B) 15 3.1.11 Hod (PL033) 16 3.1.12 Ula (PL019) 17 3.1.13 Tambar (PL065) 19 3.1.14 Tambar East (PL065, PL300, PL019B) 20 3.1.15 Skarv/Snadd (PL262, PL159, PL212B, PL212) 21 3.2 Development Projects 22 3.2.1 Johan Sverdrup (PL265, PL501, PL502; Pl501B) 22 3.2.2 Gina Krog (PL029B) 25 3.2.3 Oda (PL405) 26 4 Contingent Resources 28 5 Management’s Discussion and Analysis 34 Annual Statement of Reserves 2016 List of Figures 1.1 SPE reserves and recourses classification systen .................................................................... 1 3.1 Alvheim and Viper/Kobra Location Map.................................................................................... 5 3.2 Vilje location map ...................................................................................................................... 7 3.3 Volund location map.................................................................................................................. 8 3.4 Bøyla location map.................................................................................................................. 10 3.5 Ivar Aasen Unit and Hanz location map.................................................................................. 13 3.6 Valhall and Hod location map................................................................................................. -

Oil and Gas Fields in Norway

This book is a work of reference which provides an easily understandable Oil and gas fields in n survey of all the areas, fields and installations on the Norwegian continental shelf. It also describes developments in these waters since the 1960s, Oil and gas fields including why Norway was able to become an oil nation, the role of government and the rapid technological progress made. In addition, the book serves as an industrial heritage plan for the oil in nOrway and gas industry. This provides the basis for prioritising offshore installations worth designating as national monuments and which should be documented. industrial heritage plan The book will help to raise awareness of the oil industry as industrial heritage and the management of these assets. Harald Tønnesen (b 1947) is curator of the O Norwegian Petroleum Museum. rway rway With an engineering degree from the University of Newcastle-upon- Tyne, he has broad experience in the petroleum industry. He began his career at Robertson Radio i Elektro before moving to ndustrial Rogaland Research, and was head of research at Esso Norge AS before joining the museum. h eritage plan Gunleiv Hadland (b 1971) is a researcher at the Norwegian Petroleum Museum. He has an MA, majoring in history, from the University of Bergen and wrote his thesis on hydropower ????????? development and nature conser- Photo: Øyvind Hagen/Statoil vation. He has earlier worked on projects for the Norwegian Museum of Science and Technology, the ????????? Norwegian Water Resources and Photo: Øyvind Hagen/Statoil Energy Directorate (NVE) and others. 47 tHe VAlHAll AReA The Valhall area lies right at the southernmost end of the NCS in the North Sea, just south of Ekofisk, Eldfisk and Embla. -

CCS from the Gas-Fired Power Station at Kårstø? a Commercial Analysis1

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics CCS from the gas-fired power station at Kårstø? A commercial analysis1 by Petter Osmundsen* and Magne Emhjellen** * University of Stavanger ** Petoro AS Summary The article presents a commercial investment analysis of the carbon capture project at the Kårstø gas processing plant in south-western Norway. We update an earlier analysis and critically review the methods used including those applied for cost estimating. Our conclusion is that carbon capture and storage (CCS) at Kårstø would be a very unprofitable climate measure with poor cost efficiency. It would require more than USD 1.7 billion2 in subsidies, or in excess of USD 133 million per year. That corresponds to a subsidy of roughly USD 0.1 per kilowatt-hour on the power station s electricity output. The cost per tonne of carbon emissions abated is about USD 333, which is about 20 times the international carbon emission allowance price and many times higher than alternative domestic climate measures. * Petter Osmundsen, department of industrial economics and risk management, University of Stavanger, NO-4036 Stavanger, Norway E-mail: [email protected], home page: http://www5.uis.no/kompetansekatalog/visCV.aspx?ID=08643&sprak=BOKMAL ** Magne Emhjellen, Petoro AS, P O Box 300 Sentrum, NO- 4002 Stavanger, Norway. E-mail: [email protected] 1 Thanks are due to Johan Gjærum, Per Ivar Gjærum, Kåre Petter Hagen and Knut Einar Rosendahl for constructive comments. We would also like to thank a number of specialists in business and the civil service for useful comments and proposals. -

TOTAL S.A. Yearended December3l, 2015

KPMG Audit ERNST & YOUNG Audit This isa free translation info English of the statutory auditors' report on the consolidated (mandai statements issued in French and it is provided solely for the convenience 0f English-speaking users. The statutory auditors' report includes information specifically requ?red by French law in such reports, whether modified or flot. This information is presented below the audit opinion on the consolidated financial statements and includes an explanatory para graph discussing the auditors' assessments of certain significant accounting and auditing matters. These assessments were considered for the purpose 0f issuing an audit opinion on the consolidated financial statements taken as a whole and not f0 provide separate assurance on individual account balances, transactions or disclosures. This report also includes information relating to the specific verification of information given in the groups management report. This report should be read in conjunction with and construed in accordance with French law and pro fessional auditing standards applicable in France. TOTAL S.A. Yearended December3l, 2015 Statutory auditors' report on the consolidated financial statements KPMG Audit ERNST & YOUNG Audit Tour EQHO 1/2, place des Saisons 2, avenue Gambetta 92400 Courbevoie - Paris-La Défense 1 CS 60055 S.A.S. à capital variable 92066 Paris-La Défense Cedex Commissaire aux Comptes Commissaire aux Comptes Membre de la compagnie Membre de la compagnie régionale de Versailles régionale de Versailles TOTAL S.A. Year ended December 31, 2015 Statutory auditors' report on the consolidated financial statements To the Shareholders, In compliance with the assignment entrusted to us by your general annual meeting, we hereby report to you, for the year ended December 31, 2015, on: the audit of the accampanying consolidated financial statements of TOTAL S.A.; the justification of our assessments; the specific verification required by law. -

Uncertainty Analysis of Emissions from the Statoil Mongstad Oil Refinery

25th International North Sea Flow Measurement Workshop, Oslo, Norway, 16-19 October 2007 Uncertainty analysis of emissions from the Statoil Mongstad oil refinery Kjell-Eivind Frøysa1, Anne Lise Hopland Vågenes2, Bernhard Sørli2 and Helge Jørgenvik2 1Christian Michelsen Research AS, Box 6031 Postterminalen, N-5892 Bergen, Norway. 2Statoil Mongstad, 5954 Mongstad, Norway ABSTRACT In new European and national legislations, there is increased focus on the reporting of the emmissions related to greenhouse gases from process plants. This includes reporting and documentation of uncertainty in the reported emmissions, in addition to specific uncertainty limits depending on the type of emission and type of measurement regime. In a process plant like the Statoil Mongstad oil raffinery, there may be a huge number of measurement points for mass flow. These measured mass flow rates have to be added in order to obtain the total emission for a given source. Typically, orifice plates are used at many of the measurement points. These orifice plate meters are ususally not equipped with individual densitometers. In stead, they are pressure and temperature corrected from a common upstream densitometer. This will give correllations between the individual flow meters. In the present paper, the flow meter set-up for Statoil Mongstad will be briefly addressed. thereafter, an uncertainty model suitable for the CO2 emission from the Statoil Mongstad oil raffinery will be presented, included a practically method for handling the partial correllation between the uncertainty of the various flow meters. This model will comply with the ISO 5168 for measurement uncertainty. Various uncertainty contributions will be reviewed, in order to work out an uncertainty budget for the specific emission sources. -

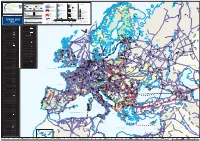

TYNDP 2017 FID Status (Final Investment Decision) White Sea PCI Status (Project of Common Interest) Submission

SHTOKMAN SNØHVIT Pechora Sea ASKELADD MELKØYA KEYS ALBATROSS Hammerfest Salekhard Cross-border points / intra-country or intra balancing zone points Transport by pipeline LNG Import Terminals Storage facilities Compressor stations Barents KILDIN N Acquifer Sea 1ACross-border interconnection point Cross-border interconnection point Pipeline diameters : LNG Terminals’ entry point within Europe within Europe Diameter < 600 mm intro transmission system Salt cavity - cavern or export point to non-EU country or export point to non-EU country Operational Under construction or Planned Diameter 600 - 900 mm Depleted (Gas) eld on shore / oshore MURMAN Diameter > 900mm Other type Unknown Cross-border interconnection point Cross-border third country (import) with third country (import) Under construction or Planned Pomorskiy Project categories : Project categories : Project categories : Project categories : Strait Intra-country or Murmansk Third country cross-border FID projects FID projects FID projects intra balancing zone points interconnection point FID projects Non-FID, advanced projects Non-FID, advanced projects Non-FID, advanced projects REYKJAVIK Non-FID, advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Gas Reserve areas Countries Non-FID, non-advanced projects ENTSOG Member Countries ICELAND Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Drilling platform ENTSOG Associated Partner P ENTSOG -

Last Ned Brosjyre Om Prosessanlegget På Kollsnes

FAKTA Kollsnes prosessanlegg Som en oase lyser prosessanlegget opp kystlandskapet en sensommerkveld Kollsnesanlegget spiller en nøkkelrolle når det gjelder transport av gass i store mengder fra felt i norsk del av Nordsjøen til kunder i Europa. Gass fra Kollsnes utgjør nærmere 40 prosent av totale norske gass- leveranser. De enorme gassmengdene i Troll-feltet var starten på det hele. Kollsnes prosessanlegg er i dag et Selve prosessanlegget består i hovedsak Troll er selve hjørne- senter for behandling av gass fra feltene av tre duggpunktsanlegg for behand- steinen i norsk gass- Troll, Fram, Visund og Kvitebjørn. På ling av henholdsvis gass, kondensat og Kollsnes blir gassen renset, tørket og monoetylenglykol (MEG). I tillegg finnes produksjon. Da feltet komprimert før den sendes som tørrgass et eget anlegg for utvinning av flytende gjennom eksportrør til Europa. I tillegg våtgass (Natural Gas Liquids -NGL). ble erklært drivverdig i transporteres noe gass i eget rør til I anlegget blir våtgass (NGL) først Naturgassparken, vest i Øygarden, der skilt ut. Deretter blir tørrgass trykket 1983, kom spørsmålet Gasnor behandler og distribuerer gass opp ved hjelp av de seks eksport- om hvilken vei de til innenlands forbruk. Kondensat, eller kompressorene og sendt ut i transport- våtgass, som er tyngre komponenter i systemet via eksportrør-ledningene enorme gassmengdene gassen, føres via Stureterminalen i rør Zeepipe IIA og IIB. til Mongstad (Vestprosess). Her videre- skulle ta for å komme behandles produktet og fraksjoneres til trygt fram til brukerne. propan, butan og nafta. Løsningen ble et mottaksanlegg på Kollsnes i Øygarden kommune nordvest 40% Gass fra Kollsnes utgjør nærmere for Bergen. -

Oil and Gas Delivery to Europe

Oil and gas delivery to Europe An Overview of Existing and Planned Infrastructures GOUVERNANCE EUROPÉENNE ET GÉOPOLITIQUE DE L’ÉNERGIE 4 bis Susanne NIES l es é tud es The French Institute for International Relations (Ifri) is France’s premier centre for independent research, information, and debates on today’s most important international issues. Founded in 1979 by Thierry de Montbrial, Ifri is an officially recognized organization (1901 law). It is not beholden to any administrative authority, independently chooses its projects, and regularly publishes its works. Ifri brings together, through studies and debates and in an interdisciplinary manner, political and economic decision-makers, researchers and experts from the global level. With its Brussels branch (Ifri Brussels), Ifri is one of the rare French think-tanks that is at the heart of European debates. * Site Int 1 © Ifri Contents ABSTRACT ......................................................................................... 4 INTRODUCTION ................................................................................... 5 I. THE CONSTRUCTION OF GAS AND OIL INFRASTRUCTURES IN EUROPE11 Summary.................................................................................................11 1. From the Discovery of Resources to the Construction of Separate East-West Networks .......................12 2. Developing Infrastructures in the Soviet Block, and their Extension to Western Europe .............................................16 3. Conclusion: Continuity and Ruptures.............................................19 -

Statoil Gas Seminar

Creating value in times of low commodity prices Statoil gas seminar, 18 February 2016, London Jens Økland, EVP, Marketing, Midstream & Processing (MMP) Classification: Internal 2012-10-24 Our industry is in a challenging situation • Low oil and gas prices Commodity prices 140 120 Climate 100 80 • High costs 60 USD/boe 40 20 0 • Oil and gas in a 2013 2014 2015 2016 Oil Gas (NBP) decarbonising world Costs 2 Sources: Platts, Heren, IHS Statoil’s mid- and downstream business is adding value • With low commodity prices, the relative MMP1) - adjusted earnings2) importance of our mid- and downstream activity increases 25 20 • Through Asset Backed Trading, the value of our products can be increased 15 10 Billion NOK • MMP earnings in 2015 exceeds NOK 20 5 billion and accounts for nearly 30% of Statoil’s adjusted earnings 0 2012 2013 2014 2015 MMP 1) Marketing, Midstream & Processing (MMP). Before 2015: Marketing, Processing and Renewables (MPR) 2) Before tax 3 Source: Statoil Asset Backed Trading – an extensive toolbox for value creation • Our most successful trading activities imply Adjusted earnings 1) MMP - 2015 use of physical infrastructure or contractual assets − Storages − Refineries − Terminals − Shipping − Rail − Capacity bookings • Active use of assets add flexibility and optionality to our portfolio and increase our Natural gas Europe Natural gas US competitiveness Liquids Other 1) Before tax 4 Source: Statoil Resetting costs in MMP Continue efforts to become more competitive A sustained culture of continuous improvement Respond to