TGV Paris-Milan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

37685 70 1.Pdf

IT DECISIONE DELLA COMMISSIONE del 27.08.2003 in un procedimento ai sensi dell'articolo 82 del trattato CE (COMP/ 37.685 GVG/FS) LA COMMISSIONE DELLE COMUNITÀ EUROPEE, visto il trattato che istituisce la Comunità europea, visto il regolamento (CEE) n. 17 del Consiglio, del 6 febbraio 1962, primo regolamento di applicazione degli articoli 85 ed 86 del trattato1, modificato da ultimo dal regolamento (CE) n. 1216/992, in particolare l'articolo 3 e l'articolo 15, paragrafo 2, visto il regolamento (CEE) n. 1017/68 del Consiglio, del 19 luglio 1968, relativo all'applicazione di regole di concorrenza ai settori dei trasporti ferroviari, su strada e per vie navigabili3 vista la domanda con la quale la società a responsabilità limitata Georg Verkehrsorganisation GmbH, a norma dell'articolo 10 del regolamento (CEE) n. 1017/68 in data 25 ottobre 1999 ha denunciato, in data 25 ottobre 1999, un'infrazione all'articolo 82 del trattato CE, vista la decisione della Commissione del 21 giugno 2001 di avviare il procedimento nel caso di specie, dopo aver dato alle imprese interessate l'occasione di manifestare il proprio punto di vista circa gli addebiti comunicati dalla Commissione, a norma dell'articolo 19, paragrafo 1 del regolamento n. 17 e dell'articolo 26 del regolamento (CEE) 1017/68, in combinato disposto con il regolamento (CE) n. 2842/98 della Commissione, del 22 dicembre 1998, relativo alle audizioni in taluni procedimenti a norma dell'articolo 85 e dell'articolo 86 del trattato CE4, sentiti il Comitato consultivo in materia di intese e di posizioni dominanti ed il Comitato consultivo in materia di intese e di monopoli nel settore dei trasporti, 1 GU 13 del 31.3.1962, pag. -

Comunicato Stampa

Comunicato Stampa INNOTRANS 2018, FS ITALIANE: SVILUPPO DEL BUSINESS FERROVIARIO IN EUROPA E NEI MERCATI INTERNAZIONALI • esaminato lo sviluppo del mercato ferroviario europeo, quello di riferimento per le società operative di FS Italiane • valutati gli scenari per il miglioramento industriale e dei servizi di trasporto delle società estere del Gruppo FS Italiane in Europa • illustrate strategie per esportare know-how ferroviario italiano nei mercati extra-europei Berlino, 19 settembre 2018 Sviluppo del business ferroviario in Europa e nei mercati extra UE, scenari futuri per la competizione nel mercato dei trasporti del Vecchio Continente e strategie per esportare il know-how ferroviario italiano all’estero. Questi i temi affrontati oggi a InnoTrans 2018, la Fiera internazionale dedicata al trasporto ferroviario, nel corso della tavola rotonda Internazionalizzazione e Mercati Esteri e durante il Focus Mercati Internazionali. Alla tavola rotonda Internazionalizzazione e Mercati Esteri, moderata da Barbara Morgante, Direttore Centrale Governance e Partecipate Estere di FS Italiane, hanno preso parte Jost Knebel, Amministratore Delegato di Netinera Deutschland, e Mirko Pahl, Amministratore Delegato di TX Logistik, società che operano in Germania rispettivamente nel trasporto passeggeri (ferro e gomma) e in quello merci e logistico. Sono intervenuti anche Ernesto Sicilia, Presidente di Trenitalia UK, società che possiede il 100 per cento di Trenitalia c2c, operativa con un servizio commuters fra Londra e Shoeburyness (Essex), e Johan Thissen, Chief Financial Officer (CFO) di Qbuzz, controllata da Busitalia, terzo operatore olandese di trasporto pubblico locale su gomma. Chiudono il panel Petros Arvanitis, Consigliere economico dell'Amministratore Delegato e Responsabile Budget e Controllo di TrainOSE, impresa ferroviaria più importante in Grecia, e Maria Luisa Grilletta, Membro del Board di Thello, società che offre collegamenti ferroviari (diurni e notturni) fra Italia e Francia. -

Network Advisory Board

PRESS RELEASE – English Translation Network Advisory Board Press release 01 / 2021 dated: 29.01.2021, topic: Network Advisory Board Federal Railway Authority appoints Network Advisory Board for the period 2021-2023 The first meeting of the newly appointed Network Advisory Board, which will advise DB Netz AG on issues relating to the expansion, development, maintenance, provision and nature of the rail-network will be held on 2 March 2021. The Federal Railway Authority has selected 18 leading representatives of freight and passenger transport, of the task authorities and transport associations, and of rail transport associations from various regions and from companies of different sizes for the body. The advisory board members serve on an honorary basis. The Network Advisory Board is an independent advisory body provided for by law that represents the network users and also publicly represents their interests. DB Netz AG is required to make the recommendations and opinions of the Network Advisory Council the subject of its Board of Management deliberations. Further information and the names of the members can be found on the website of the Network Advisory Board (https://www.netzbeirat.de). Members: (https://www.netzbeirat.de/NB/DE/Mitglieder/mitglieder_node.html) BusinessUnit Name Organisation Region Long distance passenger Dr. Matthias DB Fernverkehr AG nationwide Feil Long distance passenger Dr. Markus RDC Deutschland GmbH nationwide Hunkel Long distance passenger Mag. Klaus ÖBB Personenverkehr AG nationwide Garstenauer Freight Stefan Marx boxXpress.de-GmbH north Freight Thorsten Dieter DB Cargo AG nationwide Freight Wolfgang Birlin RheinCargo GmbH & Co. KG west Freight Thilo Beuven RTB CARGO GmbH west BusinessUnit Name Organisation Region Regional passenger Anne Mathieu KEOLIS Deutschland GmbH & Co. -

Dossier De Pressev 14

Assises du ferroviaire Ouvrir un débat national sur l’avenir du modèle français Jeudi 15 septembre 2011 Sommaire 1. Pourquoi des Assises du ferroviaire ? 2. Un débat national sur l’avenir du modèle ferroviaire français Le ferroviaire français au cœur de l’Europe La gouvernance du système ferroviaire L’économie du ferroviaire La filière ferroviaire française 3. Les Assises du ferroviaire : organisation et calendrier Organisation Le calendrier 4. Les grands chantiers déjà sur les rails : La rénovation et la modernisation du réseau La rénovation du matériel roulant Le service annuel Les projets de nouvelles lignes à grande vitesse L’ouverture à la concurrence Annexes Présentation des Présidents des quatre commissions Composition de l’Assemblée plénière Composition des Commissions 1. Pourquoi des Assises du ferroviaire ? Symbole de performance industrielle, de succès commerciaux et d’innovation technologique, le système ferroviaire français est une vitrine pour notre pays. Pourtant, ce secteur est aujourd’hui confronté à des enjeux de taille : ouverture à la concurrence du transport de voyageurs sous l’impulsion des politiques européennes, stagnation voire dégradation des parts de marchés de certains services de transport, besoin de modernisation du réseau pour absorber l’augmentation du trafic et améliorer la qualité de services pour le voyageur… Face à ces défis, le secteur ferroviaire doit trouver un nouveau souffle pour continuer à créer de nouveaux emplois en France et accélérer la conquête de nouveaux marchés. Dans ce contexte, le Président de la République a annoncé le 8 septembre dernier, lors de l’inauguration de la LGV Rhin-Rhône, que Nathalie Kosciusko-Morizet, ministre de l'Ecologie, du Développement durable, des Transports et du Logement, et Thierry Mariani, ministre des Transports, allaient mettre en débat le modèle ferroviaire français de demain. -

NS Annual Report 2018

See www.nsannualreport.nl for the online version NS Annual Report 2018 Table of contents 2 In brief 4 2018 in a nutshell 8 Foreword by the CEO 12 The profile of NS 16 Our strategy Activities in the Netherlands 23 Results for 2018 27 The train journey experience 35 Operational performance 47 World-class stations Operations abroad 54 Abellio 56 Strategy 58 Abellio United Kingdom (UK) 68 Abellio Germany 74 Looking ahead NS Group 81 Report by the Supervisory Board 94 Corporate governance 100 Organisation of risk management 114 Finances in brief 126 Our impact on the environment and on society 134 NS as an employer in the Netherlands 139 Organisational improvements 145 Dialogue with our stakeholders 164 Scope and reporting criteria Financial statements 168 Financial statements 238 Company financial statements Other information 245 Combined independent auditor’s report on the financial statements and sustainability information 256 NS ten-year summary This annual report is published both Dutch and English. In the event of any discrepancies between the Dutch and English version, the Dutch version will prevail. 1 NS annual report 2018 In brief More satisfied 4.2 million trips by NS app gets seat passengers in the OV-fiets searcher Netherlands (2017: 3.1 million) On some routes, 86% gave travelling by passengers can see which train a score of 7 out of carriages have free seats 10 or higher Customer 95.1% chance of Clean trains: 68% of satisfaction with HSL getting a seat passengers gave a South score of 7 out of 10 (2017: 95.0%) or higher 83% of -

2015 Annual Report

(Translation from the Italian original which remains the definitive version) 2015 ANNUAL REPORT CONTENTS 2015 ANNUAL REPORT 1 Chairman’s letter 3 GROUP HIGHLIGHTS 6 Disclaimer 7 Key and glossary 8 The future is founded on history 11 Consolidated highlights 12 DIRECTORS’ REPORT 13 Corporate governance and ownership structure report 14 The group’s performance 29 Transport 37 Infrastructure 42 Real Estate Services 45 Other Services 48 Ferrovie dello Stato Italiane S.p.A.’s performance 52 Macroeconomic context 55 Customers 59 Performance of markets and domestic railway traffic 63 Traffic figures of major European railway companies 67 Safety in railway operations 68 Sustainability 69 Human resources 70 The environment 75 Risk factors 77 Investments 81 Research and development 90 Main events of the year 92 Other information 101 Parent’s treasury shares 113 Related party transactions 114 Events after the reporting date 115 Outlook for the group 116 Proposed allocation of the profit for the year of Ferrovie dello Stato Italiane S.p.A. 118 CONSOLIDATED FINANCIAL STATEMENTS OF FERROVIE DELLO STATO ITALIANE GROUP AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2015 119 Consolidated financial statements 120 Notes to the consolidated financial statements 126 Annexes 210 SEPARATE FINANCIAL STATEMENTS OF FERROVIE DELLO STATO ITALIANE S.P.A. AS AT AND FOR THE YEAR ENDED 31 DECEMBER 2015 221 Financial statements 222 Notes to the separate financial statements 228 Ferrovie dello Stato Italiane group 2 Chairman’s letter Dear Shareholder, 2015 brought a host of new developments for Ferrovie dello Stato Italiane group and its stakeholders. In many ways, it was a year of transition as the Italian macroeconomic context stabilised, public investments in the country’s strategic infrastructure resumed (with a total of €17 billion allocated to FS group for investments in railway transport over the next few years) and the tax burden was cut substantially. -

2020 Sustainability Report.Pdf

(Translation from the Italian original which remains the definitive version) Ferrovie dello Stato Italiane Group 2020 SUSTAINABILITY REPORT FERROVIE DELLO STATO ITALIANE S.p.A. COMPANY OFFICERS Board of directors Appointed on 30 July 20181 Chairman Gianluigi Vittorio Castelli CEO and general director Gianfranco Battisti Directors Andrea Mentasti Francesca Moraci Flavio Nogara Cristina Pronello Vanda Ternau Board of statutory auditors Appointed on 3 July 20192 Chairwoman Alessandra dal Verme Standing statutory auditors Susanna Masi Gianpaolo Davide Rossetti Alternate statutory auditors Letteria Dinaro Salvatore Lentini COURT OF AUDITORS’ MAGISTRATE APPOINTED TO AUDIT FERROVIE DELLO STATO ITALIANE S.p.A.3 Giovanni Coppola MANAGER IN CHARGE OF FINANCIAL REPORTING Roberto Mannozzi INDEPENDENT AUDITORS KPMG S.p.A. (2014-2022) 1 Gianfranco Battisti was appointed CEO on 31 July 2018. 2 Following the shareholder’s resolution on the same date. 3 During the meeting of 17-18 December 2019, the Court of Auditors appointed Section President Giovanni Coppola to oversee the financial management of the parent as from 1 January 2020 pursuant to article 12 of Law no. 259/1958. Section President Giovanni Coppola replaces Angelo Canale. FERROVIE DELLO STATO ITALIANE GROUP 2020 SUSTAINABILITY REPORT CONTENTS Letter to the stakeholders ................................................................... 6 Introduction ...................................................................................... 9 2020 highlights ................................................................................ -

Stand Des Wettbewerbs Im Personenverkehr

Stand des Wettbewerbs im Personenverkehr Bedauerlicherweise verdeckt die häufig sehr pauschal geführte Debatte über die Qualität des Eisen- bahnverkehrs besonders im Personenverkehr, dass sich seit der Bahnreform der Neunzigerjahre der Markt vollkommen verändert hat, und dass die Qualität auch deutlich gestiegen ist. Die Konzentration vieler Debatten auf die Deutsche Bahn AG wird der vorhandenen Betreiber- und Anbietervielfalt und den Marktanteilen nicht mehr gerecht. Sie spiegelt auch nicht wider, dass viele wichtige DB-Wettbe- werber selbst große internationale Verkehrskonzerne im Hintergrund haben, die ähnlich viel Kompe- tenz und Erfahrung aufweisen wie die DB. Im Personenverkehr wird diese Unwucht besonders deutlich, denn bei der bundesweiten Debatte um Qualität und Pünktlichkeit steht immer der DB-Fernverkehr – und hier wiederum fast ausschließlich der Hochgeschwindigkeitsverkehr mit dem DB-Produkt ICE – im Mittelpunkt, was das Gesamtbild des Marktes und auch die Erfahrung der Fahrgäste nicht adäquat widerspiegelt. Dem Fernverkehr wird in der aktuellen Diskussion und Wahrnehmung eine überdurchschnittliche Aufmerksamkeit geschenkt. Ein Vielfaches des Schienenverkehrsaufkommens des Fernverkehrs wird jedoch im regionalen Schie- nenverkehr (SPNV) erbracht. Gerade hier – im täglichen Verkehr zu Arbeit, Schule oder Universität – lassen sich Autofahrten ersetzen und liegt die Lösung für die Umweltprobleme und die durch Verkehrs- probleme sinkende Lebensqualität in den Metropolregionen. Der weitere Ausbau des SPNV besonders im Bereich 20-100 km um die größeren Städte des Landes bietet große Wachstumspotenziale und ist zur Erreichung der Klimaziele und der verkehrspolitischen Ziele zur Verlagerung von Verkehrsanteilen auf die Schiene ohne Alternative, wird aber zu wenig forciert. 1. Entwicklung des Mobilitätsbedarfs Die Bevölkerung der Bundesrepublik ist im Jahr 2018 erstmals auf über 83 Millionen Einwohner ange- stiegen.1 Trotz der insgesamt fortschreitenden Alterung der Gesellschaft wird ein leichter Trend nach oben noch einige Jahre anhalten. -

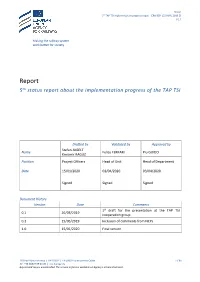

5Th Status Report About the Implementation Progress of the TAP TSI

Report 5th TAP TSI Implementation progress report - ERA-REP-152 IMPL-2019-03 V 1.0 Making the railway system work better for society. Report 5th status report about the implementation progress of the TAP TSI Drafted by Validated by Approved by Stefan JUGELT Name Felice FERRARI Pio GUIDO Kresimir RAGUZ Position Project Officers Head of Unit Head of Department Date 15/01/2020 02/04/2020 03/04/2020 Signed Signed Signed Document History Version Date Comments 1st draft for the presentation at the TAP TSI 0.1 26/03/2019 cooperation group 0.2 15/05/2019 Inclusion of comments from NCPs 1.0 15/01/2020 Final version 120 Rue Marc Lefrancq | BP 20392 | FR-59307 Valenciennes Cedex 1 / 95 Tel. +33 (0)327 09 65 00 | era.europa.eu Any printed copy is uncontrolled. The version in force is available on Agency’s intranet/extranet. Report 5th TAP TSI Implementation progress report - ERA-REP-152 IMPL-2019-03 V 1.0 Contents Acronyms ............................................................................................................................................................ 4 Reference documents ........................................................................................................................................ 5 Reference legislation .......................................................................................................................................... 5 1 EXECUTIVE SUMMARY ........................................................................................................................ 6 2 Introduction -

Eighth Annual Market Monitoring Working Document March 2020

Eighth Annual Market Monitoring Working Document March 2020 List of contents List of country abbreviations and regulatory bodies .................................................. 6 List of figures ............................................................................................................ 7 1. Introduction .............................................................................................. 9 2. Network characteristics of the railway market ........................................ 11 2.1. Total route length ..................................................................................................... 12 2.2. Electrified route length ............................................................................................. 12 2.3. High-speed route length ........................................................................................... 13 2.4. Main infrastructure manager’s share of route length .............................................. 14 2.5. Network usage intensity ........................................................................................... 15 3. Track access charges paid by railway undertakings for the Minimum Access Package .................................................................................................. 17 4. Railway undertakings and global rail traffic ............................................. 23 4.1. Railway undertakings ................................................................................................ 24 4.2. Total rail traffic ......................................................................................................... -

ERT-Newslines-Sep-2011

NEWSLINES What's new this month With winter fast approaching, this is the time of year when we start to and 323 after that date will be found on page 237. However, include advance versions of selected International tables valid from the passengers travelling between September 19 and 24 are advised to December timetable change. These will be found in our Winter check locally before travelling. International Supplement on pages 571 to 591, valid from December The new timetable from December 11 will see significant changes, 11. Asummary of the principal changes will be found on page 337. notably in the Dijon area with the opening of the Rhin-Rhoà ne high- With the opening of the Rhin-Rhoà ne high-speed line on that date, we speed line linking Dijon with Mulhouse. There will be two new stations have also included on page 591 the full Paris - Dijon - BesancË on - on the high-speed line, BesancË on Franche-Comte TGV, and Belfort Basel - ZuÈ rich timetable (Table 370) from December 11, when Montbe liard TGV. The former will have a shuttle rail service to the passengers for Mulhouse, Basel and ZuÈ rich will switch to using Paris existing BesancË on station (BesancË on Viotte) taking around 15 minutes. Gare de Lyon instead of Paris Est station. Table 370 will be extended to show the TGV service from Paris Gare Last month we expanded the European Rail Timetable by 32 pages de Lyon via Dijon through to Basel and ZuÈ rich, and an advance version and started to include a new 12-page Beyond Europe section, of this table valid from December 11 will be found on page 591. -

COGNOME NOME JOB TITLE Di Mauro Massimo DSI Architettura Di Rete BOREGGI IRENE Welfare Manager FSI Degni Alessandra Quadro

COGNOME NOME JOB TITLE Di Mauro Massimo DSI Architettura di Rete BOREGGI IRENE Welfare Manager FSI Degni Alessandra Quadro - Responsabile Formazione Finanziata Ciarniello Michele Ingegnere VOLTA LUCIANO ITALO GEOMETRA/IMPIEGATO DIRETTIVO Sperandeo Danilo Impiegato Direttivo Cannatella Marianna Quadro CARDAMONE EUGENIA QUADRO - SENIOR INTERNAL AUDITOR cosentini concetta avvocato D'ANNA EMILIO ISPETTORE DI CANTIERE Sciannameo Raffaella Geometra/Quadro PROCOPIO MONIA Q SCIOLI LUCA QUADRO/SPECIALISTA SEGRETERIA SOCIETARIA Parisi Daniela Architetto / Tecnico Amministrativo POinto Armida Ingegnere volpini cristina Ingegnere/Impiegato direttivo Bacarella Antonietta Hr Specialist Lasaponara Francesco Ingegnere Civile Giovannini Martina Impiegata Trecca Ottavia Internal Auditor Barragato Liliana Formatore Treni dozzo narciso professional DELLA SMIRRA FABIO IMPIEGATO DIRETTIVO Geusa Giorgio Responsabile Piattaforma Tecnologica Intermodale - DCISI FRATERNALI FRANCESCO TECNICO SPECIALIZZATO Iacopino Oreste Tecnico d'ufficio ANTINORI Antonella specialista comunicazione d'azienda pietropaolo lucia Q2 Gentili Elisa Specialista controllo investimenti PIETROPAOLO LUCIA Q2 Claudio Fabrizi macchinista MANZO ANTONIA CRISTINA Responsabile struttura operativa Oscurato Rosa Ingegnere/Tecnico MORABITO ANNA PROFESSIONAL Corradini Valerio Tecnico della Circolazione DI PALERMO GISELLA IMPIEGATO DIRETTIVO SICARI ALBERTO CAPO TRENO Ulanio Fabiola Impiegato Direttivo - DCER Contrattualistica Porcelli Eugenia Ingegnere Ambientale Laghezza Roberto RFI SpA - Direttore