TN at the 2012 Paris Motor Show: Also in This Bulletin: Glamorous As Always but Did It Impress?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

China Economic Update by NAB Group Economics 11 August 2015

China Economic Update by NAB Group Economics 11 August 2015 China’s auto industry may be reaching its Manufacturers (CAAM), the market share of domestic branded vehicles was around 41.5% over the first half of domestic limit, but is not yet ready to take 2015. The largest sales over this period were recorded by on the world Volkswagen, Hyundai-KIA and General Motors, while China’s motor vehicle industry has experienced spectacular China’s largest sellers among domestic brands were SAIC growth over the last decade – reflecting in part a broader and Chang’an (ranked fourth and fifth respectively in the evolution in China’s industrial sector over this period. At a first half of 2015). national level, China is no longer the global factory for low Foreign branded vehicles dominated China’s motor value added, labour intensive manufacturing – having lost vehicle sales in the first half of 2015 competitiveness to a range of emerging economies in Asia Rank Brand Domestic Sales – while production of more complicated, higher value partner(s) (‘000) goods (such as motor vehicles) has expanded. That said, China’s auto manufacturing industry is still in its infancy, 1 Volkswagen SAIC, FAW 1742.9 2 Hyundai-KIA BAIC, Dongfeng 813.4 with producers still some way from having a foothold in 3 General Motors SAIC 789.1 global markets. 4 SAIC 588.0 China’s rise to become a major motor vehicle 5 Chang'an 522.4 manufacturer is a recent phenomenon 6 Toyota FAW, GAC 463.7 7 Nissan Dongfeng 457.8 Although motor vehicle manufacturing has a reasonably 8 Ford Chang'an 429.7 long history in China – there was some limited production 9 Honda Dongfeng, GAC 420.6 in the 1950s and China’s production had overtaken 10 PSA Peugeot Citroën Dongfeng, 368.5 Australia’s by the mid 1980s – China’s emergence as a Chang'an major motor vehicle producer has been a far more recent Source: CAAM, CEIC, NAB Economics phenomenon. -

2011 Interim Results Announcement

長城汽車股份有限公司 Great Wall Motor Company Limited * 2011 Interim Results Announcement * for identification purpose only 22 August 2011 Improving little by little every day Disclaimer This presentation is prepared by Great Wall Motor Company Limited (the “Company”) and is solely for the purpose of corporate communication and general reference only. The presentation is not intended as an offer to sell, or to solicit an offer to buy or form any basis of investment decision for any class of securities of the Company in any jurisdiction. All such information should not be used or relied on without professional advice. The presentation is a brief summary in nature and do not purport to be a complete description of the Company, its business, its current or historical operating results or its future prospects. This presentation is provided without any warranty or representation of any kind, either expressed or implied. The Company specifically disclaims all responsibilities in respect of any use or reliance of any information, whether financial or otherwise, contained in this presentation. 2 Improving little by little every day Agenda 1 Performance Highlights 2 Financial Review 3 Business Review 4 Future Prospects 3 Improving little by little every day Performance Highlights Sales volume for 1H 2011 reached 218,288 units, representing a 47.3% YoY growth Revenue for 1 H 2011 amounted to RMB13,670 million, representing a 49.8% YoY growth 1 H 2011 profit attributable to owners of the Company reached RMB1,812 million , representing a 109% YoY growth -

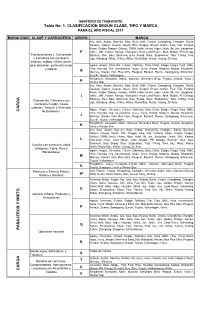

P ASAJ E ROS Y MIX to CA RGA Tabla No. 1. CLASIFICACIÓN

MINISTERIO DE TRANSPORTE Tabla No. 1. CLASIFICACIÓN SEGÚN CLASE, TIPO Y MARCA PARA EL AÑO FISCAL 2011 MODALIDAD CLASE Y CARROCERIA GRUPO MARCA Aro, Asia, Austin, Barreiro, Baw, Bock Wall, Chana, Changfeng, Changhe, Dacia, Daewoo, Datsun, Desoto, Deutz, Dfm, Dragon, Ernest Gruber, Faw, Fiat, Forland, Foton, Golden Dragon, Goleen, GWM, Hafei, Hersa, Higer, Huali, Ifa, Jac, Jiangchan, F Jinbei, JMC, Kaizer, Kamaz, Kiamaster, Kraz, Land Rover, Man, Mudan, PH Omega, Tractocamiónes y Camionetas Ramírez, Reo, Saic, Sinotruck, Sisu, Skoda, Steyr, Studebaker, Tata, T-King, Tmd, y Camiónes con carrocería Uaz, Wartburg, White, Willco, Willys, World Star, Xinkai, Yutong, ZX Auto estacas, estibas, niñera, panel, picó, planchón, portacontenedor Agrale, Ample, Chevrolet, Citroen, Daihatsu, Dina, Delta, Dodge, Fargo, Ford, GMC, y reparto. Hino, Hyundai, Kia, International, Isuzu, Iveco, Honda, Magirus, Mazda, Mitsubishi, G Mercury, Nissan, Non Plus Ultra, Peugeot, Renault, Renno, Ssangyong, Schacman, Suzuki, Toyota, Volkswagen Freigthliner, Kenworth, Mack, Marmon, Mercedes Benz, Pegaso, Scania, Volvo y H Wester Star Aro, Asia, Austin, Barreiro, Baw, Bock Wall, Chana, Changfeng, Changhe, Dacia, Daewoo, Datsun, Desoto, Deutz, Dfm, Dragon, Ernest Gruber, Faw, Fiat, Forland, Foton, Golden Dragon, Goleen, GWM, Hafei, Hersa, Higer, Huali, Ifa, Jac, Jiangchan, I Jinbei, JMC, Kaizer, Kamaz, Kiamaster, Kraz, Land Rover, Man, Mudan, PH Omega, Camionetas, Camiónes con Ramírez, Reo, Saic, Sinotruck, Sisu, Skoda, Steyr, Studebaker, Tata, T-King, Tmd, Uaz, Wartburg, -

Future International Business Strategy of Chinese Automotive Manufacturers: a Case Study on Their Overseas Operations in the Russian Market

Annals of Business Administrative Science 9 (2010) 13–32 Online ISSN 1347-4456 Print ISSN 1347-4464 Available at www.gbrc.jp ©2010 Global Business Research Center Future International Business Strategy of Chinese Automotive Manufacturers: A Case Study on Their Overseas Operations in the Russian Market Zejian LI Abstract: Since 1955, when new China began to reconstruct its automotive industry, and for a long time after, Chinese car exports consisted mainly of commercial automobile products (chassis and finished vehicles, etc.) which were exported in small quantities by state-owned manufacturers. Since 2000, however, with the emergence of independent automobile manufacturers, the number of vehicles exported has increased rapidly, and the makeup of exports has shifted gradually from a focus on commercial vehicles to a focus on passenger vehicles. With regard to overseas expansion, manufacturers’ market access strategy has led to the rapid transition from parts trade to local knock-down manufacturing. However, despite the rapid progress of foreign expansion, problems have arisen due to insufficient risk management know-how with regard to foreign expansion on the part of independent Chinese manufacturers, and the fact that their experience acquired from domestic markets is not applicable to overseas markets. For these reasons, following a period of prosperous overseas expansion, some Chinese automobile manufacturers have been forced to withdraw from one market or have chosen to switch to another market. This entire process, from rapid prosperity -

New Car Retailing Industry Market Study by the ACCC Submission

New Car Retailing Industry market study by the ACCC Submission from carsales.com Ltd 14 November 2016 1 Background to carsales.com Ltd carsales.com Ltd (ASX: CAR) (carsales) is the largest online automotive, motorcycle and marine classifieds business in Australia. Together with its subsidiaries, carsales develops world-leading technology and advertising solutions that drive its business around the world. Carsales has operations across the Asia Pacific region and has interests in leading online automotive classified businesses in Brazil, South Korea, Malaysia, Indonesia, Thailand, Mexico and Chile. 2 Index of questions responded to in this submission Issue Paper questions Questions about the structure and operation of the new car retailing industry 1 How well does the ACCC’s understanding of the new car retailing industry supply chain reflect market participants’ understanding of the supply chain? Which key market participants does it not capture? How could the ACCC’s definitions be improved? 7 Has competition increased in the new car industry over time and, if so, what is driving this change and how have dealers / manufacturers responded? 8 What are the main drivers of the increase in new car sales? 9 Are there other trends developing in the new car retailing industry in Australia? For example, has there been any consolidation in the dealership segment? What Impact might these trends and changes have on consumers? 10 What is the level of intra-brand competition (for example competition between retailers of the same branded product)? Questions -

Table of Contents

MEXICO’s AUTOMOTIVE INDUSTRY by Pat Shaw TABLE OF CONTENTS Subject Page PROLOGUE 4 - Mexico : a country of contrasts - Mexico’s automotive significance - About this report ECONOMIC INDICATORS 8 - General economic indicators - Automotive industry trends - Reasons to be cautious - Local business sentiment VEHICLE MANUFACTURING IN MEXICO 14 - Cars and Light Trucks – the key players - Commercial Vehicles – the key players - The vehicle parc in Mexico - Newcomers - Recent investments THE COMPONENT SECTOR IN MEXICO 26 - Overview - Key global players - Key domestic players - Business opportunities - Employment and wage levels in the component sector - A note on the Mexican aftermarket - Diversification into aerospace - Recent investments INTERNATIONAL RELATIONS 41 - USA - NAFTA - Latin America - European Union - Asia 2 INVESTMENT IN MEXICO 45 - The importance of FDI to Mexico - Current patterns of investment - Automotive investment clusters - The Maquiladora programme LOGISTCS & INFRASTRUCTURE 49 - Overview - Typical transit times - Typical transportation costs - Customs clearance procedures - Special Economic Zones - Infrastructure Plans CONCLUSIONS & BUSINESS OPPORTUNITIES 51 - Key conclusions and recommendations - Generic business opportunities - Specific business opportunities ACKNOWLEDGMENTS 58 USEFUL CONTACTS 60 3 PROLOGUE MEXICO : A COUNTRY OF CONTRASTS Mexico presents a series of contrasting, and sometimes confusing, images to the outside world. Geographically, at 1.92 million square kilometres, Mexico is the 14th largest country in the world, equivalent in size to Western Europe and stretching from the dry deserts in the North to the tropical rain-forests in the South. It has the bulk and power to be a dominant force amongst the countries of Central and South America. But Mexico itself remains dominated – economically, politically and increasingly culturally – by its giant northern neighbour, the United States of America. -

Compilación De Disposiciones Aplicables Al MUNICIPIO DE MEDELLÍN N.D

RESOLUCIÓN 1458 DE 2013 (mayo 2) Diario Oficial No. 48.778 de 2 de mayo de 2013 MINISTERIO DE TRANSPORTE Por la cual se adiciona y ajusta a la tabla 1 anexa a la Resolución número 11177 del 30 de noviembre de 2012. LA MINISTRA DE TRANSPORTE, en ejercicio de las facultades legales, en especial de las conferidas por los artículos 143 de la Ley 488 de 1998, 6 numeral 6.4 y 15 numeral 15.6 del Decreto número 087 de 2011, y CONSIDERANDO: Que el Ministerio de Transporte mediante la Resolución número 11177 del 30 de noviembre de 2012, estableció la base gravable de los vehículos de carga y colectivo de pasajeros, para el año fiscal 2013. Que se han recibido comunicaciones de propietarios de vehículos solicitando la inclusión en la tabla 1 anexa a la Resolución 11177 de 2012, de la siguiente línea: Vehículos de Pasajeros Marca: Línea Chevrolet N300 Que se hace necesario ajustar en la Tabla número 1 Clasificación según Clase, Tipo y Marca para el año fiscal 2013, los cilindrajes de las camionetas de carga con carrocería tipo Picó en los grupos Y, Z. En mérito de lo expuesto, este Despacho, RESUELVE: ARTÍCULO 1o. Adicionar a la tabla 1, Clasificación según Clase, Tipo y Marca para el año fiscal 2013, anexa a la Resolución número 11177 de 2012, en el Grupo W la siguiente línea: Marca: Línea Chevrolet N300 ARTÍCULO 2o. Ajustar los cilindrajes en la tabla 1, Clasificación según Clase, Tipo y Marca para el año fiscal 2013, los grupos Y, Z, los cuales quedaran así: - Grupo Y: de 1401 cc hasta 2800cc. -

Saudi Cafe) for Incoming Light Duty Vehicles (Saso 2864/2015)

SAUDI ARABIA CORPORATE AVERAGE FUEL ECONOMY STANDARD (SAUDI CAFE) FOR INCOMING LIGHT DUTY VEHICLES (SASO 2864/2015) Fuel Economy Performance Review Year-End 2019 Summary: The objective of Saudi Arabia Corporate Average Fuel Economy Standard is to set the fuel economy performance requirements for all light-duty vehicles (i.e. passenger cars and light trucks) incoming to the Kingdom of Saudi Arabia, which includes vehicles imported or vehicles locally produced for the intent of sale in the Kingdom of Saudi Arabia. The standard is part of Saudi Arabia’s integrated approach to improve energy efficiency in the transportation sector. As SASO/SEEC commitment to provide all automotive manufacturers with their new light-duty vehicles fuel economy performance, credits obtained during the same enforcement cycle, and the accrued credit balance, an annual report will be published for each enforcement cycle. This 2019 report will be made public and published on SASO portal and will include the mentioned details for all automotive manufactures. SASO/SEEC has collected imports data for all new light-duty vehicles imports to the Kingdom of Saudi Arabia and based on that these results were calculated. This report should give an overall look of the performance of Automotive Manufacturers. The mentioned results are final. 2 2019 Year-End Credit Summary PC LT Acutal Target Accumulated Acutal Target Accumulated OEM FE FE Credit FE FE Credit Aston Martin Lagonda Ltd 9.8 10.4 -324 NA NA 0 BMW Group 17.1 13.8 538796 12.9 12.2 65764 BYD AUTO CO., LTD 15 16.5 6864 28.1 12.7 462 Changan International Corporation 15.6 16.4 -107275 12.4 13.4 -26450 CHERY AUTOMOBILE CO., LTD. -

JASPAR Update

Vol. 27, No. 3 u hansenreport.com u April 2014 JASPAR Big Data Benefits for Carmakers in the Distant Future Update At $18.6 billion the global IT market Amidst plenty of hype from the IT com- for big data is already huge and growing panies and others about the value of big Since its founding a decade ago, JAS- fast, rising annually by 28.1% from 2013 data, the market research firm SBD recent- PAR, the Japan Automotive Software Plat- through 2017, according to the Wikibon ly published a report, Automotive Big Data, form and Architecture consortium, has Project. Thus far, some of the biggest bene- What’s It Really Worth?, and came up with enlisted 136 member companies. In addi- ficiaries of the big data market are the some numbers that it thinks are realistic: tion to the five board members, the ranks mega-IT vendors such as IBM, HP, Dell, $130 total value per car, per year, based on include 75 regular members and 56 associ- SAP, Oracle and Cisco Systems, companies 15 use cases. ate members. JASPAR was founded to en- that provide the services and produce the “We are seeing some fairly wild claims able the Japanese companies to speak with hardware and software used to wrest value about the value of automotive big data; the a collective voice at the international stan- from big data. One needs to look no fur- industry needed some harder facts,” said dardization bodies but many Western auto ther than Google to see the vast potential Lee Colman, one of the study’s authors. -

Carbrain Function List

Function list of Car Brain Content European Vehicle BENZ SKODA VOLVO BMW LANDROVER PEUGEOT VW/AUDI CITROEN OPEL SEAT RENAULT FIAT American Vehicle CHRYSLER FORD GM OBDII/EOBDII CAN/OBD INJECTION SYSTEM OBDII EOBDII CAN INJECTION SYSTEM Asian Vehicle 【1】Japanese Vehicle TOYOTA/LEXUS HONDA NISSAN SUZUKI MITSUBISHI MAZDA DAIHATSU 【2】Korean Vehicle HYUNDAI KIA DAEWOO 【3】Chinese Vehicle Northeast of China FAW-VW SHENYANG JINBEI AUTO FAW-JIQING FAW-HONGQI FAW-ERFA CHINA-MOTOR FAW-MAZDA AOKESI AUTO POLARSUN AUTO FAW-JIABAO SG AUTO DONGAN AUTO HAFEI AUTO GONOW AUTO North of China Beijing Jeep Heibao Motor Tongbao Motor Beijing Hyundai Huatai Auto Xinkai Auto BAW Qinhuangdao Motor Beijing xingtiandi motor Great wall motor Shuanghuan Auto Qingdao Estong Dadi Auto Tianma Auto Beilv Auto FOTON Tianye Auto ZXauto Huabei Motor Tianjing Toyota East of China Shanghai GM Fuzhou Mazda Landwind Shanghai VW Shanghai Maple Automobile Nanjing FIAT Chery Huayang Auto SAIC Motor Soueast-motor IVECO Shanghai Wanfeng Auto Jiangnan Alto JAC Soyat Changhe Auto JMC Yangzi Vehicle Changhe-Suzuki Geely Dongfeng KIA Fuzhou Motor King-long Yuejin Auto South of China Guangzhou Honda Baolong Motor Jingan Clouded leopard Wuling Motor Fudi Motor Hainan Mazda YCACO Midland of China Dongfeng Citroen Dongfengxiaokang Hanjiang Motor Dongfeng GEUGEOT Dongfeng CNG Wuhan Wantong Dongfeng Nissan DFAC light truck Zhengzhou Nissan Dongfeng MPV Changfeng Liebao Southwest & Northwest of China Changan Vehicle Changan Suzuki Changan Ford BYD Auto Chengdu New-dadi Xian Qinghua vehicle -

Lonsdor-K518S-Vehicle-List.Pdf (523K)

Immobilization Brand Menu Application TRUMPCHI\GS5\Immobilizer Add key,Delete key,Read key count, TRUMPCHI\GS5\Smart key Program smart key, TRUMPCHI\GA5\Immobilizer Add key,Delete key,Read key count, TRUMPCHI\GA5\Smart key Program smart key, TRUMPCHI\GA3\Immobilizer Add key,Read key count,All key lost, TRUMPCHI\GA8\Immobilizer Add key,Read key count,All key lost, TRUMPCHI\GS4\Immobilizer Add key,Read key count,All key lost, TRUMPCHI\GA6\Immobilizer Add key,Read key count,All key lost, TRUMPCHI\Extended electric Add key,Delete key,Read key count, vehicles\Immobilizer TRUMPCHI\GA3\Smart key Program smart key, TRUMPCHI\GA6\Smart key Program smart key, TRUMPCHI\GA8\Smart key Program smart key, TRUMPCHI TRUMPCHI\GS4\Smart key Program smart key, TRUMPCHI\GS8\Smart key Program smart key, TRUMPCHI\GS8\Immobilizer Add key,Delete key,Read key count, TRUMPCHI\GA4\Immobilizer Add key,Read key count,All key lost, TRUMPCHI\GA4\Smart key Program smart key, TRUMPCHI\GS3\Immobilizer Add key,Delete key,Read key count, TRUMPCHI\GS3\Smart key Program smart key, TRUMPCHI\GS7\Smart key Program smart key, TRUMPCHI\GE3\Smart key Program smart key, TRUMPCHI\GM8\Smart key Program smart key, TRUMPCHI\New energy vehicles\Immobilizer Add key,Read key count,All key lost, TRUMPCHI\GA3S(PHEV)\Smart key Program smart key, TRUMPCHI\GS4(PHEV)\Smart key Program smart key, Add key,Lost all key,Read CEM security data,Key recognition & VOLVO\S60\Smart key[insert start] unlocking, Add key,Lost all key,Read CEM security data,Key recognition & VOLVO\S80\2009-\Smart key[insert