Voda Idea Puts AGR Dues At

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Avenue Supermarts Limited AVEU.BO, DMART in Value Retailer at Premium Multiples; Initiate with Price: Rs664.40 Neutral Price Target: Rs635.00

Completed 07 Apr 2017 04:07 AM HKT Disseminated 07 Apr 2017 04:44 AM HKT Asia Pacific Equity Research 07 April 2017 Initiation Neutral Avenue Supermarts Limited AVEU.BO, DMART IN Value Retailer at Premium Multiples; Initiate with Price: Rs664.40 Neutral Price Target: Rs635.00 We initiate on Avenue Supermarts (ASL) with a Neutral rating and Mar-18 price India target of Rs635. ASL (operates stores under D-Mart brand), with a strong Consumer, Retail, Media execution track record, is a quality play on the Indian F&G retail sector in our AC opinion, being the fastest-growing and most profitable retailer. We forecast Latika Chopra, CFA 27%/34% revenue/EPS CAGR over FY17-20. However, significant gains post the (91-22) 6157-3584 [email protected] listing (120% above the offer price) lead to current valuations of 55x/42x Bloomberg JPMA CHOPRA <GO> FY18E/19E P/E, which fairly reflect the long-term growth opportunity in our J.P. Morgan India Private Limited view. Any minor lapse near term (store opening, comps, and/or margins) and Ebru Sener Kurumlu substantial investments in E-Commerce (earnings dilutive) could strain valuation (852) 2800-8521 multiples. [email protected] Much to like here. Food retailing is about format and execution and in our J.P. Morgan Securities (Asia Pacific) Limited view ASL has been able to achieve this combination well. We like ASL’s execution capabilities, single format focus, best-in-class productivity metrics Price Performance (sales densities ~2-3x peers), prudent store expansion strategy and strong focus 650 on customer satisfaction partly aided by its ‘everyday low price’ positioning. -

First Call 22Mar21

India Equity Research March 22, 2021 FIRST CALL DAILY REPORT MARKETS Change in % Metals & Mining - Sector Update - Tangshan cuts may push up steel prices 21-Mar-21 1D 1M 1Y Media reports suggest local authorities in Tangshan have imposed a fresh set of Nifty 50 14,558 -1.1 -2.8 76.2 Nifty 200 7,583 -1.2 -2.6 76.7 production curbs on steel value chain until end-CY21 in order to reduce air pollution. Nifty 500 12,174 -1.2 -2.1 78.8 According to Mysteel consultancy, if the draft plan is adopted, pig iron production and iron ore demand would fall by 22mt and 35mt, respectively. Taken together with INDIA STOCK PERFORMANCE the possibility of export rebate cuts, we believe exports from China can reduce significantly, thereby supporting steel prices. 16,000 80,000 14,500 70,000 Dabur India - Company Update - Growing naturally 13,000 (x) 11,500 60,000 (x) We recently met Mr. Mohit Malhotra, CEO of Dabur India, to gain insights into the 10,000 50,000 company’s growth plans, product launches and strategy to counter competition, 8,500 7,000 40,000 among others. Highlights: i) The pandemic has brought in new consumers to the health portfolio. ii) The worst is behind for fruit juices and other segments squeezed Nifty Index MSCI EM Index - Local Currency (RHS) by the lockdown. iii) Strong focus on innovation (recent launches in PET bottle juices, health drops, health juices, Amla-plus juices, pickles and apple cider vinegar are all doing well). GLOBAL 21-Mar-21 1D 1M 1Y Avenue Supermarts - Company Update - Time to whet appetite for online Dow 32,862 -0.5 4.3 63.6 While DMart has taken incremental steps to ramp up online grocery, it still seems to China 3,432 -0.9 -7.1 27.0 be on the sidelines and contemplating its merit. -

Grant Thornton Bharat's Report on Integrated Reporting in India

Integrated reporting in India Survey on adoption and way forward December 2020 Contents Forewords 03 Grant Thornton Bharat survey on integrated reporting – key findings 05 Overview of integrated reporting 08 Benefits for organisations 12 Global landscape 16 Evolving scenario in India 21 Path to success 28 Way forward 32 02 Integrated reporting in India Foreword - Grant Thornton Bharat The ongoing pandemic has reinforced my belief that inclusive growth is more important to shape a #VibrantBharat than any other priority. Indian businesses must step up to this challenge as catalysts of employment, technological advancement and innovation. Since the new Companies Act 2013, India has made recognise the exceptional work done by individuals significant progress in corporate reporting and and organisations in India towards sustainable disclosures. I believe this decade will see similar progress development goals (SDGs). Our firm works extensively on integrated reporting, as it is an opportunity to not with such stakeholders to build social capital, address only differentiate yourself but to contribute to shaping a gender inequalities, protect the environment for future more vibrant Indian economy. generations and achieve the shared purpose of helping shape our #VibrantBharat. Almost 70% of those surveyed believe that integrated reporting will help them enhance stakeholder value, Vishesh C. Chandiok while the consensus seems to be that greater awareness CEO and clearer guidelines will pave the way for more Grant Thornton Bharat companies to adopt integrated reporting in India. I am delighted that this report is being released at the Grant Thornton Bharat SABERA Awards 2020 that Integrated reporting in India 0 3 Foreword - IIRC With intangible assets now making up 90% of market value in the S&P 500, businesses need to show their stakeholders that they create value and report on not just financial capitals but also intellectual, environmental, manufactured and human capitals. -

Trends of Judicial Pronouncements Regarding Comparative Advertising in India

January 2018, Volume 5, Issue 1 JETIR (ISSN-2349-5162) TRENDS OF JUDICIAL PRONOUNCEMENTS REGARDING COMPARATIVE ADVERTISING IN INDIA Dr. Puneet Bafna (Associate Professor, Amity Law University, Rajasthan) ABSTRACT: Comparative advertising came into existence to increase consumer awareness and allow consumer to make a judicial selection from plethora of choices, however under market pressures it has engaged in unhealthy practices of product disparagement and infringement of trademarks. Consequently, in the last few decades, there have been spates of litigations in this regard. As there have been a proliferation in the number of cases in the courts regarding this matter and there have been interestingly such conflicting judgments concerning the issue in the recent past that the topic seemed quite fascinating and motivating to ponder and analyze at. Here the author has listed cases of prominence in India. The decisions of the Courts indicate that the judiciary tends to accept the global trend of advertising regulation, which allows comparative advertising as a way of ensuring free competition for all market players, provided that the information presented is objective and verifiable, and does not damage the integrity and reputation of the compared trademark. It is vital that the court issues precedents and guidance in order to harmonize the issue at national level. Keywords: Comparative Advertising, Product disparagement, Trademark infringement, judicial pronouncement 1. Introduction By Comparative advertising the market players want to ensure that the consumer receives the message that their product is superior and more sought after. However, in order to grab the attention of the consumer towards its brand and to hold their market share a number of firms have started taking bolder stance by show their rival / competitors product in a poor light and denigrating them. -

Inner 29 Equity Savings Fund

Modera erate tely Mod High to H w te ig o ra h L de o M V e r y w H Tata Equity Savings Fund o i L g (An open-ended scheme investing in equity, arbitrage and debt) h Riskometer Investors understand that their principal As on 28th February 2021 PORTFOLIO will be at Moderate Risk % to % to % to NAV Company name Company name INVESTMENT STYLE NAV NAV Derivative Predominantly investing in equity and equity related instruments, Equity & Equity Related Total 67.21 NTPC Ltd. 1.80 equity arbitrage opportunities and debt and money market instruments. Unhedge Positions 34.10 NTPC Ltd.- Future -1.80 Auto Divi Laboratories Ltd. 1.77 INVESTMENT OBJECTIVE Tata Motors Ltd. 0.85 Divi Laboratories Ltd.- Future -1.78 The investment objective of the scheme is to provide long term capital Mahindra & Mahindra Ltd. 0.65 Maruti Suzuki India Ltd. 1.25 appreciation and income distribution to the investors by predominantly Maruti Suzuki India Ltd. 0.40 Maruti Suzuki India Ltd.- Future -1.26 investing in equity and equity related instruments, equity arbitrage Banks Ambuja Cements Ltd. 1.25 opportunities and investments in debt and money market instruments. HDFC Bank Ltd. 5.01 Ambuja Cements Ltd.- Future -1.25 However, there is no assurance or guarantee that the investment ICICI Bank Ltd. 4.08 United Spirits Ltd. 1.15 objective of the Scheme will be achieved. The scheme does not assure State Bank Of India 0.47 United Spirits Ltd.- Future -1.16 or guarantee any returns. Axis Bank Ltd. 0.40 HCL Technologies Ltd. -

Previous Awardees

LIST OF AWARDEES “ICSI NATIONAL AWARD FOR EXCELLENCE IN CORPORATE GOVERNANCE” 2001 – 2017 2001 Best Governed Company Second Best Governed Company Infosys Technologies BSES Limited Limited 2002 Best Governed Companies Best Governed Company in Private Sector in Public Sector Dr. Reddy’s Laboratories Ltd. IBP Co. Limited Tata Iron & Steel Co. Ltd. 2003 Best Governed Companies Best Governed Company in Private Sector in Public Sector HDFC Ltd. ONGC Ltd. Reliance Industries Ltd. 2004 Best Governed Companies Best Governed Company in Private Sector in Public Sector Hero Honda Motors Ltd. Tamilnadu Newsprint and Wipro Ltd. Papers Ltd. 2005 Best Governed Companies (in alphabetical order) Dabur India Ltd. Infosys Technologies Ltd. 2006 Best Governed Companies (in alphabetical order) Abhishek Industries Ltd. ITC Limited 2007 Best Governed Companies (in alphabetical order) Kansai Nerolac Paints Limited TATA Consultancy Services Limited 2008 Best Governed Companies (in alphabetical order) Mahindra & Mahindra Limited MindTree Limited 2009 Best Governed Companies (in alphabetical order) Maruti Suzuki India Ltd. NTPC Limited 2010 Best Governed Companies Certificate of Recognition to other (in alphabetical order) top 5 companies Dr. Reddy’s Laboratories (in alphabetical order) Limited CMC Limited Larsen & Toubro Limited GAIL (India) Limited Oil & Natural Gas Corporation Ltd. Persistent Systems Ltd. Union Bank of India 2011 Best Governed Companies Certificate of Recognition to other (in alphabetical order) top 5 companies Gail (India) Limited (in alphabetical order) Hindustan Unilever Limited CMC Limited HCL Technologies Limited Oil and Natural Gas Corporation Limited Persistent Systems Limited Union Bank of India 2012 Best Governed Companies Certificate of Recognition to other (in alphabetical order) top 5 companies HCL Technologies Limited (in alphabetical order) Indian Oil Corporation Limited CMC Limited Engineers India Limited Oil and Natural Gas Corporation Limited Persistent Systems Limited Power Grid Corporation of India Ltd. -

Global Pharma 3.Indd

the globalization of innovation: June 2008 PHARMACEUTICALS Can India and China Cure the Global Pharmaceutical Market? The Globalization of Innovation: Pharmaceuticals i The Globalization of Innovation: Pharmaceuticals ii Authors Vivek Wadhwa Executive in Residence, Pratt School of Engineering, Duke University Wertheim Fellow, Labor and Worklife Program, Harvard University Fellow, Social Sciences Research Institute, Duke University Ben Rissing Wertheim Fellow, Labor and Worklife Program, Harvard University Gary Gere! Director of the Center on Globalization, Governance & Competitiveness; and Professor, Sociology Department, Duke University John Trumpbour Research Director, Labor and Worklife Program, Harvard University Pete Engardio Senior Writer, BusinessWeek Magazine Student authors and acknowledgements Jason Anastasopoulos, John P. Harvey, Udai Kaura, Jasmita Mohan, Ravi Prodduturi, Aishwarya Ramaswamy, David Siet, Elizabeth Skiotis, Tarun Wadhwa Global Engineering and Entrepreneurship @ Duke www.GlobalizationResearch.com " is research was funded in part by the Ewing Marion Kau# man Foundation. " e contents of this publication are solely the responsibility of the authors. The Globalization of Innovation: Pharmaceuticals iii The Globalization of Innovation: Pharmaceuticals iv Table of contents Overview: Globalization of innovation — industry by industry . 1 Summary of ndings . 2 Global pharmaceutical intellectual-property creation . 2 Business relationships . 2 Value-chain activity. 2 Examples of Pharmaceutical Opportunities in India and China. 3 Other observations . 3 Introduction: The pharmaceutical industry . 4 Global value chains: an introduction . 5 The pharmaceutical global value chain . 6 Vertical opportunities in the pharmaceutical value chain . 8 Storm over intellectual property . 10 Our ndings. 11 India and China in the global value chain . 12 Business models and work complexity . 12 Local advantages . 17 Cost savings . 17 Ethical issues and constraints on future growth . -

Model Portfolio Update

Model Portfolio update September 2, 2016 LatestDeal Team Model – PortfolioAt Your Service Large cap Midcap Name of the company Weightage(%) Name of the company Weightage(%) Auto 15.0 Aviation 6.0 Tata Motor DVR 4.0 Interglobe Aviation 6.0 Bosch 3.0 Auto 6.0 Maruti 5.0 Bharat Forge 6.0 EICHER Motors 3.0 BFSI 6.0 BFSI 25.0 Bajaj Finserve 6.0 HDFC Bank 8.0 Capital Goods 6.0 Axis Bank 3.0 Bharat Electronics 6.0 HDFC 8.0 Cement 6.0 Bajaj Finance 6.0 Ramco Cement 6.0 Capital Goods 4.0 Consumer 30.0 L & T 4.0 Symphony 606.0 Cement 4.0 UltraTech Cement 4.0 Supreme Ind 6.0 FMCG/Consumer 18.0 Kansai Nerolac 6.0 Dabur 5.0 Pidilite 6.0 Marico 4.0 Rallis 6.0 Asian Paints 5.0 Infrastructure 8.0 Nestle 4.0 NBCC 8.0 IT 18. 0 Logistics 606.0 Infosys 10.0 Container Corporation of India 6.0 TCS 8.0 Pharma 20.0 Media 2.0 Natco Pharma 6.0 Zee Entertainment 2.0 Torrent Pharma 6.0 Pharma 14.0 Biocon 8.0 Lupin 6.0 Textile 6.0 DRddDr Reddys 505.0 Arvind 6.0 Aurobindo Pharma 3.0 Total 100.0 Total 100.0 • Exclusion - ITC, Wipro and Reliance Industries • Exclusion – Nestlé shifted to Large cap • Inclusion – Dabur, increased weight in Maruti, Marico, Bajaj Finance & • Inclusion - Biocon UltraTech. Also Nestlé transferred from Midcap to Large cap Source: Bloomberg, ICICIdirect.com Research *Diversified portfolio - Combination of 70% large cap and 30% midcap portfolio OutperformanceDeal Team – At continues Your Service across all portfolios… • Our indicative large cap equity model portfolio has continued to deliver an • In the large cap space, we continue to remain positive on auto, impressive return (inclusive of dividends) of 108.5% since its inception infrastructure & cement. -

Corporate Governance Scores S&P BSE 100 Companies

Corporate Governance Scores S&P BSE 100 companies Technical Partner Supported by the Government of Japan January 2018 TABLE OF CONTENTS Foreword 2 1 Introduction 4 2 SENSEX Trends 6 3 S&P BSE 100 Findings 8 4 Conclusion 12 5 Annexures 13 6 1 1. FOREWORD Vladislava Ryabota Regional Lead for Corporate Governance in South Asia, IFC Welcome to this second report on the Indian Corporate Governance Scorecard, developed jointly by the BSE, IFC and Institutional Investor Advisory Services (IiAS), with the financial support of the Government of Japan. The goal of a scorecard is to provide a fair assessment of corporate governance practices at the corporate level. This, in return, gives investors, regulators and stakeholders key information to help them in their decisions with regards to such companies. Since we started this journey in India, with our first scorecard issued in December 2016, a lot of dynamic changes have been set in motion. For instance, the scorecard of 2016 scored 30 companies, and now we have a 100 in this year’s edition. We were also happy to notice that several best practice requirements, covered by the scoring methodology, have been recommended by the Kotak Committee, formed in 2017 at the initiative of the Securities and Exchange Board of India. Changes have also taken place at the regulatory level to incite investors to take a more active role at Annual General Assemblies and vote in order to bring positive changes in the practices of their investee companies. All these changes form part of an overall dynamic aimed at helping the private sector raise its visibility in India and throughout the world and IFC is proud to be a solid partner and actor to this initiative. -

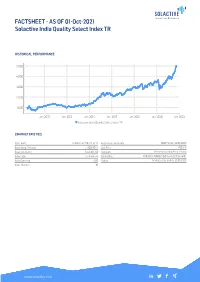

FACTSHEET - AS of 01-Oct-2021 Solactive India Quality Select Index TR

FACTSHEET - AS OF 01-Oct-2021 Solactive India Quality Select Index TR HISTORICAL PERFORMANCE 5,000 4,000 3,000 2,000 1,000 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive India Quality Select Index TR CHARACTERISTICS ISIN / WKN DE000SLA7YX0 / SLA7YX Base Value / Base Date 1000 Points / 20.06.2008 Bloomberg / Reuters / .SOLINQST Last Price 4853.15 Index Calculator Solactive AG Dividends Reinvested (Total Return Index) Index Type Total Return Calculation 1:00 am to 5:00 pm (CET), every 15 seconds Index Currency AUD History Available daily back to 20.06.2008 Index Members 30 FACTSHEET - AS OF 01-Oct-2021 Solactive India Quality Select Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance 1.52% 14.27% 21.70% 39.77% 26.71% 385.31% Performance (p.a.) - - - - - 12.63% Volatility (p.a.) 12.09% 11.48% 13.24% 15.04% 15.58% 21.01% High 5024.21 5024.21 5024.21 5024.21 5024.21 5024.21 Low 4780.68 4247.09 3717.57 3429.28 3717.57 653.56 Sharpe Ratio 1.66 6.26 3.70 2.69 2.38 0.60 Max. Drawdown -3.40% -3.40% -6.78% -7.85% -7.85% -42.48% VaR 95 \ 99 -25.0% \ -42.5% -30.9% \ -58.3% CVaR 95 \ 99 -35.5% \ -49.0% -49.0% \ -83.6% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES INR 100.0% IN 100.0% TOP COMPONENTS AS OF 01-Oct-2021 Company Ticker Country Currency Index Weight (%) INFOSYS (INFOSYS TECH) LTD ORD INFO IS Equity IN INR 7.98% TATA CONSULTANCY SVCS LTD TCS IS Equity IN INR 7.34% HINDUSTAN UNILEVER LTD HUVR IS Equity IN INR 6.61% KOTAK MAHINDRA BANK LIMITED KMB IS Equity IN INR 5.79% RELIANCE INDUSTRIES LTD ORD RIL IS Equity IN INR 5.02% ICICI BANK LTD ORD ICICIBC IS Equity IN INR 5.00% AXIS BANK LTD AXSB IS Equity IN INR 3.90% HOUSING DEVELOPMENT FINANCE HDFC IS Equity IN INR 3.55% DIVIS LABORATORIES LTD ORD DIVI IS Equity IN INR 3.34% DABUR INDIA LTD ORD DABUR IS Equity IN INR 3.24% FACTSHEET - AS OF 01-Oct-2021 Solactive India Quality Select Index TR DISCLAIMER © Solactive AG, 2021. -

Dabur India Limited – the World Leader in Ayurvedic Products - Sustaining Competitive Advantage

AJMR Volume 1 Issue 1 2016 Amity Journal of Management Research 1(1), (124–142) ©2016 ADMAA Dabur India Limited – The World Leader in Ayurvedic Products - Sustaining Competitive Advantage Thomas Mathew K J Somaiya Institute of Management Studies & Research, Mumbai, India (Received : 29/09/2015; Accepted: 19/04/2016) Abstract The fast moving consumer goods (FMCG) sector with a market size of US$ 47.3 billion in 2015 is expected to more than double to USD 103.7 billion by 2020 and is the fourth largest sector in the Indian economy. This sector has seen several of the top players trying to consolidate their existing business portfolios by innovation or customization in the food & beverages; healthcare; and household and personal care segments. The customers are now more aware and with changing lifestyles and brand consciousness they are willing to pay a premium for easily accessible products. In this competitive markets, companies adopt several strategies like small pack size, exports to nearby similar markets, eco-friendly products, private label substituting premium brands, rural market focus, backward and forward front end integration including third party manufacturing. This case study focuses on the analytical decisions and strategy that Dabur, India’s oldest and the largest ayurvedic company uses to be among the top three FMCG business companies in the Indian market. A detailed insight into their growth strategy is analyzed wherein Dabur is strengthening its new categories in the FMCG sector by strong innovative programs that target inorganic opportunities while expanding across geographies. Dabur is making a strong appeal to the young generation with the brand campaign that is contemporary, vibrant and socially conscious. -

Tata Consultancy Services Ltd

The Institution TATA CONSULTANCY SERVICES LTD. (PROFORMA FOR ACCREDITATION DEENBANDHU WITH CHHOTU THE TCS) RAM UNIVERSITY OF SCIENCE & INSTITUTETECHNOLOGY PROFILE DATED:Name 25.07.2011 of the Institution (STATE UNIVERSITY OF HARYANA 1.1 GOVT.) VPO MURTHAL, DISTT. SONEPAT Postal Address (HARYANA) PIN CODE- 131039 1.2 Contact Person 1.3 Name DR. VIRENDER AHLAWAT Designation TRAINING & PLACEMENT OFFICER Mobile 9416342915 Landline with Station Code 130-2484129 [email protected] & Email [email protected] Principal/ Registrar Registrar 1.4 Name Sh. R. K. Arora Mobile Landline with station code 0130-2484005 Email [email protected] Chairman/ Vice Chancellor VICE CHANCELLOR 1.5 Name SH H.S. CHAHAL Mobile 9416067400 Landline with Station code 0130-2484003 Email [email protected] Nearest Airport/ Railway Station IGI AIRPORT, NEW DELHI 1.6 RAILWAY STATION:- SONEPAT C.R.State College of Engg. Murthal (1987) morphed into the Deenbandhu Chhotu Ram Year of Establishment University of Science & Technology on 1.7 NOVEMEBER, 2006 Govt University/Deemed/University Affiliated Govt College/ Affiliated Private College/ Status (Please Color whichever applicable) Autonomous /Govt aided Private College 1.8 University Grant Commission Under Section University to which affiliated 12(B), of UGC Act 1956 1.9 Approved by AICTE YES 1.10 Accredited by NBA NO 1.11 Are you ISO certified, if so details NO 1.12 To facilitate and promote studies and research in emerging areas of higher education with focus on new frontiers of Science, Engineering, Technology, Architecture and Management, Please state your Vision Statement leading to evolution of enlightened technocrats, innovators, scientists, leaders and entrepreneurs who will contribute to national growth in particular and to international community as a whole.