Ferrovial, S.A. & Subsidiaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Corporate Governance Report

REPSOL S.A. 2019 Annual Corporate Governance Report Translation of a report originally issued in Spanish. In the event of a discrepancy, the Spanish language version prevails DETAILS OF ISSUER DETAILS OF ISSUER Dated end of year 31/12/2019 TAX REGISTRATION NUMBER: A-78375725 Name: Repsol, S.A. Registered office: C/ Méndez Álvaro, 44, Madrid 2 DETAILS OF ISSUER TABLE OF CONTENTS A. Executive summary ......................................................................................................................................................................... 4 1. Presentation by the Chairman of the Board of Directors .......................................................................................................... 4 2. At a glance .................................................................................................................................................................................. 5 3. The Board of Directors ............................................................................................................................................................... 9 4. Interaction with investors ........................................................................................................................................................ 12 B. The Repsol Corporate Governance System ................................................................................................................................... 15 1. Regulatory Framework ............................................................................................................................................................ -

Management Committee

CORPORATE GOVERNANCE A 105 MANAGEMENT COMMITTEE ÍÑIGO MEIRÁS CEO He is a Law graduate and holds an MBA from the Instituto de Empresa. He joined Ferrovial in 1992, was Mana- ging Director of Autopista del Sol and later on Toll Roads Director in Cintra until November 2000. Between 2000 and 2007 he headed the expansion of Ferrovial Services as Managing Director, later on as CEO, and in 2007 he was appointed CEO of Ferrovial Aeropuertos. He held the position of Group Managing Director of Ferrovial between April and October 2009, when he became CEO. MARÍA DIONIS JORGE GIL Managing Director of Human Resources CEO of Ferrovial Airports She holds a degree in Psychology from the Complu- He has a degree in Business and Law from ICADE tense University of Madrid and a Master’s in HR Mana- University. In 2010, he was appointed Director of gement from the University of Maryland. Before joining Finance and Capital Markets of Ferrovial. He began Ferrovial, she worked at Andersen Consulting, Watson his career at The Chase Manhattan Bank, where Wyatt, Soluziona and Getronics Iberia. She joined the he was part of the Corporate Finance and M&A company in 2006 as HR Development Director. In May divisions. In December 2012 he was named CEO of 2010, she became HR and Communications Director Ferrovial Airports. at Ferrovial Services. In June 2015 she became Group HR Director. ERNESTO LÓPEZ MOZO Finance Director ALEJANDRO DE LA JOYA He is a civil engineer (Polytechnical University of CEO of Ferrovial Agroman Madrid) and holds an MBA from The Wharton School He is a civil engineer who joined the company in 1991. -

Hechos Relevantes

Hechos Relevantes Palacio de la Bolsa Plaza de la Lealtad, 1 28014 Madrid Tel.: +34 91 709 58 10 Fax: +34 91 709 53 96 [email protected] HECHOS RELEVANTES Información en tiempo real a través de la BME Data Feed y en un formato estandarizado de los Hechos Relevantes y otra información financiera remitida por los emisores a la CNMV. El servicio incluye la información en castellano que se difunde a través de la CNMV así como la información en inglés de aquellas entidades emisoras que formen parte de la red de contribuidores de este servicio. DESCRIPCION DE PRODUCTO Los clientes de Hechos Relevantes recibirán en tiempo real un mensaje con el titular/resumen del Hecho Relevante y un enlace a la documentación proporcionada por la entidad emisora. El producto ofrece la siguiente información: • Nombre de la emisora • Código ISIN de la emisora • NIF de la emisora • Hecho Relevante comunicado por la emisora (PDF, XBRL…) • Tipología de Hecho Relevante (únicamente para servicio en español) El producto se ofrece en español y en inglés (en este idioma, únicamente con la cobertura que se indica en la sección “red de contribuidores”). BENEFICIOS Punto único de información VENDORS del mercado español Estandarización FONDOS DE INVERSIÓN Información completa del FEED Hecho Relevante Tiempo Real BANCOS Rapidez “Hechos Disponibilidad de la Relevantes” MEDIOS DE COMUNICACIÓN información en inglés Servicio PUSH EMISORES OTROS 2 TIPOS DE HECHOS RELEVANTES 3 RED DE CONTRIBUIDORES (a 1 de diciembre de 2015) Hechos Relevantes en inglés IBEX 35® IBEX -

Tecnicas Reunidas

Tecnicas Reunidas Spain/ Oil Services Post results note Investment Research 11 NOVEMBER 2016 Accumulate Resultados del 3T16, en línea con lo estimado. Recommendation unchanged La noticia: Técnicas Reunidas presentó ayer los resultados del 3T16. Share price: EUR 33.75 closing price as of 10/11/2016 Nuestro análisis: Los resultados han estado en línea con lo estimado. Target price: EUR 36.00 TECNICAS REUNIDAS : 9M16 RESULTS Target Price unchanged 9M15 %sles 9M16 %sles %y/y 2Q16 3Q15 3Q16 Sales 3,006.0 100% 3,437.9 100% 14.4% 1,252.6 1,122.4 1,134.0 Reuters/Bloomberg TRE.MC/TRE SM EBITDA 159.2 5.3% 154.1 4.5% -3.2% 55.4 56.6 51.6 Daily avg. no. trad. sh. 12 mth 480 Depreciation -11.6 -0.4% -15.2 -0.4% 31.0% -5.2 -4.0 -5.0 Daily avg. trad. vol. 12 mth (m) 20,834.07 EBIT 147.6 4.9% 138.9 4.0% -5.9% 50.3 52.6 46.5 Price high 12 mth (EUR) 38.31 Financial results 4.2 0.1% -1.1 0.0% -1.4 1.0 3.2 Price low 12 mth (EUR) 21.75 EBT 151.8 5.0% 137.8 4.0% -9.2% 48.8 51.4 48.2 Abs. perf. 1 mth -6.2% Income tax -36.6 -1.2% -36.5 -1.1% -0.3% -13.2 -11.3 -12.7 Abs. perf. 3 mth 6.2% Net profit 115.2 3.8% 101.3 2.9% -12.1% 35.7 40.1 35.4 Abs. -

The New ACS Group Construction 1H/03 Revenues

Global Construction Conference November,November, 20032003 Index Highlights The new ACS Group Outlook for 2003 Conclusions 2 Highlights Strategic rationale of the merger Creation of a European leader • #1 in the most profitable market: Spain • Market leader in all businesses related to the development and management of infrastructures Excellent growth opportunities • Diversified portfolio of activities • Government Investment Plans Potential synergies from the merger Financial strength Industry’s reference stock • Market Capitalization > € 4.3 bn • Liquidity > € 20 mn daily 3 Highlights Creation of a market leader … # 1 in Spanish Construction # 1 in Industrial Services in Spain, Portugal & Latam # 1 in Waste Management in Spain # 1 in Ports and Logistics Services in Spain Core shareholder in the # 1 transport infrastructure concessions company worldwide (by # of concessions) 4 Highlights … of European size … Comp. EBIT 03e* € million 650 Margin on sales 6,0% 525 425 4,3% 3,3% 285 3,0% 250 1,9% 200 1,6% Sales 03e (€ bn) ACS Vinci Bouygues Skanska Ferrovial** Hochtieff Total Sales 10.8 17.5 21.5 14.9 7.0 12.3 Comp. Sales* 10.8 15.7 14.2 12.3 5.8 12.3 * Comparable data are estimated figures in those activities carried out by all companies:Construction, Services & Industrial. It does not include data from Concessions, Real Estate and other businesses. ** Ferrovial figures include CESPA & Amey full year data Source: Analysts’ Reports and Companies data 5 Highlights … and invested in Concessions Equity Investments in Concessions* € billion 3.0 1.7 1.0 Vinci Ferrovial ACS Main Cofiroute(85%), carparks, Cintra (60%), including Abertis (12%), highways, Assets airports & ASF (17%) ETR 407, carparks & airports airports & railroads Accounting Global consolidation Global consolidation Equity accounted method (except ASF: Equity acc.) * Source: Companies’ Reports. -

Iron, Steel & Metals

Hidroambiente S.A.U. Calle Mayor, 23 E, 1º 48930 Getxo (SPAIN) T: +34 94 480 40 90 - F: +34 94 480 30 76 [email protected] Hidroambiente S.A.U. Rio Rhin 56 - 6ª Planta Colonia Cuauhtemoc 06500 CDMX (MEXICO) T: +52 55 6811-6556 / +52 55 6732-1809 [email protected] | water treatment plants | Everblue Private Ltd. B-402, Ganga Osian Square, Near LG Showroom, Mankar Chawk, Wakad, Pune 411057 (INDIA) T: +91 20 6473 1585 IRON, STEEL METALS [email protected] & www.hidroambiente.es Hidroambiente, within the Elecnor Group, was This commitment is possible thanks to a very founded in 1993 to deliver Water Treatment experienced innovation-committed highly- solutions to highly demanding customers skilled staff. from the industrial and public sector. Our long-standing experience, our countless We strive to meet our customers’ satisfaction references and our prestige in the market by addressing every stage in a water treatment together with the importance of our customers project, i.e. Design, Construction, Assembly, encourage us to go on with this strategy. Commissioning, Operation & Maintenance and Technical Assistance. n Services 1 n Manufacturing of “Turn Key” Water Treatment Plants n Equipment Manufacturing n Supply of Materials n “In House” Construction and Assembly n Start-up Service n Technological Adjustment and Upgrading n Transfers and Revamping Before undertaking any Investment: n Basic Engineering Solutions n Detail Engineering n Technical Assessment on the Design of New Plants n Water Networks Audits and Solutions n Water Treatment Plants 2 Technologies: n Freshwater from Rivers and Lakes. Settler Tanks, Flotation Systems and Sand Filters n Freshwater from Wells and Reservoirs. -

April 2020 Monthly Update

Sustainable Technology and Infrastructure Monthly Market Update // April 2020 Performance of Key Market Indices(1) 60.0% 40.0% 20.0% 16.4% 9.8% 0.0% (1.1%) (20.0%) (8.5%) (40.0%) Apr-19 Jun-19 Aug-19 Oct-19 Dec-19 Feb-20 Apr-20 NASDAQ Clean Edge Green Energy Dow Jones Industrial Average NASDAQ Composite S&P 500 Index Performance(1) April Ending Versus April YTD CY 2019 52 Wk High 52 Wk Low Dow Jones Industrial Average 11.1% (14.7%) 22.3% (17.6%) 30.9% NASDAQ Composite 15.4% (0.9%) 35.2% (9.4%) 29.6% S&P 500 12.7% (9.9%) 28.9% (14.0%) 30.2% NASDAQ Clean Edge Green Energy 21.8% (1.6%) 40.7% (21.0%) 44.6% Notable Recent Transactions & Capital Raises Target Acquirer Transaction Description Lime, a provider of micro-mobility products, acquired the IP and Boosted Lime assets of Boosted, a provider of electric skateboards, for an undisclosed sum First State Investments, an Australia-based infrastructure investor, M&A First State MVV Energie acquired a 45.1% interest in MVV Energie, a Germany-based Transactions Investments energy provider, for €753mm ($816mm) Nippon Nippon Suisan (Europe) and Marubeni jointly acquired a 67% Danish Suisan interest in Danish Salmon, an operator of a salmon farming Salmon business that specializes in the implementation of a recirculating Marubeni aquaculture system, for an undisclosed sum Company Transaction Description Kurly, a Korea-based developer of an online grocery delivery platform, raised a Kurly $150mm round led by Sequoia Capital, Hillhouse Capital and DST Global Capital Nio, a China-based electric vehicle manufacturer, raised a $1bn round led by Hefei Raises Nio Construction Investment Holding and New Technology Industrial Investment Co. -

Diapositiva 1

WHY ACS? January 10th, 2017 Building the world of tomorrow 7th Spain Investors Day Why ACS is an attractive investment? 1. A global leading contractor 2. Highly diversified in terms of activities and geographies 3. Resilient operating performance 4. Sustainable growth potential 5. Successful transformation process completed 6. Trading at reasonable prices 2 1. A global leading contractor… US & Canada market share(1) US & CAN total construction output $ 891br → top contractors revenues represent 8% Others ACS 21% 18% st Obayashi 1 3% Lendlease 4% Fluor 14% Jacobs 4% Bouygues Skanska 5% 9% Balfour Beatty 6% Tutor Perini BECHTEL 7% 9% ASIA PACIFIC* market share(1) Vinci Others Chinese companies 3% 5% Shimizu excluded Bouygues 17% 3% BECHTEL 13% Taisei 16% Hyundai (1) Market share: from total revenues of top contractors in the region 13% Obayashi TOP 1 INTERNATIONAL 16% Source: ENR, bloomberg, companies’ reports, internal analysis ACS CONTRACTOR 14% 3 2. Highly diversified in terms of activities and geographies North America Europe Asia Pacific 46% 22% 25% 6% 14.6 €bn 6.8 €bn 7.9 €bn 2% 3% 1% 38% 8% R 1% 5% 13% South America Africa 6% 1% 15% 1.8 €bn 0.3 €bn 1% 1% R 4% NOTE: Sales distribution excluding recent disposals of Urbaser & Sintax LTM sales as of Sep 16 4 2. Highly diversified in terms of activities and geographies Facility management EPC 5% 9% Construction Support 75% Services 11% 32% Civil Works Contract mining 5% Industrial Services 20% 38% Environment Building 5% NOTE: Sales distribution excluding recent disposals of Urbaser & Sintax 9M16 Sales. -

2019 Sustainability Committee Activity Report

Translation of the original in Spanish. In case of any discrepancy, the Spanish version prevails. SUSTAINABILITY COMMITTEE OF THE BOARD OF DIRECTORS OF REPSOL, S.A. 2019 ACTIVITIES REPORT _____________________________________ TABLE OF CONTENTS 1. BACKGROUND 2. COMPOSITION 3. REGULATION OF THE SUSTAINABILITY COMMITTEE 4. FUNCTIONING 5. COMMITTEE RESOURCES 6. MAIN ACTIVITIES DEVELOPED DURING 2019 6.1. Activities related to the environment and safety 6.2. Activities related to sustainability 6.3. Activities related to the non-financial risk management and control 6.4. Activities related to the expectations of the different stakeholders and the Company’s positioning on sustainability 6.5. Assessment of the functioning of the Sustainability Committee APPENDIX: Schedule of meetings held in 2019 1 Translation of the original in Spanish. In case of any discrepancy, the Spanish version prevails. 1. BACKGROUND In its meeting of May 27, 2015, in the framework of the assessment of its organisation and functioning conducted with external advice, the Board of Directors resolved to create the Sustainability Committee of the Board of Directors of Repsol, S.A., replacing the former Strategy, Investments and Corporate Social Responsibility Committee. The establishment of this type of specialist Committee within the Board of Directors is envisaged in Recommendation 52 of the Spanish National Securities Market Commission's Good Governance Code for Listed Companies and in article 37 of Repsol’s Articles of Association. In this regard, pursuant to article 32 of the Board Regulations, this body can create specialist committees within it, with oversight, reporting, advisory and proposal functions, as well as the others that the law, the Articles of Association or those Regulations attribute it in the scope of its competences to facilitate decision-making by means of prior studies and to strengthen the objectivity and reflection guarantees with which the Board must address certain issues. -

Ferrovial Awarded Contract to Underground Madrid's M-30 Beltway in the Environs of the Former Calderón Stadium

CONTRACTS, SPAIN, CONSTRUCTION Ferrovial awarded contract to underground Madrid's M-30 beltway in the environs of the former Calderón stadium • Madrid City Government has awarded the contract to a joint venture of Ferrovial and Acciona • The work consists of undergrounding a section of Madrid's Calle 30 as part of the “Nuevo Mahou- Calderón” project in order to enhance mobility and accessibility in the area • Work is scheduled to commence on September and to be completed in 20 months. Madrid, 07/07/2021.- Ferrovial, via its construction subsidiary, has been awarded the contract to Corporate underground Madrid's M-30 beltway in the vicinity of the Calderón stadium. The project is intended to Communications provide continuity to the Calle 30 tunnel, as this is the only segment of the southern arc of the road that is newsroom.ferrovial.com still overground, since it ran below the western stand of the Vicente Calderón stadium. It will be carried out @ferrovial in a joint venture with Acciona. The project will also expand the “Madrid Río” park by eliminating this section of overground highway, which is a barrier to mobility. North America Mari Pillar The work consists of building a cut-and-cover tunnel 620 meters long with a width varying from 26 meters +1 832 829 6597 at its southern end to slightly over 21 meters at its northern end. [email protected] Europe The new infrastructure will have all the facilities and services required to operate it and integrate with the Paula Lacruz adjoining sections of Calle 30; the tunnel roof is designed to accommodate bushes and trees to create a +34 91 586 25 26 new green area linked to the “Madrid Río” park. -

Ferrovial, S.A

Separate Directors´ Report and Financial Statements Ferrovial, S.A. 1 SEPARATE DIRECTORS' REPORT Page 1 PROFIT(LOSS) FOR 2015 4 2 NON FINANCIAL INDICATORS 4 3 OTHER RELEVANT INFORMATION 4 3.1 FINANCIAL RISKS 4 3.2 DISTRIBUTION OF DIVIDENDS AND TRANSACTIONS WITH TREASURY SHARES 4 3.3 OUTLOOK FOR THE BUSINESS ACTIVITIES 5 3.4 EVENTS AFTER THE REPORTING PERIOD 5 4 ANNUAL CORPORATE GOVERNANCE REPORT AND OTHER RELEVANT INFORMATION 5 5 AVERAGE PAYMENT TERM 5 SEPARATE FINANCIAL STATEMENTS: BALANCE SHEETS AS AT 31 DECEMBER 2015 AND 2014 7 STATEMENTS OF PROFIT OR LOSS FOR 2015 AND 2014 9 STATEMENTS OF CHANGES IN EQUITY FOR 2015 AND 2014 10 STATEMENTS OF CASH FLOWS FOR 2015 AND 2014 11 1 COMPANY ACTIVITIES 12 2 BASIS OF PRESENTATION OF THE FINANCIAL STATEMENTS 12 3 DISTRIBUTION OF PROFIT 13 4 ACCOUNTING POLICIES 13 5 PROPERTY, PLANT AND EQUIPMENT 16 6 OPERATING LEASES 16 7 INVESTMENTS IN GROUP COMPANIES 16 8 DERIVATIVES 19 9 CASH AND CASH EQUIVALENTS 21 10 BALANCES AND TRANSACTIONS WITH GROUP COMPANIES 21 11 TRADE PAYABLES 25 12 SHAREHOLDERS' EQUITY 26 13 PROVISIONS FOR CONTINGENCIES AND CHARGES 28 14 BANK BORROWINGS AND OTHER FINANCIAL LIABILITIES 28 15 TAX MATTERS 29 16 GUARANTEE COMMITMENTS TO THIRD PARTIES AND OTHER CONTINGENT LIABILITIES 31 17 INCOME AND EXPENSES 32 18 EMPLOYEES 32 19 REMUNERATION OF THE BOARD OF DIRECTORS 32 20 SHARE-BASED PAYMENT 36 21 RELATED PARTY DISCLOSURES 37 22 CONFLICTS OF INTEREST 40 23 ENVIRONMENTAL POLICY 40 24 FEES PAID TO AUDITORS 40 25 EVENTS SUBSEQUENT TO YEAR-END 40 26 COMMENTS ON APPENDICES 40 AUDITOR’S REPORT: AUDITOR'S REPORT OF FINANCIAL STATEMENTS 46 2 2015 Separate Directors' Report, Ferrovial, S.A. -

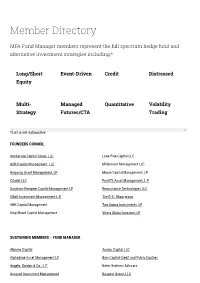

Member Directory

Member Directory MFA Fund Manager members represent the full spectrum hedge fund and alternative investment strategies including:* Long/Short Event-Driven Credit Distressed Equity Multi- Managed Quantitative Volatility Strategy Futures/CTA Trading *List is not exhaustive FOUNDERS COUNCIL Anchorage Capital Group, LLC Lone Pine Capital LLC AQR Capital Management, LLC Millennium Management LLC Balyasny Asset Management, LP Moore Capital Management, LP Citadel LLC Point72 Asset Management, L.P. Davidson Kempner Capital Management LP Renaissance Technologies LLC Elliott Investment Management L.P. The D. E. Shaw group HBK Capital Management Two Sigma Investments, LP King Street Capital Management Viking Global Investors LP SUSTAINING MEMBERS – FUND MANAGER Abrams Capital Axonic Capital LLC Alphadyne Asset Management LP Bain Capital Credit and Public Equities Angelo, Gordon & Co., L.P. Baker Brothers Advisors Assured Investment Management Baupost Group, LLC BlackRock Alternative Investors IONIC Capital Management LLC Bracebridge Capital, LLC Junto Capital Management LP Bridgewater Associates, LP. Kensico Capital Management Brigade Capital Management, LP Kepos Capital LP Cadian Capital Management Kingdon Capital Management, LLC Campbell & Company, LP Laurion Capital Management LP Capula Investment Management LLP Magnetar Capital LLC CarVal Investors Man Group Casdin Capital Marathon Asset Management, L.P. Castle Hook Partners LP Marshall Wace North America LP Centerbridge Partners, L.P. Melvin Capital CIFC Asset Management Meritage Group LP Coatue Management LLC Millburn Ridgeeld Corporation D1 Capital Partners MKP Capital Management Diameter Capital Partners LP Monarch Alternative Capital LP EJF Capital, LLC Napier Park Global Capital Element Capital Management LLC One William Street Capital Management LP Eminence Capital, LP P. Schoenfeld Asset Management LP Empyrean Capital Partners, LP Palestra Capital Management LLC Emso Asset Management Limited Paloma Partners Management Company ExodusPoint Capital Management, LP PAR Capital Management, Inc.