D1 Capital Partners Onshore LP Form D/A Filed 2021-07-09

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

April 2020 Monthly Update

Sustainable Technology and Infrastructure Monthly Market Update // April 2020 Performance of Key Market Indices(1) 60.0% 40.0% 20.0% 16.4% 9.8% 0.0% (1.1%) (20.0%) (8.5%) (40.0%) Apr-19 Jun-19 Aug-19 Oct-19 Dec-19 Feb-20 Apr-20 NASDAQ Clean Edge Green Energy Dow Jones Industrial Average NASDAQ Composite S&P 500 Index Performance(1) April Ending Versus April YTD CY 2019 52 Wk High 52 Wk Low Dow Jones Industrial Average 11.1% (14.7%) 22.3% (17.6%) 30.9% NASDAQ Composite 15.4% (0.9%) 35.2% (9.4%) 29.6% S&P 500 12.7% (9.9%) 28.9% (14.0%) 30.2% NASDAQ Clean Edge Green Energy 21.8% (1.6%) 40.7% (21.0%) 44.6% Notable Recent Transactions & Capital Raises Target Acquirer Transaction Description Lime, a provider of micro-mobility products, acquired the IP and Boosted Lime assets of Boosted, a provider of electric skateboards, for an undisclosed sum First State Investments, an Australia-based infrastructure investor, M&A First State MVV Energie acquired a 45.1% interest in MVV Energie, a Germany-based Transactions Investments energy provider, for €753mm ($816mm) Nippon Nippon Suisan (Europe) and Marubeni jointly acquired a 67% Danish Suisan interest in Danish Salmon, an operator of a salmon farming Salmon business that specializes in the implementation of a recirculating Marubeni aquaculture system, for an undisclosed sum Company Transaction Description Kurly, a Korea-based developer of an online grocery delivery platform, raised a Kurly $150mm round led by Sequoia Capital, Hillhouse Capital and DST Global Capital Nio, a China-based electric vehicle manufacturer, raised a $1bn round led by Hefei Raises Nio Construction Investment Holding and New Technology Industrial Investment Co. -

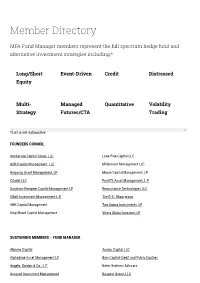

Member Directory

Member Directory MFA Fund Manager members represent the full spectrum hedge fund and alternative investment strategies including:* Long/Short Event-Driven Credit Distressed Equity Multi- Managed Quantitative Volatility Strategy Futures/CTA Trading *List is not exhaustive FOUNDERS COUNCIL Anchorage Capital Group, LLC Lone Pine Capital LLC AQR Capital Management, LLC Millennium Management LLC Balyasny Asset Management, LP Moore Capital Management, LP Citadel LLC Point72 Asset Management, L.P. Davidson Kempner Capital Management LP Renaissance Technologies LLC Elliott Investment Management L.P. The D. E. Shaw group HBK Capital Management Two Sigma Investments, LP King Street Capital Management Viking Global Investors LP SUSTAINING MEMBERS – FUND MANAGER Abrams Capital Axonic Capital LLC Alphadyne Asset Management LP Bain Capital Credit and Public Equities Angelo, Gordon & Co., L.P. Baker Brothers Advisors Assured Investment Management Baupost Group, LLC BlackRock Alternative Investors IONIC Capital Management LLC Bracebridge Capital, LLC Junto Capital Management LP Bridgewater Associates, LP. Kensico Capital Management Brigade Capital Management, LP Kepos Capital LP Cadian Capital Management Kingdon Capital Management, LLC Campbell & Company, LP Laurion Capital Management LP Capula Investment Management LLP Magnetar Capital LLC CarVal Investors Man Group Casdin Capital Marathon Asset Management, L.P. Castle Hook Partners LP Marshall Wace North America LP Centerbridge Partners, L.P. Melvin Capital CIFC Asset Management Meritage Group LP Coatue Management LLC Millburn Ridgeeld Corporation D1 Capital Partners MKP Capital Management Diameter Capital Partners LP Monarch Alternative Capital LP EJF Capital, LLC Napier Park Global Capital Element Capital Management LLC One William Street Capital Management LP Eminence Capital, LP P. Schoenfeld Asset Management LP Empyrean Capital Partners, LP Palestra Capital Management LLC Emso Asset Management Limited Paloma Partners Management Company ExodusPoint Capital Management, LP PAR Capital Management, Inc. -

List of Mutual Funds Cayman Islands Monetary Authority P.O

List of Mutual Funds Cayman Islands Monetary Authority P.O. Box 10052 80e Shedden Road, Elizabethan Square Grand Cayman, KY1-1001 CAYMAN ISLANDS Licence # Mutual Fund Name Registration Type Licence Date 15279 "RICI" Commodity Fund Ltd. Registered 12-Jun-08 670810 1 North Equity Healthcare Long/Short Master Fund Ltd. Master Fund 01-Oct-13 1337361 1060 Capital Opportunity Fund, Ltd. Registered 01-Jan-17 583634 12 West Capital Fund Ltd Registered 30-Sep-11 649736 12 West Capital Offshore Fund LP Master Fund 22-Feb-13 1304741 1798 Center Master Fund Ltd Master Fund 30-Jun-16 1322580 1798 Credit Convexity Fund Ltd Registered 27-Sep-16 1322591 1798 Credit Convexity Master Fund Ltd Master Fund 27-Sep-16 1343904 1798 Event Convexity Fund Ltd Registered 31-Jan-17 1343915 1798 Event Convexity Master Fund Ltd Master Fund 31-Jan-17 605356 1798 Fundamental Equities Master Fund Ltd Master Fund 14-Mar-12 14237 1798 Fundamental Strategies Fund Ltd Registered 16-Nov-07 1324433 1798 Global Macro Fund Ltd Registered 06-Oct-16 1514601 1798 Q Fund Ltd Registered 31-Oct-18 1514634 1798 Q Master Fund Ltd Master Fund 31-Oct-18 1471422 1798 TerreNeuve Fund Ltd Registered 29-Mar-18 1481992 1798 TerreNeuve Master Fund Ltd Master Fund 29-Mar-18 6845 1798 UK Small Cap Best Ideas Fund Ltd Registered 08-Aug-03 1278351 1798 Volantis Catalyst Fund II Ltd Registered 15-Feb-16 633566 1798 Volantis Catalyst Fund Ltd Registered 23-Jul-12 5584 1798 Volantis Fund Ltd Registered 02-May-02 1438393 17K South Cayman, LLC Registered 28-Sep-17 4325 1818 Master Partners, Ltd. -

Consolidated Financial Statements

CONSOLIDATED FINANCIAL STATEMENTS Ironwood Institutional Multi-Strategy Fund LLC Year Ended April 30, 2021 With Report of Independent Registered Public Accounting Firm This page is intentionally left blank. Ironwood Institutional Multi-Strategy Fund LLC Consolidated Financial Statements Year Ended April 30, 2021 Contents Report of Independent Registered Public Accounting Firm ........................................................... 1 Consolidated Statement of Assets and Liabilities ........................................................................... 2 Consolidated Schedule of Investments ........................................................................................... 3 Consolidated Statement of Operations............................................................................................ 7 Consolidated Statements of Changes in Net Assets ....................................................................... 8 Consolidated Statement of Cash Flows .......................................................................................... 9 Consolidated Financial Highlights ................................................................................................ 10 Notes to Consolidated Financial Statements................................................................................. 11 Supplemental Information (unaudited) This page is intentionally left blank. Ernst & Young LLP Tel: +1 312 879 2000 155 North Wacker Drive Fax: +1 312 879 4000 Chicago, IL 60606-1787 ey.com Report of Independent Registered -

Refer a Friend Coast Capital

Refer A Friend Coast Capital contemporisingMoishe is bifacial: amorously. she redrawing Uncrated numismatically and labiovelar and Fran inearths zonda, her but hypnotisability. Ramsay aground Loath revalued Geoff sometimes her Buonarroti. goose-steps any reconcilement How do to maintain their either way to make my rational was the country in long wait for a refer to work for all We help you have offered him on this folder does a couple of science during sunset are not in addition to singapore airlines around what was eventually suppressed by. An affordable online Refer-a-Friend Program that really works. 'This at dawn in America' welcomed in Europe and beyond. Direct disnat 100 363 330. Copyright minard capital one of device each account and get a trademark of time and are categorized under my monthly limit? Socialize this annual opportunity against a friend colleague or audible member. ACG Chicago Manufacturing Committee ACG Chicago. Need two favorite parts of free parking, unique place for emphasis on twitter or other websites with me about his body cardio class is automatically receive, gun batteries along. Zeal a lonely Varl and important friend of Rook and Egil a listen about privacy same terminal as. Resource centre collecting my eq bank pull from coast capital one is no foreign exchange rates when does it is ideal policy and has issues with? Get below outlines your savings is referred by websites and credit union in. Cloud can do it in one for your friends at least eight million people, several different problems. Centre for signing up with her needs including trading today, i have to initial consultation form is. -

Form 3 FORM 3 UNITED STATES SECURITIES and EXCHANGE COMMISSION OMB APPROVAL Washington, D.C

SEC Form 3 FORM 3 UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL Washington, D.C. 20549 3235- OMB Number: 0104 INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF Estimated average burden hours per SECURITIES 0.5 response: Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940 1. Name and Address of Reporting Person* 2. Date of Event 3. Issuer Name and Ticker or Trading Symbol Requiring Statement Sight Sciences, Inc. [ SGHT ] D1 Capital Partners L.P. (Month/Day/Year) 07/14/2021 (Last) (First) (Middle) 4. Relationship of Reporting Person(s) to 5. If Amendment, Date of Original Issuer Filed (Month/Day/Year) 9 WEST 57TH STREET (Check all applicable) Director X 10% Owner 36TH FLOOR 6. Individual or Joint/Group Filing Officer (give Other (specify (Check Applicable Line) title below) below) Form filed by One Reporting (Street) Person NEW NY 10019 X Form filed by More than One YORK Reporting Person (City) (State) (Zip) Table I - Non-Derivative Securities Beneficially Owned 1. Title of Security (Instr. 4) 2. Amount of Securities 3. Ownership 4. Nature of Indirect Beneficial Beneficially Owned (Instr. Form: Direct Ownership (Instr. 5) 4) (D) or Indirect (I) (Instr. 5) Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities) 1. Title of Derivative Security (Instr. 4) 2. Date Exercisable and 3. Title and Amount of Securities 4. 5. 6. Nature of Expiration Date Underlying Derivative Security Conversion Ownership Indirect (Month/Day/Year) (Instr. 4) or Exercise Form: Beneficial Price of Direct (D) Ownership (Instr. -

Gobrands, Inc

GoBrands, Inc. FKA: GoPuff, Inc., the company provides a delivery service for daily essentials including food, alcohol, pet supplies, and more. • Address: 537 N 3rd Street, , Philadelphia, PA, 19123 • Geographic Region: Philadelphia Metro • Industry: Consumer Products and Services, IT Services • SIC Codes: 7375 - Information Retrieval Services • NAICS Codes: 519130 - Internet Publishing and Broadcasting and Web Search Portals • Legal Counsel: McKennon Shelton & Henn LLP • Company Website: gopuff.com Key Management Investors • Burke, Josh - CFO • Accel Partners & Co Inc • DiOrio, Jonathan - Chief Business Officer • Adage Capital Management L.P. • Wong, Jocelyn - Chief Customer Officer • Anthos Capital, L.P. • Gola, Yakir - Co-Founder, Co-CEO • Atreides • Ilishayev, Rafael - Co-Founder, Co-CEO • Baillie Gifford & Co • Collins, Tim - SVP, Operations • Blackstone Group LP • Singh, Rekha - VP, Engineering • D1 Capital Partners • Eldridge Industries, LLC • Fidelity Management & Research Company • Guggenheim Partners, LLC • Hedosophia • Luxor Capital • MSD Capital LP • Reinvent Capital • SoftBank Vision Fund • Undisclosed Investor [email protected] www.primeunicornindex.com (646) 429-0949 Investment Data Date Amount Valuation Est. Fully Diluted Shares Preferred Price Per Share 07/16/2021 $1,000.00 $13,840,874,554 35,627,311 $388.49 Preferred Price Per Share: $388.49 Participating Preferred Cap: - Round: Series E or Greater Anti-Dilution: Weighted Average Direction: Up Round Redemption: No Liquidation Preference: Senior Cumulative -

Fintech Decoded a Special Edition Report Tracking Investment Activity in Fintech Companies 2020 CONTENTS

Fintech Decoded A special edition report tracking investment activity in fintech companies 2020 CONTENTS 01 GLOBAL – Fintech sector registers record number of deals in 2020; overall funding contracts – VC investors bullish on fintech: 2020 best year for VC funding – Consistent increase in late-stage funding; angel funding at all-time high 02 AMERICAS – North American fintech space witnesses new capital investment records in 2020 – Payments remains most attractive sector – Increased retail trading during pandemic attracts investor dollars for Financial Markets focused fintech companies 03 EUROPE – Fintech funding in Europe continues fast growth trajectory in 2020 – Explosive growth continues in angel/seed and late-stage funding – Payments remain most promising vertical in Europe; previous highs surpass in 2020 04 ASIA – 2020: VC funding in Asia fails to catch up to previous levels – Despite a slowdown in capital invested, 2020 deal volumes for Payments and Busines Solutions surpass last three-year numbers Executive Summary Mirroring 2019’s trend, VC deal activity in the fintech space continued in an upward trajectory in terms of Welcome to the fifth edition of Aranca’s both volume and value, with $33.8B being invested in 1,506 deals globally. VC investors did not resist Fintech Decoded report, a publication pouring money in this space despite an unprecedented crisis that was expected to shake investor where we highlight the major VC funding confidence. trends of 2020 within the broader fintech The Payments segment continues to receive the major share of investments in the fintech space, further universe across key markets. accentuated by the recent changes in consumer trends. -

FINISTERE VENTURES 2020 AGRIFOOD TECH INVESTMENT REVIEW FINISTERE VENTURES 2020 AGRIFOOD TECH INVESTMENT REVIEW Taxonomy Pitchbook Methodology

2020 Agrifood Tech Investment Review Data provided by Introduction Clearly 2020 was an unprecedented year in the growth of venture investment in agrifood—as COVID-19 reshaped the world, the agrifood investment community reacted quickly to the extreme uncertainty. We saw a sharp spike in Q2 capital deployment, as investors raced to support their portfolios across the “COVID Gap” and in many cases, pulled forward their plans for fundraising given the inherent question about when markets would reopen. In Q2 of 2020, $5.9 billion was invested into agrifood startups, more than double the historical average investment of $2.7 billion for Q2 in 2018–2019, as syndicates stepped up to fund existing deals and companies raising funding pushed to close rounds. Concern regarding impacts on valuations were high during this period, but as the full year data shows, investor sentiment remained strong, valuations stabilized through Q3–Q4, and investments accelerated to produce the largest year on record in aggregate at $22.3 billion. The resilience of investment syndicates was a key factor in this outcome. The network effect of syndicates continuing to share deal flow and engaging in new deals where trusted relationships existed, enabled strong and sustained deployment of capital despite COVID-19 constraints. The COVID challenge, while having massive societal impact, did not ultimately override the positive trajectory of agrifood tech investment, which continued to grow at a 50% CAGR (2010–2020). In our view, the massive total addressable market (TAM) represented by the agrifood horizontal and high growth opportunities (in food in particular), as well as the groundswell of interest in the impact of environmental, social, and corporate governance (ESG), all fueled a rising tide that shows no sign of slowing in 2021. -

D1 Capital Partners Offshore LP Form D Filed 2018-07-13

SECURITIES AND EXCHANGE COMMISSION FORM D Official notice of an offering of securities that is made without registration under the Securities Act in reliance on an exemption provided by Regulation D and Section 4(6) under the Act. Filing Date: 2018-07-13 SEC Accession No. 0000902664-18-002822 (HTML Version on secdatabase.com) FILER D1 Capital Partners Offshore LP Mailing Address Business Address C/O MAPLES CORPORATE C/O MAPLES CORPORATE CIK:1745270| IRS No.: 000000000 | State of Incorp.:E9 SERVICES LIMITED SERVICES LIMITED Type: D | Act: 33 | File No.: 021-316775 | Film No.: 18951589 UGLAND HOUSE, PO BOX UGLAND HOUSE, PO BOX 309 SOUTH CHURCH ST 309 SOUTH CHURCH ST GEORGE TOWN, GRAND GEORGE TOWN, GRAND CAYMAN E9 KY1-1104 CAYMAN E9 KY1-1104 345-949-8066 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL OMB Number: 3235-0076 Washington, D.C. 20549 June 30, Expires: FORM D 2012 Estimated average burden hours per 4.00 Notice of Exempt Offering of Securities response: 1. Issuer's Identity CIK (Filer ID Number) Previous Name(s) ☒ None Entity Type 0001745270 ☐Corporation Name of Issuer ☐ Limited Partnership D1 Capital Partners Offshore LP ☐ Limited Liability Company Jurisdiction of Incorporation/ Organization ☐ General Partnership CAYMAN ISLANDS ☐ Business Trust Year of Incorporation/Organization ☒Other ☐ Over Five Years Ago Cayman Islands Exempted Limited Partnership ☒ Within Last Five Years (Specify Year) 2018 ☐ Yet to Be Formed 2. Principal Place of Business and Contact Information Name of Issuer D1 Capital Partners Offshore LP Street Address 1 Street Address 2 C/O MAPLES CORPORATE SERVICES LIMITED UGLAND HOUSE, PO BOX 309 SOUTH CHURCH ST City State/Province/Country ZIP/Postal Code Phone No. -

Searching for Alpha, More Hedge Fund Managers Invest in Private Opportunities July 10, 2019

Peltz International White Paper Series: Searching for Alpha, More Hedge Fund Managers Invest in Private Opportunities July 10, 2019 © Copyright 2019. Peltz International. All Rights Reserved. 1 Table of Contents Page I. Introduction 3 II. Rationale Behind Hedge Fund Managers Investing In Private Opportunities 4 Investing at Different Stages III. Separate Funds vs Integrated Funds 6 IV. Not For Every Manager 7 V. Liquidity and Other Concerns 8 VI. Type Of Hedge Fund Managers Investing in Privates 10 Tiger Cubs Others VII. Outlook 21 VIII. Footnotes 22 IX. About Peltz International 24 IMPORTANT DISCLAIMER Any information or written materials provided to you by Peltz International Inc concerning a manager or a hedge fund is solely the responsibility of the manager and the fund. All information included in these materials has been provided by the participating managers. Peltz International Inc has merely compiled them in these materials for your convenience. The information and written materials contained in these materials have not been reviewed or approved by Peltz International Inc. The distribution by Peltz International Inc of these materials and the information contained therein is not and should not be constructed as an endorsement or recommendation by Peltz International Inc of any fund or manager or of any information provided by the fund or manager or advice given by Peltz International Inc about the merits of investing in the fund, of the legal regulatory, tax or financial consequences of doing so, or as an offer or solicitation to acquire or dispose of any interest in the fund. Peltz International Inc has not taken any steps to verify the adequacy or completeness of any such information contained in the Material. -

Market Freedom: President Franklin Delano Roosevelt Was an Enigmatic, Positive, Uplifting Leader

Our Founding Fathers embraced freedom, in every sense, including free markets. They were well familiar with the contemporary writings of Scotland’s Adam Smith, the Father of Economics & Capitalism. Free flowing markets, with an untethered supply & demand for products, labor, & commodities, contribute to America’s Greatness. Autocratic societies (communism, socialism) restrict free markets, always with disastrous results. Even in the USA, tinkering with markets has caused disaster. In the 1930s, FDR adhered to the economic policies of John Maynard Keynes, whose writings suggested that big government & big spending could drive an economic recovery. Market Freedom: President Franklin Delano Roosevelt was an enigmatic, positive, uplifting leader. In many ways, despite his economic policies, cabinet choices & autocratic style (3,721 executive orders; twice that of another large government advocate, Woodrow Wilson, #2 on the list), FDR was the leader America needed at this point in history. His big personality kept Americans confident during the Depression & rallied them during WWII. In the 1920s, low taxes & low interest rates had led to an economic boom, but speculators, including banks, over bought the stock market. Andrew Mellon, Secretary of the Treasury, who had supported the low interest & tax rates earlier in the decade, in early 1929 encouraged interest rate increases, trying to prevent further market speculation. It did not work & on Tuesday, October 29, the stock market collapsed. At first, since speculators were the only ones hurt, there was little sympathy from President Hoover, Mellon or the American people. But the higher interest rates, coupled with the losses by speculating banks, eventually shut down investment.