Registration Document Including the Financial Report PROFILE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Carbon Footprint & Energy Transition Report

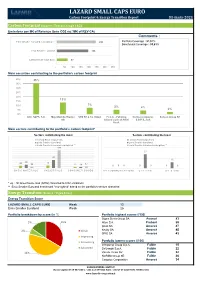

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

Projet De Note En Réponse) Which Was Filed with the French Autorité Des Marchés Financiers on 23 September 2019 and Which Remains Subject to Its Review

This document is an unofficial English-language translation of the draft response document (projet de note en réponse) which was filed with the French Autorité des marchés financiers on 23 September 2019 and which remains subject to its review. In the event of any differences between this unofficial English- language translation and the official French draft response document, the official French draft response document shall prevail. The draft offer and this draft response document remain subject to the French Financial Market's Authority review. DRAFT DOCUMENT PREPARED BY IN RESPONSE TO THE PUBLIC TENDER OFFER FOR THE SHARES OF THE COMPANY ALTRAN TECHNOLOGIES LAUNCHED BY This draft response document (projet de note en réponse) was filed with the French Financial Markets Authority (the "AMF") on 23 September 2019, in accordance with the provisions of Article 231-26 of the AMF's general regulation. It was prepared in accordance with Article 231-19 of the AMF's general regulation. The draft offer and this draft response document remain subject to the review of the AMF. Important notice Pursuant to Articles 231-19 and 261-1 et seq. of the AMF's general regulation, the report of Finexsi, acting in its capacity as independent expert, is included in this draft response document. This draft response document (the "Draft Response Document") is available on the websites of ALTRAN (www.altran.com) and the AMF (www.amf-france.org) and may be obtained free of charge from Altran Technologies' registered office at 96, avenue Charles de Gaulle, 92200 Neuilly-sur-Seine – FRANCE. In accordance with the provisions of Article 231-28 of the AMF's general regulation, information relating to Altran Technologies, in particular legal, financial and accounting information, will be filed with the AMF and made available to the public in the same manner no later than the day before the opening of the tender offer. -

Preparing Health Systems for Tumour-Agnostic Treatment

Preparing Health Systems for Tumour-Agnostic Treatment Tumour-agnostic therapies will play an important role in a new era of personalised healthcare, challenging existing diagnostic and value assessment frameworks. The 2017 A.T. Kearney Foreign Direct Investment Confidence Index: Glass Half Full 1 Advances in oncology have resulted in several revolutionary treatment modalities, which have made inroads into the way we fight cancer. One of these breakthroughs entails the development of medicines that target specific mutations or genomic alterations in different tumours, resulting in a complete and lasting response to treatment in affected patients.1, 2 This new class of treatments is known as “tumour-agnostic” or “histology-independent” therapies because of how they target the genomic alteration within a tumour, regardless of where in the body it has formed. By the end of 2018, the Food and Drug Administration (FDA) had approved two medicines for tumour-agnostic indications, paving the way for their commercialisation in the US. However, these types of therapies face significant challenges in adoption due to both how these new technologies will be assessed for value and reimbursed, and to the diagnostic infrastructure required to ensure that the patients most likely to respond to these treatments are identified and can gain timely access. This report was commissioned by F. Hoffmann-La Roche in November 2018 to review the landscape for tumour-agnostic treatment in the five largest European healthcare markets (Germany, France, Italy, United Kingdom and Spain) and Canada. The research is based on a review of publicly available industry reports, articles, recent publications and 30 interviews with oncologists, regulators, health technology assessors, policymakers, pathologists and payers across these markets. -

Empresas Adjudicatarias Del Acuerdo Marco Para El Servicio De Desarrollo De Sistemas De Información

Empresas adjudicatarias del acuerdo marco para el servicio de desarrollo de sistemas de información. AM 26/2011. - ALTEN SOLUCIONES PRODUCTOS AUDITORIA E INGENIERIA, S.A.U. ** - ATOS ORIGIN S.A.E. ** - BULL ESPAÑA, S.A. ** - CAPGEMINI ESPAÑA, S.L. ** - EVERIS SPAIN, S.L.U. ** - HEWLETT PACKARD ESPAÑOLA, S.L. ** - IBERMÁTICA, S.A. ** - IBM GLOBAL SERVICES ESPAÑA, S.A) ** - INFORMÁTICA EL CORTE INGLÉS, S.A ** - INGENIERIA DE SOFTWARE AVANZADO, S.A ** - SADIEL TECNOLOGIAS DE LA INFORMACIÓN, S.A. * - SERESCO, S.A. * - SERIKAT, CONSULTORÍA E INFORMÁTICA, S.A. ** - SOPRA GROUP INFÓRMATICA, S.A. ** - TECNOCOM ESPAÑA SOLUTIONS, S.L ** - UTE ACCENTURE, S.L.- ACCENTURE OUTSOURCING SERVICES, S.A.Y CORITEL, S.A. * - UTE ALTIA CONSULTORES,S.A.-KPMG ASESORES S.L. ** - UTE ALTRAN INNOVACION, S.L.-GESEIN, S.L.-NEORIS ESPAÑA, S.L. ** - UTE AVENTIA IBERIA, S.L Y EPTISA SERVICIOS DE INGENIERIA, S.L.. ** - UTE AXPE CONSULTING S.L.-ORACLE IBERICA, S.R.L. ** - UTE B2B (COMERCIO ELECTRÓNICO B2B 2OOO, S.A.-TAISA SYVALUE,S.L.- ALBA TECHNOLOGY, S.L. REALTECH SYSTEM CONSULTING, S.L. -INDENOVA, .-TECNICOS ASOCIADO * - UTE BILBOMATICA, S.A & CIBERNOS & GRUPO EIDOS ** - UTE DELOITTE, S.L.-DELOITTE CONSULTING, S.L.-DXD APLICATIONS, IT SOLUTIONS ** - UTE ENTEL IT CONSULTING, S.A. ENTEL IBAI CONSULTING, S.A. NOVASOFT INGENIERIA, S.L. SYSTEMS MAINTENANCE SERVICES EUROPA, S.A. ** - UTE FUJITSU TECHNOLOGY SOLUTIONS, S.A.-DELAWARE CONSULTORIA, S.L. ** - UTE G9 ( BLOM SISTEMAS GEOESPACIALES, S.L.U. EXIS INVERSIONES EN CONSULTORÍA INFORMÁTICA Y TECNOLOGÍA, S.A.-INTELIGENCIA SISTEMÁTICA 4, S.L., ARISTA * - UTE GMV SOLUCIONES GLOBALES DE INTERNET, S.A. GMV AEROSPACE AND DEFENCE, S.A. -

Mise En Page 1

40, avenue André Morizet 92514 Boulogne-Billancourt Cedex www.alten.fr Technology Consulting and Engineering Business Report 2008 This document and the corresponding business report constitute the ALTEN reference document for the 2008 fiscal year. It was submitted to France’s financial market authority (Autorité des Marchés Financiers) on 3 June 2009 in accordance with Article 212-13 of the Autorité des Marchés Financiers’ general regulations. This Reference Document may be used in connection with a financial transaction if it is accompanied by a prospectus approved by the Autorité des Marchés Financiers. Furthermore, pursuant to Article 28 of Directive No. 809/2004 of the European Commission, the following information is incorporated by reference in this Reference Document: - The company and consolidated financial statements at 31 December 2007, along with the related reports prepared by the Statutory Auditors and presented on pages 137 through 194 of reference document no. D.08-0297 filed with the Autorité des Marchés Financiers on 25 April 2008. - The company and consolidated financial statements at 31 December 2006, along with the related reports prepared by the Statutory Auditors, presented on pages 88 through 149 of reference document no. D.07-0593 filed with the Autorité des Marchés Financiers on 14 June 2007. It was prepared by the issuer under the responsibility of the persons who signed it. Rapport d’activité ALTEN 2007 Sommaire BUSINESS REPORT I - GROUP GOVERNANCE Page Message from the Chairman 5 The Board of Directors and -

Engineering Services Top 50 2019

20192019 WHAT IS THE EVEREST GROUP ENGINEERING SERVICES TOP 50™? Engineering services include all activities (across software, embedded, mechanical, and process engineering functions) that support the design, development, testing, and management of products, both hardware and software1. The Everest Group Engineering Services Top 50™ is a global list of the 50 largest third-party providers, based on their Engineering Services (ES) revenues and year-on-year growth for CY 2018. This is the inaugural edition of the list; we are launching it to help ES stakeholders understand the broad dynamics of growth and success in the industry. WHY THE EVEREST GROUP ENGINEERING SERVICES TOP 50™? The global third-party ES industry is valued at more than US$40 billion. Enterprises have traditionally kept the design-to-development process in-house, but the need for scalability and rapid innovation has compelled them to consider third-party providers. As a result, ES providers have grown, through both more and larger deals, expanding the industry breadth, solution breadth, and global footprint. They are developing domain expertise and gaining scale through IP engagements and acquisitions. And, the market is becoming more favorable to engineering services providers as more high-end engineering services opportunities are being outsourced. Engineering services providers are diverse. Some are pure-play engineering services providers, while others offer engineering services as part of a broader portfolio (IT and/or business process services, consulting, technology products, etc.). Some are focused on a particular domain or geography, while others are broad- based. Some are listed, while others are privately held. This list helps enterprises to identify the largest providers and their functional coverage. -

Recruitment Today: Managing the On-Campus Brand

Recruitment Today: Managing the On-campus Brand By Kathryn Christie UNIVERSITY-BASED RECRUITING PRACTICES HAVE COME A LONG WAY FROM THE days of alumni looking to bring on new hires from their alma maters, when firms could just ship flyers to a school’s career centre and make a few phone calls. Recruiting has flourished into a heavily resourced, high-touch Kathryn Christie is an approach to connect with, educate, and entice the most promising students analytics and talent as early as their first week on campus. management consultant. The evolution has been dramatic, from a one-size-fits-all approach to She is focused on high- a focus on being the preferred choice for the preferred customer. If that impact research and sounds like marketing, it’s no accident: on-campus recruiting is paralleling analytics that improve the world of marketing, specifically the niche world of content marketing. talent practices Content marketing involves creating and distributing relevant content — throughout the entire from how-to videos and buying guides to infographics and crowd-sourced employee life cycle. Kathryn earned a Master of lists — to attract and acquire a clearly defined audience. As firms Science, management, increasingly focus on generating marketing content to attract their ideal from Smith School of customers, so to do corporate recruiters provide high-potential students Business, Queen’s with compelling and useful material that also brands the company as a top University. employer. It’s been termed “content recruitment,” and the trend is picking Additional reporting by up steam. Alan Morantz, editor of This form of recruiter-driven brand management takes many forms. -

2020 Compensation and Benefits Report

2020 CompensationTEMPORARY SOLUTIONSand Benefits Report Report to the Joint Legislative Appropriations Committee January 2021 Barbara Gibson | State Human Resources Director Andrea Clinkscales| Director, Total Rewards Division This online report was produced by the North Carolina Office of State Human Resources. TABLE OF CONTENTS I. Executive Summary ....................................................................... 2 II. Introduction .................................................................................. 5 NC Total Compensation Philosophy III. Total Compensation ...................................................................... 6 Total Compensation Model Salary and Benefits as a Percentage of Total Compensation IV. Economic Review ........................................................................... 8 General Salary and Budget Trends Consumer Price and Employment Cost Indices V. Base Pay and Labor Market Analysis .............................................. 10 Market Pricing Methodology Market Pricing Findings VI. Additional Analysis ........................................................................ 18 Use of Salary Adjustment Funding Recruitment and Retention New Hire Demographics and Strategies Turnover Rates and Cost Longevity VII. Benefits Analysis ........................................................................... 23 State Benefits Offered During COVID-19 Pandemic Paid Parental Leave Paid Time Off Analysis Health Insurance Statewide Flexible Benefits Program (NCFlex) Retirement Appendix -

Wharton Consulting Club Casebook

WHARTON CONSULTING CLUB CASEBOOK December 2010, © Wharton Consulting Club Contents 2 Section Page # Introduction 3 Consulting Industry Guide 6 Industry Overview Firm Overviews (10 Firms) Interview Preparation 18 Interview Overview – Fit + Case Sample Frameworks Industry Snapshots Practice Cases 50 14 Practice Cases Links to Other Cases 126 Cases from Firm Websites Suggested Cases from other Casebooks Note to the reader 3 Dear Consulting Club Member, This casebook is meant to provide you with a brief overview of consulting recruiting and interview preparation as well as a number of practice cases. Please note that this is meant to supplement the excellent work done by our and other schools in earlier caseboo ks, so we strongl y encourage you to not make this your sole reference. We have indicated which other casebooks we found particularly useful at different points in this casebook. Good luck! - 2009 Wharton Consulting Casebook Editorial Team BIG PICTURE: CONSULTING RECRUITING INVOLVES LOTS OF LITTLE THINGS… THERE IS NO SILVER BULLET 4 Your objective What resources you will need to use Gather Info, • Is consulting what you want to do? • MBACM industry chats Network & • Which firm do you want to join? • Firm websites / Vault / WetFeet • Why do you want to join a certain • Coffee chats Decide firm? • EISes • Chd(Connect the dots (pre-MAMBA to MAMBA • SdSecond Years / First Years fffrom firms to consulting) • Speakers on campus • Get invited to interview (prepare • MBACM resume review Apply good resume and cover letter) • Resumania -

La Classifica Delle TOP100 Software E Servizi IT Coglie Con Uno Sguardo

La Classifica delle TOP100 Software e Servizi IT coglie con uno sguardo complessivo le tensioni dinamiche che scuotono il settore IT in Italia, attraverso l’aggregazione dei risultati dei principali attori sul mercato. IDC stima che i dati aggregati della Classifica vadano sostanzialmente a intercettare circa i due terzi del valore complessivo del settore in Italia. Sebbene sia opportuno ricordare che la Classifica rappresenta una parte importante del comparto Software e Servizi IT in Italia, di fatto copre in misura prevalente la componente Grandi Imprese, presentando un minore grado di risoluzione sullo scenario PMI. Il fatturato prodotto dall’aggregato delle società presenti in Classifica si concentra in un numero ristretto di grandi attori multinazionali (Tab.1, Fig.1). Le società con un fatturato superiore ai 500 milioni di euro, le prime cinque posizioni nella Classifica, rappresentano il 39,2% dei ricavi complessivi nella Top100 (circa 4,9 miliardi di euro), mentre le imprese con un fatturato inferiore ai 500 milioni (le restanti 95 posizioni) totalizzano complessivamente il 60,8% (circa 7,69 miliardi di euro). Come già rilevato lo scorso anno, rispetto al 2012 prosegue e accelera la tendenza a uno spostamento dei risultati dal vertice del mercato verso la restante parte degli operatori, con una riduzione di quasi un punto e mezzo percentuale del valore complessivo riconducibile alle prime cinque posizioni. Nel corso dell’ultimo anno, l’indice di Herfindahl (HHI), calcolato sullo spazio competitivo rappresentato dalla Classifica Top100, è andato incontro a una progressiva riduzione, passando dal HHITOP100, 2011=0,047 al HHITOP100, 2012=0,045 a HHITOP100, 2013=0,043: i dati dell’ultimo triennio mettono in evidenza un processo di trasformazione della struttura competitiva del settore che prosegue in modo irriducibile senza dare segni di inversione. -

Andreas Blancke Grad

BRIEF PROFILE Andreas Blancke Grad. Eng. in Food Technology Food Resource Management GmbH Grad. Eng. in Industrial Engineering Andreas Blancke Managing Partner Business Psychology (M.Sc.) Heinrich-Zille-Straße 7A · 01219 Dresden, Germany Interim Expert Telephone: +49 351 485 24 801 Mobile: +49 176 782 772 95 Operations / Food Email: [email protected] Internet: www.food-resource.de Competencies Notable projects and experiences Ability to supply Business assessment Significant improvement in efficiency and productivity through sustainable change Change management Continuous improvement processes management coupled with coaching, mediation and moderation Cost optimisation at a manufacturer of Trend products Lean management / lean production Equipment planning Relocation of production processes in the international arena with subsequent Factory planning plant closure as part of a strategic repositioning of a renowned sugar producer Increasing productivity Kaizen Interim Management of an insolvent frozen food producer with transfer process Key figure systems to the investor Leadership Development Mediation Introduction of Lean Management at renowned manufacturers Production planning of dairy and frozen products Project controlling Project management Introduction of TPM and OEE at international starch producers in 3 locations Process analysis Construction of a meat production facility with a project volume of €100 m Raw materials use Systems planning Restructuring of a commercial kitchens with 5000 meals per day Succession management -

ISG Providerlens™ Quadrant Report

Next-Gen Private/Hybrid A research report Cloud - Data Center comparing provider strengths, challenges Services & Solutions and competitive differentiators Managed Hosting for MidMarket Nordics 2020 Quadrant Report Customized report courtesy of: July 2020 ISG Provider Lens™ Quadrant Report | July 2020 Section Name About this Report Information Services Group Inc. is solely responsible for the content of this report. Un- ISG Provider Lens™ delivers leading-edge and actionable research studies, reports less otherwise cited, all content, including illustrations, research, conclusions, assertions and consulting services focused on technology and service providers’ strengths and and positions contained in this report were developed by, and are the sole property of weaknesses and how they are positioned relative to their peers in the market. These Information Services Group Inc. reports provide influential insights accessed by our large pool of advisors who are The research and analysis presented in this report includes research from the ISG actively advising outsourcing deals as well as large numbers of ISG enterprise clients Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, who are potential outsourcers. briefings with services providers and analysis of publicly available market information from multiple sources. The data collected for this report represents information that For more information about our studies, please email [email protected], ISG believes to be current as of April 2020 for providers who actively participated as call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time, but those changes are not reflected in this report.