2017 Feature Film Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Human Voice and the Silent Cinema. PUB DATE Apr 75 NOTE 23P.; Paper Presented at the Society Tor Cinema Studies Conference (New York City, April 1975)

i t i DOCUMENT RESUME ED 105 527 CS 501 036 AUTHOR Berg, Charles M. TITLE The Human Voice and the Silent Cinema. PUB DATE Apr 75 NOTE 23p.; Paper presented at the Society tor Cinema Studies Conference (New York City, April 1975) EDRS PRICE MF-$0.76 HC-$1.58 PLUS POSTAGE DESCRIPTORS *Audiovisual Communication; Communication (Thought Transfer); *Films; *Film Study; Higher Education; *History; *Sound Films; Visual Literacy ABSTRACT This paper traces the history of motion pictures from Thomas Edison's vision in 1887 of an instrument that recorded body movements to the development cf synchronized sound-motion films in the late 1920s. The first synchronized sound film was made and demonstrated by W. K. L. Dickson, an assistant to Edison, in 1889. The popular acceptance of silent films and their contents is traced. through the development of film narrative and the use of music in the early 1900s. The silent era is labeled as a consequence of technological and economic chance and this chance is made to account for the accelerated development of the medium's visual communicative capacities. The thirty year time lapse between the development of film and the -e of live human voices can therefore be regarded as the critical stimuli which pushed the motion picture into becoming an essentially visual medium in which the audial channel is subordinate to and supportive of the visual channel. The time lapse also aided the motion picture to become a medium of artistic potential and significance. (RB) U SOEPARTME NT OF HEALTH. COUCATION I. WELFARE e NATIONAL INSTITUTE OF 4 EOUCATION D, - 1'HA. -

The University of Chicago Looking at Cartoons

THE UNIVERSITY OF CHICAGO LOOKING AT CARTOONS: THE ART, LABOR, AND TECHNOLOGY OF AMERICAN CEL ANIMATION A DISSERTATION SUBMITTED TO THE FACULTY OF THE DIVISION OF THE HUMANITIES IN CANDIDACY FOR THE DEGREE OF DOCTOR OF PHILOSOPHY DEPARTMENT OF CINEMA AND MEDIA STUDIES BY HANNAH MAITLAND FRANK CHICAGO, ILLINOIS AUGUST 2016 FOR MY FAMILY IN MEMORY OF MY FATHER Apparently he had examined them patiently picture by picture and imagined that they would be screened in the same way, failing at that time to grasp the principle of the cinematograph. —Flann O’Brien CONTENTS LIST OF FIGURES...............................................................................................................................v ABSTRACT.......................................................................................................................................vii ACKNOWLEDGMENTS....................................................................................................................viii INTRODUCTION LOOKING AT LABOR......................................................................................1 CHAPTER 1 ANIMATION AND MONTAGE; or, Photographic Records of Documents...................................................22 CHAPTER 2 A VIEW OF THE WORLD Toward a Photographic Theory of Cel Animation ...................................72 CHAPTER 3 PARS PRO TOTO Character Animation and the Work of the Anonymous Artist................121 CHAPTER 4 THE MULTIPLICATION OF TRACES Xerographic Reproduction and One Hundred and One Dalmatians.......174 -

Jobs and Education

Vol. 3 Issue 3 JuneJune1998 1998 J OBS AND E DUCATION ¥ Animation on the Internet ¥ Glenn VilppuÕs Life Drawing ¥ CanadaÕs Golden Age? ¥ Below the Radar WHO IS JARED? Plus: Jerry BeckÕs Essential Library, ASIFA and Festivals TABLE OF CONTENTS JUNE 1998 VOL.3 NO.3 4 Editor’s Notebook It’s the drawing stupid! 6 Letters: [email protected] 7 Dig This! 1001 Nights: An Animation Symphony EDUCATION & TRAINING 8 The Essential Animation Reference Library Animation historian Jerry Beck describes the ideal library of “essential” books on animation. 10 Whose Golden Age?: Canadian Animation In The 1990s Art vs. industry and the future of the independent filmmaker: Chris Robinson investigates this tricky bal- ance in the current Canadian animation climate. 15 Here’s A How de do Diary: March The first installment of Barry Purves’ production diary as he chronicles producing a series of animated shorts for Channel 4. An Animation World Magazine exclusive. 20 Survey: It Takes Three to Tango Through a series of pointed questions we take a look at the relationship between educators, industry representatives and students. School profiles are included. 1998 33 What’s In Your LunchBox? Kellie-Bea Rainey tests out Animation Toolworks’ Video LunchBox, an innovative frame-grabbing tool for animators, students, seven year-olds and potato farmers alike! INTERNETINTERNET ANIMATIONANIMATION 38 Who The Heck is Jared? Well, do you know? Wendy Jackson introduces us to this very funny little yellow fellow. 39 Below The Digital Radar Kit Laybourne muses about the evolution of independent animation and looks “below the radar” for the growth of new emerging domains of digital animation. -

Exploring the Portrayal of Stuttering in It (2017)

POSTS AND G-G-GHOSTS: EXPLORING THE PORTRAYAL OF STUTTERING IN IT (2017) A Thesis submitted to the Faculty of the Graduate School of Arts and Sciences of Georgetown University in partial fulfillment of the requirements for the degree of Master of Arts in Communication, Culture, and Technology By Mary-Cecile Gayoso, B. A Washington, D.C. April 13, 2018 Copyright 2018 by Mary-Cecile Gayoso All Rights Reserved ii Dedication The research and writing of this thesis is dedicated to my parents and the name they gave me MY PARENTS, for always listening, for loving me and all my imperfections, and for encouraging me to speak my mind always MY NAME, for being simultaneously the bane and joy of my existence, and for connecting me to my Mamaw and to the Grandfather I never knew Thank you, I love you, Mary-Cecile iii Acknowledgements “One of the hardest things in life is having words in your heart that you can't utter.” - James Earl Jones This thesis would not have been possible without those that are part of my everyday life and those that I have not spoken to or seen in years. To my family: Thank you for your constant support and encouragement, for letting me ramble about my thesis during many of our phone calls. To my mother, thank you for sending me links about stuttering whenever you happened upon a news article or story. To my father, thank you for introducing me to M*A*S*H as a kid and to one of the most positive representations of stuttering in media I’ve seen. -

Reminder List of Productions Eligible for the 90Th Academy Awards Alien

REMINDER LIST OF PRODUCTIONS ELIGIBLE FOR THE 90TH ACADEMY AWARDS ALIEN: COVENANT Actors: Michael Fassbender. Billy Crudup. Danny McBride. Demian Bichir. Jussie Smollett. Nathaniel Dean. Alexander England. Benjamin Rigby. Uli Latukefu. Goran D. Kleut. Actresses: Katherine Waterston. Carmen Ejogo. Callie Hernandez. Amy Seimetz. Tess Haubrich. Lorelei King. ALL I SEE IS YOU Actors: Jason Clarke. Wes Chatham. Danny Huston. Actresses: Blake Lively. Ahna O'Reilly. Yvonne Strahovski. ALL THE MONEY IN THE WORLD Actors: Christopher Plummer. Mark Wahlberg. Romain Duris. Timothy Hutton. Charlie Plummer. Charlie Shotwell. Andrew Buchan. Marco Leonardi. Giuseppe Bonifati. Nicolas Vaporidis. Actresses: Michelle Williams. ALL THESE SLEEPLESS NIGHTS AMERICAN ASSASSIN Actors: Dylan O'Brien. Michael Keaton. David Suchet. Navid Negahban. Scott Adkins. Taylor Kitsch. Actresses: Sanaa Lathan. Shiva Negar. AMERICAN MADE Actors: Tom Cruise. Domhnall Gleeson. Actresses: Sarah Wright. AND THE WINNER ISN'T ANNABELLE: CREATION Actors: Anthony LaPaglia. Brad Greenquist. Mark Bramhall. Joseph Bishara. Adam Bartley. Brian Howe. Ward Horton. Fred Tatasciore. Actresses: Stephanie Sigman. Talitha Bateman. Lulu Wilson. Miranda Otto. Grace Fulton. Philippa Coulthard. Samara Lee. Tayler Buck. Lou Lou Safran. Alicia Vela-Bailey. ARCHITECTS OF DENIAL ATOMIC BLONDE Actors: James McAvoy. John Goodman. Til Schweiger. Eddie Marsan. Toby Jones. Actresses: Charlize Theron. Sofia Boutella. 90th Academy Awards Page 1 of 34 AZIMUTH Actors: Sammy Sheik. Yiftach Klein. Actresses: Naama Preis. Samar Qupty. BPM (BEATS PER MINUTE) Actors: 1DKXHO 3«UH] %LVFD\DUW $UQDXG 9DORLV $QWRLQH 5HLQDUW] )«OL[ 0DULWDXG 0«GKL 7RXU« Actresses: $GªOH +DHQHO THE B-SIDE: ELSA DORFMAN'S PORTRAIT PHOTOGRAPHY BABY DRIVER Actors: Ansel Elgort. Kevin Spacey. Jon Bernthal. Jon Hamm. Jamie Foxx. -

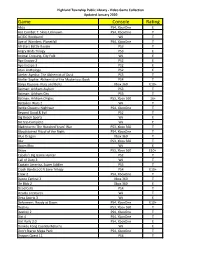

Game Console Rating

Highland Township Public Library - Video Game Collection Updated January 2020 Game Console Rating Abzu PS4, XboxOne E Ace Combat 7: Skies Unknown PS4, XboxOne T AC/DC Rockband Wii T Age of Wonders: Planetfall PS4, XboxOne T All-Stars Battle Royale PS3 T Angry Birds Trilogy PS3 E Animal Crossing, City Folk Wii E Ape Escape 2 PS2 E Ape Escape 3 PS2 E Atari Anthology PS2 E Atelier Ayesha: The Alchemist of Dusk PS3 T Atelier Sophie: Alchemist of the Mysterious Book PS4 T Banjo Kazooie- Nuts and Bolts Xbox 360 E10+ Batman: Arkham Asylum PS3 T Batman: Arkham City PS3 T Batman: Arkham Origins PS3, Xbox 360 16+ Battalion Wars 2 Wii T Battle Chasers: Nightwar PS4, XboxOne T Beyond Good & Evil PS2 T Big Beach Sports Wii E Bit Trip Complete Wii E Bladestorm: The Hundred Years' War PS3, Xbox 360 T Bloodstained Ritual of the Night PS4, XboxOne T Blue Dragon Xbox 360 T Blur PS3, Xbox 360 T Boom Blox Wii E Brave PS3, Xbox 360 E10+ Cabela's Big Game Hunter PS2 T Call of Duty 3 Wii T Captain America, Super Soldier PS3 T Crash Bandicoot N Sane Trilogy PS4 E10+ Crew 2 PS4, XboxOne T Dance Central 3 Xbox 360 T De Blob 2 Xbox 360 E Dead Cells PS4 T Deadly Creatures Wii T Deca Sports 3 Wii E Deformers: Ready at Dawn PS4, XboxOne E10+ Destiny PS3, Xbox 360 T Destiny 2 PS4, XboxOne T Dirt 4 PS4, XboxOne T Dirt Rally 2.0 PS4, XboxOne E Donkey Kong Country Returns Wii E Don't Starve Mega Pack PS4, XboxOne T Dragon Quest 11 PS4 T Highland Township Public Library - Video Game Collection Updated January 2020 Game Console Rating Dragon Quest Builders PS4 E10+ Dragon -

The Survival of American Silent Feature Films: 1912–1929 by David Pierce September 2013

The Survival of American Silent Feature Films: 1912–1929 by David Pierce September 2013 COUNCIL ON LIBRARY AND INFORMATION RESOURCES AND THE LIBRARY OF CONGRESS The Survival of American Silent Feature Films: 1912–1929 by David Pierce September 2013 Mr. Pierce has also created a da tabase of location information on the archival film holdings identified in the course of his research. See www.loc.gov/film. Commissioned for and sponsored by the National Film Preservation Board Council on Library and Information Resources and The Library of Congress Washington, D.C. The National Film Preservation Board The National Film Preservation Board was established at the Library of Congress by the National Film Preservation Act of 1988, and most recently reauthorized by the U.S. Congress in 2008. Among the provisions of the law is a mandate to “undertake studies and investigations of film preservation activities as needed, including the efficacy of new technologies, and recommend solutions to- im prove these practices.” More information about the National Film Preservation Board can be found at http://www.loc.gov/film/. ISBN 978-1-932326-39-0 CLIR Publication No. 158 Copublished by: Council on Library and Information Resources The Library of Congress 1707 L Street NW, Suite 650 and 101 Independence Avenue, SE Washington, DC 20036 Washington, DC 20540 Web site at http://www.clir.org Web site at http://www.loc.gov Additional copies are available for $30 each. Orders may be placed through CLIR’s Web site. This publication is also available online at no charge at http://www.clir.org/pubs/reports/pub158. -

RESISTANCE MADE in HOLLYWOOD: American Movies on Nazi Germany, 1939-1945

1 RESISTANCE MADE IN HOLLYWOOD: American Movies on Nazi Germany, 1939-1945 Mercer Brady Senior Honors Thesis in History University of North Carolina at Chapel Hill Department of History Advisor: Prof. Karen Hagemann Co-Reader: Prof. Fitz Brundage Date: March 16, 2020 2 Acknowledgements I want to thank Dr. Karen Hagemann. I had not worked with Dr. Hagemann before this process; she took a chance on me by becoming my advisor. I thought that I would be unable to pursue an honors thesis. By being my advisor, she made this experience possible. Her interest and dedication to my work exceeded my expectations. My thesis greatly benefited from her input. Thank you, Dr. Hagemann, for your generosity with your time and genuine interest in this thesis and its success. Thank you to Dr. Fitz Brundage for his helpful comments and willingness to be my second reader. I would also like to thank Dr. Michelle King for her valuable suggestions and support throughout this process. I am very grateful for Dr. Hagemann and Dr. King. Thank you both for keeping me motivated and believing in my work. Thank you to my roommates, Julia Wunder, Waverly Leonard, and Jamie Antinori, for being so supportive. They understood when I could not be social and continued to be there for me. They saw more of the actual writing of this thesis than anyone else. Thank you for being great listeners and wonderful friends. Thank you also to my parents, Joe and Krista Brady, for their unwavering encouragement and trust in my judgment. I would also like to thank my sister, Mahlon Brady, for being willing to hear about subjects that are out of her sphere of interest. -

Top Questions About Character Animation

Top Questions About Character Animation What are some of the exciting aspects of character animation, and how is it different than other computer animation forms? The phrase computer animation is often used as a catch-all for many computer generated effects including spinning logos, Flash programming on the Web or special effects in movies. These are not character animation. Character animation is the process of giving life to a character, whether it is a dog that can talk, a drawn person or an animated object. Character animation creates personality. How long does it take one person to create one minute of animation? This is difficult to pinpoint, but it can take one animator about 16 – 20 weeks of full-time work to produce 60 seconds of animation.1 At Pixar Animation Studios, due to their high level of quality control, animators have been known to work on two minutes of film for a year or more. How many animators typically work on an animated feature film? It depends on the studio and its needs, so anywhere from 20 – 80 animators could be working on an animated feature film. What is the biggest myth about character animation? A lot of people believe that the computer does all of the work for the animator, but the reality is that the animator is only using the computer as a tool to create detailed animation frame by frame. What are some of the most challenging aspects of character animation? Character animators work in fun, collaborative, exciting and detailed environments. They need to have a high level of patience while working with the tiny movements of a character frame by frame. -

How Pcoip® Technology Can Save Broadcasters Time & Money While

TVTechnology How PCoIP® Technology Can Save Broadcasters Time & Money While Boosting Cybersecurity COVID-19 and the need to work from home is transforming the way broadcasters produce, play- out, and distribute content. This post-KVM model prevents hostile players from hacking into broadcasters via home/remote user computers. Meanwhile, the reduced bandwidth allows many more home/remote users to connect to a broadcaster’s office or studio without overloading the corporate IT system, because so much less data is going back and forth. Industrial Light & THE SOLUTION: TERADICI’s PCoIP Magic Overcomes TECHNOLOGY ‘Dailies’ Issues with All of the post-KVM features outlined above are provided by Teradici’s PC-over-IP PCoIP Technology nfortunately, the current KVM (Keyboard- (PCoIP) communications protocol. PCoIP Video-Mouse) model of remote access is not uses advanced display compression to n the motion picture industry, adequate for this task. The reason: home- provide end users with on-premises or ‘dailies’ are raw, unedited sets of based/remote users lack secure connectivity cloud-based ‘virtual machines’. Teradici’s Ifootage shot during the production to their corporate workstations and servers. virtual workspace architecture compresses, day that are shared for review U This is because their KVM infrastructure is encrypts and transmits only pixels to a among key players. For a company designed to support local connections to broad range of software clients, mobile like Industrial Light & Magic (ILM) – nearby LAN resources, rather than delivering clients, thin clients and stateless PCoIP renowned for its visual effects in the high-performance user experiences over Zero Clients1, resulting in a highly secure, Star Wars films and other blockbusters long distance WANs. -

Free-Digital-Preview.Pdf

THE BUSINESS, TECHNOLOGY & ART OF ANIMATION AND VFX January 2013 ™ $7.95 U.S. 01> 0 74470 82258 5 www.animationmagazine.net THE BUSINESS, TECHNOLOGY & ART OF ANIMATION AND VFX January 2013 ™ The Return of The Snowman and The Littlest Pet Shop + From Up on The Visual Wonders Poppy Hill: of Life of Pi Goro Miyazaki’s $7.95 U.S. 01> Valentine to a Gone-by Era 0 74470 82258 5 www.animationmagazine.net 4 www.animationmagazine.net january 13 Volume 27, Issue 1, Number 226, January 2013 Content 12 22 44 Frame-by-Frame Oscars ‘13 Games 8 January Planner...Books We Love 26 10 Things We Loved About 2012! 46 Oswald and Mickey Together Again! 27 The Winning Scores Game designer Warren Spector spills the beans on the new The composers of some of the best animated soundtracks Epic Mickey 2 release and tells us how much he loved Features of the year discuss their craft and inspirations. [by Ramin playing with older Disney characters and long-forgotten 12 A Valentine to a Vanished Era Zahed] park attractions. Goro Miyazaki’s delicate, coming-of-age movie From Up on Poppy Hill offers a welcome respite from the loud, CG world of most American movies. [by Charles Solomon] Television Visual FX 48 Building a Beguiling Bengal Tiger 30 The Next Little Big Thing? VFX supervisor Bill Westenhofer discusses some of the The Hub launches its latest franchise revamp with fashion- mind-blowing visual effects of Ang Lee’s Life of Pi. [by Events forward The Littlest Pet Shop. -

IMAX China Holdings Soft Momentum After Avengers

14 June 2018 Hong Kong EQUITIES IMAX China Holdings 1970 HK Neutral Soft momentum after Avengers Price (at 06:39, 13 Jun 2018 GMT) HK$27.60 Valuation HK$ 26.00-29.00 Key points - PER Downgrade to Neutral with TP lowered to HK$27.77 12-month target HK$ 27.77 We expect IMAX China’s BO growth to slow down after Avengers with its Upside/Downside % +0.6 network expansion peaking 12-month TSR % +1.8 We expect earnings to drop by 4% YoY in 2H18, with a 4% 18-20E CAGR Volatility Index High GICS sector Media Market cap HK$m 9,903 Event Market cap US$m 1,246 Downgrade to Neutral. IMAX China’s share price has rallied by 45% from the Free float % 32 trough earlier this year (vs +4% for HSI), on the good box office (BO) 30-day avg turnover US$m 5.1 performance of Avengers and strong 1Q. However, we expect the earnings Number shares on issue m 358.8 growth momentum going forward to inevitably slow down on the expected soft film slate and more importantly, the peaking of network installations. We expect Investment fundamentals its earnings to decline by 4% YoY in 2H18, after a +36% YoY in 1H18E, with a Year end 31 Dec 2017A 2018E 2019E 2020E Revenue m 126.5 138.6 146.9 150.7 4% 18-20E earnings CAGR. Downgrade to Neutral from Outperform. EBIT m 57.3 65.1 68.7 70.4 EBIT growth % 20.7 13.5 5.6 2.4 Impact Reported profit m 43.7 49.0 51.8 53.1 Softer momentum after Avengers.