2016 FEATURE FILM STUDY Photo: Diego Grandi / Shutterstock.Com TABLE of CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Human Voice and the Silent Cinema. PUB DATE Apr 75 NOTE 23P.; Paper Presented at the Society Tor Cinema Studies Conference (New York City, April 1975)

i t i DOCUMENT RESUME ED 105 527 CS 501 036 AUTHOR Berg, Charles M. TITLE The Human Voice and the Silent Cinema. PUB DATE Apr 75 NOTE 23p.; Paper presented at the Society tor Cinema Studies Conference (New York City, April 1975) EDRS PRICE MF-$0.76 HC-$1.58 PLUS POSTAGE DESCRIPTORS *Audiovisual Communication; Communication (Thought Transfer); *Films; *Film Study; Higher Education; *History; *Sound Films; Visual Literacy ABSTRACT This paper traces the history of motion pictures from Thomas Edison's vision in 1887 of an instrument that recorded body movements to the development cf synchronized sound-motion films in the late 1920s. The first synchronized sound film was made and demonstrated by W. K. L. Dickson, an assistant to Edison, in 1889. The popular acceptance of silent films and their contents is traced. through the development of film narrative and the use of music in the early 1900s. The silent era is labeled as a consequence of technological and economic chance and this chance is made to account for the accelerated development of the medium's visual communicative capacities. The thirty year time lapse between the development of film and the -e of live human voices can therefore be regarded as the critical stimuli which pushed the motion picture into becoming an essentially visual medium in which the audial channel is subordinate to and supportive of the visual channel. The time lapse also aided the motion picture to become a medium of artistic potential and significance. (RB) U SOEPARTME NT OF HEALTH. COUCATION I. WELFARE e NATIONAL INSTITUTE OF 4 EOUCATION D, - 1'HA. -

Animation: Types

Animation: Animation is a dynamic medium in which images or objects are manipulated to appear as moving images. In traditional animation, images are drawn or painted by hand on transparent celluloid sheets to be photographed and exhibited on film. Today most animations are made with computer generated (CGI). Commonly the effect of animation is achieved by a rapid succession of sequential images that minimally differ from each other. Apart from short films, feature films, animated gifs and other media dedicated to the display moving images, animation is also heavily used for video games, motion graphics and special effects. The history of animation started long before the development of cinematography. Humans have probably attempted to depict motion as far back as the Paleolithic period. Shadow play and the magic lantern offered popular shows with moving images as the result of manipulation by hand and/or some minor mechanics Computer animation has become popular since toy story (1995), the first feature-length animated film completely made using this technique. Types: Traditional animation (also called cel animation or hand-drawn animation) was the process used for most animated films of the 20th century. The individual frames of a traditionally animated film are photographs of drawings, first drawn on paper. To create the illusion of movement, each drawing differs slightly from the one before it. The animators' drawings are traced or photocopied onto transparent acetate sheets called cels which are filled in with paints in assigned colors or tones on the side opposite the line drawings. The completed character cels are photographed one-by-one against a painted background by rostrum camera onto motion picture film. -

Pr-Dvd-Holdings-As-Of-September-18

CALL # LOCATION TITLE AUTHOR BINGE BOX COMEDIES prmnd Comedies binge box (includes Airplane! --Ferris Bueller's Day Off --The First Wives Club --Happy Gilmore)[videorecording] / Princeton Public Library. BINGE BOX CONCERTS AND MUSICIANSprmnd Concerts and musicians binge box (Includes Brad Paisley: Life Amplified Live Tour, Live from WV --Close to You: Remembering the Carpenters --John Sebastian Presents Folk Rewind: My Music --Roy Orbison and Friends: Black and White Night)[videorecording] / Princeton Public Library. BINGE BOX MUSICALS prmnd Musicals binge box (includes Mamma Mia! --Moulin Rouge --Rodgers and Hammerstein's Cinderella [DVD] --West Side Story) [videorecording] / Princeton Public Library. BINGE BOX ROMANTIC COMEDIESprmnd Romantic comedies binge box (includes Hitch --P.S. I Love You --The Wedding Date --While You Were Sleeping)[videorecording] / Princeton Public Library. DVD 001.942 ALI DISC 1-3 prmdv Aliens, abductions & extraordinary sightings [videorecording]. DVD 001.942 BES prmdv Best of ancient aliens [videorecording] / A&E Television Networks History executive producer, Kevin Burns. DVD 004.09 CRE prmdv The creation of the computer [videorecording] / executive producer, Bob Jaffe written and produced by Donald Sellers created by Bruce Nash History channel executive producers, Charlie Maday, Gerald W. Abrams Jaffe Productions Hearst Entertainment Television in association with the History Channel. DVD 133.3 UNE DISC 1-2 prmdv The unexplained [videorecording] / produced by Towers Productions, Inc. for A&E Network executive producer, Michael Cascio. DVD 158.2 WEL prmdv We'll meet again [videorecording] / producers, Simon Harries [and three others] director, Ashok Prasad [and five others]. DVD 158.2 WEL prmdv We'll meet again. Season 2 [videorecording] / director, Luc Tremoulet producer, Page Shepherd. -

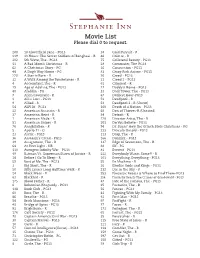

Movie List Please Dial 0 to Request

Movie List Please dial 0 to request. 200 10 Cloverfield Lane - PG13 38 Cold Pursuit - R 219 13 Hours: The Secret Soldiers of Benghazi - R 46 Colette - R 202 5th Wave, The - PG13 75 Collateral Beauty - PG13 11 A Bad Mom’s Christmas - R 28 Commuter, The-PG13 62 A Christmas Story - PG 16 Concussion - PG13 48 A Dog’s Way Home - PG 83 Crazy Rich Asians - PG13 220 A Star is Born - R 20 Creed - PG13 32 A Walk Among the Tombstones - R 21 Creed 2 - PG13 4 Accountant, The - R 61 Criminal - R 19 Age of Adaline, The - PG13 17 Daddy’s Home - PG13 40 Aladdin - PG 33 Dark Tower, The - PG13 7 Alien:Covenant - R 67 Darkest Hour-PG13 2 All is Lost - PG13 52 Deadpool - R 9 Allied - R 53 Deadpool 2 - R (Uncut) 54 ALPHA - PG13 160 Death of a Nation - PG13 22 American Assassin - R 68 Den of Thieves-R (Unrated) 37 American Heist - R 34 Detroit - R 1 American Made - R 128 Disaster Artist, The - R 51 American Sniper - R 201 Do You Believe - PG13 76 Annihilation - R 94 Dr. Suess’ How the Grinch Stole Christmas - PG 5 Apollo 11 - G 233 Dracula Untold - PG13 23 Arctic - PG13 113 Drop, The - R 36 Assassin’s Creed - PG13 166 Dunkirk - PG13 39 Assignment, The - R 137 Edge of Seventeen, The - R 64 At First Light - NR 88 Elf - PG 110 Avengers:Infinity War - PG13 81 Everest - PG13 49 Batman Vs. Superman:Dawn of Justice - R 222 Everybody Wants Some!! - R 18 Before I Go To Sleep - R 101 Everything, Everything - PG13 59 Best of Me, The - PG13 55 Ex Machina - R 3 Big Short, The - R 26 Exodus Gods and Kings - PG13 50 Billy Lynn’s Long Halftime Walk - R 232 Eye In the Sky - -

FAITHFUL UNDER FIRE: a BIBLE STUDY and DEVOTIONAL for the FILM Introduction

FAITHFUL UNDER FIRE: A BIBLE STUDY AND DEVOTIONAL FOR THE FILM Introduction Hacksaw Ridge, a new film released by Lions Gate Entertainment, Inc., tells the story of Private First Class Desmond Doss, an Army medic who received the nation’s highest award for valor, the Medal of Honor. The MOH decoration is awarded only for conspicuous and personal acts of valor that are unequivocally deemed to be “above and beyond the call of duty.” Desmond Doss was the first conscientious objector to receive that award — and one of only three ever to do so in our Nation’s history. Doss, a Seventh-day Adventist Christian, had a personal, deeply held, biblically formed conviction not to kill — or even to carry a weapon. Nevertheless, he voluntarily enlisted in the Army in 1942 as a combat medic so as to fulfill his calling to serve both his country and his fellow soldiers by saving lives rather than taking them. But a significant part of Desmond’s story is the staunch resistance he faced in the U.S. Army — from both his superiors and fellow soldiers alike, who deemed his non-combatant stance to be a guise for cowardice. The manner in which Doss tenaciously holds-onto his Scripturally based beliefs and ultimately proves himself under the most excruciating and even barbaric combat conditions not only makes for gripping drama. It also confronts everyone who similarly holds biblical convictions in a pluralistic or secular “marketplace” with a challenging roadmap for living faithfully in this world as citizens of our Nation while reserving our highest allegiance to the Kingdom of God. -

Cue the Music: Music in Movies Kelsey M

Cedarville University DigitalCommons@Cedarville The Research and Scholarship Symposium The 2017 yS mposium Apr 12th, 3:00 PM - 3:30 PM Cue the Music: Music in Movies Kelsey M. DePree Cedarville University, [email protected] Follow this and additional works at: http://digitalcommons.cedarville.edu/ research_scholarship_symposium Part of the Composition Commons, Film and Media Studies Commons, and the Other Music Commons DePree, Kelsey M., "Cue the Music: Music in Movies" (2017). The Research and Scholarship Symposium. 5. http://digitalcommons.cedarville.edu/research_scholarship_symposium/2017/podium_presentations/5 This Podium Presentation is brought to you for free and open access by DigitalCommons@Cedarville, a service of the Centennial Library. It has been accepted for inclusion in The Research and Scholarship Symposium by an authorized administrator of DigitalCommons@Cedarville. For more information, please contact [email protected]. The Music We Watch Kelsey De Pree Music History II April 5, 2017 Music is universal. It is present from the beginning of history appearing in all cultures, nations, economic classes, and styles. Music in America is heard on radios, in cars, on phones, and in stores. Television commercials feature jingles so viewers can remember the products; radio ads sing phone numbers so that listeners can recall them. In schools, students sing songs to learn subjects like math, history, and English, and also to learn about general knowledge like the days of the week, months of the year, and presidents of the United States. With the amount of music that is available, it is not surprising that music has also made its way into movie theatres and has become one of the primary agents for conveying emotion and plot during a cinematic production. -

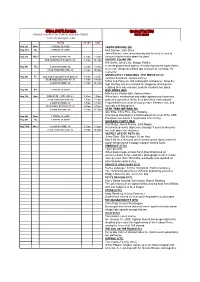

Cinema Augusta Program Coming Attractions Phone 86489999 to Check Session Times Visit Our Web Page

CINEMA AUGUSTA PROGRAM COMING ATTRACTIONS PHONE 86489999 TO CHECK SESSION TIMES VISIT OUR WEB PAGE www.cinemaaugusta.com MOVIE START END . Aug 1st Mon CINEMA CLOSED JASON BOURNE (M) Aug 2nd Tue CINEMA CLOSED Matt Damon, Julia Stiles. Jason Bourne, now remembering who he truly is, tries to Aug 3rd Wed JASON BOURNE (M) 6.30pm 8.20pm uncover hidden truths about his past. THE LEGEND OF TARZAN (M) 8.30pm 10.40pm SUICIDE SQUAD (M) Will Smith, Jared Leto, Margot Robbie. Aug 4th Thu JASON BOURNE (M) 6.20pm 8.30pm A secret government agency recruits imprisoned supervillains STAR TREK BEYOND (M) 8.40pm 10.50pm to execute dangerous black ops missions in exchange for clemency. ABSOLUTELY FABULOUS :THE MOVIE (CTC) Aug 5th Fri ICE AGE COLLISION COURSE (G) 4.45pm 6.20pm Jennifer Saunders, Joanna Lumley. STAR TREK BEYOND (M) 3D 6.30pm 8.40pm Edina and Patsy are still oozing glitz and glamor, living the JASON BOURNE (M) 8.50pm 10.55pm high life they are accustomed to; shopping, drinking and clubbing their way around London's trendiest hot-spots. Aug 6th Sat CINEMA CLOSED BAD MOMS (MA) Mila Kunis, Kristen Bell, Kathryn Hahn. Aug 7th Sun KIDS FLIX …ICE AGE (G) 9.30am 1.00pm When three overworked and under-appreciated moms are STAR TREK BEYOND (M) 1.10pm 3.20pm pushed beyond their limits, they ditch their conventional JASON BOURNE (M) 3.30pm 5.40pm responsibilities for a jolt of long overdue freedom, fun, and STAR TREK BEYOND (M) 3D 6.00pm 8.10pm comedic self-indulgence. -

Stop-Motion Animation an Introduction What Is Animation?

Stop-motion Animation An Introduction What is Animation? In its simplest form, animation is essentially making something that doesn’t move (inanimate) look like it is moving (animate). This can be done through repeated drawings or paintings (traditional 2D), using puppets or clay (stop-motion) and using computer programmes and software (CG and 3D). All of these methods have one aim in mind: to create ‘the illusion of life’. Key Resource: The Evolution of Animation The following video shows how animation has evolved from it’s very first days using contraptions like the ‘Zoetrope’. Whilst you watch these clips, think about the different types of animation used. How many of these films do you recognise? The Evolution of Animation 1833-2017 https://www.youtube.com/watch?v=z6TOQzCDO7Y Many older animations are available to watch on Youtube, such as ‘Gertie the Dinosaur’ and ‘Felix the Cat’, and it’s important to appreciate these as being the roots of modern animation. Younger Animators might also get a kick out of watching some classic ‘Looney Tunes’ cartoons. What is movement? A movement is when something goes from point A to point B in a certain amount of time. The amount of time it takes dictates how fast that movement is. In other words, if something goes from point A to B in a short amount of time then it is a fast movement, and if it takes a long time then it is a slow movement. Experiment: Try out some actions like waving, spinning in a circle and walking all at different speeds. -

Zbardhen Prapaskenat Për Arrestimin E Emiliano Shullazit, Ja Përplasjet

Çmimi 20 lekë, Tel: 2382 020 Rr.Sitki Çiço përballë Maternitetit të Ri E-mail: [email protected] Hapen qindra vende të lira pune në administratën publike, ja kushtet dhe kriteret, afatet për E Hënë 18 Prill 2016 aplikim deri më 4 maj Faqe 5 Raporti antikorrupsion, rriten denoncimet për Zbardhen prapaskenat për arrestimin afera me tenderat, në krye mbeten arsimi dhe shëndetësia e Emiliano Shullazit, ja përplasjet mes Zyra antikorrupsion pranë qeverisë, e drejtu- ar nga kryeministri Edi Rama dhe ministri Bledi Çuçi, ka publikuar raportin më të fundit sa i takon numrit të denoncimeve të rasteve të ryshfetit në prokurorisë dhe policisë, ndërhyrje portalin antikorrupsion... Faqe 8 Nis zvarritja e dekriminalizimit, të forta politike kundër ndalimit të tij zyrtarët nuk dinë të plotësojnë Faqe 2-4 formularët e vetëdeklarimit, paqartësi mbi pyetjet dhe informacionet që duhet të japin Dalin të tjerë vështirësi sa i takon procesit të dekriminalizimit. Teksa procesi ka muaj që zvarritet, problemi i ri është vështirësia në plotë- simin e formularit të vetëdeklarimit. Deri më tani, të gjitha institucionet përgjegjëse... Faqe 9 Humbet morali në zgjedhjet Basha përjashton gardën e vjetër, programet e PD për Universitetin e Tiranës, hartohen nga rrethi i Dibra i sugjeron Konit: besnikëve, përgatit terrenin Dil mbro veten publikisht për futjen e të rinjve në lista Lulzim Basha ka përjashtuar ish-ministrat dhe Dom Gjergj Meta: Kërcënimi figurat e vjetra të Partisë Demokratike nga gati çdo aktivitet i tij me natyrë elektorale. Prej disa muajsh i Mynyr Konit, jo kambanë Lulzim Basha ka urdhëruar rrethin e tij të nisin përgatitjet e programeve që do.. -

Beyond the Paths of Heaven the Emergence of Space Power Thought

Beyond the Paths of Heaven The Emergence of Space Power Thought A Comprehensive Anthology of Space-Related Master’s Research Produced by the School of Advanced Airpower Studies Edited by Bruce M. DeBlois, Colonel, USAF Professor of Air and Space Technology Air University Press Maxwell Air Force Base, Alabama September 1999 Library of Congress Cataloging-in-Publication Data Beyond the paths of heaven : the emergence of space power thought : a comprehensive anthology of space-related master’s research / edited by Bruce M. DeBlois. p. cm. Includes bibliographical references and index. 1. Astronautics, Military. 2. Astronautics, Military—United States. 3. Space Warfare. 4. Air University (U.S.). Air Command and Staff College. School of Advanced Airpower Studies- -Dissertations. I. Deblois, Bruce M., 1957- UG1520.B48 1999 99-35729 358’ .8—dc21 CIP ISBN 1-58566-067-1 Disclaimer Opinions, conclusions, and recommendations expressed or implied within are solely those of the authors and do not necessarily represent the views of Air University, the United States Air Force, the Department of Defense, or any other US government agency. Cleared for public release: distribution unlimited. ii Contents Chapter Page DISCLAIMER . ii OVERVIEW . ix PART I Space Organization, Doctrine, and Architecture 1 An Aerospace Strategy for an Aerospace Nation . 3 Stephen E. Wright 2 After the Gulf War: Balancing Space Power’s Development . 63 Frank Gallegos 3 Blueprints for the Future: Comparing National Security Space Architectures . 103 Christian C. Daehnick PART II Sanctuary/Survivability Perspectives 4 Safe Heavens: Military Strategy and Space Sanctuary . 185 David W. Ziegler PART III Space Control Perspectives 5 Counterspace Operations for Information Dominance . -

The Survival of American Silent Feature Films: 1912–1929 by David Pierce September 2013

The Survival of American Silent Feature Films: 1912–1929 by David Pierce September 2013 COUNCIL ON LIBRARY AND INFORMATION RESOURCES AND THE LIBRARY OF CONGRESS The Survival of American Silent Feature Films: 1912–1929 by David Pierce September 2013 Mr. Pierce has also created a da tabase of location information on the archival film holdings identified in the course of his research. See www.loc.gov/film. Commissioned for and sponsored by the National Film Preservation Board Council on Library and Information Resources and The Library of Congress Washington, D.C. The National Film Preservation Board The National Film Preservation Board was established at the Library of Congress by the National Film Preservation Act of 1988, and most recently reauthorized by the U.S. Congress in 2008. Among the provisions of the law is a mandate to “undertake studies and investigations of film preservation activities as needed, including the efficacy of new technologies, and recommend solutions to- im prove these practices.” More information about the National Film Preservation Board can be found at http://www.loc.gov/film/. ISBN 978-1-932326-39-0 CLIR Publication No. 158 Copublished by: Council on Library and Information Resources The Library of Congress 1707 L Street NW, Suite 650 and 101 Independence Avenue, SE Washington, DC 20036 Washington, DC 20540 Web site at http://www.clir.org Web site at http://www.loc.gov Additional copies are available for $30 each. Orders may be placed through CLIR’s Web site. This publication is also available online at no charge at http://www.clir.org/pubs/reports/pub158. -

The Influence of Jexi and Cate Towards Phil's Personality Development in Jexi Movie Script

PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI THE INFLUENCE OF JEXI AND CATE TOWARDS PHIL’S PERSONALITY DEVELOPMENT IN JEXI MOVIE SCRIPT AN UNDERGRADUATE THESIS Presented Partial Fulfilment of the Requirements for the Degree of Sarjana Sastra in English Letters By JULIUS NOVAN DENI KURNIAWAN Student Number: 164214122 DEPARTMENT OF ENGLISH LETTERS FACULTY OF LETTERS UNIVERSITAS SANATA DHARMA YOGYAKARTA 2020 PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI THE INFLUENCE OF JEXI AND CATE TOWARDS PHIL’S PERSONALITY DEVELOPMENT IN JEXI MOVIE SCRIPT AN UNDERGRADUATE THESIS Presented Partial Fulfilment of the Requirements for the Degree of Sarjana Sastra in English Letters By JULIUS NOVAN DENI KURNIAWAN Student Number: 164214122 DEPARTMENT OF ENGLISH LETTERS FACULTY OF LETTERS UNIVERSITAS SANATA DHARMA YOGYAKARTA 2020 ii PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI The universe is not outside of you. Look inside yourself; everything that you want, you already are. -Rumi vii PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI ACKNOWLEDGMENTS My deepest gratitude goes to Dr. Gabriel Fajar Sasmita Aji M.Hum. as my thesis advisor and Dr. Tatang Iskarna as my co-advisor for the patience, knowledge, insight, time, and guidance for my undergraduate thesis. I would also address my gratitude to all lecturers and staff of the English Letters Department of Sanata Dharma for your services and knowledge. I would also like to thank my good friends from Catholic Student Community (CSC) St. Aloysius Gonzaga Purwokerto, UKM KSR PMI Unit VI Universitas Sanata Dharma Yogyakarta, Anti Qecewa Qecewa Grup, and all that I am not able to mention. Thank you for your support. Julius Novan Deni Kurniawan viii PLAGIAT MERUPAKAN TINDAKAN TIDAK TERPUJI TABLE OF CONTENTS TITLE PAGE ...............................................................................................