Programmes and Investment Committee 11 October 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Walks Programme: July to September 2021

LONDON STROLLERS WALKS PROGRAMME: JULY TO SEPTEMBER 2021 NOTES AND ANNOUNCEMENTS IMPORTANT NOTE REGARDING COVID-19: Following discussions with Ramblers’ Central Office, it has been confirmed that as organized ‘outdoor physical activity events’, Ramblers’ group walks are exempt from other restrictions on social gatherings. This means that group walks in London can continue to go ahead. Each walk is required to meet certain requirements, including maintenance of a register for Test and Trace purposes, and completion of risk assessments. There is no longer a formal upper limit on numbers for walks; however, since Walk Leaders are still expected to enforce social distancing, and given the difficulties of doing this with large numbers, we are continuing to use a compulsory booking system to limit numbers for the time being. Ramblers’ Central Office has published guidance for those wishing to join group walks. Please be sure to read this carefully before going on a walk. It is available on the main Ramblers’ website at www.ramblers.org.uk. The advice may be summarised as: - face masks must be carried and used, for travel to and from a walk on public transport, and in case of an unexpected incident; - appropriate social distancing must be maintained at all times, especially at stiles or gates; - you should consider bringing your own supply of hand sanitiser, and - don’t share food, drink or equipment with others. Some other important points are as follows: 1. BOOKING YOUR PLACE ON A WALK If you would like to join one of the walks listed below, please book a place by following the instructions given below. -

1 Determinants and Consequences of Car Use Submitted By

Determinants and Consequences of Car Use Submitted by Chng Samuel Chong Wei to the University of Exeter as a thesis for the degree of Doctor of Philosophy in Medical Studies in May 2017 This thesis is available for Library use on the understanding that it is copyright material and that no quotation from the thesis may be published without proper acknowledgement. I certify that all material in this thesis which is not my own work has been identified and that no material has previously been submitted and approved for the award of a degree by this or any other University. Signature: ………………………………………………………….. 1 “The answer to global transport challenges is not less transport – it is sustainable transport.” Ban Ki-moon 8th Secretary-General of the United Nations 2 Abstract Global demand for road travel is likely to double by 2050, creating serious environmental and human health risks. Forms of transport that are more sustainable should, therefore, be encouraged. This research aimed to generate a better understanding of personal transport decisions to contribute towards improving interventions and policies for reducing car use with four studies. The first reviewed psychological theories applied to understanding car use. These theories have evolved to become more comprehensive, however, some mechanisms of car use choice remain unaccounted for. Thus, the CAUSE framework was developed with the review’s findings to provide an integrated conceptual overview of potentially modifiable antecedents of car use. The second is a quantitative analysis exploring the relationships between public transport connectivity, commuting and two aspects of wellbeing: life satisfaction and mental distress. Life satisfaction was related to mode choice and mental distress was related to public transport connectivity. -

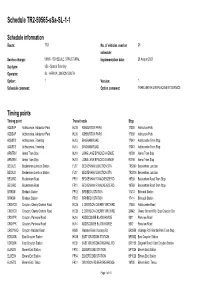

Standard Schedule TR2-58329-Ssa-SL-1-1

Schedule TR2-59565-sSa-SL-1-1 Schedule information Route: TR2 No. of vehicles used on 25 schedule: Service change: 59565 - SCHEDULE, STRUCTURAL Implementation date: 28 August 2021 Day type: sSa - Special Saturday Operator: SL - ARRIVA LONDON SOUTH Option: 1 Version: 1 Schedule comment: Option comment: TRAMLINK RAIL REPLACEMENT SERVICE Timing points Timing point Transit node Stop ADDSAP Addiscombe, Ashburton Park HJ08 ASHBURTON PARK 17338 Ashburton Park ADDSAP Addiscombe, Ashburton Park HJ08 ASHBURTON PARK 17339 Ashburton Park ADDSTS Addiscombe, Tramstop HJ15 BINGHAM ROAD 17342 Addiscombe Tram Stop ADDSTS Addiscombe, Tramstop HJ15 BINGHAM ROAD 17343 Addiscombe Tram Stop ARNTRM Arena Tram Stop HJ10 LONG LANE BYWOOD AVENUE 18799 Arena Tram Stop ARNTRM Arena Tram Stop HJ10 LONG LANE BYWOOD AVENUE R0746 Arena Tram Stop BECKJS Beckenham Junction Station FJ07 BECKENHAM JUNCTION STN TRS169 Beckenham Junction BECKJS Beckenham Junction Station FJ07 BECKENHAM JUNCTION STN TRS174 Beckenham Junction BECKRD Beckenham Road FP01 BECKENHAM R MACKENZIE RD 19768 Beckenham Road Tram Stop BECKRD Beckenham Road FP01 BECKENHAM R MACKENZIE RD 19769 Beckenham Road Tram Stop BIRKSN Birkbeck Station FP02 BIRKBECK STATION 17413 Birkbeck Station BIRKSN Birkbeck Station FP02 BIRKBECK STATION 17414 Birkbeck Station CROYCO Croydon, Cherry Orchard Road HC25 E CROYDON CHERRY ORCH RD 17348 Addiscombe Road CROYCO Croydon, Cherry Orchard Road HC25 E CROYDON CHERRY ORCH RD 26842 Cherry Orchard Rd / East Croydon Stn CROYPR Croydon, Parkview Road HJ14 ADDISCOMBE BLACK HORSE -

Planning Reports

2. Application No : 03/02718/FULL1 Ward: Kelsey And Eden Park Address : Tesco Stores Ltd Croydon Road Conservation Area:NO Beckenham Kent BR3 4AA OS Grid Ref: E: 535737 N: 168194 Applicant : Tesco Stores Ltd Objections : YES Description of Development: Enlargement of retail store site to include adjacent land to south and site of demolished railway substation, and single storey extensions to store, decked car park over existing car park and extension of surface car park (to increase number of parking spaces from 393 to 564), realignment of access road to service yard, and relocation of service yard, recycling facilities, staff car park and sprinkler tank/pump building 7 0 78 72 PO Pa th FB LB C 5 R 7 33. 4m CF Car 5 Pa rk 4 Pa th H C d n U 3 5 5 2 7 TCB th a P South Norwood Country Park ta ll 2 El me rs En d Ha 9 S 3 b 1 u S Free Ch urch R l C E 1 3 in a r in D ra 8 D 3 34. 4m y 2 d 5 B y B d BM 3 4.9 4m L B d 2 2 r 33. 3m 3 a 1 W 1 1 2 9 7 G 8 O 3 D 1 D 5 A R h SP t D a P R O A 2 D 5 D 0 OA 1 N R O Y D RO 5 C 3 t h 7 k . a n 2 P l i m m ra Su p erst ore T 3 5 El Sub St a 0 2 in ra D El Sub St a F C 2 LB 2 4 2 m .5 5 3 ef D 5 4 a t S b u S l E M 1 P 3 1 1 . -

Research on Weather Conditions and Their Relationship to Crashes December 31, 2020 6

INVESTIGATION OF WEATHER CONDITIONS AND THEIR RELATIONSHIP TO CRASHES 1 Dr. Mark Anderson 2 Dr. Aemal J. Khattak 2 Muhammad Umer Farooq 1 John Cecava 3 Curtis Walker 1. Department of Earth and Atmospheric Sciences 2. Department of Civil & Environmental Engineering University of Nebraska-Lincoln Lincoln, NE 68583-0851 3. National Center for Atmospheric Research, Boulder, CO Sponsored by Nebraska Department of Transportation and U.S. Department of Transportation Federal Highway Administration December 31, 2020 TECHNICAL REPORT DOCUMENTATION PAGE 1. Report No. 2. Government Accession No. 3. Recipient’s Catalog No. SPR-21 (20) M097 4. Title and Subtitle 5. Report Date Research on Weather conditions and their relationship to crashes December 31, 2020 6. Performing Organization Code 7. Author(s) 8. Performing Organization Report No. Dr. Mark Anderson, Dr. Aemal J. Khattak, Muhammad Umer Farooq, John 26-0514-0202-001 Cecava, Dr. Curtis Walker 9. Performing Organization Name and Address 10. Work Unit No. University of Nebraska-Lincoln 2200 Vine Street, PO Box 830851 11. Contract or Grant No. Lincoln, NE 68583-0851 SPR-21 (20) M097 12. Sponsoring Agency Name and Address 13. Type of Report and Period Covered Nebraska Department of Transportation NDOT Final Report 1500 Nebraska 2 Lincoln, NE 68502 14. Sponsoring Agency Code 15. Supplementary Notes Conducted in cooperation with the U.S. Department of Transportation, Federal Highway Administration. 16. Abstract The objectives of the research were to conduct a seasonal investigation of when winter weather conditions are a factor in crashes reported in Nebraska, to perform statistical analyses on Nebraska crash and meteorological data and identify weather conditions causing the significant safety concerns, and to investigate whether knowing the snowfall amount and/or storm intensity/severity could be a precursor to the number and severity of crashes. -

(Public Pack)Agenda Document for Executive, 28/03/2018 19:00

BROMLEY CIVIC CENTRE, STOCKWELL CLOSE, BROMLEY BRI 3UH TELEPHONE: 020 8464 3333 CONTACT: Graham Walton [email protected] DIRECT LINE: 020 8461 7743 FAX: 020 8290 0608 DATE: 16 March 2018 To: Members of the EXECUTIVE Councillor Colin Smith (Chairman) Councillors Graham Arthur, Peter Fortune, William Huntington-Thresher, Kate Lymer, Peter Morgan and Diane Smith A meeting of the Executive will be held at Bromley Civic Centre on WEDNESDAY 28 MARCH 2018 AT 7.00 PM MARK BOWEN Director of Corporate Services Copies of the documents referred to below can be obtained from http://cds.bromley.gov.uk/ A G E N D A 1 APOLOGIES FOR ABSENCE 2 DECLARATIONS OF INTEREST 3 QUESTIONS FROM MEMBERS OF THE PUBLIC ATTENDING THE MEETING In accordance with the Council’s Constitution, questions to this Committee must be received in writing 4 working days before the date of the meeting. Therefore please ensure questions are received by the Democratic Services Team by 5pm on Thursday 22nd March 2018. 4 TO CONFIRM THE MINUTES OF THE MEETINGS HELD ON 7TH FEBRUARY 2018 AND 7TH MARCH 2018 (Pages 5 - 38) 5 PROGRESS IN IMPLEMENTING CHILDREN'S SERVICES IMPROVEMENTS - ORAL UPDATE 6 BUDGET MONITORING 2017/18 (Pages 39 - 94) 7 HOMELESSNESS STRATEGY (Pages 95 - 178) 8 BROMLEY DRAFT LOCAL PLAN EXAMINATION - APPROVAL FOR MAIN MODIFICATIONS CONSULTATION (Pages 179 - 206) 9 NATIONAL INCREASE IN PLANNING APPLICATION FEES (Pages 207 - 210) 10 WEST WICKHAM LEISURE CENTRE AND LIBRARY REDEVELOPMENT (Pages 211 - 238) West Wickham Ward 11 NORMAN PARK ATHLETICS TRACK - UPDATE -

Addiscombe – Croydon

1/2 Beckenham – Addiscombe – Croydon 1/2 Mondays to Fridays Beckenham Junction 0454 0554 -- -- 1930 0106 Beckenham Road 0457 0557 -- -- 1933 0109 Avenue Road 0458 0558 -- -- 1934 0110 Birkbeck 0459 0559 -- -- 1935 0111 Harrington Road 0502 Then 0602 -- Then -- 1938 Then 0114 Elmers End Station ↓ every12 ↓ 0609 every12 1933 ↓ every12 ↓ Arena 0505 minutes 0605 0611 minutes 1935 1941 minutes 0117 Woodside 0507 until 0607 0613 oneach 1937 1943 until 0119 Blackhorse Lane 0508 0608 0614 branch 1938 1944 0120 Addiscombe 0510 0610 0616 until 1940 1946 0122 Sandilands 0512 0612 0618 1942 1948 0124 Lebanon Road 0514 0614 0620 1944 1950 0126 East Croydon 0516 0616 0622 1946 1952 0128 1/2 Saturdays Beckenham Junction 0454 0654 -- -- 1806 1812 0112 Beckenham Road 0457 0657 -- -- 1809 1815 0115 Avenue Road 0458 0658 -- -- 1810 1816 0116 Birkbeck 0459 0659 -- -- 1811 1817 0117 Harrington Road 0502 Then 0702 -- Then -- 1814 1820 Then 0120 Elmers End Station ↓ every12 ↓ 0709 every12 1809 ↓ ↓ every12 ↓ Arena 0505 minutes 0705 0711 minutes 1811 1817 1823 minutes 0123 Woodside 0507 until 0707 0713 oneach 1813 1819 1825 until 0125 Blackhorse Lane 0508 0708 0714 branch 1814 1820 1826 0126 Addiscombe 0510 0710 0716 until 1816 1822 1828 0128 Sandilands 0512 0712 0718 1818 1824 1830 0130 Lebanon Road 0514 0714 0720 1820 1826 1832 0132 East Croydon 0516 0716 0722 1822 1828 1834 0134 1/2 Sundays Beckenham Junction 0658 0834 -- 1734 -- 1746 0058 Beckenham Road 0701 0837 -- 1737 -- 1749 0101 Avenue Road 0702 0838 -- 1738 -- 1750 0102 Birkbeck 0703 0839 -- 1739 -- -

Travel from the UK

Travel from the UK The University of Sussex campus is well served by public transport with Falmer train station on the south side of campus, and frequent buses on campus to and from Brighton. The adjoining A27 also gives good access by car. Train Falmer train station is directly opposite the University campus. Pedestrian access is through a subway under the A27 - follow signs for the University of Sussex (the University of Brighton has a campus at Falmer too). Falmer is on the line between Brighton and Lewes, about eight minutes' travel time in each direction. Four trains an hour go there during the day time. Visitors travelling via London and the west should take a train to Brighton and change there for Falmer. The journey time from London to Brighton is just under an hour. You can also change at Lewes for Falmer, if you are coming from the east. Falmer station National Rail Enquiries Coach National Express Coaches to Brighton depart from London Victoria Coach Station and arrive at Pool Valley in the centre of the city. Services are every hour during the day and take about two hours. Coaches also run to Brighton from Gatwick and Heathrow. From Pool Valley you need to walk 100 metres to the Old Steine where you can catch a bus direct to the University (see Local buses section below), or you can take a taxi. National Express Coaches Taxi Taxis are available at both Brighton and Lewes train stations and at many places in the centre of Brighton. It is about four miles (six kilometres) from central Brighton to the University. -

London Underground Limited

Background Paper 1 Developing the Network 1 Introduction 1.1 Bus use has increased by over two-thirds since 1999, driven by sustained increases in the size and quality of the network, fares policy and underlying changes in London’s economy. The bus network is constantly evolving as London develops and the needs and aspirations of passengers and other stakeholders change. Enhancements take place not only to the service pattern but across all aspects of the service. • Capacity. The level of bus-km run has increased by around 40 per cent over the same period. Network capacity has increased by a faster rate, by around 55 per cent, with increases in average vehicle size. Additionally, much improved reliability means that more of the scheduled capacity is delivered to passengers. • Reliability. Effective bus contract management, in particular the introduction of Quality Incentive Contracts, has driven a transformation of reliability. This has been supported by bus priority and by the effects of the central London congestion charging scheme. Service control has been made more efficient and effective by iBus, TfL’s automatic vehicle location system. 4.0 3.5 3.0 2.5 2.0 1.5 Excess Wait Time (mins) 1.0 0.5 0.0 1977 1979 1981 1983 1985/86 1987/88 1989/90 1991/92 1993/94 1995/96 1997/98 1999/00 2001/02 2003/04 2005/06 2007/08 2009/10 2011/12 2013/14 Figure 1: Excess Waiting Time on high-frequency routes – since 1977 • Customer service. All bus drivers must achieve BTEC-certification in customer service and other relevant areas. -

IASON Final Report March 2004

FINAL PUBLISHABLE REPORT CONTRACT N° : GRD1/2000/25351-SI2.316053 IASON PROJECT N° : SI2.316053 IASON DOCUMENTNUMBER: 04 3N 026 31671 ACRONYM : IASON TITLE : INTEGRATED ASSESSMENT OF SPATIAL ECONOMIC AND NETWORK EFFECTS OF TRANSPORT PROJECTS AND POLICIES PROJECT CO-ORDINATOR : • TNO PARTNERS : • NETR • UNIKARL • UNIV. LEEDS • CAU KIEL • IRPUD • RUG • NEA • ME & P • TRANSMAN • FUA • VTT REPORTING PERIOD : FROM APRIL 1, 2002 TO DECEMBER 31, 2003 PROJECT START DATE : APRIL 1, 2001 DURATION : 33 months Date of issue of this report : March, 2004 Project funded by the European Community under the ‘Competitive and Sustainable Growth’ Programme (1998- 2002) IASON Final Report March 2004 ASSESSING THE INDIRECT EFFECTS OF TRANSPORT PROJECTS AND POLICIES FINAL REPORT FOR PUBLICATION: CONCLUSIONS AND RECOMMENDATIONS FOR THE ASSESSMENT OF ECONOMIC IMPACTS OF TRANSPORT PROJECTS AND POLICIES IASON DELIVERABLE D10 The IASON Consortium March 2004 2 IASON Final Report March 2004 IASON GRD1/2000/25351 S12.316053 Integrated Appraisal of Spatial economic and Network effects of transport investments and policies FINAL PUBLISHABLE REPORT This document should be referenced as: Final Publishable Report: Conclusions and recommendations for the assessment of economic impacts of transport projects and policies, IASON (Integrated Appraisal of Spatial economic and Network effects of transport investments and policies) Deliverable D10. Funded by 5th Framework RTD Programme. TNO Inro, Delft, Netherlands, March 2004 Authors : Tavasszy, L.A., A. Burgess, G. Renes PROJECT INFORMATION Contract no: GRD1/2000/25351 S12.316053: Integrated Appraisal of Spatial economic and Network effects of transport investments and policies Website: www.inro.tno.nl/iason Commissioned by: European Commission – DG TREN; Fifth Framework Programme Lead Partner: TNO Inro, Delft (NL) Partners: TNO Inro (NL), CAU Kiel (De), FUA (Nl), IRPUD (D), ITS/UNIVLEEDS (UK), ME&P (UK), NEA (Nl), NETR (Fr), RUG (Nl), UNIKARL (De), TRANSMAN (Hu), VTT (Fi). -

Modelling the Socio-Economic and Spatial Impacts of EU Transport Policy

COMPETITIVE AND SUSTAINABLE GROWTH PROGRAMME Integrated Appraisal of Spatial economic and Network effects of transport investments and policies Deliverable 6: Modelling the Socio-economic and Spatial Impacts of EU Transport Policy Version 1 12th January 2004 Authors: Bröcker, J., Meyer, R., Schneekloth, N., Schürmann, C., Spiekermann, K., Wegener, M. Contract: GRD1/2000/25351 S12.316053 Project Coordinator: TNO Inro, Delft, Netherlands. Funded by the European Commission 5th Framework – Transport RTD IASON Partner Organisations TNO Inro (Nl), CAU Kiel (D), FUA (Nl), IRPUD (D), ITS/UNIVLEEDS (UK), ME&P (UK), NEA (Nl), NETR (Fr), RUG (Nl), UNIKARL (D), TRANSMAN (Hu), VTT (Fi). 3 IASON GRD1/2000/25351 S12.316053 Integrated Appraisal of Spatial economic and Network effects of transport investments and policies Deliverable 6: Modelling the Socio-economic and Spatial Impacts of EU Transport Policy This document should be referenced as: Bröcker, J., Meyer, R.., Schneekloth, N., Schürmann, C., Spiekermann, K., Wegener, M. (2004): Modelling the Socio-economic and Spatial Impacts of EU Transport Policy. IASON (Integrated Appraisal of Spatial economic and Network effects of transport investments and policies) Deliverable 6. Funded by 5th Framework RTD Programme. Kiel/Dortmund: Christian-Albrechts-Universität Kiel/Institut für Raumplanung, Universität Dortmund. 12 January 2004 Version No: 1.0 Authors: as above PROJECT INFORMATION Contract no: GRD1/2000/25351 SI2.316053: Integrated Appraisal of Spatial economic and Network effects of transport investments and policies Website: http://www.wt.tno.nl/iason/ Commissioned by: European Commission – DG TREN; Fifth Framework Programme Lead Partner: TNO Inro, Delft (Nl) Partners: TNO Inro (Nl), CAU Kiel (D), FUA (Nl), IRPUD (D), ITS/UNIVLEEDS (UK), ME&P (UK), NEA (Nl), NETR (Fr), RUG (Nl), UNIKARL (D), TRANSMAN (Hu), VTT (Fi). -

Groundwater Flooding in Brighton & Hove

Section 19 Flood Investigations Report Groundwater Flooding in Brighton and Hove City (February 2014) May 2014 Revision Schedule Rev Date Details Author Checked and Approved by 1 April 2014 M Moran N Fearnley 2 May 2014 Following comments from the EA and M Moran N Fearnley Southern Water (6/05/2014) 3 June 2014 Following comments from Southern Water M Moran N Fearnley Contents 1. Introduction............................................................................................................... 1 2. Groundwater Flood History...................................................................................... 5 3. Groundwater Flood Event - February 2014............................................................. 7 4. Recommendations.................................................................................................... 13 Figures Figure 1 Geological bedrock map. (Environment Agency) ....................................................... 3 Figure 2 Topography and Areas Affected in Brighton and Hove City – February 2014 ............ 4 Figure 3 Groundwater Levels – 2000/2001 ............................................................................... 5 Figure 4 Flood Event 2000/2001 ............................................................................................... 6 Figure 5 Ditchling Road - Rainfall (mm) .................................................................................... 7 Figure 6 High Park Farm - Rainfall (mm)..................................................................................