Metromedia Int'l

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WHCA): Videotapes of Public Affairs, News, and Other Television Broadcasts, 1973-77

Gerald R. Ford Presidential Library White House Communications Agency (WHCA): Videotapes of Public Affairs, News, and Other Television Broadcasts, 1973-77 WHCA selectively created, or acquired, videorecordings of news and public affairs broadcasts from the national networks CBS, NBC, and ABC; the public broadcast station WETA in Washington, DC; and various local station affiliates. Program examples include: news special reports, national presidential addresses and press conferences, local presidential events, guest interviews of administration officials, appearances of Ford family members, and the 1976 Republican Convention and Ford-Carter debates. In addition, WHCA created weekly compilation tapes of selected stories from network evening news programs. Click here for more details about the contents of the "Weekly News Summary" tapes All WHCA videorecordings are listed in the table below according to approximate original broadcast date. The last entries, however, are for compilation tapes of selected television appearances by Mrs. Ford, 1974-76. The tables are based on WHCA’s daily logs. “Tape Length” refers to the total recording time available, not actual broadcast duration. Copyright Notice: Although presidential addresses and very comparable public events are in the public domain, the broadcaster holds the rights to all of its own original content. This would include, for example, reporter commentaries and any supplemental information or images. Researchers may acquire copies of the videorecordings, but use of the copyrighted portions is restricted to private study and “fair use” in scholarship and research under copyright law (Title 17 U.S. Code). Use the search capabilities of your PDF reader to locate specific names or keywords in the table below. -

Annual Report 2011

possibilities ANNUAL REPORT 2011 CONTENTS About the company ............................................................................... 2 Key financial & operational highlights ............................................. 12 Key events of 2011 & early 2012 ...................................................... 14 Bright upside potential from the reorganization ............................. 18 Strong market position ................................................................... 20 Up in the “Clouds” ........................................................................... 22 Chairman’s statement ........................................................................ 24 Letter from the President ................................................................... 26 Strategy .............................................................................................. 28 M&A activity ........................................................................................ 31 Corporate governance ........................................................................ 34 Board of Directors & committees .................................................... 34 Management Board & committees ................................................. 37 Internal Audit Commission ............................................................. 40 Remuneration of members of the Board of Directors and the Management Board ............................................................. 40 Dividend policy ................................................................................ -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

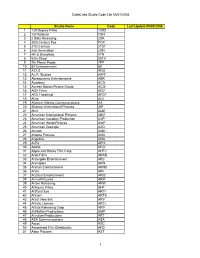

Cablelabs Studio Code List 05/01/2006

CableLabs Studio Code List 05/01/2006 Studio Name Code Last Update 05/05/2006 1 120 Degree Films 120D 2 1st National FSN 3 2 Silks Releasing 2SR 4 20th Century Fox FOX 5 21st Century 21ST 6 2nd Generation 2GN 7 4th & Broadway 4TH 8 50th Street 50TH 9 7th Planet Prods 7PP 10 8X Entertainment 8X 11 A.D.G. ADG 12 A.I.P. Studios AIPS 13 Abramorama Entertainment ABR 14 Academy ACD 15 Access Motion Picture Group ACM 16 ADV Films ADV 17 AFD Theatrical AFDT 18 Alive ALV 19 Alliance Atlantis Communications AA 20 Alliance International Pictures AIP 21 Almi ALM 22 American International Pictures AINT 23 American Vacation Production AVP 24 American World Pictures AWP 25 American Zoetrope AZO 26 Amoon AMO 27 Andora Pictures AND 28 Angelika ANG 29 A-Pix APIX 30 Apollo APO 31 Apple and Honey Film Corp. AHFC 32 Arab Films ARAB 33 Arcangelo Entertainment ARC 34 Arenaplex ARN 35 Arenas Entertainment ARNS 36 Aries ARI 37 Ariztical Entertainment ARIZ 38 Arrival Pictures ARR 39 Arrow Releasing ARW 40 Arthouse Films AHF 41 Artificial Eye ARTI 42 Artisan ARTS 43 Artist View Ent. ARV 44 Artistic License ARTL 45 Artists Releasing Corp ARP 46 ArtMattan Productions AMP 47 Artrution Productions ART 48 ASA Communications ASA 49 Ascot ASC 50 Associated Film Distribution AFD 51 Astor Pictures AST 1 CableLabs Studio Code List 05/01/2006 Studio Name Code Last Update 05/05/2006 52 Astral Films ASRL 53 At An Angle ANGL 54 Atlantic ATL 55 Atopia ATP 56 Attitude Films ATT 57 Avalanche Films AVF 58 Avatar Films AVA 59 Avco Embassy AEM 60 Avenue AVE 61 B&W Prods. -

Abstract a Case Study of Cross-Ownership Waivers

ABSTRACT A CASE STUDY OF CROSS-OWNERSHIP WAIVERS: FRAMING NEWSPAPER COVERAGE OF RUPERT MURDOCH’S REQUESTS TO KEEP THE NEW YORK POST by Rachel L. Seeman Media ownership is an important regulatory issue that is enforced by the Federal Communications Commission. The FCC, Congress, court and public interest groups share varying viewpoints concerning what the ownership limits should be and whether companies should be granted a waiver to be excused from the rules. News Corporation is one media firm that has a history of seeking these waivers, particularly for the New York Post and television stations in same community. This study conducted a qualitative framing analysis of news articles from the New York Times and the Wall Street Journal to determine if the viewpoints expressed by the editorial boards were reflected in reports on News Corp.’s attempt to receive cross-ownership waivers. The analysis uncovered ten frames the newspapers used to assist in reporting the events and found that 80% of these frames did parallel the positions the paper’s editorial boards took concerning ownership waivers. A CASE STUDY OF CROSS-OWNERSHIP WAIVERS: FRAMING NEWSPAPER COVERAGE OF RUPERT MURDOCH’S REQUESTS TO KEEP THE NEW YORK POST A Thesis Submitted to the Faculty of Miami University in partial fulfillment of the requirements for the degree of Master of Arts Department of Communications by Rachel Leianne Seeman Miami University Oxford, OH 2009 Advisor: __________________________________ (Dr. Bruce Drushel) Reader: __________________________________ (Dr. Howard -

Notification of Rostelecom Annual General

NOTIFICATION OF EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING NOTIFICATION OF ROSTELECOM EXTRAORDINARY GENERAL SHAREHOLDERS’ MEETING DEAR SHAREHOLDER! Notice is hereby given that Open Joint Stock Company Long-distance and International Telecommunications Rostelecom (hereinafter referred to as OJSC Rostelecom or the Company), located at 15 Dostoevskogo st., St. Petersburg, 191002, Russia, has decided to convene and conduct the Company’s Extraordinary General Shareholders’ Meeting in the form of absentee voting (hereinafter referred to as the Meeting or EGM), in compliance with Article 16 of the Company’s Charter, Article 65 of the Federal Law On Joint-Stock Companies No. 208-FZ dated December 26, 1995 and the decision of the Company’s Board of Directors dated May 15, 2013. The deadline for accepting voting ballots: June 26, 2013. Postal address for mailing voting ballots: OJSC “Obyedinennaya Registratsionnaya Kompaniya” (“United Registration Company”, the company running the register of the Company’s shareholders), 30 ulitsa Buzheninova, Moscow 107996, Russia. The list of persons who have the right to attend the Meeting is determined according to the register of the Company’s shareholders as of May 15, 2013. The Meeting Agenda: 1. Reorganization of the Company in the form of merger with and into the Company of Open Joint Stock Company Svyazinvest, Open Joint Stock Company NATIONAL TELECOMMUNICATIONS, Open Joint Stock Company National Cable Networks, Open Joint Stock Company St. Petersburg Cable Television Company, Closed Joint Stock Company -

Global Pay TV Fragments

Global pay TV fragments The top 503 pay TV operators will reach 853 million subscribers from the 1.02 billion global total by 2026. The top 50 operators accounted for 64% of the world’s pay TV subscribers by end-2020, with this proportion dropping to 62% by 2026. Pay TV subscribers by operator ranking (million) 1200 1000 143 165 38 45 800 74 80 102 102 600 224 215 400 200 423 412 0 2020 2026 Top 10 11-50 51-100 101-200 201+ Excluded from report The top 50 will lose 20 million subscribers over the next five years. However, operators beyond the top 100 will gain subscribers over the same period. Simon Murray, Principal Analyst at Digital TV Research, said: “Most industries consolidate as they mature. The pay TV sector is doing the opposite – fragmenting. Most of the subscriber growth will take place in developing countries where operators are not controlled by larger corporations.” By end-2020, 13 operators had more than 10 million pay TV subscribers. China and India will continue to dominate the top pay TV operator rankings, partly as their subscriber bases climb but also due to the US operators losing subscribers. Between 2020 and 2026, 307 of the 503 operators (61%) will gain subscribers, with 13 showing no change and 183 losing subscribers (36%). In 2020, 28 pay TV operators earned more than $1 billion in revenues, but this will drop to 24 operators by 2026. The Global Pay TV Operator Forecasts report covers 503 operators with 726 platforms [132 digital cable, 116 analog cable, 279 satellite, 142 IPTV and 57 DTT] across 135 countries. -

Investor Presentation

Investor Presentation May 2012 www.rt.ru Disclaimer By attending any meeting where this presentation is made, or by reading any part of this presentation, you acknowledge and agree to be bound by the following: This presentation has been prepared by OJSC Rostelecom (the “Company”). This presentation is strictly confidential to the recipient, may not be distributed to the press or any other person, and may not be reproduced in any form, in whole or in part. The Company has included its own estimates, assessments, adjustments and judgments in preparing certain market information herein, which have not been verified by an independent third party. Market information included herein is, therefore, unless otherwise attributed exclusively to a third party source, to a certain degree subjective. While the Company believes that its own estimates, assessments, adjustments and judgments are reasonable and that the market information prepared by the Company appropriately reflects the industry and the markets in which it operates, there is no assurance that the Company’s own estimates, assessments, adjustments and judgments are the most appropriate for making determinations relating to market information. Neither the Company nor any of its affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation. This presentation is confidential and does not constitute or form part of, and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of the Company or any of its subsidiaries in any jurisdiction or an inducement to enter into investment activity in any jurisdiction. -

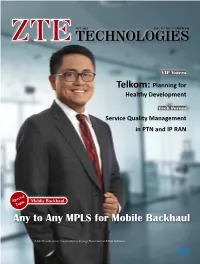

Any to Any MPLS for Mobile Backhaul

OCT 2015 VOL. 17 ● NO. 5 ● ISSUE 160 VIP Voices Telkom: Planning for Healthy Development Tech Forum Service Quality Management in PTN and IP RAN Special Moblie Backhaul Topic Any to Any MPLS for Mobile Backhaul Joddy Hernady, senior vice president of Synergy Department at Telkom Indonesia Enrique Blanco, Global CTO of Telefonica 05 CONTENTS ZTE TECHNOLOGIES OCT 2015 VIP Voices Telkom: Planning for Healthy Development 05 Reporters: Liu Yang and Zhang Ying Rostelecom Armenia Focuses on IPTV Services 10 Reporters: Liu Yang and Zhang Ying Joddy Hernady, senior vice president of Synergy Department at Telkom Indonesia DirecTV: Combining Pay-TV with Internet 13 Services to Win More Market Share Reporters: Liu Yang and Zhang Ying Telkom is the largest telecom services company in Indonesia. Joddy Hernady, senior vice president of Synergy Department at Telkom Indonesia, talked in the interview about Telkom’s investment strategy, development priorities, smart city deployment and Tech Forum main challenges in Indonesia. He also shared with us his expectations for the future cooperation between Telkom and ZTE and his views on global telecom trends. Service Quality Management in PTN and 16 IP RAN By Liu Aihua Special Topic: Mobile Backhaul Any to Any MPLS for Mobile Backhaul 19 By Cui Yanyun Introducing SDN into IP RAN 23 By Feng Zhijian Intelligent Backhaul Management 25 and Optimization By Zheng Pan Packet-Based Backhaul for Small Cell 10 27 By Zhang Yongjian, Zou Kaipu and Ma Xin 01 ZTE TECHNOLOGIES OCT 2015 19 ZTE TECHNOLOGIES Advisory Committee -

Metromedia International Group Inc

METROMEDIA INTERNATIONAL GROUP INC Filing Type: 10-Q Description: Quarterly Report Filing Date: Nov 13, 2000 Period End: Sep 30, 2000 Primary Exchange: American Stock Exchange Ticker: MMG Data provided by EDGAR Online, Inc. (http://www.edgar-online.com) METROMEDIA INTERNATIONAL GROUP INC ? 10-Q ? Quarterly Report Date Filed: 11/13/2000 Table of Contents To jump to a section, double-click on the section name. 10-Q OTHERDOC Part I ......................................................................................................................................................................................................................................................2 Item 1....................................................................................................................................................................................................................................................2 Income Statement ....................................................................................................................................................................................................................2 Balance Sheet...............................................................................................................................................................................................................................3 Cash Flow Statement............................................................................................................................................................................................................4 -

APPROVED by the Annual General Shareholders' Meeting of OJSC

APPROVED by the Annual General Shareholders’ Meeting of OJSC Rostelecom June 14, 2012 Minutes #1 dated June 18, 2012 ANNUAL REPORT FOR THE LONG-DISTANCE AND INTERNATIONAL TELECOMMUNICATIONS OPEN JOINT STOCK COMPANY ROSTELECOM BASED ON YEAR 2011 RESULTS President of OJSC Rostelecom s/s A. Yu. Provorotov Chief Accountant of OJSC Rostelecom s/s R.A. Frolov April 27, 2012 Moscow, 2012 ANNUAL REPORT CONTENTS OJSC ROSTELECOM AT A GLANCE ............................................................................................................. 4 THE CHAIRMAN’S STATEMENT ..................................................................................................................... 5 THE PRESIDENT’S MESSAGE ........................................................................................................................ 6 CALENDAR OF 2011 EVENTS ......................................................................................................................... 8 THE COMPANY’S POSITION IN THE INDUSTRY ......................................................................................... 10 THE COMPANY AND THE BOARD OF DIRECTORS’ REVIEW OF THE YEAR 2011 ................................ 15 GUARANTEE OF HIGH QUALITY COMMUNICATION SERVICES ........................................................... 16 DEVELOPING RETAIL RELATIONSHIPS .................................................................................................. 17 RUSSIAN OPERATORS MARKET ............................................................................................................. -

Federal Communications Commission Record FCC 94-54

9 FCC Red No. 7 Federal Communications Commission Record FCC 94-54 action, as well as further comments, and Viacom responded Before the only to the QVC comments. Shortly after more than 50.1 Federal Communications Commission percent of Paramount shareholders tendered their stock to Washington, D.C. 20554 Viacom on February 14, 1993, QVC terminated its tender offer, requested that the Commission dismiss its pending long-form applications, and indicated that it would not In re Applications of pursue its opposition to Viacom©s application.3 VIACOM INC. File Nos. BTCCT-930921KG BACKGROUND through KM 2. Revised several times since the Commission granted an STA to trustee Robinson, Viacom©s tender offer for For Commission Consent to purchase of 50.1 percent of Paramount common stock at the Transfer of Control of $107 per share constitutes the first step in a two-tiered Paramount Communications Inc. process for acquiring the entire common stock interest in Paramount. The "second step merger" involves the conver sion of the remaining 49.9 percent of Paramount common MEMORANDUM OPINION AND ORDER stock issued and outstanding into the right to receive a package of Viacom securities.4 Upon completion of the Adopted: March 8, 1994; Released: March 8, 1994 merger, National Amusements, Inc. (NAI), which currently is the single majority shareholder of Viacom, will hold 62 By the Commission: percent of the merged entity©s voting stock.5 NAI, in turn, is, and will continue to be, controlled by Sumner M. 1. On November 23, 1993, the Commission granted a Redstone, in his capacity as trustee of the Sumner M.