113618879 201706 990.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daat Torah (PDF)

Daat Torah Rabbi Alfred Cohen Daat Torah is a concept of supreme importance whose specific parameters remain elusive. Loosely explained, it refers to an ideology which teaches that the advice given by great Torah scholars must be followed by Jews committed to Torah observance, inasmuch as these opinions are imbued with Torah insights.1 Although the term Daat Torah is frequently invoked to buttress a given opinion or position, it is difficult to find agreement on what is actually included in the phrase. And although quite a few articles have been written about it, both pro and con, many appear to be remarkably lacking in objectivity and lax in their approach to the truth. Often they are based on secondary source and feature inflamma- tory language or an unflatttering tone; they are polemics rather than scholarship, with faulty conclusions arising from failure to check into what really was said or written by the great sages of earlier generations.2 1. Among those who have tackled the topic, see Lawrence Kaplan ("Daas Torah: A Modern Conception of Rabbinic Authority", pp. 1-60), in Rabbinic Authority and Personal Autonomy, published by Jason Aronson, Inc., as part of the Orthodox Forum series which also cites numerous other sources in its footnotes; Rabbi Berel Wein, writing in the Jewish Observer, October 1994; Rabbi Avi Shafran, writing in the Jewish Observer, Dec. 1986, p.12; Jewish Observer, December 1977; Techumin VIII and XI. 2. As an example of the opinion that there either is no such thing now as Daat Torah which Jews committed to Torah are obliged to heed or, even if there is, that it has a very limited authority, see the long essay by Lawrence Kaplan in Rabbinic Authority and Personal Autonomy, cited in the previous footnote. -

A Tribu1e 10 Eslller, Mv Panner in Torah

gudath Israel of America's voice in kind of informed discussion and debate the halls of courts and the corri that leads to concrete action. dors of Congress - indeed every A But the convention is also a major where it exercises its shtadlonus on yardstick by which Agudath Israel's behalf of the Kial - is heard more loudly strength as a movement is measured. and clearly when there is widespread recognition of the vast numbers of peo So make this the year you ple who support the organization and attend an Agm:fah conventicm. share its ideals. Resente today An Agudah convention provides a forum Because your presence sends a for benefiting from the insights and powerfo! - and ultimately for choice aa:ommodotions hadracha of our leaders and fosters the empowering - message. call 111-m-nao is pleased to announce the release of the newest volume of the TlHllE RJENNlERT JED>JITJION ~7~r> lEN<ClY<ClUO>lPElOl l[}\ ~ ·.:~.~HDS. 1CA\J~YA<Gr M(][1CZ\V<Q . .:. : ;······~.·····················.-~:·:····.)·\.~~····· ~s of thousands we~ed.(>lig~!~d~ith the best-selling mi:i:m niw:.r c .THE :r~~··q<:>Jy(MANDMENTS, the inaugural volume of theEntzfl(lj)('dia (Mitzvoth 25-38). Now join us aswestartfromthebeginning. The En~yclop~dia provides yau with • , • A panciramicviewofthe entire Torah .Laws, cust9ms and details about each Mitzvah The pririlafy reasons and insights for each Mitzvah. tteas.. ury.· of Mid. ra. shim and stories from Cha. zal... and m.uc.h.. n\ ''"'''''' The Encyclopedia of the Taryag Mitzvoth The Taryag Legacy Foundation is a family treasure that is guaranteed to wishes to thank enrich, inspire, and elevate every Jewish home. -

Research Guide to Holocaust-Related Holdings at Library and Archives Canada

Research guide to Holocaust-related holdings at Library and Archives Canada August 2013 Library and Archives Canada Table of Contents INTRODUCTION...................................................................................................... 4 LAC’S MANDATE ..................................................................................................... 5 CONDUCTING RESEARCH AT LAC ............................................................................ 5 HOW TO USE THIS GUIDE ........................................................................................................................................ 5 HOW TO USE LAC’S ONLINE SEARCH TOOLS ......................................................................................................... 5 LANGUAGE OF MATERIAL.......................................................................................................................................... 6 ACCESS CONDITIONS ............................................................................................................................................... 6 Government of Canada records ................................................................................................................ 7 Private records ................................................................................................................................................ 7 NAZI PERSECUTION OF THE JEWISH BEFORE THE SECOND WORLD WAR............... 7 GOVERNMENT AND PRIME MINISTERIAL RECORDS................................................................................................ -

Knowing When a Higher Education Institution Is in Trouble Pamela S

Marshall University Marshall Digital Scholar Theses, Dissertations and Capstones 1-1-2005 Knowing When a Higher Education Institution is in Trouble Pamela S. Sturm [email protected] Follow this and additional works at: http://mds.marshall.edu/etd Part of the Higher Education Administration Commons Recommended Citation Sturm, Pamela S., "Knowing When a Higher Education Institution is in Trouble" (2005). Theses, Dissertations and Capstones. Paper 367. This Dissertation is brought to you for free and open access by Marshall Digital Scholar. It has been accepted for inclusion in Theses, Dissertations and Capstones by an authorized administrator of Marshall Digital Scholar. For more information, please contact [email protected]. KNOWING WHEN A HIGHER EDUCATION INSTITUTION IS IN TROUBLE by Pamela S. Sturm Dissertation submitted to The Graduate College of Marshall University in partial fulfillment of the requirements for the degree of Doctor of Education in Educational Leadership Approved by Powell E. Toth, Ph. D., Chair R. Charles Byers, Ph. D. John L. Drost, Ph. D. Jerry D. Jones, Ed. D. Department of Leadership Studies 2005 Keywords: Institutional Closure, Logistic Regression, Institutional Viability Copyright 2005 Pamela S. Sturm All Rights Reserved ABSTRACT KNOWING WHEN A HIGHER EDUCATION INSTITUTION IS IN TROUBLE by Pamela S. Sturm This study investigates factors that measure the institutional viability of higher education organizations. The purpose of investigating these measures is to provide higher education officials with a means to predict the likelihood of the closure of a higher education institution. In this way, these viability measures can be used by administrators as a warning system for corrective action to ensure the continued viability of their institutions. -

Yeshiva University • Yom Ha'atzmaut To-Go • Iyar 5770

1 YESHIVA UNIVERSITY • YOM HA’ATZMAUT TO-GO • IYAR 5770 Iyar 5770 Dear Friends, may serve to enhance your ספר It is my sincere hope that the Torah found in this virtual .(study) לימוד holiday) and your) יום טוב We have designed this project not only for the individual, studying alone, but perhaps even a pair studying together) that wish to work through the study matter) חברותא more for a together, or a group engaged in facilitated study. להגדיל תורה ,With this material, we invite you to join our Beit Midrash, wherever you may be to enjoy the splendor of Torah) and to engage in discussing issues that touch on a) ולהאדירה most contemporary matter, and are rooted in the timeless arguments of our great sages from throughout the generations. Bivracha, Rabbi Kenneth Brander Dean, Yeshiva University Center for the Jewish Future RICHARD M JOEL, President, Yeshiva University RABBI KENNETH BRANDER, David Mitzner Dean, Center for the Jewish Future RABBI ROBERT SHUR, General Editor RABBI MICHAEL DUBITSKY, Editor Copyright © 2010 All rights reserved by Yeshiva University Yeshiva University Center for the Jewish Future 500 West 185th Street, Suite 413, New York, NY 10033 [email protected] • 212.960.5400 x 5313 2 YESHIVA UNIVERSITY • YOM HA’ATZMAUT TO-GO • IYAR 5770 Table of Contents Yom Haatzmaut 2010/5770 Our Dependence Upon Israel's Independence Rabbi Norman Lamm. Page 4 The Religious Significance of Israel Rabbi Yosef Blau . Page 9 Maintaining a Connection to the Land of Israel from the Diaspora Rabbi Joshua Flug . Page 12 Establishing Yom Haatzmaut as a Yom Tov Rabbi Eli Ozarowski . -

L1teracy As the Creation of Personal Meaning in the Lives of a Select Group of Hassidic Women in Quebec

WOMEN OF VALOUR: L1TERACY AS THE CREATION OF PERSONAL MEANING IN THE LIVES OF A SELECT GROUP OF HASSIDIC WOMEN IN QUEBEC by Sharyn Weinstein Sepinwall The Department of Integrated Studies in Education A Thesis submitted to the Faculty of Graduate Studies and Research , in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Education Faculty of Education McGiII University National Library Bibliothèque nationale 1+1 of Canada du Canada Acquisitions and Acquisitions et Bibliographie Services services bibliographiques 395 Wellington Street 395. rue Wellington Ottawa ON K1A ON4 Ottawa ON K1A ON4 canada Canada Our fie Notre réIérfInœ The author bas granted a non L'auteur a accordé une licence non exclusive licence allowing the exclusive permettant à la National Library ofCanada to Bibliothèque nationale du Canada de reproduce, loan, distribute or sell reproduire, prêter, distribuer ou copies ofthis thesis in microform, vendre des copies de cette thèse sous paper or electronic formats. la forme de microfiche/film, de reproduction sur papier ou sur fonnat électronique. The author retains ownership ofthe L'auteur conserve la propriété du copyright in this thesis. Neither the droit d'auteur qui protège cette thèse. thesis nor substantial extracts from it Ni la thèse ni des extraits substantiels may be printed or otherwise de celle-ci ne doivent être imprimés reproduced without the author's ou autrement reproduits sans son pemnsslOn. autorisation. 0-612-78770-2 Canada Women of Valour: Literacy as the Creation of Personal Meaning in the Lives of a Select Group of Hassidic Women in Quebec Sharyn Weinstein Sepinwall 11 Acknowledgments One of my colleagues at McGiII in the Faculty of Management was fond of saying "writing a dissertation should change your life." Her own dissertation had been reviewed in the Wall Street Journal and its subsequent acclaim had indeed, 1surmised, changed her life. -

Israel As a Jewish State

ISRAEL AS A JEWISH STATE Daniel J.Elazar Beyond Israel's self-definition as a Jewish state, the question remains as to what extent Israel is a continuation of Jewish political history within the context of the Jewish political tradition. This article addresses that question, first by looking at the realities of Israel as a Jewish state and at the same time one compounded of Jews of varying ideologies and per suasions, plus non-Jews; the tensions between the desire on the part of many Israeli Jews for Israel to be a state like any other and the desire on the part of others for it to manifest its Jewishness in concrete ways that will make it unique. The article explores the ways in which the tradi tional domains of authority into which power is divided in the Jewish po litical tradition are manifested in the structure of Israel's political sys tem, both structurally and politically; relations between the Jewish reli gion, state and society; the Jewish dimension of Israel's political culture and policy-making, and how both are manifested through Israel's emerging constitution and the character of its democracy. Built into the founding of every polity are certain unresolved ten sions that are balanced one against another as part of that founding to make the existence of the polity possible, but which must be resolved anew in every generation. Among the central tensions built into the founding of the State of Israel are those that revolve around Israel as a Jewish state. on Formally, Israel is built themodern European model of central ized, reified statehood. -

A | the Concise Dictionary of American Jewish Biography

To US'1857. • Businessman, merchant, Abarbanel, Albert (Albert Brandt); b. communal worker, Pittsburgh; pres Homer Hamburg,Jan 81896. LaughlinChina Co; a fdr Heb Benevolent Soc; To US 1933.· LLB, LLD, PhD UWiirzburg, an orgr Heb Inst.· See:A]YB, 22:164; PA]HS, post-graduate Berlin, Munich. • Philosopher, 28:257-58. Newark; pacificist & liberalldr, Germany; A faculty U Newark; author in field; WWI Aaron, Marcus; b. Pittsburgh, Dec 141869; German service, wounded eight times, awarded d. Pittsburgh,June 211954. five medals including Iron Cross. • See: Aaron, A, Howard; b. Buffalo, Feb 28 1892. Western U ofPA; honorary degree. • Mfr, WWIA], 1938. LLB U Buffalo. • Lawyer, Buffalo; active Legal civic & communalldr, Pittsburgh; mem State Aid Com, Jewisli Fedn for Social Service; Bd ofEducation; pres Bd ofEducation; bd Heb Abarbanel, Henry; b.*; d. NYC, 1896. author in field. • See: WWIA], 1926, 1928, Union ColI, Union ofAm Heb Congregations; Author, tchr, NYC; author work for Reform 1938. Homer Laughlin China Co. • See: UJE; , schools. • See: UJE. WWIA], 1926,1928, 1938;WWWIA, 3. Aaron, Abraham Higham; b. Buffalo, May Abarbanell, Jacob Ralph (pseud=Ralph 23 1889. Aaron, Max N; b. ca 1868; d. Philadelphia, Royal); b. NYC, Dec 6 1852; d. MD U Buffalo. • Physician, Buffalo; faculty U Nov 141935. 'Whitestone, LI, Nov 9 1922. Buffalo; pres City & CountyTuberculosis and Mfr, communal worker, Philadelphia. • See: AB, BS CCNY,LLB Columbia. • Lawyer, Health Assn. • See: WWWIA, 8. A]YB, 38:424. novelist, editor, translator, NYC; editor New York Family Story Paper. • See: UJE; A]YB, Aaron, Charles; b. NYC, Dec 28 '1890. Aarons, AA (AlexA); b. -

9 Sivan 1807.Dwd

SIVAN Life's splendor forever lies in wait 1 Sivan about each one of us in all its fullness, but veiled from view, deep down, Day Forty-five, making six weeks and three days, of the invisible, far off. It is there, though, Omer not hostile, not reluctant, not deaf. If Rosh Hodesh Sivan Hillula of Bohemian-born Austrian writer Franz Kafka, you summon it by the right word, by its pictured at right. Kafka was an admirer of right name, it will come. –Franz Kafka anarcho-communist theoretician Pyotr Kropotkin. As an elementary and secondary school student, Kafka wore a red carnation in his lapel to show his support for socialism. (1 Sivan 5684, 3 June 1924) Hillula of Polish-born U.S. labor lawyer Jack Zucker. When Senator Joseph McCarthy impugned Zucker’s patriotism, Zucker retorted, “I have more patriotism in my little finger than you have in your entire body!” (1 Sivan 5761, 23 May 2001) Hillula of Samaritan High Priest Levi ben Abisha ben Pinhas ben Yitzhaq, the first Samaritan High Priest to visit the United States (1 Sivan 5761, 23 May 2001) Hillula of U.S. labor leader Gus Tyler, pictured at right. Born Augustus Tilove, he adopted the sur- name Tyler as a way of honoring Wat Tyler, the leader of a 14th-century English peasant rebellion. (1 Sivan 5771, 3 June 2011) Hillula of Annette Dreyfus Benacerraf, niece of 1965 Nobel laureate in Physiology or Medicine Jacques Monod and wife of 1980 Nobel laureate in Physiology or Medicine Baruj Benacerraf (1 Sivan 5771, 3 June 2011) 2 Sivan Day Forty-six, making six weeks and four days, of the Omer Hillula of Rebbe Israel Hager of Vizhnitz, pictured at near right. -

Hasidic Judaism - Wikipedia, the Freevisited Encyclopedi Ona 1/6/2015 Page 1 of 19

Hasidic Judaism - Wikipedia, the freevisited encyclopedi ona 1/6/2015 Page 1 of 19 Hasidic Judaism From Wikipedia, the free encyclopedia Sephardic pronunciation: [ħasiˈdut]; Ashkenazic , תודיסח :Hasidic Judaism (from the Hebrew pronunciation: [χaˈsidus]), meaning "piety" (or "loving-kindness"), is a branch of Orthodox Judaism that promotes spirituality through the popularization and internalization of Jewish mysticism as the fundamental aspect of the faith. It was founded in 18th-century Eastern Europe by Rabbi Israel Baal Shem Tov as a reaction against overly legalistic Judaism. His example began the characteristic veneration of leadership in Hasidism as embodiments and intercessors of Divinity for the followers. [1] Contrary to this, Hasidic teachings cherished the sincerity and concealed holiness of the unlettered common folk, and their equality with the scholarly elite. The emphasis on the Immanent Divine presence in everything gave new value to prayer and deeds of kindness, alongside rabbinical supremacy of study, and replaced historical mystical (kabbalistic) and ethical (musar) asceticism and admonishment with Simcha, encouragement, and daily fervor.[2] Hasidism comprises part of contemporary Haredi Judaism, alongside the previous Talmudic Lithuanian-Yeshiva approach and the Sephardi and Mizrahi traditions. Its charismatic mysticism has inspired non-Orthodox Neo-Hasidic thinkers and influenced wider modern Jewish denominations, while its scholarly thought has interested contemporary academic study. Each Hasidic Jews praying in the Hasidic dynasty follows its own principles; thus, Hasidic Judaism is not one movement but a synagogue on Yom Kippur, by collection of separate groups with some commonality. There are approximately 30 larger Hasidic Maurycy Gottlieb groups, and several hundred smaller groups. Though there is no one version of Hasidism, individual Hasidic groups often share with each other underlying philosophy, worship practices, dress (borrowed from local cultures), and songs (borrowed from local cultures). -

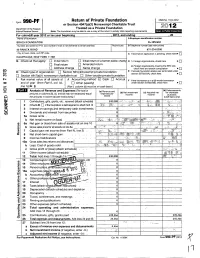

Return of Private Foundation

• t Return of Private Foundation OMB No 1545-0052 Form 990-PF ' or Section 4947(a)(1) Nonexempt Charitable Trust 201 2 Department of the Treasury Treated as a Private Foundation Internal Revenue Service Note . The foundation may be able to use a copy of this return to satisfy state reporting requirements • For calendaf! ,year 2012 or tax year beginning , 2012, and ending , 20 Name of foundation A Employer identification number BRACH FOUNDATION 26-3850684 Number and street (or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number (see instructions) 40 RANICK ROAD 631-234-5300 City or town, state, and ZIP code q C If exemption application is pending, check here ► HAUPPAUGE, NEW YORK 11788 q q q G Check all that apply: Initial return Initial return of a former public charity D 1. Foreign organizations, check here ► q Final return q Amended return 2. Foreign organizations meeting the 85 % test, q E] Address change [] Name change check here and attach computation ► organization: q Section exempt private foundation E If private foundation status was terminated under H Check type of 501 (c)(3) q section 507(b)(1)(A) , check here ► F1 Section 4947 (a) (1 ) nonexem pt charitable trust q Other taxable private foundation ti Accounting method- i Cash q Accrual Fair market value of all assets at J F If the foundation is in a 60-month termination q end of year (from Part 11, col. (c), q Other (specify) under section 507(b)(1)(B), check here ► line 16) ► $ (Part 1, column (d) must be on cash basis) CD (d) Disbursements -

Fine Judaica

t K ESTENBAUM FINE JUDAICA . & C PRINTED BOOKS, MANUSCRIPTS, GRAPHIC & CEREMONIAL ART OMPANY F INE J UDAICA : P RINTED B OOKS , M ANUSCRIPTS , G RAPHIC & C & EREMONIAL A RT • T HURSDAY , N OVEMBER 12 TH , 2020 K ESTENBAUM & C OMPANY THURSDAY, NOV EMBER 12TH 2020 K ESTENBAUM & C OMPANY . Auctioneers of Rare Books, Manuscripts and Fine Art Lot 115 Catalogue of FINE JUDAICA . Printed Books, Manuscripts, Graphic & Ceremonial Art Featuring Distinguished Chassidic & Rabbinic Autograph Letters ❧ Significant Americana from the Collection of a Gentleman, including Colonial-era Manuscripts ❧ To be Offered for Sale by Auction, Thursday, 12th November, 2020 at 1:00 pm precisely This auction will be conducted only via online bidding through Bidspirit or Live Auctioneers, and by pre-arranged telephone or absentee bids. See our website to register (mandatory). Exhibition is by Appointment ONLY. This Sale may be referred to as: “Shinov” Sale Number Ninety-One . KESTENBAUM & COMPANY The Brooklyn Navy Yard Building 77, Suite 1108 141 Flushing Avenue Brooklyn, NY 11205 Tel: 212 366-1197 • Fax: 212 366-1368 www.Kestenbaum.net K ESTENBAUM & C OMPANY . Chairman: Daniel E. Kestenbaum Operations Manager: Zushye L.J. Kestenbaum Client Relations: Sandra E. Rapoport, Esq. Judaica & Hebraica: Rabbi Eliezer Katzman Shimon Steinmetz (consultant) Fine Musical Instruments (Specialist): David Bonsey Israel Office: Massye H. Kestenbaum ❧ Order of Sale Manuscripts: Lot 1-17 Autograph Letters: Lot 18 - 112 American-Judaica: Lot 113 - 143 Printed Books: Lot 144 - 194 Graphic Art: Lot 195-210 Ceremonial Objects: Lot 211 - End of Sale Front Cover Illustration: See Lot 96 Back Cover Illustration: See Lot 4 List of prices realized will be posted on our website following the sale www.kestenbaum.net — M ANUSCRIPTS — 1 (BIBLE).