Retlof Organization Exempt Froiicome

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Faith Voices Letter

In Support Of Keeping Houses Of Worship Nonpartisan August 16, 2017 Dear Senator: As a leader in my religious community, I am strongly opposed to any effort to repeal or weaken current law that protects houses of worship from becoming centers of partisan politics. Changing the law would threaten the integrity and independence of houses of worship. We must not allow our sacred spaces to be transformed into spaces used to endorse or oppose political candidates. Faith leaders are called to speak truth to power, and we cannot do so if we are merely cogs in partisan political machines. The prophetic role of faith communities necessitates that we retain our independent voice. Current law respects this independence and strikes the right balance: houses of worship that enjoy favored tax-exempt status may engage in advocacy to address moral and political issues, but they cannot tell people who to vote for or against. Nothing in current law, however, prohibits me from endorsing or opposing political candidates in my own personal capacity. Changing the law to repeal or weaken the “Johnson Amendment” – the section of the tax code that prevents tax-exempt nonprofit organizations from endorsing or opposing candidates – would harm houses of worship, which are not identified or divided by partisan lines. Particularly in today’s political climate, engaging in partisan politics and issuing endorsements would be highly divisive and have a detrimental impact on congregational unity and civil discourse. I therefore urge you to oppose any repeal or weakening of the Johnson Amendment, thereby protecting the independence and integrity of houses of worship and other religious organizations in the charitable sector. -

Temple Times

The Monthly Magazine of Temple Emanu-El of Tucson | 225 North Country Club Road, Tucson, AZ 85716 TEMPLE(520) 327-4501 TIMES www.tetucson.org Jane 2019 - Iyyar/Sivan 5779 Vol. LXVII No. 10 So Much to Celebrate in June YSaturday, June 8th, 8:00 pm - Tikkun L’eil Shavu’ot Festival Service, Torah Study and Ice Cream Social YThursday, June 13th, 7:00 pm - Celebrating 20 Years of Song: A Concert in Honor of Cantorial Soloist Marjorie Hochberg YFriday, June 14th - Seeking Shabbat Services in honor of Cantorial Soloist Marjorie Hochberg 5:00 pm - Noshes 5:30 pm - Seeking Shabbat Services 6:30 pm - Shabbat dinner YSaturday, June 15th, 10 am - B’not Mitzvah of Shishiniyot Ron Benacot and Rotem Rapaport Mazal Tov to our Confirmands: Ben Sargus, Malachi Fisher, Darian German, and Kyra Glassey (photo by Steve Shawl) FROM RABBI MUSICAL NOTES APPEL’S DESK It’s All About Me. Shavu’ot Music@Emanu-El Presents: 20 Years of Song th We reach the end of our counting Thursday, June 13 at 7:00 pm. of days and weeks this month with (520) 327-4501 the Festival of Shavu’ot. Beginning One of my colleagues at the Temple once the second night of Passover, we described my tenure here as a life sentence. have been counting up the days un- It might turn out that way: I recently calculated that I’ve til we reach the day that commemorates the giving been involved with Temple life for 38 years (!), but I’ve only of Torah at Mount Sinai. -

Noahidism Or B'nai Noah—Sons of Noah—Refers To, Arguably, a Family

Noahidism or B’nai Noah—sons of Noah—refers to, arguably, a family of watered–down versions of Orthodox Judaism. A majority of Orthodox Jews, and most members of the broad spectrum of Jewish movements overall, do not proselytize or, borrowing Christian terminology, “evangelize” or “witness.” In the U.S., an even larger number of Jews, as with this writer’s own family of orientation or origin, never affiliated with any Jewish movement. Noahidism may have given some groups of Orthodox Jews a method, arguably an excuse, to bypass the custom of nonconversion. Those Orthodox Jews are, in any event, simply breaking with convention, not with a scriptural ordinance. Although Noahidism is based ,MP3], Tạləmūḏ]תַּלְמּוד ,upon the Talmud (Hebrew “instruction”), not the Bible, the text itself does not explicitly call for a Noahidism per se. Numerous commandments supposedly mandated for the sons of Noah or heathen are considered within the context of a rabbinical conversation. Two only partially overlapping enumerations of seven “precepts” are provided. Furthermore, additional precepts, not incorporated into either list, are mentioned. The frequently referenced “seven laws of the sons of Noah” are, therefore, misleading and, indeed, arithmetically incorrect. By my count, precisely a dozen are specified. Although I, honestly, fail to understand why individuals would self–identify with a faith which labels them as “heathen,” that is their business, not mine. The translations will follow a series of quotations pertinent to this monotheistic and ,MP3], tạləmūḏiy]תַּלְמּודִ י ,talmudic (Hebrew “instructive”) new religious movement (NRM). Indeed, the first passage quoted below was excerpted from the translated source text for Noahidism: Our Rabbis taught: [Any man that curseth his God, shall bear his sin. -

Return of Private Foundation

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491015004014 Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947( a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department of the Treasury 2012 Note . The foundation may be able to use a copy of this return to satisfy state reporting requirements Internal Revenue Service • . For calendar year 2012 , or tax year beginning 06 - 01-2012 , and ending 05-31-2013 Name of foundation A Employer identification number CENTURY 21 ASSOCIATES FOUNDATION INC 22-2412138 O/o RAYMOND GINDI ieiepnone number (see instructions) Number and street (or P 0 box number if mail is not delivered to street address) Room/suite U 22 CORTLANDT STREET Suite City or town, state, and ZIP code C If exemption application is pending, check here F NEW YORK, NY 10007 G Check all that apply r'Initial return r'Initial return of a former public charity D 1. Foreign organizations, check here (- r-Final return r'Amended return 2. Foreign organizations meeting the 85% test, r Address change r'Name change check here and attach computation H Check type of organization FSection 501(c)(3) exempt private foundation r'Section 4947(a)(1) nonexempt charitable trust r'Other taxable private foundation J Accounting method F Cash F Accrual E If private foundation status was terminated I Fair market value of all assets at end und er section 507 ( b )( 1 )( A ), c hec k here F of y e a r (from Part 77, col. (c), Other (specify) _ F If the foundation is in a 60-month termination line 16)x$ 4,783,143 -

Wertheimer, Editor Imagining the Seth Farber an American Orthodox American Jewish Community Dreamer: Rabbi Joseph B

Imagining the American Jewish Community Brandeis Series in American Jewish History, Culture, and Life Jonathan D. Sarna, Editor Sylvia Barack Fishman, Associate Editor For a complete list of books in the series, visit www.upne.com and www.upne.com/series/BSAJ.html Jack Wertheimer, editor Imagining the Seth Farber An American Orthodox American Jewish Community Dreamer: Rabbi Joseph B. Murray Zimiles Gilded Lions and Soloveitchik and Boston’s Jeweled Horses: The Synagogue to Maimonides School the Carousel Ava F. Kahn and Marc Dollinger, Marianne R. Sanua Be of Good editors California Jews Courage: The American Jewish Amy L. Sales and Leonard Saxe “How Committee, 1945–2006 Goodly Are Thy Tents”: Summer Hollace Ava Weiner and Kenneth D. Camps as Jewish Socializing Roseman, editors Lone Stars of Experiences David: The Jews of Texas Ori Z. Soltes Fixing the World: Jewish Jack Wertheimer, editor Family American Painters in the Twentieth Matters: Jewish Education in an Century Age of Choice Gary P. Zola, editor The Dynamics of American Jewish History: Jacob Edward S. Shapiro Crown Heights: Rader Marcus’s Essays on American Blacks, Jews, and the 1991 Brooklyn Jewry Riot David Zurawik The Jews of Prime Time Kirsten Fermaglich American Dreams and Nazi Nightmares: Ranen Omer-Sherman, 2002 Diaspora Early Holocaust Consciousness and and Zionism in Jewish American Liberal America, 1957–1965 Literature: Lazarus, Syrkin, Reznikoff, and Roth Andrea Greenbaum, editor Jews of Ilana Abramovitch and Seán Galvin, South Florida editors, 2001 Jews of Brooklyn Sylvia Barack Fishman Double or Pamela S. Nadell and Jonathan D. Sarna, Nothing? Jewish Families and Mixed editors Women and American Marriage Judaism: Historical Perspectives George M. -

· ,,.Apzro an E I, Z Y Rr In

mrntator Official .Undergr ate Newspaper of Yeshiva College VOL. LXXIII NEW YORK CITY, Thursday, March 25, 1971 No. 4 �232 Teachers Air Issu · Butler Elected President At Council· Meeting ·s··, • ,rr· · ,,.apzroL an d Be 1· i,·t z k y rr in By LEONARD·DAVIS In -a ratherd hard fought elec tion Davi . o (Dov) Butler defeated · , Arn ld Waldman. for · the presi� . dency of Yeshiva College Student-d Council. Mr. Butler receive 490 (64%) to d . votes Mr. Wal man's 273. o In other elections Elli t Jay d Shapiro defeate David442 Merzel for the vice-presidency votes o (63%) to 259.' Mr. Shapir has beend very active in YCSC spon� sore Jewish affairs. Despite a strong write-in campaign for. Yussie Ostreicher, Joe Beiitzky o easily won the office fo secre Beej tary-treasurer with 538 v tes. Professor Le\'y 11oing a. 1mrfect job mldresslng . of the student oowt- o Mr Butler, running on his rec eil '!leeting. rd as YC senator and THE Beej . r d COMMEl\"TATOR News Edito:, President-elect Dov Butler By ROBERT BENEDEK Levy emarke that, "the o o faculty pledged to w rk for the imple- and administration o o The alleviation of problems in- o d not argue mentati f� than to work for the students." THE COMMENTATOR were not o o n ofr re rms based n r ·v lved with faulty, inc herent or from fixed positi ns" as was sug- . C election day platforms and sufficiently "c usading" - were o o the Teache ourse Evaluation By r d o .n n - existent dial gue between gested by THE. -

A Hebrew Maiden, Yet Acting Alien

Parush’s Reading Jewish Women page i Reading Jewish Women Parush’s Reading Jewish Women page ii blank Parush’s Reading Jewish Women page iii Marginality and Modernization in Nineteenth-Century Eastern European Reading Jewish Society Jewish Women IRIS PARUSH Translated by Saadya Sternberg Brandeis University Press Waltham, Massachusetts Published by University Press of New England Hanover and London Parush’s Reading Jewish Women page iv Brandeis University Press Published by University Press of New England, One Court Street, Lebanon, NH 03766 www.upne.com © 2004 by Brandeis University Press Printed in the United States of America 54321 All rights reserved. No part of this book may be reproduced in any form or by any electronic or me- chanical means, including storage and retrieval systems, without permission in writing from the publisher, except by a reviewer, who may quote brief passages in a review. Members of educational institutions and organizations wishing to photocopy any of the work for classroom use, or authors and publishers who would like to obtain permission for any of the material in the work, should contact Permissions, University Press of New England, One Court Street, Lebanon, NH 03766. Originally published in Hebrew as Nashim Korot: Yitronah Shel Shuliyut by Am Oved Publishers Ltd., Tel Aviv, 2001. This book was published with the generous support of the Lucius N. Littauer Foundation, Inc., Ben-Gurion University of the Negev, the Tauber Institute for the Study of European Jewry through the support of the Valya and Robert Shapiro Endowment of Brandeis University, and the Hadassah-Brandeis Institute through the support of the Donna Sudarsky Memorial Fund. -

Park East Synagogue Chronicle Vol

PARK EAST SYNAGOGUE CHRONICLE VOL. LXXXVII, NO. 1 September • Tishrei 5782 Rosh Hashanah Message We would like to thank the following “Today is the birthday of the world.” individuals for generously contributing *:early to our Kol Nidre Campaign היום הרת עולם OSH HASHANAH celebrates the New Year of the world. Sadly, marked by the persistent COVID-19 Warren and Sue Appleman Rand its variants, conflict and hatred in a divided world and divided States of America. Also facing Zondra Dell Barricks the Taliban rule of Afghanistan emboldening Jihad terrorism that has claimed the lives of 13 U.S. troops Joseph and Rozalia Bistricer and over 170 Afghans. We Jews, members of the human family are impacted by what is happening in the Leonard and Joanne Brumberg world, with the added burden of the ancient hatred of anti-Semitism particularly widespread at times of David and Sheila Cornstein societal upheaval. Shana means change. The world indeed has changed. It is also a time of technological Todd Dimston innovation and new discovery that carefully managed can be a blessing for humanity. How we adapt to Scott and Elisabeth Domansky the changes in the workplace, at home, society, resolution of conflicts, a new world order, international Charles and Madeline Dreifus cooperation, the devastating increase in assimilation among Jews, the security and peace of Israel, will Marilyn Dukoff affect our future. Justin Epstein At Mount Sinai the Torah was embraced by the Jewish people. It has served as a constitution for Alan and Mille Fell survival, as a compass, guide and anchor even during revolutionary changes. -

Liste Des Établissements Reconnus Mise À Jour: Janvier 2017

La Première financière du savoir ‐ Liste des établissements reconnus Mise à jour: janvier 2017 Pour rechercher cette liste d'établissements reconnus, utilisez <CTRL> F et saisissez une partie ou la totalité du nom de l'école. Ou cliquez sur la lettre pour naviguer dans cette liste: ABCDEFGHIJKLMNOPQRSTUVWXYZ 1ST NATIONS TECH INST-LOYALIST COLL Tyendinaga Mohawk Territory ON Canada 5TH WHEEL TRAINING INSTITUTE, NEW LISKEARD NEW LISKEARD ON Canada A1 GLOBAL COLLEGE OF HEALTH BUSINESS AND TECHNOLOG MISSISSAUGA ON Canada AALBORG UNIVERSITETSCENTER Aalborg Foreign Prov Denmark AARHUS UNIV. Aarhus C Foreign Prov Denmark AB SHETTY MEMORIAL INSTITUTE OF DENTAL SCIENCE KARNATAKA Foreign Prov India ABERYSTWYTH UNIVERSITY Aberystwyth Unknown Unknown ABILENE CHRISTIAN UNIV. Abilene Texas United States ABMT COLLEGE OF CANADA BRAMPTON ON Canada ABRAHAM BALDWIN AGRICULTURAL COLLEGE Tifton Georgia United States ABS Machining Inc. Mississauga ON Canada ACADEMIE CENTENNALE, CEGEP MONTRÉAL QC Canada ACADEMIE CHARPENTIER PARIS Paris Foreign Prov France ACADEMIE CONCEPT COIFFURE BEAUTE Repentigny QC Canada ACADEMIE D'AMIENS Amiens Foreign Prov France ACADEMIE DE COIFFURE RENEE DUVAL Longueuil QC Canada ACADEMIE DE ENTREPRENEURSHIP QUEBECOIS St Hubert QC Canada ACADEMIE DE MASS. ET D ORTOTHERAPIE Gatineau (Hull Sector) QC Canada ACADEMIE DE MASSAGE ET D ORTHOTHERAPIE GATINEAU QC Canada ACADEMIE DE MASSAGE SCIENTIFIQUE DRUMMONDVILLE Drummondville QC Canada ACADEMIE DE MASSAGE SCIENTIFIQUE LANAUDIERE Terrebonne QC Canada ACADEMIE DE MASSAGE SCIENTIFIQUE QUEBEC Quebec QC Canada ACADEMIE DE SECURITE PROFESSIONNELLE INC LONGUEUIL QC Canada La Première financière du savoir ‐ Liste des établissements reconnus Mise à jour: janvier 2017 Pour rechercher cette liste d'établissements reconnus, utilisez <CTRL> F et saisissez une partie ou la totalité du nom de l'école. -

2021-02-12 FY2021 Grant List by Region.Xlsx

New York State Council on the Arts ‐ FY2021 New Grant Awards Region Grantee Base County Program Category Project Title Grant Amount Western New African Cultural Center of Special Arts Erie General Support General $49,500 York Buffalo, Inc. Services Western New Experimental Project Residency: Alfred University Allegany Visual Arts Workspace $15,000 York Visual Arts Western New Alleyway Theatre, Inc. Erie Theatre General Support General Operating Support $8,000 York Western New Special Arts Instruction and Art Studio of WNY, Inc. Erie Jump Start $13,000 York Services Training Western New Arts Services Initiative of State & Local Erie General Support ASI General Operating Support $49,500 York Western NY, Inc. Partnership Western New Arts Services Initiative of State & Local Erie Regrants ASI SLP Decentralization $175,000 York Western NY, Inc. Partnership Western New Buffalo and Erie County Erie Museum General Support General Operating Support $20,000 York Historical Society Western New Buffalo Arts and Technology Community‐Based BCAT Youth Arts Summer Program Erie Arts Education $10,000 York Center Inc. Learning 2021 Western New BUFFALO INNER CITY BALLET Special Arts Erie General Support SAS $20,000 York CO Services Western New BUFFALO INTERNATIONAL Electronic Media & Film Festivals and Erie Buffalo International Film Festival $12,000 York FILM FESTIVAL, INC. Film Screenings Western New Buffalo Opera Unlimited Inc Erie Music Project Support 2021 Season $15,000 York Western New Buffalo Society of Natural Erie Museum General Support General Operating Support $20,000 York Sciences Western New Burchfield Penney Art Center Erie Museum General Support General Operating Support $35,000 York Western New Camerta di Sant'Antonio Chamber Camerata Buffalo, Inc. -

Parshat Beshalach

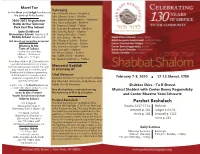

Mazel Tov Yahrzeits to the Dror and Sedgh families on Mrs. Marcelle Faust - Husband the birth of Mika Rachel. Mrs. Marion Gross - Mother 2020-2021 Registration Mrs. Batya Kahane Hyman - Husband Rabbi Arthur Schneier Mrs. Rose Lefkowitz - Brother Mr. Seymour Siegel - Father Park East Day School Mr. Leonard Brumberg - Mother Early Childhood Mrs. Ginette Reich - Mother Elementary School: Grades 1-5 Mr. Harvey Drucker - Father Middle School: Grades 6-8 Mr. Jack Shnay - Mother Ask about our incentive program! Mrs. Marjorie Schein - Father Mr. Andrew Feinman - Father Mommy & Me Mrs. Hermine Gewirtz - Sister Taste of School Mrs. Iris Lipke - Mother Tuesday and Thursday Mr. Meyer Stiskin - Father 9:00 am - 10:30 am or 10:45 am - 12:15 pm Ms. Judith Deich - Mother Mr. Joseph Guttmann - Father Providing children 14-23 months with a wonderful introduction to a more formal learning environment. Through Memorial Kaddish play, music, art, movement, and in memory of Shabbat and holiday programming, children learn to love school and Ethel Kleinman prepare to separate from their beloved mother of our devoted members February 7-8, 2020 u 12-13 Shevat, 5780 parents/caregivers. Elly (Shaindy) Kleinman, Leah Zeiger and Register online at ParkEastDaySchool.org Rabbi Yisroel Kleinman. Shabbat Shira - Tu B’Shevat or email [email protected] May the family be comforted among Musical Shabbat with Cantor Benny Rogosnitzky Leon & Gina Fromer the mourners of Zion & Jerusalem. Youth Enrichment Center and Cantor Maestro Yossi Schwartz Hebrew School Parshat Beshalach Pre-K (Age 4) This Shabbat is known as Shabbat Shira Parshat Beshalach Kindergarten (Age 5) because the highlight of the Torah Reading Exodus 13:17-17:16 Haftarah Elementary School (Ages 6-12) is the Song at the Sea. -

Form 990-PF Return of Private Foundation

OMB NO 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Internal Revenue Treated as a Private Foundation Service Note : The organization may be able to use a copy of this return to satisfy state reporting requirements . 2003 Far calendar year 2003, or tax year beginning and endin G Check all that a I 0 Initial return ~ Final return ~ Ame Address change U Use the IRS Name of organization Employer identification number label. EX & RUTH FRUCHTHANDLER Otherwise, FOUNDATION INC 13-6156031 print Number and street (or P O box number if mail is not delivered to street address) Room suite B Telephone number or type. 111 BROADWAY 20TH FLOOR 212-266-8200 See Specific City or town, state, and ZIP code If exemption application is pending, check here Instructions . NEW YORK NY 10006 D 1 . Foreign organizations, check here 2 . Foreign organizations meeting the 85% test, , a H Check type of organization OX Section 501(c)(3) exempt private foundation check here and attach computation Section 4947(a)(1) nonexempt charitable trust 0 Other taxable private foundation E If private foundation status was terminated I Fair market value of all assets at end of year J Accounting method M Cash 0 Accrual under section 507(b)(1)(A), check here " D (from Part 11, Col. (c), line 16) D Other (specify) F If the foundation is in a 60-month termination 111114 8 5 6 7 3 3 4 . (Part l, column (d) must be on cash bass s.) under section 507 b 1 B , check here part I Analysis of Revenue and Expenses (d) Disbursements (The total of amounts In columns (b), (c), end (d) may not (a) Revenue and (6) Net investment (c) Adjusted net rorchantablepurposespurposes necessarily equal the amounts in column (a) ) expenses peg books income income (cash basis onlv) 1 Contributions, gifts, grants, etc ,received 1,112,000 .