Foreign Investment in Chile 55

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kosovo Commercial Guide

Kosovo Table of Contents Doing Business in Kosovo ____________________________ 6 Market Overview ___________________________________ 6 Market Challenges __________________________________ 7 Market Opportunities ________________________________ 8 Market Entry Strategy ________________________________ 9 Political and Economic Environment ____________________ 11 Selling US Products & Services ________________________ 11 Using an Agent to Sell US Products and Services _________________ 11 Establishing an Office ________________________________ 11 Franchising ______________________________________ 11 Direct Marketing ___________________________________ 12 Joint Ventures/Licensing ______________________________ 12 Selling to the Government ______________________________ 12 Distribution & Sales Channels____________________________ 13 Express Delivery ___________________________________ 13 Selling Factors & Techniques ____________________________ 13 eCommerce ______________________________________ 14 Overview ____________________________________________ 14 Current Market Trends ___________________________________ 14 Domestic eCommerce (B2C) ________________________________ 14 Cross-Border eCommerce __________________________________ 14 Online Payment________________________________________ 15 Major Buying Holidays ___________________________________ 15 Social Media __________________________________________ 15 Trade Promotion & Advertising ___________________________ 15 Pricing _________________________________________ 19 Sales Service/Customer -

MADE by ORIGIN SHAREHOLDER REVIEW 2014 Strategy Performance Growth

MADE BY ORIGIN SHAREHOLDER REVIEW 2014 Strategy Performance Growth ENERGY BY ORIGIN In 2014 Origin generated 17,195 gigawatt hours of electricity... WASHED BY ALEX ...enough energy to power around 16 billion (1) loads of washing. PERFORMANCE Statutory Profi t ($m) Statutory Earnings Per Share (¢) Dividends Per Share (¢) (2) HIGHLIGHTS $530m 48.1¢ 50¢ 2014 530 2014 48.1 2014 50 2013 378 2013 34.6 2013 50 A reconciliation between Statutory and 2012 980 2012 90.6 2012 50 Underlying profi t measures can be found 2011 186 2011 19.6 2011 50 in note 2 of the Origin Consolidated Financial Statements. 2010 612 2010 67.7 2010 50 Underlying EBITDA ($m) Underlying Profi t ($m) Underlying Earnings Per Share (¢) Free Cash Flow ($m) $2,139m $713m 64.8¢ $1,599m 2014 2,139 2014 713 2014 64.8 2014 1,599 2013 2,181 2013 760 2013 69.5 2013 1,188 2012 2,257 2012 893 2012 82.6 2012 1,415 2011 1,782 2011 673 2011 71.0 2011 1,316 2010 1,346 2010 585 2010 64.8 2010 800 01 ...............PERFORMANCE HIGHLIGHTS 02 ...............MESSAGE FROM THE CHAIRMAN AND MANAGING DIRECTOR 03 ...............FINANCIAL CALENDAR 2014/2015 03 ...............KEY MILESTONES IN 2014 03 ...............OUR COMPASS 04...............ENERGY MARKETS 04............... CONTACT ENERGY 05 ...............EXPLORATION & PRODUCTION 05 ...............LNG 06 .............. BOARD OF DIRECTORS 06 ..............EXECUTIVE MANAGEMENT TEAM 07 ...............FIVE YEAR FINANCIAL HISTORY 07 ...............GLOSSARY 08 ..............BUSINESS STRATEGY 08 ..............MAP OF ASSETS & OPERATIONS MESSAGE FROM THE CHAIRMAN AND MANAGING DIRECTOR During the period, we announced the acquisition starting to deliver results, as refl ected in the Fellow shareholder, of a 40 per cent interest in the Poseidon improvement in margins in the second half. -

We Help Jess Harness the Sun's Energy to Power Her

WE HELP JESS HARNESS THE SUN’S ENERGY TO POWER HER HOME ENERGY MADE FRESH DAILY SUSTAINABILITY REPORT 2015 CONTENTS 02 .................. MANAGING DIRECTOR’S MESSAGE 04 ..................OUR COMPASS 05 ..................WHERE WE OPERATE 06.................. OUR YEAR AT A GLANCE 08.................. BUSINESS STRATEGY 09 ..................OUR PERFORMANCE 10 ..................GLOBAL TRENDS 12 .................. APPROACH TO MATERIALITY 14 .................. ENGAGING WITH OUR STAKEHOLDERS 17 ................... ENERGY DEVELOPMENTS 32 .................. DELIVERING ENERGY 40 .................. MANAGING OUR BUSINESS 60 .................. FUTURE ENERGY SOLUTIONS 64 .................. PHILANTHROPY 67 ................... RATINGS AND BENCHMARKS 68 ..................GLOSSARY DISCOVER MORE ONLINE IMPORTANT INFORMATION Origin has been reporting its sustainability The following Report includes an assessment performance since 2002 via an annual of upstream activities by Australia Pacific LNG, Sustainability Report. in which Origin has a 37.5 per cent shareholding Unless otherwise stated, Origin’s Sustainability (consistent with its holding as at 30 June 2014) Report provides a summary of activities, operated and is the Upstream operator. assets and non-financial performance between This Report does not contain information 1 July 2014 and 30 June 2015. Emissions on the sustainability performance of Contact performance is reported on an operated and Energy, in which Origin held a 53.1 per cent equity basis. Significant events occurring after interest at the close of the reporting period. the close of the period may also be referenced. After the close of the period, Origin divested Origin’s Sustainability Report outlines the its entire interest in Contact Energy. Information Company’s performance against a number regarding Contact Energy can be found of Material Aspects. Origin’s approach to at www.contactenergy.co.nz. determining Material Aspects is informed All monetary amounts are in Australian dollars by the Global Reporting Initiative and the unless otherwise stated. -

Dns in Action a Detailed and Practical Guide To

DNS in Action A detailed and practical guide to DNS implementation, configuration, and administration Libor Dostálek Alena Kabelová BIRMINGHAM - MUMBAI DNS in Action A detailed and practical guide to DNS implementation, configuration, and administration Copyright © 2006 Packt Publishing All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, without the prior written permission of the publisher, except in the case of brief quotations embedded in critical articles or reviews. Every effort has been made in the preparation of this book to ensure the accuracy of the information presented. However, the information contained in this book is sold without warranty, either express or implied. Neither the authors, Packt Publishing, nor its dealers or distributors will be held liable for any damages caused or alleged to be caused directly or indirectly by this book. Packt Publishing has endeavored to provide trademark information about all the companies and products mentioned in this book by the appropriate use of capitals. However, Packt Publishing cannot guarantee the accuracy of this information. First published: March 2006 Production Reference: 1240206 Published by Packt Publishing Ltd. 32 Lincoln Road Olton Birmingham, B27 6PA, UK. ISBN 1-904811-78-7 www.packtpub.com Cover Design by www.visionwt.com This is an authorized and updated translation from the Czech language. Copyright © Computer Press 2003 Velký průvodce protokoly TCP/IP a systémem DNS. ISBN: 80-722-6675-6. All rights reserved. Credits Authors Development Editor Libor Dostálek Louay Fatoohi Alena Kabelová Indexer Technical Editors Abhishek Shirodkar Darshan Parekh Abhishek Shirodkar Proofreader Chris Smith Editorial Manager Dipali Chittar Production Coordinator Manjiri Nadkarni Cover Designer Helen Wood About the Authors Libor Dostálek was born in 1957 in Prague, Europe. -

Global Shipping Transaction Guide

v 2600 or higher Global Shipping Transaction Guide Important Information Payment of this guide may be distributed or disclosed in any form to any third party without written permission of FedEx. This guide is provided to you and its use is You must remit payment in accordance with the FedEx Service Guide, tariff, subject to the terms and conditions of the FedEx PowerShip Placement service agreement or other terms or instructions provided to you by FedEx Agreement. The information in this document may be changed at any time from time to time. You may not withhold payment on any shipments because of without notice. Any conflict between this guide and the FedEx Service Guide equipment failure or for the failure of FedEx to repair or replace any shall be governed by the FedEx Service Guide. equipment. © 2012 FedEx. FedEx and the FedEx logo are registered service marks. All Confidential and Proprietary rights reserved. Unpublished. The information contained in this guide is confidential and proprietary to FedEx Corporate Services, Inc. and its affiliates (collectively “FedEx”). No part FedEx Ship Manager® Software PassPort, Global Shipping Transaction Guide 2 Contents FedEx Home Delivery with Printed Return Shipping Label Output 1 Overview ................................................................................................................ 6 Transaction .............................................................................................................. 30 Features ..................................................................................................................... -

INFOCOM PDF Export File

Mount Alexander Shire Council Community Services Directory Table Of Contents ACCOMMODATION . 1 Emergency Accommodation . 1 Holiday . 1 Hostels . 1 Nursing Homes . 1 Public Housing . 1 Tenancy . 2 AGED AND DISABILITY SERVICES . 2 Aids and Appliances . 2 Intellectual Disabilities . 3 Home Services . 3 Learning Difficulties . 4 Psychiatric/Mental Health . 4 Physical Disabilities . 4 Senior Citizen's Centres . 5 Rehabilitation . 5 Respite Services . 5 ANIMAL WELFARE . 6 Animal Welfare Groups . 6 ANIMALS . 6 Dingos . 6 Dogs . 6 Horses . 7 Pony Clubs . 7 Pigeons . 7 ANTIQUES AND SECONDHAND GOODS . 7 Opportunity Shops . 7 ARTS AND CRAFTS . 7 Dancing . 7 Drama . 7 Drawing . 8 Embroidery . 8 Film . 8 Hobbies . 8 Instruction . 8 Music and Singing . 8 Painting . 9 Quilting . 9 Spinning and Weaving . 9 COMMUNICATIONS . 9 Computers . 9 Fax Transmissions . 10 Languages . 10 Media Newsletters . 11 Postal Communications . 11 Radio . 12 Telephone Services . 12 COMMUNITY ORGANISATIONS . 12 Associations . .. -

2012 Annual Report

Telecommunications Industry Ombudsman TELECOMMUNICATIONS INDUSTRY OMBUDSMAN 2012 ANNUAL REPORT PREPARING FOR THE FUTURE CONTENTS ABOUT US 1 COMPLAINT STATISTICS 16 ENGAGEMENT 32 About the TIO 1 Dashboard 16 Awareness of TIO services 32 Ombudsman’s message 2 New Complaints by quarter 16 Resilient Consumers 32 New Complaints v. concilations TIO Talks 32 Board Chairman’s message 3 and investigations 16 First online annual report 32 Council Chairman’s message 4 New complaints by consumer type 16 Accessibility 32 New complaints by service type 17 A new website 32 Board and Council in 2011-12 5 Conciliations and Investigations Community engagement 33 Board members in 2011-12 5 by service type 17 Council members in 2011-12 8 Top 7 issues in new complaints 17 Industry engagement 34 Trends overview 18 Account management model 34 Ombudsman roadshow 34 PERFORMANCE 11 Complaints about the “big three” service providers 18 MNews 34 Conciliation 11 Complaints about mobile phone Our membership 34 services 18 Live transfers 11 Government and regulation 34 Small business complaints 19 Conciliation snapshot 11 Highlights 34 Increase in enquiries 19 List of submissions 35 Timeliness 12 Geographical trends 20 Consumer satisfaction Australia wide 20 ORGANISATION 36 with TIO services 12 Victoria 21 Feedback about the TIO 12 South Australia 21 Staff overview 36 Amendments to the Australian Capital Territory 22 New teams 36 TIO Constitution 13 New South Wales 22 TIO organisational structure 36 Queensland 23 Wellness program 36 Monetary limits 13 Western Australia -

2007 Flock Register Vol 53

1 FLOCK REGISTER FOR POLL DORSET SHEEP IN AUSTRALIA VOLUME 53, 2007 Covering flocks as at 31st March, 2007 Editor: P. G. Weston Published by the AUSTRALIAN POLL DORSET ASSOCIATION INC. G.P.O. Box 75, Melbourne, Vic. 3001 Telephone: (03) 9817 6711 Fax: (03) 9817 6125 Web: www.polldorset.org.au E-mail: [email protected] ABN: 65 206 172 969 (Incorporated in Victoria No. A1491) Founded 28th September, 1954 Chief Executive PETER G. WESTON Head Office: 2 Peverill Street, Deepdene, Vic. 3103. PRICE: Members..............................................................................................Gratis Non-Members....................................................................$22.00 (includes GST) MELBOURNE - AUGUST 2007 2 CONTENTS page Objective Measurement Systems ..............................................................IFC Foundation Members........................................................................................ 3 Past Presidents, and Honorary Life Members ................................................. 4 Office-bearers ................................................................................................... 5 Poll Dorset Ram & Ewe in the wool .................................................................. 6 Region Boundaries ........................................................................................... 7 Region Committees .......................................................................................... 8 Privacy Act Statement .................................................................................10 -

For Personal Use Only Use Personal For

To Company Announcements Office Facsimile 1300 135 638 Company ASX Limited Date 1 December 2011 From Helen Hardy Pages 116 ORIGIN MAKES INITIAL $800M ALLOCATION OF SUBORDINATED NOTES AND Subject OPENS SHAREHOLDER OFFER AND GENERAL OFFER Please find attached a release on the above subject. Regards Helen Hardy Company Secretary 02 8345 5023 – [email protected] For personal use only Origin Energy Limited ACN 000 051 696 • Level 45 Australia Square, 264-278 George Street, Sydney NSW 2000 GPO Box 5376, Sydney NSW 2001 • Telephone (02) 8345 5000 • Facsimile (02) 9252 1566 • www.originenergy.com.au ASX/Media Release 1 December 2011 Origin makes initial $800m allocation of Subordinated Notes and opens Shareholder Offer and General Offer Origin Energy Limited (Origin) today announced the successful completion of the Bookbuild for its recently launched offer of Origin Energy Subordinated Notes (Notes). • $800 million of Notes allocated through the Bookbuild • Margin set at 4.00% per annum • Broker Firm Offer, Shareholder Offer and General Offer open today • Replacement Prospectus lodged with ASIC Following very strong demand for the Offer, Origin has allocated $800 million of Notes through the Bookbuild and has set the Margin at 4.00% per annum. The final size of the Offer will depend on the volume of applications received under the Shareholder Offer and General Offer. Notes will mature on 22 December 2071, unless redeemed earlier. Holders of Notes are entitled to receive quarterly floating rate interest payments (subject to deferral at Origin's discretion or in certain circumstances mandatorily) equal to the sum of the Bank Bill Rate plus the Margin. -

Download the 2017 Annual Report ( 6.3

ANNUAL 2017 ANNUAL REPORT HOW ARE YOU ADAPTING TO A RAPIDLY CHANGING ENERGY LANDSCAPE? Trish Kelliher Shareholder Everything you want to know about how we’re tackling the big questions. ORIGIN ENERGY CONTENTS 02 WELCOME TO THE 2017 ANNUAL REPORT 04 YEAR AT A GLANCE 08 DIRECTORS' REPORT 12 OPERATING AND FINANCIAL REVIEW 38 RENUMERATION REPORT 67 LEAD AUDITOR’S INDEPENDENCE DECLARATION 68 BOARD OF DIRECTORS 70 EXECUTIVE MANAGEMENT TEAM 73 CORPORATE GOVERNANCE STATEMENT 82 FINANCIAL STATEMENTS 145 DIRECTORS’ DECLARATION 146 INDEPENDENT AUDITOR’S REPORT 152 SHARE AND SHAREHOLDER INFORMATION 154 EXPLORATION AND PRODUCTION PERMITS AND DATA 156 ANNUAL RESERVES REPORT 164 FIVE YEAR FINANCIAL HISTORY 166 GLOSSARY AND INTERPRETATION On the cover of this Annual Report is Trish Kelliher, an Origin shareholder and also one of our employees. When we recently spoke to Trish, she asked what Origin is doing to ensure that energy remains affordable for families; and how are we making life easier for customers? This information is found in the Energy Markets section of the Operating and Financial Review, as well as in our Shareholder Review and Sustainability Report. ORIGIN ENERGY 1 Origin is focused on a cleaner, smarter and customer-centric energy future. 2 WELCOME TO THE 2017 ANNUAL REPORT In compiling this year’s report, we spent Given our primary focus was to reduce debt, WELCOME time reflecting on common questions the Board determined not to pay a dividend we've been hearing from our shareholders. for the second half of FY2017. We are acutely aware of the importance of dividends Did you meet your commitments for the year? TO THE to many of our shareholders and this Is the business in good shape? What are you decision was not taken lightly. -

Origin Energy

To Company Announcements Office Facsimile 1300 135 638 Company Australian Stock Exchange Limited Date 12 September 2008 From Bill Hundy Pages 179 Subject ANNUAL REPORT, REVIEW AND NOTICE OF MEETING Attached are the following documents: 1. 2008 Shareholder Review 2. The Annual Report including Financial Statements and Directors’ Report for year ended 30 June 2008 3. Notice of Annual General Meeting and Proxy Appointment Form These documents are being sent to shareholders in accordance with their elections as to the receipt of printed reports. Regards Bill Hundy Company Secretary 02 8345 5467 – [email protected] For personal use only Origin Energy Limited ACN 000 051 696 • Lvl 45 Australia Square, 264-278 George Street, Sydney NSW 2000 GPO Box 5376, Sydney NSW 2001 • Telephone (02) 8345 5000 • Facsimile (02) 9252 1566 • www.originenergy.com.au SHAREHOLDER REVIEW 2008 Review 08 Delivering STRATEGY PERFORMANCE GROWTH For personal use only Origin Energy Limited ABN 30 000 051 696 Contents P.2 Our year in review P.3 A message from your Chairman and Managing Director P.6 Company scorecard P.8 Operations review P.8 – Exploration and Production P.9 – Generation P.10 – Retail P.11 – Contact Energy P.12 – Sustainability P.13 Board of directors P.14 Executive management team P.15 Financial history P.16 Exploration and production data IBCFor personal use only Share and shareholder information Financial calendar 2008/2009 3/10/08 Final dividend paid 15/10/08 Annual general meeting 31/12/08 Half year end 26/2/09 Half year profi t announcement 30/6/09 Financial year end Cover photo: Tom Lynam, Spring Gully Field Operator, at a wellhead on site. -

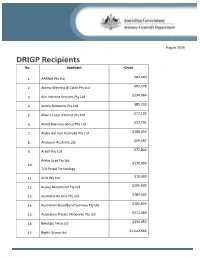

DRIGP Recipients No

August 2016 DRIGP Recipients No. Applicant Grant $82,440 1. AARNet Pty Ltd $83,378 2. Access Wireless & Cable Pty Ltd $294,084 3. Ace Internet Services Pty Ltd $85,200 4. Acurix Networks Pty Ltd $77,102 5. Albury Local Internet Pty Ltd $37,792 6. Allied Business Group Pty Ltd $180,000 7. Alpha Dot Net Australia Pty Ltd $69,387 8. Amaysim Australia Ltd $72,800 9. Area9 Pty Ltd Atthis Sept Pty Ltd $132,000 10. T/A Portal Technology $10,000 11. Arris Pty Ltd $265,600 12. Aussie Broadband Pty Ltd $184,000 13. Australia On Line Pty Ltd $265,600 14. Australian Broadband Services Pty Ltd $373,080 15. Australian Private Networks Pty Ltd $334,050 16. Bendigo Telco Ltd $1,042,666 17. BigAir Group Ltd Grant No. Applicant $48,000 18. Bitwave Networks Pty Ltd $32,408 19. BIZCOM (NT) Pty Ltd $81,719 20. Blast Technologies Pty Ltd $80,800 21. Blue Apache Pty Ltd $30,400 22. Blue Net Pty Ltd $133,600 23. BorderNet Internet Pty Ltd $96,320 24. Brennan Voice and Data Pty Ltd $2,201,006 25. Broadband Solutions Pty Ltd $128,510 26. BT Business Pty Ltd $190,763 27. BT Residential Pty Ltd $30,519 28. BT Trade Pty Ltd $28,318 29. BT Utilities Pty Ltd $26,000 30. C2A internet.com.au Pty Ltd $36,010 31. Call Dynamics Pty Ltd $196,800 32. Central Data Systems Pty Ltd $439,200 33. CipherTel Pty Ltd $18,800 34. Cirrus Communications Pty Ltd Clear Technology Ptd Ltd $161,600 35.