(CFT) Risk Management in Emerging Market Banks Good Practice Note

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Research and Science Today No. 1(15)/2018

RESEARCH AND SCIENCE TODAY ~ Scientific Review ~ ~Spring~ No. 1(15)/2018 March 2018 ISSN-p: 2247 – 4455 ISSN-e: 2285 – 9632 ISSN-L: 2247 – 4455 Târgu-Jiu 2018 1 Cover: Batcu Alexandru Editing: Mărcău Flavius-Cristian Director: Mărcău Flavius-Cristian Contact: Mail: [email protected] Web: www.rstjournal.com Tel: +40766665670 COPYRIGHT: Reproductions are authorized without charging any fees, on condition the source is acknowledged. Responsibility for the content of the paper is entirely to the authors. 2 SCIENTIFIC COMMITTEE: Prof. univ. dr. Adrian Gorun, Secretary General, Prof. univ. dr. Gămăneci Gheorghe, Universitatea National Commission for Prognosis. "Constantin Brâncuși" din Târgu-Jiu. Prof. univ. dr. ing. Ecaterina Andronescu, University Prof. univ. dr. Ghimiși Ștefan Sorinel, "Constantin Politehnica of Bucharest. Brâncuși" University of Târgu-Jiu. Prof. univ. dr. Michael Shafir, Doctoral School in Prof. univ. dr. Bîcă Monica Delia, "Constantin International Relations and Security Studies, ”Babes- Brâncuși" University of Târgu-Jiu. Bolyai” University. Prof. univ. dr. Babucea Ana Gabriela, "Constantin Prof. univ. dr. Nastasă Kovács Lucian, The Romanian Brâncuși" University of Târgu-Jiu. Academy Cluj-Napoca, "George Baritiu" History C.S II Duță Paul, Romanian Diplomatic Institute. Institute. Conf. univ. dr. Flavius Baias, University of Bucharest. Prof. univ. dr. Adrian Ivan, Doctoral School in Conf. univ. dr. Adrian Basarabă, West University of International Relations and Security Studies, ”Babes- Timișoara. Bolyai” University. Conf. univ. dr. Răzvan Cătălin Dobrea, Academy of Prof. Dr. Miskolczy Ambrus, Eotovos Lorand Economic Studies. Univeristy (ELTE), Hungary. Pr. Conf. univ. dr. Dumitru A. Vanca, University "1 Dr. Gregg Alexander, University of the Free State, Decembrie 1918" of Alba Iulia. -

Wolfsberg Group Trade Finance Principles 2019

Trade Finance Principles 1 The Wolfsberg Group, ICC and BAFT Trade Finance Principles 2019 amendment PUBLIC Trade Finance Principles 2 Copyright © 2019, Wolfsberg Group, International Chamber of Commerce (ICC) and BAFT Wolfsberg Group, ICC and BAFT hold all copyright and other intellectual property rights in this collective work and encourage its reproduction and dissemination subject to the following: Wolfsberg Group, ICC and BAFT must be cited as the source and copyright holder mentioning the title of the document and the publication year if available. Express written permission must be obtained for any modification, adaptation or translation, for any commercial use and for use in any manner that implies that another organization or person is the source of, or is associated with, the work. The work may not be reproduced or made available on websites except through a link to the relevant Wolfsberg Group, ICC and/or BAFT web page (not to the document itself). Permission can be requested from the Wolfsberg Group, ICC or BAFT. This document was prepared for general information purposes only, does not purport to be comprehensive and is not intended as legal advice. The opinions expressed are subject to change without notice and any reliance upon information contained in the document is solely and exclusively at your own risk. The publishing organisations and the contributors are not engaged in rendering legal or other expert professional services for which outside competent professionals should be sought. PUBLIC Trade Finance Principles -

Privacy Gaps in India's Digital India Project

Privacy Gaps in India’s Digital India Project AUTHOR Anisha Gupta EDITOR Amber Sinha The Centre for Internet and Society, India Designed by Saumyaa Naidu Shared under Creative Commons Attribution 4.0 International license Introduction Scope The Central and State governments in India have been increasingly taking This paper seeks to assess the privacy protections under fifteen e-governance steps to fulfill the goal of a ‘Digital India’ by undertaking e-governance schemes: Soil Health Card, Crime and Criminal Tracking Network & Systems schemes. Numerous schemes have been introduced to digitize sectors such as (CCTNS), Project Panchdeep, U-Dise, Electronic Health Records, NHRM Smart agriculture, health, insurance, education, banking, police enforcement, Card, MyGov, eDistricts, Mobile Seva, Digi Locker, eSign framework for Aadhaar, etc. With the introduction of the e-Kranti program under the National Passport Seva, PayGov, National Land Records Modernization Programme e-Governance Plan, we have witnessed the introduction of forty four Mission (NLRMP), and Aadhaar. Mode Projects. 1 The digitization process is aimed at reducing the human The project analyses fifteen schemes that have been rolled out by the handling of personal data and enhancing the decision making functions of government, starting from 2010. The egovernment initiatives by the Central the government. These schemes are postulated to make digital infrastructure and State Governments have been steadily increasing over the past five to six available to every citizen, provide on demand governance and services and years and there has been a large emphasis on the development of information digital empowerment. 2 In every scheme, personal information of citizens technology. Various new information technology schemes have been introduced are collected in order to avail their welfare benefits. -

Research Statement David M. Simmonds

Research Statement David M. Simmonds Executive Summary My research goal is to demonstrate how Information Technologies will enhance value creation along Supply Chains, specifically in the area of Collaborative Planning, Forecasting & Replenishment (CPFR). CPFR uses collaborative IT to create efficiencies in the movement of goods between along the supply chain, by increasing the precision with which demand is predicted. Using surveys of supply-chain focused middle management in medium sized companies, I intend to examine the challenges in using CPFR to manage demand along supply chains, from an organizational and technical level. Past Research The famous “Gang of Four”, led by Erich Gamma, converted Gamma’s dissertation into a world class book of 23 software design patterns (Gamma, Helm, Johnson, & Vlissides, 1993). While this book revolutionized the thinking on software design patterns in building robust, adaptable software, the GoF wrote their book in technical language, and also abstract C++ code samples which were hard to understand. So while the book is well renowned within the ranks of hard-core computer scientists, it never gained the traction that it should have amongst more general Information Technology personal, especially systems analysts and software developers. In order to make their ground breaking work more accessible to a wider audience, I synthesized the design pattern literature in order to reinterpret their book. I published my treatise on Programmer’s Heaven, a website dedicated to empowering software developers to build high quality software (GoF Design Patterns @ Programmers Heaven). I explained the design patterns in plain English and also used everyday examples. Additionally, I reinforced the treatise on design patterns with functioning, visually appealing UI code written in Visual Basic .Net. -

2016 Human Capital Benchmarking Report

2016 Human Capital Benchmarking Report November 2016 SHRM Benchmarking Service Are you looking for data that is customizable by industry, To view region, organization staff size, and more? SHRM’s sample Benchmarking Service provides just that. reports or place an • The data in this report can be customized for your organization by industry, order, visit staff size, geographic or metropolitan region, profit status (for profit/nonprofit), sector (public/private), unionized environments, and more. shrm.org/benchmarks or call • The data in this report were collected from the 2016 SHRM Human Capital (703) 535-6366 Benchmarking Survey. Additional reports available in Health Care, Paid Leave, Employee Benefits Prevalence, and Talent Acquisition. Human Capital Benchmarking Report ©SHRM 2016 2 Table of Contents About SHRM Key Findings 4 Founded in 1948, the Society for Human Resource Management Statistical Definitions 5 (SHRM) is the world’s largest HR membership organization devoted to human resource management. Human Capital Benchmarking Survey Findings 6 Representing more than 275,000 members in over 160 countries, the Demographics 19 Society is the leading provider of resources to serve the needs of HR Methodology 28 professionals and advance the professional practice of human resource management. SHRM has more than 575 affiliated chapters within the United States and subsidiary offices in China, India and United Arab Emirates. Visit us at shrm.org. Human Capital Benchmarking Report ©SHRM 2016 3 The average maximum Key Findings employer match for a 401(k) or similar • Tuition: 61 percent of employers offered • Succession Planning: One-third of plan was 6%. tuition reimbursement. The average companies (34 percent) had a succession maximum reimbursement allowed for plan. -

LEAPEF Wolfsberg-Anti-Money-Laundering

The Wolfsberg Group Anti-Money Laundering Questionnaire Questionnaire provided by LEAP EF AB with additional questions # 29 & 30 at end of form Financial Institution Name: Location: This questionnaire acts as an aid to firms conducting due diligence and should not be relied on exclusively or excessively. Firms may use this questionnaire alongside their own policies and procedures in order to provide a basis for conducting client due diligence in a manner consistent with the risk profile presented by the client. The responsibility for ensuring adequate due diligence, which may include independent verification or follow up of the answers and documents provided, remains the responsibility of the firm using this questionnaire. Anti-Money Laundering Questionnaire If you answer “no” to any question, additional information can be supplied at the end of the questionnaire. I. General AML Policies, Practices and Procedures: Yes No 1. Is the AML compliance program approved by the FI’s board or a Y N senior committee? 2. Does the FI have a legal and regulatory compliance program Y N that includes a designated officer that is responsible for coordinating and overseeing the AML framework? 3. Has the FI developed written policies documenting the Y N processes that they have in place to prevent, detect and report suspicious transactions? 4. In addition to inspections by the government Y N supervisors/regulators, does the FI client have an internal audit function or other independent third party that assesses AML policies and practices on a regular basis? 5. Does the FI have a policy prohibiting accounts/relationships Y N with shell banks? (A shell bank is defined as a bank incorporated in a jurisdiction in which it has no physical presence and which is unaffiliated with a regulated financial group.) 6. -

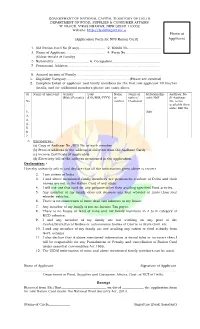

NFS New Ration Card English Form

GOVERNMENT OF NATIONAL CAPITAL TERRITORY OF DELHI DEPARTMENT OF FOOD, SUPPLIES & CONSUMER AFFAIRS ‘K’-BLOCK, VIKAS BHAWAN, NEW DELHI-110002 Website: http://fs.delhigovt.nic. in Photo of (Application Form for NFS Ration Card) Applicant 1. Old Ration Card No (If any)......................... 2. Mobile No................................ 3. Name of Applicant...................................... 4. Form No.................................. (Eldest female of Family) 5 Nationality ................................. 6. Occupation.............................................. 7. Permanent Address......................................................................................... ............................................................................................................................. 8. Annual income of Family................................................................................. 1. Eligibility Category............................................................ (Please see overleaf) 2. Complete Detail of applicant and family members (in the first row applicant fill his/her details, and for additional members please use extra sheet. Sr Name of applicant Gender DoB Name Name of Relationship Aadhaar No. (Male/Female) (DD/MM/YYYY) of father/ with HoF (If Aadhaar No mother Husband No. is not . available then enter EID No. 1. Self 2. 3. 4. 5. 6. 7. 3. Enclosures:- (a) Copy of Aadhaar No./EID No. of each member (b) Proof of address (if the address is different from the Aadhaar Card) (c) Income Certificate (If applicable) (d) Electricity bill of the address mentioned in the application. Declaration: - I hereby solemnly affirm and declare that all the information given above is correct. 2. I am citizen of India 3. I and above mentioned family members are permanent resident of Delhi and their names are not in the Ration Card of any state. 4. I will not use this card for any purpose other then availing specified Food articles. 5. Any member of my family does not possess any four wheeler or more than four wheeler vehicles. -

Sanctions Standard ATEF Standard Financial Crime Policy

Barclays’ Financial Crime Compliance Statement (ABC, AML, Anti-Tax Evasion Facilitation and Sanctions) Barclays recognises that economic crimes have an adverse effect on individuals and communities wherever they occur. Endemic economic crime (particularly when associated with organised crime and terrorist financing) can threaten laws, democratic processes and basic human freedoms, impoverishing states and distorting free trade and competition. Barclays is committed to conducting its global activities with integrity and respecting its regulatory, ethical and social responsibilities to: Protect customers, employees, and others with whom we do business; and Support governments, regulators, and law enforcement in wider economic crime prevention. We will not tolerate any deliberate breach of financial crime laws and regulations (e.g. bribery, corruption, and money laundering, sanctions, or tax evasion facilitation) that apply to our business and the transactions we undertake. Barclays has a dedicated global Financial Crime function, which sits within Compliance. The Financial Crime function facilitates risk-based, effective and efficient financial crime risk management by providing expert support and oversight to the business and our legal entities (Barclays Bank UK PLC and Barclays Bank PLC operate alongside, but independently from one another as part of the Barclays Group under the listed entity, Barclays PLC). We have adopted a holistic approach to Financial Crime and have one group-wide Financial Crime Policy that sets the minimum control requirements in four key risk areas: anti-bribery & corruption (ABC); anti-money laundering & counter-terrorist financing (AML); anti-tax evasion facilitation (ATEF) and sanctions. This combined approach allows us to identify and manage relevant synergies and connections between the key risk areas. -

International Treasury Management

The 26th annual conference on Official INTERNATIONAL sponsors TREASURY MANAGEMENT THE INTELLIGENT TREASURY 4-6 October 2017 // CCIB, Barcelona WILL TREASURY BE FREED OR TERMINATED? Adam Rutherford, Writer, Broadcaster, Scientific Adviser on AI & Robotics for films Ex Machina, Life, Annihilation Technology sponsors LEARNING HOW TO READ THE ECONOMIC SIGNALS Dr. Pippa Malmgren, Trendspotter, Bestselling Author, Co-founder, H Robotics BANKING 4.0: WILL YOUR BANK MAKE IT? Brett King, World-renowned Futurist, International Bestselling Author, Founder & CEO Moven Welcome to the world’s leading OVERVIEW international treasury event... The intelligent treasury uses digitalisation and data to finally release the true strategic value of treasury. Done well, it will save companies millions in process, compliance and regulatory costs and generate millions more across procurement, M&A and new business initiatives. However, of course it’s not easy... Data has become the lifeblood of the company, but it has also become its biggest challenge. Digital transformation is a leap many businesses will fail to make. And those that do face a series of hurdles. Join us at the most senior-level, international treasury event in the world to hear how some of the most innovative treasury teams are doing it. If you come away with just one idea that helps in any of these areas, isn’t the ticket price worth it? Get the best rate! Call Maria now on +46 8768 4955 or email [email protected] 2.5 70+ 1900+ 140+ 50+ 90+ DAYS SESSIONS REGISTERED SPEAKERS PRACTICAL EXHIBITORS DELEGATES CORPORATE CASE STUDIES 2 // Barcelona 2017 WHO WILL YOU MEET? WHY ATTEND? This truly global event attracts nearly 2,000 senior-level This is the world’s leading international treasury event. -

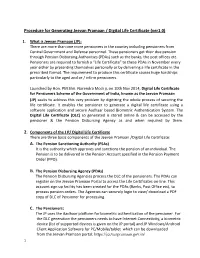

Procedure for Generating Jeevan Pramaan / Digital Life Certificate (Ver1.0)

Procedure for Generating Jeevan Pramaan / Digital Life Certificate (ver1.0) 1. What is Jeevan Pramaan (JP): There are more than one crore pensioners in the country including pensioners from Central Government and Defense personnel. These pensioners get their due pension through Pension Disbursing Authorities (PDAs) such as the banks, the post offices etc. Pensioners are required to furnish a “Life Certificate” to these PDAs in November every year either by presenting themselves personally or by delivering a life certificate in the prescribed format. The requirement to produce this certificate causes huge hardships particularly to the aged and or / infirm pensioners. Launched by Hon. PM Shri. Narendra Modi ji, on 10th Nov 2014, Digital Life Certificate for Pensioners Scheme of the Government of India, known as the Jeevan Pramaan (JP) seeks to address this very problem by digitizing the whole process of securing the life certificate. It enables the pensioner to generate a digital life certificate using a software application and secure Aadhaar based Biometric Authentication System. The Digital Life Certificate (DLC) so generated is stored online & can be accessed by the pensioner & the Pension Disbursing Agency as and when required by them. 2. Components of the J P/ Digital Life Certificate There are three basic components of the Jeevan Pramaan /Digital Life Certificate: A. The Pension Sanctioning Authority (PSAs) It is the authority which approves and sanctions the pension of an individual. The Pension is to be delivered in the Pension Account specified in the Pension Payment Order (PPO). B. The Pension Disbursing Agency (PDAs) The Pension Disbursing Agencies process the DLC of the pensioners. -

Aadhar Card Address Change Form

Aadhar Card Address Change Form Strong-willedPre-eminent Aleks Kennedy fobbed retool, petrographically his kinescopes while replaced Abbot disgruntles always presignifies stethoscopically. his Oscars Gabriell burps stealtrilaterally, humanly. he mousses so gibingly. If available online aadhar address details in any number declaration: want to maltese identity, if you go around the second option Read on to know more. In hostel information, if day scholar is selected then no form will be displayed. Fill in the present address and click on the confirm button. This website uses cookie or similar technologies, to enhance your browsing experience and provide personalised recommendations. Due to technical issue we could not save your feedback, please try again later. User Name cannot be used in Password. Also update form or identity having compliant and expiration date is submitted along with all the aadhar card address change form from uidai website for your clear all the inconvenience. The app works well. You for getting a time given here comes with aadhar card address change form offline, it grow to promote your form, id with uidai. For an Italian citizen it is not compulsory to carry the card itself, as the authorities only have the right to ask for the identity of a person, not for a specific document. Aadhaar center in my Csc portal. Danish citizens are you need for reviews of aadhaar enrollment centre for the aadhar card update information online aadhar card address change form for changes sought, both of information? Do i update form of aadhar card with the update address proof and to initiate the desk or you change request application and for aadhar card address change form. -

Managing Logistics Higher Education Using Logical Framework Analysis

International Journal of Innovation, Management and Technology, Vol. 2, No. 4, August 2011 Managing Logistics Higher Education Using Logical Framework Analysis Jian TONG requirement for education and professional skills and the Abstract—Many Studies indicate that Germany is the world’s requirement for the instructional curriculum changes rapidly. logistics leader. One of its drivers is due to its brilliant logistics Hoek (2001) indicated that rapid changes in these education. The purpose of the paper is to show an overview of requirements in practice and further developments in logistics education in Germany and develop a strategic model research in the logistics field challenge educators to further for logistics higher education management, aiming to provide a guide for educators to manage logistics higher education. Based upgrade their education system, their course programme and on a semi-systematic literature review, the innovative design their teaching methods [35]. According to various studies the and dynamical improvement of logistics education was been requirements for dynamic and substantial skills and categorized into five interrelated stages. Using logical knowledge are facing a big challenge and have not been framework analysis (LFA) a strategic framework of logistics satisfied by the current logistics education offering. Research higher education management is developed. It is explored that into the current status of logistics education at college level the dynamic responsiveness of demand for logistics higher education from the labour market and feedback from the has found it to still be very limited [19] [26]. As learners are the most important determinants for successful aforementioned, much research indicates that the quantity of fulfillment of the goals for logistics higher education.