Final Thesis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BUY RH Petrogas

Resources | 6 January 2011 BUY RH Petrogas Initiating Coverage A powerhouse in the making Analyst We initiate coverage on RH Petrogas (RHP) with a BUY recommendation and Rohan Suppiah target price of $1.35/share, which is based on a conservative sum‐of‐the‐parts [email protected] (65) 6432 1455 valuation of its oilfield assets. RHP is the Rimbunan Hijau Group’s vehicle for its ambitions into the energy sector. Formerly an electronics company called Tri‐M, it has been transformed by the injection of Chinese oilfield assets, the acquisition of Orchard Energy from Temasek Holdings, and a subsequent Price $0.745 oilfield purchase in West Papua, Indonesia. We expect RHP to cement its place Target $1.35 as a major player in the regional upstream energy sector. ST Index 3,254.25 China oilfield acquistion kick‐started transformation RHP acquired Kingworld Resources (KRL) in 2008 for $110m from within the Historical Chart private holdings of the Tiong family. KRL’s primary asset is an oilfield concession in Northeast China. We conservatively estimate that this concession alone is Price ($) Vol ('000) 0.90 2,000 worth a minimum of $625m, or $1.29/share, and potentially worth several 0.80 1,500 multiples over this base value. 0.70 1,000 0.60 Enter the heavy hitters 500 0.50 In 2010, Orchard Energy along with its West Belida concession was acquired 0.40 0 from Temasek Holdings. The real jewel in the crown from this deal is the 10 10 10 10 10 10 10 11 10 10 10 10 10 10 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Jul Oct Jan Jun Apr Jan ‐ Dec Nov Sep Aug Feb ‐ Mar Mar ‐ ‐ May ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ inheritance of Orchard Energy’s capable management team, led by industry ‐ 20 12 04 22 27 05 07 09 14 17 02 30 02 25 veteran Dr Tony Tan. -

Situation Analysis Report

MAD3003 FINAL YEAR PROJECT 1 SITUATION ANALYSIS REPORT NAME : CHEE WAI YAEN STUDENT ID : 1142700928 MAJOR : ADVERTISING DESIGN LECTURERS : MDM ROSNANI BINTI ABDUL RAHMAN MR. FAUZAN BIN MUSTAFFA 1 Chapter 1 Introduction 2 Chapter 1: Introduction 1.1 Introduction Islamic Arts Museum Malaysia officially opened on 12 December 1998. The museum is a 30,000 square metre building which is located amid the leafy environment of central Kuala Lumpur’s Lake Gardens. It is the largest Islamic arts museum in Southeast Asia. The IAMM consists of 12 galleries and houses more than ten thousand artefacts. The museum puts emphasis of Islamic works from Asia instead of Persian and Middle Eastern countries. China and Southeast Asia are well represented. Islamic Arts Museum Malaysia was founded by Syed Mohamad Albukhary and his brother, Syed Mokhtar Albukhary, the chairman of the Albukhary Foundation, helped to build and develop the museum. The former Prime Minister, Tun Dato’ Seri Dr Mahathir bin Mohamad, suggested to hire craftsman from Uzbekistan and Iran, who are well known in the Islamic world for their rich artistic heritage and continued practice of traditional crafts. Forty skilled craftsmen from both countries came down to produce the museum building. Islamic Arts Museum Malaysia became the custodians of the Islamic Centre (JAKIM) which was entrusted to them by the Malaysian Government at the official launch of the museum. The museum opens every day from 10am to 6pm while the museum restaurant opens on Tuesdays to Sundays from 10am to 6pm. 3 1.2 Problem Statement and Issues People are not aware of the fact that Islamic arts exists in the Islamic world as the perception of Islam is negative most of the time. -

Iproperty Group Limited ABN 99 126 188 538 Appendix 4E Preliminary Financial Report

iProperty Group Limited ABN 99 126 188 538 Appendix 4E Preliminary Financial Report “Results for announcement to the Market.” Information for the year ended 31 December 2014 given to ASX under listing rule 4.3A Key iProperty Group information 2014 2013 Year ended 31 December $000 $000 Change Revenues from ordinary operations 21,836 19,046 15% Profit/(Loss) from ordinary activities after tax attributable to members (10,731) 1,706 (729%) Profit/(Loss) after tax attributable to members (10,731) 1,706 (729%) Cents Cents Profit/(Loss) per Share (basic) (5.91) 0.94 (729%) Profit/(Loss) per Share (diluted) (5.90) 0.94 (728%) NTA per Share 4.58 5.52 (19%) Dividends iProperty Group Limited does not propose to pay a dividend for this reporting period (2013: nil). Basis of this report This report includes the attached audited financial statements of iProperty Group Limited and controlled entities (iProperty) for the year ended 31 December 2014. Together these documents contain all information required by Appendix 4E of the Australian Securities Exchange Listing Rules. It should be read in conjunction with iProperty’s Annual Report when released, and is lodged with the Australian Securities Exchange under listing rule 4.3A. For and on behalf of the Board Patrick Grove Chairman 19 February 2015 iProperty Group Limited And Controlled Entities iProperty Group Limited ABN 99 126 188 538 Audited Financial Statements for the financial year ended 31 December 2014 iProperty Group Limited And Controlled Entities Index Contents Page Directors’ Report 2 Auditor’s -

New Albukhary Foundation Gallery of the Islamic World to Open 18 October 2018

Press release New Albukhary Foundation Gallery of the Islamic World to open 18 October 2018 The Albukhary Foundation Gallery of the Islamic World opens to the public on 18 October 2018. A major re-display of the British Museum’s world-class Islamic collection, the new gallery will be a comprehensive presentation of the Islamic world through art and material culture. Situated within a new suite of rooms at the heart of the Museum, it will underscore global connections across a vast region of the world from West Africa to Southeast Asia and reflect links between the ancient and medieval as well as the modern worlds. Islam has played a significant role in great civilisations as a faith, political system and culture. The new gallery will feature objects that give an overview of cultural exchange in an area stretching from Nigeria to Indonesia and from the 7th century to the present day. From cooking pots to golden vessels, and from 20th-century dress to contemporary art, the objects displayed will demonstrate the extraordinary richness of global encounters. The place and role of other faiths and communities including Christians, Jews and Hindus - will be reflected throughout the gallery, showing their significant contributions to the social, economic and cultural life of the Islamic world. The British Museum’s collection of Islamic material uniquely represents the finest artworks alongside objects of daily lifesuch as modern games and musical instruments. The collection includes archaeology, decorative arts, arts of the book, shadow puppets, textiles and contemporary art. The creation of the Albukhary Foundation Gallery provides an extraordinary opportunity to display these objects in new ways that showcase the peoples and cultures of the Islamic world, as well as the ideas, technologies and interactions that inspired their visual culture. -

Icar Asia Limited and Controlled Entities ACN 157 710 846

iCarAsiaLimited ACN157710846 Appendix4E RESULTSFORANNOUNCEMENTTOTHEMARKET Fortheyearended31December2014 Dec14 Dec13 12monthsended $000 $000 Change Revenuesfromordinaryoperations 2,814 1,446 95% Lossfromordinaryactivitiesaftertaxattributabletomembers (16,700) (6,902) (142%) Lossaftertaxattributabletomembers (16,700) (6,902) (142%) Cents Cents LossperShare(basic&diluted) (8.64) (4.10) (111%) NTAperShare 5.34 5.94 (10%) Dividends Nodividendshavebeenpaidordeclaredin2014(2013:nil).Thereisnodividendreinvestmentplanin operation. Basisofthisreport ThisreportincludestheattachedauditedfinancialstatementsofiCarAsiaLimitedanditscontrolledentities fortheperiodended31December2014.Togetherthesedocumentscontainalltheinformationrequiredby Appendix4EoftheAustralianSecuritiesExchangeListingRules.ItshouldbereadinconjunctionwithiCarAsia Limited’sAnnualReportwhenreleasedandislodgedwiththeAustralianSecuritiesExchangeunderlistingrule 4.3A. ForandonbehalfoftheBoard For personal use only PatrickGrove Chairman 25thFebruary2015 iiCar Asia Limited and Controlled Entities ACN 157 710 846 Annual Report for the financial year ending 31 December 2014 For personal use only Annual Report Year Ending 31 December 2014 ICAR ASIA LIMITED (ICQ) / ACN 157 710 846 Directors’ Report 1 Auditor’s Independence Declaration 19 Statement of Comprehensive Income 20 Statement of Financial Position 21 Statement of Changes in Equity 22 Statement of Cash Flows 23 Notes to Financial Statements 24 Directors’ Declaration 60 InDependent AuDit Report 61 Corporate Governance 63 -

Evaluation of the Islamic World Gallery at the British Museum

Evaluation of the Islamic World Gallery at the British Museum An Interactive Qualifying Project Report submitted to the Faculty of the WORCESTER POLYTECHNIC INSTITUTE in partial fulfillment of the requirements for the Degree of Bachelor of Science BY: Dian Chen Yang Gao Anna Mederer Meadow Wicke DATE: 20 June 2019 SUBMITTED TO: Professor Joel Brattin, Advisor Professor Seth Tuler, Advisor Stuart Frost, Sponsor This report represents the work of four WPI undergraduate students submitted to the faculty as evidence of a degree requirement. WPI routinely publishes these reports on its website without editorial or peer review. For more information about the projects program at WPI, see http://www.wpi.edu/Academics/Projects Abstract The goal of our project was to assess how visitors engaged with the Albukhary Foundation Gallery of the Islamic World in the British Museum. The Albukhary Gallery replaced the John Addis Gallery, which presented a narrow view of Islamic culture and attracted few visitors according to previous evaluations. We conducted counting, timing, tracing, and surveying to measure visitor engagement in the new gallery and provide a benchmark for future evaluations. From the heat and trace maps we generated, the newly displayed objects (instruments, clothes, and works on paper) presented high attracting and holding power. We recommended that the British Museum provide detailed descriptions and translations for objects, integrate audio clips for displayed instruments, and make family labels obvious. i Executive Summary The mission of the British Museum is to “inspire and excite visitors … through well- presented and serviced public galleries and study collections” (“Report and accounts,” 2003). -

Northern New South Wales Gas Company to List On

ACN 165 522 887 ASX CODE: IBY ASX ANNOUNCEMENT 13 August 2014 IBUY GROUP COO, KRIS MARSZALEK PROMOTED TO CEO August 13, 2014 – Leading Asian e-Commerce company, iBuy Group Ltd (ASX: IBY), today announced that Krzysztof Marszalek (“Kris”), has been promoted from the Company’s Chief Operating Officer to Chief Executive Officer. Kris will replace outgoing CEO, Patrick Linden, who will leave the company to pursue new opportunities. “As the business expands in complexity and enters a new phase of growth, Kris’s tremendous experience, entrepreneurial energy, passion and drive, make him the perfect candidate to lead iBuy through a period of transformation and consolidation. His contribution whilst COO of the Company made it abundantly clear to the Board that he is the best person to head up the business. We thank Patrick Linden for his excellent service and work in bringing the companies together. We look forward to the next phase of the business under Kris’s guidance and are excited he has chosen to take leadership of the company as it moves to the next level,” said Patrick Grove, Chairman of iBuy Group. Kris said, “The iBuy businesses have extraordinary potential and I am more than excited to be charged with driving the business now and in the future. Our markets offer a once in a lifetime possibility to create an incredible e-Commerce business and I am ready to lead this team to execute on all the opportunities ahead of us. " Prior to co-founding iBuy Group in 2013, Kris has had an outstanding record of achievement as an entrepreneur. -

ANNUAL REPORT Annual Report for the Financial Year Ended 31 December 2014

2014 ANNUAL REPORT Annual Report for the financial year ended 31 December 2014 iProperty Group Limited ABN 99 126 188 538 0 iProperty Group Limited And Controlled Entities Table of Contents Table of Contents Highlights 2 Message from the Chairman 3 CEO’s Review of Operations 4 Financial Report Directors’ Report 6 Corporate Governance Statement 18 Auditor’s Independence Declaration 27 Financial Statement: . Directors’ Declaration 28 . Consolidated Statement of Comprehensive Income 30 . Consolidated Statement of Financial Position 31 . Consolidated Statement of Cash Flows 32 . Consolidated Statement of Changes in Equity 33 . Notes to the Financial Statements 34 Independent Auditor’s Report 59 Additional Investor Information 61 Corporate Directory 62 2014 Financial Report This 2014 Financial Report is a summary of our activities and financial position. Reference in this Report to a “year” is to the financial period ended 31 December 2014 unless otherwise stated. All figures are expressed in Australian current unless otherwise stated. Revenues and expenses are recognised net of the amount of Goods and Services Tax. 1 iProperty Group Limited And Controlled Entities Key Highlights Key Highlights Key highlights for the iProperty Group Limited for 2014 include: Growth of 15% in total income to $21.8m Operating expenditure growing only at 1% EBITDA improved from a loss of $2.9m (2013) to a loss of $0.4m (2014) due to start up losses in the transaction business Record 4Q14 billings of $7.9m provides strong platform for 2015 Entry into -

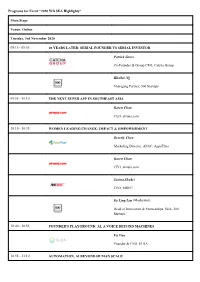

Programs for Event "2020 WD SEA Highlights" Main Stage Venue

Programs for Event "2020 WD SEA Highlights" Main Stage Venue: Online Tuesday, 3rd November 2020 09:15 - 09:55 10 YEARS LATER: SERIAL FOUNDER VS SERIAL INVESTOR Patrick Grove Co-Founder & Group CEO, Catcha Group Khailee Ng Managing Partner, 500 Startups 09:55 - 10:10 THE NEXT SUPER APP IN SOUTHEAST ASIA Karen Chan CEO, airasia.com 10:10 - 10:35 WOMEN LEADING CHANGE: IMPACT & EMPOWERMENT Beverly Chen Marketing Director, APAC, AppsFlyer Karen Chan CEO, airasia.com Surina Shukri CEO, MDEC Ee Ling Lim (Moderator) Head of Innovation & Partnerships, SEA, 500 Startups 10:40 - 10:55 FOUNDER'S PLAYGROUND: AI, A VOICE BEYOND MACHINES Vu Van Founder & CEO, ELSA 10:55 - 11:10 AUTOMATION, AI BEYOND HUMAN SCALE Main Stage Venue: Online Tuesday, 3rd November 2020 Malina Platon Managing Director, Strategic Accounts, APAC, UiPath FROM THE PHILIPPINES TO THE WORLD: STARTUPS & INVESTORS' GROWTH 11:10 - 11:30 PERSPECTIVES Minette B. Navarrete Co-Founder & President, Kickstart Ventures J.P. Ellis Co-Founder & Chief Executive, C88 Financial Technologies Rexy Dorado (Moderator) Co-Founder & President, Kumu TOP FUNDRAISING TECHNIQUES - HOW TO WIN THE HEARTS & MINDS OF 11:30 - 11:45 INVESTORS Bill Reichert Partner, Pegasus Tech Ventures 11:45 - 12:00 SOUTHEAST ASIA – WHAT IS BEYOND 2020? Dave Ng General Partner, Altara Ventures 12:05 - 12:30 ECOMMERCE IN SEA RIDES HIGH ON PANDEMIC BOOM Giulio Xiloyannis Chief Commercial Officer, ZALORA Casey Liang Co-Founder, Pomelo Fashion Main Stage Venue: Online Tuesday, 3rd November 2020 Joel Leong Co-Founder, ShopBack Ganesh -

Class and Politics in Malaysian and Singaporean Nation Building

CLASS AND POLITICS IN MALAYSIAN AND SINGAPOREAN NATION BUILDING Muhamad Nadzri Mohamed Noor, M.A. Political Science College of Business, Government and Law Flinders University Submitted in fulfillment of the requirements for the degree of Doctor of Philosophy August 2017 Page Left Deliberately Blank. Abstract This study endeavours to deliver an alternative account of the study of nation-building by examining the subject matter eclectically from diverse standpoints, predominantly that of class in Southeast Asia which is profoundly dominated by ‘cultural’ perspectives. Two states in the region, Malaysia and Singapore, have been selected to comprehend and appreciate the nature of nation-building in these territories. The nation-building processes in both of the countries have not only revolved around the national question pertaining to the dynamic relations between the states and the cultural contents of the racial or ethnic communities in Malaysia and Singapore; it is also surrounded, as this thesis contends, by the question of class - particularly the relations between the new capitalist states’ elites (the rulers) and their masses (the ruled). More distinctively this thesis perceives nation-building as a project by political elites for a variety of purposes, including elite entrenchment, class (re)production and regime perpetuation. The project has more to do with ‘class-(re)building’ and ‘subject- building’ rather than ‘nation-building’. Although this thesis does not eliminate the significance of culture in the nation-building process in both countries; it is explicated that cultures were and are heavily employed to suit the ruling class’s purpose. Hence, the cultural dimension shall be used eclectically with other perspectives. -

Annual Report

Malaysia Mining Corporation Berhad (30245-H) 2004 annual report Two tunnel boring machines, each almost the length of a football field, will bore 9.7 km under Kuala Lumpur city to create a stormwater tunnel that will divert flood water away from and bypass the city centre. Imaginative ideas and advanced technologies are employed to overcome some of our toughest problems. 01 cover rationale continuous momentum We have focused on consolidating our operations and growing our core businesses. From here on, we will continue the momentum to position the Group for future growth. 02 contents corporate 3 > 36 compliance and voluntary reports 37 > 58 financials 59 > 151 others 152 > 164 19 37 59 11 development growth opportunities performance 3 corporate information 55 additional compliance 4 5-year financial highlights information 5 profile of directors 56 corporate social responsibility report 13 management team 58 shared services report 15 chairman’s letter to stakeholders 59 financial statements 21 management’s discussion 152 shareholding statistics & analysis (MD&A) 155 list of properties 35 highlights of the year 161 notice of annual 39 audit committee report general meeting 43 statement on corporate governance 163 statement accompanying 49 internal control statement notice of annual general meeting 53 risk management report proxy form 03 corporate information Board of directors Dato’ Wira Syed Abdul Jabbar bin Syed Hassan Dato’ Ismail Shahudin Tan Sri Dato’ Thong Yaw Hong Tan Sri Dato’ Dr. Secretaries Abdul Khalid Sahan Elina Mohamed Tan Sri Dato’ Ir. (Dr.) Wan Abdul Muhammad Firdaus Abdullah Rahman bin Haji Wan Yaacob Registered office Dato’ Hilmi bin Mohd. -

Norma Md SAAD1, Saim KAYADIBI2, and Zarinah HAMID3

Türkiye İslam İktisadı Dergisi, Cilt 4, Sayı 1, Şubat 2017, ss. 1-29 Turkish Journal of Islamic Economics, Vol. 4, No. 1, February 2017, pp. 1-29 THE CONTRIBUTION OF W AQF INSTITUTIONS IN MALAYSIA AND TURKEY IN IMPROVING THE SOCIO-ECONOMIC CONDITIONS OF THE SOCIETY Norma Md SAAD1, Saim KAYADIBI2, and Zarinah HAMID3 Abstract It has been widely acknowledged that waqf institutions play an important role in the socio-economic development of the Muslim Ummah in the Islamic history. This paper elaborates the contribution of selected waqaf entities in Turkey and Malaysia in improving the socio-economic conditions of the society. The waqaf entities involved in this study include two corporate waqaf institutions from Malaysia, namely Al-Bukhary Foundation and Kumpulan Waqaf An-Nur Berhad; and four waqaf entities in Turkey, namely, IHH Foundation, Diyanet Foundation, Hakyol Foundation, and TIMAV. This study discusses the projects and programs undertaken by these selected waqf entities to achieve their respective objectives. Such a comparison is important considering the diverse experiences of these selected waqaf entities in view of the differences in their endowments and different corporate management models. The paper investigates whether these waqaf entities have implemented a novel approach in developing waqf programs and experimenting new ways of new reaching out to the beneficiaries. Keywords: Waqf, Best Practice, Management Model, Malaysia, Turkey MALEZYA VE TÜRKİYE’DEKİ VAKIFLARIN TOPLUMUN SOSYO- EKONOMİK KOŞULLARINA YAPTIĞI KATKILAR Özet İslam tarihinde vakıf kurumlarının müslüman ümmetinin sosyo-ekonomik gelişiminde önemli bir rol oynadığı yaygın olarak kabul edilmektedir. Bu makale, Türkiye ve Malezya’daki seçilmiş vakıf kurumlarının toplumun sosyo-ekonomik koşullarına yaptığı katkıları incelemektedir.