Annual Report & Appendix 4E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Joint Bid Relief

13 August 2021 Carsome and Catcha obtain ASIC joint bid relief iCar Asia Limited (“iCar” or the “Company”) refers to its announcements dated 13, 20 and 29 July 2021 (the “Prior Announcements”) regarding the conditional, non-binding indicative proposal from Carsome Group Pte. Ltd (“Carsome”) to acquire all of the ordinary shares of iCar that Carsome and its associates do not already own for A$0.55 cash per share by way of a scheme of arrangement (the “Proposal”). iCar advises that Carsome and Catcha have now obtained joint bid relief from ASIC in respect of: the Sale Agreement, under which Carsome will acquire 89,456,448 shares (representing no more than 19.9% of iCar’s shares on issue as at the time of completion of the Sale Agreement) from Catcha in exchange for the issue of Carsome shares; and the Joint Bid Agreement under which Carsome and Catcha will co-operate with respect to the potential transaction including in respect of Carsome acquiring Catcha’s remaining shareholding in iCar. Under the terms of the joint bid relief instrument, Carsome and Catcha have agreed to customary ‘match or accept’ provisions. A copy of the instrument is attached. The acquisition of the iCar shares under the Sale Agreement and the Joint Bid Agreement were conditional on Carsome and Catcha obtaining joint bid relief. The acquisition of the remaining iCar shares under the Joint Bid Agreement is also conditional on the scheme of arrangement becoming effective. iCar understand that Carsome has not yet completed any acquisition of iCar shares from Catcha under the Sale Agreement. -

Common Ground Enters Co-Working Game, and Why

64 THEEDGE MMALAYSIAALAYSIA | MARCH 13, 2017 MALAYSIA venture MOHD IZWAN MOHD NAZAM/THE EDGE caption: xxx Common Ground co-founders Teo Common Ground enters (left) and Erman Akinci plan to expand in Malaysia co-working game, and and Southeast Asia why developers are very quickly watching this closely BY CHUA SUE-ANN do work and make money. and networking while they carry on “I think that is the secret sauce their day-to-day business. o-working spaces are that people have to find in co-work- “If you are not building that com- nothing new but Com- ing. You need both elements: com- munity, then what are you? You are mon Ground, Malaysia’s munity and privacy.” a commodity. You are just a desk and newest entrant to this The key thing that sets Common internet connection, which can be C business, is shaping up Ground apart from other players found at cafés, at home or renting to be a game changer for — like The Co, Worq and the many out a shop lot somewhere.” KEY FACTS tenants and landlords alike. other operators in town — is its size In its first week, Common Ground • Common Ground’s co-founders Fitness First gym memberships and Common Ground launched its and ambition. has already secured leases for 35% of include Juhn Teo, who was formerly tax advice and financial health checks first location on March 1, occupying At 17,000 sq ft, Common Ground its space, beating its own internal CEO of Tower Real Estate Investment by Baker Tilly the prized double-storey penthouse is likely the largest co-working projections, he adds. -

Asian Technology Newsletter

Issue 90, March 2017 Asian Technology Newsletter A S I A N TECHNOLOGY NEWSLETTER MARCH 2017 , I S S U E 90 We hope that you find the Asian Technology Newsletter informative. BDA Partners is an investment banking firm specializing in executing cross-border transactions involving Asia, including acquisitions, divestments, JVs, capital raising and restructuring. We have offices and professional staff throughout Asia, the Middle East, Europe, and the US. If you would like to learn more about how BDA is positioned to help your business grow through acquisitions, or to achieve maximum value in a divestment or fund raising exercise, please contact us at any one of our offices. Jeff Acton Matthew Doull Managing Director, Managing Director, Head of Technology Head of Internet and Digital Media [email protected] [email protected] CONTENTS Market Update 2 Deal Digest – Recent Tech Deals Across Asia China 4 Hong Kong 5 India 5 Japan 6 Singapore 7 Vietnam 7 1 | P a g e A S I A N TECHNOLOGY NEWSLETTER MARCH 2017 , I S S U E 90 50 40 30 20 10 0 -10 -20 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 India Europe China US Japan Korea Global technology indicies have traded 12% higher, on average, in the first quarter of 2017. Growth has primarily come from a global post-US election rally, favorable opening week for Snap, Inc., and a cheap money environment. Over the past twelve months, technology- focused stocks have all traded positively with the Chinese technology companies leading the way. -

Iproperty Group Limited ABN 99 126 188 538 Appendix 4E Preliminary Financial Report

iProperty Group Limited ABN 99 126 188 538 Appendix 4E Preliminary Financial Report “Results for announcement to the Market.” Information for the year ended 31 December 2014 given to ASX under listing rule 4.3A Key iProperty Group information 2014 2013 Year ended 31 December $000 $000 Change Revenues from ordinary operations 21,836 19,046 15% Profit/(Loss) from ordinary activities after tax attributable to members (10,731) 1,706 (729%) Profit/(Loss) after tax attributable to members (10,731) 1,706 (729%) Cents Cents Profit/(Loss) per Share (basic) (5.91) 0.94 (729%) Profit/(Loss) per Share (diluted) (5.90) 0.94 (728%) NTA per Share 4.58 5.52 (19%) Dividends iProperty Group Limited does not propose to pay a dividend for this reporting period (2013: nil). Basis of this report This report includes the attached audited financial statements of iProperty Group Limited and controlled entities (iProperty) for the year ended 31 December 2014. Together these documents contain all information required by Appendix 4E of the Australian Securities Exchange Listing Rules. It should be read in conjunction with iProperty’s Annual Report when released, and is lodged with the Australian Securities Exchange under listing rule 4.3A. For and on behalf of the Board Patrick Grove Chairman 19 February 2015 iProperty Group Limited And Controlled Entities iProperty Group Limited ABN 99 126 188 538 Audited Financial Statements for the financial year ended 31 December 2014 iProperty Group Limited And Controlled Entities Index Contents Page Directors’ Report 2 Auditor’s -

ASX ANNOUNCEMENT ASX CODE: ICQ 15 November 2017

ASX ANNOUNCEMENT ASX CODE: ICQ 15 November 2017 $10.0 Million Underwritten Non-Renounceable Rights Issue and $5.0 Million Loan Facility Overview 1 for 5.8 non-renounceable Rights Issue to raise approximately $10.0 million at an issue price of $0.18 per share Eligible shareholders to receive 1 attaching unlisted option for each new share subscribed under the Rights Issue, exercisable at $0.20 until an expiry date of 18 months from the date of issue Right Issue fully underwritten by Bell Potter Securities Limited Funds from the Rights Issue to be used to accelerate the growth of the Company by investing in marketing, business development and technology $5.0 million secured loan facility provided by Catcha Group Pte Ltd to be used for working capital purposes if and when required and which may be drawn down subject to a related issue of options to Catcha Group Pte Ltd which is subject to shareholder approval iCar Asia Limited (‘iCar Asia’ or the ‘Company’) is pleased to announce a 1 for 5.8 non-renounceable rights issue of fully paid ordinary shares (New Shares) in the Company to Eligible Shareholders (Offer) at $0.18 per New Share (Offer Price) to raise approximately $10.0 million before transaction costs. Eligible Shareholders who subscribe to the Offer will also receive 1 attaching unlisted option for every New Share subscribed for, exercisable at $0.20 until an expiry date of 18 months from the date of issue. The Offer is to be fully underwritten by Bell Potter Securities Limited who is acting as Lead Manager and Underwriter to the Offer. -

Icar Asia Limited and Controlled Entities ACN 157 710 846

iCarAsiaLimited ACN157710846 Appendix4E RESULTSFORANNOUNCEMENTTOTHEMARKET Fortheyearended31December2014 Dec14 Dec13 12monthsended $000 $000 Change Revenuesfromordinaryoperations 2,814 1,446 95% Lossfromordinaryactivitiesaftertaxattributabletomembers (16,700) (6,902) (142%) Lossaftertaxattributabletomembers (16,700) (6,902) (142%) Cents Cents LossperShare(basic&diluted) (8.64) (4.10) (111%) NTAperShare 5.34 5.94 (10%) Dividends Nodividendshavebeenpaidordeclaredin2014(2013:nil).Thereisnodividendreinvestmentplanin operation. Basisofthisreport ThisreportincludestheattachedauditedfinancialstatementsofiCarAsiaLimitedanditscontrolledentities fortheperiodended31December2014.Togetherthesedocumentscontainalltheinformationrequiredby Appendix4EoftheAustralianSecuritiesExchangeListingRules.ItshouldbereadinconjunctionwithiCarAsia Limited’sAnnualReportwhenreleasedandislodgedwiththeAustralianSecuritiesExchangeunderlistingrule 4.3A. ForandonbehalfoftheBoard For personal use only PatrickGrove Chairman 25thFebruary2015 iiCar Asia Limited and Controlled Entities ACN 157 710 846 Annual Report for the financial year ending 31 December 2014 For personal use only Annual Report Year Ending 31 December 2014 ICAR ASIA LIMITED (ICQ) / ACN 157 710 846 Directors’ Report 1 Auditor’s Independence Declaration 19 Statement of Comprehensive Income 20 Statement of Financial Position 21 Statement of Changes in Equity 22 Statement of Cash Flows 23 Notes to Financial Statements 24 Directors’ Declaration 60 InDependent AuDit Report 61 Corporate Governance 63 -

Northern New South Wales Gas Company to List On

ACN 165 522 887 ASX CODE: IBY ASX ANNOUNCEMENT 13 August 2014 IBUY GROUP COO, KRIS MARSZALEK PROMOTED TO CEO August 13, 2014 – Leading Asian e-Commerce company, iBuy Group Ltd (ASX: IBY), today announced that Krzysztof Marszalek (“Kris”), has been promoted from the Company’s Chief Operating Officer to Chief Executive Officer. Kris will replace outgoing CEO, Patrick Linden, who will leave the company to pursue new opportunities. “As the business expands in complexity and enters a new phase of growth, Kris’s tremendous experience, entrepreneurial energy, passion and drive, make him the perfect candidate to lead iBuy through a period of transformation and consolidation. His contribution whilst COO of the Company made it abundantly clear to the Board that he is the best person to head up the business. We thank Patrick Linden for his excellent service and work in bringing the companies together. We look forward to the next phase of the business under Kris’s guidance and are excited he has chosen to take leadership of the company as it moves to the next level,” said Patrick Grove, Chairman of iBuy Group. Kris said, “The iBuy businesses have extraordinary potential and I am more than excited to be charged with driving the business now and in the future. Our markets offer a once in a lifetime possibility to create an incredible e-Commerce business and I am ready to lead this team to execute on all the opportunities ahead of us. " Prior to co-founding iBuy Group in 2013, Kris has had an outstanding record of achievement as an entrepreneur. -

ANNUAL REPORT Annual Report for the Financial Year Ended 31 December 2014

2014 ANNUAL REPORT Annual Report for the financial year ended 31 December 2014 iProperty Group Limited ABN 99 126 188 538 0 iProperty Group Limited And Controlled Entities Table of Contents Table of Contents Highlights 2 Message from the Chairman 3 CEO’s Review of Operations 4 Financial Report Directors’ Report 6 Corporate Governance Statement 18 Auditor’s Independence Declaration 27 Financial Statement: . Directors’ Declaration 28 . Consolidated Statement of Comprehensive Income 30 . Consolidated Statement of Financial Position 31 . Consolidated Statement of Cash Flows 32 . Consolidated Statement of Changes in Equity 33 . Notes to the Financial Statements 34 Independent Auditor’s Report 59 Additional Investor Information 61 Corporate Directory 62 2014 Financial Report This 2014 Financial Report is a summary of our activities and financial position. Reference in this Report to a “year” is to the financial period ended 31 December 2014 unless otherwise stated. All figures are expressed in Australian current unless otherwise stated. Revenues and expenses are recognised net of the amount of Goods and Services Tax. 1 iProperty Group Limited And Controlled Entities Key Highlights Key Highlights Key highlights for the iProperty Group Limited for 2014 include: Growth of 15% in total income to $21.8m Operating expenditure growing only at 1% EBITDA improved from a loss of $2.9m (2013) to a loss of $0.4m (2014) due to start up losses in the transaction business Record 4Q14 billings of $7.9m provides strong platform for 2015 Entry into -

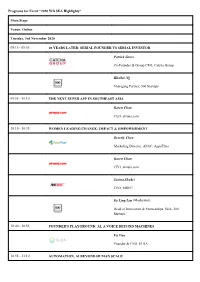

Programs for Event "2020 WD SEA Highlights" Main Stage Venue

Programs for Event "2020 WD SEA Highlights" Main Stage Venue: Online Tuesday, 3rd November 2020 09:15 - 09:55 10 YEARS LATER: SERIAL FOUNDER VS SERIAL INVESTOR Patrick Grove Co-Founder & Group CEO, Catcha Group Khailee Ng Managing Partner, 500 Startups 09:55 - 10:10 THE NEXT SUPER APP IN SOUTHEAST ASIA Karen Chan CEO, airasia.com 10:10 - 10:35 WOMEN LEADING CHANGE: IMPACT & EMPOWERMENT Beverly Chen Marketing Director, APAC, AppsFlyer Karen Chan CEO, airasia.com Surina Shukri CEO, MDEC Ee Ling Lim (Moderator) Head of Innovation & Partnerships, SEA, 500 Startups 10:40 - 10:55 FOUNDER'S PLAYGROUND: AI, A VOICE BEYOND MACHINES Vu Van Founder & CEO, ELSA 10:55 - 11:10 AUTOMATION, AI BEYOND HUMAN SCALE Main Stage Venue: Online Tuesday, 3rd November 2020 Malina Platon Managing Director, Strategic Accounts, APAC, UiPath FROM THE PHILIPPINES TO THE WORLD: STARTUPS & INVESTORS' GROWTH 11:10 - 11:30 PERSPECTIVES Minette B. Navarrete Co-Founder & President, Kickstart Ventures J.P. Ellis Co-Founder & Chief Executive, C88 Financial Technologies Rexy Dorado (Moderator) Co-Founder & President, Kumu TOP FUNDRAISING TECHNIQUES - HOW TO WIN THE HEARTS & MINDS OF 11:30 - 11:45 INVESTORS Bill Reichert Partner, Pegasus Tech Ventures 11:45 - 12:00 SOUTHEAST ASIA – WHAT IS BEYOND 2020? Dave Ng General Partner, Altara Ventures 12:05 - 12:30 ECOMMERCE IN SEA RIDES HIGH ON PANDEMIC BOOM Giulio Xiloyannis Chief Commercial Officer, ZALORA Casey Liang Co-Founder, Pomelo Fashion Main Stage Venue: Online Tuesday, 3rd November 2020 Joel Leong Co-Founder, ShopBack Ganesh -

Press Release

PRESS RELEASE 18/03/2013 Opt Inc Catcha Digital Asia PTE Opt acquires Catcha Digital Asia Former Apple APAC Head of Online Marketing, Mitsuru Kikunaga to take on CEO role Opt Inc. (“Opt”), Japan’s leading e-marketing company and one of the largest in Asia, today announced that it has acquired Catcha Digital Asia Pte Ltd (CDA), one of Southeast Asia’s leading digital media networks, from Catcha Group Pte Ltd (“Catcha Group”). Former Apple Asia-Pacific Head of Online Marketing, Mitsuru Kikunaga, currently Opt’s Asia-Pacific Business General Manager, will step into the role of CDA CEO. Opt, which has operations in Japan, Korea and China and a head count of 1261 employees, is listed on the Japan Securities Exchange (JASDAQ) and generates revenue of ¥78.9 billion (US$825 million) annually. Its decision to acquire 90 percent of CDA is designed to strengthen its position across Asia and enable CDA to become the one-stop digital solution to meet the requirements of its clients in the ASEAN region, including those of Japanese companies that want to advance into ASEAN’s rapid growth markets. Appointed as CDA’s incoming CEO, Mitsuru Kikunaga, has extensive business experience in the APAC region and is well placed to take advantage of the business opportunities available in this emerging market. Commenting on the move, Kikunaga said, “Opt has determined ASEAN as an important market for Opt’s overseas expansion and will aggressively invest the resources of the company in the region. We are targeting to generate ¥10 billion (US$105 million) in revenue through our overseas businesses by 2020.” As part of this strategy, Opt will be dispatching specialists in performance-based advertising such as Search Engine Marketing (“SEM”) and Display Advertising to South-East Asia; both are fields in which Opt is a Japan market-leader. -

A Branding Revolutionist

1I SUCCESSFUL BRANDING LESSONS: Jack Ma, Richard Branson & Usain Bolt YUSUF TAIYOOB : The King Of Dates MYDIN : Heartland Retail Empire SAY YES2BRAND : Aspiring for a Better Tomorrow, Today TAN SRI DATO’ SRI LEONG HOY KUM RM15 WM RM18 EM A BRANDING REVOLUTIONIST DECEMBERMAY-JANUARY’ - JUNE’ 1714 #ISSUE4119 II 1 All information herein is correct at time of publication. THE TEAM | The views and opinions expressed or implied in The BrandLaureate Business World Review ADVISOR are those of the authors and contributors and do not necessarily Dr KKJohan reflect those of The BrandLaureate, its editorial & staff. All editorial content and materials are copyright of PUBLISHER/EDITOR-IN-CHIEF THE BRANDLAUREATE BUSINESS WORLD REVIEW Chew Bee Peng No Permit KDN PQ/PP16972/08/2011)(028331) MANAGING EDITOR The BrandLaureate Business World Review is published by Ida Ibrahim THE BRANDLAUREATE SDN BHD (690453K), 39B & 41B, SS21/60, Damansara Utama, 47400 Petaling Jaya. Tel: (603) 7710 0348 Fax: (603) 7710 0350 SENIOR WRITER Ian Gregory Edward Masselamani Printed in Malaysia by PERCETAKAN SKYLINE SDN BHD (PQ 1780/2317) WRITERS 35 & 37, Jalan 12/32B, TSI Business Industrial Park, Batu 6 1/2, Nurilya Anis Rahim Off Jalan Kepong, 52000 Kuala Lumpur, Malaysia. Ain M.C. Gerald Chuah CONTRIBUTORS Anu Venugopal, Tony Thompson, Justin Chew, Sean Tan CREATIVE MANAGER Ibtisam Basri ASSISTANT CREATIVE MANAGER Mohd Shahril Hassan SENIOR GRAPHIC DESIGNER Mohd Zaidi Yusof MULTIMEDIA DESIGNER Zulhelmi Yarabi EDITORIAL ASSISTANTS Kalwant Kaur Lau Swee Ching For suggestions and comments or further enquiries on THE BRANDLAUREATE BUSINESS WORLD REVIEW, please contact [email protected]. “Position Your Brand on a World Class Platform” THE BRANDLAUREATE • BUSINESS WORLD REVIEW MAY - JUNE’ 17 #ISSUE41 2 3 PUBLISHER NOTE | What’s in a name, you may ask? Minister of Canada show that age does not really W Everything if I may say! matter. -

Forbes Asia August 2017.Pdf

200 ‘BEST UNDER A BILLION’: JAPAN JUMPS AUGUST 2017 • WWW.FORBES.COM PLUS 50SINGAPORE’S RICHEST 5-STAR STIR SONIA CHENG IMPORTS ROSEWOOD HOTEL BRAND UNDER WING OF HER HONG KONG CLAN AUSTRALIA...............A $12.00 INDIA............................RS 375 KOREA........................W 9,500 PAKISTAN....................RS 600 TAIWAN......................NT $275 CHINA....................RMB 85.00 INDONESIA............RP 77,000 MALAYSIA...............RM 24.00 PHILIPPINES..................P 260 THAILAND......................B 260 HONG KONG................HK $80 JAPAN.................¥1238 + TAX NEW ZEALAND.......NZ $13.00 SINGAPORE..............S $12.50 UNITED STATES........US $10.00 CONTENTS — AUGUST 2017 VOLUME 13 NUMBER 7 S PAGE 20 10 | FACT & COMMENT // STEVE FORBES “I WAS SHOCKED, Crackdown on North Korea unavoidable now. EVERYBODY WAS SHOCKED.” SINGAPORE’S 50 RICHEST — Sushi King founder 42 | MAYO FOR THE MAINLAND FUMIHIKO KONISHI Loo Choon Yong is taking his Raffles hospital brand to China. on Malaysia’s large appetite BY JANE A. PETERSON for sushi 46 | WHEN THE ‘LOVE’ GOES Choo Chong Ngen woos a different customer to his new inn brands. BY JESSICA TAN 50 | THE LIST Fortunes rise amid a bitter battle in Singapore’s first family. BY NAAZNEEN KARMALI BEST UNDER A BILLION 26 | MAKE IT FLOW Zhang Chunlin gave up a prized state job to hustle for China’s burgeoning water industry. BY JANE HO 29 | LESSONS LEARNED Asset-heavy Indian schooling firms sink after good early marks. BY ANURADHA RAGHUNATHAN 30 | EYEING NEW MARKETS Why China’s largest ophthalmological chain is focusing on the U.S. BY ELLEN SHENG 32 | THE LIST Sales of our top 200 publicly traded Asia-Pacific companies grew an average 55% last year.