Joint Bid Relief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Common Ground Enters Co-Working Game, and Why

64 THEEDGE MMALAYSIAALAYSIA | MARCH 13, 2017 MALAYSIA venture MOHD IZWAN MOHD NAZAM/THE EDGE caption: xxx Common Ground co-founders Teo Common Ground enters (left) and Erman Akinci plan to expand in Malaysia co-working game, and and Southeast Asia why developers are very quickly watching this closely BY CHUA SUE-ANN do work and make money. and networking while they carry on “I think that is the secret sauce their day-to-day business. o-working spaces are that people have to find in co-work- “If you are not building that com- nothing new but Com- ing. You need both elements: com- munity, then what are you? You are mon Ground, Malaysia’s munity and privacy.” a commodity. You are just a desk and newest entrant to this The key thing that sets Common internet connection, which can be C business, is shaping up Ground apart from other players found at cafés, at home or renting to be a game changer for — like The Co, Worq and the many out a shop lot somewhere.” KEY FACTS tenants and landlords alike. other operators in town — is its size In its first week, Common Ground • Common Ground’s co-founders Fitness First gym memberships and Common Ground launched its and ambition. has already secured leases for 35% of include Juhn Teo, who was formerly tax advice and financial health checks first location on March 1, occupying At 17,000 sq ft, Common Ground its space, beating its own internal CEO of Tower Real Estate Investment by Baker Tilly the prized double-storey penthouse is likely the largest co-working projections, he adds. -

Asian Technology Newsletter

Issue 90, March 2017 Asian Technology Newsletter A S I A N TECHNOLOGY NEWSLETTER MARCH 2017 , I S S U E 90 We hope that you find the Asian Technology Newsletter informative. BDA Partners is an investment banking firm specializing in executing cross-border transactions involving Asia, including acquisitions, divestments, JVs, capital raising and restructuring. We have offices and professional staff throughout Asia, the Middle East, Europe, and the US. If you would like to learn more about how BDA is positioned to help your business grow through acquisitions, or to achieve maximum value in a divestment or fund raising exercise, please contact us at any one of our offices. Jeff Acton Matthew Doull Managing Director, Managing Director, Head of Technology Head of Internet and Digital Media [email protected] [email protected] CONTENTS Market Update 2 Deal Digest – Recent Tech Deals Across Asia China 4 Hong Kong 5 India 5 Japan 6 Singapore 7 Vietnam 7 1 | P a g e A S I A N TECHNOLOGY NEWSLETTER MARCH 2017 , I S S U E 90 50 40 30 20 10 0 -10 -20 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 India Europe China US Japan Korea Global technology indicies have traded 12% higher, on average, in the first quarter of 2017. Growth has primarily come from a global post-US election rally, favorable opening week for Snap, Inc., and a cheap money environment. Over the past twelve months, technology- focused stocks have all traded positively with the Chinese technology companies leading the way. -

ASX ANNOUNCEMENT ASX CODE: ICQ 15 November 2017

ASX ANNOUNCEMENT ASX CODE: ICQ 15 November 2017 $10.0 Million Underwritten Non-Renounceable Rights Issue and $5.0 Million Loan Facility Overview 1 for 5.8 non-renounceable Rights Issue to raise approximately $10.0 million at an issue price of $0.18 per share Eligible shareholders to receive 1 attaching unlisted option for each new share subscribed under the Rights Issue, exercisable at $0.20 until an expiry date of 18 months from the date of issue Right Issue fully underwritten by Bell Potter Securities Limited Funds from the Rights Issue to be used to accelerate the growth of the Company by investing in marketing, business development and technology $5.0 million secured loan facility provided by Catcha Group Pte Ltd to be used for working capital purposes if and when required and which may be drawn down subject to a related issue of options to Catcha Group Pte Ltd which is subject to shareholder approval iCar Asia Limited (‘iCar Asia’ or the ‘Company’) is pleased to announce a 1 for 5.8 non-renounceable rights issue of fully paid ordinary shares (New Shares) in the Company to Eligible Shareholders (Offer) at $0.18 per New Share (Offer Price) to raise approximately $10.0 million before transaction costs. Eligible Shareholders who subscribe to the Offer will also receive 1 attaching unlisted option for every New Share subscribed for, exercisable at $0.20 until an expiry date of 18 months from the date of issue. The Offer is to be fully underwritten by Bell Potter Securities Limited who is acting as Lead Manager and Underwriter to the Offer. -

Press Release

PRESS RELEASE 18/03/2013 Opt Inc Catcha Digital Asia PTE Opt acquires Catcha Digital Asia Former Apple APAC Head of Online Marketing, Mitsuru Kikunaga to take on CEO role Opt Inc. (“Opt”), Japan’s leading e-marketing company and one of the largest in Asia, today announced that it has acquired Catcha Digital Asia Pte Ltd (CDA), one of Southeast Asia’s leading digital media networks, from Catcha Group Pte Ltd (“Catcha Group”). Former Apple Asia-Pacific Head of Online Marketing, Mitsuru Kikunaga, currently Opt’s Asia-Pacific Business General Manager, will step into the role of CDA CEO. Opt, which has operations in Japan, Korea and China and a head count of 1261 employees, is listed on the Japan Securities Exchange (JASDAQ) and generates revenue of ¥78.9 billion (US$825 million) annually. Its decision to acquire 90 percent of CDA is designed to strengthen its position across Asia and enable CDA to become the one-stop digital solution to meet the requirements of its clients in the ASEAN region, including those of Japanese companies that want to advance into ASEAN’s rapid growth markets. Appointed as CDA’s incoming CEO, Mitsuru Kikunaga, has extensive business experience in the APAC region and is well placed to take advantage of the business opportunities available in this emerging market. Commenting on the move, Kikunaga said, “Opt has determined ASEAN as an important market for Opt’s overseas expansion and will aggressively invest the resources of the company in the region. We are targeting to generate ¥10 billion (US$105 million) in revenue through our overseas businesses by 2020.” As part of this strategy, Opt will be dispatching specialists in performance-based advertising such as Search Engine Marketing (“SEM”) and Display Advertising to South-East Asia; both are fields in which Opt is a Japan market-leader. -

Annual Report & Appendix 4E

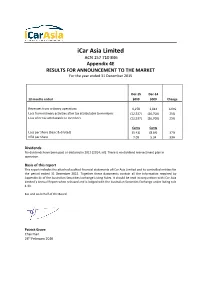

iCar Asia Limited ACN 157 710 846 Appendix 4E RESULTS FOR ANNOUNCEMENT TO THE MARKET For the year ended 31 December 2015 Dec-15 Dec-14 12 months ended $000 $000 Change Revenues from ordinary operations 6,278 2,814 123% Loss from ordinary activities after tax attributable to members (12,537) (16,700) 25% Loss after tax attributable to members (12,537) (16,700) 25% Cents Cents Loss per Share (basic & diluted) (5.43) (8.64) 37% NTA per Share 7.09 5.34 33% Dividends No dividends have been paid or declared in 2015 (2014: nil). There is no dividend reinvestment plan in operation. Basis of this report This report includes the attached audited financial statements of iCar Asia Limited and its controlled entities for the period ended 31 December 2015. Together these documents contain all the information required by Appendix 4E of the Australian Securities Exchange Listing Rules. It should be read in conjunction with iCar Asia Limited’s Annual Report when released and is lodged with the Australian Securities Exchange under listing rule 4.3A. For and on behalf of the Board Patrick Grove Chairman 24th February 2016 iiCar Asia Limited and Controlled Entities ACN 157 710 846 Annual Report for the financial year ended 31 December 2015 Annual Report Year Ended 31 December 2015 ICAR ASIA LIMITED (ICQ) / ACN 157 710 846 Directors’ Report 1 Auditor’s Independence Declaration 21 Statement of Comprehensive Income 22 Statement of Financial Position 23 Statement of Changes in Equity 24 Statement of Cash Flows 25 Notes to the Financial Statements 26 Directors’ Declaration 67 Independent Audit Report 68 Shareholder Information 70 Corporate Directory 72 iCar Asia Limited and Controlled Entities Directors’ report 31 December 2015 The directors present their report, together with the consolidated financial statements, of iCar Asia Limited and Controlled Entities (referred to hereafter as the 'Group') for the year ended 31 December 2015. -

Catcha Group Or That SEA Would Have More Internet Here’S a Midway Checkpoint of Those Users Than the US? Predictions

December 2018 8 Predictions for the Southeast Asian Tech Scene – A Checkpoint Plus 3 New Predictions for Indonesia 2 FOREWORD Hey folks! brand-new ones just for Indonesia! Even I never expected that SEA’s tech If you know me, you know how much of entrepreneurs would be killing it at this Let’s see how many we get right. And a Southeast Asia (SEA) believer I am! level! more importantly, let’s see if SEA can surpass even Catcha’s wildest I’m always impressed, inspired and But my team and I like a challenge. So expectations in the next 24 months! invigorated by the talent, opportunities, we thought we’d try to predict the BOOM! and growth coming out of this region. future. That’s why, since 2017, we’ve That’s why I’ve focused my entire released our predictions for where the journey as an entrepreneur out of here. SEA tech landscape would go. Would you have guessed that a local Earlier this year, we announced 8 startup would acquire its competitor, predictions which we felt would reshape the largest provider and pioneer of e- the market till 2020. And today, just in Patrick Grove hailing services? time for Wild Digital Indonesia 2018 (our Co-Founder & Group CEO rockin’ premier tech conference), Catcha Group Or that SEA would have more Internet here’s a midway checkpoint of those users than the US? predictions. Bonus: we’ve added 3 If you have any questions on the report, please reach out via [email protected]. Opinions expressed are solely perspective of Catcha Group. -

Download Icar Asia Prospectus

iCar Asia Limited ACN 157 710 846 Rights Issue Offer Prospectus For a non-renounceable rights issue of one New Share for every 5.8 Shares held by Eligible Shareholders at an issue price of $0.18 per New Share to raise up to approximately $10,000,000, together with one attaching option for every one New Share issued (New Option) (Offer). The Offer is fully underwritten by Bell Potter Securities Limited (ACN 006 390 772) (the Underwriter). IMPORTANT NOTICE This document is important and should be read in its entirety. If after reading this Prospectus you have any questions about the Securities being offered under this Prospectus or any other matter, then you should consult your stockbroker, accountant or other professional adviser. Important Notices Offer The Offer contained in this Prospectus is an invitation to Eligible Shareholders to acquire fully paid ordinary shares in iCar Asia Limited (Company or iCar), on the basis of an Entitlement comprising one New Share for every 5.8 Shares held on the Record Date at an Offer Price of $0.18 per New Share, to raise approximately $10 million (before costs). Lodgement This Prospectus is dated 15 November 2017 and was lodged with ASIC on that date. ASIC, the ASX and their respective officers take no responsibility for the contents of this Prospectus or the merits of the investment to which this Prospectus relates. The Company will apply to ASX for quotation of the New Shares on ASX within seven days after the date of this Prospectus. No Securities will be issued on the basis of this Prospectus later than 13 months after the date of this Prospectus. -

VENTURE CAPITAL in SOUTHEAST ASIA Alternative Assets

VENTURE CAPITAL IN SOUTHEAST ASIA alternative assets. intelligent data. VENTURE CAPITAL IN SOUTHEAST ASIA Using data from Preqin’s Venture Capital Online database, we profile the burgeoning venture capital industry in Southeast Asia, looking at fundraising, funds in market, deals and exits and investors in the region. Fig. 1: Southeast Asia-Focused Venture Capital Fundraising, Fig. 2: Five Largest Southeast Asia-Focused First-Time Venture 2007 - 2017 YTD (As at August 2017) Capital Funds in Market (As at August 2017) 16 1,200 Target Fund Firm Type 14 Raised Capital ($mn) Aggregate Size ($mn) 14 13 1,000 Insitor Impact Asia Swiss-Asia 12 Early Stage 500 12 Fund Financial Services 10 10 800 10 Venture Capital FullCycle Energy FullCycle Energy 300 8 (All Stages) 8 7 600 6 I-4 Capital 6 I-4 Investment Fund I Early Stage 150 5 400 Partners 4 No. of Funds Closed of Funds No. 4 Credera Myanmar The Credera Venture Capital 200 Frontier Opportunity 100 2 Group (All Stages) 1 Fund 0 0 Venture Capital Iron Pillar Fund I Iron Pillar 100 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 (All Stages) YTD Year of Final Close Source: Preqin Venture Capital Online No. of Funds Closed Aggregate Capital Raised ($mn) Source: Preqin Venture Capital Online Fig. 3: Venture Capital Deals in Southeast Asia by Industry, Fig. 4: Top Southeast Asian Countries by Venture Capital Deal 2017 YTD (As at August 2017) Activity, 2017 YTD (As at August 2017) Aggregate Deal 120 1,800 Industry No. of Deals 1,707 Value ($mn) 107 1,600 Internet 98 1,088 100 ($mn) Value Deal Aggregate 1,400 IT - Software & Related 51 132 Telecoms 39 179 80 1,200 Business Services 9 1,362 943 1,000 60 55 Healthcare 6 24 800 IT - Other 6 - of Deals No. -

Asian Founders at Work

ASIAN FOUNDERS AT WORK STORIES FROM THE REGION’S TOP TECHNOPRENEURS Ezra Ferraz Gracy Fernandez Asian Founders at Work: Stories from the Region’s Top Technopreneurs Ezra Ferraz Gracy Fernandez Makati City, Philippines Makati City, Philippines ISBN-13 (pbk): 978-1-4842-5161-4 ISBN-13 (electronic): 978-1-4842-5162-1 https://doi.org/10.1007/978-1-4842-5162-1 Copyright © 2020 by Ezra Ferraz, Gracy Fernandez This work is subject to copyright. All rights are reserved by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. Trademarked names, logos, and images may appear in this book. Rather than use a trademark symbol with every occurrence of a trademarked name, logo, or image we use the names, logos, and images only in an editorial fashion and to the benefit of the trademark owner, with no intention of infringement of the trademark. The use in this publication of trade names, trademarks, service marks, and similar terms, even if they are not identified as such, is not to be taken as an expression of opinion as to whether or not they are subject to proprietary rights. While the advice and information in this book are believed to be true and accurate at the date of publication, neither the authors nor the editors nor the publisher can accept any legal responsibility for any errors or omissions that may be made. -

FY19 Results Presentation

ONLINE MARKETPLACES IN EMERGING MARKETS For personal use only FY19 FULL YEAR RESULTS PRESENTATION | FEBRUARY 2020 FRONTIER DIGITAL VENTURES Results and strategy overview SECTION 1 • +75% increase in full year FY19 portfolio revenue to A$72.5m (100% basis), up from +57% increase achieved in FY18 FY19 results • +66% increase in FDV economic share of FY19 portfolio revenue to A$23.6m • 4 operating companies recorded positive EBITDA in FY19 (Zameen, Infocasas, iMyanmarhouse and AutoDeal) Refer to pages 3 – 7 • 2 additional operating companies recorded positive EBITDA in 4Q 2019 (Encuentra24 and Moteur) SECTION 2 • Recent portfolio optimisation activities have included: Strategy overview ‒ Valuation uplift at MeQasa which achieved a 4.4x value uplift to FDV’s initial investment ‒ Increased shareholdings in Infocasas, AutoDeal, iMyanmarhouse and LankaPropertyWeb ‒ Sale of Propzy shareholding which generated A$6.9m cash and achieved a ~300% return in ~2.5 years • Propzy was the first material monetisation event in FDV's history and accelerated the pathway to Refer to pages 8 – 17 portfolio-wide profitability SECTION 3 • FDV’s current portfolio (ex. Propzy) contains: Appendix – additional ‒ 9 investments which are accounted for on a consolidated basis; and information ‒ 3 investments which are reported as “associates” under the equity method AASB 128 Refer to pages 18 – 30 For personal use only • An update on each operating company is provided in this section Note: FY19 results figures quoted are for entities with continuing operations as at -

Sky's $60 Million Stake Boosts Iflix's Growth Potential

THE AUSTRALIAN Sky’s $60 million stake boosts iflix’s growth potential DARREN DAVIDSON THE AUSTRALIAN MARCH 11, 2016 12:00AM While iflix does compete with Netflix for subscribers, it is positioning itself as a challenger brand. The founder of streaming service iflix said a $US45 million ($60m) investment by panEuropean payTV giant Sky will provide benefits beyond funds by providing invaluable industry expertise as Netflix’s global buying power expands. Online entrepreneur Patrick Grove said iflix would collaborate with Sky on content and technology to support growth in Malaysia, Thailand and The Philippines, as well as push into new markets in the Middle East and Africa. “Sky is one of the most forwardthinking media companies globally; the ideal partner for us as we build a dream team of partners,” Mr Grove told The Australian. “What we are trying achieve is incredibly challenging, but most importantly, not impossible with the right mix of partners. Sky has one of the largest production budgets globally and the leanings from that we can tap into are monumental.” While iflix does compete with Netflix for subscribers, Mr Grove believes the challenger brand has identified a new battleground by meeting untapped demand for “original productions” and “hyperlocal content” with a “differentiated consumer proposition”. “Our vision is to be largest premium overthetop service in emerging markets globally,” Mr Grove said. “We believe that Netflix will be very focused on the developed world. Most people in the emerging world don’t have a big flat screen TV in their living room, but they have a smartphone.” Andrew Griffith, Sky group chief financial officer, which is majority owned by Rupert Murdoch’s 21st Century Fox, said the investment would support iflix’s “ambitious plans”. -

The Nextcentury

PROMOTION 1 THE NEXT CENTURY SEPTEMBER 26 – 27, 2017 • HONG KONG This year marks a major milestone for Forbes – the 100th anniversary of its inaugural September 1917 issue. In conjunction with Forbes’ centennial anniversary celebration, the 17th annual Forbes Global CEO Conference was held in Hong Kong from September 26 to 27, 2017, under the theme of ‘The Next Century’. As Forbes enters its second century, the conference looked forward to what lies ahead. Gathering some 490 of the world’s top visionaries, CEOs, tycoons and investors, the conference provided a high-level platform to discuss and evaluate how far the global community has come, what needs to be done, and where it is going next. (L-R) David Fong, MD, Hip Shing Hong (Holdings); Christopher Forbes, Vice Chairman, Forbes Media; Vincent Fong, Founder, Acoustic Metamaterials, Speakers at the Forbes Global CEO Conference Director, Hip Shing Hong (Holdings) (L-R) Suphachai Chearavanont, (L-R) TC Yam, Chairman, Integrated Capital Holdings; CEO, Charoen Pokphand Group, Chairman of the Executive Committee, William Adamopoulos, CEO/Asia, Forbes Media; True Corporation; Steve Forbes, Chairman & Editor-in-Chief, Forbes Media Sammy Wong, Partner, Whale Capital PROMOTION 2 A Meeting of Minds: A conversation between Carrie Lam, The Chief Executive, Hong Kong Special Administrative Region, People’s Republic of China, and Steve Forbes, Chairman & Editor-in-Chief, Forbes Media During the final session of the conference, Hong Kong Chief Executive Carrie Lam engaged in A Meeting of Minds with Steve Forbes and spoke about Hong Kong’s economic strategy. In the discussion, she highlighted opportunities for businesses in the Guangdong-Hong Kong- Macao Bay Area.