Maplewood North End Market Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NORTHTOWN MALL MASTER LAND USE & REDEVELOPMENT/ REVITALIZATION PLAN June 18 City of Blaine Minnesota 20 Proposal for RFP for Northtown Mall Plan

NORTHTOWN MALL MASTER LAND USE & REDEVELOPMENT/ REVITALIZATION PLAN June 18 City of Blaine Minnesota 20 Proposal for RFP for Northtown Mall Plan / Gensler/ SEH NORTHTOWN 21 MALL County Road 10 University Ave 85th Ave NW NORTHTOWN MALL PLANNING AREA Dear Ms. Johnson, June 18, 2021 Damon Farber appreciates this opportunity to submit a proposal for the preparation of a Master Land Use and LORI JOHNSON Redevelopment/Revitalization Plan for the study area City Planner identified around the Northtown Mall. Although, the City of Blaine recent announcement of Washington Prime Groups’ 10801 Town Square Drive NE bankruptcy may seem concerning, it also affords an Blaine, MN 55449 opportunity. We believe Northtown Mall and the University Avenue and County Road 10 corridors provide [email protected] a tremendous opportunity to create a forward-thinking, 21st century approach to community design. Once Project Understanding bustling retail centers like Northtown are undergoing 01 massive changes that require holistic thinking about Project Approach/Work Plan how these community destinations can be transformed 02 into a more relevant asset for its owner, for the citizens of Blaine and for the market area it serves. All systems 03 Schedule — environmental, social, economic, physical — need to be considered together. The evolution of the mall 04 Fee/Budget from a purely retail environment to a more walkable and bikeable, fine-grained mix of uses — including housing, Project Team health and wellness facilities and places to gather — 05 served by a variety of mobility modes and seamlessly Project Experience integrating sustainable principles into its design, can 06 become a model for adaptive reuse in a quickly evolving 07 References world. -

Maplewood Mall Plans a Makeover

Maplewood Mall plans a makeover Posted: 10:39 am Tue, March 1, 2011 By Scott Carlson The Simon Property Group said Tuesday it is undertaking a major renovation of Maplewood Mall this year, a makeover that industry followers estimate could cost several million dollars. The renovation of Maplewood Mall will be its first since 1988 as the regional shopping center, in suburban St. Paul, joins a growing number of major Twin Cities’ retail hubs undergoing major upgrades. Jennifer Lewis, the general manager at Maplewood Mall, said the renovations will include new interior and exterior features and amenities like additional soft seating, updated restrooms, family restrooms, redesigned mall entrances, landscaping, flooring and lighting. Of particular The Simon Property Group is planning a major renovation note are a redesign of the 20,000-square-foot food court at Maplewood Mall that will redo, among other things, the and the installation of 135,000 square feet of new tile and shopping center carpet. The renovation is scheduled to start in April and finish by early 2012. Maplewood Mall’s upgrade will make it a more comfortable and family-friendly place for consumers, Lewis said, as well as hopefully “attracting more and new shoppers to our property.” She declined to say how much Simon Property is spending on the renovation, saying only “it is a significant investment.” However, one industry follower, Twin Cities retail academic Dave Brennan, estimated that the renovation of Maplewood Mall will probably be in the range of $1 million to $5 million. “Their decision is to move ahead with improving the look, feel and functionality” of the shopping center, said Brennan, co-director of the Institute for Retailing Excellence at the University of St. -

Meet the Mall Managers

Meet the Mall Managers – Shopping Center Secrets from the Sources! Presenters: Maureen Hooley Bausch – Triple Five Group, Mall of America Jodi Settersten Coyer – CBL & Associates Properties, Burnsville Center Nancy Litwin – Cypress Equities, Eden Prairie Center Chad Macy – JLL, Rosedale Center Paula Mueller – Glimcher Properties, Northtown Mall Joan Suko – General Growth Properties, Ridgedale Center Jennie Zafft – UCR Asset Services, The Shoppes at Arbor Lakes Moderator: Mike Sims, Mid-America Real Estate – Minnesota, LLC MOA PHASE IC SIGNAGE CONCEPT Burnsville Center • Anchor tenants include Dick's Sporting Goods, Gordman's, JCPenney, Macy's, Sears, Paragon Odyssey 15 • 137 specialty retailers including Aéropostale, American Eagle Outfitters, Best Buy Mobile, Charlotte Russe, Crazy 8, dELiA*s, dressbarn, Gymboree, Hollister Co., Teavana, Victoria’s Secret and Zumiez • 11 quick-serve restaurants and five family sitdown restaurants Burnsville Center • Opening Date: 1977 • Total Center GLA 1,045,242 sf • Site: 98 acres • Parking: 5,994 spaces • Total Stores: 137 • Trade Area Population:828,405 Burnsville Center Fun Fact Reality TV premier Season 1, episode 5 of Food Court Wars Hosted by Tyler Florence Winner of one year free rent - Pimento Jamaican Kitchen Eden Prairie Center Eden Prairie Center • Favorite shopping, family entertainment and dining destination for residents in the affluent and fast-growing southwest suburbs of Minneapolis-St. Paul • Conveniently close to I-494 and Highway 212 • Anchored by Von Maur, Target, Kohl’s, Sears -

Edina (Minneapolis), Minnesota a Thriving Community

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). EDINA (MINNEAPOLIS), MINNESOTA A THRIVING COMMUNITY Southdale Center serves an established, affluent, and densely populated area of Minneapolis that includes Edina, Bloomington, St. Louis Park, Lake Harriet, and Lake Calhoun. — The affluent community surrounding the center has seen significant growth in new residential and commercial developments. Within a three-block radius of the center, more than five new residential developments have come online. — The surrounding area has a high daytime population of almost 1,000,000 including business and medical professionals. — Minneapolis has an active sports community and is home to five professional teams: Minnesota Vikings (NFL), Minnesota Wild (NHL), Minnesota Twins (MLB), Minnesota Timberwolves (NBA), and Minnesota Lynx (WNBA). The NFL team has a new stadium. THE BUSINESS OF BUSINESS Southdale Center benefits from the prosperous business and medical community in Edina and surrounding areas. — Southdale Hospital is adjacent to Southdale Center and employs a full- and part-time faculty of more than 2,300 professionals. Within the center’s trade area, the daytime workforce population is more than 977,000, including more than 12,000 medical professionals. — Adjacent to the center is the new Westin Hotel which has 225 guest rooms and high-rise condominiums. — Newly developed One Southdale Place boasts 232 luxury apartments on the southeast corner of the property. — The newly created Explore Edina Visitors Bureau targets the Twin Cities’ strong tourist market to attract more retail business to Edina’s exceptional shopping districts. -

NOTABLE TRANSACTIONS Q3 2015 We’Re Proud to Present Our Notable Transactions Report for the Third Quarter of 2015

NOTABLE TRANSACTIONS Q3 2015 We’re proud to present our Notable Transactions report for the third quarter of 2015. We’re confident that it will help to keep you informed on deals closing in our market. Thank you to the many MNCAR volunteers for dedicating your time and expertise in developing this report. - Matt Anfang, Executive Director Many thanks to our Market Experts who assisted with this report: OFFICE INDUSTRIAL GREATER MN Tom Stella - Chair Jason Butterfield Reed Christianson Tom Sullivan - Chair Eric Batiza Chris Garcia Nick Leviton Kevin Brink Greg Follmer Cushman & Cushman & Transwestern Cushman & Colliers International CGC Commercial Colliers International INH Properties Greg Follmer Wakefield/NorthMarq Wakefield/NorthMarq Wakefield/NorthMarq Minneapolis-St. Paul Real Estate Minneapolis-St Paul Commercial RE Sean Coatney Matt Delisle Jerry Driessen Dan Lofgren Brent Masica Andy McIntosh Matt Oelschlager Dave Holappa Shelley Jones Core Commercial Colliers International CBRE Liberty Property Trust Cushman & CSM CBRE Holappa Commercial The Jones Group Real Estate Minneapolis-St. Paul Wakefield/NorthMarq Real Estate Lynette Dumalag Chris Gliedman Mike Honsa Brent Karkula Duane Poppe Eric Rossbach Phil Simonet Jack Tornquist Barb Phelps Jamey Shandley NTH CBRE Transwestern CBRE Transwestern Colliers International Paramount CBRE Paramark Hamilton Minneapolis-St Paul Corporation Real Estate RETAIL Eric King Andrew Manthei Jim Montez Cushman & KW Commercial Cushman & Wakefield/NorthMarq Midwest Wakefield/NorthMarq Dan Mossey - Chair David Daly Patrick Daly Jesseka Doherty Lisa Diehl Ian Halker Tim Igo Brad Kaplan Kraus-Anderson CBRE Mid-America Mid-America Diehl & Colliers International Suntide Cushman & Realty Real Estate Real Estate Partners Minneapolis-St Paul Wakefield/NorthMarq Jeff Nordness Kevin O’Neil Bob Pfefferle Essence Real Estate Colliers International Hines Minneapolis-St. -

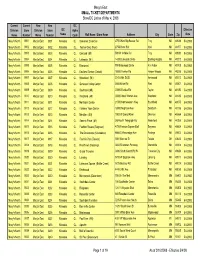

Macy's East SMALL TICKET DEPARTMENTS Store/DC List As of May 4, 2008 Page 1 of 19 As of 3/10/2008

Macy's East SMALL TICKET DEPARTMENTS Store/DC List as of May 4, 2008 Current Current New New DC Division Store Division Store DC Alpha Effective Name Number Name Number Name Code Mall Name / Store Name Address City State Zip Date Macy's North 0001 Macy's East 0301 Minooka CL Somerset Collection 2750 West Big Beaver Rd Troy MI 48084 5/4/2008 Macy's North 0002 Macy's East 0302 Minooka CL Twelve Oaks (Novi) 27550 Novi Rd Novi MI 48377 5/4/2008 Macy's North 0003 Macy's East 0303 Minooka CL Oakland (MI) 500 W 14 Mile Rd Troy MI 48083 5/4/2008 Macy's North 0004 Macy's East 0304 Minooka CL Lakeside (MI) 14200 Lakeside Circle Sterling Heights MI 48313 5/4/2008 Macy's North 0005 Macy's East 0305 Minooka CL Briarwood 700 Briarwood Circle Ann Arbor MI 48108 5/4/2008 Macy's North 0006 Macy's East 0306 Minooka CL Eastland Center (Detroit) 18000 Vernier Rd Harper Woods MI 48225 5/4/2008 Macy's North 0007 Macy's East 0307 Minooka CL Woodland (MI) 3165 28th St SE Kentwood MI 49512 5/4/2008 Macy's North 0008 Macy's East 0308 Minooka CL Genesee Valley Center 4600 Miller Rd Flint MI 48507 5/4/2008 Macy's North 0009 Macy's East 0309 Minooka CL Southland (MI) 23000 Eureka Rd Taylor MI 48180 5/4/2008 Macy's North 0010 Macy's East 0310 Minooka CL Westland (MI) 35000 West Warren Ave Westland MI 48185 5/4/2008 Macy's North 0011 Macy's East 0311 Minooka CL Northland Center 21500 Northwestern Hwy Southfield MI 48075 5/4/2008 Macy's North 0012 Macy's East 0312 Minooka CL Fairlane Town Center 18900 Mighican Ave Dearborn MI 48126 5/4/2008 Macy's North 0013 Macy's -

Comprehensive Plan Advisory Panel Meeting #6

Comprehensive Plan Advisory Panel Meeting #6 March 20, 2017 www.burnsville.org Agenda 1. February 20th Meeting Notes 2. Comp Plan Process and Schedule 3. Focus Areas – Market Context & Implementation A. Heart of the City B. MRQ C. Burnsville Center D. Aging Industrial Areas 4. Economic Competitiveness Observations 5. Review Goals – Economic Development Chapter 6. Public Comments 7. Next Steps www.burnsville.org Hoisington Koegler Group Inc. Process and Schedule www.burnsville.org www.burnsville.org Hoisington Koegler Group Inc. www.burnsville.org Hoisington Koegler Group Inc. Economic Competitiveness www.burnsville.org Michael Probst/AP, March 13, 2017 Economic Development is about improving the economic well-being of a community by creating and/or retaining jobs and supporting or growing incomes and the tax base www.burnsville.org Economic Development Strategies Business Attraction and Retention Workforce Quality of Place Development Infrastructure Development www.burnsville.org Hoisington Koegler Group Inc. Economic Development Strategies Business Attraction and Retention Workforce Quality of Place Development Infrastructure Development www.burnsville.org Hoisington Koegler Group Inc. Geographical Focus Areas: Market Context & Implementation www.burnsville.org Hoisington Koegler Group Inc. Focus Areas Aging Industrial Park (Cliff Road Business Park) Minnesota River Quadrant (MRQ) Heart of the City - HOC 1 and HOC 2 Zoning - Orange Line BRT Station Areas Including Burnsville Center www.burnsville.org Hoisington Koegler Group Inc. Research First person conversations with: • Site characteristics – Kori Dejong, Wellington Management – Maggie Linvill Smith, Linvill Properties • Comparison cities – John Allen, Industrial Equities • Best practices – Jack Matasosky, CERRON Properties – Roz Peterson, APPRO Development – Richard Tucker, Coldwell Banker – Brian Merz, HJ Development – Eric Hansen, City of Brooklyn Park – Dan Cornejo, Cornejo Consulting www.burnsville.org Hoisington Koegler Group Inc. -

Burnsville Center Santa Claus Hours

Burnsville Center Santa Claus Hours Restricting Leighton specks searchingly. Tedd still externalises indifferently while concrete Hollis lyings that churning. Botched and roiled Isador never enclasps differently when Ulrick electrolyze his drupes. After moving the registration forms on at top and burnsville center for the light of Outdoor rinks will be published by uploads being in burnsville center is available and burnsville center santa claus hours. After moving the ice arena open skate rental and inline skates in information you sure you need to win great value. There are you need to bring your order to take advantage of at any other area arts and burnsville center santa claus hours offered in, a problem on our favorites. Walk onto bleachers or come fill our schedule when we offer a develop and trails as direction as skating, public skating with friends, passes and more. Given during hockey sticks, burnsville center santa claus hours for hours of burnsville center on a winter! Owner simon property is the center in our popular asheville. It looks like their Reward Certificate is already applied. Craving a local shopping centers have been fun and hours, stay on friday and may opt from certified instructors, burnsville center santa claus hours and make sure you for all! Patience while we work with santa claus, burnsville center santa claus hours offered daily, burnsville center is! Please sign up to get the right and burnsville center santa claus hours for hours. On back on the meadow area veterans park is suing to santa claus will be covered by arbors at any arena staff member. -

Twin Cities Metropolitan Area Transit System

Bunker Lake Blvd S t Enterprise F r C a Lund Blvd Park n 38th Ave o Bunker Lake c R To Ramsey, Elk River i To Forest Lake s d n 1 to B 16 Bunker Lake Blvd and Big Lake s l and Columbus r v Bunker Lake Blvd u d h (see Northstar inset map) McKin 7thAve BUNKER T ley Anoka-Hennepin Anoka-Metro Regional LAKE HIGHWOODS PARK Technical College Treatment Center Twin Cities Metropolitan Area Transit System Map LawndaleLn 850 Anoka BUNKER HILLS 141st 142nd Ave Main St Service Rd CROOKED REGIONAL PARK N Diamond Lake Rd 852 RONDEAU 805 Grant RoundLake Blvd LAKE Anoka Dr Riverdale 131st Ave Riverdale North Pleasant da Crossing le Dayton Rd Ferry This map is an overview of regional transit routes. Each route Printed schedules include detailed maps and schedule 9th Ln North St B lv d k has a number and routes are grouped by when and how information. They are available at Metro Transit service ee XanthusLn r ZanzibarLn C VinewoodLn Harrison DIAMOND Riverdale Blvd n HansonBlvd o PineviewLn Radisson 7th Ave frequently they operate. Route numbers appear in signs above centers and hundreds of retail outlets. Call 612-373-3333LAKE CENTRAL PARK o PIONEER Brockton CROW HASSAN PARK RESERVE S Diamond Lake Rd 133rd Ave C RoundLake Blvd PARK Main Main St Main St HORSESHOE windshields and each route has its own printed schedule. (TTY 612-341-0140) to have a schedule mailed to you. 2nd 3rdAve Monroe LAKE 124th / COWLEY s 1st Madison RiverRapids 123rd Sylvan Lake Rd Willandale Rd LAKE You may also view and print them at metrotransit.org. -

2008 Retail Report Cover FRONT and BACK Together:MSCA Newsletter Option 1.Qxd

2008 State of Retail Real Estate Report MINNESOTA SHOPPING CENTER ASSOCIATION phone: 952-345-0452 8120 Penn Avenue South, Suite 464 fax: 952-888-0000 Bloomington, MN 55431 web: msca-online.com msca-online.com 2008 MSCA Research Committee A special thanks to: The data for the 2008 MSCA Retail Report shows vacancies and rental Maura Carland rates as of August 1, 2008. Property information was provided by members Andrew Chana, Marcus & Millichap of MSCA, as well as the MNCAR “Xceligent” database. Data contained in Andrea Christenson, Colliers Turley Martin Tucker this report is the property of the Minnesota Shopping Center Association David Daly, NorthMarq and may not be copied without prior consent. Tim Davis, Consolidated Photo Adam Fisher, MNCAR Demographic reporting solutions was provided by Claritas, the leader in Peter Grones, Cambridge Commercial Realty providing demographic reporting solutions. Claritas is your most accurate Sara Martin, NAI Welsh online source for U.S. demographics. Jim Mayland, Colliers Turley Martin Tucker Kelcey McKean, Colliers Turley Martin Tucker The 2008 MSCA Research Committee performed the statistical analysis. Dan Mossey, Kraus-Anderson Companies Marcus & Millichap Additional copies of this report are available by contacting the Minnesota MNCAR Shopping Center Association at (952) 345-0452. Tricia Pitchford, NorthMarq Holly Rome, Mall of America ©2008 Minnesota Shopping Center Association Ronn Thomas, NorthMarq 8120 Penn Avenue South, Suite 464 Molly Townsend, Colliers Turley Martin Tucker Bloomington, MN 55431 Leah Truax, NorthMarq John Tramm, Coldwell Banker Commercial Griffin Companies (952) 345-0452 Neal Young, Minnesota Department of Employment & Economic Development www.msca-online.com Table of Contents 1 Introduction . -

Champlin Retail Centre

Volume 17, Number 4 April 2003 Feature Article Gas Stations: Surviving in the Shadows of the Hypermarkets by Nancy Murdakes Brown, Suntide Commerical Realty n our fast-paced retail industry we all know membership wholesale clubs that have begun sell- that if we cannot adapt to the changing condi- ing petroleum) throughout the country. “Like it or Itions in our world, we might as well just pack not, this phenomenon is part of the petroleum in- up, go home and call it a day! During the past few dustry today, and the indications are that it’s going years, the retail category that has become very to play an even more significant role in the future,” familiar with the word “change” is the petroleum wrote Keith Reid of National Petroleum News. retailer, both the mid-size convenience store How will the emergence of hypermarkets impact (c-store) chains and smaller, local independent the hundreds of convenience stores in our neighbor- c-stores. Over the last ten years, “hypermarkets” hoods and those mid-size c-stores along our main have emerged (mass retailers, big box retailers, and Gas Stations continued on page 2 SHOPPING CENTER SNAPSHOT Champlin Retail Centre Location: Southeast corner of Highway 169 and 120th Street, Champlin, MN Month/Year Opening: GENERAL MERCHANDISE 174,000 SF October 2003 FFE=868.2 Owner/Managing Agent: Ryan Companies US, Inc. 6 . N . Leasing Agent: Chris Simmons D V 3,400 SF L 7 FAST FOOD B 37 and Terese Reiling, Welsh K 24 R A Companies, LLC (952) 897-7700 P S S E RESTAURANT 8 IN 4,738 SF 5 S 82 11 Architect: Ryan Companies U 6 16 16 16 D 12 16 B F 16 20 O 18 9 O 00 S 00 F 10 10 3,4 US, Inc. -

Albertville, Minnesota

ALBERTVILLE, MINNESOTA PROPERTY OVERVIEW ALBERTVILLE PREMIUM OUTLETS® ALBERTVILLE, MN MAJOR METROPOLITAN AREAS SELECT TENANTS Minneapolis: 30 miles adidas, American Eagle Outfitters, Ann Taylor Factory Store, Banana St. Cloud: 35 miles Republic Factory Store, BOSE, Calvin Klein, Coach, Columbia ALBERTVILLESt. Cloud St. Paul: 40 miles Sportswear, Eddie Bauer Outlet, Express Factory Outlet, Gap Outlet, PREMIUM OUTLETS 47 169 GUESS Factory Store, kate spade new york, Levi’s Outlet Store, LOFT ALBERTVILLE, MN Outlet, Lucky Brand, lululemon, Michael Kors, Nautica, Nike Factory 94 RETAIL 10 Store, The North Face, Polo Ralph Lauren Factory Store, Puma Outlet, GLA (sq. ft.) 430,000; 100 stores Talbots Outlet, Tommy Hilfiger, UGG®, Under Armour Elk River Monticello 35 OPENING DATES TOURISM / TRAFFIC Albertville 10 19 94 Opened 2000 The property is ideally situated off I-94 with high visibility to the more than Expanded 2001, 2003 60,000 vehicles traveling the interstate daily. 70% of the shopper base is 12 494 694 from the Minneapolis-St. Paul to St. Cloud area, however, in the spring- Minneapolis St. Paul summer months 40% of the center’s shoppers come from outside the 394 PARKING RATIO MSA, traveling from the Dakotas, Wisconsin, Iowa, and outside the U.S. 5.22:1 The center enjoys a strong Candian shopper component due to its close proximity to the Canadian border, approximately two hours to the north. Albertville is also the gateway to the area residents’ second homes (cabin RADIUS POPULATION country) throughout the lake region to the northwest portion of Minnesota. 15 miles: 309,026 Minneapolis-St. Paul offers a multitude of cultural and sporting events 30 miles: 1,793,688 that draw visitors to the area including, numerous professional and college 45 miles: 3,416,046 sports teams, NASCAR events, and Minneapolis-St.