Champlin Retail Centre

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Information Form 2014

SLATE GROCERY REIT ANNUAL INFORMATION FORM For the Year Ended December 31, 2020 Dated February 23, 2021 TABLE OF CONTENTS INFORMATION ..................................................................................................................................................... 1 FORWARD-LOOKING STATEMENTS ................................................................................................................ 1 NON-IFRS MEASURES ....................................................................................................................................... 2 ORGANIZATIONAL STRUCTURE ....................................................................................................................... 2 GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................................... 4 DESCRIPTION OF THE BUSINESS .................................................................................................................... 5 Overview ........................................................................................................................................................ 5 Manager ......................................................................................................................................................... 6 Objectives....................................................................................................................................................... 6 Growth Strategies ......................................................................................................................................... -

NORTHTOWN MALL MASTER LAND USE & REDEVELOPMENT/ REVITALIZATION PLAN June 18 City of Blaine Minnesota 20 Proposal for RFP for Northtown Mall Plan

NORTHTOWN MALL MASTER LAND USE & REDEVELOPMENT/ REVITALIZATION PLAN June 18 City of Blaine Minnesota 20 Proposal for RFP for Northtown Mall Plan / Gensler/ SEH NORTHTOWN 21 MALL County Road 10 University Ave 85th Ave NW NORTHTOWN MALL PLANNING AREA Dear Ms. Johnson, June 18, 2021 Damon Farber appreciates this opportunity to submit a proposal for the preparation of a Master Land Use and LORI JOHNSON Redevelopment/Revitalization Plan for the study area City Planner identified around the Northtown Mall. Although, the City of Blaine recent announcement of Washington Prime Groups’ 10801 Town Square Drive NE bankruptcy may seem concerning, it also affords an Blaine, MN 55449 opportunity. We believe Northtown Mall and the University Avenue and County Road 10 corridors provide [email protected] a tremendous opportunity to create a forward-thinking, 21st century approach to community design. Once Project Understanding bustling retail centers like Northtown are undergoing 01 massive changes that require holistic thinking about Project Approach/Work Plan how these community destinations can be transformed 02 into a more relevant asset for its owner, for the citizens of Blaine and for the market area it serves. All systems 03 Schedule — environmental, social, economic, physical — need to be considered together. The evolution of the mall 04 Fee/Budget from a purely retail environment to a more walkable and bikeable, fine-grained mix of uses — including housing, Project Team health and wellness facilities and places to gather — 05 served by a variety of mobility modes and seamlessly Project Experience integrating sustainable principles into its design, can 06 become a model for adaptive reuse in a quickly evolving 07 References world. -

MSCA Newsletter

JUNE 2014 In this Issue Grocery Market ------------ - 1 Caribou Coffee -------------- 3 Minnesota Marketplace ---- 4 Legislative Update ----------- - 6 Property Management ------ 7 Connection Member Profiles ------------- 7 Program Recap -------------- 8 Feature Article THE GROCERY MARKET: by Mike Sturdivant , COMPETITION BETWEEN THE AISLES Paster Enterprises rocery shopping continues to evolve with new formats • Des Moines-based Hy-Vee recently made a large disrupting the industry. Traditional grocers are still announcement with plans to expand into the Twin Cities dominant, but what people want and how they are market. Their first store is likely to be the former Kmart Ggetting it has changed dramatically over the past decade. As redevelopment in New Hope. Flying in the face of some consumers, we now have more options in our market than recent trends towards smaller stores, Hy-Vee’s prototypical ever before. Gone are the days where a grocery store is a store is around 90,000 square feet, which includes a sit- one-stop shop for most consumers. Traditional grocers are down bar and restaurant, drive-up pharmacy, sushi bar, seeing increased competition from Walmart, ALDI, Target, continued on next page > natural-food focused stores, dollar stores, and even convenience stores. Snapshot For instance, Kwik Trip has expanded their grocery offerings Shops at BlueStone and even their grocery advertising over the past several years. With their growth in the Twin Cities, Kwik Trip is increasingly viewed as a grocery player. As a result of increasing competition, grocers will need to continue to connect with consumers and build brand loyalty. Recent Activity • Milwaukee-based Roundy’s Inc. -

Maplewood North End Market Study

MAPLEWOOD NORTH END MARKET STUDY Prepared for: Prepared by: City of Maplewood, MN Perkins+Will, Inc. June 2018 TABLE OF CONTENTS Table of Contents ........................................................................................................................................... i Executive Summary ....................................................................................................................................... ii Introduction .................................................................................................................................................. 1 Study Area Analysis ....................................................................................................................................... 2 Socio-Economic Analysis ............................................................................................................................... 8 Housing Market ........................................................................................................................................... 18 Retail Market .............................................................................................................................................. 30 Office Market .............................................................................................................................................. 38 Medical Office ............................................................................................................................................. 44 Planned -

Fact Finder - Page 1 “Doctor on Demand” by Paul Crandall, Secretary-Treasurer

Local 653 Minneapolis,Fact MN http://ufcw653.org FinderVol. 55, No. 5, May 2017 Eastside Food Co-op Workers Vote to Unionize with UFCW Local 653 Submitted by Matt Utecht, President orkers at Eastside Food Co-op in co-op continues to be a sustainable store for the Minneapolis won their election on workers and the neighborhood.” WThursday, April 20th to form a union Many workers live close to Eastside Food Co- with the United Food and Commercial Workers, op in Northeast Minneapolis. Forming a union Local 653. More than 70% of workers voted in is how workers can actively ensure family favor of unionization. sustaining jobs for the whole community. “Addressing economic justice issues like When workers first started discussing forming implementing a genuine living wage is a clear a union, they met discreetly to create a safe extension of our cooperative values,” said Brian space to refine their goals and identify who David who works in Eastside’s IT department. would be most interested in organizing. They ”We are excited to begin the bargaining process wanted to create their own organizing plan because now, everyone will have an opportunity without worrying about potential management to be heard.” interference. Workers have begun circulating bargaining “Organizers gave advice, and UFCW members surveys to help the bargaining committee from Linden Hills Co-op and other retail stores understand their coworkers’ priorities. offered support, but we led the organizing - “I have been working at Eastside for seven years. Eastside Co-op workers,” said Alex Bischoff from Forming a union is going to help workers have the Meat Department. -

Feature Advertising by U.S. Supermarkets Meat and Poultry

United States Department of Agriculture Agricultural Feature Advertising by U.S. Supermarkets Marketing Service Meat and Poultry Livestock, Poultry and Seed Program Independence Day 2017 Agricultural Analytics Division Advertised Prices effective through July 04, 2017 Feature Advertising by U.S. Supermarkets During Key Seasonal Marketing Events This report provides a detailed breakdown of supermarket featuring of popular meat and poultry products for the Independence Day marketing period. The Independence Day weekend marks the high watershed of the summer outdoor cooking season and is a significant demand period for a variety of meat cuts for outdoor grilling and entertaining. Advertised sale prices are shown by region, state, and supermarket banner and include brand names, prices, and any special conditions. Contents: Chicken - Regular and value packs of boneless/skinless (b/s) breasts; b/s thighs; split, bone-in breasts; wings; bone-in thighs and drumsticks; tray and bagged leg quarters; IQF breast and tenders; 8-piece fried chicken. Northeast .................................................................................................................................................................. 03 Southeast ................................................................................................................................................................. 21 Midwest ................................................................................................................................................................... -

Your Benefits Card Merchant List

Your Benefits Card Merchant List ¾ Use your benefits card at these stores that can identify FSA/HRA eligible expenses. ¾ Check the list to find your store before you order prescriptions or shop for over-the- counter (OTC) items. ¾ Swipe your benefits card first and only your FSA/HRA eligible purchases will be deducted from your account. ¾ You won’t have to submit receipts to verify purchases from these stores, but you should still save your receipts for easy reference. ¾ Merchants have the option of accepting MasterCard and/or Visa for payment. Before making a purchase with your benefits card, please make sure you know which cards are accepted. Ist America Prescription Drugs* Albertville Discount Pharmacy* AmiCare Pharmacy Inc* 3C Healthcare Inc, dba Medicap Alden Pharmacy* Anderson and Haile Drug Store* Pharmacy* Alert Pharmacy Services-Mt Anderson County Discount 50 Plus Pharmacy* Holly* Pharmacy* A & P* Alexandria Drugs Inc* Anderson Drug-Athens TX* Aasen Drug* Alfor’s Pharmacy* Anderson Pharmacy-Denver PA Abeldt’s Gaslight Pharmacy* Allcare Pharmacy* Anderson Pharmacy/John M* ACME * Allen Drug* Anderson’s Pharmacy* Acres Market (UT) * Allen’s Discount Pharmacy* Andrews Pharmacy* Acton Pharmacy Allen Family Drug* Anthony Brown Pharmacy Inc* Adams Pharmacy* Allen’s Foodmart* Antwerp Pharmacy* Adams Pharmacy Inc* Allen’s of Hastings, Inc.* Apotek Inc. Adams Pharmacy and Home Allen's Super Save #1 Provo Apotek Pharmacy* Care* UT* Apoteka Compounding LLC* Adamsville Pharmacy* Allen's Super Save #2 Orem UT* Apothecare Pharmacy* Adrien Pharmacy* -

Maplewood Mall Plans a Makeover

Maplewood Mall plans a makeover Posted: 10:39 am Tue, March 1, 2011 By Scott Carlson The Simon Property Group said Tuesday it is undertaking a major renovation of Maplewood Mall this year, a makeover that industry followers estimate could cost several million dollars. The renovation of Maplewood Mall will be its first since 1988 as the regional shopping center, in suburban St. Paul, joins a growing number of major Twin Cities’ retail hubs undergoing major upgrades. Jennifer Lewis, the general manager at Maplewood Mall, said the renovations will include new interior and exterior features and amenities like additional soft seating, updated restrooms, family restrooms, redesigned mall entrances, landscaping, flooring and lighting. Of particular The Simon Property Group is planning a major renovation note are a redesign of the 20,000-square-foot food court at Maplewood Mall that will redo, among other things, the and the installation of 135,000 square feet of new tile and shopping center carpet. The renovation is scheduled to start in April and finish by early 2012. Maplewood Mall’s upgrade will make it a more comfortable and family-friendly place for consumers, Lewis said, as well as hopefully “attracting more and new shoppers to our property.” She declined to say how much Simon Property is spending on the renovation, saying only “it is a significant investment.” However, one industry follower, Twin Cities retail academic Dave Brennan, estimated that the renovation of Maplewood Mall will probably be in the range of $1 million to $5 million. “Their decision is to move ahead with improving the look, feel and functionality” of the shopping center, said Brennan, co-director of the Institute for Retailing Excellence at the University of St. -

Meet the Mall Managers

Meet the Mall Managers – Shopping Center Secrets from the Sources! Presenters: Maureen Hooley Bausch – Triple Five Group, Mall of America Jodi Settersten Coyer – CBL & Associates Properties, Burnsville Center Nancy Litwin – Cypress Equities, Eden Prairie Center Chad Macy – JLL, Rosedale Center Paula Mueller – Glimcher Properties, Northtown Mall Joan Suko – General Growth Properties, Ridgedale Center Jennie Zafft – UCR Asset Services, The Shoppes at Arbor Lakes Moderator: Mike Sims, Mid-America Real Estate – Minnesota, LLC MOA PHASE IC SIGNAGE CONCEPT Burnsville Center • Anchor tenants include Dick's Sporting Goods, Gordman's, JCPenney, Macy's, Sears, Paragon Odyssey 15 • 137 specialty retailers including Aéropostale, American Eagle Outfitters, Best Buy Mobile, Charlotte Russe, Crazy 8, dELiA*s, dressbarn, Gymboree, Hollister Co., Teavana, Victoria’s Secret and Zumiez • 11 quick-serve restaurants and five family sitdown restaurants Burnsville Center • Opening Date: 1977 • Total Center GLA 1,045,242 sf • Site: 98 acres • Parking: 5,994 spaces • Total Stores: 137 • Trade Area Population:828,405 Burnsville Center Fun Fact Reality TV premier Season 1, episode 5 of Food Court Wars Hosted by Tyler Florence Winner of one year free rent - Pimento Jamaican Kitchen Eden Prairie Center Eden Prairie Center • Favorite shopping, family entertainment and dining destination for residents in the affluent and fast-growing southwest suburbs of Minneapolis-St. Paul • Conveniently close to I-494 and Highway 212 • Anchored by Von Maur, Target, Kohl’s, Sears -

Participating Distributors Revised 05.26.15 Page 1 of 13

Participating Distributors Revised 05.26.15 Page 1 of 13 Recently Added Distributors Blair’s Market Dick’s TDL Group Corp (Tim Hortons) Blazer’s Fresh Foods DJ’s Inc Calgary Food Bank Blue Mountain Foods DJ’s Pilgrim Market The North West Company Bob’s Supermarket Don’s Market M&M Meat Shops Ltd. Bob’s Valley Don’s Thriftway T.I.G.O. Trading Bowman’s Double D Market Devash Farms Bradley’s Bestway Dove Creek Superette KCCP Distribution Company Broulim’s Market Downey Food Center Nutricion Fundemental Burney & Company Dry Creek Stations Pasquier Busy Corner Market Duane’s Foodtown Horizon Distributors Ltd. Buy Low Market Duckett’s Market Fruiticana Produce Ltd. Cactus Pete’s Country Store El Mexicano Market Dollarama L.P. Caliente Store El Rancho Market Camas Creek Country Store El Rodeo Market 99 Cents Only Stores Canyon Foods Elgin Foodtown Affiliated Foods Midwest Carter’s Market Emigrant General Store Affiliated Foods Inc - Amarillo Cash and Carry Foods Etcheverry’s Foodtown Ahold Cedaredge Foodtown F T Reynolds American Sales Company Central Market Familee Thriftway Giant Foods Chappel’s Market Family Foods Martin’s Foods Chuck Wagon General Family Market Stop & Shop Clarke’s Country Market Farmer’s Corner Albertson’s LLC Clark’s Market Farmer’s Market ACME Clinton Market Finley’s Food Farm Aldi Colter Bay Store Flaming George Market Asian Imports/Navarro Transportation Columbine Market Food Ranch Bestway Associated Food Stores (Far West) Cook’s Foodtown Food RoundUp A&A Market Cooperative Mercantile Corp Food World Thriftway Adamson’s Corner Market Fortine Merc. Alamo Store Cottonwood Market Fresh Approach Aldapes Market Cottonwoods Foods Fresh Market Allen’s Inc. -

Putting DLX Proximity to Work DLX Proximity: Because You Shop

Targeting DLX Proximity DLX Proximity: Because You Shop Where You Live Audiences built from: As consumers, we prefer to shop close to home, which is why by 2017 • Known offline address data location-based marketing will account for over $8B of advertising spend.* on 110MM+ HHs Built from highly accurate, offline-sourced data, DLX Proximity allows you to • Retail location data built from latitude/ reach audiences based on household distance to the surrounding retailers. longitude coordinates for each store From syndicated to custom-built audiences, use DLX Proximity to help including over 30 major CPG retailers reduce waste by targeting the customers and prospects closest to the • Households within a five-mile retailers that matter. radius for grocery, mass, drug and convenience stores; 10-mile radius for *eMarketer 2014 club stores (for syndicated audiences) How to Use DLX Proximity Create a targeted shopper Eliminate waste by targeting only the Choose from over 30 syndicated marketing program to drive households that matter; reach consumers segments or build a custom traffic to specific retailers. who live within five miles of key retailers. audience to meet your exact needs. Putting DLX Proximity to Work A major beverage company is launching a new energy drink sold only though a specific convenience chain. 1mi. 2mi. 3mi. 4mi. 5mi. The beverage company wants to reach only those consumers who buy caffeinated beverages and live within a five-mile radius of each store in the chain. Using DLX Proximity, we build a custom audience of caffeinated beverage buyers who also live within a five-mile radius of each store to hyper-target the new energy drink campaign. -

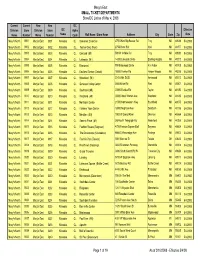

Macy's East SMALL TICKET DEPARTMENTS Store/DC List As of May 4, 2008 Page 1 of 19 As of 3/10/2008

Macy's East SMALL TICKET DEPARTMENTS Store/DC List as of May 4, 2008 Current Current New New DC Division Store Division Store DC Alpha Effective Name Number Name Number Name Code Mall Name / Store Name Address City State Zip Date Macy's North 0001 Macy's East 0301 Minooka CL Somerset Collection 2750 West Big Beaver Rd Troy MI 48084 5/4/2008 Macy's North 0002 Macy's East 0302 Minooka CL Twelve Oaks (Novi) 27550 Novi Rd Novi MI 48377 5/4/2008 Macy's North 0003 Macy's East 0303 Minooka CL Oakland (MI) 500 W 14 Mile Rd Troy MI 48083 5/4/2008 Macy's North 0004 Macy's East 0304 Minooka CL Lakeside (MI) 14200 Lakeside Circle Sterling Heights MI 48313 5/4/2008 Macy's North 0005 Macy's East 0305 Minooka CL Briarwood 700 Briarwood Circle Ann Arbor MI 48108 5/4/2008 Macy's North 0006 Macy's East 0306 Minooka CL Eastland Center (Detroit) 18000 Vernier Rd Harper Woods MI 48225 5/4/2008 Macy's North 0007 Macy's East 0307 Minooka CL Woodland (MI) 3165 28th St SE Kentwood MI 49512 5/4/2008 Macy's North 0008 Macy's East 0308 Minooka CL Genesee Valley Center 4600 Miller Rd Flint MI 48507 5/4/2008 Macy's North 0009 Macy's East 0309 Minooka CL Southland (MI) 23000 Eureka Rd Taylor MI 48180 5/4/2008 Macy's North 0010 Macy's East 0310 Minooka CL Westland (MI) 35000 West Warren Ave Westland MI 48185 5/4/2008 Macy's North 0011 Macy's East 0311 Minooka CL Northland Center 21500 Northwestern Hwy Southfield MI 48075 5/4/2008 Macy's North 0012 Macy's East 0312 Minooka CL Fairlane Town Center 18900 Mighican Ave Dearborn MI 48126 5/4/2008 Macy's North 0013 Macy's